The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

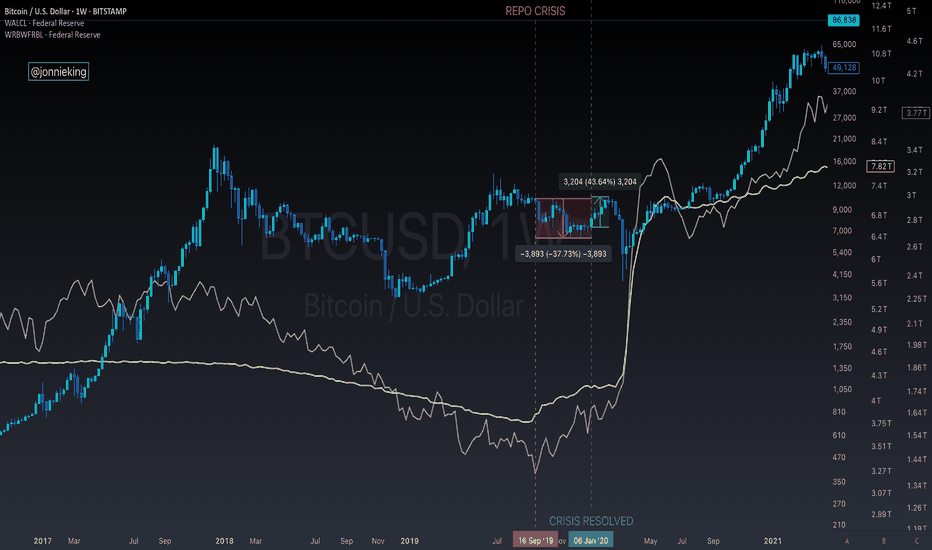

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

Altseason

Potential long trade $DAGPA UPCOM:DAG doesnt look like it used to be, but the company is still hard working & evolving.

If UPCOM:DAG breaks $0.05 with power, i could really see UPCOM:DAG go to $0.20

@ the end of Q1 they are going to activate staking, the change in metanomics will push the price higher. Significant amount of UPCOM:DAG will be burnt.

Also UPCOM:DAG will launch its own DEX end March/April. With the token ECONOMICS:PACA , because of this the network will be used more.

Things to look out for this year:

* Delegated staking ⏳

* Constellation's DEX ⏳

* Panasonic Metagraph ⏳

* Sentiment Metagraph ⏳

* USA National DigiFoundry Metagraph to mainnet ⏳

* Intrana Metagraph to mainnet ⏳

* Upsider Ai Metagraph to mainnet ⏳

* Cyberleet Metagraph to mainnet ⏳

* BioFi Metagraph to mainnet ⏳

ARB/USDT – The zone is interesting for starting accumulation.Arbitrum - is an Ethereum layer-two (L2) scaling solution. It uses optimistic rollups to achieve its goal of improving speed, scalability and cost-efficiency on Ethereum. Arbitrum benefits from the security and compatibility of Ethereum. Another benefit is the higher throughput and lower fees compared to Ethereum. That is made possible thanks to moving most of the computation and storage load off-chain.

Arbitrum’s native token is called ARB and is used for governance. Offchain Labs, the developers behind Arbitrum, announced the shift to a decentralized autonomous organization (DAO) structure — the Arbitrum DAO. ARB holders can vote on proposals that affect the features, protocol upgrades, funds allocation and election of a Security Council.

CoinMarketCap : #51

The hyped-up Arbitrum! 😂

📉 January - February - March 2024: Bloggers trapped a huge number of people, and now we’re seeing a massive -87% decline!

Looking at the main trend, a large descending channel is forming. The price is currently at the support of the inner channel, and if the market makes a final liquidity grab with a downward wick, the price could head toward the support of the outer channel, targeting a -30% drop.

In my previous trading idea, I marked the 1.1552 zone, which is exactly where the price reversed. Everything is marked on the chart—the potential profit is very solid, especially for spot trading. The price will react strongly to the resistance zones of both the inner and outer channels.

🚀 These are the moments to watch for position accumulation—when no one is interested and belief in growth is dead, not when everyone is screaming "BUY NOW!" at local tops!

*I will update the trading idea as the trend develops.

