Bitcoin Might be Bullish, but Prepare for Worst!BTCUSD down about -8% from today opening, dragging down whole altcoin markets.

Bitcoin opens today in weaker structure than I thought. Shape obviously looking like H&S and 42800 neckline may not hold much...

Bitcoin always drag altcoins more % down than itself. Dominance chart confirms the idea. So be careful, especially if you took alts during recent period of 2 months.

Today bitcoin may stay near 44-ish zone, also expected some false shakeouts up and downs. So be patient before taking any risk on current, I should say, choppy environment.

US market opening soon, might open below prior closing, which drag down SP and stocks down by a few %.

So wait for your opportunity and now it is better to hedge your investments with stable assets.

Best regards

Artem Shevelev

Artemcrypto

FETCH FET / BTC idea to watchIn this case price formed triangle shape, which can be bearish, and considering placement of this shape I think chances for breakdown are higher.

This shape is also found in Wyckoff Distribution models.

Looking for targets near 1500 sat

USD target can be found on pic below:

Best regards

Artem Shevelev

SOLANA How dip it can go?!In fact SOLANA one of the most performing and reached top of the alt list this season. Only by summer the price increased by an enormous 800% percent.

I think this could be the possible end of the growth for this project at least for this year.

Now I am expecting a correction movement in the range of 130$ and 100$ USD.

I cannot recommend any long term buys in this price action, cause things can be extra choppy in the range.

Best regards

Artem Shevelev

ETHEREUM Fractal Proving possible $5000, but first $2600Guys look, this thing on ETH / USD showing pretty similar movement in different scale. In between February and April we had smaller triangle with same price action inside.

I think this year price will made similar movement. So next stop might be 2600 before another leg up towards 4000 and 5000-5200.

So long term expectations is to buy near support range 2800-2600 and wait for the launch!

Best regards

Artem Shevelev

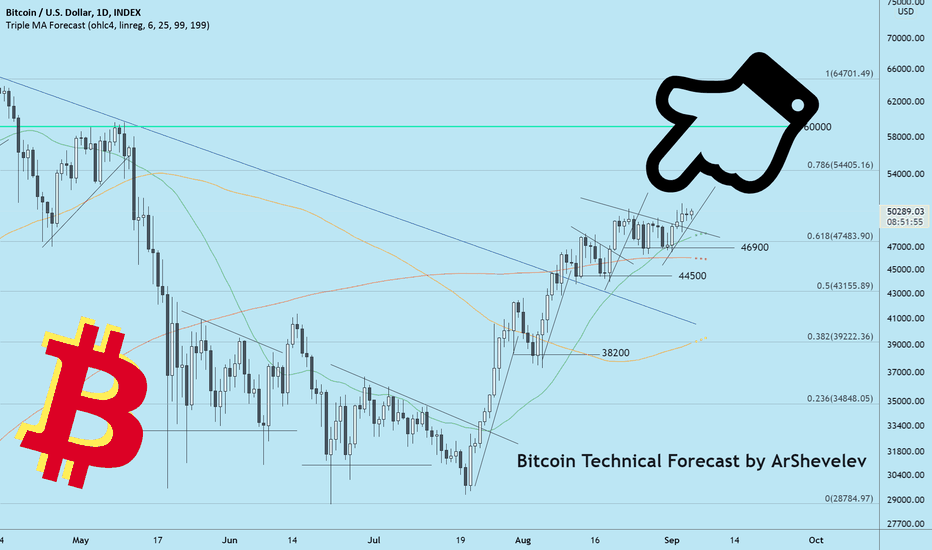

Bitcoin Testing $50000 and Sideways planBitcoin approaching target of previous updates, now chasing 50K target.

From daily charts expectations was shared here and we can expect small move upside.

From mid-term perspective I will expect price to calm down, probably we will see 44300 or pretty close to it.

So there will be another opportunity to increase exposure on crypto market.

