Bearmarket

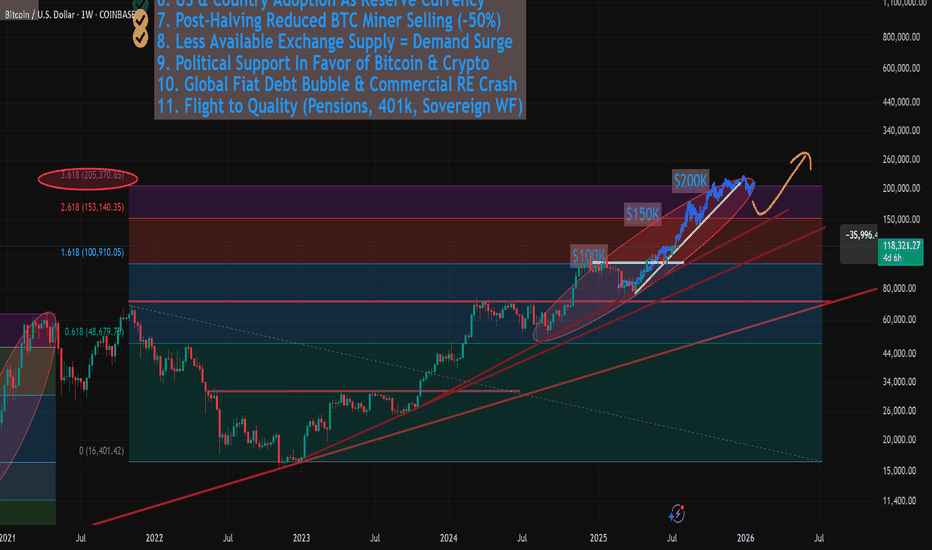

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

Bitcoin vs Gold: Driving the Point Home📉 Bitcoin vs Gold: Driving the Point Home The long-term comparison we can't afford to ignore.

Gold, after achieving mainstream status, weathered a 20-year consolidation phase, low volatility, muted investor excitement, but enduring presence. This historical precedent forces us to reconsider expectations for Bitcoin, now in its 15th year.

⚡ While Bitcoin’s adoption curve has been sharper, its market dominance has steadily declined since 2017. Despite intermittent, and often deceptive relief rallies, the trend remains downward. Altcoins, forks, and shifting narratives (DeFi, NFTs, meme tokens) continue to fragment attention and capital.

⚡ Could Bitcoin follow gold’s path and enter a prolonged era of post-hype consolidation? If so, the next bull run might be a decade away or more … if it happens at all. In an age of digital abundance, durability; not innovation, may define Bitcoin’s legacy.

📊 Chart Highlights: The latest image visualizes Bitcoin’s current phase against gold’s historical arc. The final label "Monetary Maturity" suggests a shift from speculative highs to a more sober test of endurance.

🔍 Will Bitcoin evolve into a true store of value or fade as just another chapter in financial innovation? Let the markets answer, but history offers clues. Only Time will tell.

#Bitcoin #Gold #CryptoAnalysis #BTCdominance #CryptoHistory #DigitalAssets #TradingView

CRYPTO:BTCUSD INDEX:BTCUSD TVC:SILVER NASDAQ:MSTR NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:DXY NYSE:CRCL

RAY Outlook: Is a -60% Drop the Reset We Need?RAY marked its bottom in December 2022 at just $0.133, entering a prolonged accumulation phase that lasted nearly a year. Then, in late 2023, it broke out into an explosive bull run, skyrocketing +6421% over 756 days and peaking at an impressive $8.70.

This run completed a full five-wave Elliott Wave structure. After topping out, RAY dropped -84% down to $1.388 — likely marking the Wave A correction. A strong relief rally followed into the $4 region before facing rejection at the yearly VWAP, possibly completing Wave B. Now, all signs point toward us being in the final Wave C of the larger corrective structure.

