Bearish drop off multi swing high resistance?AUD/USD has reacted off the resistance level which is a multi swing high resistance and could drop from this level to our take profit.

Entry: 0.6386

Why we like it:

There is a multi swing high resistance.

Stop loss: 0.6447

Why we like it:

There is an overlap resistance level.

Take profit: 0.6265

Why we like it:

There is a pullback support level that lines up with the 23.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDUSD

AUDUSD keeps surging upwardFrom a technical analysis perspective, the moving average system presents a typical bullish arrangement pattern. The 5-day moving average and the 10-day moving average are continuously rising and diverging 🚀, providing a solid support foundation for the exchange rate of the Australian dollar against the US dollar. At the moment, the MACD indicator is above the zero axis, and its histogram bars are also continuously expanding 📈, which clearly indicates that the bullish momentum is in a strong state 💪. At the same time, although the KDJ indicator is in the overbought area, there has been no significant sign of a turn, which means that the current upward trend is highly likely to continue 😎.

In terms of fundamentals, Australia's recent economic data has been rather remarkable 🌟. For example, Australia's employment data has shown a good growth trend, and the unemployment rate has decreased, indicating that the vitality of Australia's labor market is increasing 💪, which in turn provides strong positive support for the Australian dollar 😃. In addition, Australia's commodity export data is also quite excellent. As a resource-exporting country, the stable increase in commodity prices and the growth in export volume have greatly promoted Australia's economic development 🚀 and further enhanced the attractiveness of the Australian dollar 😍. In contrast, there is a certain degree of uncertainty in the economic policies of the United States. Especially, the progress of the fiscal stimulus plan has been slow, which has somewhat weakened the market's confidence in the US dollar 😕. Based on considerations of risk, investors have started to gradually shift their funds to other currencies, including the Australian dollar, injecting strong impetus into the rise of AUDUSD 💥.

💰💰💰 GBPUSD💰💰💰

🎯 Buy@1.3200 - 1.3230

🎯 TP 1.3300 - 1.3350

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

👇The accuracy rate of our daily signals has remained above 98% within a month! 📈 We sincerely welcome you to join our channel and share in the success with us! 👉

AUD/USD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/USD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 9H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 0.622 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDUSD SHORT FORECAST Q2 W16 D15 Y25AUDUSD SHORT FORECAST Q2 W16 D15 Y25

Good Morning Traders!

A very similar setup to what was forecast yesterday! Take a look.

We are sitting in varies higher time frame order blocks with confluence stacking.

We have had a move off the point of interest identified yesterday and a 15' order block was created on the bearish move.

Let price action gravitate to our 15' order block in London for a continued short.

FRGNT X

AUDUSD: Detailed Support & Resistance Analysis 🇦🇺🇺🇸

Here is my latest structure analysis for AUDUSD

for this week.

Resistance 1: 0.6385 - 0.6430 area

Resistance 2: 0.6455 - 0.6470 area

Resistance 3: 0.6518 - 0.6560 area

Support 1: 0.6078 - 0.6135 area

Support 2: 0.5914 - 0.5954 area

Consider these structures for pullback/breakout trading!

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD. Can we expect price to retrace higher?Good morning traders, we back with another idea on GBPAUD, yesterday I entered some positions and since I swing all my trades to TP/SL. Today morning following the AUD news, my stops were triggered but only due to ignorance because on Sunday as I was looking at it my plan was to enter today after the 8 am news on GBP. But it’s another lesson for the journal, on the daily TF this pair is ready to move lower but on this 1 hour we can see that price swept the liquidity below and failed to close below the lows, proving that price will move higher for our hourly high in purple.

But since I’ve hit my daily loss, I’ll just monitor and study this setup to avoid today’s loss.

AUDUSD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for AUDUSD below:

The instrument tests an important psychological level 0.6314

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.6202

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAU/USD: A Huge Fall Ahead? (READ THE CAPTION)By re-examining the gold chart on the 30-minute timeframe, we can see that the price once again moved exactly as expected and finally managed to rise back above $3100, reaching as high as $3136.5! Currently, gold is trading around $3120, and I expect we will soon see further decline in gold. The potential downside targets are $3115, $3105, and $3100 respectively. This analysis will be updated again!

The Last Analysis :

AUDUSD INTRADAY key resistance retest at 0.6390 AUDUSD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 0.6266 – previous consolidation range and pivotal support

Upside Targets:

0.6390 – initial resistance

0.6420 and 0.6550 – extended bullish targets on higher timeframes

A bullish breakout from 0.6390 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive reversal and daily close below 0.6390 would invalidate the bullish structure, opening the door for further retracement toward 0.6266, with additional support at 0.6100 and 0.6030.

Conclusion

AUDUSD remains bullish above 0.6390. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/USD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

We are going short on the AUD/USD with the target of 0.621 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Market Analysis: AUD/USD Gains Pace, Bulls Are Back?Market Analysis: AUD/USD Gains Pace, Bulls Are Back?

AUD/USD started a decent increase above the 0.6150 and 0.6200 levels.

Important Takeaways for AUD USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6000 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6260 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.5940 support. The Aussie Dollar was able to clear the 0.6065 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6200 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6315 zone. A high was formed near 0.6314 and the pair recently started a consolidation phase.

There was a move below the 0.6300 level. The pair remained above the 23.6% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the downside, initial support is near the 0.6260 level. There is also a connecting bullish trend line forming with support at 0.6260. The next major support is near the 0.6220 zone. If there is a downside break below the 0.6220 support, the pair could extend its decline toward the 0.6205 level.

Any more losses might signal a move toward 0.6065 and the 61.8% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6315. The first major resistance might be 0.6340. An upside break above the 0.6340 resistance might send the pair further higher.

The next major resistance is near the 0.6385 level. Any more gains could clear the path for a move toward the 0.6450 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Aussie H4 | Potential bullish bounceThe Aussie (AUD/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 0.6264 which is a pullback support.

Stop loss is at 0.6170 which is a level that lies underneath an overlap support.

Take profit is at 0.6390 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDUSD(20250414)Today's AnalysisMarket news:

Fed Collins: It is currently expected that the Fed will need to keep interest rates unchanged for a longer period of time. If necessary, the Fed is "absolutely" ready to help stabilize the market; Kashkari: No serious chaos has been seen yet, and the Fed should intervene cautiously only in truly urgent situations; Musallem: The Fed should be wary of continued inflation driven by tariffs.

Technical analysis:

Today's buying and selling boundaries:

0.6256

Support and resistance levels:

0.6374

0.6330

0.6301

0.6210

0.6182

0.6138

Trading strategy:

If the price breaks through 0.6301, consider buying, the first target price is 0.6330

If the price breaks through 0.6256, consider selling, the first target price is 0.6210

Week of 4/13/25: AUDUSD AnalysisDaily bias is bullish, prior week ended bullish with a V shape recovery showing that bulls are in control. As always our MTF internal structure dictates our immediate bias (bullish) and until it breaks, we're continuing our longs.

Price is reaching an important level at the extreme of the HTF supply level so once price gets there, it's good to see what happens next.

Major News: Unemployment Claims - Thursday

AUDUSD: Expecting Bearish Movement! Here is Why:

The analysis of the AUDUSD chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bitcoin is not going back to 100k anytime soon!!Good day traders, back against it with this bitcoin idea I’m currently on back on what price has shown us in recent weeks.

1W- Here price is still very much bearish as we can see that the market is in an expansion meaning any idea of price moving higher is what we all wish for but price does not care so overall here we bearish and need to be ready alert to price always wanting to move higher by taking recent highs.

4H- Now here we can see price shot higher for the liquidity that was resting above the recent broken highs, keeping in mind that our weekly bias is still bearish we than wanna see a shift in structure on the 1 hour TF to give us our first confirmation of many confirmations we use to come at a decision. After price respects our idea than we wanna see price go take the equal lows(Sellside liquidity) below.

Now I wanna make this bold prediction, and it’s my opinion by the way it’s not a fact or anything like that right. In my opinion I don’t think bitcoin will see 100k for the rest of 2025. And my prediction is based on my analysis only!!

AUDUSD Technical Analysis! SELL!

My dear friends,

My technical analysis for AUDUSD is below:

The market is trading on 0.6377 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6324

Recommended Stop Loss - 0.6403

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 0.6200 which is now

A support and the breakout

Is confirmed so we are locally

Bullish biased and we will be

Expecting a further move up

After a potential pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/USD - Sellers remain in control!The AUD/USD pair has been in a clear and consistent downtrend on both the 4-hour and daily timeframes. Sellers have maintained firm control over price action, driving the pair lower while it continues to respect the prevailing bearish market structure. Each failed bullish attempt further validates the dominance of the bears, reinforcing the narrative that the path of least resistance remains to the downside.

Recently, however, the 4-hour chart witnessed a sharp move to the upside, tapping into and filling a previously unmitigated 4H Fair Value Gap (FVG). Despite this temporary rally, the broader structure remains bearish, with the market still printing lower highs and lower lows, a classic hallmark of a sustained downtrend. As such, the current momentum favors a continuation lower, potentially targeting the green imbalance/FVG zone on the 4H timeframe, which aligns with the next logical area of liquidity.

This green FVG also coincides with the golden pocket retracement zone (61.8%–65%), adding confluence and strengthening its validity as a potential support area. A reaction here could provide an opportunity for a short-term bullish correction or even the start of a larger reversal, depending on how price behaves around this level.

That said, a bullish scenario is not entirely off the table. Should price decisively break above the red FVG to the upside, and ideally close above it with conviction, it may signal a potential shift in market sentiment. This would be the first sign of buyers regaining control, suggesting a possible trend reversal or at least a deeper retracement toward higher time frame resistance zones.

Until such confirmation is seen, however, bearish momentum prevails. Traders can continue to favor short setups, with particular interest around premium zones on the 4H chart. Any bullish setups should be approached cautiously and ideally considered only at key areas of support like the green FVG, especially where it aligns with high-probability fib levels.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

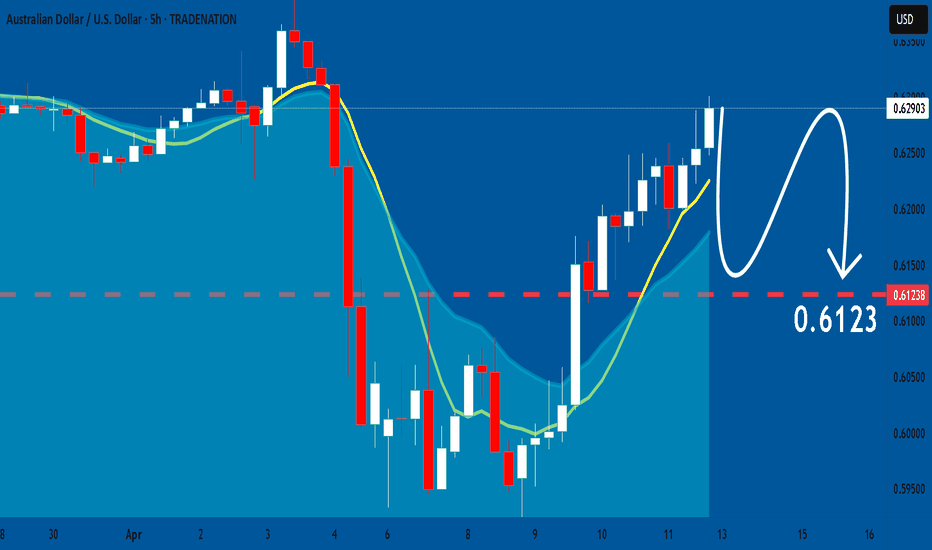

AUDUSDWe await a retest and withdrawal of liquidity and a correction to the area we specified at points 0.6135 and 0.61084. From this area, we wait for a confirmation candle and a buy entry, targeting 0.62555. But noticing any movement in the market may change the goals. This is a region, so we will wait and see what update we publish.

AUDUSD Will Fall! Sell!

Please, check our technical outlook for AUDUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.622.

Considering the today's price action, probabilities will be high to see a movement to 0.602.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/USD Breakdown: Bears in ControlThe AUD/USD pair has officially broken below its medium-term ascending channel on the daily chart, signaling a strong shift in momentum. After failing to hold above the resistance zone at 0.6311 – 0.6386, the pair reversed sharply and is now trading around 0.6213.

🔍 Key technical highlights:

A confirmed breakout beneath the channel support, accompanied by strong bearish candles, suggests growing seller dominance.

Both the EMA 34 and EMA 89 are now positioned well above the current price, reinforcing a medium-term bearish trend.

A potential short-term pullback to the 0.6240 – 0.6266 area may occur before further downside continuation.

📉 Next downside target: If bearish momentum persists and price fails to reclaim the broken support, the pair is likely to slide toward the marked support at 0.59142.

💬 With the USD gaining strength amid hawkish Fed expectations and the AUD facing domestic economic headwinds, selling the rallies remains the favored strategy in the current environment.