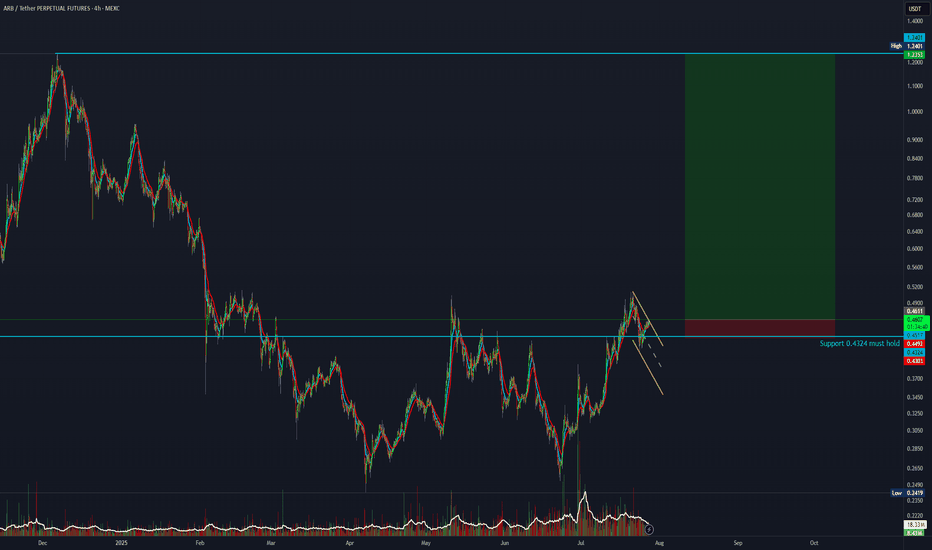

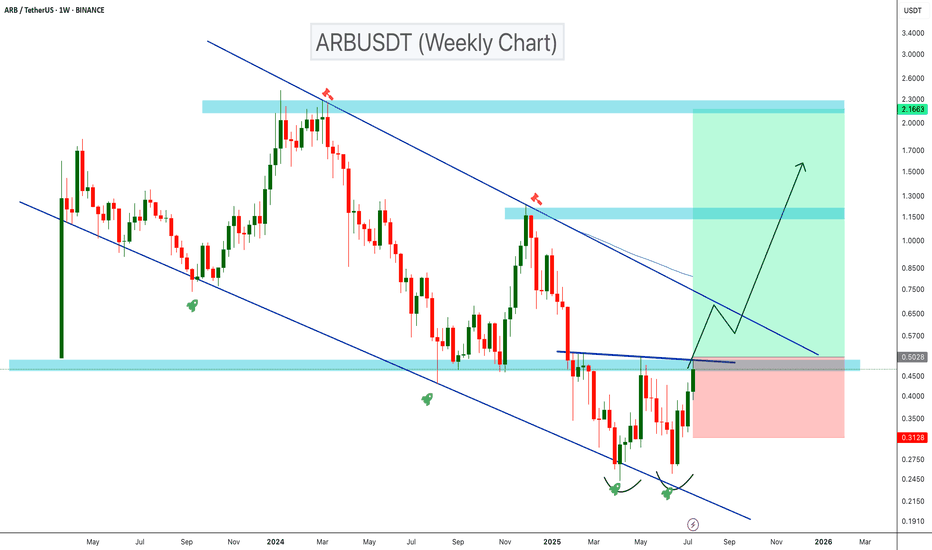

Arbitrum ARB price analysis — Can It Reclaim $1 ?Airdrop history 🪂 left a trail of regret — #ARB was widely distributed near $1, but most holders are still underwater 2 years later 💀

🔹 For recovery to start: break $0.50

🔻 Avoid the death zone: $0.30 must hold

🔄 If momentum returns and GameFi/DeFi reawakens — #ARB could lead.

