APTUSD

Scamtos and it's futureWe've all seen how the indian founder ( a.k.a scammer) sold his stack of APT when it was at 14-15$ and left the company. A few weeks later the market crashes and APT is now ~ 5$.

- Aptos during 3 years didn't succeed nor in good gains or adoption.

- The asian founder that is in charge now ( a.k.a new scammer) just proposed the community to cut staking rewards from 7% to 3%. This will make whales re-think their holdings

Meanwhile SUI did a few times already 4-7x'es and it attracts more users and community so it's clear SUI will be the winner of the cycle ( but it's market cap is already 12 bln circulating so ...)

For me, it's clear that APT, from the very beginning, was meant for 1 thing only: Dump on retail long-term, while "building" to show that they are working, in other words : an old form of scam but with new design :)

This was my biggest dissapointment as investment all these years and I'm not sure it has any future but : you never know ) If bullrun continues, it might pump 10x one day

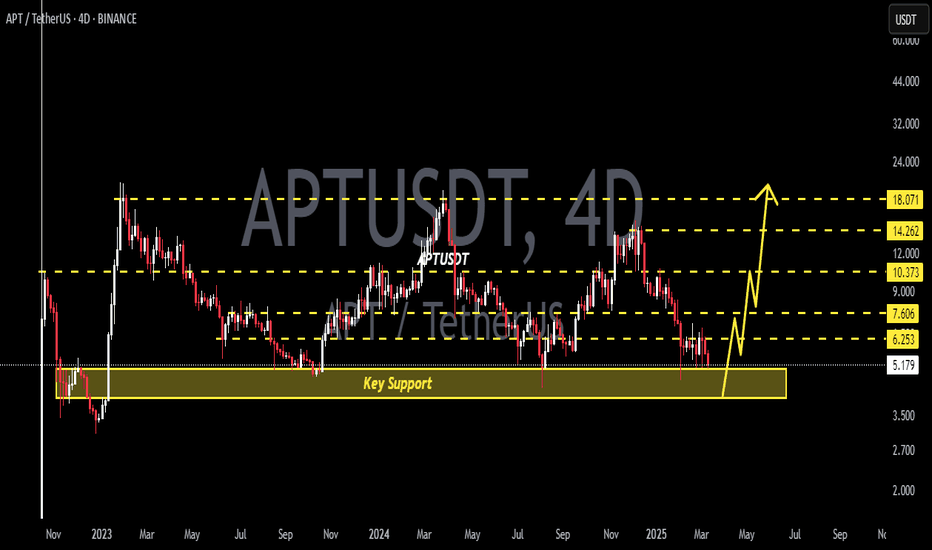

Aptos Will Prove Its Worth (Daily Analysis)After breaking out from a simple trendline, Aptos (APT) has gained significant momentum, similar to many other altcoins over the past two weeks.

However, Aptos is currently presenting a unique structural situation. It appears to have completed a full five-wave bearish impulse and has now transitioned into a new five-wave bullish impulse. From a daily timeframe perspective, Aptos seems to be developing wave 1 of this new cycle.

A closer examination of Aptos’ historical price movements reveals some interesting patterns: • During the previous bullish phase, Aptos formed a reversed Head and Shoulders pattern. • Following the breakout of a key trendline, Aptos rallied to levels that were largely unexpected by the market. • The previous cycle took exactly four months to reach its lower high, aligning precisely with the Fib Time Zone (Level 4) before retracing.

Assuming that history tends to repeat itself (and being conservatively pessimistic), Aptos could potentially reach the $10 region again this summer.

There are two major additional reasons supporting this outlook:

Wave 3's potential target in this cycle aligns perfectly with a high-liquidity zone, increasing the probability of a strong upward move. (Refer to the previous bullish cycle’s Wave 3 in the Fib retracement for additional confirmation.)

A new reversed Head and Shoulders pattern appears to be forming right now, which, if confirmed, would further strengthen the bullish case.

Using the Fib Time Tool again, the estimated timeline for reaching the target without any major pattern formation points to late July.

However, if the Head and Shoulders structure fully forms before the breakout, it could extend the move by an additional month, but would likely result in a much higher target beyond $10.

Invalidation level for this analysis: Below the $4 mark.

— Thanks for reading.

#APT/USDT

#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.75.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.95

First target: 5.06

Second target: 5.17

Third target: 5.28

APT Is Squeezing Into a Reversal Pattern at a Key Weekly Level!Yello, Paradisers! Is #APT quietly gearing up for one of the cleanest reversal plays we’ve seen in weeks?

