ETHUSDT → Retest of MA200 and trend supportBINANCE:ETHUSDT is testing a strong support area in the correction phase amid a bullish global trend. Bitcoin is falling and dragging the whole market with it

The price of Efirium is testing the support of the ascending triangle - this set-up is now global. At the same time, the price is testing the MA-200 (daily), which supports the trend. In our case, if this retest turns out to be false and the price forms a false breakout and is able to consolidate above the MA-200 and above the 1800 level, then the market may switch to a bullish direction again. In this case, the scenario will start to develop, which includes price growth to 2020 and in the medium term to 2457.

While bitcoin is dragging the whole market down, it will be hard for altcoins to break out upwards.

At the moment, the moving averages are clamping down on the price, with the coin trading in a narrow range.

Support levels: 1800, MA200

Resistance levels: 1872, MA50, 1900

In priority I am waiting for a false breakdown and continuation of the ascending triangle formation.

Regards R. Linda!

Ascending Triangle

Ascending traingle chart Look at chart weakly frame breakout ascending traingle chart breakout

India government planned to 2030 carbon mukta railway so energy stock take advantage first so keep watching all energy stock are at up trend so this kind of breakout show how chart potentially up side move

No recommendation for buy or sell

💱EURCAD - Ascending triangle EURCAD continues its bullish trend. The price is testing the resistance on the background of upward movement. There is a chance for a quick breakout

TA on the high timeframe:

1) Accumulation is formed near the level of 1.47728. At the next retest, the price may break the resistance

2) The liquidity area of interest for the price is above 1.48560.

TA on the low timeframe:

1) A triangle is forming

2) Price bounces off the support on the background of a bullish trend

3) A retest of resistance is forming, increasing the chance for a breakout

Key resistance📈: 1.47600, 1.4796

Key support📉: 1.4700, 1.4654

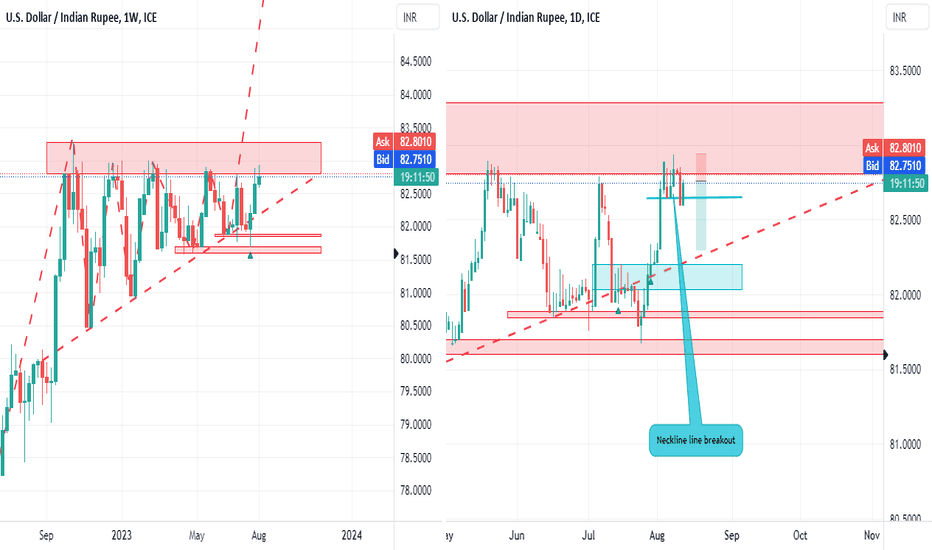

Double top neckline breakout In weekly the market is in Ascending triangle pattern. where the current market price is at weekly resistance.

In daily time frame there is change in trend(from bull to bear) formed by double top neckline breakout, so the market is expected to fall further till the weekly ascending trend line(support).

After the DT neckline breakout now the market is in retest, a good level to sell where minimum risk : reward ratio is 1:2.5

BTCUSD → A logical correction will test a strong support area BITSTAMP:BTCUSD continues to form a global ascending price channel. The actual counter-trend correction at the moment does not indicate any change of trend, an adequate reaction to the strong resistance area formed back in 2021 is being formed.

The price on the daily chart is forming a local support line 28850, a pre-breakdown consolidation and false breakdown is formed, there is no reaction in the form of a rebound, and the price continues to form a squeeze to the support. In the near future 28850 may be broken and the price will test 28450, a false breakdown is possible. Also within this correction the price may test the support of the ascending triangle and 200-day moving average. The price may technically decline in order to purchase the asset at more favorable prices.

The cryptocurrency market emphasizes more on fundamentals than on technical analysis, it plays a secondary role in this partnership. Crypto players are waiting for some news to activate the movement in one direction or another.

Interesting nuances recently:

1) Approval of the spot BTC-ETF will lead to billions of dollars of non-investment inflows into the market

2) The government has stepped up BTC protagging for June-July

3) Mainers collectively stopped selling and started accumulating BTC. Their reserves are growing

4) Minimal liquidity is accumulating strong consolidation. A surge in volumes may follow in the near future

Strong support levels: 28850, 28450, figure support, MA-200

Strong resistance levels: 29650, 30575, figure resistance.