Resistance at 1.3T: Is a Deeper Crypto Correction Coming?The long-awaited Trump inauguration, which was expected to trigger an altcoin season, had the exact opposite effect. This once again proves that when the majority of market participants expect one outcome, the market often does the opposite.

After several days of testing support, the "tax policy" announcement triggered a breakdown below the 1.3T level, causing Total 3 to drop around 30% to 1T.

The market is now experiencing a normal rebound, but I am not very optimistic in the medium term.

Technically, 1.3T has now turned into strong resistance. In my opinion, after this rebound, a new leg down is likely.

I expect a drop below 1T, potentially reaching around 900B in the near future.

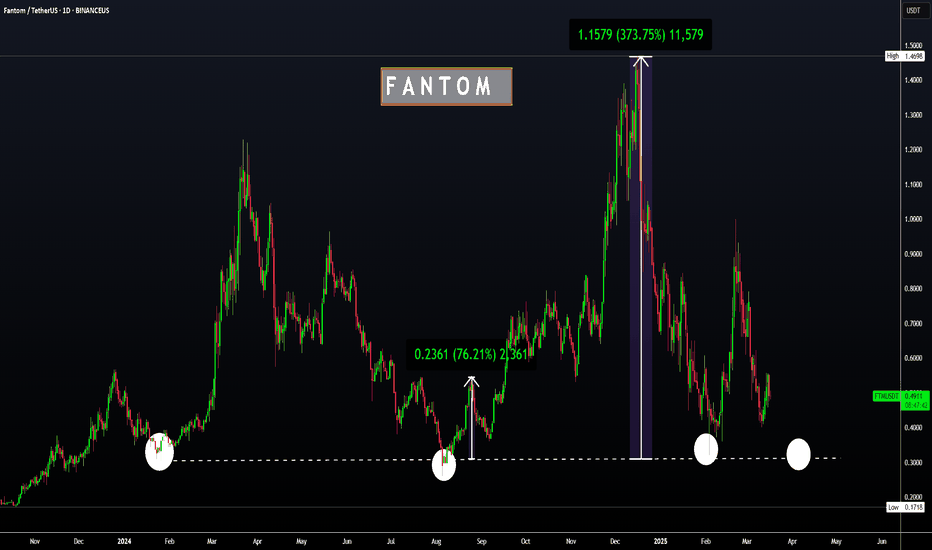

FTM | FANTOM | Altcoin with GREAT UPSIDE POTENTIALFTM has recently increased 11% in the weekly, but is making more red candles in the daily and the impulse up seems to be over for now.

Looking at the corrections, from -45% to -80% is not uncommon for Fantom.

The good news, is that the bottom is likely close - and from here, there exists great upside potential.

I am NOT saying we can't fall lower here - infact, a full retracement may be likely, just as we saw the previous cycle. In which case, the upside is even bigger. 30c is indeed a very popular demand zone:

_____________________

BINANCEUS:FTMUSDT

STRK/USDT – Position accumulation in a descending channel.StarkNet - is a permissionless decentralized Validity-Rollup (also known as a “ZK-Rollup”). It operates as an L2 network over Ethereum, enabling any dApp to achieve unlimited scale for its computation – without compromising Ethereum’s composability and security, thanks to StarkNet’s reliance on the safest and most scalable cryptographic proof system – STARK.

StarkNet Contracts and the StarkNet OS are written in Cairo – supporting the deployment and scaling of any use case, whatever the business logic.

CoinMarketCap : #106

Twitter(X) : 346,4k

Currently, STRK is trading within a large descending channel , with the price sitting at the support of the inner channel . After the hype, the price has dropped by -95% ! The Series B & C Round zones are being tested. A -30% drop to the support of the outer channel is not ruled out.

STRK will likely move only when ETH starts growing , as it is an L2 solution.

During the listing phase , this coin was heavily hyped— bloggers were screaming to buy before it "took off" , but they forgot to mention that the rocket was headed downward . Most of them had no real idea what they were doing—it was all just for hype and content .

Now, few still believe in its potential … faith is gone .

But this is exactly why fear is unnecessary . Historically, negative zones often provide some of the best entry points.

I expect STRK to outperform ETH in profitability due to its low liquidity.

