EURUSD Potential DownsidesHey Traders, in today's trading session we are monitoring EURUSD for a selling opportunity around 1.08500 zone, EURUSD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.08500 support and resistance area.

Trade safe, Joe.

Bearish Patterns

NZDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring NZDJPY for a selling opportunity around 85.800 zone, NZDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 85.800 support and resistance area.

Trade safe, Joe.

Gold Potential Pullbacks To DowsidesHey Traders, in today's trading session we are monitoring XAUUSD for a selling opportunity around 3035 zone, Gold is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 3035 support and resistance area.

Trade safe, Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 149.500 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 149.500 support and resistance area.

Trade safe, Joe.

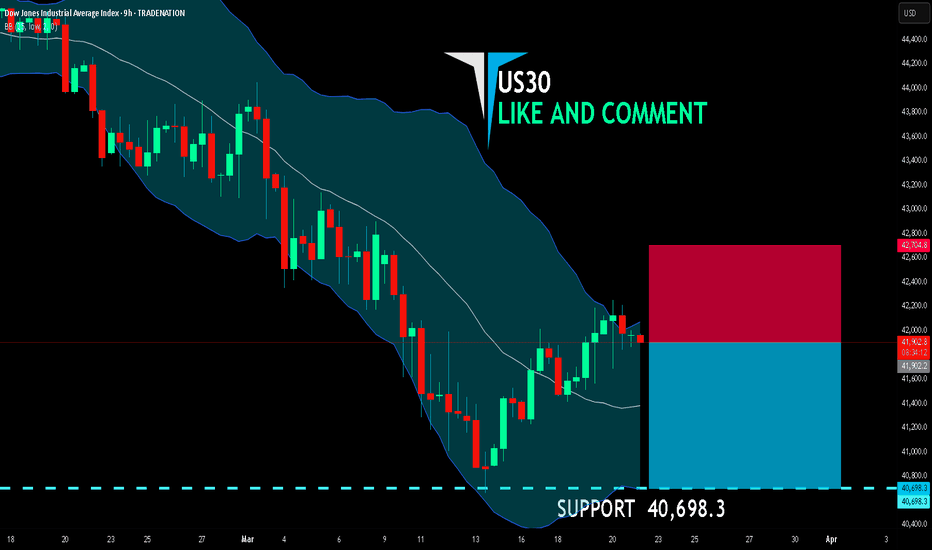

US30 BEARISH BIAS RIGHT NOW| SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 41,902.2

Target Level: 40,698.3

Stop Loss: 42,704.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDCHF Potential DownsidesHey Traders, in today's trading session we are monitoring USDCHF for a selling opportunity around 0.88900 zone, USDCHF is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.88900 support and resistance area.

Trade safe, Joe.

Bitcoin Potential DownsidesHey Traders, in today's trading session we are monitoring BTCUSDT for a selling opportunity around 90000 zone, Bitcoin is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 89000 support and resistance area.

Trade safe, Joe.

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish OutlookChart Overview

This is a 1-hour chart of Silver (XAG/USD) from OANDA, showing recent price action forming a rising wedge pattern followed by a bearish breakdown. The price initially rallied within the wedge but failed to sustain gains above the key resistance zone, leading to a strong rejection and downward momentum.

Key Chart Elements & Analysis

1. Rising Wedge Formation (Bearish Pattern)

The market was in an uptrend, forming higher highs and higher lows within a rising wedge pattern.

A rising wedge is a classic bearish reversal pattern, which indicates weakening buying pressure as price consolidates upward.

The price eventually broke below the lower trendline, signaling a shift in momentum from bullish to bearish.

2. Resistance Zone & Rejection

A strong resistance zone was identified around $33.80 - $34.20 USD (highlighted in blue).

Price attempted multiple times to break above this level but faced selling pressure, leading to a sharp reversal.

The final breakout attempt failed, confirming that sellers are in control.

3. Breakdown & Retest of Support

After breaking down from the wedge, the price found temporary support around $33.20 USD, which aligns with a previous consolidation area.

A retest of the broken wedge support turned into resistance, further confirming the bearish bias.

The rejection from this level strengthened the case for a move lower.

4. Next Support Level & Target Projection

The next significant support zone is around $31.95 - $32.00 USD (marked as the "Target" area).

This level coincides with previous price action support, making it a high-probability bearish target.

The breakdown is expected to follow a measured move projection, bringing price toward this level.

Trade Plan & Execution Strategy

📉 Bearish Setup (Short Opportunity)

Ideal Entry: A pullback to the previous support (now resistance) at $33.20 - $33.40 USD could offer an entry for shorts.

Stop-Loss: Above $33.80 USD, just above the resistance zone.

Target Levels:

Primary Target: $32.50 USD

Final Target: $31.95 - $32.00 USD

Confirmation: Look for price rejection or bearish candlestick formations at resistance before entering.

⚠️ Risk Management & Considerations

Bullish Scenario: If price reclaims $33.80 USD, the bearish setup could be invalidated, and a move higher toward $34.50 USD is possible.

Market Conditions: Keep an eye on macroeconomic factors, news events, and USD strength, as they can influence silver prices.

Conclusion: Bearish Outlook with Downside Target 🎯

The rising wedge breakdown signals further downside potential.

A support retest rejection confirms selling pressure.

$31.95 - $32.00 USD remains the main target, aligning with technical projections.

Short positions with proper risk management remain favorable in this setup.

GOLD BEARS WILL DOMINATE THE MARKET|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,031.48

Target Level: 2,966.31

Stop Loss: 3,074.79

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/CHF SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

USD/CHF is making a bullish rebound on the 3H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 0.878 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

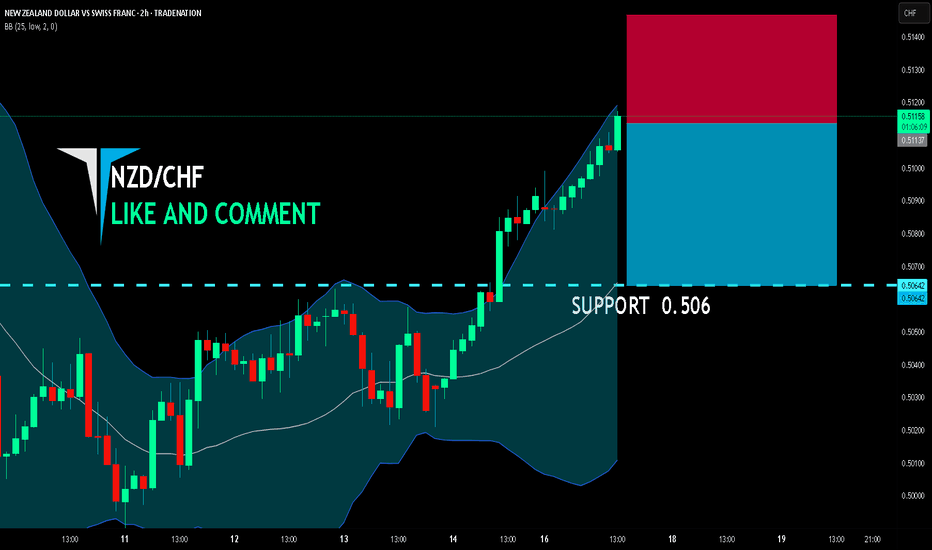

NZD/CHF BEST PLACE TO SELL FROM|SHORT

NZD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.511

Target Level: 0.506

Stop Loss: 0.514

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDJPY Breakout And Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 149.300 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 149.300 support and resistance area.

Trade safe, Joe.

ADI rally slowing already?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for ADI, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. Wave 4 does not need to gain too much more to meet completion criteria, but the sideways movement of the past few days could place the top below 218. During Minor wave 5, at the very least it should drop below wave 3's bottom of 202.59. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 186-195. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

WFC is moving ahead of the market for better or worse?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for WFC, Minor wave 3 was the shortest impulsive wave, likely indicating wave 5 will be 49 bars (30 minute scale) or less. This will likely put a restriction on the length of the decline. Additionally wave 4 is moving faster for this ticker than it has been on the others I have studied. Minor wave 5 should drop below wave 3's bottom of 65.515. Using some basic movement extensions, it will likely go lower, but likely not too much more. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

While WFC has been trading with most of the other signals I am watching, the current rally could be a sign of Intermediate wave 1 possibly having ended at the current Minor 3 bottom. This would mean we are in Intermediate wave 2 now. In this case, the top of Intermediate wave 2 is quickly approaching (no higher than 78.98. I will evaluate this solution if the rally continues next week.

SPY rally done soon?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for SPY, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. In that time, at the very least it should drop below wave 3's bottom of 549.68. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 525-538. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

Another possibility that could play out is we rally through the weekend. In this case Intermediate wave 1 possibly ended at the current Minor 3 bottom. This would mean we are in Intermediate wave 2 now. I will evaluate this solution if the rally continues next week.

WMT ready to resume drop?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for WMT, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. In that time, at the very least it should drop below wave 3's bottom of 83.87. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 74-79. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

JPM rally ending soon?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for JPM, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. In that time, at the very least it should drop below wave 3's bottom of 224.23. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 203 and 214. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

avax sell midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

EUR/GBP Bearish Trading Setup | Resistance Rejection & BreakdownMarket Context & Overview

The EUR/GBP currency pair is currently showing signs of bearish momentum, as illustrated in this 1-hour trading chart. The price is facing a strong resistance zone while forming a descending trendline, indicating that sellers are gaining control over the market. Given this technical setup, traders can anticipate a potential breakdown leading to further downside movement.

This analysis highlights key price levels, technical indicators, and potential trade opportunities based on current price action. The bearish outlook is supported by the market structure, which is displaying signs of a potential trend reversal from the resistance zone.

🔹 Key Technical Levels

1️⃣ Resistance Zone (0.84200 - 0.84300)

This area has acted as a strong selling zone in previous price action.

Multiple rejection points indicate that buyers are struggling to push beyond this level.

This resistance aligns with the descending trendline, further strengthening the bearish bias.

2️⃣ Support Level (0.84000)

The current support level has provided temporary demand, preventing immediate downside movement.

