euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD (Australian Dollar)

AUD/NZD Multi-Timeframe Breakdown: Trend Shift or Retracement?Welcome back, guys! 👋 I’m Skeptic , and today we’re diving into a multi-timeframe analysis of AUD/NZD. (As I mentioned this pair on our weekly watchlist on March 9th.) At the end, I’ll also share some solid long and short triggers that you definitely don’t want to miss—so let’s get into it!

📉 Daily Time Frame Analysis

In the daily time frame, we can clearly see a strong major uptrend that has been holding the price upward. However, recently, the upward trendline has broken, which could indicate the start of a retracement . This break hints at a potential shift or correction rather than a complete trend reversal, so we need to stay cautious.

🔍 4H Time Frame Analysis: Finding Triggers

Moving on to the 4-hour time frame, it’s clear that we’ve had a clean pullback to the previous upward trendline. As I pointed out in my weekly watchlist analysis, the main trigger for a short position was at 1.10115 , which has just been activated . If you took that trade with me, you’re in profit right now!

But don’t worry if you missed it—you still have a chance to catch the next move. Since the trendline is broken, we could see a sharp uptrend retracement movement if the price breaks our 4h support level.

Short Trigger: I’ll be waiting for a breakout below 1.10087 to look for another short opportunity.

Long Trigger: I’ll be watching for a higher high and higher low to confirm that the uptrend is still intact. Specifically, a breakout above 1.10544 would signal a potential long entry.

💡 Always remember:

trading in the direction of the main trend typically yields higher R/R and win rates. Don’t trade against the trend unless you have a very strong reason to do so.

I’d love to hear your thoughts on AUD/NZD —drop your opinions in the comments below! Also, if you have any questions about trading or strategy, just ask—I’ll make sure to reply. Let’s keep growing together, not alone! 💪

AUD/JPY BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

AUD/JPY pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 92.334 area.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD challenging important resistance at 1.7330The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/CAD stalls around 91c, pullback pending?A 3-wave move has developed from the January low, that for now appears hesitant to hold above 91c or its 50% retracement level. Twice we have seen false breaks of the 91c level on the daily chart, and Monday presented a bearish pinbar which closed below the 200-day SMA.

Bearish divergences have also formed on the weekly and daily RSI (14) and daily RSI (2). Perhaps a pullback is brewing.

Bears could fade into moves towards the 200-day SMA, in anticipation for a move down to at least 90c, just above the 50-day SMA and weekly VPOC (volume point of control).

And if the BOC refrain from promising further cuts while delivering an expected 25bp cut tomorrow, it could further strengthen the Canadian dollar and weaken AUD/CAD further.

Matt Simpson, Market Analyst at City Index and Forex.com

AUDNZD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The instrument tests an important psychological level 1.1011

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1026

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

AUDCAD: Bearish Continuation & Short Signal

AUDCAD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short AUDCAD

Entry - 0.9095

Sl - 0.9134

Tp - 0.9028

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURAUD continues to flirt with the highest point of 2024We mentioned this pair last week and told you to keep an eye on the highest point of 2024. And there we are, MARKETSCOM:EURAUD is flirting with that area. If we continue to see the rate struggling to remain above that hurdle, there might be a chance for a slight retracement.

What do you think?

Let's dig in!

FX_IDC:EURAUD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

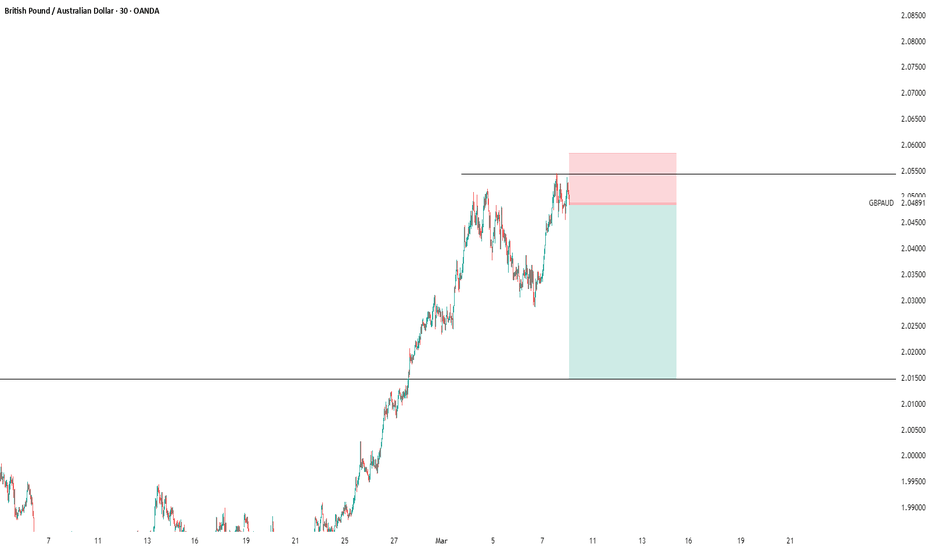

GBPAUD INTRADAY Bullish consolidation supported at 2.0227The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a bullish rebound from 2.0227, could extend the upside, targeting 2.0499, with further resistance at 2.0577 and 2.0737 over a longer timeframe.

