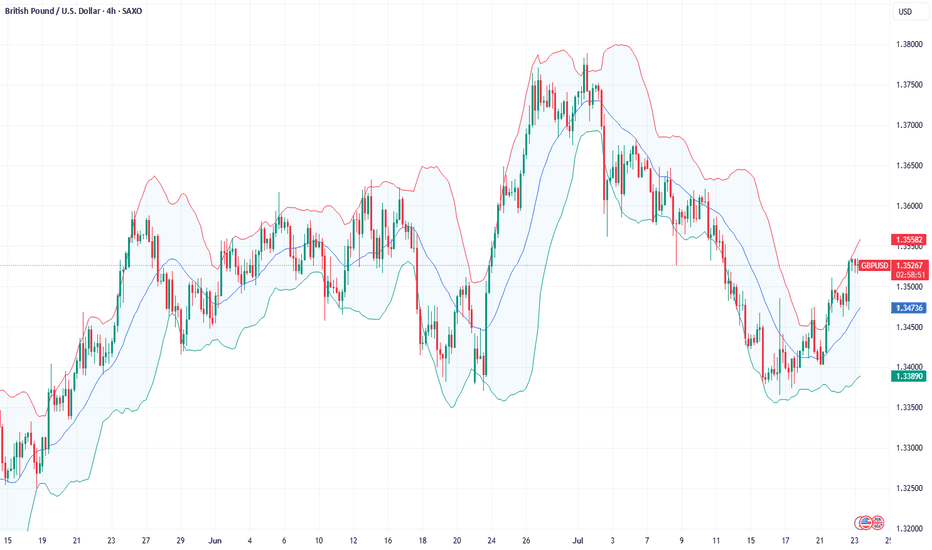

Fundamental Market Analysis for July 23, 2025 GBPUSDSterling is struggling to hold above 1.35 as fundamentals tilt against it. US CPI has accelerated to 2.7 % y/y, reinforcing expectations that the Fed will delay its easing cycle, whereas in the UK subdued GDP growth and a cooling labour market have revived talk of a Bank of England rate cut as early as August.

Political noise adds to the pressure: London must balance the US’s hard‑line trade stance with the need to mend ties with the EU, heightening uncertainty for businesses. Meanwhile, capital is flowing toward higher‑yielding US Treasuries, sapping demand for UK assets.

The situation is compounded by Britain’s persistent current‑account deficit, which—amid a stronger dollar—requires ever‑higher risk premia to finance. All told, short positions in cable with a tight stop above 1.35750 look attractive in the short run.

Trade recommendation: SELL 1.35250, SL 1.35750, TP 1.34750

Analysis

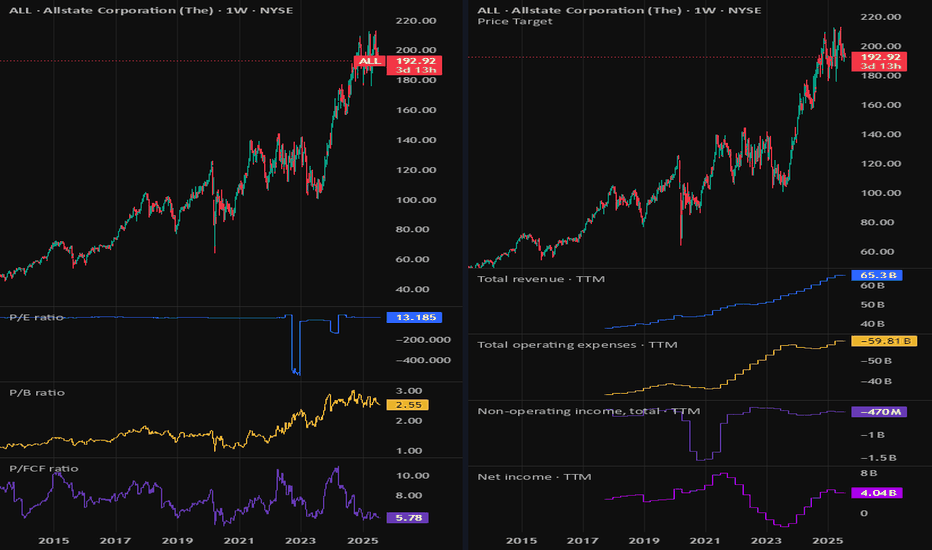

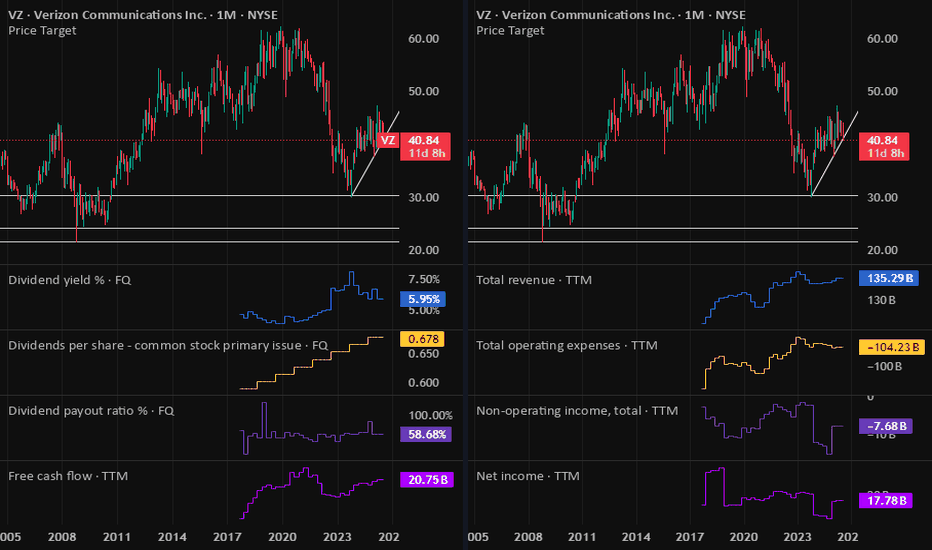

VZ: Verizon stock update after earningsVerizon jumped on positive results, which aligned with my bullish view on it.

Tomorrow will have its competitors T-Mobile & AT&T earnings result, this will update us on the industry as well. Most probably that I will go long on it in the next 24Hr.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

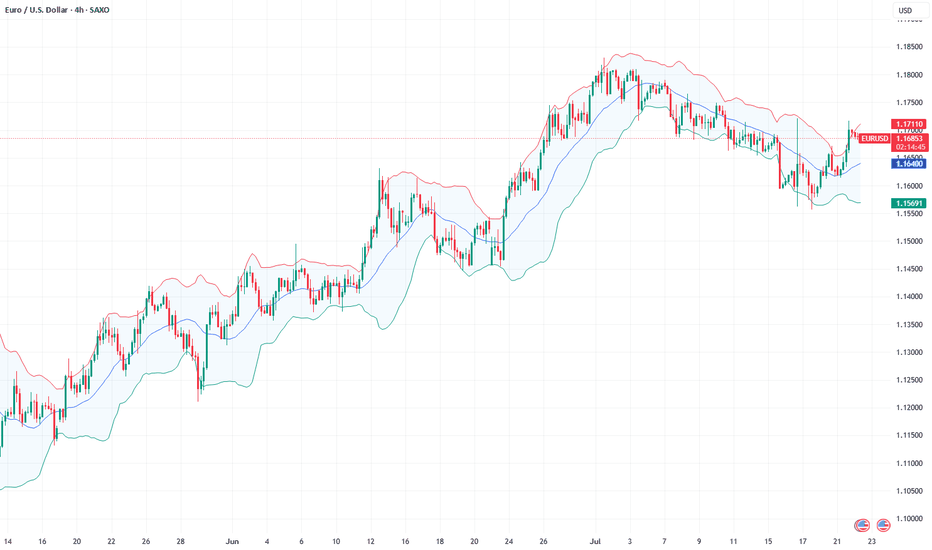

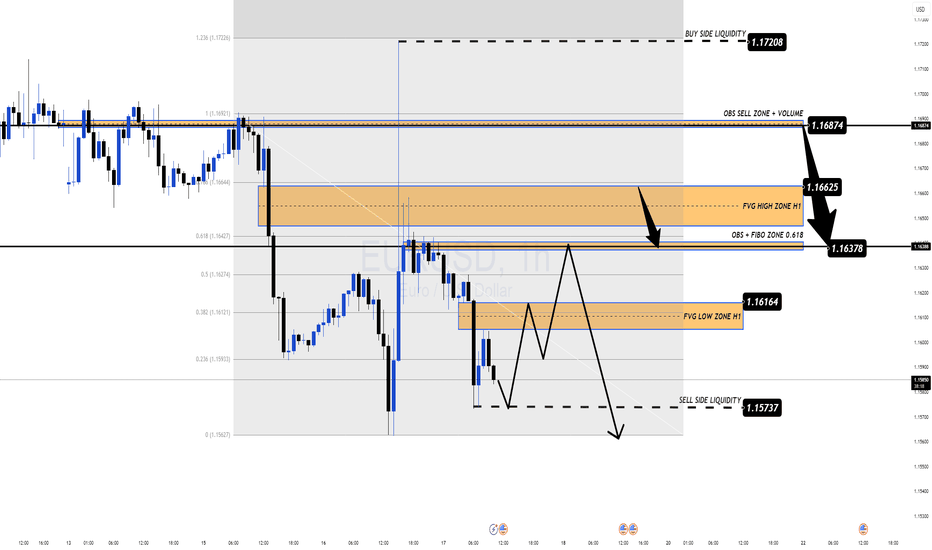

Fundamental Market Analysis for July 22, 2025 EURUSDThe euro is trading near 1.1700, having retreated from an intraday high of 1.1720 after the release of the final June U.S. CPI figures, which confirmed a slowdown in inflation to 2.7% y/y and 0.1% m/m while keeping the core reading steady at 3.1%. The brief rise in risk appetite quickly gave way to stronger demand for the dollar as the probability of the Fed’s first rate cut in September fell from 65% to 55%.

