#CAKEUSDT is setting up for a breakout📉 Long BYBIT:CAKEUSDT.P from $2,710

🛡 Stop loss $2,607

1h Timeframe

⚡ Plan:

➡️ POC is 2,515

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $2,790

💎 TP 2: $2,870

💎 TP 2: $2,920

🚀 BYBIT:CAKEUSDT.P is setting up for a breakout—preparing for an upward move!

Analysischart

#1000XUSDT is setting up for a breakout📉 Long BYBIT:1000XUSDT.P from $0,05470

🛡 Stop loss $0,05297

1h Timeframe

⚡ Plan:

➡️ POC is 0,04229

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,05640

💎 TP 2: $0,05775

🚀 BYBIT:1000XUSDT.P is setting up for a breakout—preparing for an upward move!

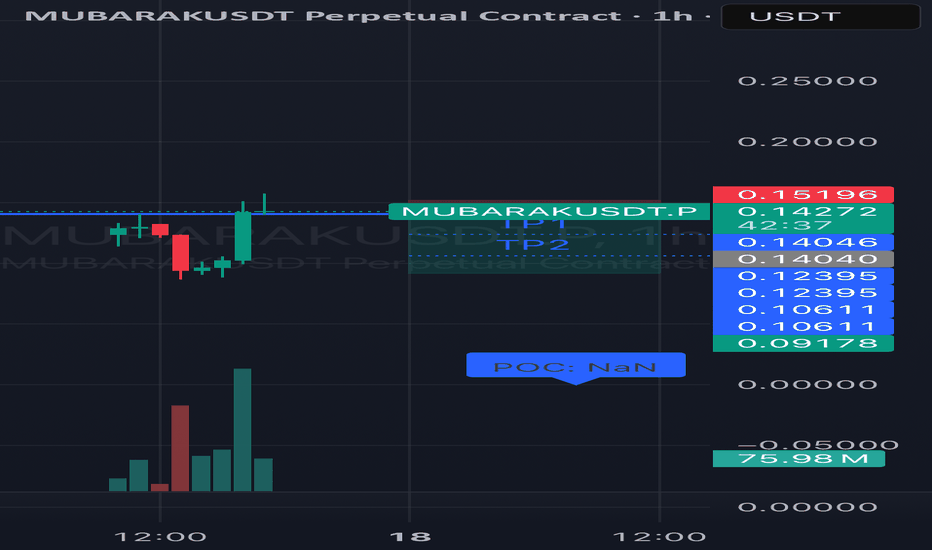

#MUBARAKUSDT continues its downtrend📉 Short BYBIT:MUBARAKUSDT.P from $0,14040

🛡 Stop loss $0,15196

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is Nan

🎯 TP Targets:

💎 TP 1: $0,12395

💎 TP 2: $0,10611

💎 TP 3: $0,09178

📢 Monitor key levels before entering the trade!

BYBIT:MUBARAKUSDT.P continues its downtrend — watching for further movement!

Gold (XAU/USD) 4H Chart Analysis: Resistance Test & Potential BrPrice Trend:

The chart shows a steady upward movement in the price of gold, starting from late February into March 2025. The price is currently around $2,917.25 and has reached near the resistance level marked on the chart.

Resistance Zone:

The resistance area, located between $2,911 and $2,920, seems to be a crucial level. Gold has faced difficulty breaking through this level multiple times, as seen in the sideways movement after hitting the resistance.

Target Level:

The target above this resistance zone is marked around $2,960, indicating the potential for further price appreciation if gold can break above the current resistance.

Price Action and Potential Breakout:

There's a potential for a breakout as the price appears to be forming a bullish structure near the resistance, indicating that if gold manages to break above this zone, it could continue its upward trajectory toward the target area.

Volume and Market Sentiment:

The volume indicators on the lower part of the chart are not heavily discussed here, but there might be a correlation with market strength. The chart suggests potential consolidation before a move upward if the resistance breaks.

