AUDUSD

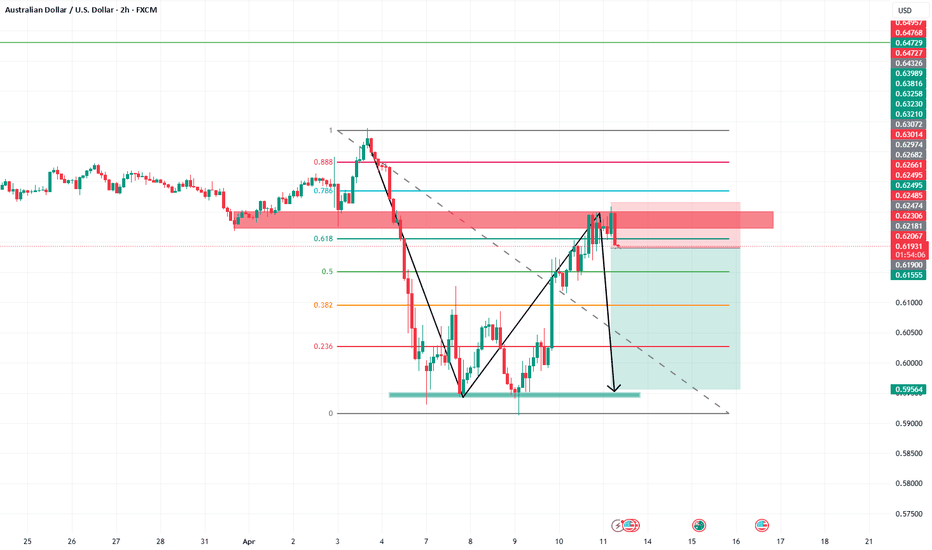

Bearish drop?The Aussie (AUD/USD) is reacting off the pivot and could reverse to the 1st support which lines up with the 38.2% Fibonacci retracement.

Pivot: 0.6228

1st Support: 0.6130

1st Resistance: 0.6314

CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the pullback resistance.

Pivot: 102.61

1st Support: 101.62

1st Resistance: 103.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDUSD Long – Fair Value Gap + Macro Confluence + Bullish LEI AUDUSD Swing Long Setup – Technical + Macro Confluence

✅ Bias: Long AUD/SD

Based on a multi-factor thesis:

Macro: RBA steady; AUD LEI rising steadily (87 → 96), Endogenous improving

USD Weakness: Fed dovish + GDP downgraded = downside pressure

Seasonality: USD historically weak entire April

BTC/USD more sells incoming? 66k?!Good morning traders, I’m back again with another beauty guys!! I’m sure everyone is asking what’s happening in the markets recently, well Trump(era) is happening.

Back to the charts, here I have a 1 hour TF, yesterday we saw very big moves in price following the news that the tariffs are on hold, but that doesn’t or shouldn’t take always our market sentiments and our biases we had coming into this new week.

This setup is basically a continuation set up but for now I’m only focusing on the relative equal lows because we understand that’s there is sell stops resting below those lows. For the rest of the day we can expect price to deliver lower price for the rest of the week but my question is this…can price drop to the 66k level?

Good luck traders and remember we study price and time not technical analysis!

AUDUSD(20250410)Today's AnalysisToday's buying and selling boundaries:

0.6079

Support and resistance levels:

0.6339

0.6242

0.6179

0.5980

0.5917

0.5820

Trading strategy:

If the price breaks through 0.6179, consider buying, the first target price is 0.6242

If the price breaks through 0.6079, consider selling, the first target price is 0.5980

Could the Aussie reverse from here?The price is rising towards the resistance level which is a pullback resistance that lines up with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.6206

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 0.6321

Why we like it:

There is a pullback resistance level.

Take profit: 0.6067

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUD/USD Bearish Trade Setup – Trendline Rejection & SBR Zone📉 Trendline & Market Structure

🔵 Downward trendline connects lower highs (🔴🔴🔴), showing a bearish trend.

🔵 Price is forming lower highs and lower lows, confirming the downtrend.

🟦 SBR Zone (Support Became Resistance)

🔵 SBR Zone (🟦) was previously a support but now acts as resistance.

🔵 Price is testing this area → Possible rejection and move down.

📌 Trade Setup

✅ Entry: Short (Sell) near SBR zone if rejection occurs.

❌ Stop Loss: 0.60650 (🔺 Above SBR Zone)

🎯 Target Point: 0.59150 (🔻 Downside goal)

📉 Potential Drop: -2.08% (-125.4 pips)

📊 Confirmation Checklist

✔️ Price must reject 🟦 SBR Zone.

✔️ Bearish candles like Pin Bars or Engulfing confirm entry.

✔️ DEMA (9) at 0.60175 → If price drops below, trade is valid.

⚠️ Risk Management

🚀 Good Risk-to-Reward Ratio → Worth considering if rejection occurs.

🔄 Invalidation: If price breaks above 0.60650, setup is canceled.

Aussie H1 | Rising into a multi-swing-high resistanceThe Aussie (AUD/USD) is rising towards a multi-swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 0.6079 which is a multi-swing-high resistance that aligns close to the 38.2% Fibonacci retracement.

Stop loss is at 0.6140 which is a level that sits above the 127.2% Fibonacci extension and a swing-high resistance.

Take profit is at 0.5944 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDUSD Double Bottom PatternFenzoFx—AUD/USD formed a double bottom pattern with the immediate support at $0.5932. From a technical perspective, a new consolidation phase toward $0.6085 resistance is imminent if the price holds above the support.

Conversely, the bullish outlook should be invalidated if bears push the AUD/USD prices below the $0.5932 support. If this scenario unfolds, the downtrend will be triggered, targeting $0.5850.

>>> Trade Forex with Low spread, and No swap at FenzoFx

AUD/USD Supply Zone Rejection Trade Setup🔵 Supply Zone → (Blue highlighted area) The price is expected to reverse from here.

🔹 Entry Point → 0.60610 📍 (Marked with a blue line) The trade is planned to start here.

🟠 Stop Loss → 0.60934 ❌ (Marked with an orange line) If the price goes above this, the trade will be exited to prevent further loss.

🔻 Target Point → 0.59400 🎯 (Marked at the bottom) Expected profit zone if the trade moves as planned.

📉 Trade Plan:

✅ Short position (Sell trade) expected to drop from the supply zone.

🚀 Risk-to-reward ratio looks good as the potential profit is higher than the risk.

⚠️ Risk Factor: If price breaks above the supply zone, the setup might fail.

Eur/Usd sell setup update!!Good day traders, we back again we another beauty of a setup well Atleast I like to believe that😂.

Eur/Usd a set was posted here by me on TradingView before market opened on Monday and if you go look at that set up today’s move was seen before hand and now that price went higher, we can now expect to see price move lower for the rest of the week to our liquidity resting below(equal lows). On the 4 hour price just broke structure higher solidifying a low that we want to see get broken during today trading day.

As soon as price breaks structure lower on the LTF’s than we have a alert to enter our shorts, good luck and have a wonderful day✌️

My name is Teboho Matla but you don’t know me yet…

AUDUSD(20250409)Today's AnalysisTechnical analysis:

Today's buying and selling boundaries:

0.5996

Support and resistance levels:

0.6135

0.6083

0.6049

0.5943

0.5909

0.5857

Trading strategy:

If the price breaks through 0.5996, consider buying, the first target price is 0.6049

If the price breaks through 0.5943, consider selling, the first target price is 0.5909

Nas100 continuation lower?Good evening traders, I am busy with my market recap and I saw this beautiful idea on nas100/US100 or whatever name your broker uses.

Indices have been pretty bearish from our understanding as we saw price crush, well my thought process when analysing chart is question based, question like did price move above our weekly opening price to give us our manipulation phase in the power of 3, and in this case or in the case of this analysis the answer is yes it moved higher following this week’s open. Today in the 1 hour TF we have a structure shift lower and before we can do anything we need to see price come higher to Atleast the FVG that is marked on the chart, I know ICT teaches deeper about FVG but for me it’s fine for price to completely cover it. Or if maybe the OTE(optimal trade entry) is the method you use to enter trades it’s still fine or even order blocks if maybe you can see any than it’s also completely fine.

