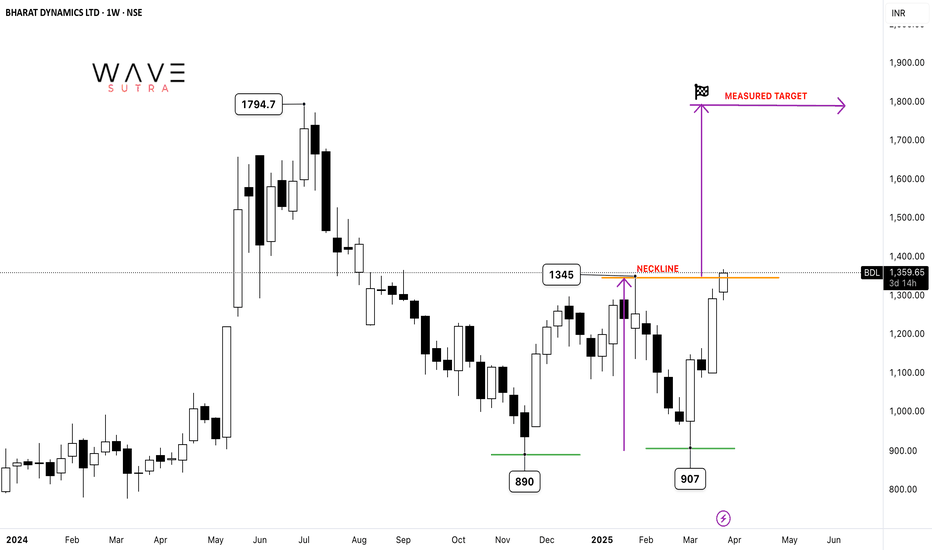

BDL: DOUBLE BOTTOM BREAKOUTThe Double Bottom pattern is a bullish reversal chart pattern that signals the potential end of a downtrend and the beginning of an uptrend. It consists of two consecutive troughs (lows) at roughly the same level, separated by a peak. The pattern resembles the letter "W."

Key Features:

Two Lows: Nearly equal in price, indicating strong support.

Neckline: The peak between the two lows acts as a resistance level.

Breakout: A bullish signal is confirmed when the price breaks above the neckline with strong volume.

Price Target: The expected upward movement is typically equal to the distance between the lows and the neckline.

Double Bottom pattern in Bharat Dynamics Ltd. (BDL) is confirmed, with both lows near ₹888 and a breakout above the ₹1,345 neckline, the price projection suggests a potential upside. The expected price target can be estimated by measuring the distance between the neckline and the lows, which is ₹1,345 - ₹888 = ₹457. Adding this to the breakout point, the projected price target would be ₹1,345 + ₹457 = ₹1,802. If the stock sustains above ₹1,345 with strong volume, it could gain further bullish momentum, potentially reaching ₹1,800 or higher in the medium term.

Bdllongterm

Bharat Dynamics BDL Short Setup on 1D Daily TF on RisologialBharat Dynamics BDL Short Setup on 1D Daily TF on Risologial

After 125% upside rally, BDL has given signs of a possible SHORT trade.

The BDL price is crossing under the Risological trend line, and if we see a red candle today, it is a sign of a good short trade.

Once the trade is confirmed, the Risological swing trading indicator will set the Entry, stoploss and profit targets for this trade.

I will update on this trade post 3:30 closing.

Take care.

Namaste!

Bharat Dynamics looking like it's about to launch into new orbitBharat Dynamics Ltd. is one of the leading defence PSUs in India engaged in the manufacture of Surface to Air missiles (SAMs), Anti-Tank Guided Missiles (ATGMs), Underwater weapons, Launchers, Counter Measures Dispensing System (CMOS) and Test Equipment. The Company is engaged in the business of refurbishment and life extension of stored and deployed missiles. It is the sole manufacturer in India for SAMs, torpedoes, ATGMs.

Bharat Dynamics Ltd. CMP is 1729.40. The Negative aspects of the company are High Valuation (P.E. = 66.5), Declining annual net profit. The positive aspects of the company are No debt, Zero promoter pledge, MFs are increasing stake, Improving cash from operations annual.

Entry can be taken after closing above 1730. Targets in the stock will be 1834 and 1926. The long-term target in the stock will be 1995. Stop loss in the stock should be maintained at Closing below 1600.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Bharat Dynamics Positional Entry LevelsAs per my analysis NSE:BDL has given a breakout for some upside levels. Best level to take positional buy entry will be 990 with stop loss of 890 (-100 Risk). My expected upside target would be 1087 (+97) & 1145 (+155). This could be low risk and reward idea.

Note: This is my personal analysis, only to learn stock market behavior.

Thanks.

Bharat Dynamics Trend AnalysisPrice pattern shows a potential reverse Adam & Eve pattern formation.

Price is heading towards support around 570 level which is also at golden FIB zone.

If this support breaks, then the price will fall to 375-400 levels.

Broader view shows price is moving inside the ascending channel and it should touch the bottom of the channel in confluence with the support zone highlighted.

Better to accumulate around 400 levels for a positional target of 1230 (207.50% ROI with 16.6 R:R)

Mandatory stoploss @ 350 due to cyclical nature and inconsistent cashflow which is a matter of concern.

Do your own due diligence before taking any action.

Peace!!