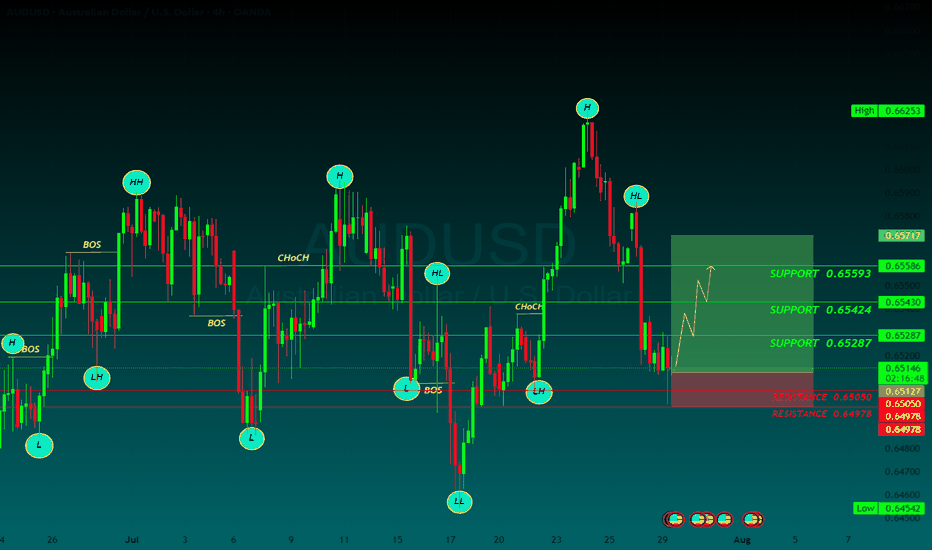

AUDUSD BUYThe AUD/USD pair is trading around 0.6520 on Tuesday. The daily chart’s technical analysis indicates a prevailing bullish bias as the pair remains within the ascending channel pattern. However, the 14-day Relative Strength Index (RSI) has moved below the 50 mark, indicating that a bearish bias is active. Additionally, the pair is positioned below the nine-day Exponential Moving Average (EMA), indicating that short-term price momentum is weaker.

The US and EU reached a framework trade agreement on Sunday that sets 15% tariffs on most European goods, taking effect on August 1. This deal has ended a months-long stand-off, per Bloomberg.

Traders keep their eyes on further developments in the US-China trade talks. The discussions are set to resume on Tuesday after top economic officials from both nations held over five hours of negotiations in Stockholm on Monday. The purpose of this meeting is to resolve ongoing disputes and extend their trade truce by another three months.

US Treasury Chief Scott Bessent met with China’s Vice Premier He Lifeng at Sweden’s Rosenbad government offices. The meeting comes ahead of an August 12 deadline to finalize a long-term tariff agreement with the Trump administration, building on preliminary deals reached in May and June that had helped ease tensions.

The US Federal Reserve (Fed) is widely expected to keep the benchmark interest rate steady between 4.25% and 4.50% at its July meeting. The FOMC press conference will be observed for any signs that rate cuts may start in September.

The Reserve Bank of Australia (RBA) is expected to closely watch the June labor force data and second-quarter inflation figures before deciding on a potential rate cut. Both the monthly and quarterly CPI reports are scheduled for release later this week.

