SOL | Solana Game Plan - Swing Long IdeaSOL | Solana Game Plan - Swing Long Idea

📊 Market Sentiment

Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets continue to favor crypto assets.

We’re currently seeing a minor retracement, primarily driven by the Nasdaq’s pullback — but the overall outlook for the crypto market remains bullish in the weeks ahead.

📈 Technical Analysis

Price was rejected from the HTF bearish trendline near $207 and is now retracing.

The retracement aligns with a HTF bullish trendline, which I believe could spark a strong move to the upside.

This area also aligns with the 0.5 Fibonacci retracement level (discount zone) and a HTF demand zone — forming a strong confluence for a potential bounce.

📌 Game Plan

I want to see price hit the HTF demand zone at $152 (purple box).

It should also tap the bullish trendline.

The zone aligns with the 0.5 Fibonacci level — my key discount area.

🎯 Setup Trigger

After these levels are tagged, I’ll be looking for a 4H bullish break of structure, which should also form a new 4H demand zone for confirmation.

📋 Trade Management

Stoploss: Below swing low of the 4H demand zone

Targets:

• TP1: $188

• TP2: $207

• TP3: $297

I’ll trail my stop to lock in profits aggressively as price moves in my favor.

💬 Like, follow, and comment if this breakdown supports your trading!

More setups and market insights coming soon — stay connected!

Altseason2025

SUI | Sui Network - Swing Long Idea - Altcoin

📊 Market Sentiment

Market sentiment remains bullish, supported by expectations of a 0.25% rate cut at the upcoming FOMC meeting. The weakening USD and rising risk appetite across global markets are favoring crypto assets in particular.

📈 Technical Analysis

SUI recently gained bullish momentum, largely following Bitcoin's strength.

We’re now seeing a healthy retracement, which is expected after a strong move.

The break of the LTF bullish trendline suggests potential for a deeper pullback toward HTF confluence zones.

📌 Game Plan

I'm eyeing the HTF demand zone around $3.06, which aligns with the 0.5 Fibonacci retracement—a key discount zone.

Just below this, we also have a higher time frame bullish trendline, which could offer dynamic support.

These overlapping levels provide a strong confluence for a swing long idea.

🎯 Setup Trigger

I’ll wait for a 4H bullish break of structure and the formation of an LTF demand zone before entering.

📋 Trade Management

Stoploss: Below 4H demand swing low

Target: Up to $4.44

I’ll trail my stop to lock in profits aggressively along the way.

💬 Like, follow, and comment if this breakdown supports your trading!

More setups and market insights coming soon — stay connected!

Cardano ADA Buying Opportunity📈 CRYPTO:ADAUSD has completed a 3-swing pullback against the June low and entered the extreme buy zone at $0.72–$0.64. While marginal new lows are still possible, this area aligns with Fibonacci confluence, making it a prime zone for a bullish reversal or at least a 3-wave bounce next week.

