BTC/USD Bearish Setup – Trendline Retest Before the Fall?🔍 Technical Breakdown – BTC/USD 3H Timeframe

Bitcoin is displaying a textbook Double Top pattern formation on the 3-hour chart, signaling a potential bearish reversal after a strong bullish run. This classic pattern suggests buyer exhaustion and sets the stage for a downward move. Let's break down the analysis:

🧠 Pattern Insight: Double Top Reversal

A Double Top is one of the most reliable trend reversal patterns, especially when it forms after a sustained uptrend — just like we're seeing here.

Top 1 and Top 2 both formed inside a strong Resistance Zone between $106,500 and $107,000, showing repeated rejection from buyers to push price higher.

The formation of lower highs and long wicks near Top 2 further reinforce the weakening bullish momentum.

💥 Neckline Breakdown & Bearish Trigger

The Neckline, aligned with a horizontal Support Zone (~$103,300–$103,800), was decisively broken, confirming the pattern.

This breakdown acts as the trigger for bearish entries, and we are now in the "Retest Phase", where price often pulls back to the neckline or a nearby trendline before continuing lower.

📐 Trendline Confluence – Retest Opportunity

A short-term descending trendline drawn from Top 2 intersects near the neckline zone.

Price is now approaching this confluence area, offering a potential high-probability short entry if bearish price action confirms (e.g., a rejection candle like a bearish engulfing or pin bar).

🎯 Price Targets & Trade Setup

Parameter Value

📍 Entry On bearish confirmation near neckline/trendline retest (~$105,300)

❌ Stop Loss (SL) Above recent swing high / Top 2 (~$107,100)

🎯 Target ~$97,126 (based on measured move from top to neckline projection)

⚖️ Risk:Reward Approx. 1:3 or better (depending on entry timing)

Measured Target Calculation:

Height from neckline to peak (~$107,000 - $103,500 = $3,500)

Target = Neckline break - height = ~$103,500 - $3,500 = $97,000–$97,100

🔥 Market Context & Psychological Edge

This chart structure reflects a shift in market sentiment. What was once strong bullish momentum is now hesitating — with buyers failing to make higher highs and sellers stepping in aggressively. The double top is not just a pattern, it's a narrative of exhaustion and reversal.

“Let price confirm your bias. Don't just predict; react to structure and behavior.”

Being patient and letting the retest play out is crucial. Don’t rush in early — let the market give you a clean signal. This is where technical discipline pays off.

⚠️ Risk Management Notes

Crypto markets are highly volatile — avoid oversized positions.

A failed double top can lead to a bullish continuation, so SL discipline is key.

Wait for confirmation — candlestick patterns, momentum shifts, or bearish volume spikes can add confidence.

📌 Summary

✅ Pattern: Double Top

✅ Confirmation: Neckline Break

🔄 Current Phase: Retesting Neckline/Trendline

📉 Bias: Bearish

🎯 Target: ~$97,100

❗ SL: Above Top 2

💬 What do you think? Are we headed to GETTEX:97K or is this just a fakeout? Drop your thoughts below and don’t forget to like and follow for more trade setups!

Bearishsetup

BTC Just Entered the Killzone — Order Block + Strong High Reject🔍 Bitcoin Smart Money Breakdown | May 18, 2025

We’re looking at a potential high RRR short opportunity forming on BTC/USD — chart structure screams SMC precision. Here’s what we’re seeing:

🧩 1. Key Setup Details

Price tapped into a premium Order Block between 103,438–103,526 🔴

Sitting just above a Strong High — liquidity is baiting shorts

Rejection occurred precisely at the 79% Fib retracement level, giving confluence

Bearish structure intact with lower highs & descending trendline

💣 2. Liquidity Map

Above: Strong High = buy-side liquidity trap

Below: Weak Low = prime sell-side magnet

Sell-side liquidity pools at:

102,797.13

102,677.19 (final TP zone)

This is exactly where institutions hunt for exits 🔪

🎯 3. Trade Idea

Entry Zone: 103,438 – 103,526 (OB zone)

Stop Loss: Above Strong High ~103,560

Target Zones:

TP1: 103,120 (50% Fib level)

TP2: 102,797.13 (SSL pool)

TP3: 102,677.19 (final flush zone)

Estimated Risk-to-Reward: 1:3.2 to 1:4.5 depending on SL/TP config 🧠📏

🧠 Bonus Insight:

If BTC wicks above the OB and returns with momentum = potential liquidity grab fakeout — a textbook SMC confirmation entry 👌

🎤 Caption Idea for Short-Form:

“BTC is playing right into the banks’ trap… are you on the right side of this rejection? 😮💨💰”

📲 Follow @ChartNinjas88 for elite SMC plays, sniper-level breakdowns, and real liquidity flow setups!

