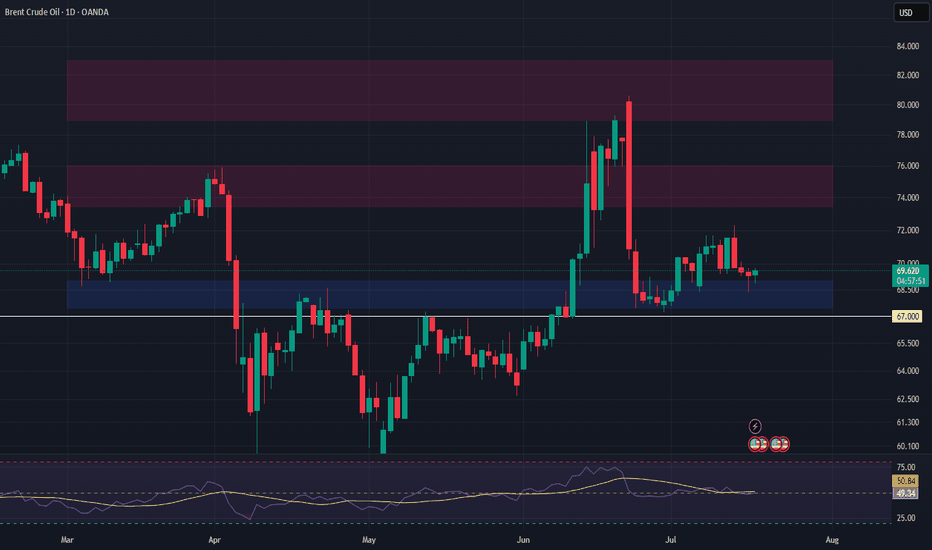

BCOUSD Long Swing Setup – Holding Support with Upside PotentialNYSE:BCO is currently sitting on a key support level, offering a potential long spot entry as buyers defend the $69.50 zone. A bounce from here could open the way for a move toward higher resistance levels.

📌 Trade Setup:

• Entry Zone: Around $69.50

• Take Profit Targets:

o 🥇 $73.50 – $76.00

o 🥈 $79.00 – $83.00

• Stop Loss: Daily close below $67.00

BCOUSD

Crude Oil Prices: Double-Edged Sword for Indian Marketers

The global crude oil market, a volatile beast, dictates the energy landscape for nations worldwide.1 For India, a nation heavily reliant on oil imports, the fluctuations in crude oil prices carry significant implications.2 While a dip in crude oil prices might seem like a welcome relief, especially for consumers, it presents a complex and often challenging scenario for oil marketing companies (OMCs) operating within the Indian market. This seemingly beneficial drop in prices acts as a double-edged sword, bringing with it a unique set of complexities that stem from market dynamics, government policies, and the intrinsic characteristics of the oil and gas sector.3

The initial and seemingly positive impact of lower crude oil prices is the potential for reduced import costs.4 For a country like India, where a substantial portion of its energy needs are met through imports, this can lead to a decrease in the overall expenditure on crude oil. This reduction can, in turn, alleviate pressure on the nation's current account deficit and theoretically translate to lower fuel prices for consumers. However, this potential benefit is often overshadowed by the ever-present threat of government intervention through excise duty hikes.

Governments, seeking to bolster their revenue, often capitalize on falling crude oil prices by increasing excise duties on petrol and diesel.5 This strategic move allows them to capture a significant portion of the savings that would otherwise be passed on to consumers. For OMCs, this translates to a reduction in the potential for increased margins. While they still benefit from reduced raw material expenses, the extent of the gain is substantially diminished. This delicate dance between market forces and government policies creates a complex environment for OMCs to navigate.

Furthermore, the expectation of price cuts for end consumers becomes a significant challenge for OMCs. Consumers naturally anticipate a corresponding reduction in fuel prices when crude oil prices decline. However, OMCs must carefully balance this expectation with the need to maintain their financial health. Rapid and substantial price cuts can strain their profitability, especially when coupled with excise duty adjustments. This balancing act requires a delicate approach, as OMCs must ensure their financial stability while remaining responsive to consumer demands.

