AUD (Australian Dollar)

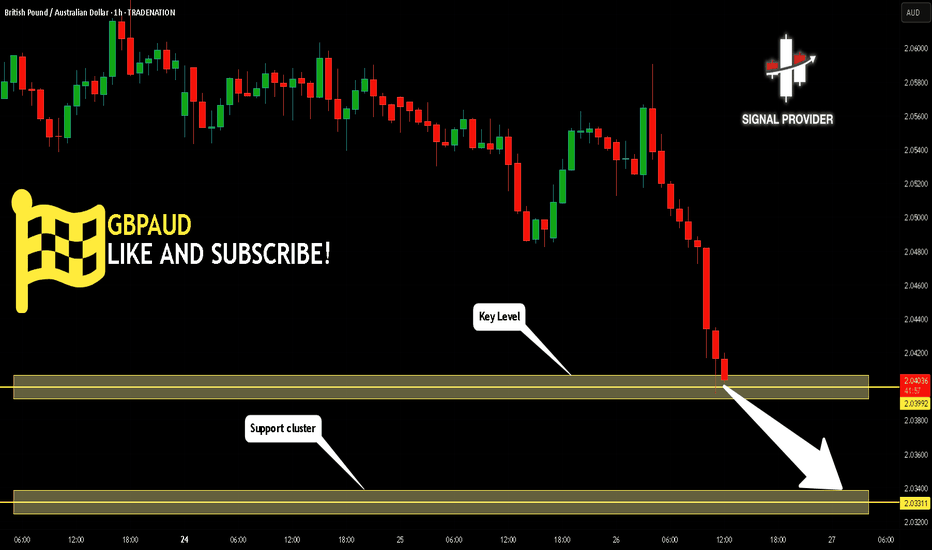

GBPAUD Will Move Lower! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 2.039.

Considering the today's price action, probabilities will be high to see a movement to 2.033.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/NZD BEARISH BIAS RIGHT NOW| SHORT

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.098

Target Level: 1.089

Stop Loss: 1.104

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 6h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/AUD Breakout (25.3.25)The GBP/AUD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.0448

2nd Support – 2.0400

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/AUD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/AUD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.054 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

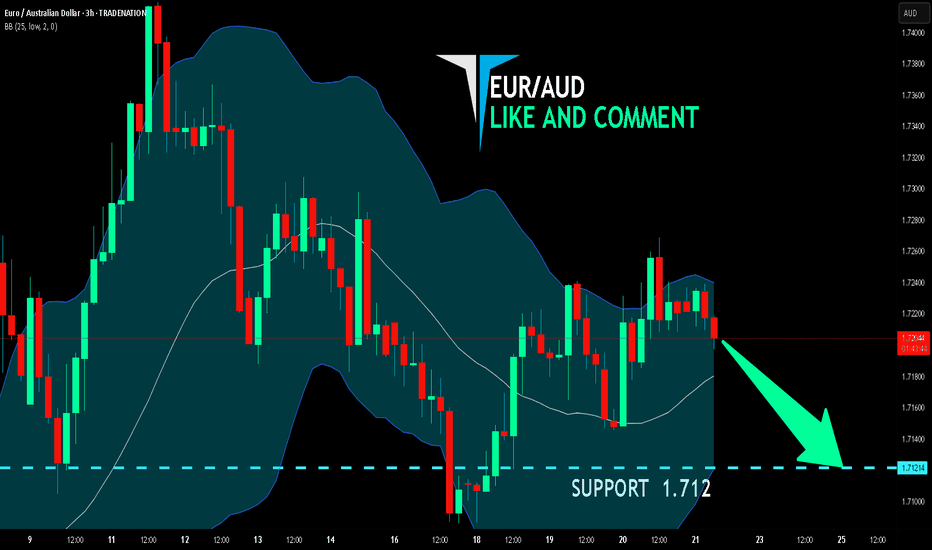

EUR/AUD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

EUR/AUD pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.712 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

My GBPAUD Long idea 26/03/2025The AUD currency has been seeing some weakness and if we look at the inflation it is relatively weakening. The inflation rate in Australia went from 2.8 to 2.4 and the interest rate for AUD is sitting at 4.1.

The Pound has seen some love due to raising inflation narrative we are sitting at 3.0 and it is expected to drop to 2.9 with the interest rate sitting at 4.5.