Hopefully price will make it and break previous high at 53K, which will allow us to dream about approach the ATH again.

We will see, btc is slow since summer, but usually things getting faster closely to the year end.

See you in the next updates,

Stay tuned

Artem Shevelev

PS: Do your own research and always trade with affordable risk.

Bitcoin Long story Short | choppy 46KSince my previous updates, Bitcoin sits in the range 46K and 43K. Causing price jump up and down 5% within a day.

Keep your positions on hold, this might take a time before trend show up again.

Hopefully we going to see daily closing above 46K, which can give us another impulse leg up.

Price resistances givs us good understanding of targets and possible reversal points.

But in case breakdown from 42K, we most likely will see price failing lower to sub 38K so take it to account before taking big bets for your positions.

Keep your heads up

Artem Shevelev

Whats next for Bitcoin: Levels and ThoughtsQuick pullback from 52k wiped -20% from the price, creating opportunities in support zone. Demand in Bitcoin high enough, so it is quite possible to see recovery from here.

Keep in mind 42.3K level which important for sellers. If support will be strong enough - the price may do good pullback from this support and take another chance to break 52k. Quite good opportunity with nice risk/reward, so I will rebuild my long position to try.

If price failed 42k - this will trigger another selling wave — in this case we must watch for levels near 38K.

Best regards

Artem Shevelev

Ethereum Pushing Down, but we should wait for new ATHEthereum did a great job moving upwards to $4000 since last week.

This move started from $1800 in late July and now seems like finished near $4000.

I can say price certainly needs rest. Might face a few road bumps before continuation, so take a step back and follow price action closely.

On chart I located important supports and resistance trends and levels.

Thanks for reading

Best profits

Artem Shevelev

Bitcoin Making it's way up $52K. Expected lows and highs.Bitcoin rally continues and now approaching $54K resistance zone. Over last week price made +13% profit move, which is awesome for crypto, most of alts did major move up simultaneously.

Keep in mind possible start of correction down to $47-42K in mid-late September.

But before that, personally, I am expecting reaching $54-60K as main target for taking profits.

In 60K we have a strong resistance which will hard to break IMHO.

Thanks for reading,

Have a nice profits

Artem Shevelev

If you missed previous update:

Will Bitcoin Break to New Swing High — 02 September 2021Hey there! Since last day Bitcoin price moved up +8% making it's way to $50000. From 26 August price managed to float above Daily Moving Average (DMA) 200 period and it seems like a strong evidence of buyers dominance.

Since breakout from triangle I am expecting price to reach new swing high during next 3 or 4 days, targeting $53200.

Stay profitable

Best regards

Artem Shevelev

Bitcoin levels you not expectPrice entering saturated zone, I think we might see a volatility action near 54k down 50k and even more bumps near 57-60k zone which is highly volatile and liquidity will jump in this zone too.

Current setup for btc is hold

Day trading opportunities will be open in dips, direction long.

Stay safe traders!

Bitcoin Price Action and DMA100x200 16 August 2021Price of Bitcoin still going up, trying to make another swig high.

⚠ Looking at key Moving Averages (100x200) we can see price going above both MAs, but moving averages crossed in bearish order.

🟡 While price action compressing in Wedge shape, looking for breakout in support regions.

💚 Bullish note that price broke resistance line on Log scale too, this probably a good sign.

Best regards

Artem Shevelev

ALTCOIN REVIEW by Artem Shevelev — 12 August 2021Hey guys, in this review we will look in another important altcoins which extremely popular among crypto holders 👍

1. DOGE

2. THETA

3. HBAR

4. ADA

And lets start from DOGE coin

which is forming some interesting pattern, which I will cover more detailed in next reviews. Price located in between DMA100 and DMA200, still in bullish shape, but now price might wanna reach 0.5 Fib level at $0.34 - 0.35. From these levels I will expect pullback in bearish side.