Beyond the immediate impact on OMCs, lower crude oil prices pose a significant challenge to the upstream oil and gas sector. Upstream companies, involved in exploration and production, are directly affected by the decline in realized prices for their crude oil. This can lead to reduced profitability, delayed or cancelled investment projects, and even financial distress for some companies. The economic viability of many oil and gas fields is contingent on a certain price threshold. When prices fall below this level, production becomes less attractive, potentially hindering future energy security.

The impact on the gas sector is particularly noteworthy. Natural gas economics are often intertwined with crude oil prices, with gas prices sometimes linked to oil price benchmarks.6 A decline in crude oil prices can thus indirectly affect gas prices, making gas production and distribution less profitable. This can have broader implications for the energy sector, as natural gas is increasingly seen as a cleaner alternative to other fossil fuels.7 Reduced investment in gas infrastructure and production can hinder the transition towards a more sustainable energy mix.

Moreover, the volatility associated with fluctuating crude oil prices creates uncertainty for OMCs and the entire energy sector.8 Long-term planning and investment decisions become more difficult when the market is subject to rapid and unpredictable price swings. This uncertainty can deter investment in new projects and hinder the development of a stable and reliable energy supply. This volatility necessitates a robust and adaptable strategy for OMCs to navigate the unpredictable market.

From a macroeconomic perspective, while lower crude prices can potentially stimulate economic activity by reducing fuel costs for businesses and consumers, the potential for reduced government revenue due to lower oil prices (if excise duties are not increased) must be considered. In a country like India, where government revenue is crucial for funding infrastructure projects and social programs, a significant decline in oil-related revenue can have far-reaching consequences. This highlights the need for a balanced approach to fiscal policy, ensuring that government revenue remains stable while providing relief to consumers.

The challenges posed by lower crude oil prices highlight the need for a balanced and nuanced approach to energy policy. Governments must strike a delicate balance between providing relief to consumers, maintaining fiscal stability, and supporting the long-term health of the oil and gas sector. This requires careful consideration of excise duty adjustments, pricing mechanisms, and investment incentives. A coherent and forward-looking energy policy is essential to navigate the complexities of the global crude oil market and ensure the nation's energy security.

In conclusion, while lower crude oil prices may appear to be a boon, they present a complex set of challenges for OMCs and the broader Indian oil and gas sector. The potential for excise duty hikes, concerns about price cuts, and the impact on upstream realisations and gas economics create a double-edged sword scenario. Navigating this complex landscape requires careful policy decisions and a comprehensive understanding of the intricate dynamics of the global energy market. OMCs must remain adaptable and resilient, while governments must implement policies that balance consumer needs with fiscal stability and long-term energy security.

US Sanctions Send Oil Prices to 4-Month High

Oil prices have surged to a four-month high following the announcement of new U.S. sanctions targeting oil exports. This sudden price spike reflects the market's sensitivity to geopolitical events and the potential global oil supply disruption. The sanctions, aimed at Russia and potentially India, have immediately triggered concerns about reduced supply, pushing prices upward. This article delves into the details of these sanctions, their potential impact on the oil market, and the broader economic implications.

The Sanctions and Their Target

The U.S. government has imposed new sanctions on Indian shipping companies. These sanctions specifically target the country's or entities' ability to export oil, a crucial source of revenue. The rationale behind these sanctions, as stated by the U.S. government, is to punish countries that trade for Russia’s oil during a war with Ukraine. The U.S. aims to exert economic pressure on the targeted entity by restricting oil exports, forcing them to change their policies or behavior.

Immediate Market Reaction

The oil market reacted swiftly to the news of the sanctions. Both Brent crude and West Texas Intermediate (WTI), the global benchmarks for oil prices, experienced significant jumps, reaching levels not seen in four months. This immediate price surge underscores the market's anticipation of reduced supply. Traders are factoring in the potential loss of barrels from the market, leading to increased buying activity and pushing prices higher.

Potential Impact on Global Oil Supply

The extent of the impact on global oil supply depends on several factors, including the volume of oil previously exported by the sanctioned entity and the ability of other oil-producing nations to compensate for the lost supply. If the sanctioned entity was a significant exporter, the impact on global supply could be substantial, leading to further price increases. Conversely, if other producers can ramp up production to offset the shortfall, the price impact might be mitigated.

Impact on Consumers

Rising oil prices inevitably translate to higher prices at the pump for consumers. This increase in gasoline prices can have a ripple effect throughout the economy, impacting transportation costs, the price of goods and services, and overall inflation. Consumers may face higher costs for commuting, travel, and everyday purchases.

Impact on Businesses

Businesses, particularly those in transportation, logistics, and manufacturing, are also significantly affected by rising oil prices. Higher fuel costs increase operating expenses, potentially squeezing profit margins. Businesses may be forced to pass these increased costs on to consumers, further contributing to inflationary pressures.

Geopolitical Implications

These sanctions and their impact on oil prices also have broader geopolitical implications. They can strain relationships between the U.S. and other countries, particularly those that rely on oil imports from the sanctioned entity. The sanctions can also create opportunities for other oil-producing nations to increase their market share.

Strategic Petroleum Reserve (SPR)

In response to potential supply disruptions, governments may consider releasing oil from their strategic petroleum reserves (SPR). The SPR is an emergency stockpile of crude oil maintained by several countries, including the U.S. Releasing oil from the SPR can temporarily increase supply and help stabilize prices. However, the effectiveness of this measure depends on the size of the release and the duration of the supply disruption.

Long-Term Outlook

The long-term impact of these sanctions on oil prices is uncertain. It depends on various factors, including the duration of the sanctions, the response of other oil-producing nations, and the overall state of the global economy. If the sanctions remain in place for an extended period and other producers cannot fully compensate for the lost supply, oil prices could remain elevated.

Conclusion

The recent surge in oil prices following the announcement of new U.S. sanctions highlights the interconnectedness of geopolitics and energy markets. The sanctions, aimed at exerting pressure on India and Russia, have triggered concerns about reduced oil supply and have led to a significant price increase. The impact of these sanctions will be felt by consumers, businesses, and the global economy as a whole. The situation underscores the importance of monitoring geopolitical events and their potential impact on energy markets. While the long-term outlook remains uncertain, the immediate impact is clear: higher oil prices and increased volatility in the energy sector.

Oil Prices Slip as Gaza Talks and China Worries WeighOil prices edged lower at the start of the week, as traders weighed the potential impact of ongoing Middle East tensions and softening demand from China. Brent crude, the global benchmark, dipped towards $79 a barrel, while West Texas Intermediate (WTI) hovered around $76.

The recent decline follows a turbulent week for oil markets, marked by significant volatility. Prices had shed nearly 2% on Friday as investors grappled with concerns over China's economic recovery and the potential implications for global oil demand. The world's second-largest economy has shown signs of weakness, with data indicating a slowdown in industrial activity and consumer spending. This has raised doubts about China's ability to drive oil consumption growth.

Meanwhile, the ongoing conflict between Israel and Hamas in the Gaza Strip continues to cast a shadow over the energy market. While diplomatic efforts to broker a ceasefire have intensified, the situation remains volatile, and the potential for disruptions to oil supplies in the region cannot be ruled out. The geopolitical risk premium, which has supported oil prices in recent months, could diminish if a ceasefire is achieved.

Analysts caution that the oil market is likely to remain volatile in the near term, as traders navigate a complex interplay of factors. On one hand, the potential for supply disruptions due to geopolitical tensions could underpin prices. On the other hand, weakening global economic growth and efforts to transition to cleaner energy sources could exert downward pressure.

Looking ahead, investors will be closely monitoring developments in the Middle East, as well as economic indicators from China and other major economies. Any escalation of the conflict or further signs of weakness in the Chinese economy could lead to renewed volatility in the oil market.

Ultimately, the price of oil will depend on the balance between supply and demand. While the market has experienced periods of tightness in recent months, concerns about slowing demand growth may start to weigh on prices if they materialize.

Oil Prices Climb on Inventory DrawdownOil prices edged higher on July 3rd, 2024, buoyed by signs of a significant decline in U.S. crude oil stockpiles. Brent crude, the benchmark for international oil prices, for September settlement rose 0.1% to $86.34 a barrel by 10:21 AM in London. Meanwhile, West Texas Intermediate (WTI), the U.S. oil benchmark for August delivery, inched up to $82.88 a barrel.

This price increase comes amidst a wider risk-on sentiment in the global financial markets. Equity markets, including the S&P 500, have been reaching record highs, and this optimism appears to be spilling over into the oil market.

Inventory Drawdown: A Cause for Optimism

The primary driver behind the oil price increase is a report from the American Petroleum Institute (API) indicating a substantial drawdown in U.S. crude oil inventories. According to sources familiar with the data, crude inventories fell by a significant 9.2 million barrels last week. If confirmed by the official figures released by the Energy Information Administration (EIA) later this week, this would mark the largest single-week decline in stockpiles since January 2024.

A decline in stockpiles indicates a tightening of supply, which can lead to higher prices. This is because crude oil is a fungible commodity, meaning a barrel of oil from one source is generally equivalent to a barrel from another. So, if stockpiles decline in the United States, it can impact global supply and drive prices up.

Geopolitical Tensions and Summer Driving Season Lend Support

Apart from the inventory drawdown, several other factors are contributing to the current oil price rally. Geopolitical tensions remain elevated around the world, particularly in the Middle East. The ongoing war between Israel and Hezbollah, along with potential upcoming elections in France and the UK, are keeping investors on edge. Disruptions to oil supplies from these regions could significantly impact prices.

Summer is typically a season of increased demand for gasoline due to vacation travel. While the API report also indicated a decline in gasoline stockpiles, concerns linger about weak U.S. gasoline demand, which could temper the current price uptick.

Looking Ahead: Factors to Consider

The oil market remains susceptible to several factors that could influence prices in the coming weeks and months. Here are some key elements to keep an eye on:

• Confirmation of API Inventory Data: Official confirmation from the EIA regarding the inventory drawdown will be crucial. If the data is validated, it will solidify the current bullish sentiment in the market.

• Global Economic Growth: The health of the global economy, particularly major oil-consuming countries like China, will significantly impact demand. A strong global economic recovery will likely lead to higher oil demand and consequently, higher prices.

• The Upcoming Hurricane Season: The Atlantic hurricane season officially began on June 1st, 2024. If major hurricanes disrupt oil production facilities or shipping routes in the Gulf of Mexico, it could lead to price spikes.

• Geopolitical Developments: Any escalation of geopolitical tensions in major oil-producing regions like the Middle East could lead to supply disruptions and price increases.

Overall, the recent oil price increase is a result of a confluence of factors, including a potential decline in U.S. crude oil inventories, a risk-on sentiment in the financial markets, and ongoing geopolitical tensions. While some headwinds exist, such as concerns about weak U.S. gasoline demand, the near-term outlook for oil prices appears cautiously optimistic.

In conclusion, the oil market is currently in a state of flux. While several factors currently support higher prices, the path forward remains uncertain. Close monitoring of inventory data, global economic indicators, geopolitical developments, and the Atlantic hurricane season will be crucial for understanding how oil prices will behave in the coming months.

Jump on the Oil Swings with Confidence!I am excited to share some positive news with you regarding the recent developments in the oil industry.

According to the Energy Information Administration (EIA), crude inventories took a significant dip last week, falling by a whopping 6.37 million barrels. This decline has sparked a wave of optimism in the market, with WTI prices hovering around $83 a barrel and swinging between gains and losses.