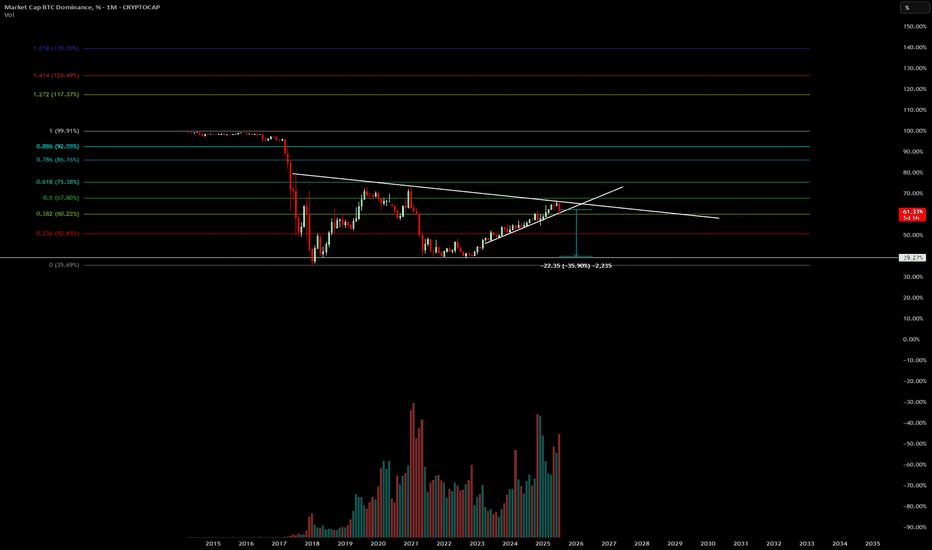

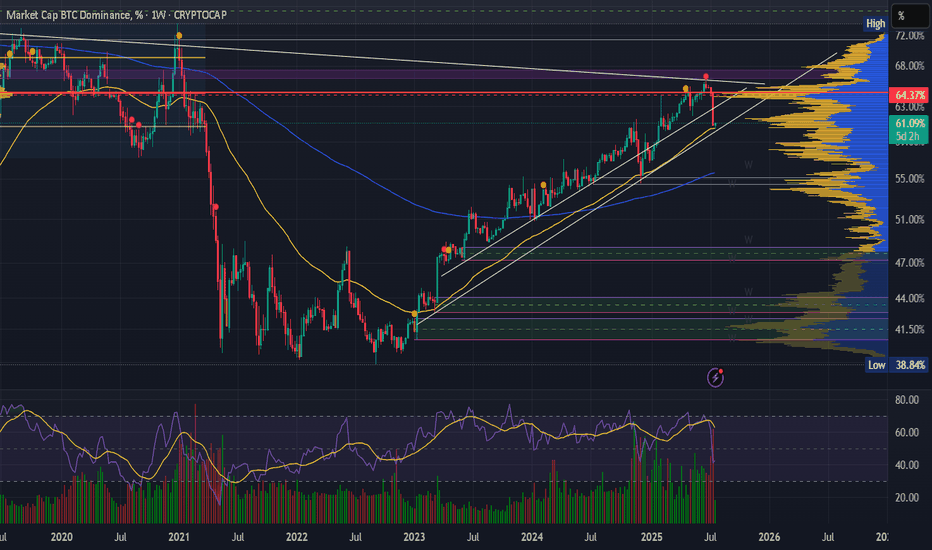

Bitcoin Dominance Topping Out? Bitcoin dominance ( CRYPTOCAP:BTC.D ) may be hitting a cycle top, signaling a potential major shift in capital rotation across the crypto markets.

Historically, when Bitcoin dominance peaks, we tend to see:

🔄 A rotation of capital into altcoins

🚀 Explosive rallies in ETH, SOL, and mid-cap alts

💰 Increased retail speculation and trading volume across DeFi and meme coins

Previous cycle tops in BTC dominance (e.g., 2017, 2021) preceded major altcoin seasons, with dominance falling sharply while total crypto market cap continued to grow.

⚠️ A rejection at key resistance (like the 200-week MA or golden fib levels) could confirm a reversal, hinting that altseason is around the corner.

💡 Keep an eye on:

ETH/BTC breakout potential

Total3 (crypto excluding BTC & ETH) trends

Risk-on sentiment and social metrics

Will history repeat? Or is this cycle different?

📈 Chart shows confluence of horizontal resistance, weakening RSI, and declining momentum on BTC.D.

Not financial advice. Always DYOR. Use proper risk management.

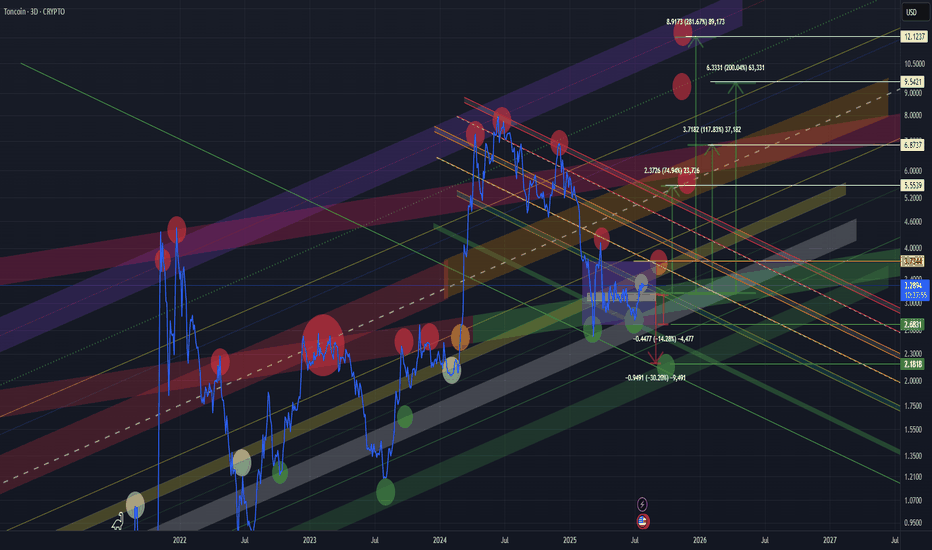

TONUSD TONUSDT TONCOIN mid- to long-termIn my view, we are still in the accumulation phase. The current price action and reactions at key levels suggest ongoing accumulation.

🔻 Bearish Scenarios:

In the short term, a retest of the lower boundary of the accumulation zone (purple box) is possible if the market weakens.

The worst-case scenario would be a move down to the lower green support zone, which has historically triggered strong bullish reactions. This is a critical demand area.

🔼 Bullish Scenarios:

A confirmed breakout and hold above the white line (within the purple box) would signal strength and a potential move higher.

We would then likely see a retest of the upper boundary of the accumulation zone.

A breakout and consolidation above the yellow line would open the door for a move toward the wider yellow channel, which could act as a final target zone

🚨 High-Risk Zone:

The yellow channel might represent the final phase of the current move.

From there, we could see either a sharp correction

Or, if trend strength and macro conditions allow, a continuation towards a new ATH (purple line).

📌 📌 📌 :

All marked lines and zones represent key support and resistance levels.

Price reaction at these areas will be crucial for decision-making.

As always, risk management and trend confirmation are essential.

PENGU. Main trend. Trend reversal zone. 04 07 2025Logarithm. Main trend. Fresh cryptocurrency, which is being driven into hype.

Locally now. Price at the median of the bowl.

Buyer volume dominates. Most likely, there will be a large pump in case of a breakout.

The chart is somewhat reminiscent of the Bitcoin chart, the reversal zones of this secondary trend, after the first local wave of growth. The first local, significant target is shown.

There is a possibility of a helicopter, that is, to collect stops in both directions, and thereby dump passengers before a potential pump.

Such cryptocurrencies (low liquidity, monopoly over the price due to the concentration of cryptocurrency in “one hand”) at a good time "the hamster is not scared", will be pumped up conditionally, like Shiba Inu (SHIB), driving the hype (raising the price over and over again, and coming up with positive news) and 0.5 million Twitter subscribers (X). Medium-term — long-term level zones are shown on the chart.

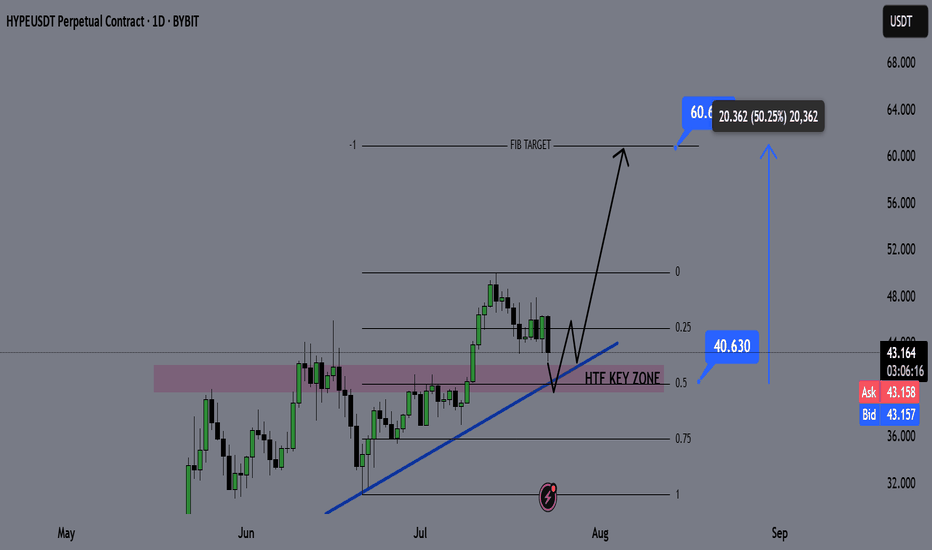

HYPE Swing Long Opportunity - Altcoin Season📌 Fundamental Sentiment:

The crypto market — alongside broader risk assets — continues to gain traction. This momentum is largely fueled by rising expectations of policy shifts in the U.S., with Trump intensifying pressure on Jerome Powell and advocating for aggressive rate cuts from the Fed.

📌 Technical Analysis:

HYPE is approaching a key HTF bullish trendline, and confluences are stacking up in the same region:

✅ HTF Demand Zone

✅ Equilibrium (EQ) of the HTF bullish trend

✅ Bullish Trendline Support

These three HTF confluences overlapping at the same price zone indicate a high-probability setup for a significant bounce and a possible swing long opportunity.

📌 Gameplan:

Price hits HTF bullish trendline

HTF demand zone gets tested

EQ level tapped → discount offered to buyers

📌 LTF Confirmation Criteria:

I’ll wait for:

A 1H swing break

A strong 4H rejection candle

These will confirm momentum shift. If confirmed, I’ll enter a swing long.

🎯 Target: $60

💰 Potential gain: ~+50%

❗ Stop-loss: Below the swing low that triggers the LTF confirmation

—

🔔 Follow for daily setups and weekly macro recaps

💬 Drop your chart or questions below!

When Altseason? Clues in other chart Ex) #1Hi guys.

So Its no secret bitcoin has been ripping.

We are at new all time highs, and in full on price discovery mode.

I recently posted an ongoing macro analysis on ADA (Cardano) supporting my theory that it is one of the better alts to be investing in for alt explosion.

I want to look elsewhere to see if i can find supporting evidence that its time to invest or trade altcoins.

