Audcadforecast

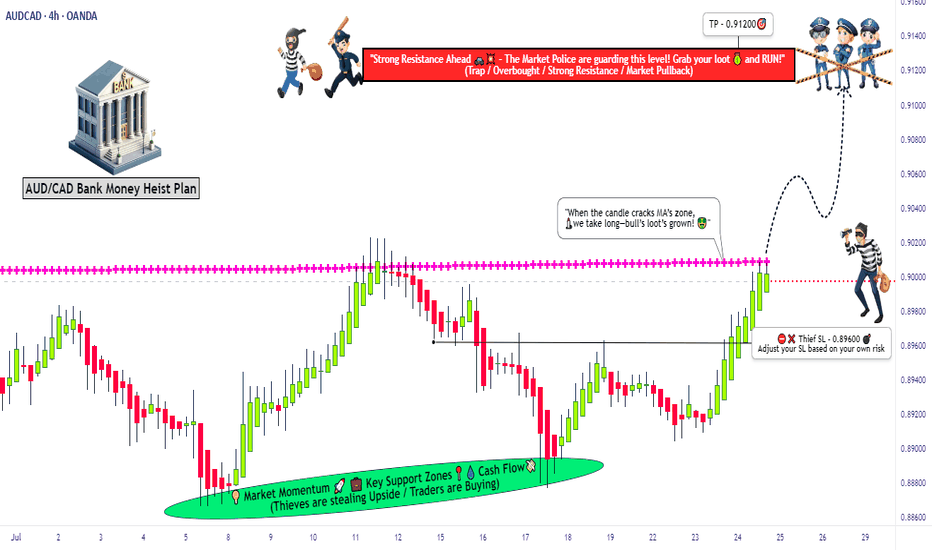

AUDCAD Forex Heist Plan: Entry, SL & TP by Thief Trader Style🏴☠️🔥 AUD/CAD Bank Heist Plan – Thief Trader's Long Con in Motion! 🔥🏴☠️

Breakout Bulls vs Bearish Guards – Who Wins the Forex Vault This Time?

🌍 Hello Money Makers, Market Bandits, and Strategic Robbers! 💰🚀💣

It’s Thief Trader back again, dropping heat with another high-stakes Forex bank job – this time we're targeting the AUD/CAD vault. This is not your grandma’s trading plan. We’re executing a well-calculated heist based on a fusion of technical breakouts + fundamental drivers with a dose of pure trading psychology warfare. 🎯

💼 The Heist Blueprint: Long Entry Game Plan

🧠 Our job is to move in silence until the breakout alarms go off.

We target 0.90200 as the clean breakout trigger over the Moving Average. This zone marks the guard shift — bulls take over if we break through.

📌 Entry Types (Choose your weapon):

🔹 Buy Stop: Above 0.90200 (Post-MA breakout confirmation).

🔹 Buy Limit (DCA Style): Set limit buys at recent lows (M15/M30 swing low) for pullback entries. Layer your entries like a true strategist.

🔔 Set Alerts: Don't sleep on this. Place alerts at breakout zones – let the chart notify you when the bank door opens. 📡

🛑 Risk Management – The Escape Plan

We don't jump in blind. Place your Stop Loss ONLY AFTER the breakout confirms.

📍Suggested SL: 0.89600, near recent 4H wick low.

🔥 Reminder: Your stop depends on your lot size, risk tolerance, and how many entries you're stacking. Don't set it too tight – we don't want early alarms killing the mission.

🎯 Profit Target – Rob & Exit

📍 Primary TP: 0.91200

🎭 Or simply: Escape before the alarm rings (i.e., close early if you see price weakness near resistance or news surprises).

🧲 Scalpers, stick to long bias only. If you're running capital deep, go in hard. If not, ride with the swing team. Use trailing SLs to protect and ride the move like a ghost.

🧠 Behind the Heist – What Fuels Our Mission?

The AUD/CAD pair is showing bullish signs backed by:

✴️ Macroeconomic indicators

✴️ Central Bank divergences

✴️ COT data (Commitment of Traders)

✴️ Intermarket correlations

✴️ Sentiment shifts & positioning strategies

Before executing any trade, read your fundamentals. Study the landscape. Then strike. 🕵️♂️

⚠️ Trading Safety Alert – Timing Is Everything

🚫 Avoid placing trades during high-impact news.

✅ Use trailing SL to lock in profits and prevent whipsaw hits.

📊 Protect your capital like it’s stolen loot – because it is!

💥Support the Crew 💥

🚀 Smash that 💗 Boost Button if you’re vibing with the plan.

