AUD/CAD "Aussie-Loonie" Forex Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/CAD "Aussie-Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (0.86400) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.89500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/CAD "Aussie-Loonie" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUD (Australian Dollar)

Last Week’s FX Recap: April 7–11 (Zone Reactions & Trade Notes)📈 Weekly Forex Recap – Market Reactions & Lessons (Apr 7–11)

Last week there were about +320 pips of reaction potential (excluding Gold, which I was completely off on). There were multiple opportunities to capture solid intraday or swing setups.

3 out of 6 weekly targets were hit.

5 out of 6 trend biases were either accurate or neutral —meaning no major misreads, aside from one or two volatile zones. The only pair that really got me was Gold.

Let’s run it back real quick:

✅ AUDJPY

Bearish bias accurate.

30 pip reaction off zone with just 1 pip drawdown.

Weekly target hit.

✅ NZDJPY

Bearish bias accurate.

Weekly target hit, though price never reached the watch zone.

No setup triggered, but direction was respected.

⚠️ EURUSD

Range-bound bias played out majority of the week.

Gave about 90–100 pip drop from the hot zone mentioned.

Weekly target came close but didn’t hit.

⚠️ GOLD

Watch zone completely failed.

Short-term bounce gave 480 pip reaction—but that volatility was tough to catch cleanly.

Directional bias wasn’t helpful here. Gold was chaos.

✅ EURGBP

Cleanest setup of the week.

Bias was bullish, price tapped the buy zone and ran 100 pips.

Weekly target hit. Textbook move.

⚠️ GBPUSD

Consolidation-heavy.

Watch zone gave 100 pip reaction, but weekly target didn’t hit.

Bias was unclear—no real conviction either way.

📉 Total Zone Reaction Potential: 320 pips

🎯 Weekly Targets Hit: 3/6

📊 Trend Accuracy: 50% (3 clear hits, 2 neutral, 1 miss)

But that’s done now.

Whether you hit it last week or fumbled the ball, let it go.

We trade forward. Eyes up. Mind clear.

Time to dive into the new week.

Let’s get it. 👊

GBPAUD to continue in the uptrend?GBPAUD - 24h expiry

The primary trend remains bullish.

Bullish divergence is expected to support prices.

The RSI is trending higher.

Preferred trade is to buy on dips.

Bespoke support is located at 2.0830.

We look to Buy at 2.0830 (stop at 2.0710)

Our profit targets will be 2.1250 and 2.1320

Resistance: 2.1000 / 2.1200 / 2.1250

Support: 2.0730 / 2.0620 / 2.0500

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUD/CAD 4H Analysis – Smart Money Building a CaseStructure: Bullish | Timeframe: 4H | Pair: AUD/CAD

Alright, keeping this clean and honest 👇

Price swept buyside liquidity earlier around 0.90500, tapped into a bearish order block and dumped hard. That entire move was textbook—OB reaction, BOS confirmed, and then a clean drive down.

Fast-forward:

We swept sell-side liquidity at the bottom (~0.84400), tapped into a refined bullish OB and flipped structure with an MSS → then BOS followed. So yes, bulls took control.

After that, price formed an FVG between 0.85700 and 0.86100 — and it filled beautifully. Price respected it, and we pushed up toward 0.87800.

Right now… we’re in premium territory.

Let me say it clearly:

No fresh buys here. Not the place.

We wait for the price to come back to the FVG zone or OB and then look for a lower timeframe CHoCH or bullish candle.

Not guessing.

Not forcing.

Just reacting to the flow.

If price breaks below BOS and closes below FVG → we flip bias. Simple.

Until then:

📌 Patience wins. Revenge trading doesn’t.

💬 Drop a comment if you're watching this level too.

Let’s see if smart money brings it home from the FVG again.

And yeah, follow if you trade based on logic, not hype.