Conclusion:

Gold is currently testing the resistance area, and if it successfully breaks through, it could aim for the target level around $2,960. Keep an eye on this price level as it could signal further bullish movement.

The Steps to Identify Key Levels on Chart Scalping Opportunity)**The Steps to Identify Key Levels on Chart:**

1. **Support & Resistance:**

- Identify areas where the price has bounced multiple times.

- Based on your chart, key **support** seems around **2900**, while **resistance** could be near **2925-2930**.

2. **Trendlines:**

- Check if highs/lows are forming a triangle pattern.

- If lower highs and higher lows appear, it could be a **symmetrical triangle** (potential breakout).

3. **Moving Averages & Volume:**

- The **moving averages (EMA)** are close together, suggesting consolidation.

- Look for a volume spike near breakout points (above 2925 or below 2900).

### **Possible Chart Pattern Scenarios:**

- If price **breaks above 2925-2930 with volume**, it could be a **bullish breakout**.

- If price **drops below 2900**, it may confirm a **bearish breakdown** (continuation down).

- If price keeps bouncing between 2900-2925, it's likely **range-bound** (scalping opportunity).

Gold (XAU/USD) Chart Analysis### **📊 Gold (XAU/USD) Chart Analysis**

🔹 **Current Trend:** Bullish momentum continues after two strong bullish days.

🔹 **Key Indicator:** RSI trending in bullish territory.

### **🔺 Bullish Scenario (Buy Trade)**

- **Next Resistance:** $2,950

- **Major Resistance:** Record high at $2,954

- **Breakout Target:** If $2,954 is broken, gold could reach $3,000.

### **🔻 Bearish Scenario (Sell Trade)**

- **Support Level:** $2,900

- **Breakdown Risk:** A daily close below $2,900 could trigger a pullback.

### **🛑 Risk Management**

✅ If going **long**, watch for resistance at **$2,950-$2,954** before adding positions.

✅ If going **short**, wait for confirmation of a **close below $2,900** for a potential correction.

✅ Maintain a proper stop loss based on **volatility and market structure**.

#VRUSDT continues its uptrend📈 LONG BYBIT:VRUSDT.P from $0.011718

🛡 Stop Loss: $0.011470

⏱ 1H Timeframe

⚡ Action Plan:

✅ BYBIT:VRUSDT.P price broke the resistance level and is consolidating above it, confirming a bullish scenario.

✅ The asset is trading above the POC (Point of Control) at $0.00862, indicating buyer dominance.

✅ Increasing volume on the breakout confirms the strength of the upward movement.

🎯 Target TP Levels:

💎 TP 1: $0.012110

📢 A breakout above $0.011718 will confirm the continuation of the uptrend.

📢 POC $0.00862 remains a key support zone.

📢 Rising volume at the breakout suggests a high probability of reaching target levels.

📢 Partial take-profit at TP1 ($0.012110) helps minimize risks in case of a pullback.

🚀 BYBIT:VRUSDT.P continues its uptrend – watch for upward movement and secure profits at TP!

GBPUSD: Short Setup at Key ResistanceOANDA:GBPUSD is nearing a key supply zone that has been a critical area for bearish reversals in the past. The current price action suggests sellers may regain control at this resistance level.

If bearish patterns appear, such as long upper wicks or bearish engulfing candles, I anticipate a move toward 1.25890.

However, if the price successfully breaks and holds above the zone, this would invalidate the bearish outlook and might indicate further upside.

Proper risk management is essential, given the possibility of price breaking higher.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management!

#1000RATSUSDT maintains bearish momentum📉 SHORT BYBIT:1000RATSUSDT.P from $0.01823

🛡 Stop Loss: $0.01855

⏱ 15M Timeframe

✅ Overview:

➡️ BYBIT:1000RATSUSDT.P is in a downtrend after rejecting the descending trendline, confirming buyer weakness.

➡️ Volume Profile suggests that the main liquidity (POC) is positioned at $0.01938, reinforcing selling pressure.

➡️ The Head and Shoulders pattern strengthens the bearish case, and a break below $0.01823 will trigger further decline.

➡️ The main downside targets are in the $0.01800 – $0.01764 range, where profit-taking may occur.

⚡ Plan:

➡️ Short entry upon breaking $0.01823, confirming the bearish scenario.

➡️ Stop-Loss at $0.01855—placed above the nearest resistance to minimize risk.

➡️ Main targets: $0.01800, $0.01780, and $0.01764, where downside movement may slow down.

🎯 TP Targets:

💎 TP 1: $0.01800

🔥 TP 2: $0.01780

⚡ TP 3: $0.01764

🚀 BYBIT:1000RATSUSDT.P maintains bearish momentum — expecting further downside!

📢 BYBIT:1000RATSUSDT.P remains weak, and a breakdown below $0.01823 could accelerate the decline.

📢 Watch for price reactions near $0.01764, where a slowdown or bounce may occur.

#BTCUSDT: The Turning Point is Near! Will the Market Crash or Re🚀 BYBIT:BTCUSDT.P has entered a critical zone! After a prolonged uptrend, the asset formed a "Rising Wedge" pattern and tested resistance twice (Top 2), indicating a potential trend exhaustion.

━━━━━━━━━━━━━━━━━━━━

🔥 Market Overview for BYBIT:BTCUSDT.P

✔️ The Volume Profile shows that the current range is below the Point of Control (POC), meaning the main liquidity zone (where the highest trading volume occurred) remains above the current price.

✔️ BYBIT:BTCUSDT.P is currently trading within a consolidation zone after a notable short-driven drop.

🟢 The price has already broken below the wedge’s lower boundary, which is historically a bearish signal. However, the market is still holding above a key liquidity level (POC: 96,125.2).

🟢 If BYBIT:BTCUSDT.P continues consolidating without reclaiming lost levels, altcoins will likely face selling pressure or stagnation.

🟢 If BYBIT:BTCUSDT.P recovers above the critical horizontal volume level (POC), this could trigger a market-wide rebound and push altcoins higher.

🔥 Technical Outlook

✔️ A 10–15% correction is common for Bitcoin before it enters a consolidation phase. If no major negative news emerges and there is no aggressive short squeeze, the market may stabilize and attempt a recovery.

✔️ However, if BYBIT:BTCUSDT.P starts trading significantly below key levels (e.g., drops under $90,000 or $85,000), this could signal a deeper correction phase.

💡 Key Market Factors at Play:

✔️ Current Price: $95,901

✔️ Volume: 19.64K BYBIT:BTCUSDT.P – moderate but not extreme, indicating possible market indecision.

✔️ Key POC Level: 96,125.2 – the point of highest volume, which may determine the next direction.

🔥 General Market Sentiment

✔️ If BYBIT:BTCUSDT.P continues its downtrend, most altcoins will follow. In this case, it makes sense to look for buy opportunities at support levels when bounce signals appear.

✔️ Pay attention to key support and resistance levels for BYBIT:BTCUSDT.P . If BYBIT:BTCUSDT.P finds strong support, this could trigger a broader altcoin recovery.

🔥 Technical Indicators:

📉 RSI (Relative Strength Index): If RSI for most assets approaches oversold territory, short-term bounces may occur. This could present good buying opportunities.

🔥 What’s Happening with BYBIT:BTCUSDT.P ?

📌 Breaking the Rising Wedge – a strong bearish signal for further downside.

📌 Support at 96,125.2 is holding for now, but selling pressure remains strong.

📌 Projected downside target: $68,000 - $48,000 if the breakdown is confirmed.

📌 Alternative scenario: A move back above $100,000, which could lead to renewed bullish momentum.

🔥 Action Plan for Buying:

✔️ Short-term: Look to buy during dips, focusing on support levels close to recent lows.

✔️ Mid-term : Use a dollar-cost averaging strategy if a larger recovery is expected, while managing risk as the market stabilizes.

