AVAX Is My The Most Confident Investment!Hello, Skyrexians!

It's time to update my previous BINANCE:AVAXUSDT analysis because when I told that correction is over as usual I have a lot of haters in comments. They told me how you can bet for one altcoin growth and other's dump - easy!

This crypto has the clearest structure for me. Wave 1 was very impulsive and after that we have seen almost flat correction. Wave B finished slightly below wave's 1 top, wave C slightly below wave's A bottom. Divergence on Awesome oscillator and momentum growth is showing that correction is over and the next target is 1.61 Fibonacci above $100 in wave 3.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

AVAXUSDT

AVAX Potential UpsidesAVAX/USDT is currently trading within a broader uptrend and is in a corrective phase. The price is approaching the 24.60 level, a key support and resistance area that aligns with the prevailing trend structure. This zone may offer insight into potential market reaction and the strength of the ongoing trend.

Avalanche With Higher Targets —1,700% Profits PotentialWe've been looking at Avalanche many times but each time only with short-term targets, that is because we were considering a leveraged trade setup. When using leverage, we tend to ignore the higher targets because profits tend to climb pretty high pretty fast even with the short-term ones. But this doesn't mean that these targets won't hit or that you should ignore them. In these types of leveraged trade setup, once the great entry is achieve and the market goes bullish, it is easy to hold long-term. Once the holding is in place, you can wait for whatever target you prefer. Leveraged trading is for experienced traders and you have to develop your own plan, I only share the numbers, the timing and the charts.

Looking at AVAXUSDT, notice the blue line and inverted triangle. The current week recovered the early March drop that led to the correction bottom. The correction produced the lowest prices since November 2023.

Now that the low is in and fully confirmed, we know the market will enter a bullish phase. This means long-term growth, thus we need to map some long-term targets.

The main target that I am mapping for you is $162, this is an easy target. By easy I mean that Avalanche has potential to grow beyond it. Total profits from current price is equal to 560%.

The final target on this chart is 949% at $257. I believe this isn't likely to be the end for this pair and even higher is possible. In fact, if you move the chart upwards a little bit you will find additional targets.

While Avalanche can grow really strong, ~900% is a lot, incredible and perfect. We are happy with such big wins/moves if it happens but we are ready for more.

It will go higher.

Thanks a lot for your continued support.

Namaste.

$AVAX/USDT Trade Setup - Daily TF$AVAX/USDT Trade Setup – Daily TF

#AVAXUSDT has broken a multi-month downtrend and is retesting a key demand zone, offering a clean long opportunity.

Entry: $19.70–$20.00

Stop Loss: $15.00

Targets: $27 / $35 / $55

Invalidation: Close below $15... DYRO, NFA

Watch for a bullish confirmation before entry.

Swing setup with strong potential if the demand holds.

Avalanche Will Grow, You Can Count On It! (460% PP)After a bullish breakout, there is always a retrace. A retrace can be short or long but never deep. If the retrace goes too deep it turns into a correction.

Notice here AVAXUSDT after the 7-April low, it starts to grow. There were two red sessions, total of 4 days (2D candles) followed by additional growth. We have a red session now which is the current active session. AVAXUSDT can continue growing right away or produce a few of these red sessions before additional growth.

The market never moves in a straight line, up or down, it always fluctuates and these fluctuations can seen like a big deal when we are looking up-close. If we zoom-out and consider the bigger picture, we soon realize it is all noise.

After the bottom is in, we get growth. Not only that, always higher highs and higher lows. So AVAXUSDT will continue growing long-term regardless of the short-term. Never worry about what happens today, tomorrow or in a single day. By the end of the week, it turns green; at the end of the month, prices are up. It is only the start, Avalanche is going higher for sure.

Just a friendly update and reminder to let you know that you can sleep easy, there is nothing that can stop this event we've been waiting for. It works like the Sun, it comes out everyday, you can count on it. Crypto goes down and then goes up, you can count on it...

Avalanche will grow!

Namaste.

AVAX Analysis: Building Up for a Potential Breakout🔹 Since mid-December, AVAX dropped hard, losing more than 70% from the highs.

🔹 Recently, the coin found strong support around the $15 zone, testing it twice — possibly forming a double bottom pattern.

🔹 At the time of writing, price is consolidating right under the neckline and seems to be building momentum for a move.

Key technical points:

• Massive drop from $55 opens room for a stronger relief rally.

• A breakout above the $23 resistance would confirm bullish continuation.

• $18 is now the new support zone — as long as it holds, the bias remains bullish.

• Major target for bulls: $30–31 area.

🚀 Plan: Watching for a confirmed breakout above $23 for potential continuation higher. As long as $18 support holds, dips could be seen as opportunities.

#AVAX/USDT#AVAX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 21.50, which acts as strong support from which the price can rebound.

Entry price: 22.28

First target: 22.87

Second target: 23.44

Third target: 24.00

Avalanche Bullish Confirmed (1,425% Easy Profits With 5X Lev.)Some trade setups are hard, risky, while others are very easy. This one is really easy with relatively low risk.

How are you doing in this wonderful day my fellow Cryptocurrency trader?

» Avalanche is now confirmed green.

While we looked at a pair recently, DOGEUSDT, where trading volume isn't present but the chart signals are still pointing up, here we have a pair that has very strong volume to mark the most recent correction bottom low.

Also, while DOGEUSDT produced a higher low in April 2025 vs August 2024, here Avalanche (AVAXUSDT) produced a lower low. This lower low is good for buyers, it means the bears went beyond 100% and when this happens, there is nothing more to sell, this increases the chances of the next move being strong when it develops. The high buy volume on the drop confirms this statement. This will be a strong bullish wave.

Avalanche is set to grow very strong in the coming months, what I am showing you here is an easy target, very strong potential, mid- to short-term. This can all develop within 1-3 months. So this is perfect. A great opportunity to grow your bank and go beyond any losses the correction produced.

Such strong high volume at "critical level" support indicates that buyers were waiting, ready and present. Now that the low is in, the market reverses from red to green.

» The first target is an easy 90% for spot traders, but leverage traders can extract as much as 450% with just 5X.

» The second and main target, which is also easy because total growth for this newly development bullish cycle will be much higher than what is shown on the chart, goes to $81 for 285%. When we add the reasonable 5X, that's a nice 1,425%. That's it. Timing is of the essence.

The market is good now. The chart looks good now. Once the next bullish wave starts, there is no going back, low prices will be gone forever and the market will be rising until the end of 2025.

Thanks a lot for your continued support, I hope you enjoyed the chart.

Namaste.

AVAX Jumping the Creek My previous two "bear flag" ideas were invalidated. This is a Jump the Creek situation. Shown here is a zoom in to the 30 minute time frame of the part that I thought was a bear flag.

Bellow is some info in layman's terms of the Wyckoff Reaccuumulation Trading phases also known as "Jump Across the Creek"

----------------------- Please Hit the Rocket if You Like This......------------------

Think of a market like a tug-of-war between buyers and sellers. Sometimes, after a big uptrend, the market takes a "break" to recharge before heading higher again. This “resting” period is called reaccumulation — it's like a pit stop in a race.

Imagine price action moving through a messy sideways area — picture a creek with lots of rocks and water making it hard to cross.

In this phase, the market has been struggling to get above a certain price zone (the "creek") — there are little rallies and dips, but no clear breakout.

Then, suddenly, the price "jumps across" this resistance zone with a strong move upward — like a bold leap across the creek.

This jump typically: ✅ Comes with strong volume (showing conviction from big buyers)

✅ Breaks above the previous highs in the consolidation zone

✅ Signals the beginning of a real uptrend — the reaccumulation is ending, and the next bullish phase is beginning

🧠 Think of it Like This:

The market’s been jogging in place, building strength.

“The creek” = a resistance zone keeping price trapped.

“Jump Across the Creek” = price finally gathering strength to leap out of the mud and start sprinting again.

📈 Traders Look for:

A breakout with higher volume

Pullbacks that don’t break down — these often retest the “creek” area before moving higher

Avalanche Potential UpsidesHey Traders, in today's trading session we are monitoring Avalanche for a buying opportunity around 19.20 zone, Avalanche is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 19.20 support and resistance area.

Trade safe, Joe.

Reversal Pattern in Play – Will AVAX Flip Bullish?CRYPTOCAP:AVAX is showing signs of a potential reversal after forming a double bottom near the $17 zone. It’s currently testing a key resistance trendline along with a minor horizontal resistance around $19.50–$20.50.

A successful breakout and close above this zone could trigger bullish momentum toward $22+. However, rejection here may lead to another dip back toward support.

Price action is tightening, so a decisive move is likely soon.

DYOR, NFA

AVAX printing BEAR Flag on 4 hourMany times I have seen a failed H&S pattern play out days later. It appears that a bear flag is forming and that the failed plunge will take place soon. Shown here is the 4 hour chart, showing a recent double top. If the price of AVAX holds above $19.20 than this theory will be invalid.

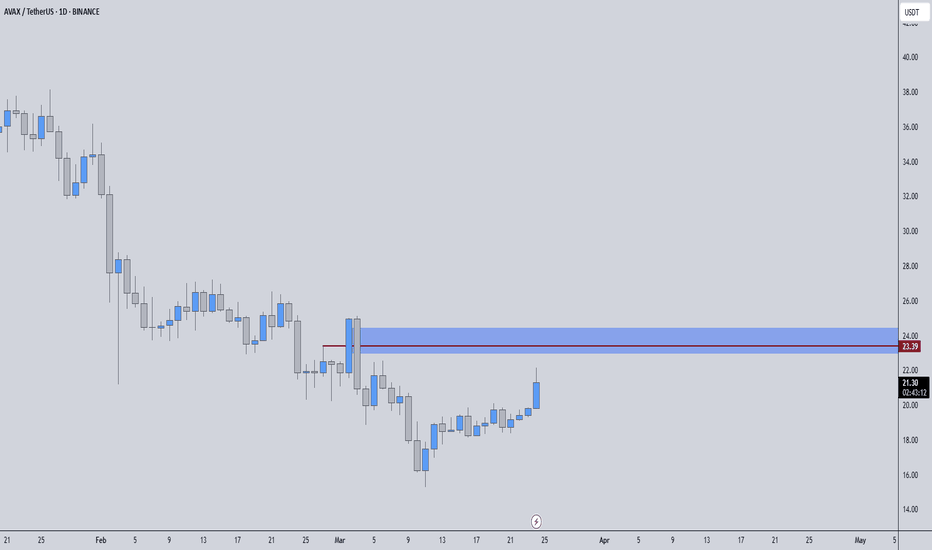

AVAXUSDT – %180 VOLUME SPIKE! Major Resistance Ahead 📊 What’s Happening?

✅ Volume is exploding (+180%) – This means big money is moving, but in which direction?

✅ Blue Box = A HUGE Resistance Zone – This is where sellers may step in aggressively.

✅ Breakout vs. Rejection? – We’re at a critical decision point.

💡 How I’m Trading This:

📌 Scenario 1: Rejection – If price stalls at the blue box, I’ll watch for LTF breakdowns + CDV confirmation for a high-R short.

📌 Scenario 2: Breakout & Retest – If price pushes above with strong volume, I’ll wait for a clean retest before considering a long.

🔑 Pro Trading Mindset:

I don’t marry my bias. If price shifts structure, I shift with it. No guessing. No hoping. Just data-driven execution.

Follow me for real-time, high-probability trade setups. Smart traders adapt, amateurs gamble.🔥

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

AVAX/USDT:BUYHello friends

Given the good price growth, we see that the price has not managed to reach a higher ceiling and has fallen, so we can buy in stages during the price decline within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

AVAXUSDT Ready to Explode? Avalanche ( BINANCE:AVAXUSDT ) has successfully retested its previous support zone, showing strong signs of a potential upward move. This retest confirms the level as a solid base, and the price action is hinting at a shift in momentum. Currently undervalued and flying under the radar, Entering the trade at this level offers a favorable risk-reward ratio, with the previous swing low acting as a logical stop-loss point. Once the market gains momentum, we could see explosive moves from $AVAX. As always, manage your risk wisely and never trade without a stop-loss. This could be the calm before the storm — don’t miss out on the next big wave!

BINANCE:AVAXUSDT Currently trading at $19

Buy level : Above $18.7

Stop loss : Below $17.5

Target : $25

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

Avalanche Update: Easy 510% Profits TargetThis is a perfect chart setup. Price dynamics are revealing a strong potential for the development of a major bullish wave; let me explain.

There was a low around 10-March, followed by a small bounce. This small bounce I take as an early reversal signal but being early caution is advised. Then we have another support in the critical zone.

The initial bounce produced a lower low but there was strong buying right at the "critical level," this signal is strong. The low session ended as a Doji and is immediately confirmed by two days of green. Volume is high on the buy. Prices are now up.

Touch and go. There was a drop below support but the action recovered right away. A failed signal for the bears, a bullish reversal is in place.

Seeing marketwide action, Bitcoin and everything we already know, Avalanche is preparing for a nice up-thrust. This can be big, many times bigger than anything we've seen in several years. We are going up.

An easy target is mapped on the chart, it goes beyond 300%. 500%+ can be achieved within months. So much more by the time this year ends. It will be great.

Thank you for reading and for your continued support.

Early is best. Keep it simple.

Namaste.

AVAX Triple Bottom or Crazy Cup and Handle?I think most traders will view this as an invalidated cup & handle, but you could consider the current state of affairs as a triple bottom. I think the handle dipped down too much due to the USA tarrif turmoil, but that does not mean the cup was not formed.

This idea is invalid if we dip below $14.50, in that case, AVAX could go down to the mid $8.00 range.

However, with the bullish news of VanEck and Nasdaq about to launch an AVAX ETF... my prediction is that we will see $23 very soon.

-Best Wishes

NFA

AVAX Set for a 90% Takeoff — Catch It Before the Lift-Off! (1D)AVAX has reached the weekly support zone.

The structure is still bearish, but there is an expectation that enough buy orders exist in this area to create a bullish substructure.

One resistance base ahead of the price has already been consumed, and above that base, there is a liquidity pool that may get swept.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

invalidation level : 11.09$

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you