AUDUSD(20250410)Today's AnalysisToday's buying and selling boundaries:

0.6079

Support and resistance levels:

0.6339

0.6242

0.6179

0.5980

0.5917

0.5820

Trading strategy:

If the price breaks through 0.6179, consider buying, the first target price is 0.6242

If the price breaks through 0.6079, consider selling, the first target price is 0.5980

Audusdforecast

AUD/USD Bearish Trade Setup – Trendline Rejection & SBR Zone📉 Trendline & Market Structure

🔵 Downward trendline connects lower highs (🔴🔴🔴), showing a bearish trend.

🔵 Price is forming lower highs and lower lows, confirming the downtrend.

🟦 SBR Zone (Support Became Resistance)

🔵 SBR Zone (🟦) was previously a support but now acts as resistance.

🔵 Price is testing this area → Possible rejection and move down.

📌 Trade Setup

✅ Entry: Short (Sell) near SBR zone if rejection occurs.

❌ Stop Loss: 0.60650 (🔺 Above SBR Zone)

🎯 Target Point: 0.59150 (🔻 Downside goal)

📉 Potential Drop: -2.08% (-125.4 pips)

📊 Confirmation Checklist

✔️ Price must reject 🟦 SBR Zone.

✔️ Bearish candles like Pin Bars or Engulfing confirm entry.

✔️ DEMA (9) at 0.60175 → If price drops below, trade is valid.

⚠️ Risk Management

🚀 Good Risk-to-Reward Ratio → Worth considering if rejection occurs.

🔄 Invalidation: If price breaks above 0.60650, setup is canceled.

AUDUSD Double Bottom PatternFenzoFx—AUD/USD formed a double bottom pattern with the immediate support at $0.5932. From a technical perspective, a new consolidation phase toward $0.6085 resistance is imminent if the price holds above the support.

Conversely, the bullish outlook should be invalidated if bears push the AUD/USD prices below the $0.5932 support. If this scenario unfolds, the downtrend will be triggered, targeting $0.5850.

>>> Trade Forex with Low spread, and No swap at FenzoFx

AUD/USD Supply Zone Rejection Trade Setup🔵 Supply Zone → (Blue highlighted area) The price is expected to reverse from here.

🔹 Entry Point → 0.60610 📍 (Marked with a blue line) The trade is planned to start here.

🟠 Stop Loss → 0.60934 ❌ (Marked with an orange line) If the price goes above this, the trade will be exited to prevent further loss.

🔻 Target Point → 0.59400 🎯 (Marked at the bottom) Expected profit zone if the trade moves as planned.

📉 Trade Plan:

✅ Short position (Sell trade) expected to drop from the supply zone.

🚀 Risk-to-reward ratio looks good as the potential profit is higher than the risk.

⚠️ Risk Factor: If price breaks above the supply zone, the setup might fail.

AUDUSD(20250409)Today's AnalysisTechnical analysis:

Today's buying and selling boundaries:

0.5996

Support and resistance levels:

0.6135

0.6083

0.6049

0.5943

0.5909

0.5857

Trading strategy:

If the price breaks through 0.5996, consider buying, the first target price is 0.6049

If the price breaks through 0.5943, consider selling, the first target price is 0.5909

#AUDUSD: Three Swing Target Accumulating Total of 1400+ Pips! Analysing the AUDUSD currency pair on a broader timeframe of three days reveals a bearish trend. This suggests a potential final decline in prices before a significant bullish surge in the market.

Two golden lines are drawn around the entry area, indicating potential entry points at the first, second, or intersection of these lines. Alternatively, the first and second lines can serve as entry and stop loss points, tailored to your trading strategy.

Additionally, important economic indicators are set to impact the market. For instance, the Non-Farm Payrolls (NFP) report scheduled for this coming Friday will significantly influence the direction of the DXY monthly price.

If you find our analysis valuable, please consider liking and commenting on our ideas. Your feedback will be instrumental in our efforts to provide more detailed and insightful analysis.