GBPJPY ChoCh + Order Block = Bearish Liquidity Hunt Setup 🧠 Smart Money Breakdown: GBPJPY | 30-Min Chart

This is one of those A+ textbook SMC setups where Smart Money is likely loading shorts before the next liquidity raid.

Let’s break it down:

🔄 1. Change of Character (ChoCh)

Market flipped structure cleanly, printing a ChoCh below a key internal low. That’s our signal that Smart Money is likely done accumulating and prepping for a distribution move.

🟪 2. Order Block + Premium Price Zone

Price is retracing into a well-defined bearish Order Block right inside a premium zone. This OB sits just below a Strong High at 195.855 — a clear inducement level. Retail traders will chase that high... and get wrecked.

You’ll notice that OB is marked around 195.341–195.600 — right where liquidity pools stack.

🧲 3. Target: Weak Low at 193.640

Smart Money doesn’t care about patterns. It wants liquidity — and there’s a juicy Weak Low sitting at 193.640 waiting to be swept.

📐 4. Trade Setup Idea (R:R Approx. 4:1)

🔼 Entry Zone: 195.300–195.500

❌ Stop Loss: Just above Strong High: 195.880

✅ Target: 193.640 (liquidity sweep)

This setup gives you a tight stop and a wide target — just how SMC likes it.

🎯 Execution Tip:

Wait for:

Rejection wick inside OB

Bearish engulfing confirmation

BOS on lower timeframe before entering

Partial TP at mid-FVG or 194.200. Let the rest run.

📎 Confluences:

✅ ChoCh

✅ Bearish OB

✅ Rejection from premium pricing

✅ Clear inducement above Strong High

✅ Weak low as draw-on-liquidity

⚠️ Risk Reminder:

Don’t front-run the OB. Let price come to you. Watch how Smart Money manipulates before you execute. Confirmation > prediction.

🔚 Summary:

GBPJPY is set for a bearish redistribution move. The structure shift, clean OB, and weak low target all scream “trap above, raid below.”

You’re either trading with Smart Money… or you’re the liquidity.

💬 Drop “🎯” if you’re targeting the same liquidity level.

📉 Follow @ChartNinjas88 for more deadly-accurate setups.

🚨 Tag a friend who keeps buying into strong highs 😅

EURGBP Short SetupEURGBP Short Setup

4H Chart Trendline Breakdown and Retest

Entry : 0.84944

Stop Loss : 0.86678

Take Profit : 0.83310

RR 1 to 1.9

Market broke below the ascending support and retested the underside of a broken trendline confluence. Bearish pressure is building as price fails to reclaim 0.85396 zone. Clean structure for continuation to the downside.

Price is now respecting lower highs with momentum shifting beneath structure. This setup targets the previous demand zone near 0.833 region where price consolidated before the last impulse up.

As long as price holds below 0.854 zone, bearish bias remains valid.

CAKEUSDT Short Setup – Watching 2.40 Zone for RejectionHey Traders,

CAKEUSDT is currently trading within a well-defined downtrend, consistently forming lower highs and lower lows. The recent move appears to be a corrective rally, bringing price back toward a key daily resistance zone around 2.40, which also aligns with the descending trendline.

I’m monitoring this area closely for potential bearish price action to develop, signaling a continuation of the dominant bearish trend.

Key Confluences:

Major daily resistance at 2.40

Approaching descending trendline

Market still in a clear downtrend

Possible lower high formation in progress

Trade Plan:

If I see bearish confirmation in this zone (e.g. rejection candles, bearish structure break on lower timeframes, or weakening momentum).

A strong break and hold above 2.40 would invalidate the setup!

Dovish ECB Meets Technical Confluence – EUR/USD at Make-or-BreakEUR/USD has been respecting a clear bearish trend structure, consistently forming lower highs and lower lows across the lower timeframes. The pair is currently in a corrective phase, retracing toward the 1.13600 zone, a critical area where the descending trendline, horizontal resistance, and prior support converge. This level could serve as a strong turning point.