🎯 If OKX:ARBUSDT price touches $1 again — don’t let greed win this time 😉

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

ARB

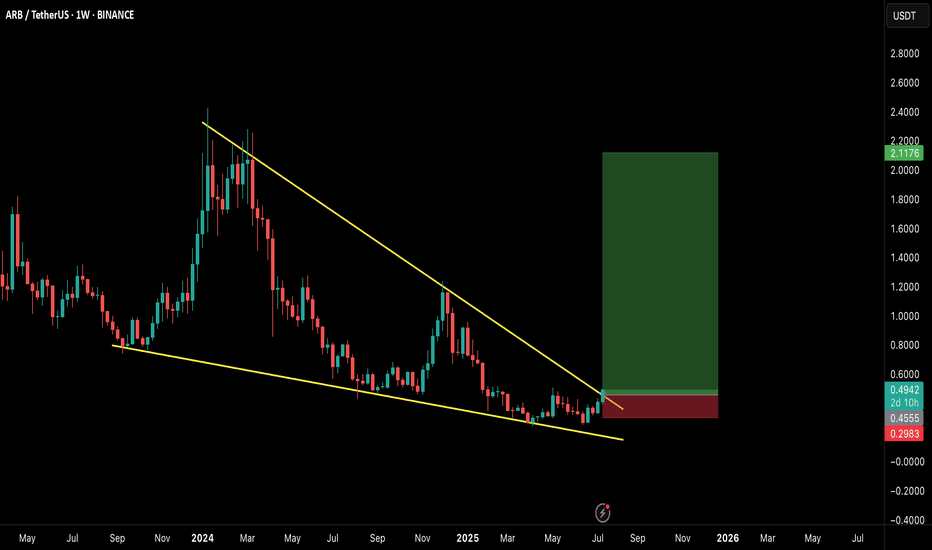

ARB Setup – Watching Key Support for Long EntryArbitrum (ARB) has pulled back into a critical support zone after recent declines. This level is showing strong buyer interest, and we’re eyeing a potential spot long entry as price consolidates near the lows.

📌 Trade Setup:

• Entry Zone: $0.386 – $0.38

• Take Profit Targets:

o 🥇 $0.50 – $0.60

o 🥈 $0.95 – $1.20

• Stop Loss: Just below $0.33

#ARB/USDT#ARB

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.3735.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area (in green) at 0.3688, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3832.

First target: 0.3913.

Second target: 0.4025.

Third target: 0.4145.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Altseason is Loading... Which One’s Your 10x Pick – $POL or $ARB🚨 BULL MARKET ACCUMULATION ALERT 🚨

Both PSX:POL and AMEX:ARB are currently trading below $0.40, and both charts are showing strong long-term bullish structure.

PSX:POL Analysis:

• Current Price: Under $0.40

• Strong Entry Zone: $0.20 – $0.17

• Bull Run Targets: $2 – $5

• Backed by powerful fundamentals, strong tech, and serious investors.

AMEX:ARB Analysis:

• Current Price: ~$0.40

• Key Accumulation Zone: $0.40 – $0.30

• Bull Run Targets: $2 – $5

• One of the strongest L2 ecosystems with deep liquidity and solid fundamentals.

Both are technically oversold, fundamentally strong, and positioned for major upside in the coming altseason.

Question for the community:

Which one hits $2 first — PSX:POL or AMEX:ARB ?

Drop your pick below 👇

NFA & DYOR

ARB – Critical Support ZonePrice is retesting a major support at $0.363. This level has acted as a strong pivot multiple times in the past, providing both support and resistance. Bulls need to hold this zone to avoid a deeper retrace. Below it, next support is down at $0.264.

Plan:

• Hold above $0.363 – could see a local bounce and retest of $0.44–0.50 resistance

• Lose $0.363 – opens the way for a larger flush down toward $0.26

• No setup for longs if we close below support — would flip bias to short on breakdown