Every like strengthens the Thief Trading Crew – and gets us closer to daily market domination. 🎉💪

📲 Stay locked in. Another heist is coming soon.

Till then – rob smart, trade sharp, and vanish like a legend. 🐱👤💸

🔑 #AUDCAD #ThiefTrader #ForexBreakout #LongSetup #ScalpToSwing #TradeWithPlan #DCAEntry #ForexHeist #MarketStrategy #RiskReward

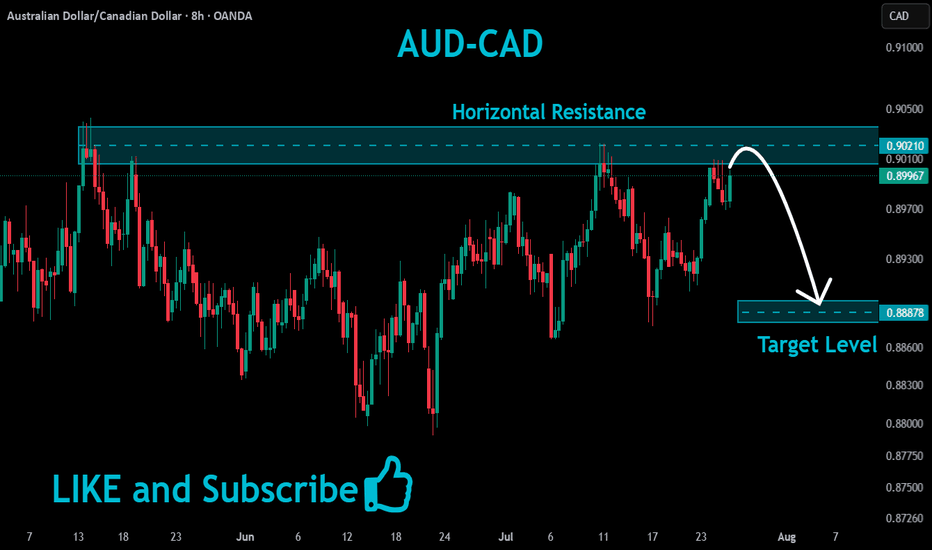

AUDCAD - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

AUDCAD – Bearish Rejection at Key Resistance ZoneAUDCAD is showing signs of weakness near the 0.8980 supply zone after an extended rally. The pair is now reacting to a historically respected resistance area, with bearish momentum building as exhaustion sets in.

🔍 Technical Outlook:

✅ Price rejected at multi-touch resistance around 0.8980

📐 Clean bearish structure forming after wedge-like exhaustion

📉 Expecting a move down toward:

TP1: 0.89365 – recent minor structure

TP2: 0.89080 – key demand zone from early July

TP3: 0.88654 – full measured target from range

📛 Invalidation above: 0.8985

🌍 Fundamental Breakdown:

🇦🇺 Australia:

📉 Softening inflation and retail sales

🏦 RBA cautious with limited appetite for further hikes

🇨🇳 Weak Chinese demand adds pressure on AUD

🇨🇦 Canada:

💪 Supported by rising oil prices and solid employment data

🏦 BoC remains vigilant on inflation, though on hold

🛢️ Strong WTI prices continue to support CAD

⚠️ Risks to the Bearish View:

⚡ Unexpectedly strong China data could boost AUD

📉 Sudden drop in oil prices would hurt CAD

🗣️ Surprise hawkish shift from RBA

🔗 Correlation & Flow:

AUDCAD is a lagging asset, heavily influenced by WTI crude (boosting CAD) and China-linked risk flows (affecting AUD).

Keep an eye on AUDUSD and USDCAD for early signals.

📆 Upcoming Key Events:

🇦🇺 RBA Minutes, Jobs Data, Wages Index

🇨🇦 BoC Business Outlook, CPI Print

🛢️ US Oil Inventories (affects CAD)

🧭 Summary:

🔻 Bias: Bearish

📊 Drivers: Oil strength, RBA caution, CAD resilience

⚠️ Risk: China rebound or oil correction

🕵️ Watch: Canadian CPI + Australian jobs data

📉 Likely to Follow: Oil and AUDUSD/USDCAD macro trends

Why AUDCAD is On My Watchlist for a Short Trade🔎 AUDCAD Trade Idea Overview 🔎

Currently watching AUDCAD closely 👀 — and here’s what I’m seeing across the key timeframes:

📉 On the weekly timeframe, the pair remains in a clear bearish trend, with lower highs and lower lows forming consistently.

🕰️ Dropping down to the daily, we’re seeing continued bearish momentum in alignment with the higher timeframe bias.

⏳ On the 4-hour chart, there’s been a clean break of market structure, confirming short-term weakness.