If the price breaks below this support, it will confirm a bearish continuation.

3️⃣ Major Resistance Zone (0.84495)

This is the all-time high resistance zone in the short-term structure.

A break above this level would invalidate the bearish setup and could lead to bullish momentum.

4️⃣ Target Level (0.83735)

If the price successfully breaks below 0.84000, the next target would be 0.83735.

This level aligns with previous swing lows, making it a realistic downside target for short positions.

5️⃣ Stop Loss Placement (Above 0.84201)

A stop-loss above 0.84201 ensures protection against false breakouts.

If price breaks above this level, it could signal a shift in market structure.

🔹 Technical Insights & Market Sentiment

1️⃣ Descending Trendline: The price is respecting a descending trendline, indicating a bearish bias.

2️⃣ Multiple Resistance Rejections: Price has tested the resistance zone multiple times without breaking through.

3️⃣ Bearish Price Action: The recent candles show lower highs, reinforcing the downtrend.

4️⃣ Volume Analysis: A drop in buying pressure at resistance signals potential weakness among buyers.

5️⃣ Fundamental Factors : GBP strength due to macroeconomic factors could add further pressure on EUR/GBP.

🔹 Trade Plan & Strategy

📌 Entry Criteria

Ideal entry near 0.84150 - 0.84200 if price shows rejection at resistance.

Alternatively, enter after a confirmed breakdown below 0.84000 for safer confirmation.

🎯 Profit Target

First target: 0.83735

If bearish momentum continues, price could extend towards 0.83600 as an extended target.

🛑 Stop Loss Placement

Above 0.84201 to minimize risk.

This ensures the trade remains valid while avoiding market noise.

🔹 Risk-Reward Ratio & Trade Management

✅ Risk-Reward Ratio (RRR): Approximately 2:1, making this a favorable setup.

✅ Trade Management:

If price starts reversing before hitting the target, consider trailing stop-loss to secure profits.

If price consolidates around support, watch for breakout confirmations before entering.

🔹 Final Thoughts & Market Sentiment

This trading setup suggests a strong bearish opportunity based on price action, resistance rejection, and trendline confluence. The break below 0.84000 will be the key trigger for further downside movement. If price remains below resistance, a sell position with a stop-loss above 0.84201 and a target of 0.83735 offers a high-probability trade setup.

Bitcoin (BTC/USD) – Bearish Rejection from Supply ZoneThis chart represents a technical analysis of Bitcoin (BTC/USD) on the daily timeframe, highlighting key levels of resistance, support, and potential price movement. It indicates a bearish rejection from a supply zone, which suggests that BTC may experience further downside pressure.

Key Components of the Chart:

📌 1. All-Time High (ATH) + Resistance Zone (~$110,000 - $115,000)

This is the highest price level Bitcoin has ever reached on this chart.

It acts as a strong resistance zone, meaning sellers are likely to step in if the price approaches this level again.

📌 2. Supply Zone (~$88,000 - $90,000)

The supply zone is an area where selling pressure is high.

BTC attempted to break above this zone but got rejected, leading to a sharp decline.

This rejection confirms that bears are in control, pushing the price downward.

📌 3. Stop Loss (~$95,629)

This level represents the point where a bearish trade would be invalidated.

If BTC breaks above this level, it could indicate a shift in momentum toward bullish territory.

📌 4. Current Price Action (~$83,444)

BTC is currently trading below the supply zone, showing weakness.

The recent lower high formation suggests a continuation of the downtrend.

📌 5. Take Profit (TP) Level (~$65,969)

This is the target level for a potential bearish move.

The $65,969 level has acted as major support in the past, meaning buyers may step in here.

If BTC reaches this level, it could either bounce back up or break lower, leading to further downside movement.

📌 6. Major Support Level (~$45,000 - $50,000)

If BTC breaks below the $65,969 support, the next major support zone is around $45,000 - $50,000.

This area is historically significant and could provide a strong buying opportunity.

Trade Plan & Strategy:

🔴 Bearish Bias:

The rejection from the supply zone signals a continuation of the downtrend.

A short position can be considered if BTC fails to break above the supply zone again.

🎯 Trade Setup:

Entry: Around $85,000 - $88,000 (if BTC retests the supply zone and gets rejected again).

Stop Loss: Above $95,629 to protect against an unexpected bullish breakout.

Take Profit (TP): Around $65,969, targeting the next major support level.

Conclusion:

BTC is showing signs of a bearish continuation, with strong resistance at the supply zone.

A potential move toward $65,969 is likely if selling pressure continues.

If BTC breaks below this key level, a further decline toward $45,000 - $50,000 could happen.

⚠️ Disclaimer : This is not financial advice. Always conduct your own research before making trading decisions. 🚀📉

USD/JPY BEST PLACE TO SELL FROM|SHORT

USD/JPY SIGNAL

Trade Direction: short

Entry Level: 149.497

Target Level: 146.249

Stop Loss: 151.651

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/USD SHORT FROM RESISTANCE

Hello, Friends!

Previous week’s green candle means that for us the NZD/USD pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.569.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