Additional pressure on the euro comes from the yield differential: 10-year U.S. Treasuries hover around 4.45%, while German Bunds yield only 2.30%. The gap of more than 215 bp encourages capital to flow from the eurozone into dollar assets, supporting USD demand.

Fundamentally, risks for the euro remain tilted to the downside: after June’s rate cut the ECB said further moves depend on price dynamics, and the eurozone composite PMI dropped to 50.1 – the brink of stagnation. Against the backdrop of weak continental activity and moderate yet persistent U.S. inflation, the pair may test support at 1.1615 in the coming sessions, especially if U.S. durable-goods orders exceed forecasts.

Trading recommendation: SELL 1.1700, SL 1.1720, TP 1.1615

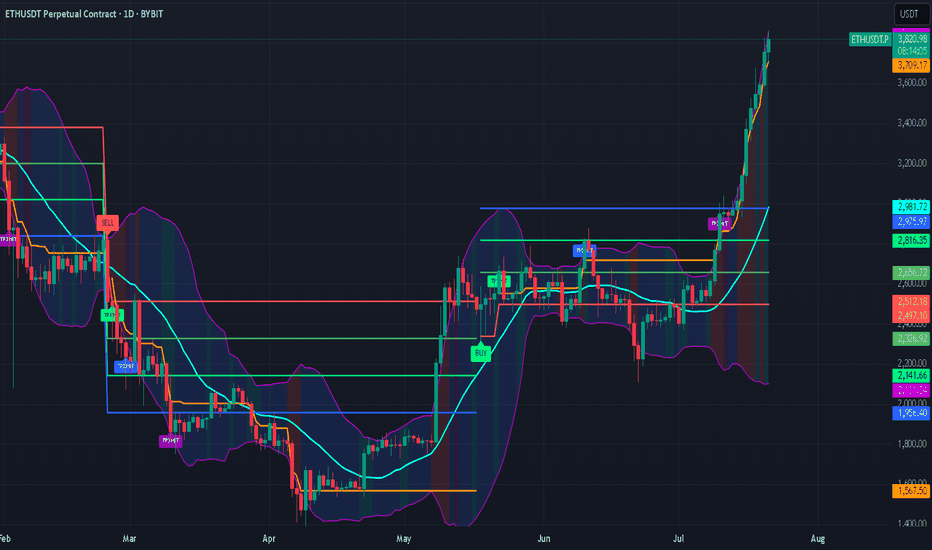

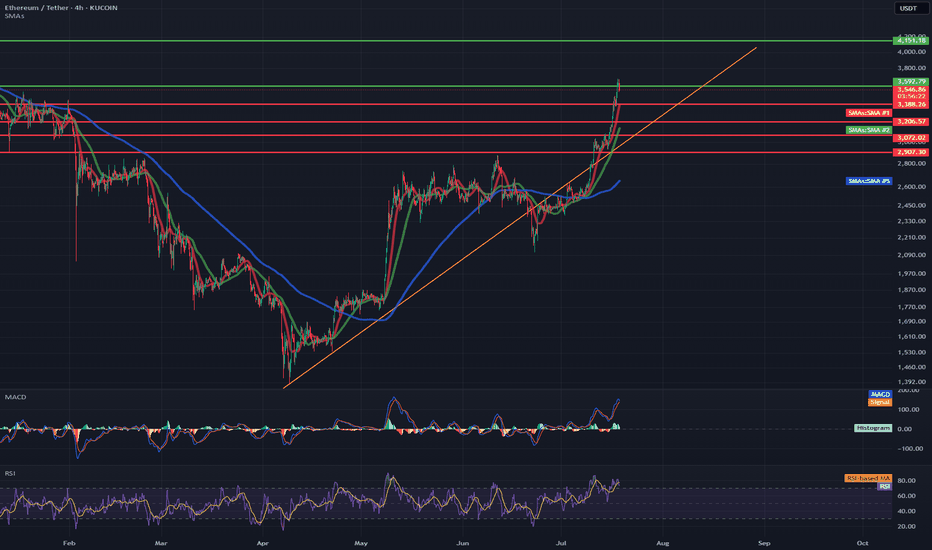

ETH: Huge Reversal or Correction Still in the Horizon?The recent price action in Ethereum (ETH) has left market participants questioning its next major move. With volatility high and sentiment shifting, is ETH headed for a massive reversal, or is a correction still looming on the horizon?

Key Points to Consider

Macro Environment: Global markets are facing uncertainty from shifting interest rates and regulatory developments in crypto. These factors may spark continued volatility for ETH in the near term.

Technical Analysis: ETH has many analysts watching key support and resistance areas. A clean break above resistance could signal a reversal, while a failure to hold recent gains may suggest a correction is not over yet.

On-Chain Data: Activity on the Ethereum network, including DeFi usage and staking patterns, can offer clues as to whether accumulation or distribution is taking place.

Market Sentiment: Traders remain divided, with some calling the recent bounce a bull trap, and others anticipating renewed upside momentum.

My Take

While the case for a reversal is gaining strength, the possibility of a broader correction can’t be dismissed. It’s crucial for investors to stay alert, watch the charts, and position size accordingly. I'm not longing any crypto in the short run...As for the long run, extremely BULLISH!

*not investment advice*

#Ethereum #Crypto #Investing #MarketAnalysis #Web3 #crypto #bitcoin #trading

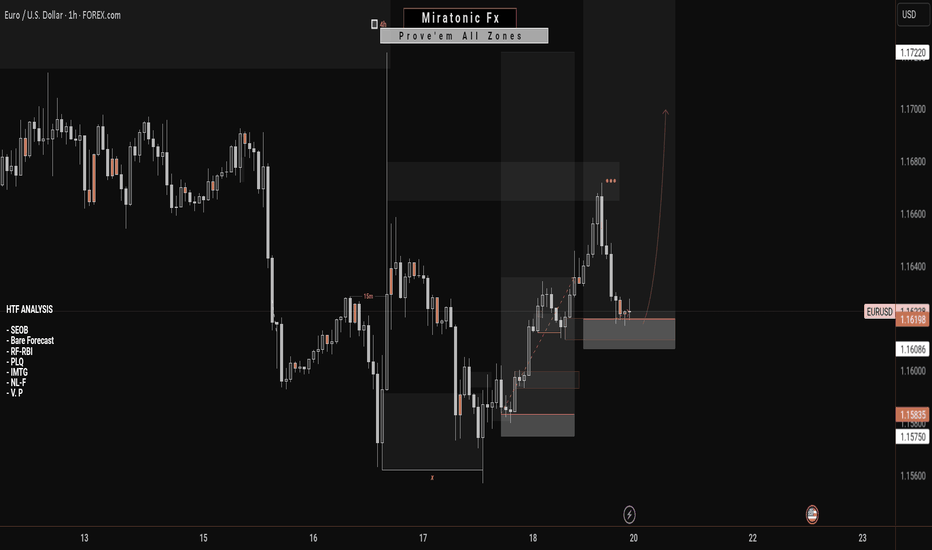

EURUSD Bullish ProjectionIt’s been a while since my last update here.

Here’s my projection and actual entry/entries on EURUSD, based on a sweep of the previous 1H swing low and mitigation of a Daily imbalance (Fair Value Gap).

We're anticipating a full Change of Character to mark the end of the ongoing Daily pullback.

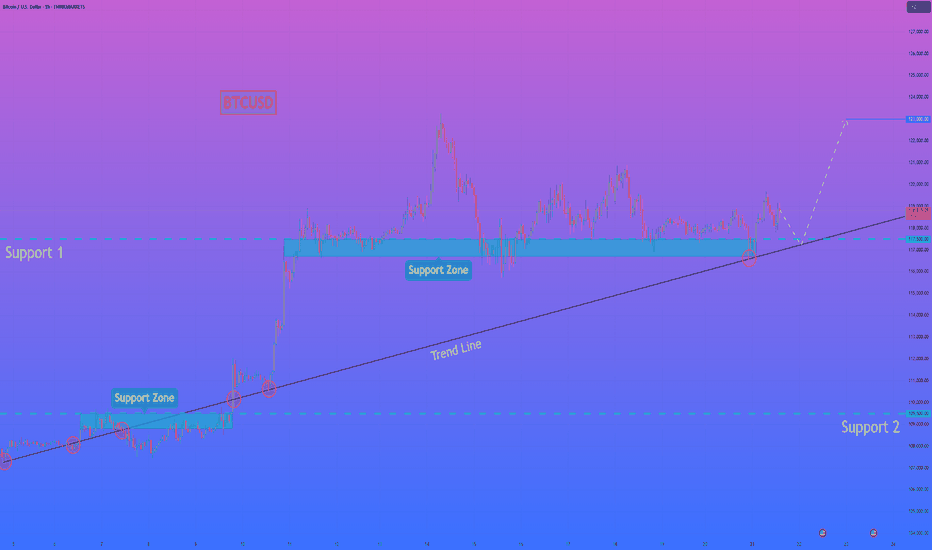

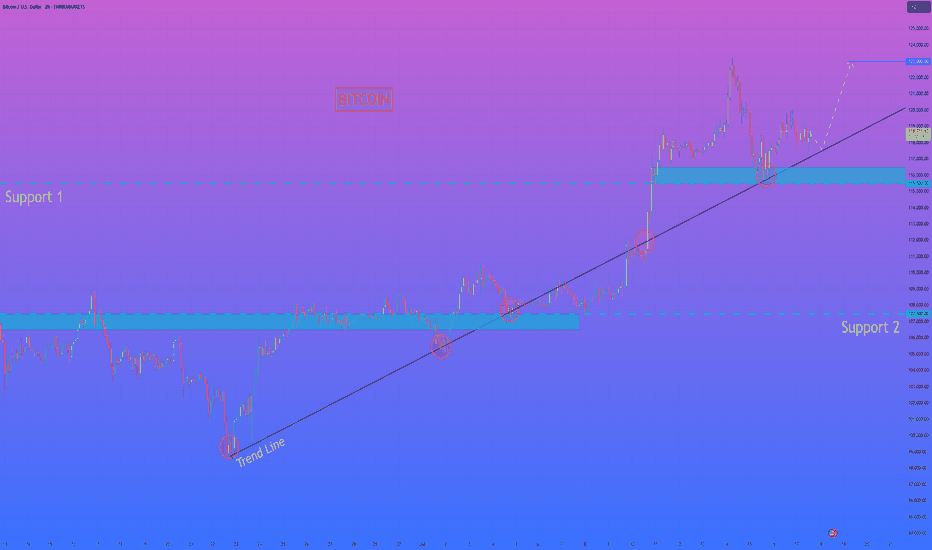

HelenP. I Bitcoin will rebound from trend line and rise to $123KHi folks today I'm prepared for you Bitcoin analytics. If we look at the chart, we can see a very clear and long-term bullish structure. The entire uptrend is supported by a major ascending trend line that has acted as a reliable foundation for the price for a significant amount of time. Currently, the price is consolidating above this crucial trend line and is interacting with the key support zone between 117500 and 116700 points. I believe that the most probable scenario here is a brief corrective move downwards for the price to properly retest the main ascending trend line. This type of retest is often a healthy sign in a strong trend, as it allows for the confirmation of support and gathers momentum for the next leg up. A strong rebound from this trend line would serve as a powerful signal that the buyers are still in control. Therefore, once the price confirms its bounce from this dynamic support, the path should be clear for a continuation of the uptrend. For this reason, my primary goal for this trade idea is set at the 123000 points. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

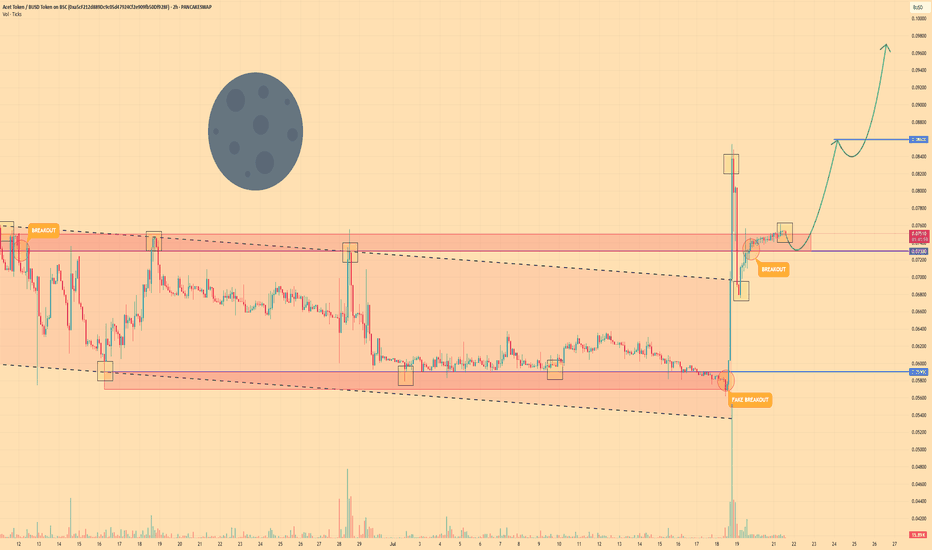

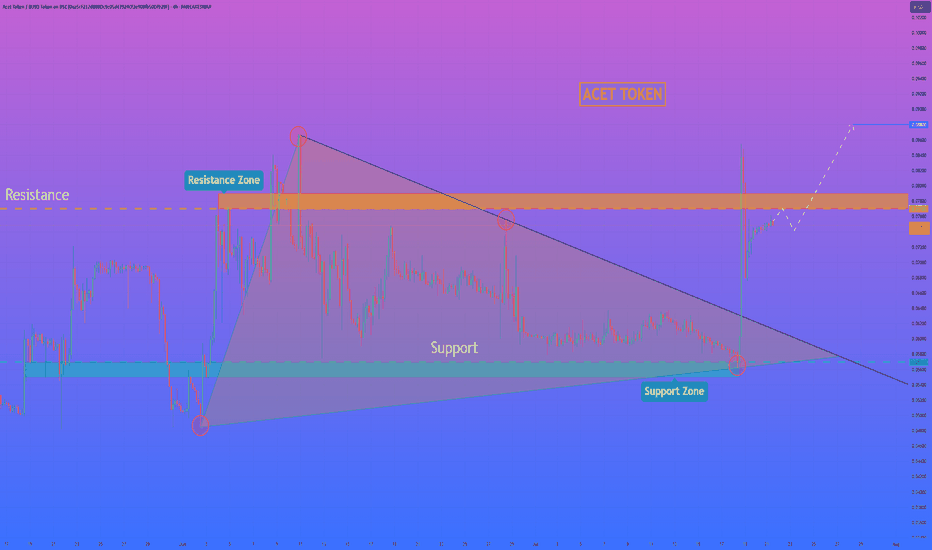

ACT TOKEN - Price can fall to support area and then bounce upHi guys, this is my overview for ACTBUSD, feel free to check it and write your feedback in comments👊

The price was trading within a descending channel for a considerable period.

The asset consistently found support at the lower boundary of this formation, within the 0.0590 - 0.0570 price zone.

Recently, a strong upward impulse allowed the price to break out from the upper boundary of the channel.

Following the breakout, the price executed a corrective move back to the broken resistance line, successfully retesting the 0.0730 - 0.0750 area.

This zone is now acting as a new support level, and the price has begun to move upwards from it, showing renewed buyer strength.

