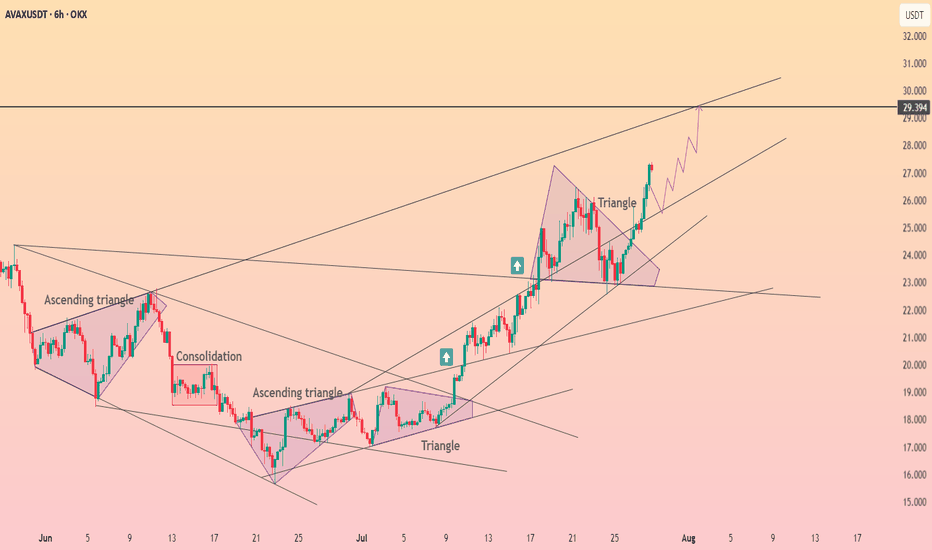

AVAXUSDT The overall trend of BINANCE:AVAXUSDT on the 4H timeframe shows signs of a potential bullish reversal, as a higher low has formed around the 20.40 support level after a strong downtrend. Currently, the price is ranging between the key support at 20.40 and the resistance at 23.10. A breakout above 23.10 could push the price toward the next major resistance at 24.40, which is a critical decision zone for the market. If buyers maintain momentum and break above 24.40, the next bullish target will be around 26.50 ✅ However, if the 20.40 support fails to hold, lower supports at 18.50 and 16.30 may come into play. The momentum currently leans slightly bullish, but price behavior between 23.10 and 24.40 will determine the next strong move. 📊

Key Support & Resistance Levels:

Supports: 20.40 – 18.50 – 16.30

Resistances: 23.10 – 24.40 – 26.50

Always remember to manage and control your risk properly. 🔒

AVAXUSD

Avalanche will retest the $21.5 level ┆ HolderStatBINANCE:AVAXUSDT bounced sharply from the $21.50 support, confirming the level as a pivot zone. Previous breakout patterns remain intact, and the current price action indicates potential for a move toward $25.00 resistance if buyers maintain control.

AVAX Has Been Quiet for Too Long! Don’t Miss What Comes NextYello, Paradisers! Have you been ignoring #AVAX because of its sideways chop? That might be a costly mistake, because what’s forming now could be the foundation of a major trend reversal that catches most traders completely off guard.

💎After an extensive downtrend, AVAX has been trading sideways for nearly 184 days, signaling the market is in accumulation mode. This long consolidation is beginning to take shape as a possible reversal base, and when it breaks, it could break hard.

💎Right now, #AVAXUSDT is battling a complex resistance zone between $23.50 and $27. This region is packed with overlapping technical barriers, many of which date back to December 2024, adding to its significance. It's a make-or-break zone.

💎Once $27 is broken with strong volume confirmation, the stage will be set for a powerful breakout, with upside potential targeting the next major resistance between $36 and $39.20. This zone aligns perfectly with the 61.8% Fibonacci retracement, which is historically where larger moves tend to conclude or stall.

💎On the downside, support remains solid between $20.30 and $19.75. This band has been a reliable support/resistance flip during the range and continues to act as the primary defense zone.

💎Adding fuel to the bullish outlook is the potential golden cross formation between the EMA 50 and EMA 200. If this confirms, it would add serious momentum to any breakout and attract trend-followers back into the market.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

AVAX at the Edge: Golden Pocket Support or Breakdown Incoming?🧠 Overview:

AVAX is currently trading at a decisive support zone, aligned perfectly with the Fibonacci golden pocket (0.5–0.618) at $21.03–$19.54. This level has historically acted as a strong pivot zone, serving both as resistance during bear markets and support in bullish recoveries.

The market has compressed into this key demand zone after a prolonged sideways structure. Now, all eyes are on how price will react — this zone will likely determine AVAX's mid-to-long-term trend.

---

🔍 Key Technical Highlights:

🔸 Fibonacci Confluence Zone (Golden Pocket):

0.5 Fib Level: $21.03

0.618 Fib Level: $19.54

This area coincides with a weekly demand block — a high-probability reversal zone where buyers have historically stepped in.

🔸 Major Resistance Levels to Watch:

$28.76 – First significant supply zone.

$32.68 – Previous lower high, potential breakout confirmation zone.

$43.07 – Weekly structure resistance.

$58.30 – Mid-term bullish target.

🔸 Support Levels Below:

$15.00 – Local base during early 2023.

$8.61 – Multi-year low (critical support if demand collapses).

🔸 Structure Insight:

Price is currently forming a macro higher low, suggesting a potential accumulation phase. However, failure to hold this zone could trigger a bearish continuation.

---

🚀 Bullish Scenario:

If price sustains above $19.54–21.03 and breaks above $25.50, the following upside targets could be reached:

1. $28.76 – Local resistance

2. $32.68 – Break of bearish structure

3. $43.07 – Momentum extension

4. $58.30 – Bullish macro target

Catalyst to watch: Weekly bullish engulfing candle + volume spike + break of structure → these would confirm buyers are in control.

---

🔻 Bearish Scenario:

If the price breaks below $19.54 with strong bearish volume, then:

1. $15.00 – First zone of interest for buyers

2. $8.61 – Critical long-term support zone

This would confirm a distribution pattern and signal that the market may revisit lower accumulation zones before any major uptrend resumes.

---

🧩 Market Psychology Insight:

This current range is where smart money positions themselves — either for continuation or reversal. Retail traders often get shaken out in this kind of compression. Stay patient and wait for confirmation rather than anticipation.

---

🎯 Conclusion:

AVAX is now at a make-or-break point. With the price sitting in a high-confluence demand zone, traders should prepare for volatility and monitor weekly closes. A strong move in either direction will likely determine the next multi-week trend.

> “The bigger the base, the higher in space.” – If this is true accumulation, the upside could surprise many.

#AVAX #AVAXUSDT #CryptoTechnicalAnalysis #AltcoinWatch #FibonacciLevels #SupportResistance #BullishOrBearish #SmartMoneyZone #WeeklyChart #CryptoTrading #BreakoutOrBreakdown

AVAX – Hidden Chance for Latecomers🔥AVAX – High-Potential Setup Amid Market Catch-Up

While many crypto assets have surged in the recent bullish wave, AVAX appears to have been left behind — and that could present a high-reward opportunity ahead.

From both a fundamental and on-chain perspective, this project shows promising signs, especially with notable activity among whale wallets. I believe AVAX has the potential for a strong long-term rally — but there’s one critical condition to watch.

Price has recently reacted to a key custom demand zone. However, for confirmation of buy-side strength, we need to see a clean breakout and daily close above the ~$28 level. If that breakout is confirmed, I’ll be looking to accumulate for a long-term hold, with a target of $65 — and possibly up to $100 if momentum continues.

That said, risk management remains my top priority. I’ll allocate no more than 3–4% of my total portfolio to this position.

Keep an eye on the $28 breakout. If the trade is triggered, I’ll provide updates here.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

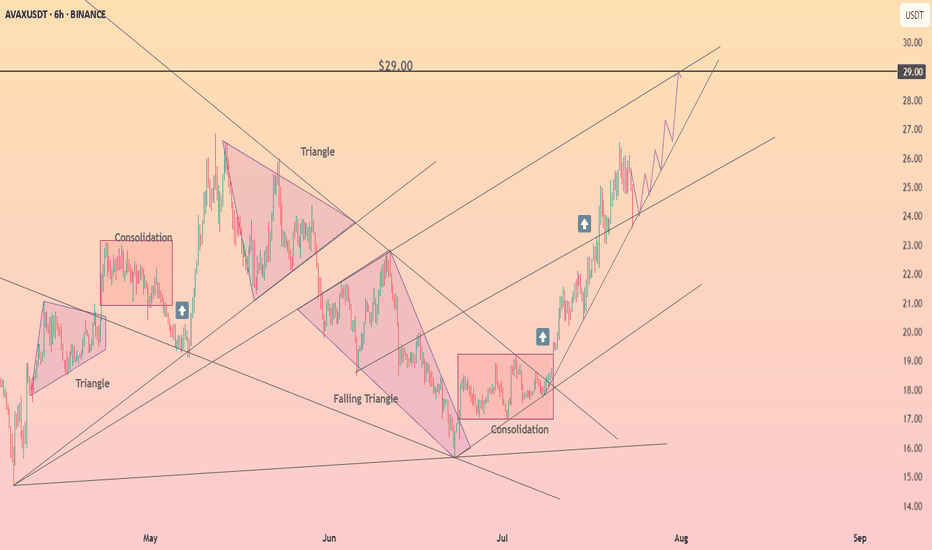

Avalanche broke through the $26 level ┆ HolderStatBINANCE:AVAXUSDT is consolidating just beneath the $33 resistance after reclaiming a prior range high. Price action is forming a classic bull flag while higher lows continue to support the structure. A breakout above $33 could confirm bullish continuation toward $35 and $36. Momentum remains strong as long as the $31.5 support holds, making AVAX one of the key watchlists this week.

AVAXUSDT 8H — Trendline Break Confirmed, Retest in ProgressAVAX just closed above a 7-month macro downtrend and is now pulling back into a high-confluence retest zone. With the prior trendline now acting as potential support — and price holding above a multi-tap demand level — this is a high-stakes inflection point.

📊 Technical Breakdown:

Breakout:

The descending trendline that defined AVAX’s entire bear structure since January has finally broken. A clean candle close above that line marked a shift in control from sellers to buyers.

Retest Zone:

Price is now sitting directly on top of the broken trendline and the horizontal demand zone that’s held since Q1. This dual-level confluence offers a high-probability bounce area — or a decisive invalidation if lost.

Momentum Check:

Stochastic RSI is resetting — not overbought — giving bulls room to push higher if this retest holds.

Targets to the Upside:

$30 – Local breakdown zone from late Jan

$38 – Pre-capitulation base (March)

$44 – Major structural resistance

$52–53 – Full retracement target from the December high

🧠 Trade Context & Bias:

Bullish case:

A bounce here with strong volume confirms the trendline flip and opens the door for midterm continuation toward the $38–$44 zones.

Bearish case:

If AVAX breaks below $22 with momentum, this would invalidate the breakout structure and shift bias back toward range-bound or bearish continuation.

This is where structure meets opportunity. A successful retest could place AVAX at the front of the next altcoin rotation — but only if buyers defend this level with conviction.

AVAXUSDT Double Bottom Confirmation.AVAX has formed a textbook double bottom pattern on the daily chart, signaling a potential reversal after months of downtrend. The neckline around the $27 zone has been broken decisively, confirming the bullish breakout.

Key Points:

- Double Bottom Structure: A strong bullish reversal pattern with a clean neckline breakout.

- Breakout Level: $27, which was acting as resistance for the past several weeks.

- Volume Surge: Noticeable increase in volume during the breakout, adding strength to the move.

- Target: $48–$50 region. ( Channel resistance)

-Stop-Loss Idea: Below $22.0

AVAX appears ready to trend higher as momentum builds. If bulls hold above the breakout zone, the rally may accelerate in the coming weeks.

Cheers

Hexa

AVAX Bull Run Loading!AVAX is showing signs of a strong bullish setup on the weekly chart, forming a double bottom pattern right at the lower support trendline of a long-term symmetrical triangle. This technical formation often indicates a potential trend reversal when confirmed with breakout and volume support.

Key Points:

-Double Bottom Support around $12–$14 with bullish momentum.

-Symmetrical Triangle structure compressing price for breakout.

-Breakout Zone near $27, a close above this level may trigger strong upside.

-Upside Target: Short-term Target- $45; Long Term Target - $125

Invalidation: A Break below $15 support could negate the setup.

Cheers

Hexa

CRYPTOCAP:AVAX BINANCE:AVAXUSDT

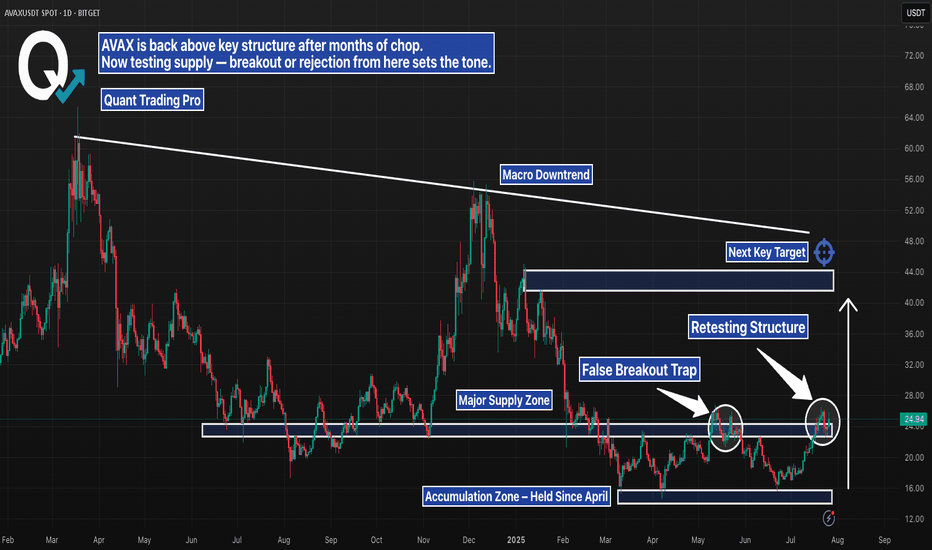

AVAX Daily – Breakout or Another Trap?AVAX just pushed into a major supply zone, testing structure that’s capped price since early 2024. After months of chop and accumulation, bulls have finally reclaimed key support — but the real test is happening now.

Here’s the setup:

– Retesting structure after first rejection

– Sitting below a clear macro downtrend line

– Above an accumulation zone that held for months

– Next key target sits near $40–44, with confluence from prior highs and trendline resistance

This is the kind of move that either builds serious momentum — or turns into another trap. Wait for confirmation. Volume and reaction here will say everything.

#AVAX #Altcoins #CryptoBreakout #SupplyZone #TrendlineResistance #TechnicalAnalysis #QuantTradingPro #PriceAction

AVAX/USDT Trade Setup: Bullish Bias with Fibonacci Targets🚀 AVAX/USDT Avalanche is currently in a strong bullish trend 🔼. On the 4H chart, price is pulling back slightly 📉, and I’m watching for momentum to pick up and break above the current range high 📊—that’s where I’ll be looking for the next entry.

🎯 My bias remains long, and in the video I break everything down in detail:

🔍 Price action

🧱 Market structure

📈 Overall trend

📍 Stop loss placement (below the previous swing low)

🎯 Targeting key Fibonacci levels

I also go over my exact Fibonacci settings and how I use them to frame the trade.