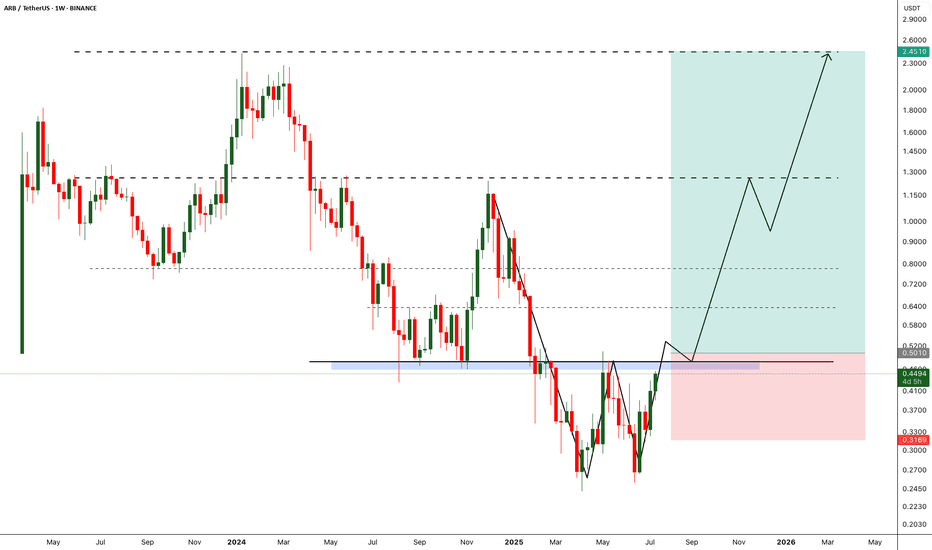

Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🚀📊 Arbitrum Structural Bull Unfolding Amid Ethereum ETF Surge 🌐🔥

🏦 Institutional Tidal Wave – Ethereum ETF Inflows Surge

Spot Ethereum ETFs have minted over $7.7 billion in net inflows, with more than $533 million coming in on a single day—a new record level of institutional capital deployment

Analysts estimate $50–100B more capital is set to flow into ETH over the next 12–18 months, fueling long-duration structural demand beyond speculators

ETF inflows are now collectively absorbing more ETH than new issuance, tightening supply dynamics and driving pricing power

🌉 Why ARB Is Positioned to Capitalize

Arbitrum TVL exceeds $2.5B, with network activity up more than 90% since spring. ⚙️ ARB’s price surged ~91% from April lows, though $0.50 remains critical resistance

Stablecoin supply on Arbitrum hit an all-time high in July , highlighting real use-case growth and on-chain USD demand

Robinhood launched tokenized U.S. stock trading on Arbitrum— a major milestone showing enterprise-level trust and integration

📈 Network Fundamentals & Technical Drivers

The In-kind ETF ruling link s real ETH custody to TradFi flows —Arbitrum sits directly in that fast lane as a scaling infrastructure ﹘ this isn’t theory, it's architectural necessity.

Recent academic research shows that optimistic MEV (arbitrage probing) constitutes over 50% of L2 gas consumption on Base/OP, though only ~7% on Arbitrum —suggesting steadier, lower-waste gas dynamics and room for growth in blockspace usage

🔧 Chart Structure – ARBUSDT (8H & 30m)

Horizontal support around $0.3950 held, while resistance at $0.5196 defines the upper micro‑range. Holding above support suggests buyers are stepping in.

Macro channel structure points toward $1.33 (mid-channel) and $2.66 (upper channel) as multi-month targets—now in play if resistance breaks

30-minute consolidation turned into a textbook breakout— volume picked up above $0.3950, reinforcing the resumption of bullish momentum.

🧠 Risk & Narrative Considerations

Vote-buying incidents in the Arbitrum DAO raised questions about governance integrity—though these were isolated and transparently addressed

A $140K exploit via signature bypass in March highlights the need for continued security evolution—though the protocol responded promptly

On-chain data shows user churn remains an obstacle—some studies find 80% of users quit blockchains within 90 days. Retention is the next frontier for L2 credibility

✅ Trade Setup Recap

📌 Entry zone: Hold above $0.3950, target initial breakout to $0.5196; next extensions toward $1.33 / $2.66.

📌 Catalysts: ETF capital flow, TradFi infrastructure demand, tokenized stock settlement, stablecoin adoption, and developer activity.

📌 Metrics watching: Futures open interest, DAO participation, new dApp deployment, stablecoin inflows.

🧵 Narrative Summary:

Arbitrum is sitting at the intersection of scaling demand, institutional capital landing in Ethereum, and real-world utility use cases. The current structure—which includes firm technical support, active protocol adoption, and ETF-induced capital flows—sets it apart from altcoin speculation cycles.

If ARB can close convincingly above $0.52, expect the macro expansion phase to begin.

Stay sharp. Structure > Noise.

