Applestock

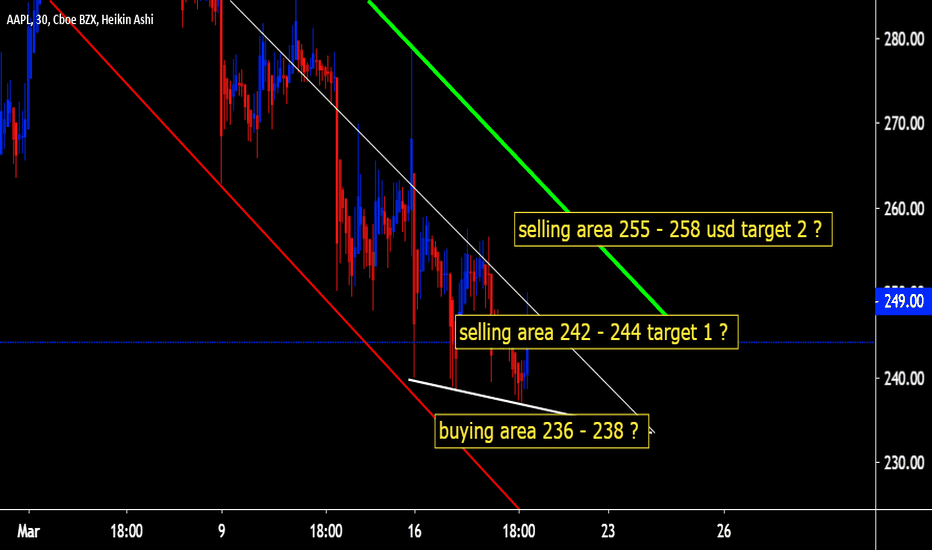

Update on AAPL Here's an update on the Apple stock. This is showing that the Take profit was hit. I'm still bullish on Apple stock, just looking for a better place to re-enter a long position. For now, i'm on the sidelines, waiting for a possible pull back?!?!? Below is an image of my original analysis.

April 16th

Apple Inc FORECAST: Meeting resistance soonWELCOME TO MY PAGE, PLEASE DO LIKE AND SUPPORT MY ANALYSIS, I hope what I shared can help everyone out in their trades! = )

AAPL Apple Inc appears to be in a long sustained BULL RUN on the D1 Time Frame, with short impulse pullbacks and long sustained daily green candles.

Stochastics and MACD points towards a strong buying pressure, both showing green in the buy zone. (Possible overbought scenario)

I'm looking for AAPL to touch the resistance line @ 314-315, for now would be a quick LONG opportunity to that line. Thereafter, watch for a rejection for a SELL to the nearest support line @ 303.25.

OVERALL, I'm bullish on Apple Inc but playing safe on the fact that:

1) 8 days of consecutive green bullish candles seen on D1 Time Frame

2) Approaching 3 lines of strong resistance levels @ 315, 323, and 327 last touched in mid - January 2020

3) Buying volume seems to be slowly dropping --> Indicating weakening buying pressure

For these reasons, I see a quick correction downwards next week or so nearing the resistance lines stated above, before continuing its bullish long term trend.

As always, REMEMBER TO LIKE AND SUBSCRIBE IF YOU LIKED WHAT I SHARED, THANK YOU ALL

Regards,

Gol D Roger

#AAPL ANALYSIS.. NEVER SAY NEVER.. In my previous analysis, I mentioned that a strong sales wave could come to the markets again, in this context, I expect a structure as I mentioned in the chart.. Never say never.. Markets will be very interesting after 6 months, we will wait and see.. I firmly believe that big crash will come eventually and oil prices were the leading indicator of this..

Disclaimer: Please do your own due diligence when it comes to investing.. Never put in money that you cannot afford to lose.. Invest at your own risk..

I wish you all the best..

Apple: Technical Gap Analysis 1D (Apr. 26)X FORCE GLOBAL ANALYSIS:

Apple has shown great strength in its recovery from the damage caused by the corona virus (Covid-19). In this analysis, we explore a purely technical approach to Apple (AAPL), using the gap theory.

Analysis

- Gaps are areas on a chart where the price of a stock moves sharply up or down, with little or no trading in between.

- As a result, the asset's chart shows a gap in the normal price pattern

- Gaps have a tendency of getting filled.