This is not financial advice ❌💼

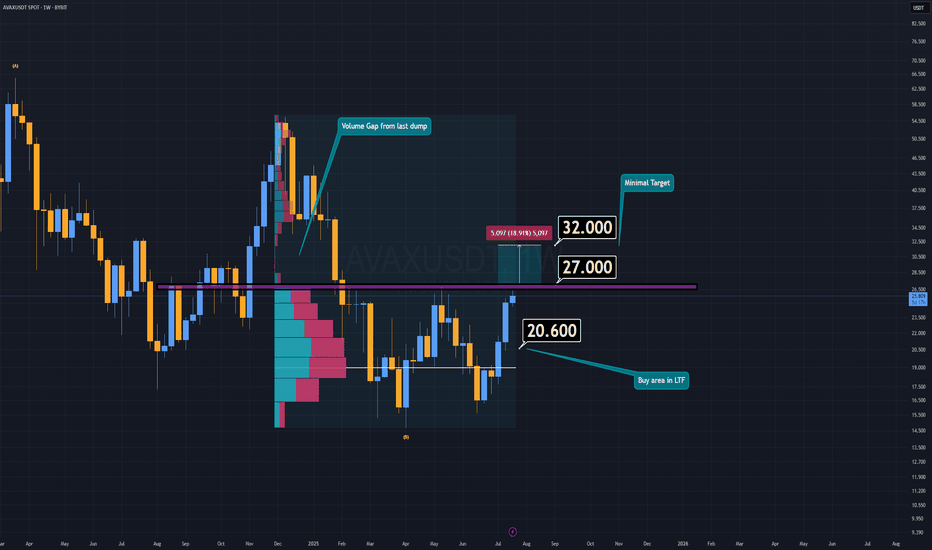

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

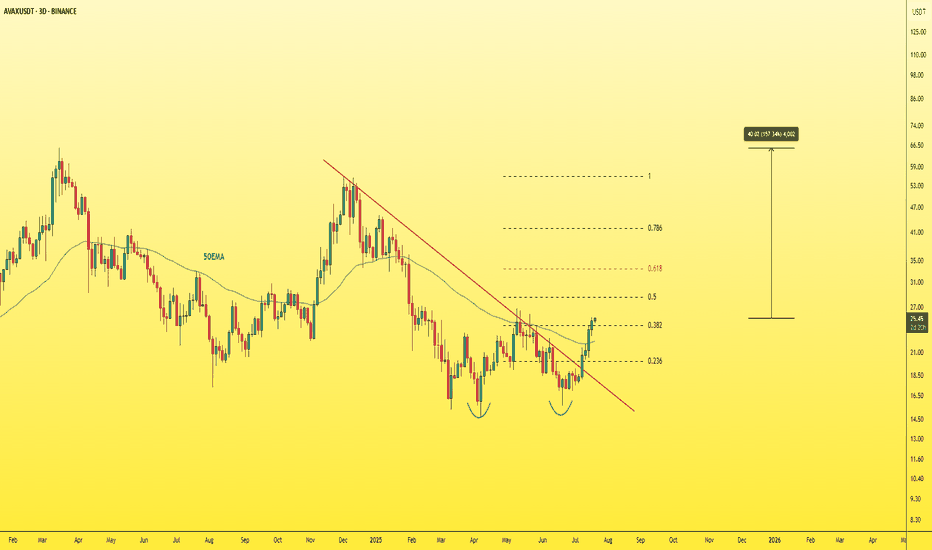

AVAXUSDT - THE real treasure must be hunted!Let's not forget about CRYPTOCAP:AVAX — it's one of the must-have assets in any crypto portfolio.

Currently trading at a discounted price after dropping from its previous top at $55, AVAX now shows strong bullish potential with plenty of upside ahead.

🚀 Key bullish signs:

-Successfully broke through multiple resistance levels, including the 0.382 Fibonacci retracement, 50 EMA, and the main descending trendline.

-A daily close above the 26$ level is a very positive signal.

With a solid project, reliable fundamentals, and low risk compared to potential reward, this could be a highly profitable opportunity.