I expect that the asset will continue its growth from this support. My first target is set at the 0.0860 level, with the second target at 0.0970 points.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

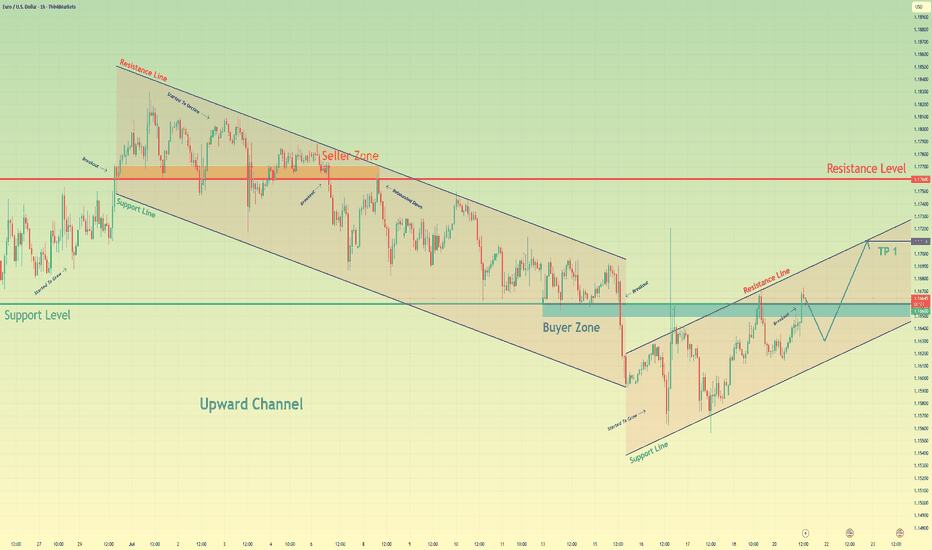

Euro may correct a little and then continue to rise in channelHello traders, I want share with you my opinion about Euro. Observing the recent price action, we can map out a clear transition in market structure. Previously, the pair was contained within a well-defined downward channel, where the seller zone around the 1.1760 resistance level consistently capped rallies, leading to multiple breakdowns and correctional movements. However, after a final push lower, the dynamic shifted, with the price action showing a clear downtrend-to-uptrend reversal. Currently, the euro has established a new upward channel, finding solid ground in the buyer zone around the 1.1660 support level. The price is now engaged in a constructive upward movement within the boundaries of this new channel. The prevailing hypothesis is that after a potential minor correction towards the channel's support line, the pair will resume its ascent. Therefore, the take-profit target for this scenario, tp 1, is strategically placed at 1.1710, as this level directly corresponds with the resistance line of the current upward channel, representing a logical point for price to react. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

HelenP. I Acet Token may make correction and then continue growHi folks today I'm prepared for you Act Token analytics. If we look at the chart, we can observe a clear technical picture. For a considerable amount of time, the price was tightly compressed inside a large downward wedge, defined by a robust support zone at 0.0570 - 0.0550 and a descending trend line that put consistent pressure on the price. Such long consolidation periods often precede a powerful expansion. Recently, we have witnessed a decisive breakout from this wedge, confirmed by a strong impulse candle. This move signals a clear shift in market sentiment from neutral to bullish and invalidates the prior constraining structure. I believe that the momentum from this breakout will be sufficient to challenge the next major obstacle: the horizontal resistance zone at 0.0770 - 0.0790. This is a critical level to watch, as it has previously rejected price advances. My scenario implies that after potentially a small, healthy correction or retest, the price will continue its upward movement. A successful break above this critical area would confirm the newfound strength of the buyers and open up a clear path for further appreciation. For this reason, my primary goal, the logical target for this move, is set at the 0.0880 level. If you like my analytics you may support me with your like/comment ❤️

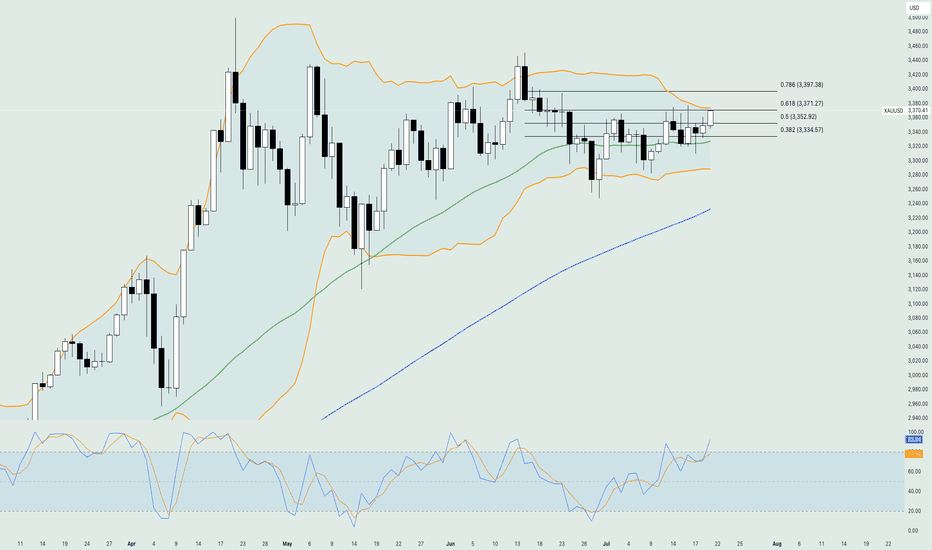

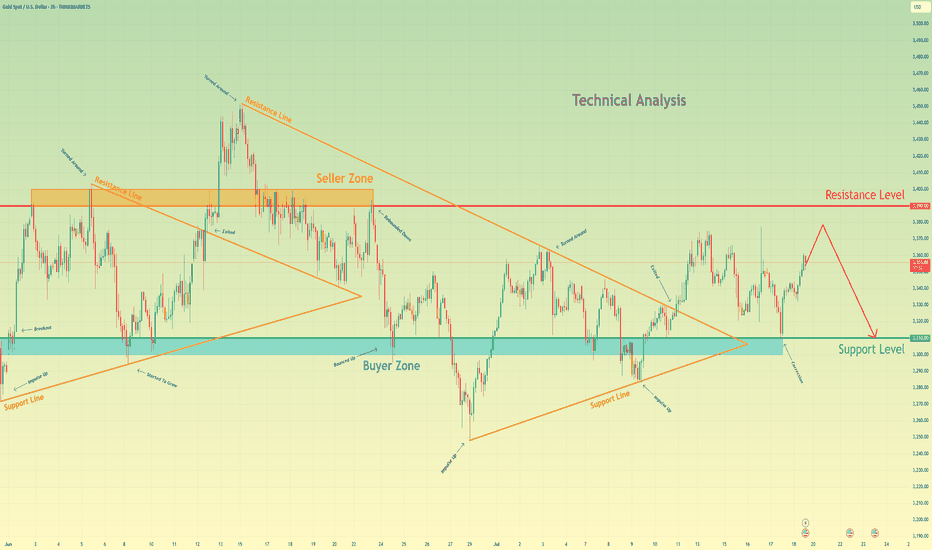

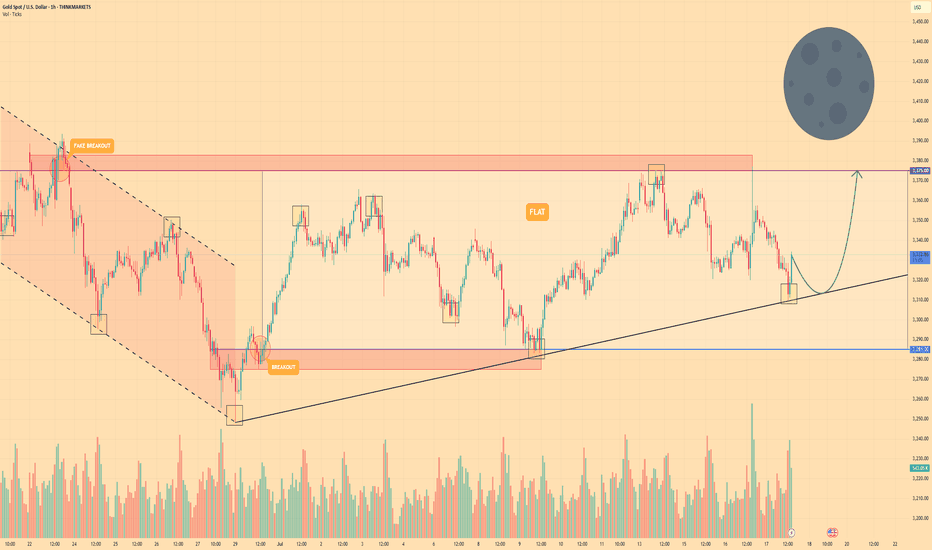

Gold - DAILY- 21.07.2025Gold held steady near $3,350 an ounce as markets opened Monday, with traders assessing mixed signals from Federal Reserve officials on the inflation impact of Trump’s tariff plans. Some Fed governors, like Waller and Bowman, signaled openness to rate cuts, while others remain cautious due to inflation risks. Trump continues pressuring the Fed to lower rates, with speculation about replacing Chair Jerome Powell. Meanwhile, EU officials are preparing for potential trade fallout as Trump’s Aug. 1 tariff deadline approaches. Gold is up over 25% this year, driven by geopolitical tensions and demand for safe-haven assets.

