Bearflags

Daily View of Bitcoin - More downside to comeBackground:

Yesterday we saw a sizable price drop. Not to the extent that I was predicting but it got within $100 of the first target. Some of the factors contributing to this were continuing downward pressure, double top formation & traditional markets. Yesterday, Bitcoin was heavily influenced by traditional market price movements, which is why I will put a little more emphasis on the traditional markets today.

Things to note about the traditional markets:

COVID: There is some positive sentiment like lockdowns being lifted (Germany) or eased. Relieve funds being provided and new ones being negotiated. As well positive results from COVID vaccines. But it must be noted that cases are still increasing. And these lifts of lockdowns will create more infections and deaths in the weeks to come, as long as a reliable cure is not found and authorized for use.

Oil May futures prices crashed and went as low as -$37 (yes that is a negative). It has gotten out of the hole since then but is currently back in the negatives.

DJI was also impacted primarily due to Oil and fell 600 points.

Kim Jong Un has been reported to be seriously ill impacting markets in Asia, due to uncertainty

The situation is critical. We are on the edge of a major breakdown. To me, oil was just the start...

Technical Analysis:

Higher timeframes still look bearish, which will influence the short term trading which we are focusing on.

12H, 1D & 2D stochs are pointing down

The double top formation still hasn't reached its target. The target for this measured move is around 5.8k.

Bitcoin is on the lower edge of a rising wedge since the previous dump in March. There is a possibility that it breaks down from here. The target for this measured move would be closed to 5k.

Since the price drop yesterday, we are in a bear flag formation / rising wedge. The target for this measured moved would be around 6.4k.

Last but not least, DJI is below the edge of its rising wedge. If it breaks then DJI will freefall several thousand points, as will Bitcoin.

My trading plan:

Keep a close eye on DJI. DJI Futures while US markets are closed and back to DJI when US markets open.

I still have an open short with half of my position hoping that Bitcoin has further downside to come. If Bitcoin price increases, I will let it stop out and look for a new short entry.

Short term, we will likely trade in the "Trading Zone" marked in the chart. There is a possibility to go above in the extended trading zone marked by the dotted rectangle. Could be $100+ opportunities to trade this range both upwards and downwards.

My guess, if we have a breakout, it will be closely linked with a breakout in traditional markets. Meaning, we probably won't see any big moves until the US markets open.

Bullish breakout: If the Bitcoin price closes a 4h candle around 7350, then expect further extension to 7700 to 7900.

Bearish breakout: if the Bitcoin price closes a 4h candle around 6700, then expect further extension to 6200.

Summary:

Overall, I am expecting further downside to come in the medium to long term. I believe that we will see downward resolution very soon, but timing is one of my weaknesses... My long-term targets are explained in the charts linked under related ideas.

If you found this interesting, please be sure to hit the like button.

Thanks for taking the time to read this idea.

This is my opinion and should not be taken as financial advice.

Finally, The BTC Drop we've all been anticipatingHey guys, I'm still kind of new to the space, but have been really working hard on my Technical Analysis. Please leave a like, and let me know your opinions down below on what you think, or what your analysis says. Or feel free to educate me. Cheers!

Critical times, calls for critical measures.

I hope you have all been safe during this pandemic.

Analysis:

Ever since the huge fall and massive sellout on all cryptocurrencies on March 12, it had seemed that we had found a super strong, valid support level.

From there, we have been seemingly travelling and forming new market structure. HHs, LHs. From here, its all been looking positive, however, hold your horses there silly investors. DID YOU FORGET WE ARE IN AN OVERALL BEARISH MARKET??

"You fell for my trap", the Bear said to the Bull.

"Huh?", the bull responded frantically.

As you can see, a key level or resistance was found along the 7400 mark. Price could not push past this point, hence confirming its validity. Once pushed through a tight corner of the bear flag, it broke downwards. April 19, we see an attempt to once again push through this level of resistance. However, this suckers rally failed, and we retested that significant level.

Here we go, the beginning of the fall... to previous structure. Slight retracements on fibs playing out currently, nonetheless, we will meet that bottom soon. See you soon support.

P.S: Hope everyone is safe and has been social distancing, look after yourself and your loved ones.

Bear flag formed?Hey guys, please leave a like if you think this idea is useful. The last two days we have formed a head and shoulders patter, we fell through the support level of $6770 and $6740. We bounced back on the support zone around $6690, I think we might retest the resistance level of $6784. As you can see on this 3h chart, we formed a bear flag , so we will probably will go down again.We will possibly fail to break through that resistance level ($6784), the first support level is around $6770 and the second is around $6740.

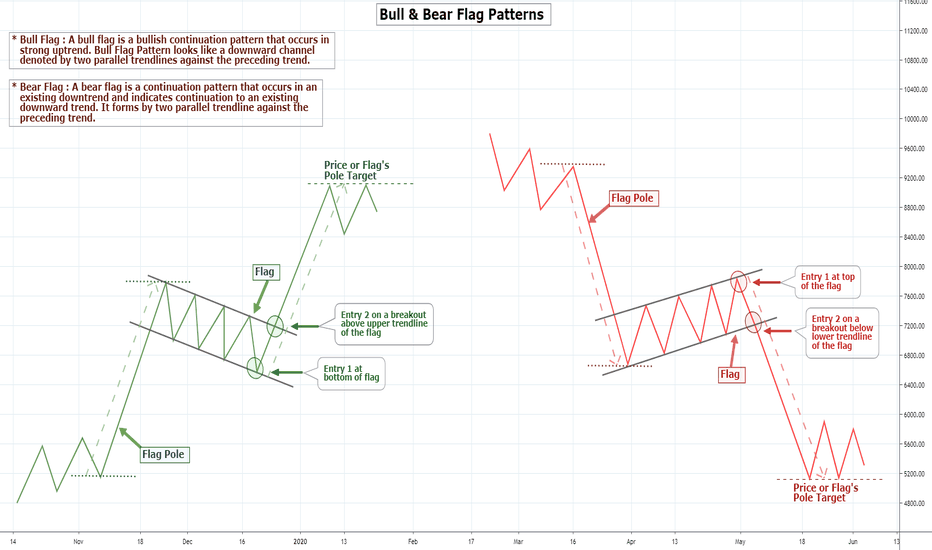

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-

NQ1! 1D BEAR FLAG SHORT TRADEBear Flags are a form of a Range Pattern and Bear Flags are repeatable trading chart patterns.

Bear Flag chart patterns will have a directional bias depending on the previous incoming trend (Short trade).

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

Whatever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of the average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

Double Trouble for Bitcoin - H&S + Bear Flag FormationsNot the cleanest H&S but it covers the criteria. In parallel, the recent dump also created a bear flag formation.

Measured move to previous support level around 6200.

Full measured move of the head to neckline would bring us down to 5921

Measured move for Bear Flag would bring us to 6025

Furthermore, I recently published an idea that showed similarities with the Dump, starting with a TD9 on Feb 12th. With the recent PA, it resemble closer the hours following the 5.5k dump.

The most decisive moment for Bitcoin. 2 more days at MOST!Hey everyone

Looks like bulls are trying to push the price above that 7000 mark. This could be a big fake-out before the price eventually goes down below 3k, probably all the way down to 1k. We could even see a 3 digit bitcoin price for a very short while. Who knows! everything is possible with bitcoin.

In details:

The two red lines show us a rising wedge. Rising wedges, by nature, are bearish patterns. It is 69% likely to break to the downside.

If we were to draw these two red lines differently, we would see a bear flag. That is also a bearish pattern and is most likely to break to the downside.

If we were to take this rising wedge as a bear flag instead, then Bitcoin has the chance to see one more leg up before it breaks to the downside. That would eventually give us a target of all the way down to 3000k and eventually lower.

At the time of writing this post, the price is battling at 7060$.

The rising wedge will be invalidated if Bitcoin breaks above 7,600$ area.

Altcoin market update + XRPUSDThe consolidated chart for the Top 10 biggest cryptocurrencies in terms of market capitalization (excluding BTC) shows us that the bear flag on the daily chart resulted in a drop to $530 where we found temporary support (actually a relatively stable horizontal S/R line). What we need here is for the price rebound from that level and surpass $610. As you can see on the chart, this level was a solid resistance in the past and it took some time before bulls break it after the last major drop registered on September 24, 2019.

The total market cap for the leading altcoins remained almost flat for the seven-day period, loosing "just" $1.5 billion down to $63.1 at the time of writing.

The Ripple company token XRP corrected its price to $0.172 on Friday, March 27 after buyers failed to capitalize on their previous attack of the $0.19 level, and were brought back down at the end of the session.

The weekend of March 28-29 started with a similar move, but in the opposite direction and the “ripple” regained its position around $0.175. On Sunday, it experienced a hard drop to $0.162 and closed the seven-day period 10 percent higher.

The XRP/USD pair opened the new trading period on Monday, March 30 by climbing up to $0.171. The coin is slowly but surely making its way up, step by step. A move in the zone above $0.18-$0.185 will set the ground for an attack of the $0.23. The $0.185 line is also coinciding with the Fibonacci retracement 23.60 line, which may serve as an endpoint.

