BB

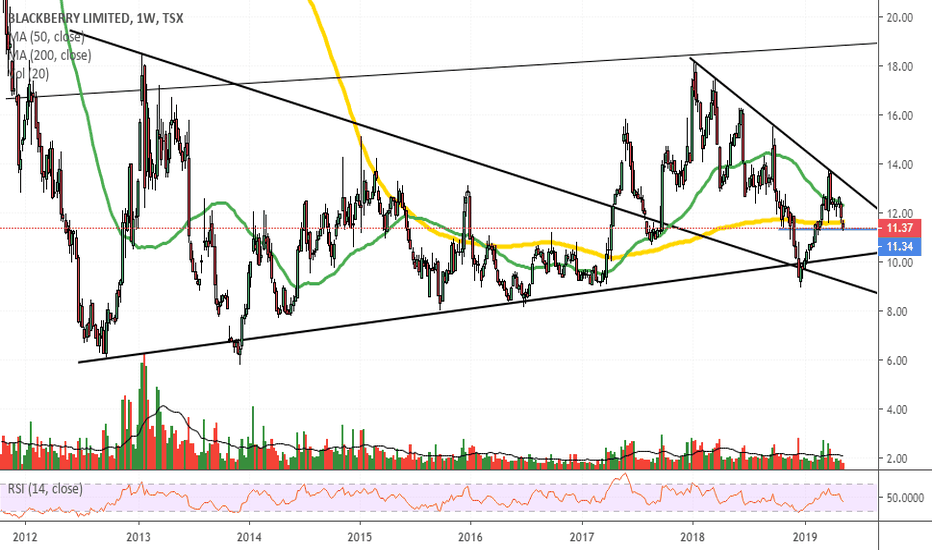

Ready for the Next Positive Wedge? $BBRight now looking at the volume, I think Blackberry is expected to garnish some more major support levels as well as higher pivot points. Overall, given previous charting correlations, I would go long on this saying it is getting close to the next positive wedge. I think Blackberry has a chance here in the red to start becoming a bit more lucrative. That being said, everything I say is on an opinion based basis. Do your own due diligence and invest at your own risk. Please proceed with caution on all trades you make.

O que será que as Bandas de Bollinger irão fazer a seguir?!No gráfico com velas de 4 horas, estou reparando uma indicação de baixa no MACD, ao passo que as Bandas de Bollinger estão se estreitando, e o preço está usando a Média Móvel (linha vermelha central das bandas azuis) como suporte!

Sempre que as Bandas de Bollinger se estreitam de forma convergente como está acontecendo, é sinal de que um movimento relativamente grande está prestes a acontecer!

Vou manter o olho aberto pra ver o que acontece nas próximas 12-24 horas, especialmente porque o MACD do gráfico com velas diárias está indicando força de alta!

Pra que direção vocês diriam que o movimento do preço tem mais probabilidade de seguir?

AVISO LEGAL: conteúdo com proósito de informação, e não deve ser considerado conselho financeiro.

BB - DAILY CHART Hi, today we are going to talk about BlackBerry and its current landscape.

BlackBerry is poised to receive increasing attention from the market as relevant events are taking place. The company reported better than expected EPS for its third quarter but missed its quarterly sales, unveiling a result of $267 million against the $275 million expected. BlackBerry is slowing rebounding, issuing sequential growth in revenue, maintaining its free cash flow, which allows the company to keep on at a healthy pace on its advance.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

FKLI - Still Testing Crucial Support LevelFKLI - Our index future is still testing important support level at 1,580. Bollinger Band is narrowing which signals the index is seeking new direction. If it breaks below this important support, it will form bearish breakout from symmetrical triangle which is shall unleash stronger downside. RSI remains weak, no sign of recovery. Support again, is at 1,530

Opportunity for BTC to show direction after BB SqueezeIt seems that right now we find ourselves in a BB Squeeze. This means that soon we will find out the direction of the next big move. People tend to be reserved right now and want to see confirmation of a move. I am going to exploit this using a good Risk Reward ratio and enter a long.

The sell is located at the old stable price, forming a logical resistance level. The stop loss should be slightly under the weak support that has been formed given the few weeks that were stopped there.

SWING TRADING BTC I have spent a lot of time studying past price action in relation to some benchmark periods, specifically 14 day, 50 day, 14 week, and 50 week. I have them loaded up on a 4H chart with BBs and Wave-PM. Past bull runs seem to respect almost perfectly the expanding 50 week 1.25 stddev distribution (PURPLE) as the bottom level of the upward trend on a macro level. It is nicely compressed and beginning an expansion, so I am looking at that as a level to determine macro trend. Here is the chart. Currently I think if we have support at the 14 day MA(GREENISH)/50 day MA(BLUE) confluence level and subsequently a break above the 14 day and 50 day upper 1.25, then parabolic upward trend will likely continue. Alternatively, a break below that will almost certainly see support at that major 50 week 1.25 upper band level.

Cotton Long Hi there ! We post the next possible trading opinion to cotton CT1! which is possible after the terrible decline which took place this week after the escalated tensions of the trade war between U.S - China. As you see the diagram in daily timeframe the possible target price is at the level of the median BB. This bounce is also confirmed by the RSI. Also farmers price is by far the worst in 2 years.

Trade with safety.

Omen

(This is only a trading idea and not an investment advice ! )

Entry 1/2Crowd Strike, although an incredible company that is rapidly growing, is a complete rip off right now. If you multiplied the total Class A and B shares by $ 70.00 high you would get a valuation of $14,135,982,257. This is obviously outrageous, even by historically low-interest rates/Trump Bull Run standards.

You can imagine the typical reaction you’d get if you said this to somebody who bought it; “It doesn’t matter, it’s a great company, just buy and hold and all those wrinkles will eventually flatten themselves out”. Think about it this way, a Mercedes Benz is a great car, but is it worth $10 000 000? Of course not. Please, wait for this company to come back down to reality before you jump over the deep end.

60% of the fully diluted outstanding shares are owned by 3 entities…That should ring some alarm bells. Once those shares start freely trading, the price will probably tank. Not good for the average mom and pop investor, that’s for sure. With only 18 000 000 Class A shares, the addition of 178 688 971 new shares would result in almost 90% dilution in the secondary markets…

Okay, brace yourselves people, we are going to do something that might seem rather unconventional; we are going to divide the total additional paid in capital prior to this offering by the total Class B stock…………

$493 000 000

Divided by 178 688 97

EQUALS…………..$2.75!!!

Let’s do some more fun little math problems. What was the closing price today? 64? Okay, let’s divide 64 by 2.75.

What do you get?

23.2727272727. That means the average gain on the Class B shares, if they were sold today, would be 2327.272727%!!!!!

Now that’s not completely fair. Yes, the average price is $2.75, but, the Series A-1 shares were priced at 50 cents, which is a bit of an outlier compared to the rest of the preferred shares. The image below is a table of each class of redeemable preferred stock

Lets us, just for fun, see what the implied profit would be for each letter in this varied alphabet of stock

The A’s………………………………. 12900% in profits

For the B’s………………………………………4571%

And for the C’s! 1422% in gains!!

Starting to understand why this valuation is ridiculous?

Okay, now let’s take a look at the book value. Even though this isn’t as relevant to this company since most of the value is intangible (i.e., people, know-how, intellectual property), it still sheds light on the extreme amount of dilution one would face if they were to buy this stock at the current price.

Pro Forma dilution is $30?….on a $34.00 stock?…….Makes sense. In order for profit margins like this to occur, almost always, there has to be a counter-party who loses big time, or else where is all this profit going to come from, especially when it is obtained without the receiver of these profits lifting so much as finger, as is the case here with Warburg Pincus, Accel, and “Capital G” (formerly Google Capital 2016, L.P…. so Google)

At least they warn us. A small remnant that is still remaining from the blue sky’s laws created way back following the Great Crash of 1929. Can you imagine the theatrics that went on back then?!

Gross profits of $162 million. That’s a pretty penny, right? Not so fast. The valuation of the company is 14 billion remember? Like we said before, we go against the grain here, do things others don’t do, so we are going to calculate how long it would take to break even if you were to buy the stock right now. …………….Here comes the magic people. Are you ready for this?

14 billion………………………………………………………………………………..

divided by…………………………………………………………………………………….

162 million………………………………………………………………………………………………………………………

…………………………………………………………………………………………………

……………………………………………………………………………………………………………..

…………………………………………………………………………..

…………………………………………………………………………………….Equals

86 YEARS!!!!! Yes!!! Just a little over the average life span for an American Citizen. Think about it. If you bought a business that was priced 86 times higher then its yearly earnings, how long is it going to take to pay it back? 86 years right?

You see, it’s not that hard to understand. None of this is. Finance is very simple; it’s 2 + 2 =4, not rocket science. It’s just the people who control the industry; the bankers, the lawyers, stockbrokers, the fund managers; they all like to guard their knowledge, just like in any profession, so they use all this bullshit lingo to keep you ignorant so you keep coming back, like your local mechanic.

Oh, we left out one small detail. That number we just mentioned, it’s not their net income, it’s their gross profit, meaning the money they make BEFORE they pay their bills!

You see that number at the bottom, that $140 077? Yeah? That’s their yearly earnings, not the 193 million we talked about before. It’s NEGATIVE, not positive, NEGATIVE 140 077 MILLION……

Which is completely OK!! They are an AMAZING company experiencing RAPID GROWTH, but $14 billion!?! That’s a little much.

They even tell you that you can’t vote!!!

BB has compelling future. I bit.Here I have drawn a couple lines showing what look like some bullish divergences.

This stock surprises me with the lack of confidence. I feel comfortable buying here seeing basically zero pump, and what appears to be market deflation.. Im no expert by any measure, but this seems to be an excellent opportunity to buy into a company that has been making a transition from hardware to subscription software, in the late stages, and at a low price. Security is key, and if these guys can become top tier, I think market will reward for many years. They seem to be off to great start, and in diverse applications. Little trade exposure, but in position to profit from any advances that may happen.

Clearly I like them, please drop a note with your take.. no need for bashing.. i know many have been burned.

$BBNYSE:BB Cae fuerte el día de hoy donde anuncian que mejoró los estimados de ingresos. Se desploma -9% y posiblemente toque la línea de tendencia de color violeta que la utilizará de soporte. MACD indica venta con una pendiente bastante pronunciada, lo cual indicaría que seguirá cayendo luego de tocar este soporte dinámico para luego tocar mínimos en 6,57, línea de retroceso de Fibonacci de 0. Otra opción es esperar un rebote en el soporte dinámico que coincide también con un soporte estático del 31/12/2018, lo cual permitiría una corrección al alza para luego volver a testear el límite inferior del canal bajista

BYND Strong IPOBYND is in a strong and tight bull channel since the IPO. This bull trend from the open is what a trader wants to see when buying for long term investments. Last week formed a reversal attempt. When the market is strong, first reversal attempts fail 80% of the time and instead create the start of a second leg up. The bears will likely need some form of second reversal attempt like a large low 2 or failed bull breakout (they act the same), in order to increase the likelihood of reversing the bull spike. Even if there is a good bear reversal, the bulls will likely look to buy again around the 50 open. If the bear pressure is not strong, the bulls will look to form a spike and bull channel which usually forms after two legs sideways to down, and generally stem from a high 2 or wedge bull flag.

If you found this helpful please like and share! Feel free to comment or ask questions.