💎After a long, relentless downside trend, APT is now starting to show signs of life. The price action is compressing inside a classic falling wedge pattern, and more importantly, this is happening right at a weekly key level — the kind of setup that usually leads to significant shifts when confirmed.

💎What’s adding more weight here is the emergence of a bullish divergence on the indicators, suggesting that while price has been making new lows, momentum has already begun to turn. That’s often one of the first early signs of a coming reversal and it’s starting to gain strength.

💎#APTUSDT is now pressing against a decisive resistance zone. The price is testing the 12-hour EMA-50, currently sitting around $5.33, and just slightly above that, the wedge breakout trendline stands at approximately $5.45. These two levels are acting as the immediate gatekeepers for a bullish shift.

💎Breaking through both of these zones will be crucial. If the bulls succeed, we can expect a push toward the $7.00 – $7.35 region — a zone where short-term traders may look to take profits. However, if the momentum continues, the bigger step lies ahead.

💎A sustained breakout could carry APT to the pattern target of $8.75 – $9.25 area. This is a strong resistance zone and this is where things get more challenging. The resistance in this range is reinforced by multiple technical confluences, including the 50% Fibonacci retracement, which often acts as a magnet but also a serious barrier during recoveries.

💎On the flip side, support remains solid. Immediate support is at $4.95, while beneath that, APT sits on a major structural base that has historically held firm. Sellers will need serious volume to crack below this foundation and for now, that pressure isn’t there.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

APT/USDT:BUYHello friends

Given the good price growth, we see that the price is in an ascending channel and has fallen, we can buy in a stepwise manner in the price decline within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 4.55

First target: 4.65

Second target: 4.74

Third target: 4.86

Apt may fall further.Very difficult days are ahead for Apt.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

APT Way Down For Long LiqudationsAptos recently hunted lots of short positions during last crash. In February 2 most of the assets crashed a lot. And there is still remaining liquidity and imbalances within the last long wick.

APT has formed a bearish flag in it's consolidation rectangle. It's headed trough 4.5$.

Thanks for reading.

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a breakout.

We have a support area at the lower boundary of the channel at 5.20.

Entry price: 5.41

First target: 5.46

Second target: 5.58

Third target: 5.70

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 5.43.

Entry price: 5.32

First target: 5.28

Second target: 5.21

Third target: 5.10

#APT/USDT

#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.45.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 5.45

First target: 5.55

Second target: 5.66

Third target: 5.80

APTOS priced long term bottom. Perfect long here.Aptos / APTUSD is trading inside a Triangle since its very first low historically and the price seems to be stabilizing after February's Low on its bottom.

In the meantime, it is double bottoming on the 1.5 year Support Zone with the 1week RSI formation common on all prior bottoms.

Buy and target 15.00 (Resistance A).

Follow us, like the idea and leave a comment below!!

Aptos ($APT) Bullish Signal and ETF PotentialAptos (APT) is currently exhibiting a descending wedge pattern on the daily chart, characterized by converging trendlines that slope downward, typically signaling a potential bullish reversal upon breakout. Concurrently, Bitwise Asset Management has submitted an S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) tracking APT. This regulatory filing underscores growing institutional interest in the asset and could enhance liquidity, market exposure, and investor confidence if approved.

From a technical perspective, the Relative Strength Index (RSI) on the daily timeframe has formed a bullish divergence, with the price establishing lower lows while the RSI (14-period) prints higher lows. This discrepancy suggests weakening bearish momentum and strengthens the likelihood of a price reversal. Collectively, these factors position APT for a potential resurgence towards recent resistance levels, aligning with the projected breakout from the wedge pattern.

The combination of favorable technical indicators and the prospect of ETF-driven capital inflows presents a constructive outlook for APT in the near term.

Alex Kostenich,

Horban Brothers.

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 5.74

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.94

First target 6.076

Second target 6.27

Third target 6.48

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.36

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.44

First target 5.72

Second target 5.96

Third target 6.20

#APT/USDT#APT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 5.67

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 5.74

First target 5.87

Second target 6.03

Third target 6.26

Aptos APT Will Reach $100 This CycleHello, Skyrexians!

Recently talked enough about the Bitcoin and Dominance, it's time to come back to altcoins with great potential. This is time for BINANCE:APTUSDT because it looks like to flash the insane long signal.

Let's take a look at the weekly time frame. We cannot define the Elliott waves, but we have the great performance in the past by the Bullish/Bearish Reversal Bar Indicator on this asset. Recently it flashed the green dot. You can see how it performed in the past. Moreover t is happening next to 0.61 Fibonacci zone. We can consider this move a a huge accumulation before the bull run. The target for the long term is $100.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!