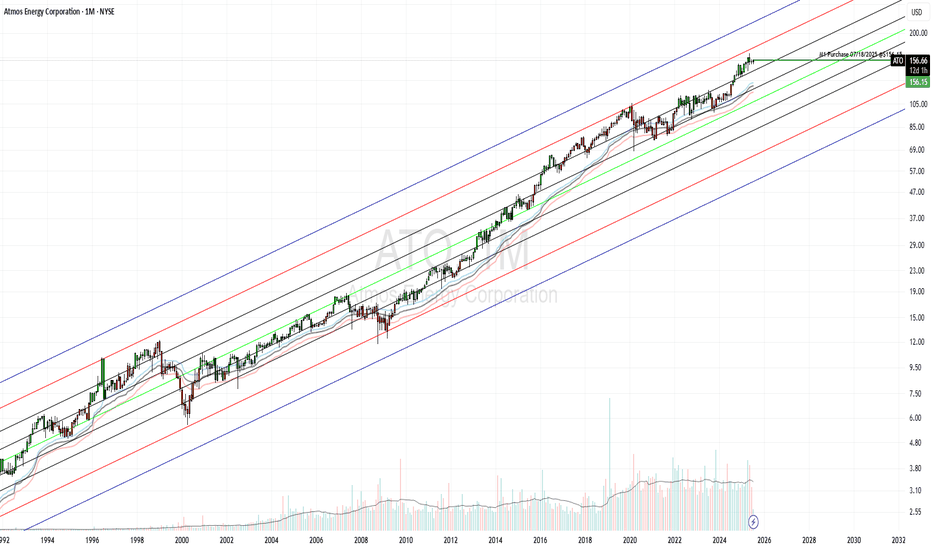

ATO Purchase: Natural GasAtmos Energy is one of the largest fully regulated natural gas utilities in the U.S., serving over 3 million customers across 8 states. It operates in a stable, recession-resistant sector with predictable cash flows and strong regulatory relationships.

$24B Infrastructure Investment Plan through 2029 to modernize pipelines and expand service

20 New Industrial Customers added recently, boosting demand

Strong Regulatory Framework ensures cost recovery and stable margins

EPS Growth Forecast: ~7.6% annually through 2029

Atmos Energy offers a low-risk, income-generating investment with:

Strong fundamentals

Reliable dividend growth

Long-term infrastructure tailwinds

Defensive positioning in volatile markets

GreenBlue Rank: 291/2500

GreenRed Rank: 3/3147

ATO

Atos : Post-Split Recovery and Key Market ScenariosFollowing the massive share split (13,497 new shares for every 24 old shares), Atos experienced a significant price drop from $1 to $0.0024. The stock reached its lowest point at $0.0015 on December 17, marking a critical bottom.

From January 9 to February 11, Atos entered a consolidation phase, ranging between $0.0024 and $0.0019, indicating a period of accumulation. However, on February 18, the price broke above its post-split all-time high, reaching $0.0035, with an intraday high of $0.0039.

Now, after this sharp extension from $0.0020 to $0.0039, a pullback is necessary to stabilize price action and determine the next trend.

Potential Scenarios for Atos Price Action

1. Bullish Continuation: Uptrend Formation

If Atos holds above $0.0028, we could see a bullish channel forming, with price moving between $0.0028 and $0.0035.

This scenario would set up a gradual uptrend, signaling continued accumulation and confidence in further recovery.

Key Level to Watch: $0.0028 must hold as support to confirm the bullish momentum.

2. Neutral Consolidation: Sideways Trading Range

If the price drops below $0.0028, Atos could enter another consolidation phase, ranging between $0.0023 and $0.0029.

This would indicate that the market is still undecided, with neither bulls nor bears taking full control.

Key Level to Watch: $0.0023 should act as strong support, preventing further downside.

3. Bearish Retest: Hunting for Liquidity at $0.0018–$0.0019

In a bearish scenario, Atos could break below $0.0023 and head toward $0.0018–$0.0019.

If this zone holds, it could trigger a new buying wave, stopping the bearish momentum and potentially creating a new hype cycle.

Key Level to Watch: Price must refuse to go under $0.0018 for buyers to regain control.

Conclusion: Crucial Levels to Watch for Atos' Next Move

Bullish scenario: Hold above $0.0028, creating an uptrend between $0.0028 and $0.0035.

Neutral scenario: Drop below $0.0028, consolidating in a range between $0.0023 and $0.0029.

Bearish scenario: Test $0.0018–$0.0019, with a potential rebound if this zone holds strong.

With the recent price breakout, Atos is now at a critical turning point, where the next few trading sessions will determine whether bullish momentum continues or if the stock will enter another consolidation or correction phase.

Atomos Energy Will Bottom SoonBased on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on September 15, 2021 with a closing price of 89.56.

If this instance is successful, that means the stock should rise to at least 91.07 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 4.175% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 7.193% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 18.853% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 35 trading bars after the signal. A 1% rise must occur over the next 35 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 16 trading bars; half occur within 24 trading bars, and one-quarter require at least 30 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

ATO Technical Analysis 🧙Atmos Energy is the largest publicly traded, fully regulated, pure-play natural gas utility in the United States, serving more than 3 million customers in Texas, Colorado, Kansas, Kentucky, Louisiana, Mississippi, Tennessee, and Virginia. About 70% of its earnings come from Texas, where it distributes natural gas in northern Texas, including Dallas, and has a 5,700-mile intrastate gas transmission pipeline spanning several key shale gas formations and interconnected with five storage facilities.

If you want more trading ideas like this one,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

ATO Bullish Divergence and StochRSI cross and nice tail!I will long ATMOS coming week.

I see a nice set of bullish divergences on EFI and MACD-H, together with StochRSI crossings.

Furthermore, a long wig is seen on the daily, which seems to mean there is a strong rejection there, and the market wants to go the other way.

I expect the target to hit +1,5 ATR line on the 4H timeframe at least.

But I will evaluate the bullish divergence on the daily as well, because if that one plays out we can enter the target zone of 110-111

Weekly impulse is still red (EMA and MACD-H both going down) and therefore I need to see how the week develops, to see if I get out at the short term target or not.

Entry: 107

Short term Target: 109.50

Longer term Target: 111

I will evaluate the strength of the move, to see if it will hit

Stop: 105.99

R/R ratio: 1:2 short term

R/R ratio: 1:3 longer term