Another altcoin for today is THETA token

It gave holders good profits on last move carrying almost x2 from last swing low. But now price seems like heading south again, facing resistance in the zone of $7.0 and downtrend as well as DMA 200 and DMA 100 death cross.

Take a look at flat-surfaced HBAR

It seems to me it is some kind of distribution going on, I've seen this manner last year and surprised by seeing it this year happening again. Looking south for this token on next period.

And last for today is ADA (cardano)

Have to admit, price of cardano made significant profits for holders, especially for long-term buyers who holding since 2020-lows.

Right now price stuck at 0.618 Fib zone from last ATH, and seems to me it is quite exhausted for another run upside. I bet on bearish outcome for mid-term, so for coins which left in portfolio I will try to fix in this zone to avoid unnecessary risks.

Thanks for your time, stay safe

Best regards

Artem Shevelev

ALTCOIN REVIEW by Artem Shevelev — 10 August 2021Hey, in the past 24h altcoin market responded well to Bitcoin price rise.

According to Binance exchange there is at least 10 altcoin pumped +20-70%.

In this review I collected few altcoins which have not pumped too much, and located at relatively good point for buying / holding and profits might be amazing

Before we go to alts, remember to use capital risk wise and calculate your maximum loss before trade. Let's go!

First chart to watch is ICP / BTC

ICP showing solid Adam & Eve bottom pattern and possible breakout from it, looking for levels above 1800 and might reach closely to 2000.

If the price goes below 1300, I would recommend stopping the trade.

The next chart is about GRT / BTC

GRT is making a solid downtrend channel / wedge shape and might go for a breakout to retest the 2000 resistance zone. In the long term price can dip below 1300 where I located the next buy zone for holders. Keep your fingers crossed :)

Third chart is for XTZ / BTC

Tezos is holding well in the support zone, forming a nice wedge and might go higher in this resistance zone. I am looking for resistance near 8000-10000. But before reaching it, xtz seems to have an opportunity to reach the 6000 support zone, which is quite good for long-term buyers.

And last chart for today is for MDT / BTC

MDT chart located pretty low and gives nice range for making mid-term trades

safe-side entry near 65-60 zone and with targets at 95 - 130 - 170

Keep your trades on the safe side, market conditions are constantly changing.

See you in next updates

Best regards

Artem Shevelev

Bitcoin Down as it approach H&S neckline!Hey guys, I am back with bitcoin update, and this time we manage to have nice pullback from 42618 level, now approaching 38000-ish with possible drop continuation towards 36000 or 35000 in upcoming days.

Targets obtained by Fibs and H&S pattern.

Stay tuned, best regards

Artem Shevelev

XMR/USDT bearish signs — XMR DOWNMonero is up +36% from last swing low, now making correction to previous swing and I am expecting price to reach zone of 240 before breaking down towards 210-s

Best regards

Artem Shevelev

Bitcoin 3 Reasons to go Down -30%Since 21 July Bitcoin is up +40% and made nice profits for holders.

Now price approach important resistance (1) and might take some timeout after 10-in-a-row days of green candles.

The growth of 21 July was supported by Bullish Divergence (2)

Now this pump is 98% similar to the pump (3) at right chart side.

Both chart complete these criterias (reasons for down)

1 - Resistance

2 - Bullish divergence

3 - Pump

I will reconsider my bearish sentiment if price will breakout from resistance with solid movement and bullish price patterns thereafter.

Stay safe

Best regards

Artem Shevelev

Bitcoin Breakout from Triangle -25% opportunity! — BTC DOWNHey! Bitcoin price surging down below $30000. I am looking for confirmation on lower timeframes, but from here it is looking solid bearish. Daily closing price will make possible to confirm further downtrend.

Stay positive and patient, cause real beer market not even opened yet.

Daily timeframe update:

Wyckoff prediction

Trading patterns

Elliott waves patterns

Best regards

Artem Shevelev