This correction is a logical move in the market. The price can't grow all the time. I expect bullish activity after retesting the support area.

Regards R. Linda!

💱EURNZD - The price is preparing for a breakout and a riseEURNZD is forming an ascending triangle and for the past few hours, the currency pair has been showing potential that is preparing the price for upward movement

TA on high timeframe:

1) A retest of 1.8000 is forming

2) Consolidation near liquidity on the resistance side

TA on the low timeframe:

1) An ascending triangle is forming

2) Price into the range and consolidates near resistance

3) Pre-breakout consolidation is forming

4) Breakout of 1.8000 will send the price to 1.81000

5) Medium-term potential is to rise to 1.83000

Key support: 1.79270

Key resistance: 1.80000

AI is showing bullish momentumI like the short-term price action on this one. Looking at the 4hr chart, I see that a trading range has developed. The trading range shows higher lows and higher highs. That is the foundation of an uptrend. Within that uptrend on the 10min chart, I see that an ascending triangle is formed. Ascending triangles are characterized by flat tops and rising lows. It shows that buyers are getting more aggressive and sellers remain stagnant. Eventually, the buyers should surpass the sellers. A break of the ascending triangle gives me confidence that the uptrend will continue to the upper end of the range. There has also been a heavy amount of call option buying and put option writing which suggests that institutions may want to take this higher as well. I am watching the following levels closely...

Entry above 42

Stop below 40

Target1 44

Target2 47

ETHUSD → Correction, after which growth to 2000 may be formedBITSTAMP:ETHUSD continues to form a bullish price channel, as evidenced by the MA-200, which accompanies the trend support. The price is forming a correction and breaking the support of 1846, thus marking the next target before further growth

Ethereum is forming a global flat 2021 - 1700. Support 1728 plays an important role for us and there is a high probability that the price may test it in the near future. But we are primarily interested in the support of the ascending channel.

The cryptocurrency market after active strengthening has moved to the correction format following bitcoin. There are no particularly key fundamental factors on this basis, as many nuances speak about the increasing interest in this market.

The price is in a range and in our case we can apply a range trading strategy, which means that in an uptrend we need to look for strong support areas to open buy trades.

Support levels: trend boundary, MA-200, 1775, 1728.

Resistance levels: 1846, 2021

I expect the correction to continue to the support area of the uptrend, after the retest of which may be followed by a bullish impulse.

Regards R. Linda!

Targa Resources Corp. WCA - Ascending TriangleCompany: Targa Resources Corp.

Ticker: TRGP

Exchange: NYSE

Sector: Energy

Introduction:

In today's examination, we focus on Targa Resources Corp. (TRGP) listed on the NYSE, a key player in the energy sector. The weekly chart exhibits a bullish breakout from an Ascending Triangle pattern, which has been forming over the past 66 weeks.

Ascending Triangle Pattern:

The Ascending Triangle is a classical charting pattern characterized by a horizontal resistance line and an upward-sloping support line. In this case it serves as a bullish continuation pattern.

Analysis:

Targa Resources' previous trend was upward, symbolized by the green diagonal line. This upward trend was momentarily halted by a consolidation phase forming the Ascending Triangle pattern. The upper horizontal boundary of the pattern is around 80, with 4 touch points, while the lower diagonal boundary ranges between 55-76 and also has 4 touch points.

The price is well above the 200 EMA, implying a bullish environment. Currently, the price appears to have broken above the horizontal boundary, favoring a long entry. The price target for this bullish setup is at 103, which corresponds to an estimated rise of 30%.

Conclusion:

The weekly chart of Targa Resources presents an attractive bullish breakout opportunity through the Ascending Triangle pattern. This setup, validated by a breach above the horizontal boundary, could offer a rewarding long trading prospect.

---------------------------------------------------------------------------------------------------------------------------

Please remember, this analysis should be a part of your comprehensive market research and risk management strategy, and is not direct trading advice.

If you find this analysis valuable, please consider liking, sharing, and following for more insights. Wishing you successful trading!

Best regards,

Karim Subhieh

Disclaimer: This analysis is not financial advice and is intended for educational purposes only. Always conduct your own research and consult with a financial advisor before making investment decisions.

💱USDCAD - ascending triangle realizationUSDCAD breaks the resistance of the bullish pattern and moves to realize the accumulated potential. The price can overcome the way to the nearest resistance quite quickly if the bulls hold their positions

TA on the high timeframe:

1) Price still has upside potential towards 1.333

2) Breakout of the liquidity area forms a consolidation above 1.32300

TA on the low timeframe:

1) Price breaks out of the range and forms a consolidation

2) A retest to 1.32280 is formed, I expect a false breakdown from below and possible consolidation of the price above the level.

3) At the moment sellers are testing the support.

