Arcs, Circles And Spirals

Ripple Vs Doppler: The pebble skedaddle. (Circular Geometry)I do not trade this but there where some rumors on the box so the thought came, lets throw some Fib Arcs and Gann Angles at it and see what happens....I should have done that sooner as it looks so beautiful.

XRP for now looks like a ripple from a skedaddle from a pebble and it could come down again to go more up...R2R

Enjoy (Circular Geometry)

Om Sri Satoshi Ji Namah

OM Sri Satoshi Mahadev! Jai!

OM

ETCBTC ETCetera (Circular Geometry)ETCBTC rally unstoppable? ETC the original Ethereum .(for more info on ETC/ETH @spacetrader )

(Circular Geometry) shows the way.

Unveiling the underlying architecture or structure of the Price/Time continuum. The Golden Means Ratio is the loom on which manifested reality is woven. It is the base (Circular Geometry) which rules everything within manifested reality, visible and invisible. It is Phi and his little brother phi.

Om Sri Satoshi Ji Namah

OM Sri Satoshi Mahadev! Jai!

OM

XBTUSD: 100th Monkey (Circular Geometry)Best viewed full screen.

Are we getting closer to Bitcoin´s 100th monkey moment?

Because of Bitcoin becoming more scarce as more and more new people will want to own it, Bitcoin´s price will go up exponentially over time.

This moment can be seen as the Bitcoin Spirit (seen left) moves from breaking the ATH through the Price/Time continuum. Killing the Bear of the previous years with a lightning strike and then accelerates with warp speed up into its new range from $1337-1400 and beyond.....

Om Sri Satoshi Ji Namah

OM Sri Satoshi Mahadev! Jai!

OM

Fibonacci Spirals #01To help better understand how to use Fibonacci Spirals when trading, I have decided to dedicate a topic about them. My quest here, is to consistently generate predictions using Fibonacci Spirals. I have only recently started to see a pattern and once I found it, I could somewhat consistently reproduce the same results, that is... visually. I could not however expand the indicator to predict, only to accept the past. What had already happened.

Before we commence, there's one thing you should know about Fibonacci Spirals on TradingView.com (at least at the moment): they don't scale proportionally to the chart. It so seems there is a miscalculation which fire once you begin to scale the chart. For this reason I would suggest not scaling the chart when using this indicator.

I have used Fibonacci Spirals to create V-shapes at the bottoms. Each Spiral is positioned from the lowest low to the past high or future high. From thereon all intersections that have been made in the far future with those spirals have been marked and given colours corresponding the spiral's colours.

I shall elaborate in the near future.

Short drawback tomorrow, then bull run for a few daysNNA has solid fundamentals, but obviously that's not enough these days to mean much in short term trading.

Dailys are showing solid bull set up with the indicators. Hourly indicators are a bit mixed.

Daily Fib-arc, Bullish Gartley, pitchfork, and pitchfan are showing gradual-immediate bull. I'm in, are you?

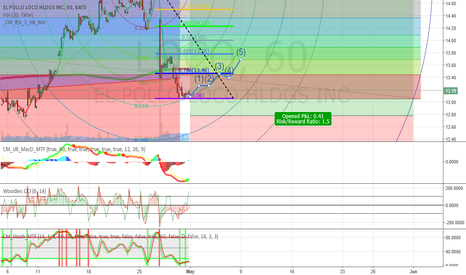

Loco long next monthI'm seeing a set up for a bull run.

Trend lines have been upward slanted the last few months and is still be tested (currently we are on/around the median).

Fibonacci resistance/support lines are being tested too.

I'm thinking either in pre-hours, or early hours after opening the price very well might fall due to exterior motives (SPY tanking); but I don't think it will go below the previous support of 12.80. If it does, it will bounce on it back into a bull Price Action.

EVHC bear cave next few daysAgain, most indicators are leading to a correction; I'm going short.

With the recently tested 23.66 resistance, plus the blue downward-slopping warning line from the pitchfork, I'm guessing the price action in the next few days won't go above the 23.66 price point.

The hourly and daily lower indicators (macd, rsi, cci, slow stoch) are all showing a possible correction in the near future. I'm guessing till the start of May.

I'm noting the first reaction line is around that end time point, so it might reverse soon thereafter.

5 day long on MHLDStrong conformance to long-term Andrew's pitchfork. Lower screen indicators are not peaking, with the macd below zero; cci looks like its moving up towards 100; all signs of some bull movement.

Have a strongly confirmed trend-based fib extension, fib retracement, and fib arc.

Signs that this isn't longer-term bull market: (besides global news and markets) price is still below Andrews pitchfork median, the sma200 (which is closer to the upper mid-parallel, in blue), most of the ema's are still above the priceaction. Therefore this might change direction within the week.

NNA bull and shortDaily indicators are showing strong bearish signs.

Hourly and minute indicators are showing the opposite. I'm therefore assuming a bull will be loose for the next two days (maybe three), then it will break for the median and lower support levels.

ETHBTC ANALYSING THE BUBBLE4 months consolidation phase spawned a considerable liftoff that exceeded my expectations and made me turn my monitor vertically to inspect the full height of that pop. What's next?

Cyclic nature of open-ended markets entails the never-ending torrent of repeatedly changing accumulation phase and distribution phase in such a way that the end of an antecedent phase corresponds to the beginning of a new phase. At first blush, eth has all signs of staying in the distribution phase known for its inherent danger of a higher negative volatility.

The axis of a symmetry connects the 0.00215 BTC floor with the 0.0372 BTC top bar separating two equivalent 70 days time periods that map a triangular shape onto a 140 bars bubble.

Fibonacci spirals and timezones agreed in setting the point at which the market sentiment may retreat to 05.22. I would anticipate a strong slump until then.

As demonstrated by fibonacci timezones the bubble was highly coordinated with btc news events and halving rumors made the latter affect the direction of the overall trend. This market was timed in the simplest way that it effectively consolidated many reasons for railing south into one.

1. Valve is on and will be adding btc to steam.

2. Segregated witness is a pending pull request.

3. New release of bitsquare.

4. gbtc has seen a surge in value.

Eth wont defend its value against btc hype elevator.

My verdict: I forecast 0.01066 BTC in the coming days and likely 0.006 BTC before the end of may.

SKX Upwards to 30.75 next 35 daysSynopsis:

RSI, Stoch, MACD all point to up trend. (Strong signal)

Fibonacci confirms strong levels of support (26.70) and Resistance

Pitchfork showing downward and sideways trend, with price on the median.

Fib arcs show upcoming resistance zones (counting one we just entered)

I labeled the action reaction lines to help better understand what I was and am measuring to.

Expectations (Long):

4/11: Upwards following 1.618 underarc. some resistance at 0.236 arc

4/12: minor sideways and down movement along 0.236 arc, moving towards pitchfork median

4/13-14: moves up to 0.382 arc

4/15: Moves up towards 0.786 fib resistance line, .5 fib arc intersept

4/18: moves upwards to Reaction Line 2:1, Fib spiral, and .618 fib resistance level.

4/19-21: retraces to 0.786 fib support

4/22+: Upwards past 0.5 fib resistance, back towards Reaction Line 2:1 resistance

Bull/Bear CRC(Oil) DependsStrong signs of upward mobility, strong indicators of bear territory.

Andrews Pitchfork Downward over the long term.

RSI, CCI, Stochastic are showing reversal from bull to bear.

Schiffs Pitchfork touch on the median, showing clear reversal over the next day or so.

Touch on the 2.09-2.20 resistance region.

Upper resistance at 0.618 pitchfan level.

Upwards Schiff's pitchfork.

Fin Spiral is much further off to show reversal (if it's any confidence, i'm doubtful)

Lower support at 1.81-1.75 region.

Lower inclined support from 0.5 on the pitchfan.

My dataminer is stating bull, but i'm only seeing bear (next 3 dMy data miner is showing high probability, based on last 20 years, of VOD going up

Longterm neutral Andrew's Pitchfork at roughly 33.50;

Shortterm schiff's pitchfork bullish (and below price action);

Showing strong support/resistance at fibonacci levels

ActionReaction showing a downtrend yet realized that should end around 4/22.

Fib Arcs showing strength by trends; both showing downward arc resistance.

All Bear news on MACD, Stoch, and CCI.

Let me know your thoughts