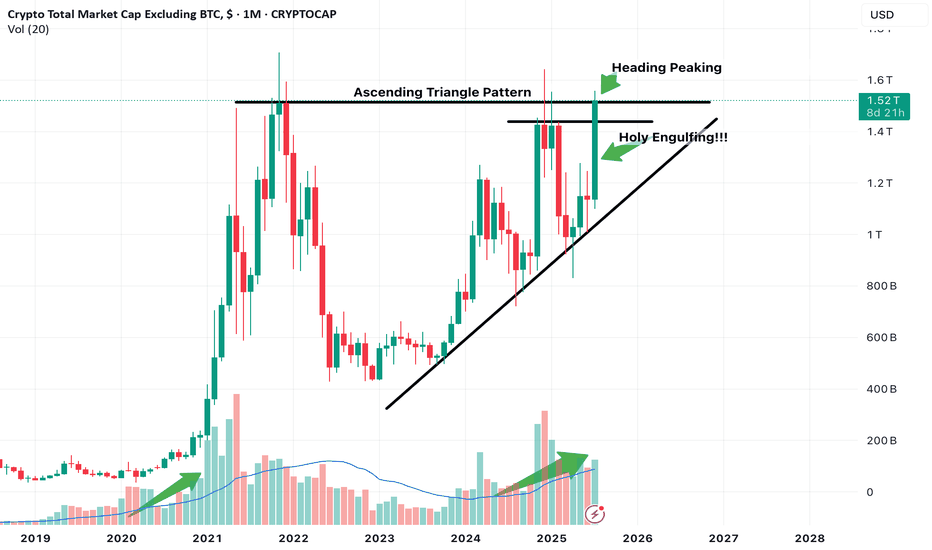

One chart that can be used is the Total Market Cap of Crypto excluding Bitcoin.

This chart showcases total altcoin market capitalization and its movements.

I believe certain Technical developments can really help us gauge at whats to come.

NOte this is on the 1 Month timeframe aka looking into Macro developments.

Just focusing on Candlestick action.

Notice we have been in this ascending channel trend, along with a potential Ascending triangle pattern development which if breakout occurs with confirmation can push Altcoin market cap higher indicating that liquidity is entering altcoins which indicates potential Uptrend.

The month of July so far is in position to print a massive engulfing Bullish candle, which is a great sign.

The upper part is also peaking its head above the Horizontal resistance line. Need to observe confirmation of this breakout. Look for it in smaller timeframes, ill look for it in the 3 day or 5 day.

We are also in position to print a higher high first time in a while.

Notice also Volume. We are seeing currently similar increasing volume as previous alt coin market cap expansion.

Keep an eye out on more posts to add to evidence that supports we are in the verge of potential altcoin season.

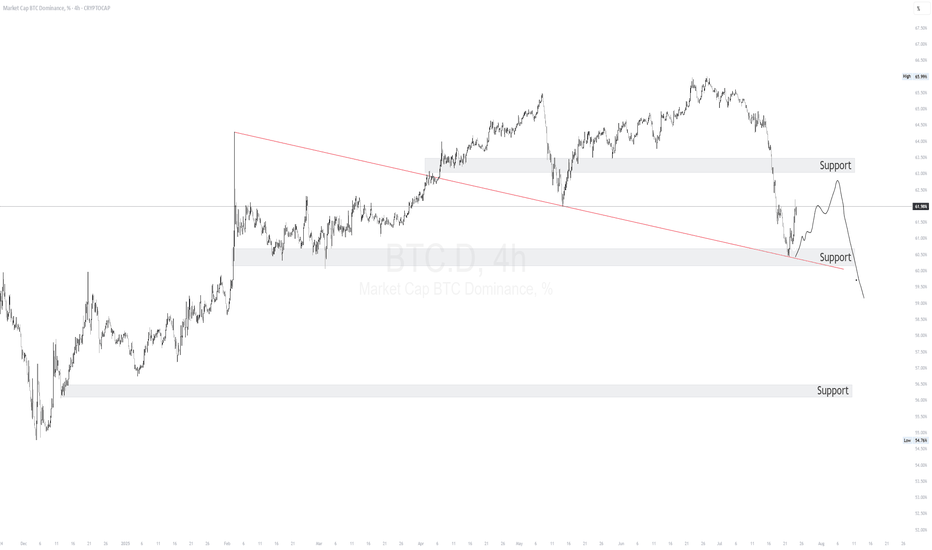

BTC.D Bitcoin Dominance on a bigger timeframe support?

This is my first time posting an idea, therefore not an expert, I hope the graphs show right.

Seeing a weekly chart, I see another support across the levels of March 6th, Dec 2nd and the current level. Could this have been only a warm up for the altseason? Do we have to wait for the week of August 25th?

CRYPTOCAP:BTC.D

If you check the Weekly chart for TOTAL3ESBTC, the week of August 25th could provide another support at 0.255.

The exact point we are hitting now is the POC for the beginning of 2019 up to today.

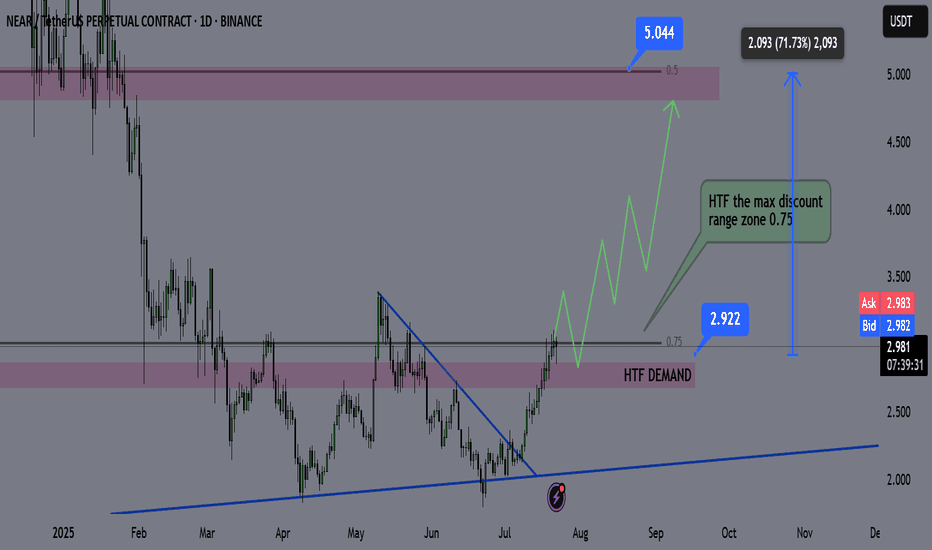

NEAR Swing Long Idea - Altseason 2025📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This is mainly driven by U.S. policy expectations — Trump is pressuring Powell to resign and aggressively pushing for rate cuts from the Federal Reserve.

📌 Technical Analysis:

NEAR has recently broken and closed above a significant HTF support/resistance level.

Additionally, we’re now trading inside the 0.75 Fibonacci retracement level of the HTF bullish trend — which I define as the maximum discounted zone.

For this setup, I’ll apply my Deep Range Theory (DRT):

If price dips below the 0.75 zone and accumulates there,

Then breaks above 0.75 after a period of consolidation,

→ It signals that price aims for the 0.5 level of the range and will likely run HTF liquidity for either reversal or re-accumulation before continuation.

📌 Gameplan:

✅ Break and close above HTF S/R

⏳ Waiting for break and daily close above 0.75

🔄 Retest to LTF demand (4H–1H)

📈 A bounce on LTF demand will trigger the long setup

📌 Trade Management:

This is a mid-term swing trade, as I’m following the HTF bullish trend.

🎯 Target: $5 — which is approximately a +70% move from current price.

❗Risk Management:

If price makes a daily close back below 0.75 after breaking and closing above, I will exit the trade to preserve capital.

I’ll also monitor macro sentiment closely. If there's a sharp bearish shift, I may consider an early exit before reaching the HTF target.

—

🔔 Follow the channel for daily trade ideas & weekly macro recaps.

💬 Drop a comment below if you have any questions or insights!

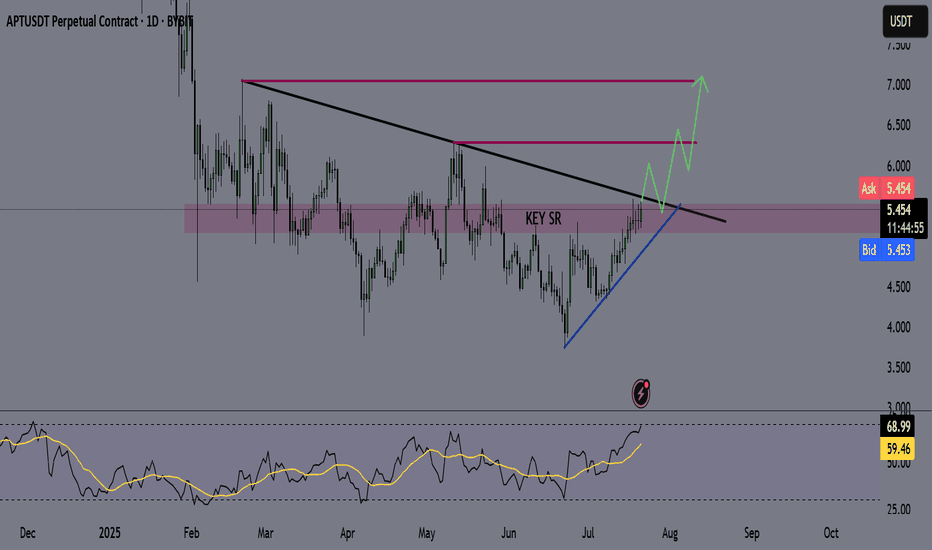

APT - APTOS Coin - Swing Long Idea📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This momentum is largely driven by U.S. policy expectations — specifically, Trump’s increasing pressure on Powell to resign and aggressively push for rate cuts from the Federal Reserve.

📌 Technical Analysis:

Price is currently testing the HTF supply zone with strong momentum. Additionally, it’s approaching a long-term bearish trendline that has dictated the downtrend since February 2025.

