BBVA

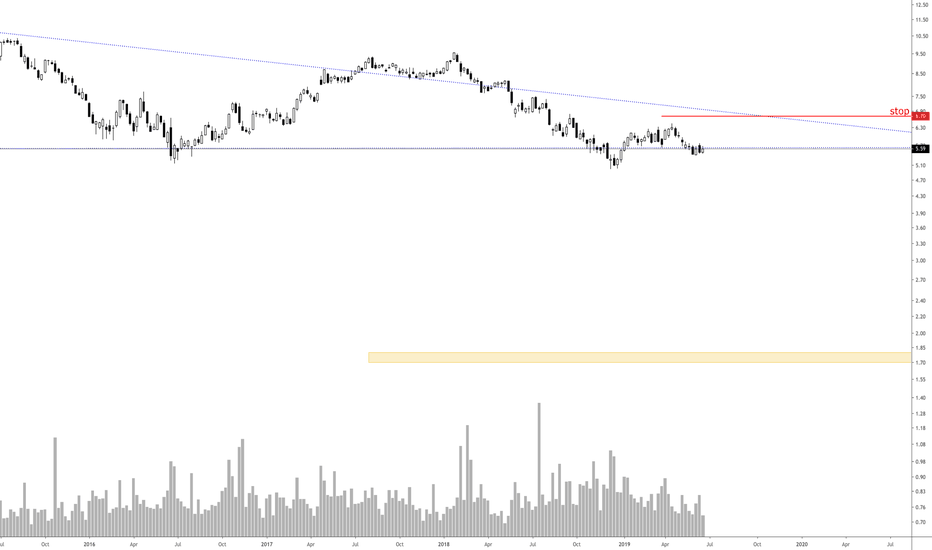

Potential Short on BBVA

BBVA is currently in an ascending wedge with bearish RSI divergence. Look for a break of trend on smaller timeframe for entry, SL at last swing high with target of $7 also could be a bigger move as in a channel on larger timeframe so will be using a trailing SL if it gets there, moving SL to BE when safe to do so.

BBVA bearish scenario:The technical figure Triangle can be found in Spanish company Banco Bilbao Vizcaya Argentaria, S.A. (BBVA.mc) at daily chart. Banco Bilbao Vizcaya Argentaria, S.A., better known by its initialism BBVA, is a Spanish multinational financial services company based in Madrid and Bilbao, Spain. It is one of the largest financial institutions in the world, and is present mainly in Spain, South America, North America, Turkey, and Romania. The Triangle has broken through the support line on 22/10/2021, if the price holds below this level you can have a possible bearish price movement with a forecast for the next 7 days towards 5.440 EUR. Your stop loss order according to experts should be placed at 5.8620 EUR if you decide to enter this position.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

BBVA Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

#Spain - #Bailout - 20.07.2020 - We the people #BBVAThe next Bailout of Spain.

The bailout of Spain has now taken place after 1 1/2 years.

But it will not stay that way.

Spain will not get back on its feet despite financial aid and loans. The socialist structures + nepotism are too strong and the trust in Government is down and LockDown break the neck of economy.

It's over!

Therefore it will come also in the next 2 1/2 years to revolts of "We the people".

The Government is never for the people only for themselves and oligarchs.

#BBVA - #Banco #Bilbao saved? #Spain #tradingviewI have been following this count for quite some time now.

Bailout Spain has arrived as expected.

All the centralbank money and buying of zombidebt could cosmetically save the balance sheet of Banco Bilbao and possibly start a turnaround.

But I will definitely not buy the share.

The first riots have also started extraordinarily early.

The CoronaLockDowns will significantly intensify the eruption of the riots in the coming months and years. As a tourist country, many Spanish families with hotels and restaurants and so on are dependent on the guests.

They are faced with the shattering of their existence and with a hungry stomach, people quickly become angry.

The LockDown governments of Spain will probably have to flee soon if they want to survive the economic collapse and the subsequent lynching.

Greetings from Hanover

Stefan Bode

TOP-10 Most Important Banks in SpainThis is a review on a monthly view of the main banks in Spain.

We are not going to make any more comments than to limit ourselves to paste the charts, just to say that they are inside a big shit. In which one would you put your savings?

Greetings and God bless us.

-------------------------------------------------------------------------------

Banco Santander:

(this one attached to the idea)

Banco Bilbao Vizcaya Argentaria, BBVA:

Caixabank:

Banco de Sabadell:

Bankia:

Banco Popular:

(no info found)

Bankinter:

Unicaja:

KutxaBank & Ibercaja Banco:

(no info found)

----------------------------------------------------

And finally a view of our main index, IBEX35:

----------------------------------------------------

We need more brrrrr brrrrr brrrrrr...! Please Lagarde give us more brrrr brrrrr brrrrr!

Bailout coming - BBVA and their podcast experts (LMAO)So I've decided to somehow repost this big scheisse after the bank doesn't stop sending me emails saying they have experts analyzing the markets and wanting to give an explanation of why the stocks are going up. Really? Who are they trying to convince with this graph?

It will be bad, very bad. And in the end we will always pay for it, always the same. Enough! Because all spanish big banks are all almost in the same situation. If you want to check other countries issues: METRO, DB... can continue forever. Buff, I'm so annoyed today.

Be careful outside!

End the FED, end this fractional reserve system. Burn them all down soon.

US stonx I'm interested inAMAT - Applied Materials

The domestic TSM, almost sounds like Tiamat. Eastern Asian spies? In my processor? It's more likely than you think.

www.nasdaq.com

CMI - Cummins

Lol, produces stuff for different industries, natgas. Should monitor PPI for April.

www.nasdaq.com

www.bls.gov

www.bloomberg.com

BBVA - Banco Bilbao Vizcaya Argentaria

This one doesn't look too hot but they're 'investing in zero knowledge proofs' and all that matters is that they mention 'blockchain' for the exit pump.

www.nasdaq.com

www.bloomberg.com

www.bbva.com

cointelegraph.com

#BBVA - In big steps #BancoBilbaoAfter almost 2 years, Banco Bilbao share is still on target.

A bailout/bailin is imminent and should lead to riots or even revolution in another 2 years.

In 2018 this was still unimaginable and today hardly anyone would doubt it or rule out the possibility, would they?

BBVA Approaching Support, Potential Bounce!BBVA is approaching its support at 4.551 (61.8% Fibonacci extension, horizontal swing low support) where it could potentially rise to its resistance at 4.832 (50% Fibonacci retracement, horizontal pullback resistance).

Stochastic (89, 5, 3) is approaching its support at 2.91% where a corresponding bounce could occur.