As we navigate through this risk-off mood and witness the US stockpile decline, now is the perfect time to consider going long on oil. The potential for further price increases is certainly within reach, and this could be a lucrative opportunity for all of us.

So, let's not hesitate and take advantage of these oil swings with confidence. Trust your instincts, do your research, and make informed decisions. Together, we can ride the wave of success in the oil market.

Brent Crude Oil Demand Spike(WTICOUSD, too)Looking forward to entering Long on BCOUSD after NFP today.

Am not too eager to enter, if it happens, its good. If it doesn't happen, I am fine too, since today is Friday, and I have to hold my positions over the weekends.

I am used to holding trades over the weekends, however I prefer the weekdays. Therefore, when Mondays roll around, I thank God its Monday!

Anyway, our discounted price zone is the 10EMA based on previous Black Friday Sale discounts offered.

Price made a kink in the 10EMA discount by offering 20EMA discount yesterday or so, however, I do not believe it would continue giving 20EMA discounts which is bigger discounts, because, the Flag Pole is very big and long, while the flag is minute.

As usual, I am very aggressive at cutting losses, and moving my stop loss towards Breakeven and into profits. Once the trade is in, I will immediately shift my stoploss upwards by one tenth of the SL size, because my intention is never to price hit my full R loss. I am wrong many a times, by being too aggressive at cutting losses, moving my stop loss forward, etc and price continues to go in my favour after I am out of the trade, however, the results does show that I am profitable, and so, I will continue with my new ways.

I began doing such aggressive SL shifting earlier this year at around February, and it has been profits for me ever since, week on week.

2002SGT

05042024

WTICO Outperforms BCO on US Oil Production RiseWTICO (West Texas Intermediate Crude Oil) has recently been outperforming BCO (Brent Crude Oil). This trend coincides with an increase in US-produced oil replacing sanctioned Indian refined oil.

Potential Opportunity in WTICO

The shift in market dynamics could present an opportunity for traders considering long positions in WTICO. However, as always, it's important to conduct your own research and consider factors like:

• Market Volatility: Oil prices can fluctuate significantly due to various factors.

• Global Oil Production: Changes in global oil production can impact WTICO's price.

• Your Investment Strategy: This trade should align with your overall risk tolerance and investment goals.

Stay Informed, Make Informed Decisions

We recommend staying updated on market developments before making any investment decisions.

We're Here to Help

Please don't hesitate to contact us if you have any questions or would like to discuss this further within the comments.

BCOUSD#Brent crude oil - H1

📣 Based on the chart structure in the 1-hour timeframe, with a break above the downtrend line around the 79.24 level, one can consider buying with a target of 81.00.

⛔ Stop Loss: 77.80

On the other hand, with a break below the 77.80 range, one can be optimistic about a price decline towards the 76.00 range.

⛔ Stop Loss: 79.24

BCOUSD#Brent crude oil - H1

📣 Based on the chart structure in the 1-hour timeframe, with the breakout of the resistance-turned-support level zone around 76.93, it is possible to initiate a sell position with a target of 73.80.

⛔ Stop Loss: 79.40

On the other hand, with the break of the range at 79.40, a price growth towards the range of 82.20 can be anticipated.

⛔ Stop Loss: 76.93

Brent to continue in the upward move?Brent - 24 expiry

The rally was sold and the dip bought resulting in mild net gains yesterday.

Intraday, and we are between bespoke support and resistance 73.72-81.78.

Immediate signals are hard to interpret.

Previous resistance, now becomes support at 77.40.

There is no clear indication that the upward move is coming to an end.

We look to Buy at 77.40 (stop at 76.40)

Our profit targets will be 79.90 and 81.78

Resistance: 79.90 / 81.78 / 84.57

Support: 77.40 / 76.61 / 73.72

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Oil Indicates Bearish Trend as EMA 50 Crosses Fibonacci .618Recent technical analysis has revealed a bearish signal as the Exponential Moving Average (EMA) 50 has crossed the Fibonacci .618 level, indicating a potential downward trend in oil prices.

Technical indicators serve as valuable tools to assess market movements and make informed investment decisions. The EMA 50, in particular, is widely recognized for its ability to provide insights into medium-term trends. When it intersects with significant Fibonacci levels, such as .618, it often signals a shift in market sentiment.

Given the current scenario, it is crucial to exercise prudence and consider the implications of this signal. While it does not guarantee a definitive outcome, it is a noteworthy indication that suggests a potential downward pressure on oil prices. Consequently, we should reevaluate our investment strategies and exercise caution before making further commitments in the oil market.

Given this information, I encourage you to hold on to your existing oil positions and refrain from further investing until we witness more precise market signals. It is essential to closely monitor the market and observe the subsequent price action to understand the potential trend direction better.

As always, it is essential to remember that market conditions can change rapidly, and it is crucial to remain vigilant and adaptable. I recommend staying updated with the latest market news and conducting thorough research before making investment decisions.

Please comment with me if you have any questions or require further clarification. I am here to assist you and provide additional insights to help you navigate these uncertain times.

Capitalize on the Crude Surge! Exciting Opportunities Await!After months of languishing, crude oil has skyrocketed above $80 a barrel in London, signaling a remarkable recovery in fuel demand across China and other regions post-pandemic. But that's not all! Brace yourselves for an even more thrilling development: production cutbacks by Saudi Arabia and its OPEC+ allies are poised to deplete storage tanks worldwide rapidly.

Now, I know what you're thinking - what does this mean for us? Well, my fellow traders, we are on the verge of an extraordinary opportunity to capitalize on this crude surge! The stars have aligned, and it's time to consider long oil positions that could potentially yield substantial profits.

As fuel demand continues to soar, propelled by China's impressive recovery and other countries following suit, the global oil market is set to witness unprecedented growth. With Saudi Arabia and OPEC+ allies tightening their grip on production, storage tanks are expected to drain rapidly, creating an environment ripe with potential for traders like us.

So, why wait? Seize the moment and take advantage of this exciting turn of events! Consider long oil positions and position yourselves to ride the wave of this remarkable crude surge. You'll strategically position yourself to maximize your gains and potentially reap substantial profits by doing so.

Remember, timing is everything in the trading world, and this is a prime opportunity that cannot be ignored. Don't let this thrilling chance slip through your fingers. Take action now and dive into the world of long oil positions to unlock the potential for extraordinary returns.

If you have any questions, need further guidance, or want to discuss this thrilling opportunity, please comment away. I am here to support and assist you every step of the way.

Target reached! Crude Oil ReviewPrice bounced strongly above the 67.31 support level towards our take profit target - but how did we do it?

Join Desmond in this analysis review where he covers the reason why this setup worked nicely.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘Name of third party provider). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Name of third party provider.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Forex Capital Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FXCM EU LTD (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FXCM Australia Pty. Limited (www.fxcm.com): **

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

FXCM Markets LLC (www.fxcm.com):

Losses can exceed deposits.

Will Brent find buyers at crucial support once again?Brent - 24h expiry

A level of 72 continues to hold back the bears.

Daily momentum has stalled and our bias is now neutral.

Expect trading to remain mixed and volatile.

We look to buy dips.

The hourly chart technicals suggest further downside before the uptrend returns.

We look to Buy at 72.13 (stop at 71.13)

Our profit targets will be 74.63 and 75.13

Resistance: 73.30 / 74.00 / 75.00

Support: 72.40 / 72.00 / 71.62

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Oil (Brent Crude) / Gold (1w, Heikin-Ashi) - little macroeconomyDear Everyone,

Now little macroeconomy. We have almost exact 1 year, when Brent Crude Oil peaked in relation to Gold.

That in my oppinion suggest as main source of inflation was the cost of energy, not the money supply.

With best regards,

Paweł

HOW TO TRADE BCO/WTI INTRADAY(VERY EASY) ?Jut keep it simplehis is one of the simplest trending strategies I use for day trading, and also one of the most effective. For this, it has been given the catchy name: Day Trade Trending Strategy. Using a one-minute chart the price will often make a larger move, have a very simple pullback, and then begin to move in the trending direction again. The strategy attempts to capitalize on that. Pullbacks aren’t always this simple, therefore, this strategy is best used in conjunction with the consolidation breakout method and the engulfing candle method (which this method is similar to).

The strategy utilizes the trend to make a profit and also keeps me out of the market when the market isn’t trending.

Before I begin, I cannot stress enough the importance of patience when employing the strategy. After you’ve exhibited patience, I am cannot stress enough the importance of restraint in not continuing to use the strategy once the window has closed. Like a fighter honing his striking skills, a strike is only effective if delivered at the exactly the right time. Too early, or too late, and the strike is not as effective. Wait for opportunities, then pounce…that’s how to trade the financial markets.

Day Trade Trending Strategy – When and How

The following day trading strategy provides roughly 4 to 8 trades per day, sometimes a bit more and sometimes a bit less. The main waves (trends) of the day are traded, usually with two trades per major price wave. Even if not taking trades using this method, it provides an overall context for the movements throughout the day, giving feedback and confirmation for many other strategies or signals which may arise.

When day trading stocks or forex I use a 1-minute chart and a Level II (not required for forex). The Level II is only used if the volume in a stock is bit low and I need to watch for when liquidity is available. If the stock has lots of volume (plenty of shares at every price level) then there is no need for a Level II, just use the chart.

Some days will turn out to be ranging days. If this case, no trades will be triggered, or very few, since intraday swing highs/lows will not be broken, thus no trend is present. Use patience and restraint. Only trade what the market actually provides. One of the most common problems new traders have is taking a trade too early and trying to get a better a price, assuming a trade will trigger in the near future. This is a big mistake. Only take a trade once the actual trade trigger (discussed a bit later) actually occurs. As alluded to prior, another mistake is waiting too long after a trade trigger has occurred. This too is detrimental to profits. Trades are taken at the exact moment of the trade trigger or not at all.

Don’t start using this strategy until about 30 minutes into the trading day. I have other strategies I use during the first half hour, such as the Truncated Price Swing Strategy.

We can now draw our downward trendline because we have broken lows and eventually we want to go short.

We then wait for a pullback towards the trendline

Please note, the trendline is only a visual and really has no significance to me. What matters, in this case, is that all the future swing highs in this move stay below the most recent swing high and new lows are created. As long as that happens, it is a downtrend. The opposite applies to an uptrend.

Enter short when the pullback is potentially ending, signaled by the price dropping back below the low of a green bar or cluster of bars near the trendline (doesn’t need to be exactly at trendline).

Day Trading Trending Strategy NOTES:

I am only taking trades in the trending direction. I am waiting for a pullback and then only entering once the price starts moving in the trending direction again. This takes skills, as it is a somewhat subjective form of analysis and trading.

The exact level of the trendline, if used, is not important. It is just a visual aid. Rather, understand that pullbacks in a downtrend can go almost all the way to the recent swing high in that downtrend, but should not exceed it (opposite for uptrend). As a pullback is occurring I am looking for any sort of shift which indicates a move back in the direction of the current primary trend.

If there is any question as to the current trend, I do not trade this strategy.

SPY is used for these trade examples, but the method can be applied to any stock or forex pair. Other stocks to consider for day trading each week are discussed on the Day Trading Stock Picks page.

If the market is pretty close to my profit target and starts to pull away from the target, I exit. I am not going to risk giving up a bunch of profit for a couple cents.

The target, which can be estimated before the trade occurs, needs to be realistically achievable based on the size of the recent price waves. If it the target will require the price have a much bigger move than it has been producing that day, the trade is skipped.