Conversely, a confirmed break below 2.0227, with a daily close under this level, could signal a corrective pullback towards 2.0077 and 2.9937.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 2.0227 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD-CHF Local Long! Buy!

Hello,Traders!

AUD-CHF went down and

The pair made a retest of the

Horizontal support level

Of 0.5514 from where

We are already seeing a

Bullish rebound and we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Weekly Watchlist & Market Outlook (#1)Welcome back, guys! I’m Skeptic , and today, I’m breaking down my weekly watchlist with key market setups. Having a structured plan before the trading week starts helps you stay mentally prepared, avoid impulsive trades, and stick to your strategy. So, let’s dive in!

1. XAUUSD (Gold) 🟡

Daily TF:

Gold has maintained a strong major uptrend and recently completed a price correction to 2842.15 (36% Fib) before resuming its upward movement. This signals a potential continuation of the bullish trend.

Trigger (Daily): Break above 2954.24 🔼

4H TF:

Price is currently in a range between 2896 (support) and 2927 (resistance).

Long trigger:Breakout above 2927

Short trigger: Below 2896 (although trading in the trend’s direction is recommended for better R/R).

2. EURJPY 💶

Daily TF: The pair is ranging between 155.551 (support) and 161.166 (resistance).

4H TF:

Long trigger: Breakout above 161.166 📈 (RSI entering overbought territory could add confluence).

Short trigger: Break below 159.291 targeting the range’s bottom.

3. GBPAU D

Daily TF: The key resistance at 2.02396 has been broken, signaling a new uptrend.

4H TF:

Long trigger: Breakout above 2.05139 🔼 for trend continuation.

Short trigger: If 2.02396 fails as support (fake breakout), look for lower TF confirmation.

4. GBPNZD

Daily TF: Similar to GBPAUD, 2.23992 resistance has been broken, and price has pulled back.

4H TF:

Long trigger: Breakout above 2.26565 📈 for continuation.

Short trigger: If 2.23992 fails (fake breakout scenario).

5. AUDNZD

Daily TF:

A strong uptrend was recently broken, potentially signaling a price correction.

4H TF:

Short trigger: Break below 1.10115 🔻 (sign of further downside).

Long trigger: If price reclaims the broken trendline, indicating a fake breakdown.

Final Thoughts 💡

Thanks for following this week’s watchlist! If you have specific pairs or assets you’d like me to analyze, drop them in the comments.

Growing alone may be fast, but in the long run, teamwork wins. Let’s grow together. ❤️

AUDJPY - Growing SHORTS! Big Move Ahead!In one of our last AUDJPY analysis, we indicated that price looked foppish. Since then, we've had almost a 2000pip drop!

That big drop can be marked as wave 1 in our new bearish impulsive trend.

We are now in Wave 2, which is an ABC correction. We have completed Wave A (3 waves). We are now in Wave B (3 waves). We're currently in subwave b of wave B. Expecting subwave c to appear very soon.

Trade Idea:

- Watch for bearish price action on lower timeframe

- You can use trendline break, fibs or BOS to find the reversal point

- When entered, put stops above subwave B.

- Target: 91 (750pips)

4Week Chart

Goodluck and as always, trade safe!

See our previous setups below:

AUDJPY The Week Ahead 10th March ‘25. Key Trading Level: 94.70

Bearish Scenario:

The overall sentiment remains bearish, aligned with the longer-term prevailing downtrend. Recent price action suggests a sideways consolidation, indicating potential continuation of the downtrend. A bearish rejection from 94.70 could reinforce selling pressure, targeting 92.33 as the first support level, with further downside extending toward 91.18 and 89.60 if bearish momentum strengthens.

Bullish Scenario:

A confirmed breakout above 94.70 and a daily close higher would invalidate the bearish outlook, signaling a potential shift in momentum. If buyers gain control, the next upside targets would be 95.56, followed by 96.60, where further resistance may emerge.

Conclusion:

The 94.70 level is a key pivot point in determining AUDJPY’s next directional move. A rejection at this level would reinforce the bearish outlook, while a breakout higher could indicate a potential trend reversal. Traders should monitor price action around 94.70 for confirmation of the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD Bullish breakout supported at 2.0227The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a bullish rebound from 2.0227, could extend the upside, targeting 2.0499, with further resistance at 2.0577 and 2.0737 over a longer timeframe.

Conversely, a confirmed break below 2.0227, with a daily close under this level, could signal a corrective pullback towards 2.0077 and 2.9937.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 2.0227 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURAUD Bullish overextended rallyThe EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURAUD looking for value zone to go long ... the week of 10 Mar Weekly – strongly bullish

Daily – strongly bullish

H4 – bullish, now pulling back towards a consolidation zone between 1.7108 and 1.69930 (marked on my chart). 20 ema is also currently located here.

When/If price reaches this zone, I will be monitoring PA on H4 and H1 timeframes with a view to find evidence of a bullish continuation. In the current uncertain US situation, it is vital to establish that control of the market has returned to the bulls, before taking a long trade. Stop can be below the zone (around 1.6930) or a bit lower with the initial target at about 1.7280.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros