Banking

$WZR: Fintech hype+ Solid uptrendFA,

- FinTech Revolution (WZR left behind while the punters bet on BNPL)

- Loan origination spikes 48% in June 2020. Consistent uptrend

- Wisr Ecosystem up 52%

- 42.4 Million in Cash

- Great vision: Improve financial wellness in Australians.

- Strong support from NAB

- Good management team including CEO Anthony Nantes

- Cool name and logo ( It’s vital for long term success, Ask Peter Lynch)

TA,

- 5EMA and 10EMA above 150EMA

- Bottom trendline of Strong uptrend

- Ascending triangle( WZR has historically broken out higher from ascending triangles)

- Volume consolidation

- Strong monthly level support(white)

- RSI not overbought (RSI<50)

Capital One -- Not in My WalletAlthough Capital One is involved with more than consumer credit cards, it doesn't feel like a great place to be with record unemployment -- while unpopular, I am taking the gamble that the longer term trend is closer to '08 style credit crisis. The indicators line up, as well as the exact price levels. If this sells off (starting with poor earnings next week?) and was to do an exact length match to the bottom as in '08, it would be 17 monthly candles, or in this case roughly December 2021. COF broke through its 200 day moving average, and I don't see the earnings impressing.

XRP Technical AnalysisI’ve been watching this for quite some time. Fundamental analysis has been hit and miss because the Information provided from Ripple, in terms of utility, has been spotty and confirmation of clients utilizing the ODL hasn’t been cut and dry. With that being said, i think some of the near term driving factors are clearer than before. For blockchain companies to succeed, we have to start seeing a symbiosis, of sorts, between the utility driving factors. IE, ethereum assisting XRP, assisting LINK—etc. The whole is greater than the sum of its parts—TEAM. “Together, Everyone Achieves More”. This ideology is finally coming to fruition in the crypto sector. And rightly so, the Remittance payments sector has been in dire need of “repair” for a decades. And when Institutions see the fruit on the trees in terms of costs savings, speed, efficiency, the sector will do an about face and rightly so.

The chart, if I’m doing this right—is relatively basic. On the weekly, we see a great setup of an inverse head and shoulders. Laid with the chart is your basic Fib retracement levels along with RSI, OBV, volume and MACD along with BBands. My leading indicator, OBV (which isn’t perfect) has been showing extreme strength in accumulation. Price, while decreasing, has been keeping the OBV high. Which is the ideal scenario for this indicator. RSI has been surprised, which can show weakness ( which can be good—trading psychology, remember)

So, what does it mean? It means a bullish trend is emerging. And with it being on the weekly timescale, the confirmation is, strictly in my own opinion, a buy signal.

*This is not investment advice; these are my opinions only and should not be misconstrued for anything but my opinion.*

Bank of America testing trend lineBank of America is near a three-month trend line today as the entire market pulls back. $BAC is far from the strongest of the bank stocks, which are a weak sector in general, so it's quite possible it won't hold the support. I've picked up a July 31 option call and set an alert to trigger to me to sell if it crosses below the trend line. Estimize is forecasting small beats on both EPS and revenue on $BAC's next earnings report.

STOXX 600 (BANKING)STOXX 600 BANKING -as indicated on the chart. the blue highlighted area is a buying opportunity with to much risk for me, so i will not participate, the greater opportunity is a SHORT, i will also not participate. The take away here is that prices can tumble all the way down to the yellow zone and a new normal will emerge in the most devastating deflationary market the world has ever seen - In line with my expectation that crypto currencies like Bitcoin, Ripple and Euthereum will sky rocket to new highs and make many rich in the a world of new normal!!

XLF - banks not looking good 6-12moPotential for a fakeout here but my hypothesis is that we see new local lows on XLF by the end of 2020. You may think the banking sector looks poised for a rebound if you look at the weekly candles, but the monthly candles look like this dump could just be getting started.

Short XLF

Entry: $23-25

Stop: 26.50

Target: $18.50 - $13

Assess in October, adjust 18.50

BARCLAYS 2.0 - STILL STRONGBy popular demand, here are my revised predictions for Barclays over the next month or so.

I will mark this chart as long, but READ THIS DESCRIPTION . I am not indicating that you long from the get go. Please read my thesis to see when and how you should enter these positions.

Barclays hit the initial target I set almost instantly. From there, it's been consolidating, choosing where to go from that area. To me, it seems as if it'll be down, and then up. Stocks don't tend to go up, then fall slightly, and then boost right back up. Tying in with the COVID-19 pandemic, I don't think it's likely that Barclays has the heart to fight through the terrors as of yet.

We can see how well Barclays followed the trendline that I set out. It hit is almost perfectly, but then proceeded to push back upwards from there on.This leaves us in a tricky position.

I can only post one thesis on a chart, although I actually have two.

Number one is one NOT on the chart. The thesis for this is that Barclays continue their run upwards off of the trendline and touch it one again, but then print a divergence and get out of the hole that they are in. I think this is more unlikely because of the traction needed to get out of the area that they're in. Their chart looks similar to HSBC, in that it's not unlikely that they will fall back into the bottom range. However, if Barclays manage to hold the consolidation period they're in, and print a nice push upwards, then it's safe to say we will hit the first (and potentially second) target with little to no effort.

Now for my second thesis. This is the one that's on the chart. As you can see, I have planted two buying zones on the chart. The reasoning for this is due to the difference between CFD and Stock trading. If you trade CFD's, it's more worth it to wait until the 75% zone. If you buy and hold stocks, it's safer to buy into the 25% zone AND the 75% zone should it hit. Use both zones at your own discretion. My prediction is that Barclays will lose the trendline, get trapped underneath it, and then proceed to fall under the line to the buying zones plotted. From here, it will try and reclaim its previous trend by pushing through the resistance; to which it should partially falter and then succeed, I have not included the resistance on here because if you enter in the two zones plotted, it should be rather irrelevant.

Hopefully this thesis gives some of you a clearer idea on what to do in this scenario. A recovery in imminent, but not immediate.

- 𝙇𝙄𝙉𝘿𝙀𝙇𝙇

HSBC Pushing Upwards...HSBC is the best bank stock to buy and hold right now. Note the hold element in that statement. Take security in the support level mapped out @ 20.50. This is very likely to hold, but we could be in for some consolidation here. It's very likely that HSBC will hit the target in the 'entry price'. From there, we have two scenarios.

One is that it lifts off from that target due to the local support within the range charted. If this happens, then we can expect HSB to hit our target with very little effort.

The second scenario is that it consolidates and goes slightly below our entry, before potentially falling through/holding that level and sitting tight for a week or two. We need sufficient volume in this situation and we should be looking to get a safe entry at all costs. Whilst the volatility is residing, we can take a technical outlook and chart onwards from there. For now, however, I think the idea presented works perfectly in conjunction with what the chart says to us here. I would expect this target to be hit by the 1st June at the latest, but as early as next Tuesday.

Maybank is interested to test The main Trendline @ RM6.5It could be the best price level to buy and to keep for a few years.

The economy is not collapsing yet,

just a little hiccup caused by a global pandemic

But if it breaks the Trendline then I'll recommend every investor to increase their Gold Reserves quickly.

JPMorgan looks resilient to recessionI read an interesting WSJ article this morning on JP Morgan. It seems that CEO Jamie Dimon believes JP Morgan can maintain its dividend even if GDP dips 35% this year. The bank has a large cash pile and a diversified portfolio because Dimon has long been designing JPM to be a "port in a storm."

www.wsj.com

JPM currently has a 4% dividend. It's possible that if you wait a while, the dividend yield will get even better. But 4% ain't bad, and if JPM believes it can maintain that, then this is probably the company to own in the banking sector right now. Also notice the positive signals on MACD and engulfing candle indicators.

Prepare for financial crisisThe biological crisis has stabilized, but the financial crisis is just beginning. True, the Fed has been injecting huge amounts of money into the financial system via repo and treasury and mortgage bond buying. In just a few weeks we're doing more QE than we did over 8 months back in 2008. That should help prevent outright bank failures, but there's still going to be a lot of pain as mortgages and corporate debt start to default.

The canary in the coal mine for a mortgage default crisis is unemployment, and this week we're likely to see initial jobless claims jump from 280,000 last week to some number in the millions. Reports indicate that New York's unemployment office is receiving 200,000-500,000 new claims per day, and California's jumped from 2,000 to 80,000 overnight. Both offices are overwhelmed and their employees are working huge amounts of overtime to keep up with all the new claims.

Bad mortgages aren't as big a risk to the economy as they were in 2008, but they're still a pretty big risk. The Trump administration has been lowering lending standards for several years, and the share of mortgages considered "high risk" has been rising rapidly. There's going to be pain in the banking sector. I will enter FAZ ahead of Thursday's ICSA report this week.

Carnage coming in oil and gas and banking sectors this weekOPEC+ failing to cut production Friday was bad, but things are about to get oh so much worse. The Saudis announced today that they are increasing production and entering an all-out price war with Russia. We may soon see US oil prices head toward $20 per barrel.

There's broad speculation among analysts that Russia is deliberately trying to collapse oil and gas prices in order to trigger a mass default on the huge amount of leveraged debt in the US oil and gas sector. Corporate junk bonds are widely expected to be the subprime mortgages of the next recession. Trump may be able to stave that off this year through bailouts, but not if Russia triggers a crisis before the US government can do anything about it. (Fun fact: Russia has net zero public debt, because Putin lived through the 1990s and is well aware how debt can collapse a political and financial system. Possibly he has been waiting for this opportunity to weaponize US debt.)

Also look for collapsing oil prices to cause deflationary pressure in the US dollar, a continued climb in long-term bond prices, and a continued collapse of US stocks (especially banks like JP Morgan with high exposure to leveraged lending).

MONEY ZONES into 2021 ADAA slow conservative approach to technical growth

.20 - .25 = x4 / 2021

If we don't continue with a rising wedge we will have a triple bottom and a very fast impulse up. 3 years of consolidation and build up just means more power over time.

Anything is possible when 2023 comes.

Especially if we are above .25 in 2021

.05 price today @ 100,000 ADA = 5K USD

5K today (could) make you 100,000 dollars within a 10 year span

Hindsight 20/20 just keep swimming and work on more than one avenue in your life.

GS Goldman Sachs: $245 artificially undervalued towards $1,000new markets new customers when the rich becomes richer and the rise of middle class require more banking needs

Goldman shall dominate this space in the next decade.

That liquidity from the FED and make America great again shall benefit strong hands

Price action wise it's a Parabolic to fresh highs

--

LOADED for the long run

warren may just mark this up to $300 to make a statement

REMINDER: this listed most issues and as underwriter packager

it knows how to surprise the PUBLIC

Canadian Banks (UPDATE)Canadian bank stocks haven't really moved in 2 years. This consolidation has confused both bulls and bears, but it will come to an end by the end of this year (2020). Breaking above the all-time high will be a big buy signal, as it will indicate that the cyclical bull market is still intact. However, breaking below the major upward trendline will confirm a change in trend. Current the bias is to the upside, but this can quickly change if time runs out and price doesn't make it above the all-time high.

Based on my own fundamental analysis of the Canadian banking sector, there are significant problems brewing that could heavily impact equity values. Bank assets that are included in this bank index are mainly composed of speculative loans (+75% of bank balance sheets) to the real estate and financial sector. In China it's the opposite situation, where most bank assets are held by corporations who are engaged in some kind of productive activity. Thus, in Canada if there is a shock in the asset values of the speculative assets underlying the loans it will have a severe negative impact on Canadian bank equity.

Also, remember that Canada's yield curve is currently negative. This is a big sign of a recession ahead for the country. Households are holding a significant amount of debt (almost the highest ratios in the world), and are staring at some of the highest asset valuations in history. Moreover, manufacturing is contracting. There are no industrial policies in Canada at the moment that could counteract these trends, and it doesn't seem like Canadian governments are shifting away from laissez-faire policies.

PS. If you found this idea useful/interesting be sure to follow me on my Twitter account where I post more frequently. The link can be found on my TradingView profile or @ErikFertsman.

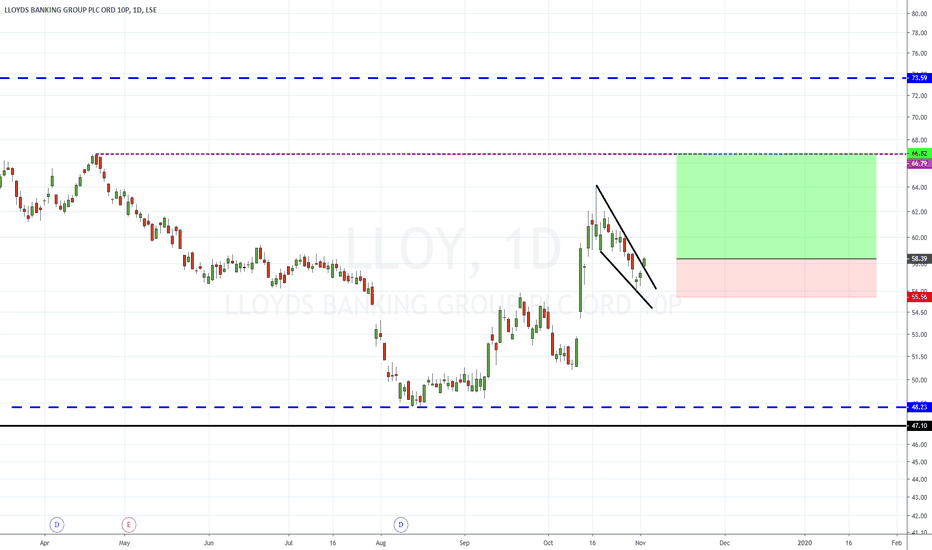

Lloyds - Banking on a move higher.Buy Lloyds Banking Group (LLOY.L)

Lloyds Banking Group plc is a provider of financial services to individual and business customers in the United Kingdom. The Company's main business activities are retail and commercial banking, general insurance, and long-term savings, protection and investment.

Market Cap: £40Billion

Lloyds gapped higher this morning and looks set to close outside of the wedge pattern that has formed on the daily chart. A continuation higher looks possible. The next major resistance to target is 66.8p.

Stop: 55.5p

Target 1: 66.8p

Target 2: 73.50p

Target 3: 80p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Happy anniversary Bitcoin.From a 1989 article in the The Wall Street Journal, by Victor Niederhoffer, speculator:

Speculators don't only create bubbles (not sure short term speculators make bubbles happen, they might actually smooth them).

The Federal Reserve was created by a US president to separate the money supply from the government.

But they ended up being control freaks very destructive. I'll make another idea more detailed on that, in particular on the Bretton Woods system.

Satoshi in his white paper, published 11 years ago, said:

And 6 months later he said:

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust."

I do not know a single Fiat currency outside of the British Pound that stood the test of time.

And just 4 months after this, Bernanke told US politicians

"The Federal Reserve will not monetize the debt". Because it was temporary apparently.

Today the FED has pumped the stock market to a point where the rich are so rich and the poor so poor than 1/3 of US citizen get in debt just to eat (corporate buybacks did not help).

Europe is not better. Some countries even have negative interest rates and they are looking into "deep negative" rates, like -10% a year.

The IMF has a guide on Enabling Deep Negative Rates to Fight Recessions

www.imf.org

The central banks are debasing currencies. And it's actually hurting the 90%. They keep pushing this pyramid scheme up.

The problem is, a peer to peer system can't even fight those low IQ central authorities, because they are just going to ban it.

They're going to have to end up in jail. The UK drifted to the right, the US drifted right, but also left, actually very far left it's scary.

Those central morons that think they are helping (are they really that stupid? It has to be intentional) won't stop, and won't let people save cash, buy gold.

So maybe citizen voting far left or right is necessary. But do those politicians understand they have to get rid of the central banks (or reduce their powers)?

All I hear is "white man bad, rich people evil, let's stop progress" it's like none of them has a clue what the real issues are.

Bitcoin reached a point where it went into a mania attracting alot of gullible unskilled speculators excited by stories of "Bitcoin millionaires".

The tech reached its saturation point, it can't scale further, and there is very low interest in using it as a viable currency.

I hope it will remain in history as a great prototype and not just a speculative bubble that cause "innocent people" to lose their shirts.

Bitcoin ended up being a ponzi/pyramid scheme, with early adopters making a huge amount of money on the back of late adopters.

But anyway, it possibly opened the way.

Central banks have done so much harm. Over and over. Just like governments trying to prevent traders from trading or forcing prices.

Take the example of oil demand being high on the east coast because it's terribly cold, and demand is very low on the west coast.

When the government forces a price, traders have no incentive to buy cheap on the west and sell high on the east (as price is not moving even with supply and demand varying).

And so on the west coast they warm their swimming pools they don't use, while on the east there is not enough Oil for everyone and people are cold.

I could list so many examples. Over and over same story.

Perhaps we could evolve into having currencies that are not completely controlled by some central authority.

The gullible victims that are dreaming of lambos would really love to see their favorite ponzi scheme be bought by everyone (greater fools).

But I have a better solution: The free market. Let's let currencies not be controlled in such a way, or very minimally, let's let the stock market not be controlled, and let them fluctuate naturally as they should.

Ultimately it does not even matter what currency we use, it's just a number to help make things convenient, to help with trade. As long as it has the basic qualities it's all good.

Central institutions hear about Bitcoin and immediately they want to control it... Risible...

Crypto gambling moonboys don't care of course, but using a crypto will serve no purpose if it is fully controlled by a central bank.

What we really need is to get rid of ultra controlling and manipulative central authorities. Central banks power must be reduced. Governments too.

Their role should be of regulation, administration, resolving conflicts, governing the military (with limitations)...

Not manipulating and spending like degens.

Look around, there are great examples of centralized systems, decentralized ones, and mixed. But I think the best ones are a fusion of both.

Just some examples off the top of my head...

Central powers have to stop sticking their filthy paws everywhere, preventing innovation and causing poverty and generally pain & destruction.

Let people with a financial incentive to do good, participate freely in the economy.

There is no simple workaround. We have to get rid of all controlling central authorities. No alternative. Just like Ron Swanson said.

Satoshi was right. We need to get rid of central institutions.

Bank Stocks: Bullish breakout. Strong long-term Buy Opportunity.BKX (Nasdaq bank index) has just broken above the Lower High trend line (dashed lines) of the 1W bearish (pull back) leg within the greater pattern of the multi year Channel Up since 2012. The technicals have turned bullish on 1W (RSI = 59.797, MACD = 1.140, Highs/Lows = 5.1079) and even the RSI is on identical levels with the last time a similar break out took place in 2016.

We are expecting a fairly similar bullish break out on the long term towards 140.00 - 149.80 (Target Zone).

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.