SUPPORT 0.65593

SUPPORT 0.65424

SUPPORT 0.65593

RESISTSNCE 0.65050

RESISTANCE 0.64973

Audusdbuy

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

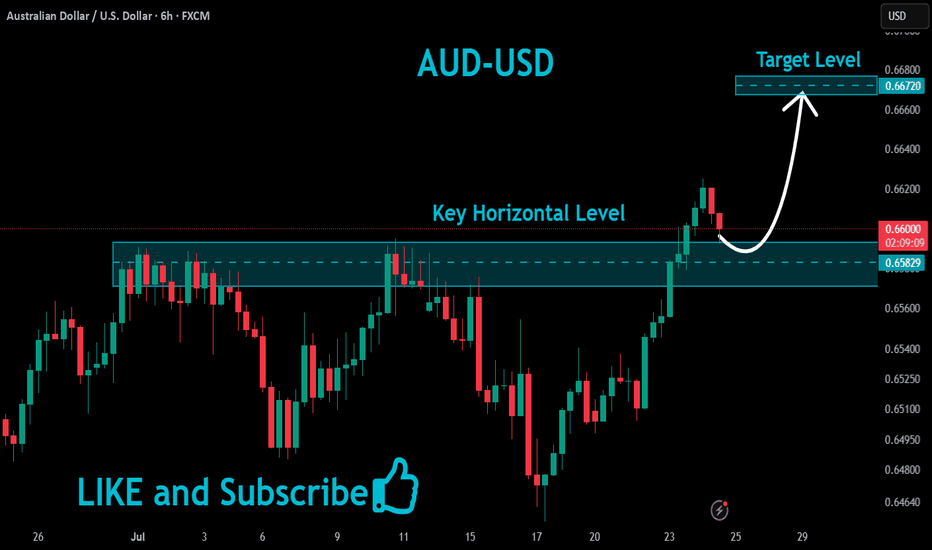

#AUDUSD: +1100 Pips Possible Swing Bullish Move! AUDUSD a strong sign of bullish behaviour has appeared alongside bullish momentum. As we have NFP tomorrow, we expect market to remain volatile; what we think now is to have market settled down before we can have any confirmation. We recommend to remain extra cautious tomorrow, once market get settled we can then enter with accurate risk management.

Like, comment and Share for more!

Team Setupsfx_

#AUDUSD:We are yet to see weaken USD! AUDUSD to make yearly highAUDUSD hasn’t seen strong bullish volume yet, but tomorrow’s NFP will be crucial for determining the future trend of the AUDUSD. Based on your analysis, you can set multiple targets.

If you like our work and want to support us, you can do so by following us:

-Liking our ideas

-Commenting on our ideas

-Sharing

Team Setupsfx_

❤️🚀

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

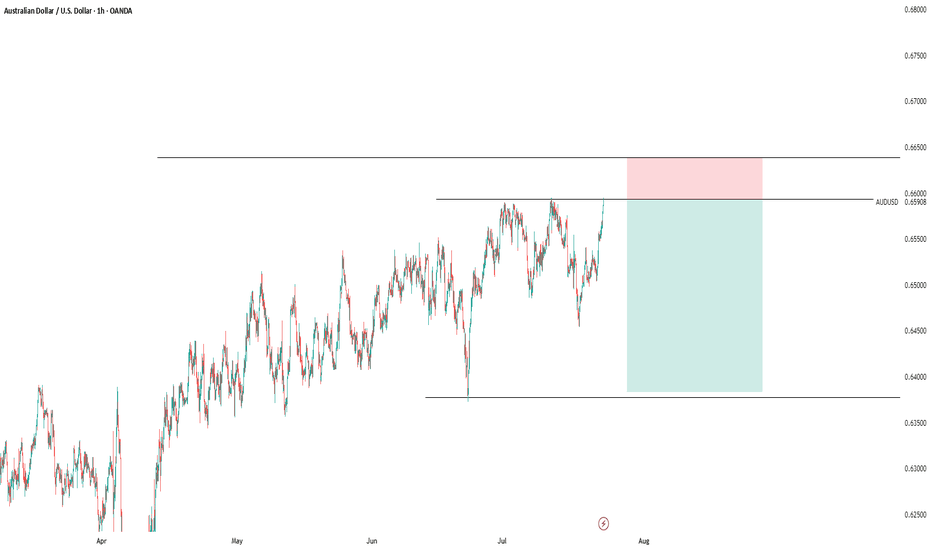

AUD Bulls Charge on China CPI & Trade HopesOANDA:AUDUSD is trading near 0.6510, buoyed by China’s better-than-expected May CPI print at -0.1% YoY (vs forecast of -0.4%) and optimism over the renewed U.S.-China trade dialogue, which has improved global risk sentiment.

Despite weak CMCMARKETS:AUDUSD Australian Q1 GDP and a narrower trade surplus, the Aussie remains firm as a proxy for Chinese demand and commodity-linked risk appetite.

From a technical perspective, the pair is moving within an ascending hourly channel and is currently testing key resistance at 0.6517. A confirmed breakout could clear the path toward monthly resistance at 0.6582. However, failure to break higher may see a pullback to 0.6492, or deeper to the critical support at 0.6411. As long as the channel structure remains intact, the bias stays bullish.

Resistance : 0.6517 , 0.6582

Support : 0.6492 , 0.6411

AUD/USD Bullish Setup: Demand Zone Bounce Toward 0.65600📈 Price Channel Analysis

🔼 The pair is moving within an ascending channel: • Support Line 🟦 – lower trendline showing bullish structure

* Resistance Line 🟥 – upper boundary acting as potential target

💡 This suggests bullish momentum is intact unless the price breaks below support.

