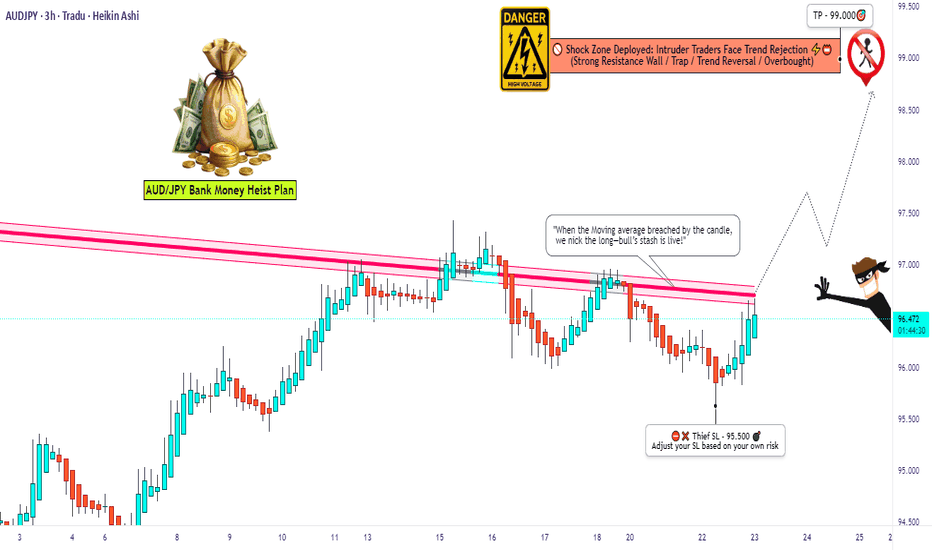

Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

Audjpylong

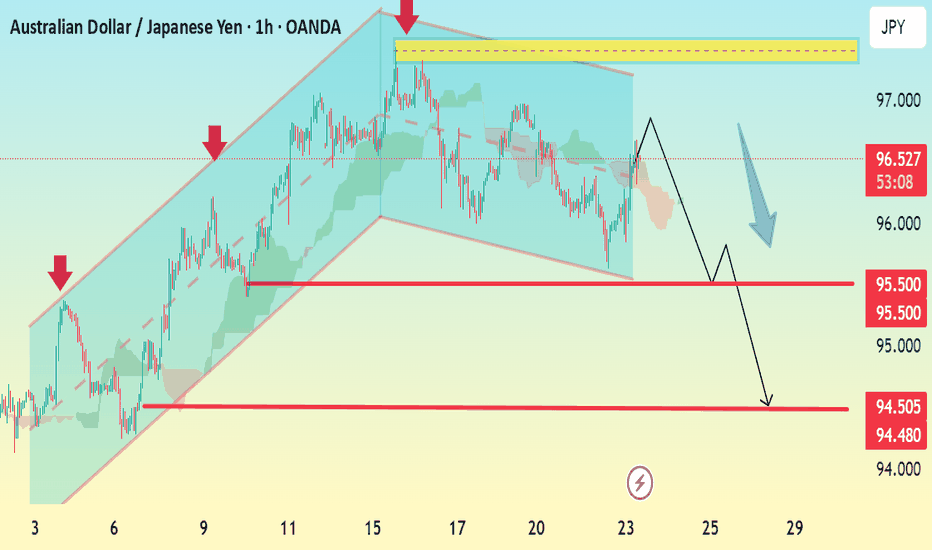

AUD/JPY 1H Bearish Reversal Setup Analysis:The chart shows a clear ascending channel that has now been broken to the downside, signaling a bearish breakout.

Price recently tested the upper boundary near 97.00 and faced rejection.

The break below the channel support and the projection with a blue arrow suggest a trend reversal.

Multiple support levels are marked, indicating potential take-profit zones.

Key Levels:

Resistance: 97.00

Immediate Support: 95.50

Target 1 (TP1): 95.00

Target 2 (TP2): 94.50 – 94.48

Bias: Bearish

Confirmation: Watch for a clean break below 95.50 to confirm further downside momentum.

AUDJPY – Waiting for the Long SetupThe price is currently in a corrective move,

and as always, we’ve already marked our key level.

📍 We’re patiently waiting for price to reach our support zone.

If a valid buy signal appears, we’ll take the long position

according to our trading plan.

❌ What if the level breaks?

No worries.

We don’t predict — we follow the market.

We’ll wait for a clean pullback and enter short if confirmed.

🎯 Our job isn’t to predict where price will go,

our job is to manage risk and stay aligned with the market.

Price can do anything —

we’re ready for every scenario.

AUDJPY LONG & SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 AUDJPY LONG & SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

AUD JPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

AUDJPY Bullish Channel Still Intact, Eyeing Breakout Above 95.00AUDJPY continues to respect its ascending channel, with the current bounce occurring right at the 61.8% Fibonacci retracement and lower trendline support. The structure supports further upside as long as price holds above the 94.00–93.80 zone, with targets set toward 94.77 and 95.36, potentially extending to 95.63 highs.

🧠 Fundamentals:

AUD Strength Drivers:

RBA remains relatively hawkish vs other G10 banks.

Australia's data this week (retail sales, NAB confidence) were mixed, but no rate cut pricing in the near term supports AUD.

Iron ore demand showing resilience despite Chinese slowdown concerns.