Currently price is showing momentum lower and maybe it’ll close prices lower but if we close the daily candle above the midpoint of the weekly gap we can expect price go than trigger the limit.

AUDCAD…When is enough, enough?!Good day traders, we back with another beautiful idea on AUDCAD but here we not focusing on buying and selling but rather to test a study I’m currently busy with, well in a nutshell I’m studying inside day candle stick pattern, currently on the 4hour TF we have a big bearish candle followed by a lot of small bullish candle sticks but all that trading is happening inside that one big 4 hour candle.

How I like to interpret this pattern in my years of back testing this pattern(still am)😂 inside day candles can be used as both a continuation or a reversal pattern but but depending on the market structure!! What price is doing currently on the 1hr TF I like to explain it to my friends as a beautiful lady who only wants your money 😂😂 because price is making traders believe that the reversal has started but truth is price is still gonna move lower the the liquidity resting below before moving higher to reverse the big move we saw last week and beginning of this current week.

We can expect price to take to low of Monday than shift structure higher to confirm our bias that price will reverse. Remember we study price and time not technical analysis.

#AUDUSD: Three Swing Target Accumulating Total of 1400+ Pips! Analysing the AUDUSD currency pair on a broader timeframe of three days reveals a bearish trend. This suggests a potential final decline in prices before a significant bullish surge in the market.

Two golden lines are drawn around the entry area, indicating potential entry points at the first, second, or intersection of these lines. Alternatively, the first and second lines can serve as entry and stop loss points, tailored to your trading strategy.

Additionally, important economic indicators are set to impact the market. For instance, the Non-Farm Payrolls (NFP) report scheduled for this coming Friday will significantly influence the direction of the DXY monthly price.

If you find our analysis valuable, please consider liking and commenting on our ideas. Your feedback will be instrumental in our efforts to provide more detailed and insightful analysis.

Much Love and Gratitude for your support in advance, happy to help.❤️🚀

Team Setupsfx_

AUDUSD INTRADAY loss of support at 0.5680AUD/USD maintains a bearish outlook, reinforced by the prevailing downtrend and a confirmed break below the previous consolidation zone.

Key Resistance Level: 0.6140 – previous support turned resistance

Downside Targets:

0.5930 – initial support

0.5890 and 0.5740 – longer-term bearish targets

An oversold bounce may retest 0.6140, but unless the pair breaks above this level, a bearish rejection could reinforce downside continuation toward the key support zones.

A daily close above 0.6140, however, would invalidate the bearish scenario, potentially shifting momentum toward 0.6240, with further gains to 0.6300.

Conclusion

AUD/USD is bearish below 0.6140. Watch for rejection at that level to confirm further downside potential. A break and daily close above 0.6140 would shift the outlook to bullish, opening the path toward 0.240 and beyond.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPUSD, EURUSD and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

AUD and NZD: WTH? RBNZ now in focusRisk aversion intensified on Friday, sending the Australian dollar down 4.56% and the New Zealand dollar 3.53% lower.

The declines followed a move by US President Donald Trump to impose a 10% tariff on imports from both Australia and New Zealand. Australian Prime Minister Anthony Albanese confirmed there would be no retaliation, noting the US represents less than 5% of Australia’s export market. New Zealand, with a higher 12% exposure, also ruled out countermeasures.

For the New Zealand dollar, markets will now be focused on this week’s Reserve Bank of New Zealand decision, where a 25-basis point rate cut is widely expected. Barring further tariff news, this could be the most important event determining whether this sell-off continues.

BTC/USD update on the drop!Good day traders, yesterday I posted the same set up on bitcoin and now I’ve decided I’m gonna update this setup till we hit our Daily lowest low.

1H TF yesterday before end of trading day we show price bounce off the the horizontal lines and that is used as my support area, going into the New York session we can expect price to retest the break after it breaks below the support which will than become my resistance.

Hopefully today we can see price run our liquidity resting below(equal lows).

My name is Teboho Matla but you don’t know me yet..#Salute