✔️ Long-term : Wait for clear signs of recovery on charts and macroeconomic conditions before making bigger moves.

📉 Bearish Scenario (Primary Outlook): Further Decline Expected

If BYBIT:BTCUSDT.P stays below $95,000 - $96,000, expect an accelerated downtrend:

✅ Target 1: $88,000 – first major support zone.

✅ Target 2: $72,000 – level where the market may seek balance.

✅ Target 3: $48,000 – critical zone, where BYBIT:BTCUSDT.P may form a bottom.

✔️ If BYBIT:BTCUSDT.P breaks $95,000, short remains the main scenario.

✔️ Confirmation: Increasing volume on the sell-off.

✔️ Caution with longs – no clear reversal signals yet.

📈 Bullish Scenario (Alternative): Reversal Possible

If BYBIT:BTCUSDT.P holds above $96,000 - $97,000 and breaks $100,000, a bullish continuation is possible:

✅ Target 1: $104,000 – nearest resistance.

✅ Target 2: $110,000 – major liquidity zone.

✅ Target 3: $120,000+ – potential new highs.

✔️ Long positions should only be considered if BYBIT:BTCUSDT.P confidently holds above $100,000.

✔️ Confirmation: Sharp increase in volume and a strong bounce off support.

⚡ Final Thoughts:

✔️ The drop from $107,673 to $96,150 over the past months suggests a mix between a local correction and the potential start of a deeper downtrend. The next move will largely depend on whether BYBIT:BTCUSDT.P can hold above key support levels and reclaim major liquidity zones (~$100,000–101,000), turning them from resistance back into support.

⚡ Critical Moment for BYBIT:BTCUSDT.P !

✔️ BYBIT:BTCUSDT.P is sitting at its final major support zone – the coming days will determine its fate.

✔️ Sellers remain in control, but the market still has a chance to regain strength.

✔️ A break below $95,000 could accelerate the drop, while a move back above $100,000 could reignite the bull run.

🚀 A major move is coming for BYBIT:BTCUSDT.P – stay ready! 🔥

USOIL(WTI) Price ActionHello Traders,

I hope you all had a great weekend and made some profits last week! As the market opens today, I’ve identified another setup on USOIL (WTI) . Here’s the breakdown:

1. Zones Marked:

- On the 4H chart, I’ve marked two key zones: a Supply Zone and a Demand Zone.

- Switching to the M30 chart, I’ve marked an additional Demand Zone.

2. Liquidity Line:

- You’ll notice a Liquidity Line on the chart. Wait for a sweep of this level before considering any trades.

3. Entry Strategy:

- Move to the M15 chart for a precise entry to lower your risk.

- Look for bullish momentum to confirm a long position.

4. Take Profit (TP):

- The TP levels will remain the same as planned.

5. Volume Observation:

- Volume is currently low, which could indicate a potential divergence. Keep an eye on this as it may impact the trade.

6. Risk Management:

- Always manage your risk carefully. Avoid trading blindly and stick to your plan.

Wishing you all the best and happy trading! Let’s make it a profitable week. Thank you!

USDILS - At Clear Support Zone. Towards 3.61000?FOREXCOM:USDILS is at a support zone that has consistently acted as a reversal point for bearish trends. The current market structure suggests that this support zone could once again provide a potential buying opportunity—provided that there is clear bullish confirmation.

If buyers confirm their presence with signals like long lower wicks or bullish engulfing patterns, we could see a move toward 3.61000.

However, a break below this support would invalidate the bullish scenario and signal potential for further declines.

Key Levels to Watch:

Bullish Target: 3.61000

Stop Loss: Below the support zone

Patience is crucial—wait for clear bullish confirmation before entering long positions. What’s your view on this setup? Share your thoughts in the comments!

Gold Analysis Update: Resistance Levels and Market OutlookHello Everyone!

How are you all? I hope everything is going great! I'm excited to announce my return with a new TradingView account. I hope you’ll show the same love and support as you did with my previous account.

