XAU/USD Outlook: Gold's Bullish Momentum Strengthens 📌 XAU/USD Analysis: Gold on a Strong Bullish Momentum Amid Economic Optimism 📈💰

✨ Overview:

Gold (XAU/USD) is currently demonstrating significant bullish momentum, driven by improved global economic sentiment. The recent 90-day tariff suspension among major global economies and hints from the recent FOMC meeting about potential rate cuts later this year are fueling investor optimism.

📊 Technical Analysis:

🔹 Key Resistance Levels:

3,146

3,162

3,168

🔸 Key Support Levels:

3,096

3,078

3,066

3,052

📈 Moving Averages Analysis:

MA 13 (Short-term): Clearly supports bullish momentum, offering buy signals as price sustains above this MA.

MA 34 (Medium-term): Supporting bullish sentiment with prices comfortably above.

MA 200 (Long-term): Reinforces the robust long-term bullish outlook with price consistently trading above this level.

🚀 Trading Strategy & Recommendations:

BUY Strategy (Preferred Scenario):

Entry Zone: 3,094 – 3,096

Stop Loss: 3,090

Take Profit Levels: 3,100 | 3,104 | 3,108 | 3,112 | 3,116 | 3,120

SELL Strategy (Cautious Approach):

Entry Zone: 3,164 – 3,166

Stop Loss: 3,170

Take Profit Levels: 3,160 | 3,156 | 3,152 | 3,148 | 3,144 | 3,140

🌍 Fundamental Context:

Positive Market Sentiment: The global economic outlook has turned favorable due to tariff suspensions and strong performance in equity markets.

Interest Rate Outlook: Recent signals from the FOMC regarding possible interest rate cuts are providing further support for gold’s upward trajectory.

⚠️ Risk Management:

Emphasize caution when engaging in short positions, given the prevailing bullish conditions.

Always implement strict stop-loss measures and maintain risk-to-reward ratios of at least 1:2.

Avoid over-leverage and ensure trades are sized appropriately.

💡 Conclusion & Final Thoughts:

Gold remains strongly bullish, backed by both technical indicators and a positive fundamental backdrop. Traders are encouraged to focus primarily on buy opportunities near significant support levels and remain alert to potential trend reversals at key resistance zones.

🗨️ Engage with Us:

What are your current strategies for gold? Share your insights and views in the comments section below! 💬👇

Analysis

Fundamental Market Analysis for April 10, 2025 USDJPYThe Japanese yen (JPY) showed strength during the Asian trading session on Thursday, reacting to the release of producer price index (PPI) data that exceeded market expectations. This macroeconomic signal reinforced speculation about possible further monetary policy tightening by the Bank of Japan (BoJ), keeping the probability of an interest rate hike in the future. Additional support for the yen was provided by positive expectations of a potential trade agreement between Japan and the United States.

Amid the weakening of the US dollar (USD), the USD/JPY pair showed a pullback and fell below the psychologically important level of 147.000, which was also supported by a limited correction of the US currency amid a general recovery in market confidence.

The divergence in monetary expectations between the Bank of Japan and the Federal Reserve remains significant. While Japan is increasingly likely to tighten monetary policy, markets in the US are pricing in a scenario of multiple cuts in the Fed's key interest rate in 2025. This discrepancy has prevented the US dollar from maintaining momentum after an overnight recovery from a weekly low, prompting a reallocation of capital in favor of the more stable yen despite its status as a low-yielding currency.

Improved global risk sentiment, driven by US President Donald Trump's announcement of a temporary suspension of retaliatory tariffs against key trading partners, may also help strengthen the yen as a safe haven asset, especially amid continued uncertainty in international markets.

Trade recommendation: SELL 146.800, SL 147.400, TP 145.400

USD/JPY(20250410)Today's AnalysisToday's buying and selling boundaries:

146.66

Support and resistance levels:

150.90

149.32

148.29

145.03

144.01

142.42

Trading strategy:

If the price breaks through 148.29, consider buying, the first target price is 149.32

If the price breaks through 146.66, consider selling, the first target price is 145.03

S&P - What will happen next for the S&P?The S&P 500 has been dropping quickly after Trump's tariff policies were announced. It fell from 5750 to 4900, and is now at 5053, all in just a few days. This is a sharp decline, and sellers are clearly in control right now.

However, after such a big drop, it's common to see a short-term bounce before the market continues to fall. There is strong resistance between 5400 and 5500, which lines up with the golden pocket (a key level in technical analysis). This could make it harder for the S&P to rise past these levels.

Looking further down, there is another strong support area between 4500 and 4600. This level also matches the golden pocket on the daily chart, making it an important point for potential support. If the market keeps falling, we could see this area tested before any significant recovery.

Right now, it seems likely that the market will keep going lower. My main expectation is that we’ll get a small rally first, which could trick some traders into thinking the market is recovering, before continuing down. However, with all the uncertainty around the news and policies right now, it's also possible the market could keep dropping sharply without much of a rally.

Keep a close eye on the markets and stick to good risk management practices. If you don’t, it could really hurt your portfolio. Stay alert and adjust your strategy as things change.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

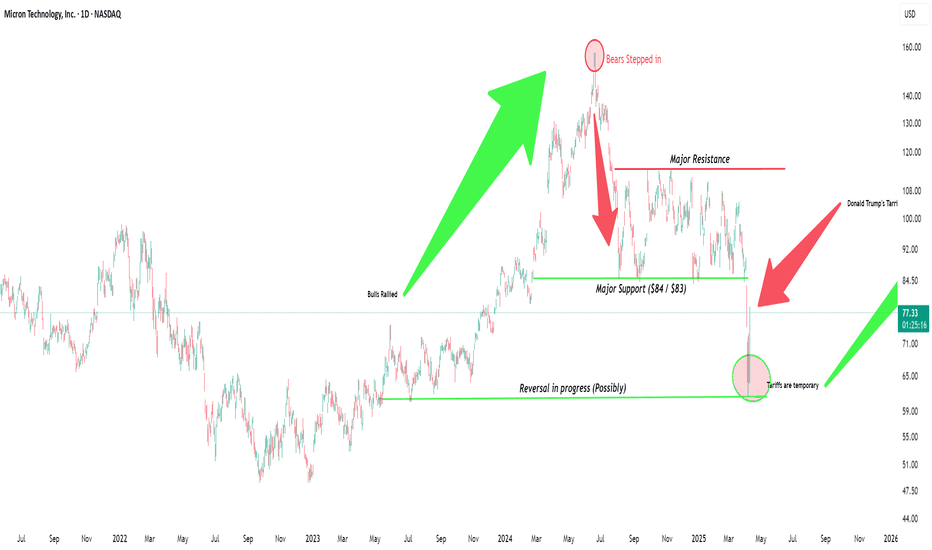

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

CADJPY: Bullish Setup Building — Fundamental AnalysisCADJPY is approaching a major support zone with a strong macro and seasonal backdrop favoring a bullish reversal.

Macro scores (LEI, endogenous) show consistent strength

Seasonality supports upside from late April into May

JPY is overbought per COT data

🔁 However, price structure remains bearish on 4H and Daily, so we are waiting for a confirmed CHoCH and HL before executing a swing long.

This idea is a "watch & prepare" setup — get ready to strike once structure flips.

USDCAD Downtrend Hinges on This SupportFenzoFx—USD/CAD is trading bearishly and failed to form a new higher high above the 1.4297 resistance. A new bearish wave could be triggered if selling pressure drives the price below the 1.4143 support level.

In this scenario, the next bearish target will likely be 1.4028. Please note that the bearish outlook should be invalidated if USD/CAD exceeds 1.4297.

