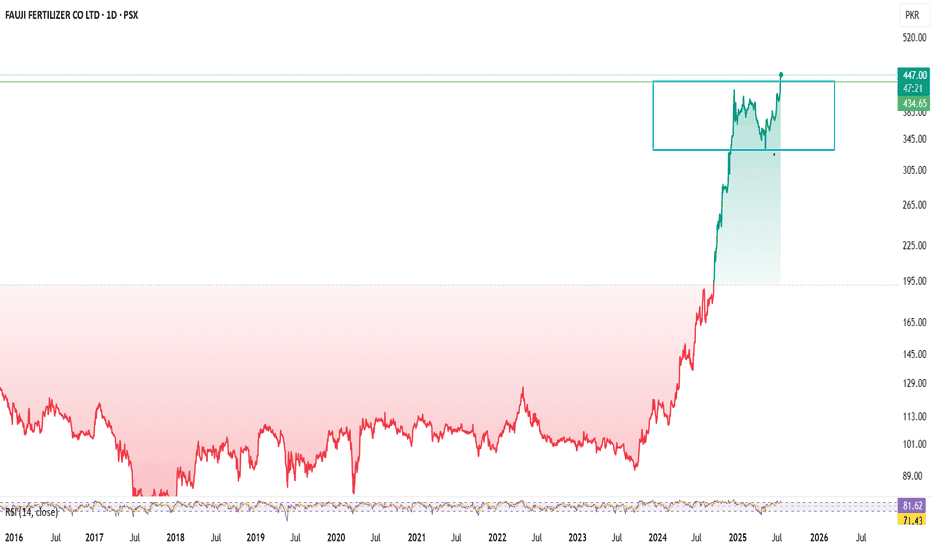

FFCFFC PSX STOCKs breakout Day Level Buy Call

Fundamental Strengths

Robust earnings growth:

FY 2024 net profit ~PKR 64.7 B vs ~PKR 29.7 B (2023) – EPS nearly doubled to PKR 45.49

Pakistan Stock Exchange

+15

StockAnalysis

+15

.

Q1 2025 EPS ~PKR 9.33 (Sep‑Nov on TTM ~PKR 66.6)

Pakistan Stock Exchange

.

Attractive valuation:

TTM P/E ~9.6× (TradingView shows ~6.6×—likely consolidated vs standalone) .

High dividend yield:

~8.7–9.9% yield in 2024, with a ~60% payout ratio

TradingView

.

Diversified portfolio:

Operations across fertiliser, power, food, banking (via Askari Bank), wind generation, phosphate JV – mitigating sector risk

TradingView

+1

+1

Strong ownership:

Backed by Fauji Foundation (~43% owner) – adds stability and governance credibility

Baseline

T. Rowe Finds Support on the Yearly Base LineJust an observation: T. Rowe (TROW) appears to have found support on the yearly base line (red line) of the Ichimoku Cloud. Which has proven to be a bottom in past years (2020). I believe that price will try to recover to at least the conversion line (blue line) $140s by the close of the year (if not much sooner). This will also bring the price back above the 5-year moving average. Caution though: the yearly oscillators are indeterminate and it is very possible that the price could drop back down and try to test the 10-year moving average ($100) before the close of the year. Does anyone have strong thoughts about TROW?

Not financial advice.

NAVIN FLOURINEHello and a warm welcome to this analysis using Ichimoku and Harmonic Patterns

We can see in daily time frame A bearish butterfly near 4200 in early SEPT lead to a sharp decline till end OCT to 3200.

Now in the bounce back it has activated a bearish reciprocal ABCD that is near the falling trend line.

As per Ichimoku we can see the Base line has gone very far from spot price. Suggesting sluggishness to pullback probability till 3700 which is the Kumo support as well as 38% retracement level of the Harmonic pattern.

The view would be invalid if it trades above 4030.

How to Swing Trade Using the Ichimoku Cloud's Base LineIn this post, I'll be introducing a swing trade technique that I like to use often, that involves the use of the base line (blue line) from the ichimoku cloud indicator, and the 5 simple moving average (SMA), marked in green.

Disclaimer: This is not financial advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

Conceptual Explanation

- The base line is a component of the ichimoku cloud that demonstrates price momentum.

- When the candles trade above the base line, it indicates that there is price momentum to the upside, and vice versa for the downside.

- The base line is combining the highest and lowest price over the last 26 period (since this is the hourly chart, 26 hours in this case), and calculating the average value.

- This means, that when the price action lacks momentum, is converges above and below the base line, as demonstrated by the box in orange.

- But when a breakout takes place that deviates upwards significantly, the base line is dragged up towards the new high, as opposed to the price returning back near the baseline.

- In other words, the base line's upward movement indicates that there is strong momentum behind the price action.

- Thus, given that the price doesn't break down below the baseline again, it's safe to assume that the price will continue to rally upwards with momentum.

Application to Trading

- The chart above is the hourly chart I was looking at for a swing trade opportunity on Bitcoin.

- Initially, there was lack of momentum as demonstrated by the box in orange; Bitcoin failed to break significantly above the baseline, and even with small breakouts, it continued to return back to the baseline and 5 SMA.

- It was also trending below a descending trend line resistance, marked by the dotted black line, indicating that a breakout through the resistance trend needed to take place.

- I then saw the price breakout of not only the baseline and 5 SMA, but also the descending trend line resistance.

- As price pulled back to retest the 5 SMA support, the baseline and 5 SMA also formed a golden cross, indicating an opportunity for a long position.

- After entering a long position, I saw the position continue to rally upwards with strong momentum.

- At a certain point, it broke down the 5 SMA, and the base line as well, and the candle closed below the base line, providing bearish confirmation.

- At that point, I closed my long position, and ultimately capitalized on a 9.11% move in 2 days and 19 hours.

Conclusion

The base line can serve as an effective indicator when scalping or swing trading. However, you need to have a clear entry/exit strategy, as well as an understanding of price action backed by momentum. Often times, the most effective trading techniques can end up being the most simple ones.

If you like this educational post, please make sure to like, and follow for more quality content!

If you have any questions or comments, feel free to comment below! :)

UBT Long short term play My Current Trade Plan UBT:

Accumulation zone .80 to 1.30 target build from 10000 - 15000 - (make it stack)

Currently at 1.07$

Resistance @ 2.37$

Support 0.80$

Target $3.12 sell off 10%

re-test for 7.00-9.12 sell off 10%

Hodl to 50$ then another 10%

Fundamentals -

Team has actually built something to rival; DOT, ATOM, SOL, CELO; even better yet real clients and established businesses such CONA, integrations with SAP, EY and Service Now as well

Big brained team (ties with Consensys aka Baseline), who've partnered with Concircle and Provide who actually BULDI - Baseledger for Baseline.... BASELINE.... which is said to be used by enterprises previously mentioned theres so miuch more to be said but simply; 150 million tokens available to buy – no more to be minted – with clients having fiat and private custodial via Coinbase to use service, plus staking, its inventible... BTFD

Enjoy

EURCAD disequilibrium between conversion and base lines Firstly, Price is currently at the conversion line after disequilibrium between the conversion line and price action, now the conversion line and price is in disequilibrium with the base line on the 4-hour timeframe. Furthermore, price should look to make a move to the base line, but on the other hand, the overall trend is down which points towards a potential downtrend continuation after this pullback to the base line. Any tips on how I could improve analysis using Ichimoku?

UBT - huge growth aheadUBT clients are getting BASEDlined as we speak; Amsterdam Port's, CONA bottling and much much more (Service Now and EY clients) - all tokens are circulating - baseDledger making staking a possibility in the future

XLMUSD : The flight is so closeAs you can see, it has been supported 3 times in the fib 0.5 & 0.61 and made a good base band for the next lunch.

The chart is so clear . I look forward to breaking the trend line and pullback and then flying.

if its useful like it please and follow me for future analysis :)

Retracement from previous ATH seems to be ending... reversal incRetracement from previous ATH seems to be ending and we are searching for some higher lows, the possibility of a ascending triangle to setup concluded with a breakout near 0.00366 Gwei is in the cards. Upcomming announcement's we waiting for are: TradeKO (Coca Cola Femsa), Sobeys inc. (Canadian grocery), Senasa Spain (Agriculture)

Make Or Break: Possible Opening of Upward ChannelThe longer the current price consolidates, the more the upward channel will open up, but if the Signal is hit and goes down, upward channel will widen or break entirely and submit to downward channel. Support is the last barrier before confirmation of longer term downward channel. This could make or break Dogecoin for the next couple of weeks.

Ichimoku Cloud Indicator MasterclassIchimoku Cloud

Ichimoku Cloud is a set of technical Indicators that show support and resistance levels, momentum as well as trend direction which is done by taking into consideration multiple averages and plotting them over the chart.

It is composed of 5 lines, 2 of which compose a cloud where the difference between the two lines is shaded in where the price may find support or resistance.

The 5 lines include,

a 9-period average (conversion line),

26-period average (baseline),

an average of those 9-period and 26-period averages (Leading Span A),

a 52-period average (Leading Span B) and

a lagging closing price line (Lagging Span)

There are different ways to interprate the Indicator:

Ichimoku Cloud

The cloud is the most prominent feature of the Ichimoku Cloud plots. The leading Span A moves faster than the Leading Span B as Leading Span A, the average of conversion line (9-period average), and base line (26-period average) while Leading Span B, 52-period average making the shorter moving average more sensitive and faster than longer moving averages.

The price is above the cloud indicates an uptrend and it is strengthened when the Leading Span A is moving above and rising from Leading Span B, similar for downtrend.

Ichimoku Crossover

For the crossover strategy there will be use of Conversion Line (9-period moving average) and Base Line (26-period moving average). The crossover line takes lesser data points into consideration and reacts to the price more quickly while the baseline considers more data points tending it away from the market price thereby making the reactions slower.

Therefore, for Ichimoku crossover a buy signal is generated when the conversion line moves above the base line and sell when the conversion line drops back below the base line.

Price-Baseline Trend

As the price moves down below the Base Line representing a short-term oversold situation within a bigger uptrend with the pull back ending when the price moved back above the Base Line to trigger Bullish signal while as the price moves above the Base Line representing a short-term overbought region within a bigger downtrend with the bounce ending when the price moved back below the Base Line trigger to a Bearish signal.

Ichimoku + RSI

The Oscillator indicator is RSI and the moving average is Ichimoku in which we’ll be using RSI to give signal i.e. the signal chart while Ichimoku will provide with the trend i.e. the trend chart.

Buy when Leading Span A is above Leading Span B, and the value of RSI crosses up 30 and sell when Leading Span A is below Leading Span B along with the value of RSI crosses below 70.

Few Limitations of Ichimoku Cloud

Can make chart complex and distracting

There are few points plotted in future which might go in vain

May become irrelevant for long period of time as price remains way above or way below the cloud

Different signals from different elements making it a bit confusing

----------------------------------------------------------------------------------------

Your questions and comments are most welcome.

If you find the post useful, please like, share and follow to make sure that you get more information once I publish it.

- Mudrex

Ascending TriangleHello everyone,

Horizontal top with an upsloping bottom on NYSE:RIG . Breakout is upward.

If the price is breaking the horizontal top, price will continue to go up.

If it is not breaking up, then we are at the resistance and you should not buy.

Using Ichimoku we can see that Lagging Span is above the price plus the the current price is above the cloud and the future cloud is green.

Base line is also upward and the the Conversion line just crossed the Base line.

However if the price break the horizontal top, we must be careful about a potential premature breakout.

Happy trading,

Ichimoku Analysis - Bullish RMBLHello everyone,

Quick analysis about NASDAQ:RMBL .

Why is this chart bullish?

Future Cloud is green

Conversion Line crosses the Base Line

Base Line is upward

Lagging Span is above the Cloud

Lagging Span is above the former price (-26 bars)

All of these elements lead to a strong trend. Even if the stock is a bit overbought.

Happy trading,

How to Use the Baseline ChartThe chart we made today shows the price of gold as a Baseline chart. The Baseline chart shows price movements relative to a baseline that you choose anywhere from 0% (the lowest point) to 100% (the highest point).

This chart shows gold since the last 1970s with a Baseline of 50%.

Why is this interesting? The chart can show you if an asset is above or below a specific baseline over any period of time. For gold, we see it is well above its average price (50% baseline) and it's been trading above that average level for years (the line turns green when an asset is above the baseline level and red when it is below).

To start using the Baseline chart, follow these simple steps:

Step 1 - Change your chart layout to Baseline. Press the Chart Style button at the top of your chart and select Baseline in the drop down.

Step 2 - Go to your chart Settings by right clicking or double tapping on the chart line.

Step 3 - In your chart settings, find and adjust your Base Level to a percentage you want to see. This can be anywhere from 0% to 50%.

We hope you enjoyed this chart and how to use the Baseline chart to follow any asset. Please press Like if you enjoyed this tutorial or write a comment below.