Gold Analysis

I'm observing that gold is facing resistance at 2762 on the H1 chart. It has been retesting this level repeatedly and pulling back to 2756.

If gold fails to break 2763 on the H4 candle, we can anticipate a bearish market movement in the next few hours.

All targets are clearly explained in the chart above for your easy understanding.

Please like, comment, follow, and support! Thank you for your love and encouragement! 🙏

INDIGO immediate support 1240The stock is currently approaching a robust support level, which indicates it may be an ideal time to consider enhancing your investment position. By adding to your holdings periodically, you can take advantage of this potential uptrend for substantial long-term growth. This strategy not only capitalizes on favorable market conditions but also positions you well for future gains as the stock matures.

BTC Eyes New Highs: A Momentum Reversal Indicator PerspectiveAs we step into the final days of the year, all eyes are on the flagship cryptocurrency, Bitcoin ( BINANCE:BTCUSD ). December has historically been a pivotal month for BTC, often setting the tone for the new year's crypto trends.

Let’s explore if Bitcoin is primed for a bullish breakout, consolidation, or a reversal as we close out 2024! 🚀

Bitcoin ( BINANCE:BTCUSD ) is gearing up for another potential surge, with the TD Sequential indicator flashing bullish signals across multiple timeframes. This analysis dives deep into the monthly, weekly, and daily charts to pinpoint high-probability entry points and profit targets for swing traders.

The Bullish Convergence

When we examine the long-term picture, a compelling narrative unfolds. The monthly chart shows a clear transition from red (bearish) to green (bullish) setups, culminating in Green Setup 3 — developing an uptrend with room to run before exhaustion sets in.

Zooming into the weekly timeframe, we see a recent Green Setup 3 followed by a brief pullback (Red Setup 1) and a renewed push higher (Green Setup 1). When the Green Setup 1 holds, it confirms the bullish bias and offers an early entry opportunity for swing traders.

Finally, the daily chart reveals a decisive shift in momentum. A Red Setup 6, signaling potential downside exhaustion, has given way to a Green Setup 2, confirming the nascent uptrend.

Pinpointing Entry and Targets

With the bullish backdrop established, let's identify precise entry points and profit targets.

Entry : Ideal entry points occur on price flips (e.g., Green 2 closing above Green 1) or breakouts above resistance levels, preferably with Green Setup 2 or 3 on the daily chart for confirmation.

Stop-Loss : Place your stop-loss below the nearest support level. This could be the TI Setup Trend Support line on the monthly chart, the recent swing low on the weekly chart, or the Green Setup 1 low on the daily chart.

Take-Profit : Aim for Fibonacci retracement levels and resistance lines. On the monthly chart, the target resistance is near Green 8 or Green 9. On the weekly chart, look for prices approaching swing highs or Fibonacci extensions (e.g., 161.8%). Utilize shorter-term resistance levels on the daily chart for partial profit booking.

Confirmation is Key

While the TD Sequential provides a robust framework, it's prudent to incorporate other indicators for confirmation.

RSI : Ensure no overbought conditions exist on the higher timeframes. Bullish divergence on the lower timeframes strengthens the trade setup.

Moving Averages : Crossovers like the Golden Cross (50-day MA crossing above the 200-day MA) support a bullish trend.

Trendlines : Breakouts from consolidation patterns aligned with TD Sequential signals offer high-probability entry points.

The Bold Prediction

Bitcoin appears poised for a significant rally based on this confluence of factors.

3-Month Projection : BTC will likely approach or exceed the resistance level corresponding to a Green 8 or 9 on the monthly chart.

6-Month Projection : If the bullish momentum persists, expect substantial upside, with BTC breaking prior resistance levels and testing higher Fibonacci extensions. Potential gains of 15-25% from the current price could unfold.

Disclaimer : This article is intended for educational purposes only and does not constitute financial advice. Conduct your own research and manage your risk responsibly before making trading decisions.

Transform Your Trading with WiseOwl - Free Edition! Take a look at Hedera's chart—and YES, this was spotted with WiseOwl Free Edition ! 🎯

🔍 What makes it powerful?