>>> Trade USDCAT at FenzoFx Decentralized Forex Broker

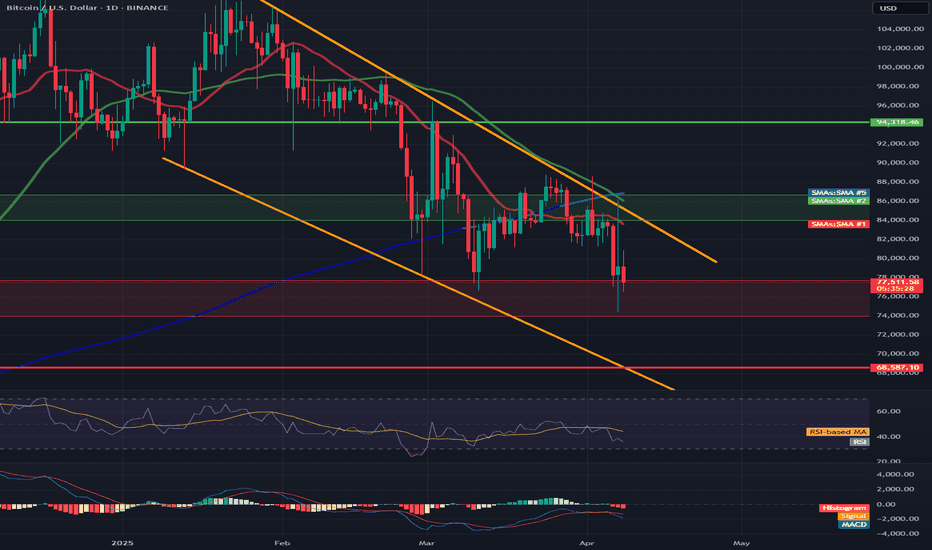

HelenP. I Bitcoin may rebound from resistance zone and fall moreHi folks today I'm prepared for you Bitcoin analytics. After a strong rejection from the second resistance zone between 86700 and 87900 points, Bitcoin lost its bullish momentum. The price attempted to hold within the range but failed to break above the trend line, which has consistently acted as dynamic resistance. This trend line marked the turning point once again, pushing BTC down with increased selling pressure. The price then sharply declined, breaking below the first resistance zone between 78200 and 79500, which is now acting as resistance. This level was previously tested multiple times, making it a key barrier. After breaching this zone, the price dropped even lower and reached the 77000 area, where it found temporary support and began a minor bounce. Currently, Bitcoin is trading just below the resistance zone and remains under the trend line. Sellers are still in control, and the recent bounce looks weak compared to the prior impulse down. Given the rejection from resistance, the position relative to the trend line, and continued bearish pressure, I expect BTC to resume its decline toward 70000 points, which is also my goal. If you like my analytics you may support me with your like/comment ❤️

Euro will break current support level and drop to 1.0735 levelHello traders, I want share with you my opinion about Euro. Recently, the price completed a pennant pattern, which resulted in a breakout to the upside. This breakout, however, didn’t gain much ground - the movement quickly lost momentum inside the resistance area between 1.0955 - 1.0985 points, where Euro sharply turned around. The reversal from this zone wasn’t unexpected, considering this level had already acted as resistance earlier. What followed was a clean break below the current support level at 1.0955 points, which shifted the market structure back to bearish. Now the price is trading lower, and the bearish impulse looks set to continue. My expectation is a further decline toward the support level at 1.0735, which also aligns with the buyer zone between 1.0695 - 1.0735 points. This level may act as the next potential area of interest where buyers could attempt a defence. The invalidation of local support, weakness after the breakout, and strong supply reaction from resistance all point to a high probability of continuation down toward TP 1 - 1.0735 level. Please share this idea with your friends and click Boost 🚀

Markets On Edge: Gold Soars, Dollar Stumbles, Bitcoin Bounces 🔍 Midweek Market Outlook: What’s Driving DXY, Gold & Bitcoin Right Now?

We’re in the middle of one of the most eventful trading weeks of the year.

The U.S. Dollar is retreating under policy pressure

Gold has officially gone parabolic, smashing through $3,000

Bitcoin is pulling back hard, down nearly 30% from its highs

These aren’t just price moves — they’re reflections of real economic stress and shifting capital flows.