Much Love and Gratitude for your support in advance, happy to help.❤️🚀

Team Setupsfx_

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD/USD "The Aussie Dollar" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie Dollar" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.64000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (0.62800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.65500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

AUD/USD "The Aussie Dollar" Forex Market Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

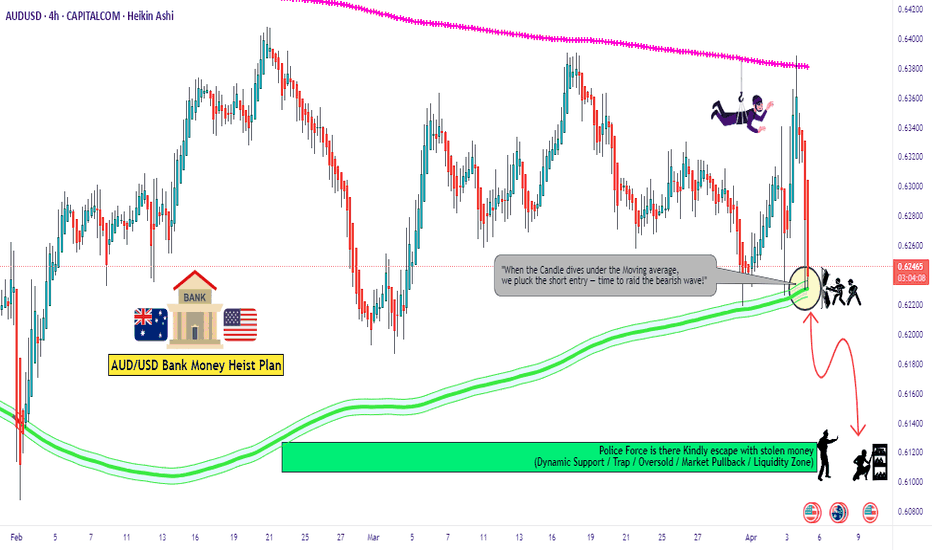

AUD/USD "The Aussie" Forex Bank Bearish Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (0.62200) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the MA level Breakout Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.42800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.62900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵AUD/USD "The Aussie" Forex Bank Heist Plan (Swing/Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDUSD POTENTIAL LONG POSITION Q2 W14 Y25 FRIDAY 4TH APRIL 2025AUDUSD POTENTIAL LONG POSITION Q2 W14 Y25 FRIDAY 4TH APRIL 2025

Could well be the only position to provide fun coupons on a successful week of trading.

The concept is quite simple but does lack a few of our favourite confluences. If this was the beginning of the week, we would perhaps wait for a 15' break of structure but this takes away the Tokyo range fill confluences.

We require a tap into the 15' order block, followed by a bullish move from the point of interest. This in turn we wish to leave behind a void and order block creation. In the same breath, we require lower time frame breaks of structure since the break of 15' would not then give us enough time on an NFP Friday for price action to pull back to the low point of interest and a move long.

Lets see how it plays.

FRGNT x

AUDUSD(20250403)Today's AnalysisToday's buying and selling boundaries:

0.6297

Support and resistance levels:

0.6380

0.6349

0.6329

0.6266

0.6246

0.6215

Trading strategy:

If the price breaks through 0.6266, consider buying, the first target price is 0.6297

If the price breaks through 0.6246, consider selling, the first target price is 0.6215

Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?

AUD/USD declined below the 0.6320 and 0.6300 support levels.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar started a fresh decline from well above the 0.6320 level against the US Dollar.

- There is a connecting bearish trend line forming with resistance at 0.6300 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair struggled to clear the 0.6330 zone. The Aussie Dollar started a fresh decline below the 0.6300 support against the US Dollar, as discussed in the previous analysis.

The pair even settled below 0.6280 and the 50-hour simple moving average. There was a clear move below 0.6270. A low was formed at 0.6269 and the pair is now consolidating losses.

On the upside, an immediate resistance is near the 0.6295 level and the 61.8% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low.

There is also a connecting bearish trend line forming with resistance at 0.6300. It is close to the 76.4% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low. The next major resistance is near the 0.6310 zone, above which the price could rise toward 0.6320.