JPY Weakness Drivers:

BoJ remains ultra-dovish. No action expected in July.

Japan’s inflation remains tame; the yield gap with other majors keeps widening.

Risk-on sentiment reduces demand for safe-havens like JPY.

🔍 Technical Structure:

Strong upward channel since early June remains valid.

Current pullback held the 61.8% Fib retracement of the June-July leg.

Bullish engulfing near support confirms entry.

Immediate resistance at 94.77 → 95.36 → potential breakout to 95.63.

Invalid if price closes below 93.80 (channel break).

⚠️ Risk Factors:

Risk-off shift (e.g., geopolitical escalation or U.S. CPI surprise) may boost JPY.

China growth fears can weigh on AUD.

A sudden dovish shift from the RBA would invalidate bullish fundamentals.

🔁 Leader/Lagger Dynamics:

AUDJPY typically leads other yen crosses (e.g., NZDJPY, CADJPY) during risk-on moves. It’s also a barometer for broader risk sentiment, often following moves in equity indices like US500 or commodity-linked assets.

✅ Trade Bias: Bullish

TP1: 94.77

TP2: 95.36

TP3 (aggressive): 95.63

SL: Below 93.80

Event to Watch: China data this week + U.S. CPI (Jul 11)

📌 Watch for a strong bullish daily candle above 94.77 for continuation confirmation. Stay nimble around key global risk events.

AUD/JPY "Aussie vs Yen" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (94.500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (92.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 87.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

AUD/JPY "Aussie vs Yen" Forex Market is currently experiencing a Bullish trend., driven by several key factors. 📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Future Trend Move:

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDJPY –From Breakdown to Breakout Long Setup After Failed ShortFX:AUDJPY

The short idea was invalidated after price broke above the key resistance zone and hit our stop.

Now, we’re watching for a pullback to the broken zone for a potential long setup, supported by bullish momentum.

Keep it clean. Wait for confirmation.

Stay sharp, stay disciplined.

Smart Forex Analysis | Weekly Setups

Clean charts. No noise. Just levels.

AUDJPY Breakout on Rising Yields – Path Open to 95.70AUDJPY is maintaining strong bullish structure after breaking through key resistance around 91.65. Price is forming higher lows supported by an ascending trendline, indicating healthy buyer momentum. Fibonacci retracement levels show price holding above the 50% and 61.8% zones, strengthening the bullish case.

🔑 Key Levels:

Current Price: 91.65

Support Zone: 90.85 – 91.00 (previous structure + fib support)

Resistance Targets:

TP1: 93.15 (previous swing high)

TP2: 95.70 (full recovery move from March highs)

✅ Bullish Confluence Factors:

Ascending triangle breakout in progress

Strong higher lows and clean market structure

Holding above major 61.8% Fib retracement

Australian dollar supported by improved risk sentiment globally

BOJ expected to stay dovish and delay hikes, keeping the yen weak

🧠 Fundamental Context:

Japan Outlook: BOJ to hold rates steady at 0.5% amid US tariff risks. IMF projects a downgrade in Japan’s growth, weakening JPY outlook.

Sentiment on JPY: No strong intervention support for yen despite media noise. Japan’s government denied any push for stronger yen.

Australia Outlook: Risk sentiment steady, equities firmer globally, and higher AUD correlations to risk-on tone favor upside continuation.

💡 Trade Idea:

Bias: Bullish above 91.00

Entry: On confirmation bounce above 91.60

Target 1: 93.15

Target 2: 95.70

Stop Loss: Below 90.50

📌 Note: Watch for possible mild pullback into 91.30-91.50 zone before new upside leg. Strong US data midweek could temporarily lift JPY but broader BOJ dovishness remains the driver.

audjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/JPY "Aussie vs Yen" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (88.500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 92.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸AUD/JPY "Aussie vs Yen" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDJPY to find buyers at previous resistance?AUDJPY - 24h expiry

There is no indication that the rally is coming to an end.

Further upside is expected.

Risk/Reward would be poor to call a buy from current levels.

A move through 91.00 will confirm the bullish momentum.

The measured move target is 92.00.

We look to Buy at 89.50 (stop at 88.50)

Our profit targets will be 91.50 and 92.00

Resistance: 91.00 / 91.50 / 92.00

Support: 90.00 / 89.50 / 89.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

audjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDJPY Approaching Key Support - Will Price Rebound to 93.940?OANDA:AUDJPY is approaching a key support level, an area where buyers have previously shown strong interest. The recent bearish movement suggests that price may soon be testing this level, potentially setting up for a rebound.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward 93.940, aligning with the next key resistance level.

However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck, TrendDiva.

audjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

audjpy analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDJPY at Key Support Level – Potential Rebound to 95.900OANDA:AUDJPY has reached a significant demand zone, where past price action shows strong buying interest. This area has historically acted as a key support, increasing the likelihood of a bullish reaction if buyers re-enter the market.

If the support holds, a bullish reversal could push the pair toward 95.900, a logical target based on previous price behavior and market structure. Confirmation signals to watch for include bullish engulfing candles, long lower wicks, or increased buying volume, which would strengthen the case for an upside move.

However, if the price breaches this zone and sustains below it, the bullish outlook may be invalidated, increasing the likelihood of further downside. Monitoring candlestick patterns and volume at this critical level is crucial for identifying potential trade opportunities.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

audjpy analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

audjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade