Audusd4hr

AUDUSD(20250324)Today's AnalysisToday's buying and selling boundaries:

0.6278

Support and resistance levels:

0.6326

0.6308

0.6297

0.6260

0.6248

0.6230

Trading strategy:

If the price breaks through 0.6278, consider buying, the first target price is 0.6297

If the price breaks through 0.6260, consider selling, the first target price is 0.6248

AUDUSD LongAUDUSD Long:

The pair is currently on strong support line and expected to bounce from the resistance level so

Buy: Only if the price sustains above 0.63144 with strong volume confirmation, targeting a move toward 0.63500. Use a tight stop-loss below 0.62803.

Sell: If the price rejects resistance at 0.63144 (e.g., forms a bearish candlestick like a shooting star or double top) or breaks below 0.62803, targeting a retest of lower support (e.g., 0.62500).

AUD/USD "The AUSSIE" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The AUSSIE" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 0.63800 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

The AUD/USD pair is looking interesting right now, with some mixed signals from the latest analysis. On one hand, the pair has stabilized at its horizontal support area, which could lead to a bullish continuation, with the price potentially breaking above the range's resistance. On the other hand, some experts are warning of a potential reversal, with the pair showing signs of exhaustion and a possible shift in momentum.

In terms of fundamentals, the Australian Consumer Inflation Expectations for July increased 6.3% annualized, while the Australian Employment Change for June came in at 88.4K and the Unemployment Rate at 3.5% . The US Initial Jobless Claims for the week of July 9th are predicted at 235K, and US Continuing Claims for the week of July 2nd are predicted at 1,383K. The US PPI for June is predicted to increase 0.8% monthly and 10.7% annualized.

The forecast for the AUD/USD turned bullish after the pair stabilized at its horizontal support area, with short-term volatility likely to rise as bulls and bears fight for control. However, the Ichimoku Kinko Hyo Cloud continues to apply downside pressure, suggesting a rocky path higher. Traders should monitor the CCI after it has formed a positive divergence in extreme oversold territory followed by a breakout above -100.

Overall, it's a bit of a mixed bag, but the bullish scenario is gaining traction. The AUD/USD pair could move in a bullish direction.

BULLISH FACTORS:

Strong US Economy: A strong US economy could lead to an increase in demand for the US dollar, which could put upward pressure on the AUD/USD pair.

Interest Rate Differentials: The interest rate differential between the US and Australia is expected to remain positive, which could support the US dollar and put upward pressure on the AUD/USD pair.

Commodity Prices: A rise in commodity prices, particularly iron ore, could put upward pressure on the Australian dollar and support the AUD/USD pair.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

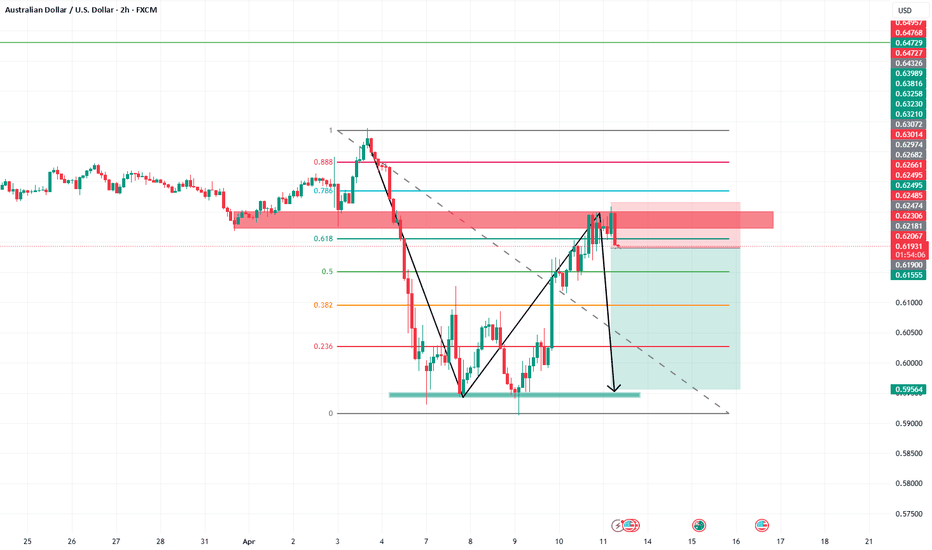

AUDUSD Bearish Butterfly Pattern Signals ReversalThe AUDUSD pair is currently forming a Bearish Butterfly Harmonic Pattern (XABCD), a classical harmonic formation that signals potential trend reversals. The critical Point D, known as the Potential Reversal Zone (PRZ), is where the pattern completes, indicating a high probability of a bearish reversal.

Confluence Factors:

Key Resistance Area: Point D aligns precisely with a significant resistance level, suggesting strong selling pressure at this zone.

4-Hour Trend Line: The PRZ also coincides with a descending trend line on the 4-hour chart, reinforcing the bearish outlook.

RSI Bearish Divergence: The Relative Strength Index (RSI) is exhibiting bearish divergence, where the price is making higher highs while the RSI is making lower highs, indicating weakening bullish momentum.

Entry and Risk Management:

Entry: Based on the confluence factors, an entry is recommended at 0.66730.

Stop Loss: To manage risk, place the stop loss at 0.67180, just above the resistance and PRZ, providing a buffer against potential volatility.

Take Profit Levels:

TP-1: 0.66280

TP-2: 0.65830

TP-3: 0.65380

These profit levels are strategically placed at key support zones and Fibonacci retracement levels, offering a structured exit plan as the market potentially moves in our favor.

Conclusion:

Given the alignment of the Bearish Butterfly Harmonic Pattern, key resistance, trend line, and RSI divergence, a bearish reversal is anticipated from Point D. This setup presents a high-probability trading opportunity, supported by multiple technical factors. The proposed trade setup provides a favorable risk-reward ratio, making it a prudent entry for traders looking to capitalize on a potential trend reversal in the AUDUSD pair.

AUDUSD Potential Short Opportunity Bearish Bat Harmonic PatternThe AUDUSD pair is currently exhibiting a potential Bearish Bat Harmonic Pattern (XABCD) formation, coupled with its proximity to a significant resistance level. This suggests a possible reversal in trend momentum, with bearish indications expected to strengthen from Point D onwards.

Harmonic Pattern Analysis:

The Bearish Bat Harmonic Pattern (XABCD) is emerging on the AUDUSD chart, indicating a potential reversal of the current uptrend. The completion point (Point D) of this pattern aligns closely with the key resistance level, adding further confluence to the bearish scenario.

Entry and Stop Loss:

We recommend taking a short position at 0.65200, anticipating the reversal from Point D. A stop loss should be placed at 0.65900 to mitigate potential losses in case of a breakout above the resistance level.

Take Profit Targets:

TP-1: 0.64520

TP-2: 0.63820

TP-3: 0.63128

Rationale:

The decision to enter a short position is supported by the confluence of the Bearish Bat Harmonic Pattern and the key resistance level. This setup suggests a high probability of a bearish reversal, with potential downside targets identified at various support levels.

Risk Management:

It's crucial to adhere to proper risk management principles when executing this trade. By maintaining a disciplined approach to position sizing and adhering to the specified stop loss level, traders can effectively manage their risk exposure.

Conclusion:

Based on the technical analysis, a short position on AUDUSD is recommended, with entry at 0.65200 and a stop loss at 0.65900. Take profit targets are set at 0.64520, 0.63820, and 0.63128. This analysis aims to capitalize on the anticipated bearish momentum following the completion of the Bearish Bat Harmonic Pattern and the resistance level confluence.

AUDUSD - Shark Harmonic Pattern Formation Detected-Bearish TrendAUDUSD is currently forming a Shark Harmonic Pattern (XABCD) on the 4-hour time frame. This pattern is characterized by specific Fibonacci ratios between the price swings. The completion point, Point D, coincides with a key Resistance level, indicating a potential reversal.

Trendline Analysis:

In addition to the harmonic pattern, there is a significant Trendline acting as a dynamic resistance level, further supporting the bearish outlook.

Entry and Stop Loss:

Based on the analysis, a prudent entry point is identified at 0.64800, just below Point D. To manage risk, a stop loss is recommended at 0.65350, above the recent swing high and the pattern completion point.