Fundamentally, the euro remains under pressure as markets anticipate a dovish stance from the ECB amid subdued inflation and softening economic data. Meanwhile we should be very cautious about the dollar with the very mixed war tariffs.

A rejection at this level with confirming bearish price action could open the door for a fresh leg lower in line with the prevailing trend. I’m closely monitoring candlestick behavior and momentum signals around 1.13600 for a potential short setup.

XAU/USD Analysis – Wedge Breakdown & Bearish Trade Setup1. Chart Overview

The 15-minute XAU/USD chart shows a descending wedge pattern forming after a price rally. The wedge is characterized by a series of lower highs and lower lows, signaling a gradual weakening of bullish momentum. After consolidating within this wedge, the price has broken down, suggesting a bearish continuation.

This setup provides a high-probability short trade with clear entry, stop-loss, and multiple take-profit levels.

2. Key Technical Elements

A) Chart Pattern – Descending Wedge Breakdown

A descending wedge is typically a bullish reversal pattern when forming at the bottom of a downtrend. However, in this case, it appears at the end of a corrective move, making it a bearish continuation setup.

The upper trendline (black dashed line) acts as resistance, preventing price from breaking higher.

The lower trendline (solid blue line) represents temporary support.

The wedge narrows as price action contracts, leading to an eventual breakdown.

👉 Breakout Confirmation:

The price has broken below the wedge’s support trendline.

A minor pullback to retest the broken trendline suggests validation of the breakdown.

B) Resistance & Support Levels

1️⃣ Resistance Level (Sell Zone) – $3,100 to $3,135

This area previously acted as a supply zone, rejecting bullish attempts.

Price was unable to sustain above this level, leading to further downside pressure.

Stop-loss should be placed above this level ($3,135.57) to protect against invalidation.

2️⃣ Support Level (Buy Zone) – $3,050 to $3,056

This was a previous reaction zone where price briefly bounced before continuing lower.

Now acting as Take Profit 1 (TP1) at $3,056.58.

3️⃣ Breakout & Retest

After breaking the wedge, price retested the trendline but failed to reclaim it, confirming the bearish trend.

3. Trade Setup & Execution

🔵 Entry Point:

Short trade activation upon the breakdown and retest of the wedge structure.

Price rejection at the trendline confirms seller strength.

🔴 Stop-Loss:

Placed at $3,135.57, slightly above recent swing highs.

This protects against false breakouts or sudden reversals.

🎯 Take Profit Levels:

TP1 ($3,056.58): First target where buyers might step in.

TP2 ($3,022.39): Midway target, acting as another strong support.

TP3 ($2,985.44): Final target where price may stabilize or reverse.

4. Market Context & Confirmation Indicators

📉 Bearish Confirmation:

Strong downward momentum suggests continued selling pressure.

Price action is failing to make new highs, confirming lower highs and lower lows.

📊 Risk-to-Reward Ratio (RRR):

The trade offers a favorable RRR, as the downside potential is significantly larger than the stop-loss range.

⚡ Additional Confirmation:

A strong bearish candle confirmed the breakout, rejecting higher levels.

Potential support breakouts suggest that price could reach TP3 if bearish momentum continues.

5. Conclusion – Trading Strategy Summary

✅ Pattern Identified: Descending Wedge Breakdown (Bearish)

✅ Trade Direction: Short (Sell)

✅ Entry Trigger: Breakout & Retest of the Trendline

✅ Stop-Loss: Above $3,135.57 (Wedge Resistance Zone)

✅ Take Profit Targets:

TP1: $3,056.58

TP2: $3,022.39

TP3: $2,985.44

📌 Final Thoughts:

This setup provides a high-probability trade with a clear breakdown structure and downside potential. If the price continues to respect the bearish trend, reaching all TP levels is likely. However, traders should monitor for reversal signals and manage risk accordingly.

🔔 Risk Warning: Always use proper risk management and adjust positions according to market conditions! 🚀

Bitcoin (BTC/USD) Rising Wedge BreakdownMarket Structure & Analysis:

Rising Wedge Formation: Price has been moving within a rising wedge pattern, which is typically a bearish reversal pattern.

Bearish Breakdown Expected: BTC is testing the lower boundary of the wedge, indicating a potential breakdown.

Resistance Zone:

$89,649 – Key resistance level preventing further upside.

$88,336 – Local resistance that price failed to sustain above.

Support Levels:

$86,852 - $85,335 – Intermediate support range.

$80,402 – Main target for a bearish move.

$76,725 – Secondary support in case of further decline.

Trading Plan:

Sell Setup:

Wait for confirmation of a breakdown below the wedge.

Enter short if price closes below $86,852 with volume confirmation.

Stop Loss: Above $88,336 to avoid false breakouts.

Take Profit Targets:

TP1: $84,474 (first support level).

TP2: $80,402 (main target).

TP3: $76,725 (extended bearish target).

Risk Factors:

If BTC finds strong support at $86,852, a bounce could invalidate the bearish setup.

Macro events (ETF approvals, institutional buy-ins, Fed rate decisions) may impact price action.

Silver (XAG/USD) – Rising Wedge Breakdown & Retest📌 Overview of the Chart

The chart illustrates a classic Rising Wedge pattern that has broken down, signaling a potential bearish continuation. The price action respected technical structures, including support and resistance levels, trendlines, and key psychological zones.

The breakdown of the rising wedge led to a sharp decline, followed by a retest of the previous support as resistance, confirming further downside momentum. Traders analyzing this setup can identify clear entry points, stop-loss placements, and target objectives based on price action behavior.

🔹 1️⃣ Understanding the Rising Wedge Pattern

A Rising Wedge is a bearish pattern that forms when price moves upward within converging trendlines. It indicates that buying momentum is slowing, and a potential reversal or breakdown is imminent.

✔ Characteristics of the Rising Wedge on This Chart:

📈 Higher Highs and Higher Lows: The price was trending upwards, but the narrowing structure indicated exhaustion.

📊 Decreasing Momentum: Volume likely started declining as the price approached resistance.

📉 Bearish Breakdown: Price broke below the lower trendline, confirming the pattern’s bearish nature.

🔻 What Happened Next?

The price dropped sharply after the wedge breakdown.

A retest of the broken trendline acted as a confirmation of resistance.

The downtrend continued, targeting a lower support level.

🔹 2️⃣ Key Support & Resistance Levels

🔵 Major Resistance – 34.27 USD (All-Time High & Supply Zone)

This level served as a strong supply zone, rejecting multiple bullish attempts.

Price struggled to break this level, leading to a sell-off.

The stop-loss for short trades is placed above this zone to minimize risk.

🟠 Support Level – 32.80 USD (Previous Support Turned Resistance)

This was a key support zone before the wedge breakdown.

Once broken, price retested this level and faced rejection, confirming a trend shift.

⚫ Trendline Support (Now Broken)

The lower support trendline was a crucial guide for bulls.

Once price broke below, it signaled strong bearish control.

A retest of the trendline was unsuccessful, confirming a bearish continuation.

🟢 Target Zone – 31.93 USD (Projected Breakdown Target)

The measured move target of the rising wedge aligns around 31.93 USD.

If selling pressure continues, price may reach this level.

🔹 3️⃣ Trading Strategy – Short Setup & Execution

This setup provides a high-probability short trade based on the pattern breakdown.

📉 Short (Sell) Entry Criteria:

✅ Entry Zone: After the price broke below the wedge and retested the trendline (~33.80 USD).

✅ Confirmation:

Bearish candlestick formations (Doji, Engulfing, or Pin Bars).

Increased volume on bearish moves.

🚫 Stop-Loss Placement:

🔹 Above the resistance level (34.27 USD) – If price breaks above this, the setup is invalid.

🔹 Reasoning: Protects against unexpected bullish reversals.

🎯 Take-Profit Target:

🔻 Target Price: 31.93 USD (based on measured move projection).

🔻 Risk-Reward Ratio: At least 2:1 (adjusted based on volatility).

🔹 4️⃣ Market Psychology & Price Action Analysis

Understanding trader sentiment is crucial:

📌 Before the Breakdown:

Bulls were in control, pushing price higher.

However, momentum slowed down, forming the rising wedge.

Traders who identified this pattern anticipated a potential trend reversal.

📌 After the Breakdown:

Sellers overpowered buyers, causing a rapid break of structure.

The price retested the previous support as resistance, confirming further downside.

The market sentiment shifted to bearish, aligning with technical confirmations.

🔹 5️⃣ Alternative Scenarios & Risk Factors

🔄 Bullish Reversal (Invalidation of Bearish Bias)

🚨 If price reclaims 34.00-34.27 USD, it invalidates the bearish setup.

📌 A break above this level could trigger a new bullish wave, targeting higher highs.

⚠️ Key Risk Factors:

Unexpected macroeconomic events (e.g., Fed policy, inflation data, geopolitical tensions).

Strong bullish rejection at lower support zones (~32.00 USD).

Volume divergence (if selling volume dries up, bears may lose control).

📢 Conclusion: High-Probability Bearish Trade with Clear Risk Management

This rising wedge breakdown provides a strong short setup, with technical confirmations and price structure supporting further downside movement.

📉 Bearish Bias Until 31.93 USD

A breakdown retest suggests sellers remain in control.

Price is expected to continue lower unless bulls regain 34.00+ levels.

🔍 Key Trading Question:

Will Silver (XAG/USD) continue to its measured target of 31.93 USD, or will bulls defend key support and push prices higher?

Let’s discuss! 🚀👇

Bitcoin (BTC/USD) – Rising Wedge Breakdown & Trading Setup 📊 Chart Overview & Market Context

The provided chart represents Bitcoin's (BTC/USD) price movement on the 1-hour (H1) timeframe, highlighting a Rising Wedge pattern. This pattern is generally bearish and signals a potential reversal or breakdown.

Over the past few trading sessions, BTC has been moving inside an ascending wedge formation, making higher highs and higher lows. However, this movement is narrowing, indicating weakening bullish momentum. As BTC approaches a critical resistance level, sellers appear to be gaining control, increasing the likelihood of a sharp decline.

This chart outlines a well-structured bearish trading setup, identifying key areas of resistance, support, stop-loss placement, and potential downside targets.

📌 Technical Analysis & Key Levels

🔹 1. Chart Pattern: Rising Wedge (Bearish Reversal Signal)

A Rising Wedge is a technical pattern characterized by:

✔ Two upward-sloping trendlines, converging over time.

✔ Diminishing bullish momentum, as higher highs become weaker.

✔ Breakdown expectation, where price typically falls below the lower support trendline.

📉 Why is this pattern important?

The rising wedge signals that buyers are losing strength and that a reversal is likely.

When price breaks below the lower boundary, selling pressure increases, leading to a strong downward move.

Traders often anticipate a breakdown from this pattern to enter short positions.

🔹 2. Resistance Level (Key Rejection Zone)

📌 Zone: 88,500 - 89,500 USD

This area has acted as a strong resistance, preventing further upside movement.

Sellers stepped in, causing the price to reject and start declining.

A confirmed rejection from this level adds bearish confluence to the setup.

🔹 3. Rising Wedge Support (Breakdown Level)

📌 Zone: 85,000 - 84,500 USD

This is the lower boundary of the wedge pattern.

If BTC closes below this level with strong volume, it confirms the breakdown.

A retest of this level as resistance after a breakdown would provide an ideal short entry.

🔹 4. Key Support Levels & Bearish Targets

Once BTC breaks down, the next areas of interest are:

📌 First Bearish Target: 80,500 - 79,500 USD

A previous demand zone where buyers previously pushed prices higher.

BTC could pause here before continuing lower.

📌 Final Target (Full Breakdown Projection): 76,802 USD

If the wedge pattern fully plays out, BTC could drop toward this level.

This aligns with a major historical support zone, where significant buying interest could emerge.

🔹 5. Stop-Loss & Risk Management

📌 Stop-Loss: 90,483 USD

If BTC moves above this level, it invalidates the bearish setup.

Keeping a tight stop-loss ensures controlled risk while maximizing potential rewards.

📉 Trading Plan: How to Trade This Setup?

✅ Short Entry Strategy:

Enter a short trade once BTC breaks below 85,000 USD, confirming the wedge breakdown.

If BTC retests the broken support (now resistance), it offers a second entry opportunity.

✅ Stop-Loss Placement:

Place a stop-loss above 90,483 USD, in case of a bullish breakout.

✅ Take-Profit Levels:

First Target: 80,500 - 79,500 USD (Support zone)

Final Target: 76,802 USD (Full wedge breakdown projection)

📌 Key Takeaways & Market Sentiment

🔸 Bearish Structure Formation: BTC is losing momentum inside a rising wedge, signaling a potential downturn.

🔸 Breakdown Confirmation Needed: A close below 85,000 USD with volume confirms the bearish trade setup.

🔸 Risk Management is Key: The stop-loss above 90,483 USD protects against invalidation.

🔸 Watch for Retests: If BTC retests the breakdown level, it can provide an ideal entry point.