- Thus, when we see gaps below the price during an uptrend, it indicates that there is a probability of a correction

- Apple's chart on the daily is rather choppy, and presents room for multiple gaps

- Gaps that have been filled are marked by green

- We currently see two major unfilled gaps both above and below the current price level

- While the Relative Strength Index (RSI) moves in an uptrend, creating higher lows, we have not yet broken the descending trend line

- The Moving Average Convergence Divergence (MACD) shows a potential death cross, as the bullish histogram show signs of weakened momentum

What We Believe

Based on the gap theory, given that all gaps fill, this would be the most probable scenario; we see a rejection at the descending trend line support, and as prices fill the gaps below, a double bottom is formed on the daily. Then, we see a breakout from the descending trend line resistance, and a continued bullish rally to fill the gaps above. However, it's imperative to note that gaps don't get filled all the time.

Trade Safe.

Apple At Dynamic Support (SMA 200)It's floating around the dynamic support (SMA 200) which can prolly hold price falling from further lower if overall market index showing positive sentiment. Stochastic supporting the bullish momentum. Knowing that China is open for business more than two months after imposing quarantines to counter the coronavirus, China is getting back to work. With new infections dwindling, factories are restarting, stores are reopening, and people are venturing outdoors. In some ways, China is where the U.S. and Europe hope to be within weeks or months.

Apple: when even business partners believe in your fallWe have repeatedly noted that in 2020 the US stock market will begin to adjust. The scale of correction is from 20% and higher. Considering that in recent years, shares of companies in the technology sector of the US stock market have grown by an average of 7-8 times (and some issuers have shown growth of 10 or even 20 times), it is this sector of the US stock market that will undoubtedly become the object of massive sales. But even in a super-overbought market, some stocks are overbought even more.

It's about Apple stocks. We will discuss the fundamental and technical reasons for the appropriateness of the sale of shares in this company in our subsequent reviews. Today we’ll talk about Goldman Sachs forecasts regarding Apple’s future capitalization. Why Goldman Sachs? The point is not even that it is one of the leading investment banks in the world with the best analysts but that GS is Apple partners in the implementation of the Apple Card project. That is, they should be interested in positive forecasts.

So Apple’s business partners expect a third reduction in the shares of the apple company! And they voice the target price in the region of $192 already in 2020.

The reasons for this pessimism, on the one hand, are the unreasonable increase in stock prices in 2019, when the company doubled its capitalization in a year, bringing it to $1.3 trillion (while shares during the fourth quarter grew by 31%). On the other hand, according to Goldman Sachs analysts, there is every reason to believe that financial companies in 2020 will be rather weak and unlikely to exceed the average market performance.

Falling by a third even with a leverage of 1 to 5 is a 150% yield on the deal. If you use the standard leverage of 1 to 100, then we are talking about a fantastic 3000% of the deal. Although there is nothing fantastic about this. And there is a great opportunity for making money.

Apple Stock Is Up 85%+ Over the Past YearWelcome to PrimeXBT ’s technical analysis of one of the stock price of one of the largest technology companies in the world: Apple.

Fundamental Analysis and News:

After the 2018 Christmas Eve collapse of U.S. equity markets, 2019 was a year that proved many forecasters wrong. The economy remained strong, markets soared, and stocks continued their decade-long expansion.

This happened despite multiple warnings from analysts of an impending recession after the yield curve inverted over the summer, producing one of the biggest signals that growth was about to turn negative.

Demand for Apple Inc. AAPL, +1.00%: iPhone sales are poised to skyrocket thanks to new 5G devices, according to Wedbush analysts, who raised their price target to $350 from $325 and maintained its outperform stock rating in a Monday note.

Apple faced several challenges at the start of 2019, including smartphone competition, diminished demand in China, and a lack of 5G innovation.

Technical Analysis:

Apple Inc. holds buy signals from both short and long-term moving averages. Some negative signals were issued as well, and these may have some influence on near-term development.

A sales signal was issued from a pivot top point on Tuesday, December 17, 2019, which indicates further losses could be imminent until a new bottom pivot has been found. Volume rose on falling prices yesterday. This may be an early warning and the stock’s price action should be followed closely.

On downwards corrections, there will be some support that’s coming from uptrend line and 1.272% Fibonacci — which is one of its major support levels. It will be the fourth correction wave of the Elliott 12345.

Several short-term signals, along with a general uptrend, are positive and we conclude that the current level may be a good buying opportunity, as there is a fair chance for this stock to perform well in the short-term.

Resistance Zone: $280 - 290

Support Level: $260

Psychological Resistance Level: $300

Market Cap: 1260.645 B

Watch closely for our future updates to be the first to get well-timed trading signals!

We hope you have great success with all your next trades.