In terms of trading volumes, they dropped from $2.7 billion on Saturday to $1.7 on Sunday evening, which resulted in a 37 percent decline. We saw a partial recovery on Monday and Tuesday with the 24-h volumes hovering around $1.9 - $2.1 billion.

Looking at the 1-h chart, no surprises as we are following the path down the very stable downtrend channel...

BTC showing multiple Bearish indicatorsCOINBASE:BTCUSD Here we see that BTC has been in a long-term downtrend since June of 2019's high. More recently, at the beginning of this year it appeared as though we could be breaking out of this bearish trend, only to see a major correction to the downside spurred by macroeconomic events.

Since the spike downward the price action of BTC over the past 2 weeks has lead to the formation of an Ascending Wedge. This is characterized by candles closing with higher highs, lower lows, and decreasing volume. It is also considered to be "more" valid if the fib retracement levels remain below the .5 line, which we can see, they still are.

As supply gives out and bullish exhaustion takes over, we can expect to see a continuation of the long term downtrend.

Coupling this with the macro environment we are all aware of, and I don't see BTC bucking this trend.

Of course, it is possible that BTC is strengthened by these factors (as it was designed to be) and we see BTC enter a new bull phase. The problems I have with this scenario are that;

1: People aren't buying any risk On or Off speculative assets (stocks or even bonds) if they can't afford food or housing, which is a very real possibility in the coming months.

2: If hyperinflation drives the price of BTC to 100k, then it will also drive the price of everything else we own up. A cheeseburger could end up costing 10k.

Does that mean it's time to go long on burgers?

Adjusted for the rate of hyperinflation, the fact is that a 100 thousand dollar BTC would actually be worth much less than it would be today, but it wouldn't be evident in the charts.

S&P 500: Not wise to bet on a dead-cat bounce. [22Mar'20]50/200 SMA Death Cross incoming on the 1D chart.

Continued to be rejected by the weekly 200 SMA, as well as the 3hrly 21 EMA (with bearish ichicloud rapidly and significantly thickening as well).

3hrly chart: CYBER ENSEMBLE {PREMIUM}

PRISM (pSAR+MACD derived Oscillator. With PRISM-Momentum/Acceleration/Jerk Oscillators; aka MAJ)

Speculation: Bear flat setup to come?

Historical recession comparison.

Boeing - The biggest bear flag I've ever seenIf this breaks to the downside where is the bottom? Very hard to say but it's not looking good for Boeing which was in trouble before orders ground to a halt in the current Covid-19 climate.

America will never let this company fail as they produce their military aircraft. But for now I'm ready and waiting to ride Boeing into the ground.

Bear Flag? Inverse H&S / Triple Bottom?It appears as though Bitcoin is creating a "micro" series of higher lows forming a pennant pattern, similar to a descending triangle in appearance because of the downward sloping resistance.

Where I have placed the first two Bitcoin Icons represents the higher lows, I'm still watching the pattern develop as the consolidation is taking the shape of an Inverse Head & Shoulders.

An inverse head and shoulders is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends

An inverse head and shoulders pattern, upon completion, signals a bull market

Investors typically enter into a long position when the price rises above the resistance of the neckline.

After long bearish trends, the price falls to a trough and subsequently rises to form a peak.

The price falls again to form a second trough substantially below the initial low and rises yet again.

The price falls for a third time, but only to the level of the first trough, before rising once more and reversing the trend.

The RSI appears to be topping out, keep an eye on this.

Where I have placed the 3rd Bitcoin icon is a possible third bottom if downward sloping resistance is too bearish.

BITCOIN ANOTHER BEAR FLAG SHORT TERM Ladies and gentle I've made enough out my long position. I don't short when am thinking of long. I'm seeing another bear flag in making. I'm seeing 6k again. Don't forget 6k is for buying it's not yet for selling it's a halving dip. Don't sell your hard earned #bitcoin to the market makers.

#LONG $BTC

5K isn't safe either but HTF says that but we will need see more then 40% correction.

TRX/USD bearish indicationsHello traders

Today today i am gonna be doing a quick and simple analyses about TRX/USD that made a Head n sholders reversal at an important Resistance level , witch defines a Bull trap. We consider traps the most powerfull indication of price action for decision making in trading.

Now the price is making a Bear Flag, We belive the price has a chance to test the next important Support level . We Only buy this asset above the resistance after a bullish acumulation, or at the important Support level .

Please support this publication with your like. You are welcome to follow us on the Tradingview.

Best regard Sandro and Gustavo.