In this week’s outlook, I break down:

📌 The key macro drivers behind these moves

📌 How the latest inflation data, Fed tone, and geopolitics are shaping sentiment

📌 Why gold is rallying like it’s 1980 all over again

📌 And what traders should anticipate next on DXY, XAUUSD, and BTCUSD

If you trade or invest in these markets, this is one of those weeks where fundamentals can’t be ignored.

🧠 Insights. 🎯 Forecasts. 🛠️ Trade Prep.

Check it out — link in the comments.

GOLD MARKET UPDATE – Trend Breakouts and Market Structure Shift🟡 GOLD MARKET UPDATE – Trend Breakouts and Market Structure Shift

Gold has broken through both the parallel ascending channel and a narrow triangle pattern at the edges, resulting in a strong buying momentum (FOMO BUY). This move can be attributed to a mild positive shift in the US stock market yesterday, along with some upward momentum in the Asian and European markets today.

📉 Current Situation: It’s still unclear whether this movement is tied to positive news about tariffs, but an important level to watch is 3075 – 3077. If this level is breached, it may be time to reassess the outlook and consider shifting towards a BUY.

💡 Currently, there’s strong buying activity during the European session. It’s recommended to avoid jumping into BUY positions at these levels and to refrain from selling too aggressively.

📌 Scenario for Today: Look for potential BUY opportunities at the important levels 3030 – 3018 during the European session, and stay tuned for updates regarding FOMC tonight.

🔮 Be Cautious: The FOMC meeting will take place later today, which could lead to significant market movements. Be prepared for potential volatility and liquidity sweeps in less liquid areas.

🧭 Key Technical Levels:

🔺 Resistance: 3075 – 3090 – 3110

🔻 Support: 3030 – 3018 – 3000 – 2988 – 2974

🎯 Trade Setup:

🔴 SELL ZONE: 3074 – 3076

SL: 3080

TP: 3070 – 3066 – 3062 – 3058 – 3054 – 3050 – 3040

🟢 BUY ZONE: 2976 – 2974

SL: 2970

TP: 2980 – 2984 – 2988 – 2992 – 2996 – 3000

📌 Reminder: The market is currently very sensitive, so stick to risk management rules, ensure full TP/SL implementation, and avoid making hasty decisions.

Be cautious and watch the market movements closely!

— AD | Money Market Flow

Long EURNZD – Seasonal, Fundamentals & Technical ConfluenceWe are entering a long position on EURNZD, capitalizing on a powerful confluence of:

Seasonal EUR strength + NZD weakness (April 10 – May 15)

A clear bullish market structure (CHoCH, HH/HL)

A clean Fibonacci retracement entry at 0.5

Strong macro divergence, with NZD exogenous conditions deteriorating

Macro & Seasonal Context

EUR enters a strong seasonal uptrend from April 10 to end of month

NZD shows seasonal weakness from April 15 onward

NZD’s exogenous model score worsened to -12 in April

While NZD LEI and endo improved, it remains structurally weak

Timing

Best execution: on pullback to 1.9373 zone, ideally between April 10–15, aligned with seasonal entry window.

BTC at a Critical Inflection Point – Bulls vs. BearsBitcoin is currently trading around $77,644, sitting right between two major trendlines:

🟢 Long-Term Bullish Support – This green ascending trendline has held since late 2023, providing key support throughout BTC’s macro uptrend.

🔴 Medium-Term Bearish Resistance – The red descending trendline has capped price since the 2025 highs, forming a clear structure of lower highs.

We're now at a pivotal confluence zone where these two trendlines intersect. Price recently bounced off the green support, but it's struggling to decisively break above the red resistance.

🔍 Key Scenarios:

✅ Bullish Breakout:

A strong daily close above the red trendline could confirm bullish continuation.

Targets: $84K, GETTEX:92K , and potentially ATH breakout above $100K.