From a technical point of view, the price of gold found sufficient support on the 38.2% of the weekly Fibonacci retracement level and is currently testing the resistance on the 50% around $3,355. The moving averages are confirming the overall bullish trend in the market, while at the same time, the Stochastic oscillator is near the extreme overbought level, hinting at a potential bearish correction move in the upcoming sessions. The Bollinger bands are quite expanded, showing that volatility is there to support any short-term move to either side, while the level around $3,380 is the first major technical resistance area consisting of the upper band of the Bollinger bands and the 61.% of the weekly Fibonacci retracement level.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

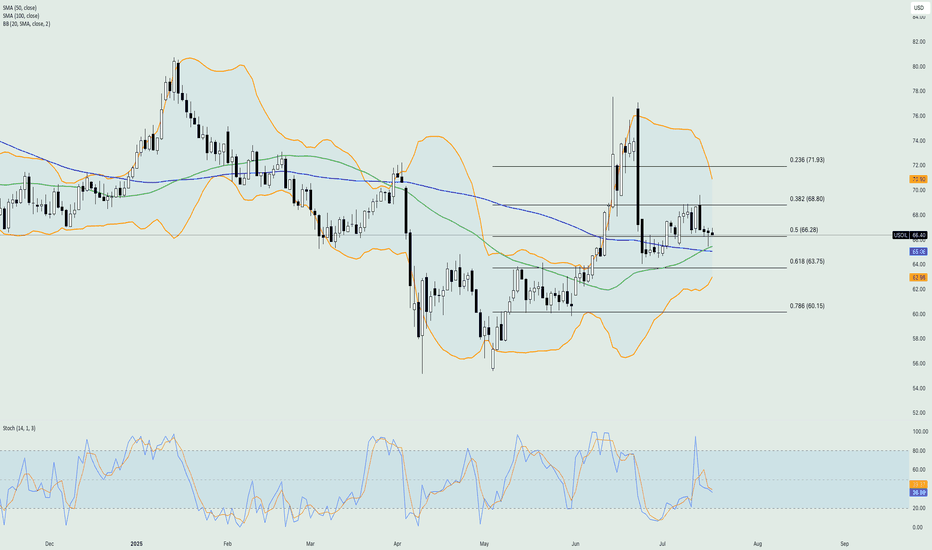

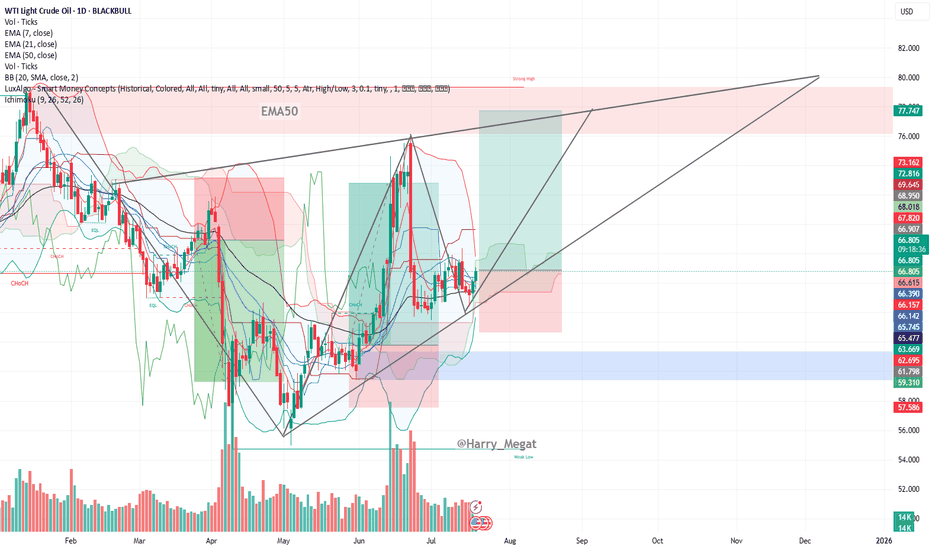

Crude Oil -DAILY- 21.07.2025Oil prices were steady after their first weekly decline this month, as attention shifted to U.S. trade negotiations and the European Union’s push to tighten restrictions on Russian energy exports. The EU is preparing new sanctions, including a lower price cap on Russian crude, limits on fuel refined from Russian oil, banking restrictions, and bans targeting an Indian refinery and Chinese firms. Despite western sanctions, Russian oil continues flowing to China and India. Meanwhile, diesel margins in Europe remain strong, signaling tight supply.

On the technical side, the price of crude oil has failed to break below the major technical support area, which consists of the 50-day simple moving average and the 50% of the weekly Fibonacci retracement level. The Stochastic oscillator has been in the neutral level since last week hinting that there is potential for the price to move to either direction in the near short term. On the other hand, the Bollinger bands have contracted rather massively showing that volatility has dried up therefore, the recent sideways movement might extend in the upcoming sessions.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

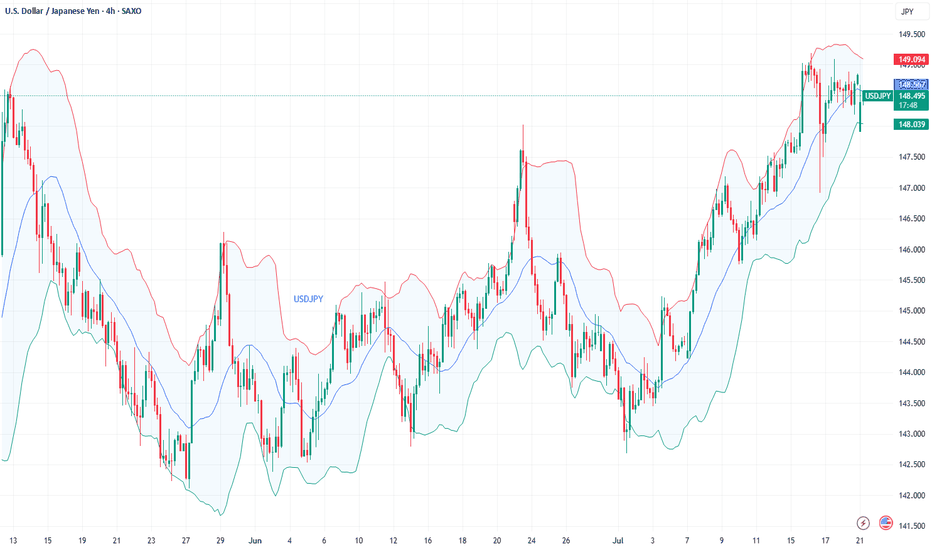

Fundamental Market Analysis for July 21, 2025 USDJPYThe pair opened the week near 148.500, clawing back ground after Sunday’s upper‑house election saw Japan’s ruling LDP‑Komeito coalition lose its majority. The outcome clouds the fiscal outlook and raises the probability of additional stimulus, a combination that tends to undermine the yen as investors anticipate higher public borrowing and a looser policy mix.

At the same time, subdued inflation and stagnant real wages have pushed expectations of Bank of Japan tightening into late‑2025 at the earliest. With the 10‑year US‑Japan yield gap hovering near yearly highs, capital continues to flow from low‑yielding JGBs into higher‑yielding US assets, reinforcing dollar demand against the yen.

Dollar strength is also underpinned by persistent tariff worries and a Federal Reserve that maintains a cautious stance rather than rushing to cut rates. Given these fundamentals, USDJPY could retest the psychological 150.000 barrier, while dips below 147.500 are likely to be viewed by the market as opportunities to re‑establish long positions rather than the start of a deeper correction.

Trading recommendation: BUY 148.500, SL 147.500, TP 149.500

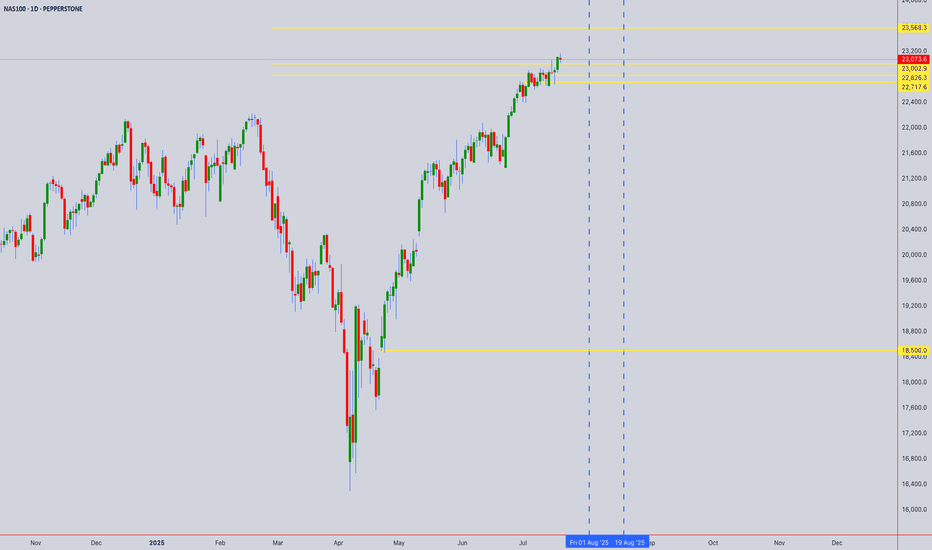

US100 (NASDAQ 100) 24-Hour Technical Analysis ForecastCurrent Price: 23,076.60 (Close: Friday, July 18th, 2025)

Analysis Period: Next 24 Hours (July 19-20, 2025)

Market Status: Weekend - Preparing for Monday Open

---------------------------------------------------------------------------------------------

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bullish (Short-term consolidation expected)

Key Resistance: 23,150 - 23,250

Critical Support: 22,850 - 22,950

Expected Range: 22,900 - 23,200

Volatility Level: Moderate (Tech earnings season approach)

---------------------------------------------------------------------------------------------

1. CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

---------------------------------------------------------------------------------------------

Pattern: Small-bodied candle with upper shadow at 23,076

Significance: Indecision after testing resistance near 23,150

Volume: Above-average volume suggesting institutional activity

Context: Failed to break cleanly above psychological 23,100 level

---------------------------------------------------------------------------------------------

Expected 24H Patterns

---------------------------------------------------------------------------------------------

Monday Gap: Potential small gap up to 23,100-23,120 area

Continuation Pattern: Bullish flag/pennant formation developing

Key Reversal: Watch for hammer formation at 22,950 support if decline occurs

---------------------------------------------------------------------------------------------

Pattern Probability Assessment

---------------------------------------------------------------------------------------------

Doji/Spinning Top: 40% probability (continued indecision)

Bullish Engulfing: 35% probability (if gap up occurs)

Bearish Reversal: 25% probability (if resistance holds)

---------------------------------------------------------------------------------------------

2. HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

---------------------------------------------------------------------------------------------

Primary Pattern: Bullish Cypher Pattern in Development

---------------------------------------------------------------------------------------------

X: 22,400 (previous major low)

A: 23,250 (recent swing high)

B: 22,800 (61.8% retracement)

C: 23,150 (127.2% extension - current test area)

D (Completion): 22,650-22,750 (78.6% retracement zone)

---------------------------------------------------------------------------------------------

Alternative Pattern: Bull Flag

---------------------------------------------------------------------------------------------

Pole: 22,400 → 23,250 (850-point move)

Flag: Current consolidation 22,950-23,150

Target: 23,250 + 850 = 24,100 (extended projection)

---------------------------------------------------------------------------------------------

Fibonacci Levels (24H Focus)

---------------------------------------------------------------------------------------------

Golden Ratio Support: 22,950 (61.8% of recent swing)

38.2% Retracement: 23,025

23.6% Retracement: 23,050

Extension Target: 23,375 (161.8% projection)

---------------------------------------------------------------------------------------------

3. ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count (Bullish Scenario)

---------------------------------------------------------------------------------------------

Macro Structure: Wave 5 of larger degree impulse in progress

Current Position: Wave 4 correction completing

Mini-wave Count: Flat correction pattern (A-B-C structure)

---------------------------------------------------------------------------------------------

24-Hour Wave Projection

---------------------------------------------------------------------------------------------

Wave A: 23,250 → 22,800 (Completed)

Wave B: 22,800 → 23,150 (Completed - 70% retrace)

Wave C: 23,150 → 22,950 (In Progress - Equal to A)

Wave 5 Target: 24,000-24,200 (1.618 extension)

---------------------------------------------------------------------------------------------

Alternative Count (Corrective Scenario)

---------------------------------------------------------------------------------------------

Structure: Double zigzag correction

Current Phase: Second zigzag development

Target: 22,750-22,850 (Wave Y completion)

---------------------------------------------------------------------------------------------

Critical Elliott Levels

---------------------------------------------------------------------------------------------

Wave 4 Low: 22,750 (must hold for bullish count)

Invalidation: Below 22,400 (Wave 1 high)

Confirmation: Break above 23,250 (Wave 3 high)

---------------------------------------------------------------------------------------------

4. WYCKOFF THEORY - 24H PHASE

Current Market Phase Assessment

---------------------------------------------------------------------------------------------

Primary Phase: Reaccumulation (Phase B-C transition)

Composite Operator Action: Testing supply at 23,150 area

Volume Analysis: Absorption of selling pressure evident

Smart Money Activity: Institutional buying on dips below 23,000

---------------------------------------------------------------------------------------------

Expected 24H Wyckoff Dynamics

---------------------------------------------------------------------------------------------

Phase Progression: Moving toward Phase D (Sign of Strength)

Testing Action: Final test of support at 22,950-23,000

Volume Expectation: Declining volume on any weakness

Breakout Setup: Spring action possible below 22,950

---------------------------------------------------------------------------------------------

Key Wyckoff Signals (24H Watch List)

---------------------------------------------------------------------------------------------

Sign of Strength (SOS): Break above 23,150 with volume

Last Point of Support (LPS): 22,950 area test

No Supply: Expected on rallies to 23,100-23,150

Backup to Edge of Creek: Potential dip to 22,850

---------------------------------------------------------------------------------------------

5. W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

---------------------------------------------------------------------------------------------

Current Position: 23,076° on Gann wheel

Next Cardinal Point: 23,100° (significant psychological resistance)

Natural Support: 23,000° (perfect square - strong magnetic level)

Critical Angle: 22,900° (45-degree angle support from recent low)

---------------------------------------------------------------------------------------------

Time Theory - 24H Cycle

---------------------------------------------------------------------------------------------

Natural Time Cycle: 24-hour cycle from Friday's close

Critical Time Windows:

---------------------------------------------------------------------------------------------

6 hours: 02:00 UTC Monday (potential turn time)

18 hours: 14:00 UTC Monday (major turn potential)

24 hours: 20:00 UTC Monday (cycle completion)

---------------------------------------------------------------------------------------------

Angle Theory Application

---------------------------------------------------------------------------------------------

Rising 45° Line: Currently at 22,950 (critical support)

Rising 63.75° Line: 23,100 (steep resistance angle)

Declining 26.25° Line: 23,150 (gentle resistance)

---------------------------------------------------------------------------------------------

Gann Price Forecasting

---------------------------------------------------------------------------------------------

Square Root Method:

---------------------------------------------------------------------------------------------

Current: √23,076 ≈ 151.9

Next resistance: 152² = 23,104

Major resistance: 153² = 23,409

---------------------------------------------------------------------------------------------

Primary Target: 23,104 (natural Gann resistance)

Extended Target: 23,409 (next perfect square)

---------------------------------------------------------------------------------------------

Time-Price Harmony

---------------------------------------------------------------------------------------------

Harmonic Time: 144 hours from last major low

Price Harmony: 23,076 in harmony with 22,500 base

Next Harmony Level: 23,400 (Fibonacci price relationship)

---------------------------------------------------------------------------------------------

6. MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Micro Trend: Consolidating triangle pattern

Support: 23,050-23,060 (recent lows)

Resistance: 23,090-23,100 (intraday highs)

Volume Profile: Balanced - no clear direction

RSI (5M): 48-52 range (neutral)

Pattern: Symmetrical triangle (breakout pending)

---------------------------------------------------------------------------------------------

15-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Structure: Bull flag formation

Flag Boundaries: 23,040-23,120

Breakout Level: Above 23,120 (bullish)

Breakdown Level: Below 23,040 (bearish)

Moving Averages: EMA20 at 23,065 (support)

MACD: Consolidating above zero line

---------------------------------------------------------------------------------------------

30-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Primary Pattern: Ascending triangle

Horizontal Resistance: 23,150 (multiple tests)

Rising Support Line: From 22,950 to current levels

Breakout Target: 23,350 (triangle height projection)

Volume: Decreasing (typical triangle behavior)

Bollinger Bands: Contracting (low volatility)

---------------------------------------------------------------------------------------------

1-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Major Structure: Bullish continuation pattern

Cup and Handle: Handle formation in progress

Handle Depth: 7% correction (healthy)

Breakout Level: 23,175 (handle resistance)

Target: 24,000 (cup depth projection)

RSI (1H): 55 (bullish but not overbought)

---------------------------------------------------------------------------------------------

4-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Macro Trend: Strong uptrend intact

Correction Type: Shallow pullback (wave 4 character)

Support Cluster: 22,900-23,000 (multiple confluences)

Resistance Zone: 23,150-23,250

Ichimoku Cloud: Price above cloud (bullish)

