Bankniftyshort

Bank Nifty ----- Where is the bottom ???NSE:BANKNIFTY

As of now... pure panic selling pressure is hammering and warning is stay out of all long positions till the time dust settles.

Sell on every rise and take limited risk, advised keep SL in system. Don't speculate , speculation do not work in these times.

Important : Keep washing your hands it will save u from COVID-19, close all positions and just watch the show, let the big boys settle the game.

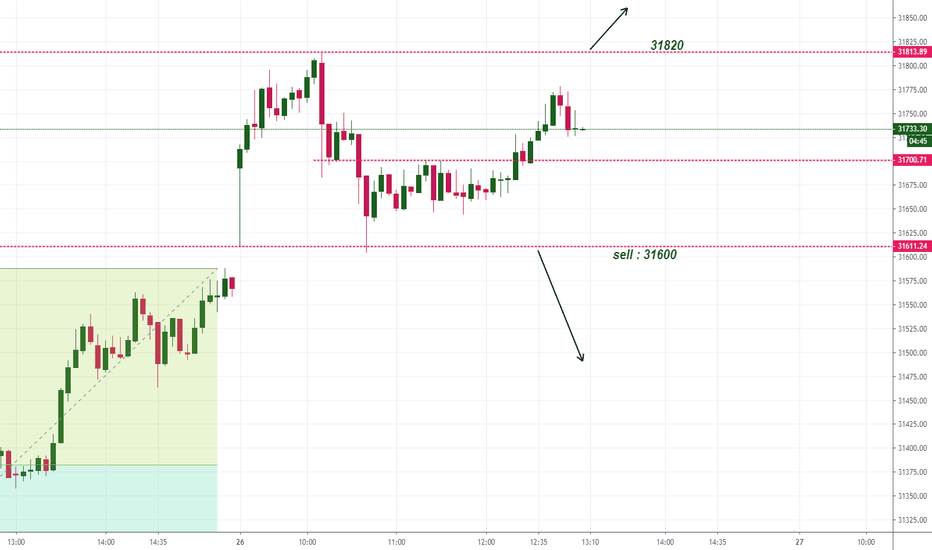

Bank Nifty Intraday Trade Setup for 25th February 2020Hello everyone.

Well Ban nifty Index is weak since a month ago but world economy has been suffering from corona virus threat. Yesterday downfall in Nifty and Bank nifty is come from corona virus Threat. Market is still bearish and we can see an another downfall today so we need to focus on sell side . There is 2 levels for short.

1st : Sell If Index break yesterday low and sustain lower then 30000

Second : In case market give a up move and test 30500-30600 Then sell from top .

BankNifty Day Trading Setup [20 Feb 2020]If BankNifty breaks the trendline with a strong selling volume, then you may witness 30500 levels. However, it may touch 31150 if it gives a breakout above 30930.

Moreover, I also found that there is a bearish divergence in 5 and 15-minute charts which may be valid for the first 30 minutes of trading.

Being an expiry day, Open Interest also suggests that expiry might be in the range of 30500 - 30100. So, I believe that 30500 will act as a support and 30100 will be a strong resistance level.

Blog: akme.co.in

Bank Nifty Intraday Trade Setup for Friday 07 FebruaryHello all,

We are accepting a correction yesterday from our harmonic prz levels. It's give around 200 points correction exact from harmonic 1.13 levels but RBI policy changed the market mood and movement . as per behavior wise Bank nifty is still bullish . Consolidate on resistance area is a dangerous sign. Today Range is 31050 to 31490 . We can see an another bull run if sustain above 31500. Bear is sleeping and can back in the action lower then 31040 so mark these levels and setup your trade on it

Bank Nifty situation is little critical, take a lookHello Guys,

1) With multiple issues popping on like DHFL 2) no much actions taken after IL & FS 3) more conversions from Debt to Equity like SBI's JetAirways deal 4) Farmers loan waivers

Considering these points, PSU's Banks situation is not good so it will look correction.

Plotted a H& S targeting to H&S neckline, we can review after the Neckline break.

Trade on break of trendline :) Good luck with your trades.