Take Profit Targets:

Three take profit targets are set to capitalize on potential downward movement:

TP-1: 0.64270

TP-2: 0.63740

TP-3: 0.63200

Risk Management:

The risk-to-reward ratio for this trade is carefully considered to ensure favorable risk management. The potential profit targets offer a balanced reward relative to the risk taken with the stop loss.

Conclusion:

With the Shark Harmonic Pattern formation, along with the confluence of the Trendline and key Resistance level, the technical analysis suggests a bearish momentum in AUDUSD. Traders may consider entering short positions with the specified entry, stop loss, and take profit levels, keeping risk management principles in mind.

AUDUSD seems perfect to deliver downside objectivelooking forward to sell AUDUSD around 0.6610 level or above as we have seen a massive shift for downside in all major currencies as dollar seems to rally higher and likely to target 104.25 level which makes this pair weaker and pois to move down towards our target of 0.6520 level

Audusd looking for a short-term surprise for the upside 0.6620Audusd looks quite good at this consolidation phase to go long and target 0.6620 level as target with entry around 0.6551 level or above with a stoploss at 0.6525 level.

this expansion seems limited and after that i am expecting price to fall further down and resume the downtrend .

i have two setups for this AUDUSD one as per the higher time frame while this trade is for shorter term perspective and my both analysis do not have a same bias. both are valid

in this one i am long just for a short term and my previous trade which is short that is also valid

AUSSIE RALLY IS STARTING! [AUDUSD] LONG POSITIONIntroduction:

The AUD/USD currency pair is exhibiting compelling signals hinting at a potential trend reversal, with a particular focus on the recent price action and key technical levels.

Current Status:

As of the close of the New York session, the price has firmly held ground at 0.65100, maintaining its position above crucial support levels. A noteworthy observation on the daily timeframe is the rebound from the 31.8% Fibonacci retracement level, signaling resilience in the bullish sentiment.

Structural Shift:

The narrative evolves further when examining the structure of the market. From early November, there was a notable Break of Structure (BOS), suggesting a shift in market dynamics. However, as of November 16, a Change of Character (CHOC) is evident, signaling a potential reversal in the prevailing trend.

4-Hour Bullish Momentum:

Zooming into the 4-hour timeframe, candlestick patterns reflect a robust bullish trend. Multiple bullish candles with few wicks rejecting the 0.65150 zone, coupled with positive volume, create a compelling case for an imminent breakout. The 0.65150 level, appearing as a psychological barrier, is poised for a potential rupture.

Long Position Opportunity:

Considering the current dynamics, there appears to be a Long Position opportunity on the horizon. A favorable entry scenario is anticipated if the price successfully breaks the 0.65150 zone and undergoes a retest, confirming the newfound support. This setup presents a potential profit target of approximately 80 pips.

Intraday Insights:

During the overlap of the London and New York sessions, the price action adds another layer of intrigue. A Hammer candlestick followed by a Belt candlestick suggests a tussle between sellers and buyers. Despite the sellers' attempt to push the price down, the momentum from buyers appears to be gaining strength, setting the stage for a potential rally.

Conclusion:

In conclusion, the AUD/USD pair is displaying multiple indicators signaling a potential reversal and the initiation of a bullish trend. Traders are advised to closely monitor the 0.65150 zone for a breakout, and consider a Long Position with a retest confirmation. The recent price action, structural shifts, and intraday patterns collectively contribute to a compelling case for a rally in the Aussie.

AUD USD LONGRisk 0.5%

TP1 = 1:2 RR

RISKY Trade as we are going aginst the trend.

Is willing to see how it turns out.

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

AUDUSD 4h long entryHello guys,

Today we are going to take a long entry in OANDA:AUDUSD currency pair. Right now, the price is coming down to take the support of 4h time frame . If you look at this currency pair of the 4-hour chart you can clearly see the price is going upward by taking the support its 4hr trendline. So, from here, there is a chance for this currency pair to go up. Once it has given a breakout from the resistance line there will be a big move ahead.

Thanks & regards,

Alpha Trading Station

Disclaimer: This view is for educational purpose only & any stock mentioned here should not be taken as a trading/investing advice. We may or may not have position in the stocks mentioned here. Please consult your financial advisor before investing. Because Price is the "King of Market".

20 Reasons For Long AUDUSD 🔆MULTI-TIME FRAME TOP-DOWN ANALYSIS OVERVIEW☀️

1:✨Eagle eye: Multi years Bearish Trend is here

2:📆Monthly: making an insider high and low also rejected from monthly order block

3:📅Weekly: and weekly Choch is formatted, but the price does not confirm high yet. After a correction, prices are halted on the previous monthly low and equilibrium area so that there is a high chance prices can go high from here

4:🕛Daily: a clear up trend now 3rd move id started on the proper discount area and also forted appropriate price actions and structure setup

😇7 Dimension analysis

🟢 analysis time frame: H4

5: 1 Price Structure: bearish & market start forming lower high

6: 2 Pattern Candle Chart: equal lows at bottom long wick candles also lower high monthly weekly and daily lows also

7: 3 Volume:

8: 4 Momentum UNCONVENTIONAL Rsi: Rsi also shift their range from bearish to sideways properly

9: 5 Volatility measure Bollinger bands: Bollinger band in a tight squeeze /also proper w pattern is formatted so walking on the band is excepted

10: 6 Strength ADX: total neutral

11: 7 Sentiment ROC: Aud is more substantial than USD on the base on Rate of change

✔️ Entry Time Frame: H1

12: Entry TF Structure: bullish

13: entry move: impulsive

14: Support resistance base: H1 equilibrium support H1 last swing support or 2nd option H1 premium breaks

15: FIB:

☑️ final comments: Buy

16: 💡decision: LOng

17: 🚀Entry: 0.6780

18: ✋Stop losel:0.6695

19: 🎯Take profit: 0.7129

20: 😊Risk to reward Ratio: 1:4

🕛 Excepted Duration: 10 Days

The logic behind the AUDUSDThe head and shoulders pattern has formed, with the US dollar maintaining its strength, indicating that bearish momentum is inevitable for the Australian dollar

The January core inflation data, including CPI , PPI and retail sales, all rebounded. Combined with the wage data in the non-agricultural employment report, it shows that US inflation has rebounded in stages. Although the downward trend of inflation remains unchanged, it will stimulate Fed extends rate hikes

The U.S. dollar rebounded strongly due to the rise in inflation and stimulated the central bank to raise interest rates. Worries prompted investors to cover the U.S. dollar, and the U.S. dollar regained its dominance in the short-term situation. At the same time, the strong US dollar depresses commodity prices, and the Australian dollar loses its power. Interest rate hike expectations are also extremely detrimental to the performance of U.S. stocks. After the end of the earnings season, U.S. stocks lack guidance, and rising inflation suppresses market liquidity and puts pressure on stock market sentiment.

In this situation, the short position of the Australian dollar has the best time, location, and harmony.

Technical head and shoulders The head and shoulders pattern is a high chance of winning in the technical trend, and it is one of the skills that must be mastered

AUDUSD top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

AUDUSD - CURRENT SITUATION AND FUNDA & TECHNICAL BIAS#AUDUSD

- Currently the MARKET SENTIMENT for AUD is slightly UP SIDE according to the MARKET SENTIMENT. Due to RISK ON for AUDUSD, there is currently an UPSIDE BIAS for it. The main reason for that is because MARKET RISK is ON, STOCKS and COMMODITIES MARKETS are now slightly UP. It is heavily influenced by the Australian dollar. And today AUSTRALIA INFLATION DATA was very POSITIVE. Due to this, the RBA made a RATE HIKE.

- It is definitely possible to break the AUDUSD STRUCTURE and go up to the higher RESISTANCE LEVEL. Accordingly, AUDUSD can go up to 0.6600 LEVEL. And after that, AUDUSD can SELL to the 0.6000 LEVEL if the MARKET SENTIMENT changes and STOCKS and COMMODITIES start going down. For that, the MARKET STRUCTURE should be BREAK. And RISK should be OFF.

AUDUSD preparing for drop!AUDUSD (4H) has formed a strong bearish price action on all timeframes. After a daily bearish engulfer on the last day of the trading week, today's price dropped early, now the price is testing this daily support and showing significant rejection on 4H forming a doji candle. It is highly likely that the price will continue to drop from this as the long-term trend is bearish.

Thank you and press the like button if you enjoy this content :)