🚨 Bitcoin is showing early signs of a bearish reversal! If the rising wedge breaks down, a significant decline toward 76,802 USD could follow. Traders should monitor price action carefully and execute the setup accordingly. 🚀

Xauusd [bearish] trend patternJust as i published yesterday, we see gold respecting the bearish trend channel. still expecting more bearish liquidity sweep as we keep our sell positions still open at 3043 and re-entry at 3025.

3016 is a vital zone as that region depicts next market interaction, still watching market behaviour

GOLD 1H | Bearish POI Reaction Setup – Clean Flow by CelestiaPipPrice is reacting to a high-probability POI formed via supply + imbalance on GOLD 1H.

After the sweep and minor bullish correction, we’re now back into the rejection zone.

As long as price holds below 3030 , we could see continuation toward 2981 .

Key levels, invalidation zone, and structure mapped clearly.

Watch how price responds — setup in motion.

— CelestiaPips

XAUUSD - Bearish Quasimodo Pattern Triggered Gold (XAU/USD) has formed a classic Quasimodo pattern on the 1H timeframe, signaling a potential bearish reversal after a strong uptrend.

🔍 Pattern Breakdown:

The structure resembles a Head & Shoulders, with a more complex formation known as the Quasimodo Pattern.

We see a clear Left Shoulder, Head, and Right Shoulder, followed by a breakdown below the neckline.

A successful retest of the neckline as resistance confirms the bearish momentum.

🎯 Target Zone:

Based on the height of the pattern, the projected target lies in the 2960–2970 region, aligning with a previous demand zone.

The expected drop is approximately -2.10%, matching the prior rally before the reversal pattern.

📌 Key Levels:

Breakdown Level: ~3030

Current Price: ~3024

Target: ~2960–2970

⚠️ Watch for:

Bearish follow-through after the retest.

Potential reaction in the highlighted target zone (yellow box).

This setup provides a great opportunity for short sellers if momentum continues to the downside. Risk management is key as always!

Gold/USD (XAU/USD)– Potential Bearish CorrectionKey Observations:

Uptrend & Resistance:

The price has been trending upwards within a parallel channel.

It reached a resistance level around $3,064 - $3,055, where selling pressure is evident.

Potential Pullback:

The price is showing signs of rejection at resistance and could move lower.

The first target for the pullback is around $3,013 - $2,964, which aligns with previous structure levels.

A deeper correction could test support near $2,880 - $2,878.

Trade Setup Idea:

Bearish scenario: If price fails to reclaim resistance, traders may look for short opportunities targeting lower support levels.

Bullish scenario: If price breaks above resistance, it could trigger further upside momentum.

Conclusion:

This chart suggests a possible short-term correction before determining the next move. Traders should watch price action near key levels for confirmation.

Gold (XAU/EUR) – Bearish Setup at Key Resistance LevelChart Overview:

This 4-hour chart of Gold (XAU) against the Euro (EUR) suggests a potential bearish setup as the price has reached a key resistance zone.

Key Observations:

Resistance Zone: The price has broken above a descending channel and is testing a significant resistance level around 2,790 - 2,800 EUR.

Sell Signal: A rejection from this resistance level has prompted a potential short entry.

Bearish Target: The projected price decline could reach the 2,727 EUR support zone, aligning with previous demand areas.

Risk-to-Reward: The expected decline represents a -2.08% move, indicating a strong risk-reward setup for sellers.

Trading Idea:

Sell Entry: Near 2,790 EUR (if rejection confirms).

Target: 2,727 EUR (support zone).

Invalidation: A breakout above resistance could signal further bullish continuation.

This setup suggests a short opportunity, but traders should watch price action for further confirmation before entering trades. 📉🔥

Bearish Setup on United Electronics Co TADAWUL Weekly TimeframeStructure & Market Behavior:

The market made a strong bullish move from the green highlighted zone labeled as "unmitigated order flow", pushing up with a clear Break of Structure (BoS) on the left side.

A strong rally continued until it peaked (highlighted by the blue dot).

After the peak, the price dropped, creating a Lower High (LH) and Lower Low (LL) structure, suggesting a bearish shift.

Key Elements Marked:

Order Block (OB): A bearish OB is marked on the right side near the current price level (~96.4). This could act as a resistance/supply zone.

Equal Highs (EQ_H): Indicating a liquidity pool where market makers may hunt before a reversal.

Market Pattern: A minor bullish bounce is expected from current levels before a sharp drop.

Forecasted Path:

Price might grab liquidity above EQ_H (false bullish move), then reverse sharply downward.

Target area: Green zone near 40-50 SAR — previously unmitigated order flow/demand zone.

Final projected low is marked around 31.75, which might be an exaggerated worst-case scenario.

Conclusion:

Your chart suggests that the price is in a distribution phase and likely to experience a major sell-off after a liquidity grab above EQ_H. The long-term bearish bias is supported by:

Order block rejection

Equal highs as liquidity targets

Previous bullish rally needing rebalancing (Fair Value Gap / Order Flow)

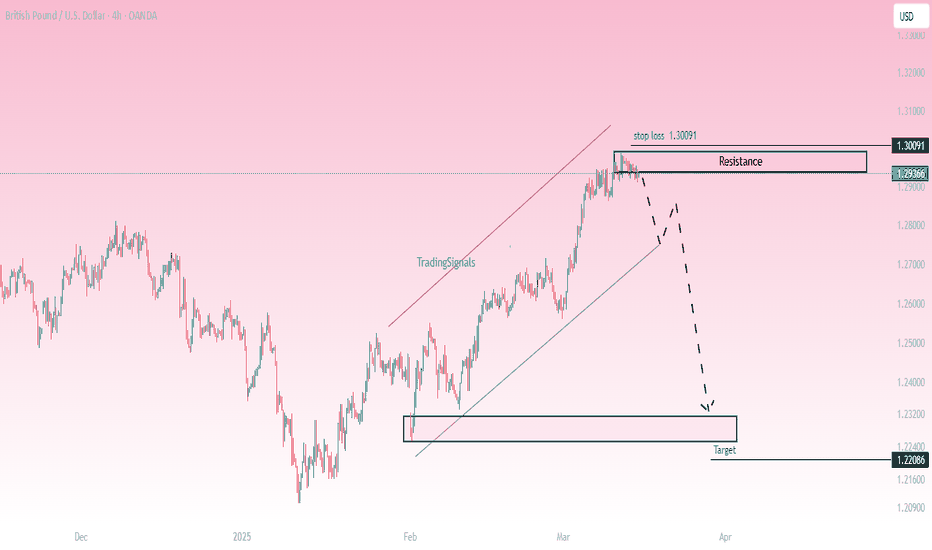

GBP/USD - Potential Bearish Reversal Setup

📉Market Structure:

The pair has been in an uptrend, forming a rising channel. However, price is now facing strong resistance around 1.2936 - 1.3009, showing signs of exhaustion. A potential reversal could be forming.

🔍 Key Levels:

Resistance Zone: 1.2936 - 1.3009

Current Price: 1.2936

Target Support: 1.2208

📊 Trade Idea:

A rejection from the resistance zone could initiate a bearish move.

A confirmed breakdown below 1.2900 may trigger further downside toward the 1.2208 target zone.

Stop-loss placed above the 1.3009 resistance to manage risk.

🚨 Confirmation & Risk Management:

Bearish Confirmation: Rejection from resistance with strong selling momentum.

Invalidation: A breakout above 1.3009, indicating bullish continuation.

Risk Management: Stop-loss at 1.3009 with a favorable risk-to-reward ratio.

This setup suggests a short opportunity if price respects resistance and begins a downward move. Traders should watch for confirmation signals before entering.

EUR/USD Technical Analysis: Bearish Momentum with 2.04R ShortEUR/USD Technical Analysis: Bearish Momentum with 2.04R Short Opportunity

Current Market Structure

The EUR/USD is displaying a clear bearish trend across multiple timeframes, with price action showing lower highs and lower lows since late 2024. Analysis of the charts reveals:

Daily timeframe: Sustained downtrend since October 2024, with price currently testing resistance near 1.0380

4-hour timeframe: "Confirmed" bearish alignment with both the 8 EMA and 21 EMA positioned below the 55 EMA

1-hour timeframe: Similar bearish configuration, reinforcing the short bias

EMA System Confirmation

The proprietary EMA System Status indicator demonstrates strong bearish conviction:

240 Signal: Bearish

240 Trend: Bearish

Alignment: Confirmed

This triple confirmation suggests high-probability conditions for short entries.

Key Technical Levels

Support Levels:

1.0300: Psychological round number

1.0230: Recent swing low and profit target

1.0200: Major psychological support

Resistance Levels:

1.0400: Key resistance zone with 200 EMA confluence

1.0430: Stop placement zone above recent swing high

1.0500: Major psychological resistance

Correlation Analysis

Supporting the bearish thesis, the DXY (Dollar Index) shows a complementary bullish structure with:

Confirmed bullish alignment on the 4-hour timeframe

Recent break above the 107.00 resistance level

Bullish momentum in MACD

This inverse correlation adds significant weight to the EUR/USD short setup.

Trade Parameters

Entry Strategy:

Short at 1.03632

Stop Loss at 1.04287 (65.5 pips)

Profit Target at 1.02296 (133.6 pips)

Risk/Reward Ratio: 2.04

Risk Management:

1% account risk allocation

0.5 lot position size

$500 risk per trade (on $50,000 account)

Potential profit: $1,019.85

Technical Confluence Factors

Several factors align to support this trade setup:

Price rejecting at 55 EMA resistance on multiple timeframes

MACD showing bearish momentum and alignment

Weekly and daily session boundaries reinforcing resistance zones

Recent higher timeframe rejection of the 200 EMA

Market Timing Considerations

The European and US economic calendars should be monitored for:

ECB monetary policy statements

Federal Reserve commentary

US dollar-impacting economic data releases

Conclusion

The EUR/USD presents a high-probability short opportunity with a favorable risk-reward ratio of 2.04. All key technical indicators align bearishly across multiple timeframes, with strong correlation confirmation from the DXY. This setup fits the criteria for a "Confirmed" signal within our trading system, meeting our standards for trade execution.

Trade management will follow our established protocol with potential scaling out at interim support levels and trailing stops implemented once price moves beyond the 1:1 risk-reward ratio point.

#BNXUSDT is weakening expecting a drop📉 SHORT BYBIT:BNXUSDT.P from $0.6458

🛡 Stop Loss: $0.6800

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:BNXUSDT.P is near resistance at $0.6853, showing signs of weakness.

➡️ A pullback is expected after failing to hold above $0.6550.

➡️ Targeting support levels at $0.6060 → $0.5642.

⚡ Plan:

✅ Bearish scenario confirmation – price needs to break $0.6550 and stay below it. If confirmed, the short position remains valid.

✅ Critical resistance level – $0.6853. If the price moves above $0.6800, the trend may shift bullish, invalidating the setup.

✅ Volume analysis shows weakening buying interest, supporting the possibility of a correction.

✅ Profit-taking zones – $0.6060 → $0.5642. If price slows down around $0.6060, a bounce is possible, so partial profit-taking is recommended.

✅ Alternative scenario – if price bounces from $0.6060, a long position with a tight stop could be considered.

📍 Take Profit targets:

🎯 TP1: $0.6060 – testing the nearest support level.

💎 TP2: $0.5642 – deeper correction zone.

🚀 BYBIT:BNXUSDT.P is weakening — expecting a drop to $0.5642!

📢 A break below $0.6550 confirms the bearish scenario.

📢 Holding below this level strengthens the case for further decline.

📢 If price surges above $0.6800, the setup is invalidated.

#BNXUSDT - Expecting price decline📉 SHORT BYBIT:BNXUSDT.P from $0.4377

🛡 Stop Loss: $0.4502

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:BNXUSDT.P experienced a sharp pump, but after reaching $0.4735, signs of buyer exhaustion appeared.

➡️ The $0.4377 level now acts as a key resistance area. If the price fails to hold above it, a downward move is expected.

➡️ POC at $0.3045 confirms a high-liquidity zone, which could serve as a deeper retracement target.

➡️ High volume on recent candles suggests profit-taking by buyers, increasing the probability of a decline.

⚡ Plan:

➡️ Enter SHORT from $0.4377 if the price confirms rejection at resistance.

➡️ Risk management through Stop-Loss at $0.4502, above key selling pressure.

🎯 TP Targets:

💎 TP1: $0.3941 — first profit-taking level.

🔥 TP2: $0.3600 — next major support zone.

🚀 BYBIT:BNXUSDT.P Expecting a reversal and price decline!

📢 After a sharp price surge, BYBIT:BNXUSDT.P is showing weakness around $0.4377. It’s crucial to monitor this level for potential rejection.

📢 If the price breaks below $0.3941, further downside movement is likely, targeting $0.3600. However, if the price climbs above $0.4502, the short scenario could be invalidated.