I’ve marked everything on the chart—consider this in your trading strategy.

Alt season Can start from this zone finally altcoins market cap reached at crucial support area, expecting successful retest from trendline, and this blue area, the question is why im expecting alt season from here, b,coz multi year symmetrical triangle got cleared, and market came for retest, healthy correction happens in markets often the time, and currently market testing crucial support area, successful retest with strong momentum can lead massive alt season from here

AltSeason Begins If/When...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🔹 Let’s keep it simple and straightforward:

📈 Altseason begins if/when ETH breaks above its falling channel (in red) 📉 and the $2,000 round number.

⚠️ Meanwhile, further downside is expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

$BTC MACD on weekly show a bearish trend. Read.You can see on the chart that in May 2024 I issued a warning, and look at what happened over the next five months.

The same pattern is repeating now, and there’s a high probability we’ll see a similar result.

Back in May 2024, the usual crowd—MMCrypto, That Martini Guy, Ash, Crypto Rover, etc.—were all saying things like, “We’re going to 110k,” “To the moon,” or “A huge bullish breakout is coming.”

What did we actually get? Five months of consolidation and an -80% drop for most altcoins.

So consider this a warning. The MACD on the weekly chart is a reliable indicator of the trend. Exchanges aren’t going to go against the trend. Even if there’s a ton of liquidity at 107k, they won’t risk buying billions worth of Bitcoin just to get wrecked by the prevailing trend and be forced to sell at a lower price than they purchased.

Those pointing to the liquidity map at 107k are missing the point. Exchanges take the easier path. Going from 97k to 107k is plausible in an uptrend, but in a downtrend? No chance.

What to Expect Now?

Since this chart is on the weekly timeframe, there will be daily bounces. Some altcoins may see 10-20% gains if you time the bottom and top correctly.

However, for holders, this is not a good time to hold.

Is Invalidation Possible?

Yes, but consider this: they’ve tried to break the trend five times and failed. The chance of a reversal now is about 1 in 9. It’s possible, but unlikely.

Key Support Levels

Support levels to watch are 95k, 91k, 85k, and 70k. While we might not drop as low as 70k, it’s better to be prepared.

What’s Next?

By May 2025, we’ll likely reach the end of this bearish trend, followed by a one-month altseason and a big BTC pump. However, starting in July 2025, we’re likely to face another five months of bearish consolidation.

The introduction of ETFs has shifted the crypto cycle into a new paradigm of five months of consolidation followed by one month of pumping.

As always, DYOR (Do Your Own Research).

ALTS Brutal altseason is about to start.The altcoin market cap just hit its 1week MA200, right at the bottom of the 2.5 year Channel Up.

This has completed a -57.89% decline from the most recent High, the same decline percentage as the ones that formed the August 5th 2024 and December 26th 2022 bottoms.

The 1week RSI has also almost hit its 2 year Support.

If bullish waves are as symmetric as bearish waves, we can expect at least a rapid rise / ALTSEASON to 575 B (+199.05%).

If the market structure follows the June 2023 - March 2024 bullish wave, we can expect a more brutal rally to the 2.0 Fibonacci extension at 865 B.

Follow us, like the idea and leave a comment below!!

bitcoin 2025btc and time

Ladies and gentlemen, let me tell you something. Bitcoin, digital currencies, it's the future. No doubt about it. The world is changing. We’re moving into the 21st century faster than ever before. And folks, the only way to keep up—truly keep up—is to embrace this technology. We have to adapt, we have to move forward, or we’ll get left behind. Believe me.

Now, some people, they’ll tell you that Bitcoin is too volatile, that it’s too risky. Well, let me tell you something. Nothing worth doing is ever easy, okay? There are always going to be risks. But Bitcoin, digital money, it’s the future. It’s the future of finance. And let me tell you, it’s already happening. We have the biggest companies, the smartest people, they’re all talking about it. Tesla, MicroStrategy, you name it. They’re already in. So why aren’t we? Why aren’t we moving faster? That’s the question. We have to be smart. We have to get ahead of the game.

Look, I’ve seen it all—the stock market, the banks, the big banks. They don’t get it. They don’t understand how fast things are changing. But Bitcoin and digital currencies—they understand change. They understand innovation. And that’s what we need. We need innovation, folks. We need to update our systems, we need to update our country. We need to update the way we think about money.

Some people say it’s just a trend, just a bubble. I’ve heard it all before. You know what? They said the same thing about the internet. They said the same thing about smartphones. And look at us now. We don’t want to be the last ones to figure it out. We want to be the first. We want to lead. And that’s what we’re going to do.

So I say to you, the future is bright. We’re talking about an economy that moves faster, more efficiently. It’s the future, folks. We need to make sure we’re part of it. Digital money is coming whether we like it or not, so we’d better make sure we’re on top of it.

And let me tell you, it’s going to be big. The biggest. The world is looking to us. They want us to lead, and I believe we will. We’re going to make sure America is at the forefront of digital finance. We’re going to make sure we’re ahead of the curve. And we’re going to win. We’re going to win big. Thank you, God bless you, and God bless America!

XCN + 333%? X4 IS WAITING FOR IT IF THIS CONFIRMS.Last time Onyxcoin (XCN) had a Bullish divergence on RSI and make a Golden cross. it made a +383% in 5 waves making the 1st wave on the bigger cycle. (152 ds).

Wave 2 a correction ( 152 ds), corrects as Elliot says to the 4th of a minor degree.

And now that the Wave 3 seems to start, we break the descending channel and made a Golden Cross. We have the bull impulse until Feb/Mar 2025.

To confirm this we need the break out on the RSI.

And remember that Wave 3 usually is the strogest of all, we will find out on OCTOBER ;)

Cheers!

XRP - Do NOT Fear The Dip - This Is Where To BUY MartyBoots here , I have been trading for 17 years and sharing my thoughts on BINANCE:XRPUSDT here.

BINANCE:XRPUSDT is looking beautiful , very interesting chart for more upside and dips into support are buys

Do not miss out on BINANCE:XRPUSDT as this is a great opportunity

DO NOT FEAR THE DIP

Watch video for more details

#ALTS market: What is next#ALTS market: ALTS market enter in 20% risk zone as NASDAQ drop 4% in first day week.

Understand the key Level: BTC support zone $77k, FWB:73K , $69k as of now. We expect local bottom around it.

Nasdaq drop near 13% from its high and it can be more if uncertainty continue.

Bitcoin and ALts market oversold and they will bounce if Nasdaq give a relief rally.

So understand that 20% risk box if btc visit towards FWB:73K and reward will be minimum 2x as a relief rally from this point.

CPI number will come tomorrow which can again give volatility.

But all Major eye on FOMC meeting on March 19 which decide next move of market.

#crypto #ALTSEASON

ONDObeen looking at this for a while... a strong and must to be added on spot portfolio

structures across most of alts are invalidated... BTC and ETH are taking their key levels and we are in the final stage of capitulation

will reupdate all the charts (I'm holding) after the dust settles

Bull Run isn't over... wait for consolidation and we can have our alts rally in a few weeks

We are due a 2017 style ALT season.One for the memory banks!

Now

do we actually get what we are "owed" ?? :)

We don't know

and nothing is owed to us of couurse

But

Selling too soon could be quite disastrous... as many peopleI speak to say to me 5X - 10X I am out..

Which may be prudent

If you are out. Stay out and don't FOMO back in again near the tops

So it's best to scale out in my opinion

last cycle was a quite difficult Alt season ... some bag holders actually did not get to experience any euphoria

Hence why I am leaning to an exsplosive alt season

BTC at $70k doesn't feel euphoric

so what will it take?

WARNING! Big Dump For Altcoins Will Start Tomorrow!Hello, Skyrexinans!

Couple of weeks ago we also warned you on the weekend that on the next week can start the huge dump on the crypto market and on altcoins especially. Today we received the red alert again that we have to be ready for the drop which will start tomorrow.

Let's take a look at the daily chart. Here we can see that price has already completed 4 waves of 5 of the Elliott waves cycle. Wave 4 is the triangle shaped, that's why it has not even reached the 0.38 Fibonacci retracement. In our opinion it's finished and now it's time for the wave 5, which has the target approximately at 7%. When we will see divergence with AO and green dot on the Bullish/Bearish Reversal Bar Indicator it can be the historical moment when the price will show us the reversal.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!