🎯 I’m eyeing a pullback into equilibrium within the current price range for a potential short entry.

🔹 Entry: On retracement into a key value zone

🔹 Stop loss: Positioned above recent swing highs

🔹 Take profit: Targeting previous lows and liquidity pockets 💧

Patience is key here — waiting for the right setup to align across multiple timeframes. 📊

⚠️ Disclaimer: This is not financial advice. This analysis is for educational and informational purposes only. Always do your own research and manage risk responsibly. 💼

DAILY HOT PICK ! AUDCAD SHORT FORECAST Q2 W23 D3 Y25AUDCAD SHORT FORECAST Q2 W23 D3 Y25

🔥🔥DAILY HOT PICK !!!!!! 🎯🎯

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Daily 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

D & 4H 50 EMA HOLD? AUDCAD SHORT FORECAST Q2 W22 D28 Y25🔥DAILY & 4H 50 EMA POI HOLD SOUTH...

AUDCAD SHORT FORECAST Q2 W22 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

VALID POI'S AUDCAD SHORT FORECAST Q2 W22 D27 Y25🔥VALID POI'S AUDCAD SHORT FORECAST Q2 W22 D27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

IN DEPTH HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 D26 Y25🔥IN DEPTH HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 D26 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25

SELL SELL SELL

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡In depth trade confluences provided during the week 📝

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

HUGE RETURNS PENDING! AUDCAD SHORT FORECAST Q2 W21 D21 Y25HUGE RETURNS PENDING!

AUDCAD SHORT FORECAST Q2 W21 D21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD Q2 W21 D19 Y25,SHORT RISK OFF ASAP ! We'll explain why...AUDCAD Q2 W21 D19 Y25 RISK OFF ASAP !

As per our most recent weekly trade forecast, we are indeed short biased & currently short AUDCAD. For those of you speculating with us, here I'll be quick in reason regarding why you should manage your risk effectively NOW. Whether that means rolling stops to half risk and or going breakeven, whatever risk management you use, the time is now.

Now here is why. Whilst, yes we do forecast but we also are hedging on reactions from price points of interests. The market does not know our lot sizes, nor our stop size nor our profit target.

Have we had the reaction from the POI? yes. Should that be good enough, YES!

In our opinion, in order to be successful trade, a robotic approach is required. To enter with minimal objectiveness. If the shoe fits and I like shoe is the one I've been waiting for then, it's simple. I try on the shoe. A lot like trading via a robotic approach, if the set up is the one that matches the catalog of setups that I acknowledge as a position, it is executed. With that said, the robotic approach works inline with when to know that its time to illuminate the potential for loss even though risk is always accepted, accepted, does not mean acceptable.

It is so very easy to be locked into a mindset that aligns with your current bias. exaggerated more so when you're in a position that stokes your thoughts ... BE MINDFUL of that. Stay robotic and try to illuminated self assurance. Look at price action with open eyes and hold no bias aside from the split second that you build your bias. then drop it and re evaluation continually. That I the "major key".

Remain open minded.

Remain Objective, not subjective.

Remember the aim. To print money.

Let’s see what price action is telling us NOW!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W21 Y25AUDCAD SHORT FORECAST Q2 W21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W20 D15 Y25AUDCAD SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W20 D14 Y25AUDCAD SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Trade towards the 50 EMA's on all time frames

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD Bullish Momentum: Pullback Setup in Play!📈 AUD/CAD Technical Outlook 📈

I’m currently analyzing the AUD/CAD currency pair, and it's showing a strong, sustained bullish trend on the daily timeframe 🔥. We’re seeing a clean sequence of higher highs and higher lows, which keeps my bias firmly bullish ✅.

I’m waiting for a pullback into equilibrium — that’s around the 50% level of the current or previous price range 🎯. If price retraces into this zone, I’ll be looking for a high-probability entry setup on the 4H and 30-minute timeframes ⏱️.

🎯 Target: Previous daily highs, as marked in the video.

This setup aligns with classic trend continuation principles, and I’ll be watching for confirmation before executing any trade.

⚠️ Disclaimer: This is not financial advice. Always trade based on your own analysis and risk management rules. 💼📊

AUDCAD SHORT FORECAST Q2 W19 D8 Y25AUDCAD SHORT FORECAST Q2 W19 D8 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅Intraday bearish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W19 D5 Y25AUDCAD SHORT FORECAST Q2 W19 D5 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅Intraday bearish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD LONG FORECAST Q2 W18 D2 Y25AUDCAD LONG FORECAST Q2 W18 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily 50 EMA

✅Intraday 15' order block

✅Tokyo ranges to be filled

✅Intraday bullish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X