📌 Gameplan:

I want to see:

A clean breakout above the HTF supply zone with daily candle closure.

A confirmed break and close above the HTF bearish trendline on the daily timeframe.

If both confirmations align, I’ll start preparing for swing long setups, potentially riding into the early stages of a 2025 altseason.

—

🔔 Like & Follow for more daily updates. Feel free to drop your thoughts in the comments!

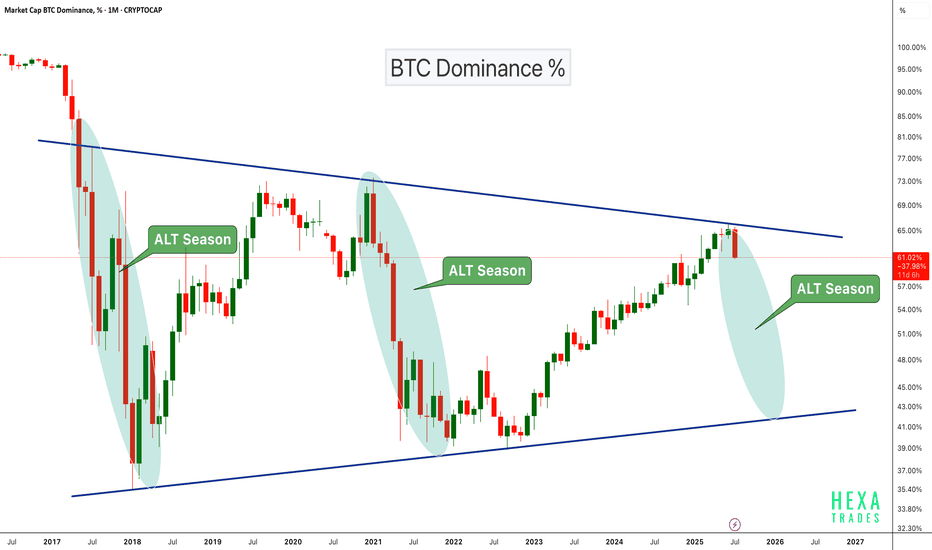

Altseason Loading?BTC Dominance chart has once again respected the long-term descending trendline resistance, showing a sharp monthly rejection. Historically, similar rejections have marked the beginning of ALT seasons, where capital flows out of Bitcoin into altcoins, boosting their performance significantly.

Chart Highlights:

-Major triangle pattern since 2017

-Clear rejections from the upper trendline coincide with previous ALT seasons (2018, 2021)

-Current rejection resembles those past cycles

-A move down in dominance could fuel strong altcoin rallies

If BTC dominance continues to decline, we could be entering another powerful altcoin season in the coming months.

Cheers

Hexa🧘♀️

CRYPTOCAP:BTC.D BINANCE:BTCUSDT

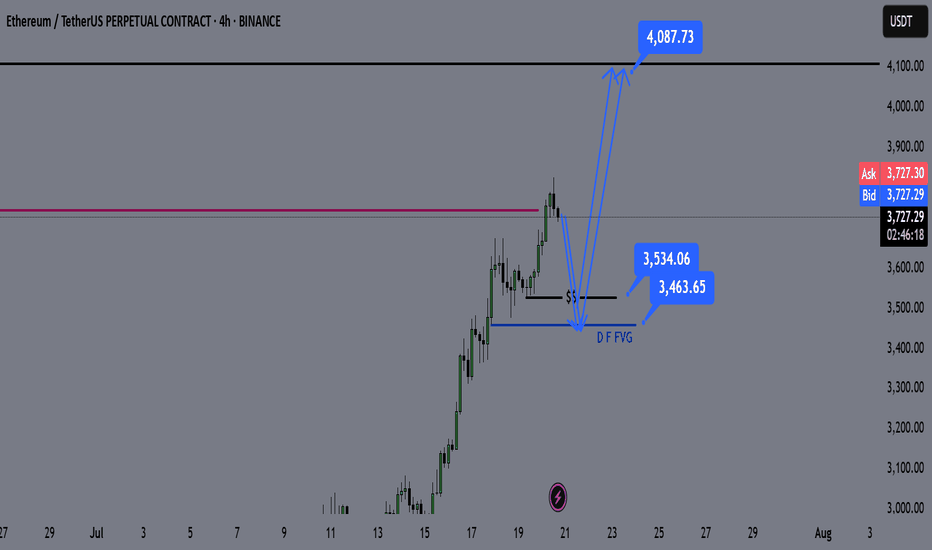

ETH Weekly Recap & Game Plan 20/07/2025📈 ETH Weekly Recap & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

ETH continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

We captured strong profits by sticking to the plan (see chart below).

🔍 Technical Analysis

✅ Price has run into HTF liquidity at $3,750

📊 Daily RSI has entered the overbought zone, signaling potential short-term exhaustion.

We may see a brief retracement or LTF liquidity grabs, which could be enough to fuel a further push higher — potentially to $4,087.

🧭 Game Plan

I’m watching two key downside liquidity levels:

$3,534 (black line)

$3,464

A sweep of either could provide the liquidity needed for continuation toward $4,087.

⚠️ I’ll wait for LTF confirmation before entering a position.

📌 Follow for Weekly Recaps & Game Plans

If you find this analysis helpful, follow me for weekly ETH updates, smart money insights, and trade setups based on structure + liquidity.

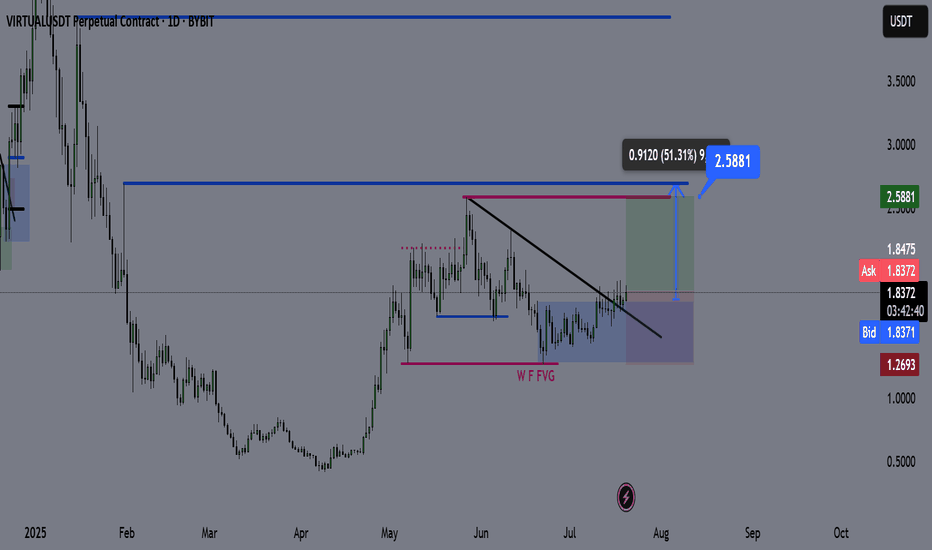

Virtual Coin – Technical Outlook & Trade Plan🔍 Technical Analysis

✅ Price has broken and closed above the bearish trendline, indicating a shift in market structure.

✅ It’s currently consolidating above the trendline, and each retest is showing strong bullish reactions.

✅ The bullish daily demand zone is holding aggressively, reinforcing upward momentum.

I do not expect a significant retracement from here until we reach the purple line (2.59). The current structure suggests price wants to seek higher liquidity.

📌 Trade Plan

Entry: Current market (above trendline + demand zone reaction)

Take Profit (TP): 2.59 (Purple Line)

Stop Loss (SL): 1.26 (Daily Close Below)

📊 Bias: Bullish

🕰️ Timeframe: Daily

📍 Invalidation: Daily close below the demand zone and trendline support

💬 Feel free to share your thoughts or ask questions below!

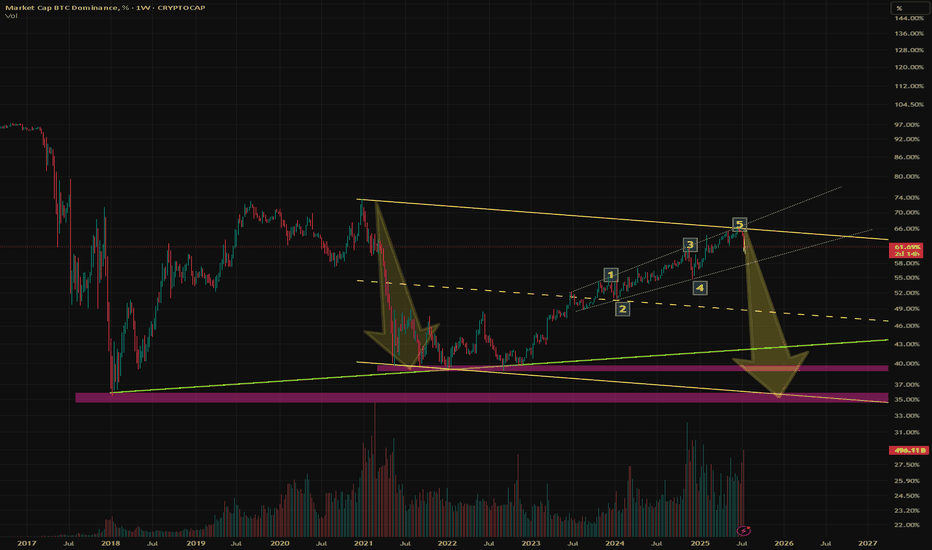

is AltSeason Started ????"The altcoin season has likely begun! We're currently witnessing Bitcoin's dominance chart breaking down at a critical juncture, and this cycle may surpass even our most optimistic expectations. The technical signals are remarkably clear and verifiable for most seasoned traders. In these market conditions, the wisest strategy is to hold strong with conviction – maintain your positions and trust in the assets you've carefully accumulated. This could very well be the start of an extended altcoin rally that rewards patience and strategic positioning. #AltSeason #CryptoMarket #BTCDominance #HODLStrategy"

OFFICIAL TRUMP Main trend. 16 05 2025Logarithm. Time frame 3 days. After a super pump and a drive of "stupid money", a descending channel was formed on a natural dump. The price came out of it. Now a triangle is forming. The price is clamped. The reversal zones and percentages to the key support/resistance levels are shown extremely accurately according to TA.