Any more gains might send the pair toward the 0.6330 resistance. A close above the 0.6330 level could start another steady increase in the near term. The next major resistance on the AUD/USD chart could be 0.6380.

On the downside, initial support is near the 0.6270 zone. The next support sits at 0.6260. If there is a downside break below 0.6260, the pair could extend its decline. The next support could be 0.6200. Any more losses might send the pair toward the 0.6165 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is This the Calm Before the Storm on AUD/USD?The AUD/USD pair is currently consolidating within a sideways range, indicating indecision in the market. Price is fluctuating between key horizontal support near 0.6150 and resistance around 0.6450.

A rising trendline is providing strong dynamic support, keeping the pair from breaking lower, while a descending resistance line continues to limit upside momentum. As long as the pair remains within this range, no clear trend is confirmed.

A breakout above resistance could signal a bullish shift, while a breakdown below the trendline may open the door for further downside.

If you find our analysis helpful, don’t forget to like and follow us.

THANK YOU

DYOR, NFA

Continue to be bullish.Economic Fundamentals

Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency.

US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect.

Market & Geopolitical Factors

High risk appetite benefits the Aussie; low appetite favors the dollar. Geopolitical tensions prompt a flight to the dollar, hurting the Aussie.

💎💎💎 AUDUSD 💎💎💎

🎁 Buy@0.62500 - 0.62800

🎁 TP 0.63500 - 0.64000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Week of 3/23/25: AUDUSD AnalysisAnalysis of my main pair AUDUSD, last week resulted in the bears taking over and my analysis explains why my bias is bearish going into the new week.

Not much volatile news except for Unemployment Claims on Thursday.

Let me know what you guys think, your analysis, and if you want to see anything else!

Goodluck this week traders, let's kill it.

AUDUSD Selling Trading IdeaHello Traders

In This Chart AUDUSD HOURLY Forex Forecast By FOREX PLANET

today AUDUSD analysis 👆

🟢This Chart includes_ (AUDUSD market update)

🟢What is The Next Opportunity on AUDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

AUDUSD LongAUDUSD Long:

The pair is currently on strong support line and expected to bounce from the resistance level so

Buy: Only if the price sustains above 0.63144 with strong volume confirmation, targeting a move toward 0.63500. Use a tight stop-loss below 0.62803.

Sell: If the price rejects resistance at 0.63144 (e.g., forms a bearish candlestick like a shooting star or double top) or breaks below 0.62803, targeting a retest of lower support (e.g., 0.62500).

USDJPY and AUDUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

AUD/USD "The Aussie" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.62500(swing Trade Basis) Using the 6H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.65670 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

AUD/USD "The Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔵Market Overview

Current Price: 0.63684

30-Day High: 0.6542

30-Day Low: 0.6147

30-Day Average: 0.6215

🟤Fundamental Analysis

Economic Trends: The Australian economy is expected to grow, driven by a rebound in consumer spending and investment

Interest Rates: The Reserve Bank of Australia is expected to maintain low interest rates, supporting the Australian dollar

🟡Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for commodities, including Australian exports

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for commodities and supporting the Australian dollar

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets

🔴COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 55%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 30%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 15%

Open Interest: 40,000 contracts

COT Ratio: 2.2 (indicating a bullish trend)

🟠Sentimental Analysis

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +30

🟢Positioning Analysis

Institutional Traders: Net long positions increased by 5% over the past week, indicating growing bullish sentiment

Retail Traders: Net long positions decreased by 2% over the past week, indicating decreasing bullish sentiment

Leverage: The average leverage used by traders has increased to 2.5, indicating growing confidence in the market

⚫Next Move Prediction

Bullish Move: Potential upside to 0.65500-0.66000

Target: 0.65670 (primary target), 0.66000 (secondary target)

Stop Loss: 0.62500 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 0.02516 vs potential loss of 0.01267)

⚪Overall Outlook

The overall outlook for AUD/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected growth in the Australian economy, low interest rates, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade