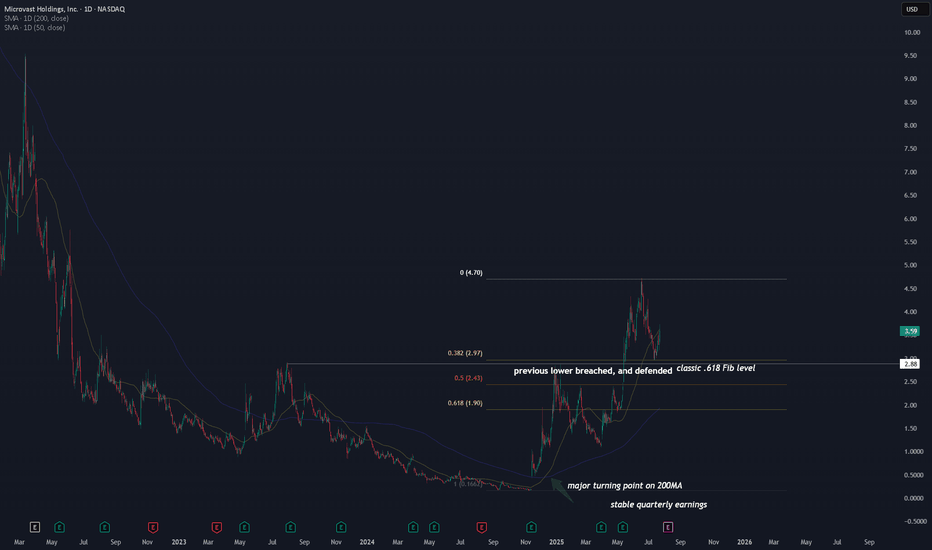

MVST, beginning of the new lithum hype? With ongoing US-China trade war, one of the key issues resides on lithium battery technology . Lithium technology is brought up as a national security concern . This is a tailwind for the industry .

Now let's get to the technicals.

A major turning point on the 200MA . We haven't seen this happening since Dec 2020, when the stock first went public.

$3.00 key level is tested three times . This is not just a .618 Fib level, but the previous cycle high in 2023.

First test happened during Dec 2024, which it failed. Second time we saw the stock blew through this key level on May 2025. Lastly we saw a solid defense on this level on July 2025. If this level were to hold, the upside can be very high .

In addition to the technical side, the company is generating $100M revenue with neutral/break-even earnings this year, up from $60-80M in 2023 and 204. A steady increase in revenue , while not losing much from earning perspective.

This places NASDAQ:MVST at a tipping point . All it needs is some tailwinds from the new geopolitical conflicts , and we will see either an increase in revenue (scale up) or an improvement in profitability. Or both. If that were to happen, MVST will skyrocket.

I am watching and monitoring this stock as right now, I am expecting to add MVST to my portfolio once I see further confirmation.

Battery

QS one to put in the booksYes they are dirt cheap and have been but this company is in position to have explosive results. They are operating right now at a negative balance per year. However They have somewhere around $821 million to use for R&D and just signed a deal with one of The V named Car Companies I want to say Volkswagen.

-QuantumScape (NYSE:QS) soared by more than 20% in trading on Thursday after the company announced that it has entered into a collaboration with Volkswagen’s (OTC:VWAGY) battery unit PowerCo....

There you have it. The kick is I was in an option play on this when it was still Low $5 and it leaped to +$6.

Because of this (I know all those lines its going to give me a seizure. or it looks like spaghetti.) To anyone that doesnt like the indicator let me say this. It makes me money. And I am not the only one that understands it now. ChatGPT can read it too. So know there are at least two smart people in the world that appreciate this indicator.

Using the indicator I can find quickly Everything I need to know about a company just by waiting for specific conditions to align.

I think this stock hits double digits in the next 3 months if not sooner.

That Said I NEVER talk about stocks that are less then Bili. Bili Bili is the cheapest company I will talk about because its proven to hit $30 and come back to low Teens several times a year.

So for me to post an idea on this, really says a lot.

The indicator, timing of the news after the signals. The Pop to $6 to show its going into expansion phase. Its all aligning.

by iCantw84it

01.02.25

Price rengeBAT/USDT Chart:

Trend: Uptrend Price above moving average (yellow line).

Support: Green zone

Around 0.2317.

Resistance: Red zone Around 0.3778.

Possible Strategy:

Buy: Breaked EMA snd firs resistance

Sell: If price fails to break resistance

Note: Always consider market new and overall trends.

FREY: Possible Short Squeeze Playing Out?This popped today on my scanner. Skimmed Jan 17 5C while it was under 0.05c. Buying under 0.02 and selling at 0.04 or above. Worked into a nice position which is mostly covered by the profits. The stocks been beaten down with some bad reviews. I would like to see it run up to at least 2.85$. It would have been a better entry Friday but I don''t think its to late to enter now. After hours Mark is 0.075. Use limit orders as there can be a spread.

Investing in Albemarle (ALB): A Strategic OpportunityAlbemarle (ALB) stock has been decimated recently, but this presents a prime opportunity for savvy investors.

If you, like me, believe in the future of lithium and electric vehicles, ALB is a stock you cannot afford to overlook.

As a leading lithium producer, Albemarle is integral to the EV revolution. The stock is a key component in many ETFs focused on batteries and lithium, alongside giants like Tesla, BYD, Panasonic, and Samsung.

With the growing demand for EVs, Albemarle's pivotal role in the supply chain ensures it is well-positioned for substantial long-term growth. Invest in ALB now to capitalize on the future of sustainable transportation.

Trading at 65% below estimate of its fair value

Earnings are forecast to grow 55% per year

THIS IS EXIDEIND FOR LONGTERM INVESTMENTAs we can see stock is not very bearish as per volume fall and price fall.

Stock trading above 20 50 100 200 ema on the day

on weekly and monthly chart double bottom formation

a bullish crossover on daily and weekly

Golden crossover on 20th Oct

1st-time breakout attempt with heavy volume but can not sustain about 175

2nd-time breakout rounding bottom with good volume and sustain above 175

RSI65,

stock can retest as shown in the chart plan accordingly. in the chart, there are two long positions you can make but you the different risk-to-reward ratios you'll get.

educational purposes only!

China's NIO & CATL Collaborates to Create Longer Life BatteriesIn a strategic move to drive innovation and lower the overall costs of electric vehicles (EVs), Chinese electric vehicle manufacturer Nio ( NYSE:NIO ) has partnered with battery giant CATL to develop longer-lasting batteries. This collaboration aims to address the critical challenge of extending the lifespan of EV batteries, ultimately enhancing the affordability and sustainability of Nio's electric fleet.

Pioneering Battery Technology for Enhanced Efficiency:

Nio's founder and CEO, William Li, emphasized the significance of addressing the longevity of EV batteries, highlighting it as a critical issue facing the entire industry. By leveraging the expertise and resources of both companies, Nio and CATL are poised to pioneer advancements in battery technology that will significantly impact the "full life cycle" costs of EVs. This collaborative effort underscores a shared commitment to driving innovation and sustainability in the automotive sector.

Extending Battery Lifespan and Lowering Operating Costs:

With warranties typically covering EV batteries for eight years, Nio recognizes the urgency of extending battery lifespan to maximize the value for customers. By extending the lifespan of swappable batteries and reducing monthly rental fees, Nio aims to lower the overall costs of EV ownership, making electric vehicles more accessible to a broader range of consumers. This strategic approach aligns with Nio's commitment to delivering exceptional value and driving widespread adoption of sustainable transportation solutions.

Investing in Core Technologies and Infrastructure:

Despite external investments and strategic partnerships, Nio remains dedicated to investing in developing core technologies such as batteries. The company's focus on commercializing advanced battery technologies, including semi-solid-state batteries with a range of up to 1,000 km, underscores its commitment to innovation and leadership in the EV market. Additionally, Nio's investment in infrastructure for battery charging and swapping reflects its commitment to providing convenient and efficient charging solutions for EV drivers.

Driving Towards a Sustainable Future:

As Nio ( NYSE:NIO ) continues to expand its footprint in the electric vehicle market, the company remains committed to driving sustainable transportation solutions. With plans to unveil its second brand, Ledao, Nio aims to target a wider range of consumers and further solidify its position as a leader in the EV industry. By forging strategic partnerships, investing in innovative technologies, and prioritizing sustainability, Nio ( NYSE:NIO ) is poised to drive the future of electric mobility and contribute to a cleaner, greener future for generations to come.

NKLA Nikola Corp Nikola Corporation Reports Earnings Results for the Full Year Ended December 31, 2023

February 22, 2024 at 09:01 am EST

Share

Nikola Corporation reported earnings results for the full year ended December 31, 2023. For the full year, the company reported revenue was USD 35.84 million compared to USD 49.73 million a year ago. Net loss was USD 966.28 million compared to USD 784.24 million a year ago.

Basic loss per share from continuing operations was USD 1.08 compared to USD 1.67 a year ago. Basic loss per share was USD 1.21 compared to USD 1.78 a year ago. Diluted loss per share was USD 1.21 compared to USD 1.78 a year ago.

QS QuantumScape Corporation Options Ahead of EarningsIf you haven`t sold QS here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of QS QuantumScape Corporation prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Puts with

an expiration date of 2023-10-27,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

NXU [D] EV Battery CompanyGraph showing some promising jump, if they can use real life products to accumulate some institutional investor. Keep eyes on it.

Invest smartly!

QS QuantumScape Corporation Options Ahead of EarningsIf you haven`t sold QS here:

Then analyzing the options chain and the chart patterns of QS QuantumScape Corporation prior to the earnings report this week,

I would consider purchasing the 10usd strike price in the money Puts with

an expiration date of 2023-8-4,

for a premium of approximately $1.17.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

TMC The Metals Company Reporting Next WeekI think TMC The Metals Company is the most undervalued battery play you can find.

TMC holds exploration and commercial rights to three contract areas which host an estimated 1.6 billion tones of polymetallic nodules containing high grade nickel, copper , cobalt and manganese, in the Clarion Clipperton Zone of the Pacific Ocean.

The Planet’s Largest Resource of Battery Metals could electrify the entire US electric vehicle fleet!

The Metals Company successfully concluded its $75 million multi-year deep-sea research program to establish the potential impacts of the Company’s proposed polymetallic nodule collection operations.

My lowest Price Target for TMC is $1.6 this year.

Looking forward to read your opinion about it.

$SGML: Lithium Gem?A few week ago we posted about the potential bear trap setting up in LIT. So far that thesis has played out and I give credence to a potential short term pullback here. However, that price action on SGML around 40 has been quite notable and when compared to other lithium based companies we see impressive relative strength. Any kind of growth / equities push could give the bulls a hand as well. Good luck

NSE:KABRA - kya lagta hai 🏋️NSE:KABRAEXTRU

Kabra Extrustiontechnik Ltd. is the flagship company of Kolsite group and one of the largest players in the plastic extrusion machinery known for its innovative offerings. The company specializes in providing plastic extrusion machinery for manufacturing pipes and films. It has two manufacturing locations in Daman. The plastic extrusion machinery industry’s prospects appear positive in the long term.

Kolsite group of companies:

Kabra Extrusiontechnik Limited (KET)

Plastiblends India Limited (PBI)

Maharashtra Plastic & Industries Limited (MPI)

Kolsite Corporation LLP – Agency Division (KCLLP)

Kolsite Group commenced its operations in the year 1962 at a small factory in Tardeo that had a total area of 800 square feet. Mr. SV Kabra left his traditional business and ventured into the plastics Industry. In 1962, the industry was at a very nascent stage, and he decided venture into processing and while processing he faced various issues with the machinery which eventually encouraged him to manufacture machinery for plastic extrusion.

The group entered into joint ventures with the Global players of this field to soon become a leader in Plastic Extrusion Machinery in India. Since then, the company is known for being the pioneers of various technologically advanced plastic extrusion plants. The group has completed 55 years of its existence.

The company has global presence in ~90 countries. Kabra Extrusiontechnik has one of the largest sales & services network in India and equally efficient agencies in South Africa, Turkey, Middle East, South East Asia & Latin America. This helps the company to cater broader spectrum of clients and enhance its capabilities as a manufacturing company.

Kabra Extrusiontechnik has 2 state-of-the manufacturing facilities with a combined area of about 83820 sq. m. These facilities consist of Administration Buildings, Govt. recognised in-house R & D Unit, Quality Testing Units, Machine Tool Equipment & Paint Shop. The company has one of the largest R & D team in the Plastics Machinery Industry with more than 45 dedicated engineers working in different areas of processing, manufacturing, application development, design, controls and automation.

Mr. SV Kabra is the Chairman and founder of the Kolsite Group of companies and has been the main driving force behind its growth over the last 54 years. In 2013, he was awarded with the Outstanding Achievement Award at Vinyl India 2013 conference for his pioneer work in the domestic plastic industry. He has been on the management & executive councils of many reputed plastics organizations in India. SV Kabra has done BA in Economics (Honours) from Mumbai University.

Mr. SN Kabra is the co-founder of the Kolsite Group and Vice-Chairman and Managing Director of the company. He holds a degree in Mechanical Engineering and has strong techno-commercial experience. Since 1960s, he has been instrumental in defining company's strategies, business goals and overall development initiatives.

Disclaimer Information shared, and all content we produce is intended for education and entertainment purposes. Any advice is general advice only and has not taken into account your personal financial circumstances, needs or objectives. No, buy or sell recommendation. Before acting on general advice, please speak to a financial professional.

ChargePoint: Bullish Bat w/Bullish Divergence at SupportChargePoint is sitting at the PCZ of a Bullish Bat that aligns with a Hard Support Floor if this Bat performs I think it will not only make it back to the top of the Harmonic but that it will also make a run for the top of the Macro range up at HKEX:19 - HKEX:20