One 💙 Love,

The FX PROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

#ARB/USDT#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.4550.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4520, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4616

First target: 0.4751

Second target: 0.4923

Third target: 0.5135

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

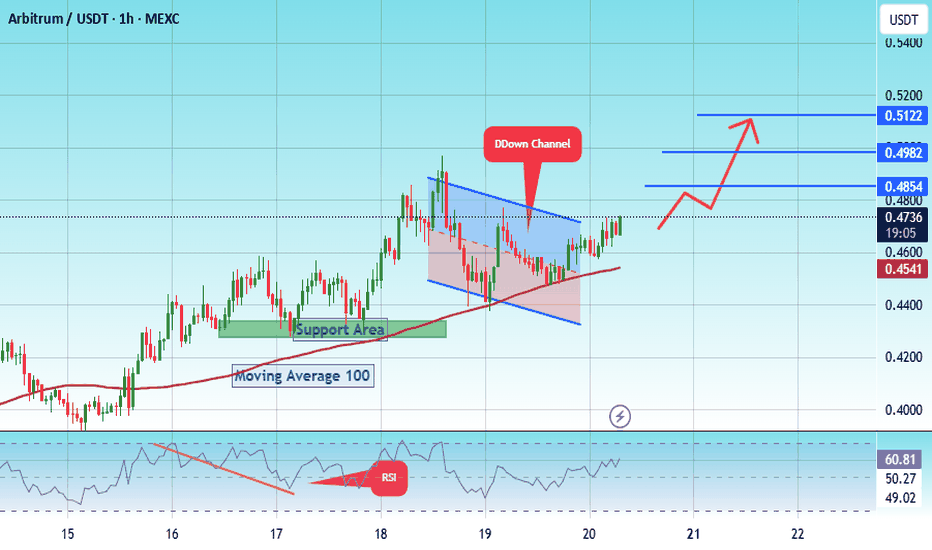

#ARB/USDT Arbitrum scalp long to $ 0.5122#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.4270.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.4300, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.4720

First target: 0.5554

Second target: 0.4982

Third target: 0.5122

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

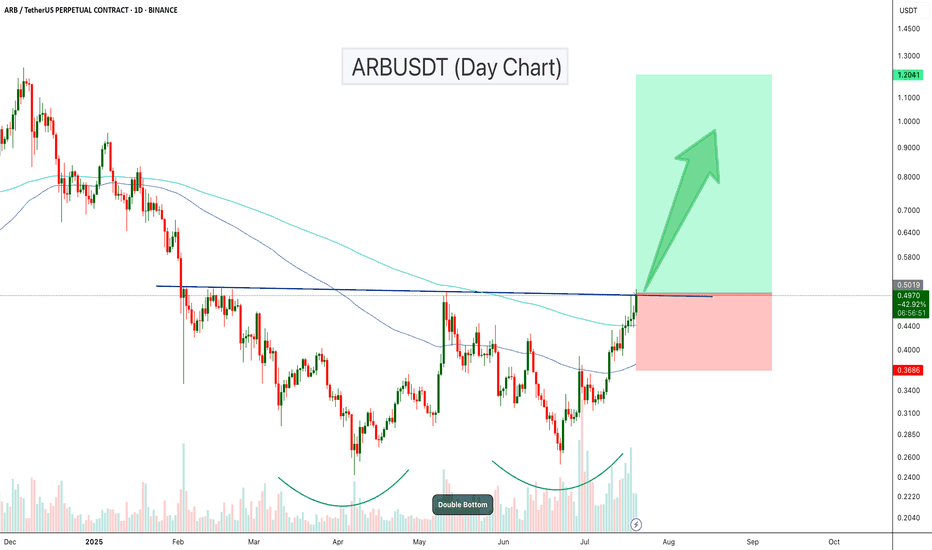

ARBUSDT Breaks Out of Double Bottom!ARB has formed a clear double bottom pattern on the daily chart, signaling a strong reversal structure. After multiple rejections, the price has now broken above the neckline resistance, confirming bullish momentum.

The breakout is also supported by increasing volume and a bullish crossover of the 100 and 200 EMA zones. If the current momentum holds, ARB could reach the target of $0.75- $1.20 level.

