GBPJPY H4 - Long Trade SetupGBPJPY H4

Quite a way from realising a support test, but nonetheless, something we definitely want to follow going forward, this pair, alongside GBPCHF has held really nicely and trading fluently between zones and setting new highs etc along the way.

Waiting patiently for that 145.000 whole number support to see a test, nice intersection price here, strong confluence zone.

Banking

NZDCAD H4 - Long Trade SetupNZDCAD H4

Our 0.91450 region held as support, even factoring in the big downside market gaps. Soon recovered just like we did on the 31st January market open too.

Same trading zones to be followed this week with this trading pair. Clear support/resistance trading range from 0.91450 to 0.92250.

Bitcoin (BTC/USD) Weekly Daily Chart Analysis For Jan 19, 2021Technical Analysis and Outlook

With the completed Inner Coin Rally of $49,955 on Jan. 8th, and with the TARC conformation (Proprietary symbol not shown), Bitcoin is heading lower to its first destination Outer Coin Dip $27,460 . The significant Mean Sup $26,810 offers an immediate buying opportunity, while the next Ultimate Buy zone lies at $22,720 . The leading destination to the upside is marked at Mean Res $36,470 - See 'Weekly Market Review & Analysis For January 19, 2020, page to continue the rest story.

Signature is doing crypto banking

Signature bank is in the crypto banking business

there earnings will push up the price

The All time high was $162.86

We are 5% from that high water mark.

Once we pass this mark

it will run up like crazy

the 50 day moving average is way below the 100 and 200 day while the RSI is knocking on the ceiling

I am not buying any more - not financial advice.

WIRECARD AG 2020 was a hard time for everyone because of Corona , but one of the biggest shock of stock market was Wirecard scandal.

I believe even after all this chaos around Wirecard, it would rise again in future. Of course the time could not be predicted.

Wirecard was a BlueChip stock, they have billions of Euro worth business running still now.

The share fell down because of scandal and closing operations in different countries, but in longer term if there comes the long waited news of selling Wirecard to a new company could push the price upwards. As, it could bring relief and trust among investors once again.

*** Do your own research. This is only my own analysis, not an investment advice.

DXY H4 - SetupDXY H4

We have dipped just below the marked S/R zone for the neckline/support retest, however 90.200 is the previous higher low support, so as long as this holds, I feel we should be okay to recover (USD strength).

This would then tie in nicely with what we have marked on GBPUSD shorts.

EUR/USD Weekly Daily Chart Analysis For January 11, 2021Technical Analysis and Outlook

The Euro retracement price action is in a corrective mode and well placed following completion of the Inner Currency Rally $1.2349 , and marginally Outer Currency Rally $1.2370 . Formation of Mean Res $1.2210 and Key Res $1.1173 are confirmed by Trade Selector System proprietary 'TARC' symbol - Trade accordingly/appropriate to your risk strategy. To continue the rest of the market story, see the 'Weekly Market Review & Analysis For January 11, 2021" at the usual site.

EURGBP H1 - Long Trade SetupEURGBP H1 - Start of a potential reversal, double bottom on our big D1 support raised my eyebrows. Looking to break above 0.89400 and then retest 0.89100.

This would be a perfect start to a 2 stage reversal, but this is required before any further consideration. D1 support zone, failed lower low, break above key level and previous high, retest support. Bullish positioning....

CIMB (Learning Notes #4)Hello Traders around the World and Malaysia,

I am currently learning Technical Analysis , and this analysis is what I call ("Learning Notes").

Any sort of constructive comments on my analysis are very much welcome and will be greatly appreciated.

Let us learn together, and grow together to be a better trader!

Sincerely,

Kenneth Lee

This is not a buy/sell recommendation. Trade at your own risk.

EURAUD H4 - Long Trade SetupEURAUD D1 - Support to resistance range is back in play, support has been adjusted slightly after last weeks downside attempt, broke back above 1.61, rejected that monthly key level at 1.62, retesting 1.61 support zone again, could be a good area to catch bid if this support holds.

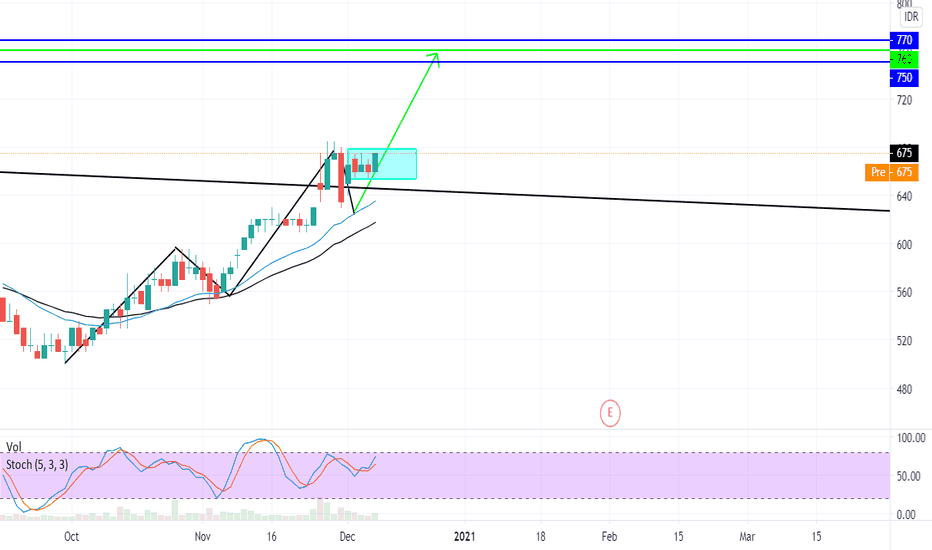

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

THE FLAG PATTERN BTPS ROAD TO 4790BTPS FORMING A PATTERN CALLED BULLISH FLAG,

THIS PATTERN CAN LEAD BTPS TO @4790 (BUT HAVE TO BREAK THE FLAG TRENDLINE FIRST!)

AFTER BREAK AND THAT DAY THE CANDLE CLOSED ABOVE THE TRENDLINE IS THE KEY TO 4790

AFTER BREAK AND RALLY, PRICE HAVE TO RE-TEST (PULLBACK/SECONDARY REACTION) TO THE TRENDLINE.

CUTLOSS AREA @ 3930 OR BREAK THE LOWER TRENDLINE OF THE BTPS.

DISCLAIMER ON !