Volume Trend: Higher lows pattern (accumulation)

---------------------------------------------------------------------------------------------

7. TECHNICAL INDICATORS MATRIX

Momentum Indicators

---------------------------------------------------------------------------------------------

RSI (4H): 58 (Bullish momentum, room for upside)

RSI (1H): 55 (Neutral-bullish)

Stochastic %K: 62 (Above %D line - bullish)

Williams %R: -35 (Not oversold, upside potential)

---------------------------------------------------------------------------------------------

Trend Indicators

---------------------------------------------------------------------------------------------

MACD (4H): Above signal line, histogram positive

ADX: 35 (Strong trend strength)

Parabolic SAR: 22,950 (supportive)

Supertrend: 22,850 (strong support)

---------------------------------------------------------------------------------------------

Volume Indicators

---------------------------------------------------------------------------------------------

OBV: Rising trend (accumulation pattern)

Volume Rate of Change: Positive

Chaikin Money Flow: +0.15 (buying pressure)

Accumulation/Distribution: Uptrend

---------------------------------------------------------------------------------------------

8. KEY SUPPORT & RESISTANCE LEVELS (24H)

Critical Resistance Levels

---------------------------------------------------------------------------------------------

R1: 23,100 (Psychological + Gann)

R2: 23,150 (Technical resistance + harmonic)

R3: 23,200 (Minor resistance)

R4: 23,250 (Major swing high)

R5: 23,350 (Extended target)

---------------------------------------------------------------------------------------------

Vital Support Levels

---------------------------------------------------------------------------------------------

S1: 23,040 (Immediate support)

S2: 23,000 (Psychological + Gann)

S3: 22,950 (Critical support cluster)

S4: 22,900 (Strong technical support)

S5: 22,850 (Major support zone)

---------------------------------------------------------------------------------------------

9. 24-HOUR TRADING SCENARIOS

Scenario 1: Bullish Breakout (50% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break above 23,120 with volume expansion

Initial Target: 23,180-23,200

Extended Target: 23,300-23,350

Stop Loss (Longs): Below 22,990

Expected Timeline: 12-18 hours from breakout

---------------------------------------------------------------------------------------------

Scenario 2: Continued Consolidation (35% Probability)

---------------------------------------------------------------------------------------------

Range: 23,000-23,150

Trading Strategy: Range-bound scalping

Buy Zone: 23,020-23,040

Sell Zone: 23,120-23,140

Duration: Full 24-hour period

---------------------------------------------------------------------------------------------

Scenario 3: Bearish Breakdown (15% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break below 22,990 on volume

Target 1: 22,900-22,950

Target 2: 22,850-22,900

Bounce Level: 22,800-22,850

Recovery Above: 23,050 negates bearish scenario

---------------------------------------------------------------------------------------------

10. RISK FACTORS & CATALYSTS (24H)

Bullish Catalysts

---------------------------------------------------------------------------------------------

Tech earnings optimism building

AI sector momentum continuation

Institutional portfolio rebalancing (month-end flows)

Strong economic data expectations

Risk-on sentiment from Asia markets

---------------------------------------------------------------------------------------------

Bearish Risk Factors

---------------------------------------------------------------------------------------------

Profit-taking ahead of earnings

Rising bond yields concern

Geopolitical tensions impact

Overbought technical condition worries

Sector rotation out of tech

---------------------------------------------------------------------------------------------

High-Impact Events (Next 24H)

---------------------------------------------------------------------------------------------

Asian market opening (risk sentiment gauge)

Weekend news flow analysis

Pre-earnings positioning

Options expiry effects

Futures gap analysis

---------------------------------------------------------------------------------------------

11. TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M Timeframes)

---------------------------------------------------------------------------------------------

Primary Setup: Triangle breakout trade

Entry Long: Above 23,120

Target: 23,160-23,180

Stop Loss: 23,080

Risk/Reward: 1:2 ratio

---------------------------------------------------------------------------------------------

For Intraday Traders (30M-1H)

---------------------------------------------------------------------------------------------

Strategy: Bull flag continuation

Entry Zone: 23,050-23,070 (on dips)

Target 1: 23,150

Target 2: 23,200

Stop Loss: 23,000

---------------------------------------------------------------------------------------------

For Swing Setup (4H basis)

---------------------------------------------------------------------------------------------

Approach: Pullback buying opportunity

Optimal Entry: 22,950-23,000

Primary Target: 23,350-23,400

Extended Target: 23,600

Stop Loss: 22,850

---------------------------------------------------------------------------------------------

12. CONFLUENCE ANALYSIS

Bullish Confluence at 22,950-23,000

---------------------------------------------------------------------------------------------

Gann Theory: 23,000° perfect square support

Elliott Wave: Wave 4 completion zone

Wyckoff: Last Point of Support (LPS)

Fibonacci: 61.8% retracement level

Moving Averages: EMA 50 confluence

Volume Profile: High volume node support

---------------------------------------------------------------------------------------------

Resistance Confluence at 23,150-23,200

---------------------------------------------------------------------------------------------

Harmonic: Cypher pattern C-point resistance

Previous Structure: Multiple test area

Psychological: Round number resistance

Gann Angles: 63.75° resistance line

Elliott Wave: Wave B completion area

Technical: Flag pattern upper boundary

---------------------------------------------------------------------------------------------

FINAL 24H FORECAST SUMMARY

Most Likely Scenario: Continued consolidation with upward bias, testing 23,150 resistance with potential breakout to 23,200+ levels.

Trading Range Expectation: 22,980 - 23,180 (primary range)

Breakout Levels:

---------------------------------------------------------------------------------------------

Bullish: Above 23,120 → targets 23,200-23,350

Bearish: Below 22,980 → targets 22,900-22,950

---------------------------------------------------------------------------------------------

Key Time Windows:

---------------------------------------------------------------------------------------------

Asian Open: 00:00-02:00 UTC (gap direction)

US Pre-market: 08:00-13:30 UTC (institutional flows)

US Cash Open: 13:30 UTC (volume confirmation)

---------------------------------------------------------------------------------------------

Risk Management Notes:

---------------------------------------------------------------------------------------------

Position sizing should account for tech sector volatility

Weekend gap risk considerations

Earnings season positioning effects

---------------------------------------------------------------------------------------------

Probability Assessment:

---------------------------------------------------------------------------------------------

50% - Bullish breakout scenario

35% - Range-bound consolidation

15% - Bearish breakdown

---------------------------------------------------------------------------------------------

Disclaimer: This analysis is for educational purposes only. Trading involves substantial risk of loss. Always use appropriate risk management and never risk more than you can afford to lose. Past performance does not guarantee future results.

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

VZ: Verizon Earnings tomorrowwith 6% dividend yield and stock price at support level on the lower channel band, this draw attention to the earnings report tomorrow pre-market hours. Focused on future outlook as well.

If all good, I will buy VZ.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

HelenP. I Bitcoin will correct to trend line and then start riseHi folks today I'm prepared for you Bitcoin analytics. The price has been trading in a strong bullish structure, clearly respecting the ascending trend line since the rebound from the 107500 level. Each time the price touched the trend line, it formed a higher low and continued the upward movement. After breaking through the important Support 1 zone (115500–116500), BTC made a strong impulse upward and reached a local high above 122000 points. Currently, the price is making a pullback and moving closer to the trend line again. This area has previously acted as a major point of interest for buyers, and now it's expected to play a key role once more. The support zone and trend line are converging, which makes this level critical for the next move. I believe BTCUSD will bounce from this area and continue its bullish momentum. My goal is set at 123000 points. Given the market structure, higher lows, and strong reaction from the support zones, I remain bullish and expect further growth from current levels. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold may rise a little and then drop to support levelHello traders, I want share with you my opinion about Gold. Initially, gold was trading within a large consolidating pennant, showing both upward and downward impulses as it moved between the converging trend lines. The price eventually saw a breakout from this pattern, followed by a strong impulse up, but this momentum stalled as it approached the major horizontal resistance level at 3390. This level, which corresponds with the upper seller zone, has proven to be a significant barrier for buyers, rejecting the price and confirming a strong seller presence in that area. Currently, the market is in a corrective phase after being rejected from the highs. The price is drifting upwards once again in what appears to be a final retest of the aforementioned seller zone. This slow upward movement lacks the impulsive strength of the previous trend, suggesting that buyers are losing control and sellers are preparing to defend the 3390 resistance level once more. I expect this corrective move to fail upon reaching the seller zone around 3390. After this retest, I anticipate a sharp reversal and the beginning of a new downward trend. The logical target for this move is the major support level at 3310, an area that has historically acted as a strong buyer zone. That is why my TP is set at 3310. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

GOLD - Price may bounce up to $3375 level from support lineHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Initially, the price action was confined within a descending channel before a decisive bullish breakout occurred.