AUD interest rate projection -> Q1 4.1 -> Q2 3.85 -> Q3 3.85 -> Q4 3.6

GBP interest rate projection -> Q1 4.5 -> Q2 4.25 -> Q3 4.0 -> Q4 4.0

I would love to see the price make some pullbacks to the 50% fib or go a little below to the 100 EMA for a better RR. However, if you pull out the Bollinger Bands you will realize that the 4H price has bounced off of the lower Bollinger.

And if you try drawing a FIB from the recent 4H Swing Low you will notice a bounce from the 50% level. I would try DCA or put a tight SL below 204738 maybe if price stays flat but slowly melting upwards.

AUDCAD - Sell Trade SetupWaiting for AUDCAD to reach the level I plotted on the chart to sell it.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

AUDCAD | Reoccurring FractalsWe're looking at 3 complete fractals and the fourth one being the current one. Same phase as the last, a bit of sideways trading/consolidation then aggressive buying breaking out to the upside.

Price action has been trending upwards with HHs and HLs and we're currently at a Lower High bouncing off the lower trendline below.

Would be ideal to look for long positions only for this setup as bulls are looking stronger from this view.

~300pips going into the 3rd wave.

GBP/AUD Bulls Eye 2020 HighFutures traders are net-long GBP/USD futures and net-short AUD/USD futures. So it is quite fitting to see GBP/AUD in a strong uptrend, with traders now eyeing the 2020 high.

However, the weekly chart suggests the current upswing may be nearing a cycle peak. A small bearish divergence has also formed on this timeframe. I am therefor seeking evidence of a swing high to form, somewhere around the 2020 high (or below).

For now, the daily chart is grinding higher and the 10-day EMA is supporting. There are also early signs of an ending diagonal / rising wedge, which could still allow for another leg or two higher before the anticipated mean reversion towards the 10 and 20-week EMAs kick in.

Matt Simpson, Market Analyst at City Index and Forex.com

AUDNZD - Sell Trade SetupTaking a look at AUDNZD on the daily timeframe, price action has pulled back to a key level of resistance. Unless something significant happens, there's no rational or fundamental reason for this pair to breakout to the upside. For this reason, I'm interested in short selling this pair.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for account management

Trade Safe - Trade Well

~Michael Harding

AUDCAD Approaching Key Support - Rebound Towards 0.90150?OANDA:AUDCAD is approaching a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 0.90150 level, a logical target based on previous price behavior and current market structure.

However, if the price fails to hold this support and breaks below the zone with momentum, the bullish outlook may be invalidated, potentially opening the door for further downside continuation. Monitoring price action and volume in this area will be crucial to confirm a valid setup.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

AUDCHF - Potential Short-Term BottomTaking a look at the daily chart, AUDCHF has began showing indications of a potential bottom. This might be a decent low risk LONG setup as a swing trade.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for account management

Trade Safe - Trade Well

~Michael Harding

EURAUD Set To Grow! BUY!

My dear subscribers,

This is my opinion on the EURAUD next move:

The instrument tests an important psychological level 1.7135

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.7187

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPAUD Bearish Breakout Imminent: Points to Potential Downside4-hour chart of GBPAUD reveals a critical juncture. We've observed a recent uptrend culminating in what appears to be a rising wedge formation. This pattern, characterized by converging trendlines, often signals a potential reversal, particularly after a sustained bullish run. The upper trendline has faced repeated tests, indicating weakening upward momentum. Crucially, the 2.04938 level acts as immediate support. A decisive break below this point would validate the wedge breakdown and likely trigger a significant bearish move.

Key Levels and Targets:

Immediate Support: 2.04938

Target 1: 2.03263 (Initial downside target)

Target 2: 2.00516 (70.0% Fibonacci Retracement)

Target 3: 1.97478 (100.0% Fibonacci Retracement)

Fibonacci Analysis: The price action has breached the 50.0% retracement level, suggesting a potential continuation towards the 61.8% and lower levels. The 70.0% and 100.0% retracements are critical downside targets.

Trading Implications:

Short Entry: A confirmed break below 2.04938 is the primary trigger for a short entry.

Stop Loss: A conservative stop-loss should be placed above the recent swing high or the upper trendline of the wedge to mitigate risk.

Risk Management: Given the potential for volatility, prudent risk management is essential.

Considerations:

Confirmation: A break below 2.04938 must be accompanied by strong bearish momentum and ideally, increased volume to validate the signal.

Fundamental Factors: Keep a close eye on upcoming economic data releases from both the UK and Australia, as these can significantly impact the pair.

EURAUD consolidation towards the key trading level at 1.0750The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/NZD Made Double Bottom , Long Setup To Get 150 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.