🔥 **Entry signals** that help time the market for you

🟢 **Bullish/Bearish backgrounds** for instant clarity

📊 **EMAs** to analyze trends like a pro

👉 Check out the WiseOwl Free Edition now and start spotting opportunities like this!

GBPUSD SELL | Idea Trading AnalysisGBPUSD is moving on support zone and and made a head & shoulder pattern

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Euro can fall to buyer zone and then rebound upHello traders, I want share with you my opinion about Euro. Observing the chart, we can see how the price a few moments ago broke the resistance level, which coincided with the seller zone and started to grow inside the upward channel. In this channel, the price grew to the resistance line, after which turned around and started to decline in a downward channel, exiting from the upward channel. In this channel, the Euro declined to the seller zone, where it soon broke the 1.0485 level and fell to the support line, but soon turned around and backed up. Next, the price some time traded near the resistance level and later rebounded and made a strong impulse down, breaking the 1.0390 support level, which coincided with the buyer zone, thereby exiting from the downward channel as well. Later Euro turned around and started to grow and some time later reached the 1.0390 level, broke it, and continued to move up. But a not long time ago, the price started to decline, so, for this case, I think that the price can decline to the buyer zone. AFter this movement, Euro will turn around and start to move up to the resistance level from the buyer zone. Therefore I set my TP at 1.0485 level. Please share this idea with your friends and click Boost 🚀

GBPCAD Wave AnalysisGBPCAD price will move in a downward direction according to the price chart to complete wave E.

Enter the trade around price: 1.80422

Stop loss: 1.82041

Take profit: 1.74477

This offer has a risk/reward ratio of around 3.5

Make sure to involve less than 2-3% of your total capital and adhere to the principles of money management

This is just a suggestion for consideration

Silver AnalysisThe chart is in a bearish phase on the daily timeframe. Given the price movement, support around the 29.140 level is not unexpected. With proper risk management, a buy position can be considered in this area.

This analysis is based on price action, multi-timeframe analysis, and ICT (Inner Circle Trader) methodology.

This analysis is brought to you by the FXonbit Traders Team

Trend Shift Confirmation Setup - Eurusd short setupMarket Context:

Current Trend: The market appears to be in a bullish phase.

Counter-Idea: Following a tap on the Fair Value Gap (FVG) formed on July 18th, a potential shift toward a bearish trend exists.

Setup Breakdown:

SSR Flip Area:

A multi-tested SSR flip zone has been identified around 1.12032, having been tested three times. This indicates a strong potential for selling opportunities.

The latest test of this zone occurred on Monday, August 26th, which resulted in a structural shift in the market. This shift has led to the taking out of a daily low, suggesting a reversal in price direction.

Entry Analysis:

Key areas were initially mapped out on the daily timeframe and then refined on the hourly chart.

Previous liquidity areas that align with the current price movement were identified to enhance the entry strategy.

Additionally, areas exhibiting the strongest volume were mapped to ensure they are in proximity to the entry zone.

The ideal entry point was determined where the breaker block and FVG intersect, creating a confluence of signals.

Risk Management:

The entry was strategically placed at the middle of the breaker block, FVG, and SSR flip areas. This approach ensures an optimum entry point while managing risk effectively.

It is crucial to emphasize that traders should conduct their own analysis before executing any trades.

Important Reminder:

Risk Management:

If you decide to take this trade, be sure not to risk more than 1% of your capital to safeguard your investment. Trading inherently carries risks, so it’s essential to trade wisely and make informed decisions.

Monday XAUUSD Breakout Alert!Attention traders! XAUUSD is on fire, setting new highs with precision! Check this out:

XAUUSD Insight: Locked in a fierce contest between 2683 and 2688. Is a breakout near?

Downside Watch: Stay cautious for potential drops if it dips below this range! Targets: 2676, 2669.

Upside Watch: Look for buying signals if it rises above! Targets: 2693, 2697.