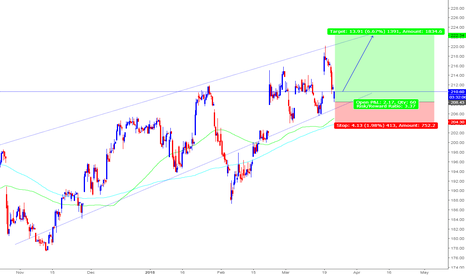

Falling Wedge pattern Barlcays- BULLISHHello traders! Barclays has a classic falling wedge pattern. This is a very bullish pattern. The SP500 has also broken the channel it was in to the upside. The market appears to have made a decision which direction it wants to go. I expect large gains from this stock.

Barclays

Barclays Growing Daily Pessimism Likely To Halt ShortlyAfter Barclays Bank Plc Impulsive run from mid-September last year, the stock is now in the early stage of its correction. The correction/pullback causing some pessimism may likely see a halt shortly to begin another phase.

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

Barclays - Heading higherBuy Barclays (BARC.L)

Barclays PLC is a global financial service holding company. The Company is engaged in credit cards, wholesale banking, investment banking, wealth management and investment management services.

Market Cap: £29.60Billion

Barclays appears to have completed an inverse head and shoulders bottom pattern back on the 11th of October 2019. The shares continue to hold up well as a Conservative win at the upcoming election remains the most likely outcome. the medium-term target is up at 200p.

Stop: 163.65p

Target 1: 181p

Target 2: 193p

Target 3: 200p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Barclays Bank - Crash V.2Never recovered from 2008 crisis, fake money has just delayed the inevitable, Wants to go lower, 4th retest of 140p-150p, each test gets a weaker reaction until support breaks, good buy opportunity at 80p, although widespread panic will be flooding the market at this point and price could go much closer to zero , Barc won't be allowed to fail or its the end, Deutsche Bank could be the catalyst for the crash (already close to zero!)

UK banks outperform FTSE 100 before stress test resultsUK banks outperformed the benchmark for UK shares during the rout in global stock markets that began in October. UK bank share prices are down over the past two months, but by less than the FTSE 100 index.

Positive expectations for stress test results have played a role in limiting the damage to UK bank shares.

BCS, Barclyas bullish trend continuation patteren spottedI believe that successful trading strategies rely heavily upon identifying consolidation zones. Consolidation zones provide us the right direction of the market. Consolidation happens when a market move sharply upside or downside. Later, a trader can use these consolidation zones to identify patterns, whether it be continuation or reversal.

It requires attention and care. Rather than turning out to be a factory of producing signals, it is better to sit down and look for a setup. Setups are important because we are planning a trade and execute them on time. If you fail to plan a setup, then you are planning to fail.

Another advantage of trade setup is that we know where to get out and the right time to go in. Know the market. Study the price movements and make your trades.

My charts use price movements, patterns, structures and indicators such as moving averages and oscillators. Trading intelligence is combining multiple knowledge to produce a favourable trade setups and plans.

Barclays - Bears score another brownie point Daily chart - Breach of the rising trend line (drawn from June low and September low) adds credence to the round top pattern and bearish breakdown on the RSI.

A daily close below 219.10 (Jan 31 low) would be an icing on the cake. Doors would be opened then for a sell-off to 200.00 levels.

Barclays – Poised for correctionBarclays is one of the volume leaders today. The stock appears priced for a correction –

Bearish price RSI divergence on the 4-hour chart

Overbought on the daily chart

Stuck at weekly 100-MA

Thus, a minor pull back to 200 from the current price of 2111 appears likely.

Barclays (BARC LN)Barclays (BARC LN) – recently Co.’s shares have taken a hit after Trump gains ground in the election polls. Yesterday shares received a lift after UK courts decided that MP’s must be involved in the invoking of article 50. This led financial names and GBP to rally as a soft Brexit may be the outcome. Taking a look at the chart we are in a technical downtrend on the D1, but on the lover timeframes we are clearly making higher highs and higher lows. In terms of the RSI on the D1 chart we are still in positive territory, albeit mildly so. On the hourly chart we are seeing a bullish failure swing develop which suggests we are slightly stretched short term. We are slightly above the relative value area on the H1 chart which does suggest after a mild retracement we could see prices move back to the 170-172 area, but the 180.53 support zone would confirm a break lower as the first lower high and lower low would be confirmed.

R3 192.99

R2 downtrend line above current price

R1 187.065

Current 180.65

S1 179.73

S2 177.04

S3 174.81

S4 161.09

Barclays – Long term falling trend line breachedDaily chart chows –

Falling trend line has been breached, however,

RSI is close to being overbought, while money flow index is going nowhere

Hence, failure to take out 175.45 (March 8 high) could yield a pull back to falling trend line level of 165 and 160 (23.6% of July 2015 high – June 2016 low).

On a larger scheme of things, the stock appears on track to test 38.2% Fibo of 185.66 as long as the 23.6% Fibo support remains intact.

REPORT. Prediction of the S&P and how you can react Q4-Q1 (2017)Gold as save haven?

No expiration timeframe, no extension possible.

S&P500 correlated to deutsche bank (DB)

Highly correlation between them. A price of 12,00 for one stock deutsche bank is to high.

take a look at this figure:

in bad fincial times we seek really horrible figures... On this moment Europe and the US have more or less the same problems in political and financial way as in 2008

take a look at my last report:

we are seeing that gold is a save investing, and the S&P reacts on financials.

information derived from Bloomberg, ING TA/FA

none of these information influence the market, trading is at you'r own risk.

Barclays PLC outlookPattern – Falling trend line intact, possible inverse head and shoulder formation ahead

Support – 159.35, 152.70, 148.25

Resistance – 162.63 (50-DMA) 177.55 (10-DMA + falling trend line), 183-185 (possible inverse H&S neckline

Again, failure to take out falling trend line resistance if followed by a daily close below 50-DMA would add credence to the bearish move and expose support range of 152-148.

Traders need to watch out for a possible rebound either off 50-DMA or from the support zone of 152.48 as that would increase odds of an inverse head and shoulder formation with neckline at 183-185 levels.

On the other hand, a break below 148.25 would negate the possibility of Inv. H&S formation and increase odds of a drift lower to 143.95.