📌 Key Trade Levels

🔵 Entry Point: 0.64361

* 👇 Positioned just above the DEMAND ZONE

* 📍Near the 70 EMA — a key dynamic support

🟨 Demand Zone: Area between 0.6400 – 0.6436

* 🧲 Buyers are expected here

* Good spot for a bullish entry

🔴 Stop Loss: 0.63995

* 🚨 Below the demand zone = limited risk

🟢 Target Point: 0.65600

* 🎯 Aligned with the upper resistance line

* Nice upside potential

⚙️ Technical Indicator

📉 EMA 70 (red line) = 0.64510

* Price is bouncing near it

* 📊 Acts as trend support — confirming buy idea

📊 Risk-to-Reward Ratio

🔻 Risk: ~36 pips (Entry → Stop Loss)

🔺 Reward: ~124 pips (Entry → Target)

✅ R:R Ratio ≈ 3.4:1 👍

🧠 Trade Idea Summary

📘 Trade Type 🔼 Buy (Long)

💰 Entry 0.64361

🛑 Stop Loss 0.63995

🎯 Target 0.65600

🌟 Bias Bullish

🔍 Final Thoughts

✅ Strong setup within a bullish channel

📉 EMA support + 🟦 Demand zone = Good confluence

📅 Watch out for USD news (see icons below chart)

AUDUSD LONG FORECAST Q2 W23 D3 Y25👀 AUDUSD LONG FORECAST Q2 W23 D3 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation & breaks of structure.

Let’s see what price action is telling us today! 🔥

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅15’ order block

✅Intraday bullish breaks of structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUDUSD Daily Squeeze – Breakout LoadingAUDUSD is pressing against descending trendline resistance, forming a bullish continuation wedge just above the 0.6420–0.6450 support zone (50% Fib level). Price has been consolidating tightly, suggesting a potential breakout setup is developing.

Key Levels:

Resistance: 0.6500 – 0.6547 (wedge top and 61.8% Fib)

Support: 0.6420 (local structure), 0.6300 (deeper demand zone)

Bullish Target: 0.6718 → 0.6900 → 0.6950

Invalidation: Daily close below 0.6410

Scenarios:

🔹 Bullish Breakout

Clean break above wedge resistance

Momentum push toward 0.6700–0.6900 zone

Confirmation = daily close above 0.6547 (Fib confluence)

🔹 Fakeout + Pullback

Temporary rejection leads to retest of 0.6420–0.6400

Holds support = high-probability long setup for second wave up

Outlook:

Bias: Bullish

AUDUSD is building bullish pressure after defending key support. Wedge structure favors breakout continuation, especially if global risk sentiment remains firm and USD softens.

audusd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Aussie Turns Bullish — All Eyes on RBACMCMARKETS:AUDUSD AUD/USD trades near 0.6448 ahead of the RBA rate decision, where a 25bps cut to 3.85% is widely expected. Technically, a breakout above the falling trendline suggests a potential bullish reversal. Immediate support lies at 0.6422–0.6406. A rejection near minor resistance at 0.6456 could trigger a pullback, while a sustained break above that level may open room for gains beyond 0.6500. Market direction hinges on RBA’s tone and Governor Bullock’s guidance on future easing.

Resistance : 0.6456 , 0.6500

Support : 0.6422 , 0.6406

AUD/USD Analysis TodayAustralia's Unemployment Rate Remained Stable in April 📊

May 15 — Data released by the Australian Bureau of Statistics (ABS) showed that after seasonal adjustment, Australia's unemployment rate stayed steady at 4.1% in April 2025 👏. The trend-based unemployment rate also held firm at 4.1%, matching the adjusted figure from March 📈.

Meanwhile, the AUD/USD is currently showing a strong upward trend 🔥, with continued bullish sentiment and a target price of 0.64800 🎯

⚡️⚡️⚡️ AUDUSD ⚡️⚡️⚡️

🚀 Buy@ 0.64400 - 0.64500

🚀 TP 0.64750 - 0.64800

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

AUDUSD(20250516)Today's AnalysisMarket news:

Fed Chairman Powell: The Fed is adjusting its overall policy-making framework. Zero interest rate is no longer a basic situation. The wording of underemployment and average inflation rate needs to be reconsidered. PCE is expected to drop to 2.2% in April.

Technical analysis:

Today's buying and selling boundaries:

0.6416

Support and resistance levels:

0.6484

0.6458

0.6442

0.6391

0.6375

0.6349

Trading strategy:

If the price breaks through 0.6416, consider buying, the first target price is 0.6442

If the price breaks through 0.6391, consider selling, the first target price is 0.6375

AUDUSD..LONG

Analysis complete — scenarios outlined. The zone could be a decision point

for [ OANDA:AUDUSD ]. Price reaction here may define the next move.

**** If price breaks and pulls back to retest, a reversal setup might emerge.

Smart Forex Analysis | Weekly Setups

Clean charts. No noise. Just levels.

