April

(JASMY) jasmy "sectioned macd - wave phase"As seen between the purple lines are the phases of the MACD with no overlap between each of the purple lines. The final bottom phase(5) was reached at which point the price rose to an astonishing 75%. Not sure if these purple lines will be of much use from here on out. I may delete them at some point.

(ETH) ethereum "triangle - slant"Ethereum is not priced for an only up direction as of right now, unlike Bitcoin. As seen in the chart and indicator. The pink and purple dotted lines are close to intersecting and if the pink link crosses over this is a good sign for the chance of a neutrality and even a possible upward forming price chart position.

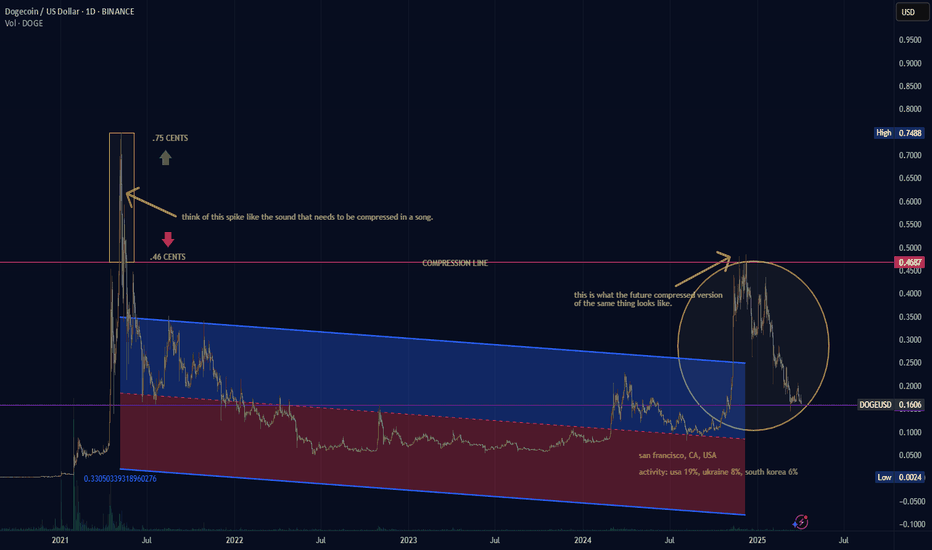

(DOGE) dogecoin "fantasy"is the fantasy over for Dogecoin? The future version versus the present tense, versus the past, is something to speculate over and theorize on whether what people say about what happened in the past versus the past few months, is worth taking a look at. All the time in music people compress music and think the music is better afterwards. By applying the same logic to this Dogecoin chart I am sure all of you would say that you would prefer the uncompressed version.

(ATOM) cosmos "wave count"Long form wave count would appear to be in trend with an entirely new cycle for Cosmos, potentially, although I did not go all the way back to the origin of the company which is necessary to get a true depiction of history. Is the history of a company based on short lived moments or is there any knowledge to keeping track of the trend of a company through the entire duration of the chart regardless of what trends occur based on major moments in society and the seasonal hype from December and end of year excitement,.

Many years in the making. . .

(APT) aptos "ahead of the game, or not"It is not use in being ahead of the price trend if the price is not going to recovery before Bitcoin, Ethereum, Dogecoin. Dogecoin used to be the one to measure between the big three cryptocurrency prices. Nowadays, Dogecoin is so popular with such a strong price hold and the fact that the unlimited coins means to measure Dogecoin is quite a bit more strange when compared to all the other limited circulating supply companies. Aptos appears to be closer to a neutral position, or will the price keep falling if Etherum and Bitcoin do not go flat? That is what I mean by this.

(SHIB) shiba inu "where to next,..."Shiba Inu price appears to be unknown based on support and resistance over the life of trades for the cryptocurrency. Right now the price is literally in the middle of a wide channel with no past information to conclude where the price is headed. Is it going up? Or is it going down? ...

(ETH) ETHEREUM "Two Options" -- The Red Doorttwo options as proposed in my graph based on the movement of Ethereum. It appears Ethereum has chosen to go through the red door this time around. Or, if it was because of Bitcoin so be it. When people refer to the news and justify financial actions based on those news events I tend to see those associations as flaky at best. The price of crypto was stated based on a large indicator of the TOTAL crypto chart to have a short. When the price fell and at the same time some news was happening, as if news isn't always happening, people have the tendency to associate big news events with the story of cryptocurrency, or whatever. This time around it was some other war. Personally, in my take, Iran was using their drones to prevent further missile attacks by Israel on Palestine. By forcing Israel to defend themselves against the drone attack this wastes many of their missiles in their artillery preventing those missiles used to defend themselves to be used as attack missiles.

Bitcoin Cash Halving 2024: A Golden Opportunity for Investors?Bitcoin Cash ( SET:BCH ) enthusiasts and investors are eagerly eyeing the upcoming halving event scheduled for April 4, 2024. With just a few weeks left until this critical network event, the cryptocurrency community is abuzz with speculation about its potential impact on BCH's price trajectory. As miners prepare for reduced block rewards, questions arise about whether Bitcoin Cash's halving presents a lucrative buying opportunity for investors.

Understanding Bitcoin Cash Halving:

Bitcoin Cash ( SET:BCH ) operates on a four-year or 200,000-block halving cycle, a mechanism designed to control inflation and ensure the scarcity of the cryptocurrency. The upcoming halving will see the block reward slashed from 6.25 BCH to 3.13 BCH, compelling miners to reassess their strategies in light of reduced profitability.

Miner Sell-Off and Market Dynamics:

In anticipation of the halving, miners have engaged in a significant selling spree, offloading approximately 2.51 million SET:BCH worth around $1.1 billion. This trend, driven by the desire to capitalize on high prices before rewards diminish, has led to a decrease in miner reserves. However, historical data suggests that such sell-offs tend to reverse post-halving, with miners accumulating reserves once again.

Impact on Mining Difficulty and Revenue:

As unprofitable miners exit the network due to reduced rewards, mining difficulty is expected to decrease, potentially enhancing revenue for remaining participants. This phenomenon was observed during the 2020 halving, where a decrease in mining difficulty coincided with significant price gains for Bitcoin Cash.

Analyzing Price Trends:

Bitcoin Cash's price has experienced a notable dip of around 20% in the lead-up to the halving, mirroring patterns observed before previous halving events. However, past performance indicates that such downturns often precede bullish cycles post-halving. With SET:BCH currently trading around $464 as at the time of writing, investors may view this correction as an opportune moment to enter the market.

Long-Term Holder Sentiment:

On-chain data suggests that long-term holders are positioning themselves for a bullish post-halving cycle, indicating confidence in Bitcoin Cash's future prospects. This sentiment aligns with historical precedents, where halving events have often catalyzed significant price appreciation for cryptocurrencies.

Overview of Cryptocurrency Volatility - 1M, April, 2023.Analysis of the volatility index in April. Time interval - 1 month.

Currency - USDT or equivalent to BUSD .

The selection is carried out according to the lists of cryptocurrencies that are represented on the spot and futures markets, with a total of more than a hundred coins.

Top 15 Coins (April):

1. BINANCE:EDUUSDT EDU/usdt - 2622.04% (High&Low: 3290%)

2. BINANCE:RNDRUSDT RNDR/usdt - 73.73% (High&Low: 99.93%)

3. BINANCE:INJUSDT INJ/usdt - 64.31% (High&Low: 111.88%)

4. BINANCE:CTSIUSDT CTSI/usdt - 61.15% (High&Low: 157.56%)

5. BINANCE:OMGUSDT OMG/usdt - 33.67% (High&Low: 38.55%)

6. BINANCE:IDUSDT ID/usdt - 32.57% (High&Low: 129.19%)

7. BINANCE:SSVUSDT SSV/usdt - 31.45% (High&Low: 43.36%)

8. BINANCE:TOMOUSDT TOMO/usdt - 30.83% (High&Low: 75.80%)

9. BINANCE:MASKUSDT MASK/usdt - 29.11% (High&Low: 32.98%)

10. BINANCE:ICXUSDT ICX/usdt - 28.39% (High&Low: 116.60%)

11. BINANCE:ANTUSDT ANT/usdt - 26.96% (High&Low: 59.55%)

12. BINANCE:JASMYUSDT JASMY/usdt - 26.79% (High&Low: 50.92%)

13. BINANCE:TUSDT T/usdt - 25.49% (High&Low: 28.14%)

14. BINANCE:ICPUSDT ICP/usdt - 23.39% (High&Low: 47.69%)

15. BINANCE:STXUSDT STX/usdt - 22.88% (High&Low: 36.52%)

The coin showed the worst result: BINANCE:GALUSDT GAL/usdt - 0.17% (High&Low: 34.94%).

Full list of analyzed coins: www.tradingview.com

Analysis information for all coins: docs.google.com

Thanks for your attention!

Overview of Cryptocurrency Volatility - 1D, April, 2023.Analysis of the volatility index in April. Time interval - 1 day.

Currency - USDT or equivalent to BUSD .

The selection is carried out according to the lists of cryptocurrencies that are represented on the spot and futures markets, with a total of more than a hundred coins.

Top 15 Coins (1 day):

1. BINANCE:EDUUSDT EDU/usdt - 2650.75% (High&Low: 2919.97%)

2. BINANCE:ICXUSDT ICX/usdt - 202.45% (High&Low: 415.39%)

3. BINANCE:CTSIUSDT CTSI/usdt - 182.08% (High&Low: 390.75%)

4. BINANCE:SXPUSDT SXP/usdt - 180.57% (High&Low: 351.78%)

5. BINANCE:LINAUSDT LINA/usdt - 178.48% (High&Low: 390.75%)

6. BINANCE:IDUSDT ID/usdt - 178.20% (High&Low: 367.64%)

7. BINANCE:INJUSDT INJ/usdt - 176.08% (High&Low: 365.44%)

8. BINANCE:WOOUSDT WOO/usdt - 157.44% (High&Low: 318.08%)

9. BINANCE:BELUSDT BEL/usdt - 154.35% (High&Low: 320.46%)

10. BINANCE:RNDRUSDT RNDR/usdt - 147.26% (High&Low: 321.78%)

11. BINANCE:TOMOUSDT TOMO/usdt - 144.10% (High&Low: 323.30%)

12. BINANCE:RDNTUSDT RDNT/usdt - 142.29% (High&Low: 331.08%)

13. BINANCE:STGUSDT STG/usdt - 140.27% (High&Low: 251.36%)

14. BINANCE:ARBUSDT ARB/usdt - 131.93% (High&Low: 269.75%)

15. BINANCE:CELRUSDT CELR/usdt - 126.61% (High&Low: 294.71%)

The coin showed the worst result: BINANCE:TRXUSDT TRX/usdt - 29.85% (High&Low: 72.91%).

Full list of analyzed coins: www.tradingview.com

Analysis information for all coins: docs.google.com

Thanks for your attention!