Don’t sleep on it.🎯

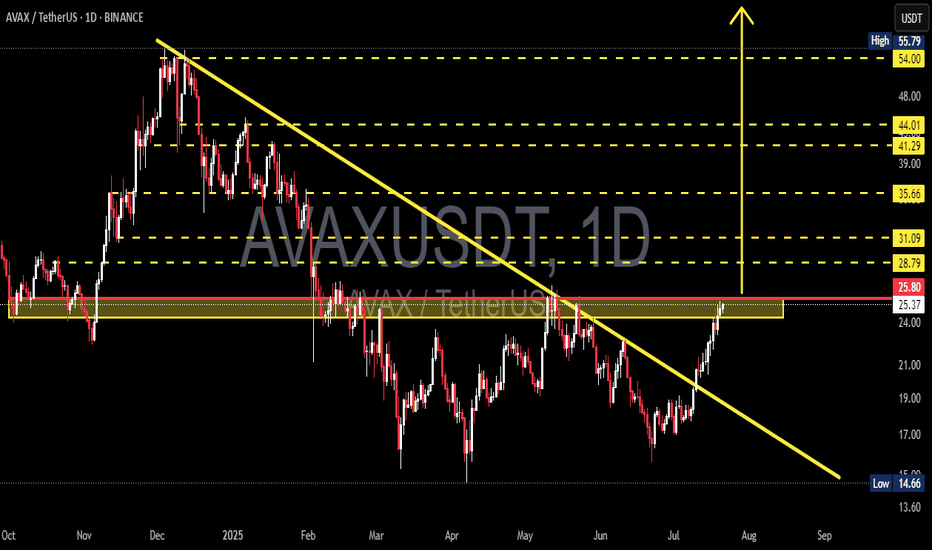

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

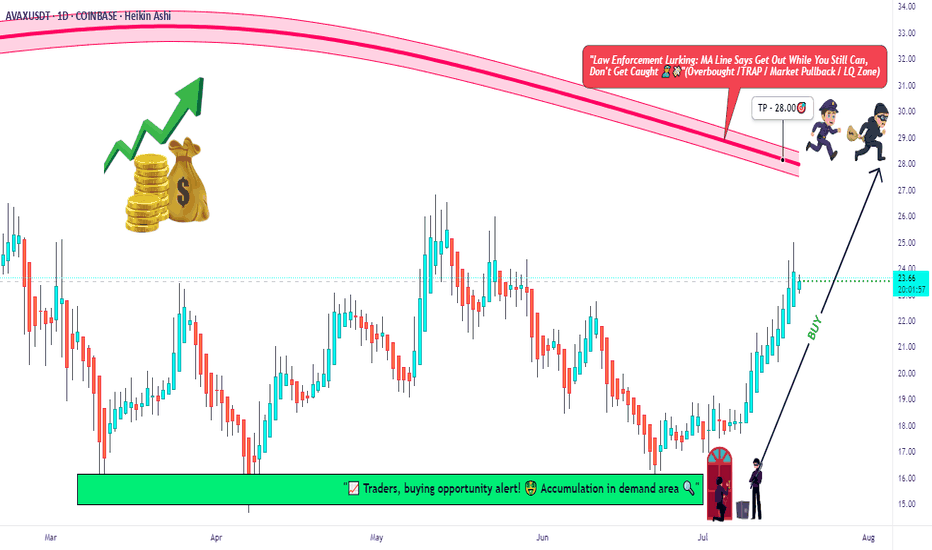

AVAX Long Only | Moving Average Trap Heist in Action🧨“Avalanche Crypto Vault Break-In 💣 | Thief Trader’s Long Playbook”⚔️💸🚀

(AVAX/USDT Crypto Heist Plan – Swing/Day Trade Blueprint)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers, Market Pirates, and Chart Snipers! 🤑💰💼✈️

This ain’t just another setup — this is a strategic crypto ambush on AVAX/USDT, cooked up with the 🔥 Thief Trading Playbook 🔥. We're planning a clean, no-fingerprint heist into the Red Moving Average Zone. That’s the liquidity vault, and yes — the police (market makers) are watching 👮♂️🚨... but so are we. Stay sharp. 💼🔦

💥 Mission Objectives:

🎯 Entry Point (The Infiltration Point)

"The vault's wide open! Swipe the Bullish loot at any decent price" 📈

Smart thieves wait for pullbacks on the 15m or 30m chart to plant their limit orders near swing lows/highs. Use layered orders (DCA style) to scale in like a pro. 💣🔁

🛑 Stop Loss (Your Getaway Exit)

Secure your trade. SL at the nearest wick low/high on the 1D timeframe (around 21:00 candle).

Your SL = your personal risk code. Choose it based on lot size & how deep you're inside the vault. 🎭🚫

🏴☠️ Take Profit Target (The Treasure Room)

🎯 Target: 28.00 USDT

...or escape early if the heat (volatility) gets too intense. Protect the bag. 💼💰

⚡ Special Note for Scalpers:

🧲Only operate on the Long Side.

If you’ve got deep pockets, smash in directly. Otherwise, ride with swing bandits. Use trailing SL to secure stolen profits. 🧨📉📈

🔍 Market Heat Map & Rationale:

The AVAX/USDT setup is flashing bullish strength, backed by:

🧠 On-Chain Metrics 📊

💡 Market Sentiment

📰 Macro Catalysts

🌐 Intermarket Synchronicity

📡 Go grab the full breakdown on:

⚠️ Red Alert: News Zones Ahead! 📰🚫

Avoid fresh trades during high-volatility news releases.

Lock in gains with trailing SL. Risk management is not optional — it’s the escape vehicle. 🚗💨

📝 Legal Talk (Don’t Skip):

This isn’t investment advice. Just a well-planned blueprint from a market thief.

You're responsible for your own loot and losses. 🎭📉📈

❤️ Boost the Brotherhood 💥

Smash the 🔥BOOST BUTTON🔥 if you found value.

Every boost powers our Thief Trading Gang’s next big score. 🚀💸

Stay tuned for the next heist plan. I’ll be back with more charts, more loot, and less mercy. 🐱👤📊💥

$AVAX Ready to breakout!CRYPTOCAP:AVAX looks ready to pop.

High Volume Node resistance and daily 200EMA is clear and now support. We don't want to see price rejected and moving back below this area.

The R5 daily pivot is my first partial take profit $35-36 followed by the major resistance High Volume Node at $48

Daily RSI is overbought with unconfirmed bearish divergence so watch out for this but should be good to run in the mean time. BTC permitting...

Safe trading

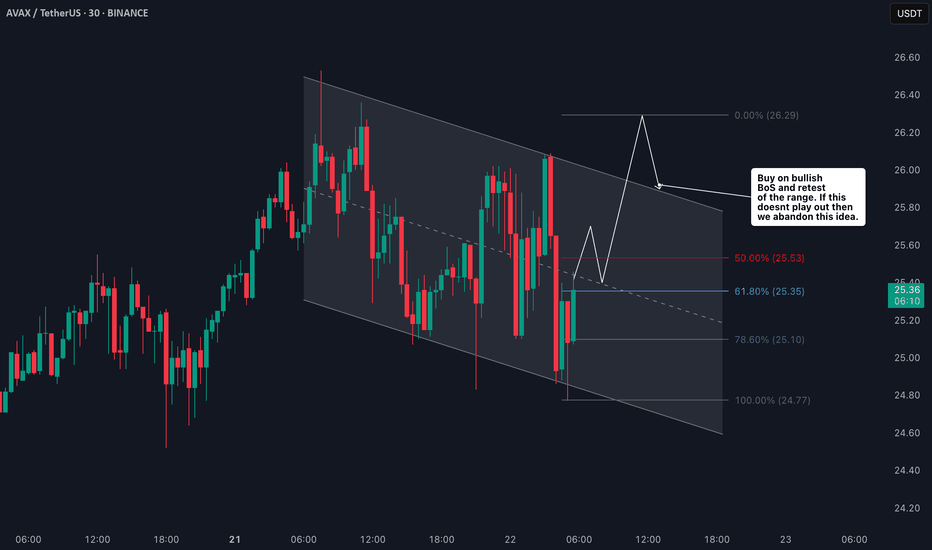

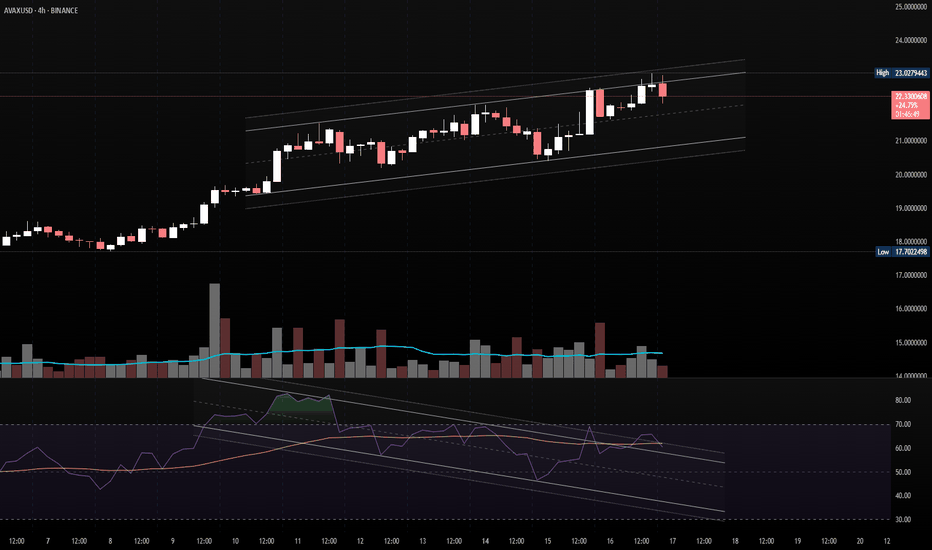

AVAXUSD - Possible Correction from Channel ResistanceStructure: Ascending Channel

Indicators: RSI Overbought, Bearish Divergence Forming

📌 Confirmation:

Look for:

A strong bearish candle or

RSI breaking below 60

Volume divergence

Bias: Short-term bearish correction, bullish structure intact as long as price holds the channel.

AVAX/USDT - H4 - Wedge Breakout (29.06.2025)The AVAX/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 21.77

2nd Resistance – 24.35

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.