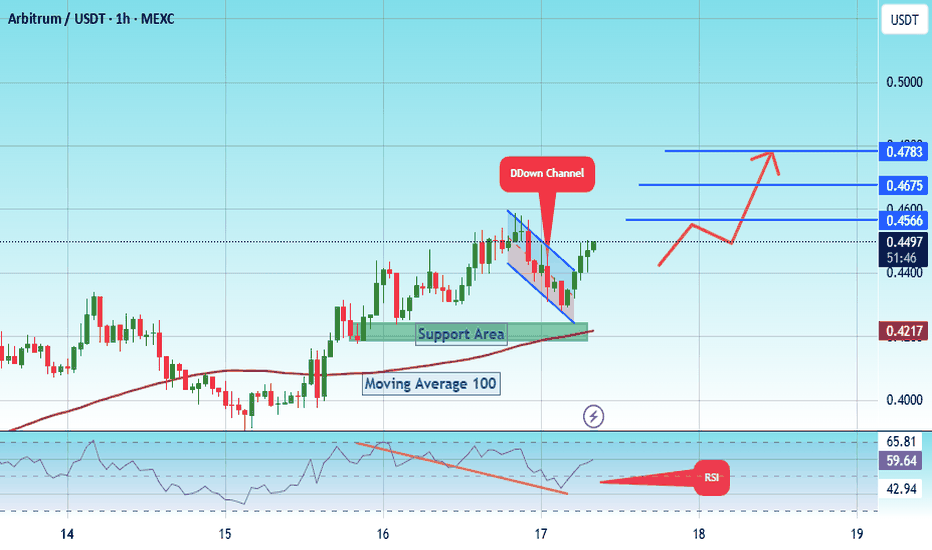

#ARB/USDT Arbitrum scalp long to $ 0.4783#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have 0.4254 from the lower boundary of the descending channel. This support is at 0.0001500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward move.

There is a key support area in green at 0.4170, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.4484

First target: 0.4566

Second target: 0.4675

Third target: 0.4783

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ARBUSDT Double Bottom Signals Bullish Reversal!ARBUSDT is showing a bullish reversal setup on the weekly timeframe after trading within a descending channel for over a year. A clear double bottom has formed near the channel’s lower support, and the price is now breaking above key resistance around $0.50. If this breakout holds, a move toward the upper resistance of the channel and potentially reach the ATH end of this bull run.

Cheers

Hexa

ARB/USDT – Weekly Breakout Setup!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

Massive Falling Wedge Breakout in Play!

ARB just confirmed a breakout from a long-term falling wedge pattern on the weekly timeframe, which has historically been one of the most reliable bullish reversal structures in technical analysis.

🧠 Why this setup matters:

The falling wedge has been forming for over a year, indicating long-term accumulation and compression.

Price has clearly broken above the descending resistance, suggesting a potential shift in momentum.

The structure resembles previous explosive moves, and this could just be the start of a multi-month rally.

🟢 Trade Setup:

Entry: CMP ($0.49) & accumulate on any dips

Targets:

🎯 $0.85

🎯 $1.30

🎯 $2.10+ (Full wedge target)

Stop-loss: 🔴 Close below $0.30

Timeframe: Mid to long term (6–12 weeks or more)

🚀 Bullish Signals:

Weekly breakout candle with strong volume (confirmation pending close).

Market-wide sentiment is gradually turning, and ARB may become one of the leaders.

📌 Final Thoughts:

This is a high-conviction swing setup with a strong reward-to-risk ratio. Keep an eye on weekly close confirmation and market sentiment for better entries.

💬 Let me know your thoughts or if you’re riding this setup too!

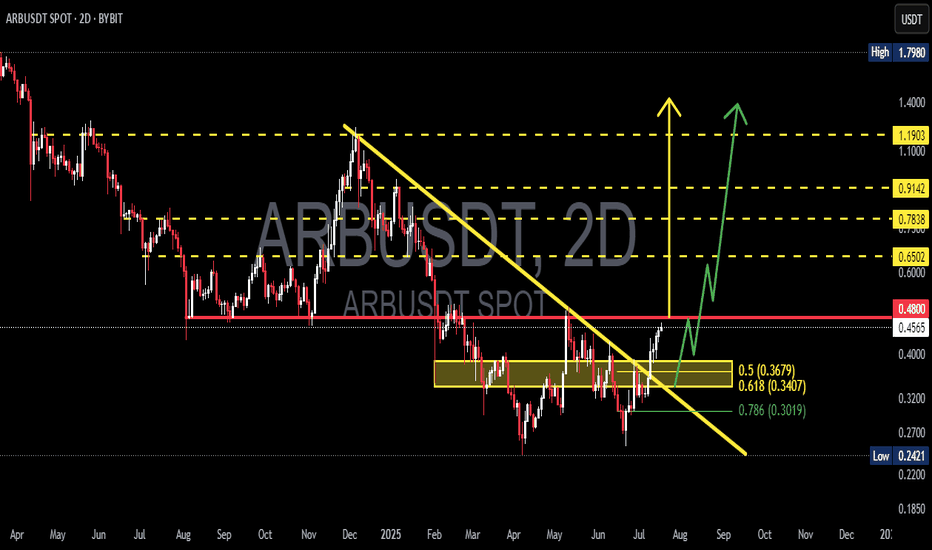

ARBUSDT Ready to Fly? Strong BreakoutARBUSDT has just completed one of its most critical technical phases in recent months — a clean breakout from a medium-term descending trendline that has been suppressing price since December 2024.

📌 Pattern and Price Structure Analysis:

🔹 Descending Trendline Breakout:

After months of downward pressure, ARBUSDT has finally broken above a long-standing trendline. This isn't just another breakout — it's a strong structural signal indicating a potential trend reversal.

🔹 Well-Defined Accumulation Zone:

A solid consolidation base formed between $0.30 - $0.37, highlighted in yellow, serving as a key demand zone. This area aligns perfectly with the Fibonacci retracement levels:

0.5 = $0.3679

0.618 = $0.3407

0.786 = $0.3019

This confluence of support suggests smart money accumulation before the breakout.

📈 Bullish Scenario (High Probability):

If price holds above the recent breakout zone ($0.45–$0.48), the bullish structure remains intact and a multi-level rally may unfold.

🎯 Bullish Targets:

1. First Target: $0.6502 — immediate horizontal resistance.

2. Key Target: $0.7838 — major resistance and previous rejection level.

3. Psychological Level: $0.9142 — pre-breakdown price zone.

4. Maximum Extension: $1.1903 — a potential target if a macro bullish wave develops.

📌 Look for higher lows (HL) and higher highs (HH) structure to confirm sustained bullish momentum.

📉 Bearish Scenario (If Breakout Fails):

A drop back below $0.45 would weaken the bullish outlook.

If the price slips below $0.3679 and loses the 0.618 Fib level at $0.3407, expect a deeper retracement toward:

$0.3019 (0.786 Fib level)

$0.2421 (previous macro low and key support)

🚨 Failure to hold the breakout level could trigger a bull trap, especially if accompanied by declining volume.

🧠 Additional Technical Notes:

Volume increased during the breakout, adding reliability to the move.

Potential formation of an inverse head and shoulders pattern within the base (still early but worth watching).

Momentum indicators like RSI and MACD (not shown) are likely to support the bullish breakout — watch for divergence confirmation.

🧭 Conclusion:

ARBUSDT stands at a critical juncture. The breakout from a long-standing downtrend coupled with a strong accumulation structure gives bulls a tactical edge. However, it must hold above key levels to sustain the momentum.

Smart traders may consider strategic entries on minor retracements while keeping risk in check below the golden pocket zone.

#ARBUSDT #CryptoBreakout #AltcoinReversal #TechnicalAnalysis

#BullishSetup #TrendlineBreakout #FibonacciLevels #CryptoTrading

#Altseason #CryptoSignals

#ARB/USDT Arbitrum scalp long to $ 0.4451#ARB

The price is moving within a descending channel on the 15-minute frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.4070, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3970.

Entry price: 0.4160.

First target: 0.4300.

Second target: 0.4407.

Third target: 0.4451.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

ARB - Breakout will break the market- Arbitrum is one of the fundamentally strong token on ETH L2.

- After back to back crashes finally we are seeing some reversal from the bottom

- A breakout from the local resistance would push the arb price further, we need to wait till the breakout to enter the trade.

Entry Price: 0.5010 (after breakout)

StopLoss: 0.3169

TP1: 0.6300

TP2: 0.7698

TP3: 1.2297

TP4: 1.7566

TP5: 2.3943

Max Leverage: 5x

Don't forget to keep stoploss

Cheers

GreenCrypto

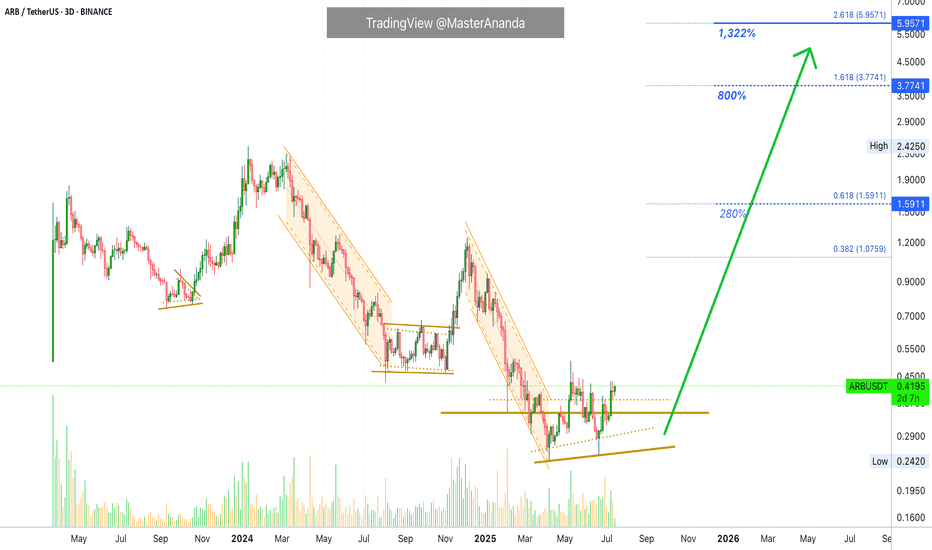

Arbitrum 1,322% Profits Potential · Easy · Crypto is Going Up!This will be intense, truly intense. Arbitrum will perform one of the strongest bullish waves in the entire market. Just one red session and we are back up, back green and ready to move. It will be huge.

This is a big project and yet, we have a standard, easy target, around 1,322%. Such huge potential for growth and there is no doubt now, 100% certainty; you can bet your house on it. We are going up.

When the market goes down, it is unforgiving, it gives no break. It goes down and down and down long-term.

When the market goes up, it is unforgiving, it gives no break. It goes up and up and up, many times higher and much more stronger than any previous bearish wave.

So the market is biased in favor of going up. Just as new all-time lows can be hit on a crash, new all-time highs will be hit during a major bullish impulse. Mark my words.

We are not talking about just "another bullish wave." Not just an "advance." We are talking about the strongest, biggest, longest, exciting and highly profitable bullish phase the Cryptocurrency market has yet to offer. We are talking about exceptional exponential growth. We are talking about a bull market like nothing you've seen before.

Get ready because Crypto is going up.

Namaste.

ARB/USDT Breaks Downtrend – Major Bullish Reversal in Play!📊 Technical Analysis (Daily Timeframe)

ARB has officially broken out of a long-standing descending trendline that has defined its downtrend since late 2024. This breakout, supported by strong demand at key Fibonacci levels, could be the start of a major bullish reversal.

🧠 Key Chart Patterns & Structure:

🔸 Descending Triangle Breakout

Originally viewed as bearish, this triangle has instead resolved to the upside — a rare but powerful bullish reversal signal when paired with growing volume and price compression near the breakout.

🔸 Fib Retracement Bounce

Price rebounded precisely from the 0.618 (0.3210) and 0.786 (0.2910) levels, confirming these zones as strong accumulation and liquidity areas.

🔸 Break & Retest Zone at 0.3422 – 0.3210

This golden zone will be key for confirming the breakout. A successful retest here sets the stage for the next leg up.

🔸 Bullish Price Structure Formation

A potential higher low and higher high formation is beginning, which would fully confirm the shift from bearish to bullish market structure.

🟢 Bullish Scenario (High Probability)

If the breakout is validated with a successful retest of the zone:

✅ Short-term Targets:

0.4873 — First major resistance

0.6701 — Mid-range zone with historical confluence

🚀 Mid to Long-Term Targets:

0.8224

0.9216

1.1730

1.2384 — Full recovery back to former highs

🔼 These zones align with Fibonacci extensions and historical resistance areas. Bull momentum can accelerate quickly due to short covering and new buyers entering.