Key support📉: 1.32279

Key resistance📈: 1.3303

USD/CAD READY TO SWING FOR UPSIDE! USD/CAD was going with the support trend line and creating higher lows, after taking support this trendline market will take rejection from the main resistance level at the 1.32278 and creating the Ascending Tringle Pattern.

Now, the market was break the Ascending Tringle Pattern and ready for the swing because at this point sellers are in control, and buyers are ready for the move.

Tell me what your point of view on this trade and make sure follow for the more ideas like this if you want.

Caution:- Please consult your financial advisor before you enter in this trade.

GOLD → Friday's buyback. NonFarm in the coming week OANDA:XAUUSD after breaking the global trend support and attempting to change the trend is not in a hurry to fall yet, most likely the price is looking for confirmation of which way to go. Consolidation is forming which may confuse many.

In the coming week there are quite important key reports:

- ISM Manufacturing PMI (analysts expect a slight strengthening of the indicator)

- ADP Nonfarm Employment Change (may be followed by an improvement on the back of GDP growth)

- Initial Jobless Claims (analysts expect deterioration of the indicator, last week the indicator was upgraded at the forecasted deterioration).

- ISM Non-Manufacturing PMI (analysts expect a deterioration)

- NonFarm Payrolls ! (Analysts expect it to worsen from 209K to 184K)

- Unemployment Rate (unchanged)

Against the backdrop of a rising GDP and a relative decline in inflation (unconfirmed), the indicators of the upcoming news may change relative to the expected data. If the expected data is confirmed, then the dollar may lose some ground and give a little room for gold to strengthen.

From the technical analysis point of view:

The price is in a sideways flat after the breakout of the global bullish channel. Everyone expected a sharp fall after breaking the support, but with the unstable fundamental background, gold is strengthening and forming a flat within 1983 - 1935. If we take a closer look, we can see a reversal set-up against the upper boundary of the range, which is a strong resistance, but on Friday gold buys back a 0.9% drop and once again questions the H&S set-up formed.

At the moment the 1959.8 resistance plays a key role, the price forms a false break of the level but at the same time closes very close to this line, from the opening of the session a gap up could follow which would open the price above 1960. Since the price is flat and closed last session within the setup, the local strengthening may continue to 1980, and then we have to watch the price reaction to these levels.

We should also pay attention to the fact that on the background of the news a strong bearish impulse was formed, which broke several supports and formed a correction to 1959.8. If this level is held by the sellers, the bears may send the price to 1948 for a retest (negative fundamental background is still present in the market).

Regards R. Linda!

Bitcoin - Huge alt-season is starting! (buy altcoins)

Bitcoin dominance is going down, and in confluence with this sideways price action, I expect a huge alt-season! It's a great time to buy some altcoins.

We can clearly see that the price of Bitcoin is stuck in this rising wedge pattern. Because of it, generally, there is a higher probability of the price going down, but we still have plenty of time, and the price can stay inside for another 30 or 50 days.

We need to wait for the rising wedge pattern to show us the direction. The trendline of the rising wedge is slightly ascending, which is unpleasant to the bulls for a breakout. It tends to make swing failure patterns above the previous high, but you can take advantage of it and short it.

This analysis is not a trade setup; there is no stop-loss, entry point, profit target, expected duration of the trade, risk-to-reward ratio, or timing. I share my trades transparently and post trade setups privately.

Trading Bitcoin on higher timeframes is currently not worth it because of its low volatility. You can still trade it on an intraday basis. But I prefer altcoins at this moment because the Bitcoin dominance chart (BTC.D) is showing some signs of weakness.

Bitcoin broke out of the market structure in recent days but quickly went back up. So we need to be patient. To increase the probability of success, switch to altcoins!

Litecoin's halving event is in 6 days, which should send the price to the moon. We will see... I am prepared for it.

This is a quick update on BTC; I am not short or long on it. I trade altcoins!

Thank you, and for more ideas, hit "Like" and "Follow"!

BTCUSD → Price is forming a consolidation. Retest of 0.382 fiboBITSTAMP:BTCUSD is in the correction phase. The market is forming a decline in volatility to the lows of the last few months. Globally we still have an ascending price channel and a bullish trend.

The price is declining to the limits of 0.382 fibo. Consolidation is formed above this line, in this case if the price continues to consolidate near 0.382 in the absence of a bounce, a breakout may follow and the price may decline to 28474 for a retest.

A positive sign for us will be a rebound from 0.382 and a breakout of 0.236 with the subsequent consolidation of the price above the level, in this case the bulls will again begin to show potential and form a retest of resistance.

The medium-term view of the situation tells us that this technical correction may continue, but not for long. The price is testing the important support area MA50 - 28474.

In the long term it is worth paying attention to strong support levels, and secondly to the resistance, because in the uptrend it is worth looking for reversal points and entry points and breakout entry at these areas.

Support levels: 0.382 fibo, 28474, 0.618 fibo

Resistance levels: 0.236 fibo, 30575

I expect the correction to continue with a possible retest of 28474, but in the long term I expect continued growth to retest 30575 with a subsequent breakout and price movement to trend resistance.

Regards R. Linda!