AUDUSD Bearish Breakout – Macro and Technicals AlignAUDUSD has broken below a rising wedge formation on the 4H chart, signaling a bearish continuation. With the Reserve Bank of Australia pausing rates and weak local data weighing on sentiment, while the Federal Reserve maintains a hawkish hold due to sticky labor costs, this trade sets up well both technically and fundamentally. I'm watching for downside continuation toward 0.6379 and potentially 0.6350. The bearish bias is invalidated on a move above 0.6475.

🔍 Technical Analysis

Structure: Price broke down from a rising wedge and continues forming bear flags — each followed by further selling pressure.

Current Price Action:

Rejected sharply at ~0.6475 (last swing high)

Confirmed breakout with downside momentum

Key Support Levels:

0.6379 – minor structural support

0.6350 – major support zone from April

Resistance / Invalidation:

Above 0.6475 – would break the bearish structure and negate the setup

Bias: Bearish — clean structure, breakout momentum, and sustained lower highs

🌏 Fundamental Context

🇦🇺 Bearish AUD Drivers:

Weak domestic data:

Building Approvals: -8.8% vs -1.7% forecast

RBA on hold:

No rate hike in sight; cautious due to housing and China concerns

China slow-down:

PBOC cut rates and reduced reserve requirements — signals broader economic softness

🇺🇸 Bullish USD Drivers:

Fed holding firm:

Benchmark rate held at 4.25–4.50%

Labor costs surged +5.3% q/q

Productivity dropped -0.4%, reinforcing inflation concerns

Market repricing rate cuts:

Cuts now expected later in 2025 or even 2026

Political pressure from Trump:

Despite attacks on Jerome Powell, Fed appears unmoved

Trump teasing a “major trade deal” — potentially USD-positive if credible

🎯 Trade Setup

Entry Area: Watching 0.6420–0.6435 as a pullback zone for potential shorts

Target Levels:

First target: 0.6379

Second target: 0.6350

Stop Loss: Placed above 0.6475 (last swing high) to protect against false breakouts

Trade Thesis:

Technical structure supports downside continuation

Macro fundamentals favor USD strength and AUD weakness

Clean reward-to-risk if structure holds

🧭 Conclusion

AUDUSD setup is supported by a strong confluence of technical breakdown and macro divergence. With the Fed staying firm and the RBA cautious amid weak data, the fundamentals validate the bearish trend. As long as price stays below 0.6475, the outlook remains bearish, with 0.6379 and 0.6350 as the next logical levels. Caution around U.S. data releases or trade deal news is advised, but the path of least resistance remains downward.

AUDUSD LONG FORECAST Q2 W19 D7 Y25AUDUSD LONG FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Intraday 15' order block

✅Tokyo ranges to be filled

✅Intraday bullish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD LONG FORECAST Q2 W19 D5 Y25

AUDUSD LONG FORECAST Q2 W19 D5 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Intraday 15' order block

✅Tokyo ranges to be filled

✅Intraday bullish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

The trend next weekJudging from the price trend presented in the chart, the current market is clearly in a bearish state 📉. Previously, after the price reached the key resistance level of 0.64500, it failed to break through effectively and continue the upward trend. Instead, it entered a consolidation pattern 📊. This indicates that the bullish forces encountered strong resistance near this price level and found it difficult to push the price higher 👎.

It is expected that in the coming period, without significant positive news stimuli, the price is highly likely to continue its downward trend 📉. Investors should closely monitor whether the support level of 0.63340 holds 👀. If this support level is broken, they may consider selling short on rallies ⏬.

⚡⚡⚡ AUDUSD ⚡⚡⚡

🚀 Sell@0.6500 - 0.6450

🚀 TP 0.6350 - 0.6300

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

AUD/USD Opening Trends and Trading Strategies Next WeekThe AUD/USD has been in a range - bound fluctuation recently. 📈 In the short term, if the price can stay above the support level of 0.63340 and market risk - appetite sentiment rises, the AUD/USD is expected to challenge the target level of 0.64500. 🎯 However, if it breaks below the support level, it may trigger further downward adjustments. 📉

⚡⚡⚡ AUDUSD ⚡⚡⚡

🚀 Buy@0.6350 - 0.6380

🚀 TP 0.6400 - 0.6450

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟

AUDUSD: Neutral View First Buy and Then Sell! Hey everyone!

Our first buy swing entry is going swimmingly! We’ve got over 500 pips running positively, and we reckon price can keep going up and then when it hits our selling zone, you can swing sell too. This is a fantastic opportunity where we can wait for price to do its thing and then when it reaches the sell zone, we can execute our order. But if you’re feeling adventurous and want to take a bit of a risk, you can take a buy entry at the given point and keep it up until it reaches our sell area.

With just one shot, we can make two entries!

Good luck and trade safely!

Thanks a bunch for your unwavering support! 😊

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

❤️🚀