#AUDCAD #SMC #OrderBlock #FairValueGap #SmartMoney #LiquiditySweep #ForexCitySignal #NoRetailNoise

GBPAUD Bearish Rejection – Short Setup Below 2.1075GBPAUD has shown a clear rejection from the key supply zone around 2.1075, forming a lower high after a failed attempt to retest recent highs. This price action confirms weakness and opens the door for a potential bearish continuation.

Key Technical Zones:

Current Price: 2.0867

Resistance Zone (Supply): 2.1075 – 2.1336

Support Targets:

TP1: 2.0636 (structure support)

TP2: 2.0335 (demand zone)

Bearish Confluence Factors:

✅ Strong rejection from previous breakout zone

✅ Bearish engulfing setup forming under resistance

✅ Price structure showing lower highs and loss of bullish momentum

✅ Potential head and shoulders breakdown pattern forming

Trade Setup Idea:

📉 Bias: Bearish below 2.1075

📌 Entry Trigger: Breakdown below recent lows (~2.0820)

🎯 Target 1: 2.0636

🎯 Target 2: 2.0335

🛑 Invalidation Zone: Break and close above 2.1075

Conclusion:

GBPAUD looks poised for a downward continuation if the current rejection holds. A confirmed break below support could see price moving toward the 2.0636 and 2.0335 zones. Watch for clean bearish candle closes for added confirmation.

GBPAUD INTRADAY breakout zone retest GBPAUD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 2.0595 – previous consolidation range and pivotal support

Upside Targets:

2.1380 – initial resistance

2.1642 and 2.1970 – extended bullish targets on higher timeframes

A bullish reversal from 2.0595 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive break and daily close below 2.0595 would invalidate the bullish structure, opening the door for further retracement toward 2.0460, with additional support at 2.0316 and 2.0134.

Conclusion

EUR/GBP remains bullish above 2.0595. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EurAud sell insight Price rejects an old weekly level 1.84352 clearing the previous week's high 1.82907 hence closing bearish.

Now I'm anticipating the previous week's low to be cleared so I'm bearish for the week 1.71115 (previous week low) as my draw of Liquidity 🧲

1.81291 and 1.84782 are my point of interest to short after getting confirmation

Kindly boost of you find this insightful 🫴

GBPAUD buy Trade IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPAUD market outlookFX:GBPAUD

Price has reached and reacted off significant level of resistance zone at 2.16400, which was last seen on the 2nd of November 2015. On Friday's NY open, price created a false bullish signal with a 190 pips pin bar candle on the H1 chart. Instead, price reacted off its recent swap zone and continued its downtrend. If it breaks below 2.07720, we can anticipate a short-term continuous downtrend to the daily demand range, which is about 200 to 300 pip movement.

On the fundamentals, the Aussie dollar has recently hit a 5 year low against the USD, trading at just 60.5 US cents as the two world's largest economies have been ramping up tariffs to as high as 125%. The AUD may be impacted due to China being Australia's biggest trading partner and the trade war is only increasing uncertainty risks. On the bright side, the ASX 200 surged by 4.5% on a single day as Trump announces tariff pause, which was the highest increase in value on a single day ever since the pandemic in 2020. Both the UK and Australia have been imposed the same reciprocal tariff rates of 10%, for now, I expect a short-term downtrend before its continuation upwards, but we'll see what the coming week brings to us.

EURAUD Will Go Down! Sell!

Here is our detailed technical review for EURAUD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.804.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.720 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY Will Move Higher! Long!

Take a look at our analysis for AUDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 90.356.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 94.801 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/CHF BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/CHF is trending up which is obvious from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a great trend following opportunity for a long trade from the support line below towards the supply level of 0.542.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/CAD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/CAD pair is in the uptrend because previous week’s candle is green, while the price is obviously falling on the 1H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 0.870 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPYWe see in Australia against the Japanese yen two scenarios, i.e. the trend is completed to the downside, or if 90.449 is breached, it begins to rise, and we target 93.498 and 92.332, but most likely the scenario is an upward trend that will be activated, i.e. we wait for the taki candle after the breach.