This first breakout triggered a strong upward impulse, setting the stage for the current market structure.

The price is now consolidating in a wide flat range, bounded by support near the $3285 level and resistance at $3375.

An ascending support line is providing dynamic support within this consolidation pattern, indicating underlying buying pressure.

I expect a brief retest of this support line, which should act as a launchpad for the price to move higher.

The primary target for this long setup is the $3375 resistance level, marking the top of the current flat range.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

WTI Crude Oil Daily Chart Analysis (symmetrical triangle)WTI Crude Oil Daily Chart Analysis

**Trend & Structure:**

* The chart displays a **symmetrical triangle** formation, signaling a **potential breakout setup**.

* Price is currently trading around **\$66.78**, gradually rising from its recent consolidation.

* **Higher lows** and **lower highs** indicate a tightening range, which usually precedes a sharp move.

**Support & Resistance:**

* **Support Zone:** Around **\$65.47–\$66.15**, marked by the 50 EMA and prior price reactions.

* **Resistance Levels:**

* **\$68.95** – Short-term resistance and previous peak.

* **\$72.81** – Strong horizontal resistance.

* **\$77.75–\$80.00** – Projected upper trendline zone of triangle.

**Moving Averages (Bullish Setup):**

* EMA 7: **\$66.15**

* EMA 21: **\$66.14**

* EMA 50: **\$65.47**

* All EMAs are aligned in bullish order (7 > 21 > 50), confirming **bullish momentum**.

**Volume Insight:**

* Volume remains relatively steady; a spike in volume with breakout from the triangle would confirm trend continuation.

**Trade Setup Suggestion (based on chart):**

* **Breakout Buy Idea:** If price breaks above **\$68.95–\$70**, potential upside to **\$77–\$80**.

* **Invalidation:** A break below **\$65** would invalidate the bullish structure.

**Conclusion:**

WTI crude oil is trading within a symmetrical triangle, supported by bullish EMAs and tightening price action. A breakout above \$69 could trigger a bullish rally toward \$77–\$80. Keep an eye on volume confirmation and geopolitical headlines that can impact oil fundamentals.

EUR/USD Forecast – Bears in Control Ahead of US Jobless DataEUR/USD Forecast – Bears in Control Ahead of US Jobless Data

🌐 Macro View: Dollar Regains Strength Amid Uncertainty

EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand, while a surprise above 240K may offer a temporary lifeline for the euro.

Amid geopolitical and economic turbulence, the euro continues to underperform as investors shift to the dollar for safety and yield advantage.

📉 Technical Outlook – MMF & Smart Money Perspective

The recent breakdown below 1.1600 confirms the bearish momentum. Based on the MMF (Market Momentum Flow) methodology, price action is currently moving within a controlled distribution structure, suggesting further downside potential.

Key zones identified from H1 structure:

OBS + FVG High Zone (1.1662 – 1.1687): Strong supply zone + volume imbalance.

1.1637: Mid-key level and possible liquidity magnet.

1.1616 – 1.1573: Ideal area for sweeping sell-side liquidity before any sustainable bounce.

If price reclaims 1.1662, intraday bullish correction may be in play. However, as long as 1.1687 holds, bears remain in control.

🧭 Trade Plan for Today

🔴 SELL ZONE: 1.1662 – 1.1687 (FVG + OBS Volume Zone)

SL: 1.1710

TP: 1.1637 → 1.1616 → 1.1590 → 1.1573

✅ Preferred entry zone aligned with high-volume imbalance & MMF rejection pattern.

🟢 BUY ZONE (Scalp Only): 1.1575 – 1.1580 (Sell-side Liquidity Zone)

SL: 1.1550

TP: 1.1612 → 1.1630 → 1.1645

⚠️ Use with caution — only upon clear price reaction at lower liquidity sweep area.

🔍 Strategy Insight

This is a classic scenario of a controlled pullback within a larger bearish structure. Patience is key — let price tap into imbalanced zones before executing. Given today's U.S. data, volatility may spike during the New York session, so risk management is crucial.

💬 What’s Your Take?

Do you expect EUR/USD to retest the 1.1550s zone, or could a surprise from U.S. job data flip the narrative?

👇 Drop your analysis below & follow for more MMF-based setups.

USD/JPY(20250718)Today's AnalysisMarket news:

① Kugler: It is appropriate to keep the interest rate policy stable for "a while".

② Daly: Whether to cut interest rates in July or September is not the most critical.

③ Bostic: It may be difficult to cut interest rates in the short term.

Technical analysis:

Today's buying and selling boundaries:

148.45

Support and resistance levels:

149.80

149.30

148.97

147.93

147.61

147.10

Trading strategy:

If the price breaks through 148.97, consider buying in, the first target price is 149.30

If the price breaks through 148.45, consider selling in, the first target price is 147.93

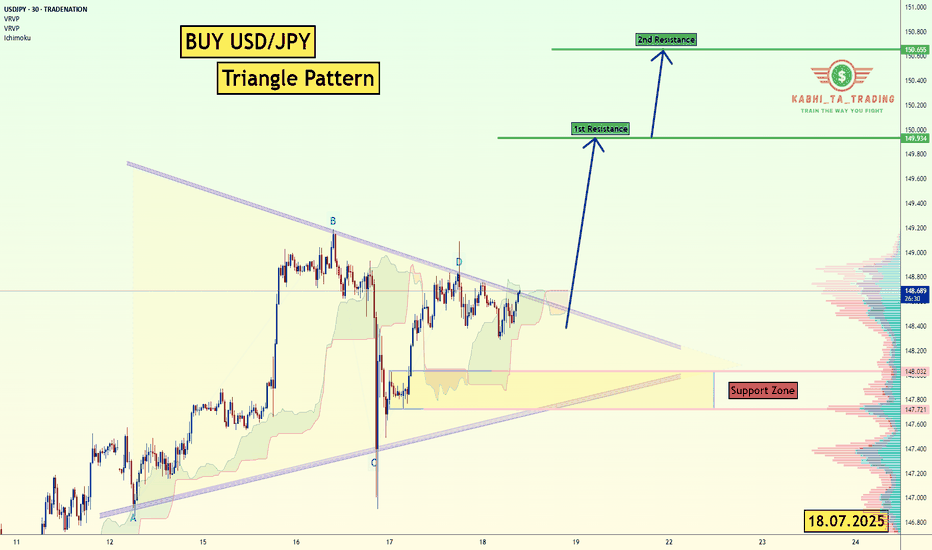

USD/JPY - Triangle Pattern (18.07.2025)The USD/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 149.93

2nd Resistance – 150.65

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

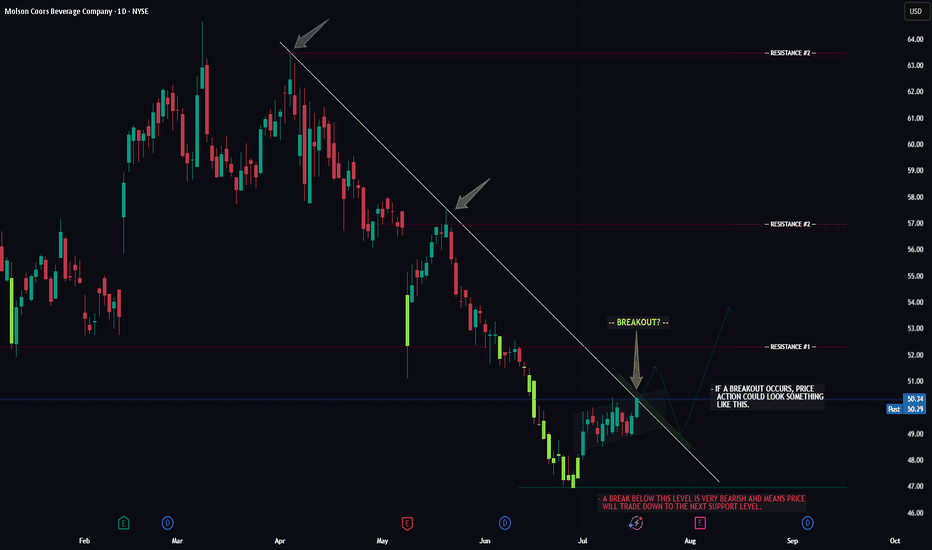

TAP -- Breakout Attempt -- Target LevelsHello Traders!

The chart of TAP (Molson Beer co.) is currently flirting with a major resistance trendline. Now whether or not price can successfully seal the deal and make it too third base remains to be seen.

If price does breakout, watch for a potential retrace to the breakout trendline first, then we could see the larger move to resistance level #1.

If price gets rejected and fails to breakout we could see a move below support before it attempts to breakout again.

Thanks everyone and best of luck with your trading journey!