❌ Bearish Rejection:

Rejection at resistance may lead to a retest of the green trendline (~$74K).

A breakdown from there opens the door to GETTEX:64K –$60K, or even deeper pullbacks.

WHY XAUUSD IS BULLISH ?? DETAILED TECHNICAL AND FUNDAMENTALSXAUUSD is currently showing strong signs of bullish continuation after completing a successful retest of the previous breakout zone near the $2,920–$2,950 region. Price action has respected this support beautifully and is now pushing back above $3,040, confirming the bullish structure. This retest and bounce pattern suggests that the market is preparing for a fresh leg higher, with my immediate target set at $3,100. The current structure is aligned with higher highs and higher lows, and momentum is shifting back in favor of buyers.

Technically, the move is clean. The bullish impulse from February to late March created a strong upside leg, followed by a healthy correction into a well-defined demand zone. This demand zone held firm, and the current reaction is supported by increasing volume and bullish candlestick formation on the 12H chart. The inverse head-and-shoulders structure around $2,930 gives this setup even more weight, with a clear breakout above the neckline indicating potential continuation toward higher time frame targets.

From a fundamental perspective, gold remains supported by ongoing geopolitical tensions, increased demand from central banks, and continued inflationary pressure globally. As the market anticipates this week's U.S. CPI data, investors are hedging against uncertainty, which is driving flows into safe-haven assets like gold. The recent pullback in the US dollar index and bond yields is also contributing to upside pressure on XAUUSD, further confirming the bullish outlook.

With both the technical setup and macro drivers favoring upside, I'm looking for continuation toward $3,100 and potentially beyond in the short to mid-term. This area also aligns with the next psychological resistance and projected extension level. As long as price holds above $3,000, any dips should be viewed as fresh buying opportunities. This setup offers an excellent risk-reward ratio for traders looking to capitalize on gold’s ongoing bullish momentum.

EURNZD - at major Resistance: Will it drop to 1.9000?OANDA:EURNZD reached a major resistance level that has previously acted as a strong barrier, triggering some strong bearish momentum. This zone can be a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 1.9000 level . However, a clear breakout above this resistance could challenge the bearish outlook and mean further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Will the support zone keep BTC falling?BTC has once again bounced off the upper border of the downtrend channel. Here, it is worth remembering the long-formed gap around $74,500, which was closed during the last decline.

Here, you can see how the price fell into a strong support zone from $77,742 to $73,980, but if this zone is broken, we can again see a strong decline around also very strong resistance and the lower border of the channel at $68,590.

Looking the other way, you can see that the increases were stopped by the resistance zone from $84,000 to $86,700, only breaking out of this zone at the top will give the possibility of growth towards strong resistance at $94,300.

The RSI is still in the lower part of the range and is again heading towards the lower borders, but here the price has formed a lower low, which can still give another reaction.

EURO - Price can bounce from resistance area to $1.0850 pointsHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

A not long time ago price moved inside a falling channel and showed weak activity with limited growth attempts.

Later Euro made a breakout, exited the channel, and started to form a new bullish structure near resistance.

After that, price made a sharp upward impulse, touching $1.1010 resistance and forming a pennant pattern.

Recently, it broke the lower border of pennant and tested $1.0990 level from below, then bounced down.

Now price trades under local resistance area and holds below broken trendline with weak upward attempts.

In my opinion, Euro can continue to decline and reach $1.0850 support level in the upcoming sessions.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

GOLD MARKET OUTLOOK – Investor Panic After Fake News🟡 GOLD MARKET OUTLOOK – Investor Panic After Fake News, Bearish Bias Remains

📉 Current Strategy: Focus on SELL setups at key resistance zones – short-term bearish outlook remains valid

📌 US Session Recap:

Gold saw a sharp sell-off after a fake news report circulated about the US delaying its planned tariff policy.

→ While the White House later confirmed it was misinformation, the damage was done — panic selling hit across global markets.

💥 As a result, gold dropped aggressively and reached the 295x zone, aligning perfectly with AD’s previous short bias.

Meanwhile, US equities also continued to bleed red.

🧠 Market Sentiment: “Cash is King” is Back

With global instability and fear on the rise:

🔹 Investors are hoarding cash

🔹 USD demand increases, along with inflows into US government bonds

🔹 Risk assets like gold, stocks, and crypto are being dumped

💡 This could be part of Trump’s larger play — forcing global capital to flow back into US Treasuries while applying pressure on speculative markets.

🔮 AD’s View:

Unless we see a clear shift in investor sentiment, the base case remains: → Sell rallies through midweek, then reassess.

🧭 Key Technical Zones to Watch:

🔺 Resistance: 3005 – 3016 – 3035 – 3056 – 3076

🔻 Support: 2980 – 2969 – 2956 – 2930 – 2912

🎯 TRADE PLAN:

🟢 BUY ZONE: 2930 – 2928

SL: 2924

TP: 2934 – 2938 – 2942 – 2946 – 2950

🔴 SELL ZONE: 3034 – 3036

SL: 3040

TP: 3030 – 3026 – 3022 – 3018 – 3014 – 3010 – ???

📌 Keep an Eye on DXY:

The US Dollar Index is currently testing a major 3-year support level.

→ If equities fail to recover and fear persists, DXY could bounce — and gold would likely continue its correction lower.

⚠️ Final Note:

We’re in a highly volatile and uncertain environment.

→ Stick to the plan. Respect your SL/TP levels. Avoid emotional decisions.

—

📣 Found this perspective useful? Follow for daily macro-backed trade ideas and real-time market structure breakdowns.

Clarity. Consistency. Risk Management.

— AD | Money Market Flow

XAUUSD Analysis: Reversal Forecasts Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels.

The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Hammer/Inverted Hammer

Double/Triple Bottom/Top

Shooting Star

Morning Star

Hanging Man

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Our Math Analysis as below are Gold Levels:-

3018.720095 - 2991.311155

3032.47144 - 2977.65356

3060.06788 - 2950.43212

3087.78932 - 2923.33568

3115.635761 - 2896.364239

3143.607201 - 2869.517799

3171.703641 - 2842.796359

3199.925081 - 2816.199919

3228.271521 - 2789.728479

3342.907282 - 2685.092718

3459.543042 - 2582.456958

3578.178803 - 2481.821197

3698.814564 - 2383.185436

3821.450324 - 2286.549676

3946.086085 - 2191.913915

4072.721845 - 2099.278155

4201.357606 - 2008.642394

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Fundamental Market Analysis for April 8, 2025 EURUSDAfter a tense week in which the US fully adopted a protectionist trade policy - despite lacking the necessary industrial infrastructure - tariffs on imports were imposed. The US now applies a general 10 per cent import tax on all goods from each country, as well as various ‘reciprocal’ tariffs calculated by dividing US imports by exports. After imposing a 34 per cent tariff on Chinese products, China responded with its own 34 per cent tariff on all goods imported from the US. Unable to find alternative solutions, the Trump administration threatened to impose an additional 50 per cent tariff on all Chinese goods, which is set to take effect on April 8.

US data takes centre stage again this week, with the release of Consumer Price Index (CPI) data on Thursday. On Friday, producer price index (PPI) data and the University of Michigan (UoM) consumer sentiment survey are expected.

Investors are raising bets that the Federal Reserve (Fed) will begin cutting interest rates to reduce recession risks. Markets are factoring in nearly 200 basis points of rate cuts through the end of 2025, despite the Fed issuing cautious policy statements indicating that trade uncertainty complicates any potential rate cut.

Trade recommendation: SELL 1.0950, SL 1.1030, TP 1.0830

USD/JPY(20250408)Today's AnalysisToday's buying and selling boundaries:

146.92

Support and resistance levels

150.22

148.99

148.18

145.65

144.85

143.61

Trading strategy:

If the price breaks through 148.18, consider buying, the first target price is 148.99

If the price breaks through 146.92, consider selling, the first target price is 145.65