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so GBP-AUD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 2.090.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bullish bounce off pullback support?EUR/AUD has bounced off the pivot and could rise to the pullback resistance.

Pivot: 1.79142

1st Support: 1.76955

1st Resistance: 1.82291

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDJPY Bearish continuation below 91.85The AUDJPY currency pair remains in a bearish trend, with the recent price action showing signs of an oversold bounce. While a temporary rebound is in play, the broader sentiment remains weak unless a decisive breakout occurs.

Key Levels to Watch:

Resistance Levels: 91.85 (critical level), 92.84, 93.62

Support Levels: 87.87, 86.60, 85.70

Bearish Scenario:

A rejection from the 91.85 resistance level could reaffirm the downside bias, leading to a continuation of the bearish move toward 87.87, with extended declines targeting 86.60 and 85.70 over the longer timeframe.

Bullish Scenario:

A breakout above 91.85 with a daily close above this level would challenge the bearish sentiment, opening the door for further gains toward 92.84, followed by 93.60.

Conclusion:

The market sentiment remains bearish, with 91.85 acting as a critical resistance zone. A rejection from this level could reinforce the downtrend, while a confirmed breakout would shift the outlook to bullish, favouring further upside. Traders should closely monitor price action at this key level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/JPY SHORT FROM RESISTANCE

Hello, Friends!

We are going short on the AUD/JPY with the target of 85.454 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY to find buyers at previous resistance?AUDJPY - 24h expiry

There is no indication that the rally is coming to an end.

Further upside is expected.

Risk/Reward would be poor to call a buy from current levels.

A move through 91.00 will confirm the bullish momentum.

The measured move target is 92.00.

We look to Buy at 89.50 (stop at 88.50)

Our profit targets will be 91.50 and 92.00

Resistance: 91.00 / 91.50 / 92.00

Support: 90.00 / 89.50 / 89.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Bullish bounce off pullback support?AUD/JPY is falling towards the pivot which acts as a pullback support and could bounce to the 1st resistance which is an overlap resistance.

Pivot: 89.50

1st Support: 87.82

1st Resistance: 93.06

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

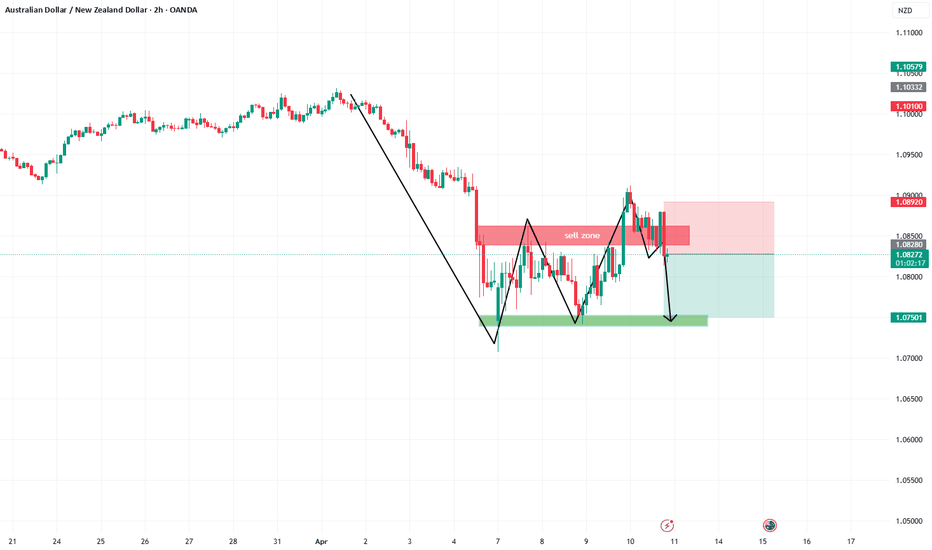

Bearish reversal?AUD/NZD is rising towards the pivot and could reverse to the 1st support.

Pivot: 1.09400

1st Support: 1.08854

1st Resistance: 1.10183

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.