If there is no aggressive exit in the medium term, then there will be consolidation and, as a consequence, the formation of a horizontal channel "sholtai / chattai", its key zones are shown.

Now, this "cryptocurrency" is now on 16 05 2025 in 41st place by capitalization.

Reductions from the price highs are about -90%.

From the liquid zone about -84%.

These are not the minimum values of the decline of such hype cryptocurrencies. Just take this into account in your money management. For clarity, the level zones and the % of potential decline if the trend breaks again are shown on the chart (pull the chart down).

Even with such a decline, the price is now at a huge profit. I am not speaking for the creators of the cryptocurrency, but for the first speculators and "investors" who may not have sold everything on the hype.

For the creators of the cryptocurrency, perhaps these are manipulators close to the Trump family, for them, any sale is super profit. But in order to sell, you need to maintain liquidity, and from time to time make interest in speculation and asset retention by investors, that is, do pumps and hype. Use this, and do not be greedy...

Levels and zones, pump/dump, which the price will "feel" are shown in advance. Click "play" on the chart and move the chart up. With a high degree of probability, the hype and pumping of the price of this cryptocurrency will be repeated, given the hype and the long term of the political figure whose name this cryptocurrency bears. Now it is a Trump dump, in the future it will become a Trump pump for some time.

Do not forget to sell on the next hype. If you understand that you are very greedy, and the news background affects you, then sell in parts, or use stop losses to protect profits.

There is no need to guess the minimums and maximums. It is important to know these zones, and have an acceptable average price, from the position of the trend, and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

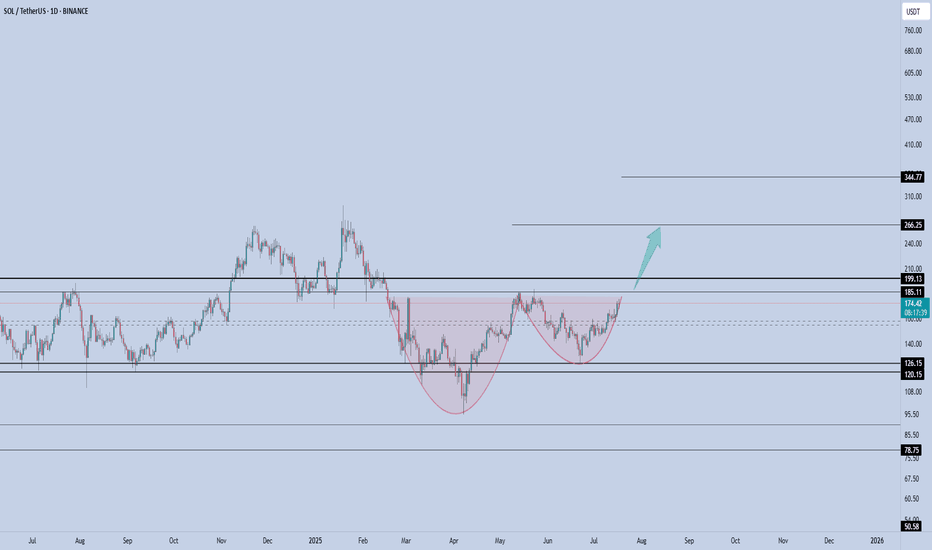

Solana - The Cup is Almost FullSolana is printing a textbook cup & handle formation on the daily, and price is now pressing against the neckline resistance near $185, just below the psychological $200 zone.

This structure reflects months of accumulation and rising momentum. A confirmed breakout above the $185–$199 resistance would likely trigger the next upward leg.

This setup signals trend reversal continuation, and if SOL closes above $199 on high volume, momentum traders may pile in quickly.

📌 Invalidation below $150 = pattern risk-off.

ATOM (COSMOS)🔹 Accumulation Phase in Play

We’re currently sitting in a clear accumulation zone — price is holding steady, showing signs of position-building by stronger hands.

📈 The next key areas are distribution zones, all of which are already marked on the chart. If you're entering a position now, odds are high you'll be able to secure profits as we move up. Just make sure to set a stop-loss — and don’t get greedy if you're aiming for the top.

⚠️ Even though it’s less likely, there’s a small chance of a shakeout near the yellow zone, but I personally doubt it — the market is already heavily shaken, sentiment is fearful, and many have been waiting for a move for too long.

🕰️ We’re also running out of time — the 4-year cycle is coming to a close by the end of this year. Historically, this aligns with significant market moves