🔴 Bearish Scenario (Invalidation Level)

If price fails to hold above 0.3210, the bullish setup is invalidated short-term:

Breakdown could revisit 0.2910 (Fib 0.786 support)

Below that: full retrace to the December–March demand base at 0.2420

🛑 Key Invalidation Level: Break below 0.3210 with strong selling pressure.

📌 Strategic Summary

ARB has broken its macro downtrend, signaling the start of a new phase.

Holding above the golden pocket zone (0.3210–0.3422) is critical for continuation.

Targets above 0.9–1.2 are realistic if the market sustains its momentum.

Monitor volume and RSI for further confirmation of bullish strength.

🔍 Traders Note:

This setup reflects an ideal blend of trend reversal, Fibonacci support, and breakout confirmation — a textbook setup for swing and positional traders aiming for medium-term upside.

#ARB #ARBUSDT #BreakoutAlert #CryptoTA #TrendReversal #BullishSetup #TechnicalAnalysis #CryptoTrading #FibonacciLevels #DescendingTriangle #AltcoinBreakoutl

ARB New Analysis (3D)Before anything else, pay attention to the timeframe | it's a higher timeframe and will take time.

The higher timeframe structure of ARB is honestly not that bullish. In this scenario, we’ve considered the entire correction | starting from where the red arrow is placed on the chart | as a diametric/symmetrical pattern.

From a time perspective, wave E has not yet completed, and it is expected to finish somewhere between the two vertical lines. Wave E here is a bearish wave.

If the price pulls back and reaches the green box, we can look for a buy setup in that area.

A 3-day candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#ARB Can Long Soon#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.3190, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.3180.

Entry price: 0.3200

First target: 0.3297

Second target: 0.3393

Third target: 0.3513

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

BTC Weekly Analysis : Rise or Fall ? Let's SeeBy analyzing the #Bitcoin chart on the weekly timeframe, we can see that last week’s candle closed at $108,350, and BTC is currently trading around $107,500. If the price manages to hold above $105,700, we could expect further upside momentum. The next potential bullish targets are $111,700, $124,000, and $131,800.

So far, this analysis has yielded over 9% return, and we’ll be sharing more updates soon from lower timeframes!

🎥 If you enjoyed this video analysis and found it helpful, please show your support with a LIKE and COMMENT below!

These video-style breakdowns take time and effort, and I’ll only continue them with your support 🙌

Your engagement is my biggest motivation to keep going 💛

Thanks for being part of the journey!

ARBUSDT Forming Descending ChannelARBUSDT is showing an interesting setup with its clear descending channel pattern on the daily chart, signaling a potential reversal is on the horizon. This technical formation suggests that the bearish momentum may be exhausting and that a breakout could pave the way for a strong bullish wave. Traders and investors alike are closely watching this pattern for a decisive move above the channel resistance, which would confirm the trend change and could set off a powerful rally.

One of the key aspects supporting this outlook is the good volume that’s been building up around current levels. Healthy volume during consolidation phases often indicates accumulation by smart money, hinting that larger players are positioning themselves for a breakout. This adds a layer of confidence to the trade idea, especially for those targeting swing trades in the crypto market. With the broader market sentiment becoming more risk-on, ARBUSDT stands out as a coin with significant upside potential.

The expected gain for ARBUSDT sits at an attractive 70% to 80%+, aligning with previous price action levels where the market found support and resistance. If the pair can maintain momentum after the breakout, there’s room for it to reclaim lost ground quickly, providing traders with multiple profit-taking zones along the way. Keeping an eye on daily closes and volume spikes will be crucial to catching this move early.

Investors are showing renewed interest in ARBUSDT, adding to its bullish case as sentiment shifts. This combination of technical pattern, volume strength, and investor confidence makes ARBUSDT a crypto pair to watch closely in the coming days and weeks. Patience and solid risk management will be key for anyone looking to capitalize on this setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#ARB/USDT Ready for a Major Breakout!#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.3500.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are looking to hold above the 100 Moving Average.

Entry price: 0.3640

First target: 0.3828

Second target: 0.4009

Third target: 0.4229

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.