So, where could Wave C bottom out?

🔍 Fibonacci Confluence Zones (Log Scale)

Let’s assess the key levels with log-scaled Fibonacci tools:

🔹 Fib Retracement (from $0.133 low to $8.7 high):

The 0.618 fib retracement lies at $0.658

🔹 Trend-Based Fib Extension (Wave A → B projection for Wave C):

1.0 TBFE sits at $0.617

✅ These two levels align nearly perfectly, giving us a strong confluence zone between $0.62 and $0.66

Additional Confluences

Anchored VWAP Bands:

The 0.618 VWAP band multiplier also aligns with this $0.6 zone

Liquidity Perspective:

This level would wipe out long positions built over the past 550 days — clearing and potentially resetting the market

🚨 Fair Value Trend Model (FV Trend Model):

According to my Fair Value Trend Model indicator, the fair value for RAY currently sits around $0.78 — right in line with the broader confluence zone. This model uses log-log regression to estimate Bitcoin’s and other assets’ fair-value over time.

👉 Feel free to use the indicator

Just head over to my profile, click on the “Scripts” tab, and you can add the Fair Value Trend Model to your charts to experiment with it yourself.

Together, these technical elements form a compelling high-probability zone for long setups around $0.6–$0.8.

💡 Educational Insight — Why 0.618 is a Critical Fib Level

In Elliott Wave theory and harmonic trading, the 0.618 retracement is known as the "Golden Ratio" — often serving as a magnet for price during corrections. When paired with a 1.0 trend-based fib extension, it can mark exhaustion zones where Wave C concludes.

🔭 Summary: What’s Next for RAY?

Potential bottom zone: $0.61–$0.78

Watch for reversal signals like bullish candlestick patterns, volume spikes, or divergences

A drop to this zone would represent a -60% drawdown from current levels

Remember: High-probability setups don’t come every day — patience is your edge

Set alerts. Stay prepared.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

ONDO — Reversal or more Pain ahead? After a strong rally back in 2024, ONDO topped at $2.15 — completing a clear 5-wave impulsive move. Since then, price has entered a prolonged downtrend, dropping over -70%, with no confirmed reversal signs yet.

We’re now trading around a critical zone near $0.70. So the question is: where’s the next potential bottom?

🔎 Technical Breakdown:

📍 VWAP Breakdown:

The yellow anchored VWAP (Volume Weighted Average Price) has been lost — a clear sign of market weakness. This VWAP was previously acting as support but has now flipped to resistance, which often precedes continued downside.

📌 Key Support Zone:

$0.80–$0.70 was a structural support area that has now been broken — another bearish sign.

📉 Fibonacci Confluence:

Taking the structure and applying a Fibonacci retracement, the 0.786 retracement lies at $0.4828 — let’s round that to a critical $0.50 zone. This level is important for several reasons:

Liquidity rests at a previous key low at $0.50128

Anchored VWAP Band (0.618 multiplier) aligns with the same area

The 8/1 Gann Fan also intersects around this zone

All roads lead to the $0.50 level as a potential high-probability reversal zone. A bounce from here — especially with volume confirmation or reversal candlesticks etc. — would be a signal worth watching.

💡 Educational Insight: Importance of 0.786–0.886 Fibonacci Zone + VWAP

While many focus on the 0.618 retracement, bear markets often go deeper.

The 0.786–0.886 zone is where emotional exhaustion kicks in — traders give up, liquidity pools build, and smart money steps in.

Combining this with Anchored VWAP adds precision:

VWAP reflects where the “average buyer” is positioned. When price reaches confluence with both deep fibs and VWAP fib bands, you have a statistically powerful setup for reversals.

🚨 Note: These zones are not automatic buy levels — watch for confirmation signs before entering.

🛎️ Set your alerts, stay patient, and as always let the trade come to you.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

The Bitcoin Manipulation Trick - How They Lure You Into the Trap📉 Bitcoin spends more time in deep drawdowns than at its peaks. Historically, BTC has spent over 80% of its existence trading 80-90% below its all-time highs, yet people keep falling for the illusion of wealth.

🧐 Here’s how the cycle works:

1️⃣ They drive up the price to make it enticing for new buyers.

2️⃣ You FOMO in at the highs, believing in the "next big wave."

3️⃣ Then they crash it, wiping out weak holders.

4️⃣ They keep it suppressed for years, forcing everyone out, via margin calls, financial strain, or sheer exhaustion.

5️⃣ When enough have capitulated, they restart the cycle.

📊 Historical Evidence:

- 2013 Crash: Over 400 days down 80%+ before recovery.

- 2017 Crash: Nearly 3 years below 80% of ATH.

- 2021 Drop: More than a year stuck 75% below peak.

🔎 If you’re buying now, be ready to:

⛔ Lose access to your money

⛔ Keep covering margins

⛔ Wait years for recovery, if it ever happens …

They play the same trick, every time. If you don’t recognize it, you’re just another part of the cycle. 🚀🔥

INDEX:BTCUSD NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:GOLD TVC:SILVER NASDAQ:MSTR TVC:DXY NASDAQ:HOOD NYSE:CRCL

Trend Base Fib Time suggesting getting out before October 2025!I have been warning you that time is running and a few months left before things start cooling off. This tool is trend base fib time , measured from one halving till the next one. I assumed halving in 2028 at some point in march so this result in a target of October to be the month matching with the 0.382 when peaks use to be found. The 0.618 would be the one for catching the bottoms around Sep 2026. Secure some gains and buy back at next bear market lows close to 40k. Cheers

Dow Jonas - Elliot wave📉 DJI — Elliott Wave Top in Sight?

🔍 A long-term analysis with serious implications...

I've been diving deep into the Dow Jones Industrial Average (DJI), using Elliott Wave principles — and what I see may signal the end of one of the longest bull markets in history.

Elliott was right — the massive bull cycle did arrive and extended well into the 2000s. But now, that journey looks to be nearing its final destination.

Currently, I believe we're witnessing the development of an Ending Diagonal pattern — a structure often seen at the end of a major impulse. This formation appears to be completing a set of blue sub-waves, which in turn cap off the larger green primary impulse wave.

📍 The box marks my anticipated top for the DJI. From this point, I expect a strong reversal and the beginning of a major correction.

Now here's the shocking part:

If this correction plays out in time and reaches the Fibonacci 0.382 level, that would suggest a retracement spanning up to 86 years — yes, 86 years.

This isn’t just about markets anymore — such a scenario could carry massive consequences for the global economy and society as a whole.

If, however, we see a strong breakout above the box, then the ending diagonal thesis would be invalidated, and we might instead be witnessing an extended wave 5 — complete with five internal sub-waves.

But either way — the top is coming. It’s just a matter of when, and how hard we fall.

💬 What are your thoughts? Could we really be on the edge of a generational peak?

Bitcoin Repeating 2022 Structure? Same Setup, Same Outcome?Bitcoin’s current market structure is starting to mirror its 2022 setup—right before the big drop.

This chart shows a familiar pattern: a rally, a peak, first drop from the ATH, a bull trap… then the major second leg down.

If history repeats, CRYPTOCAP:BTC could be on the verge of another significant move.

Will it break the cycle this time—or follow the same path again?

📉 What do you think?

Share your take in the comments below.

Please support this idea with a LIKE👍 if you find it useful🥳

Happy Trading💰🥳🤗

Bull Trap – The Real Drop May Just Be Starting! (Crash Ahead?)The market appears to be gaining bullish momentum, giving the impression that the bear market is over—but what if it’s just getting started?

On this CRYPTOCAP:TOTAL chart, the current price action seems to mirror the 2021–2022 bear market cycle: a rally to new highs, a sharp drop, a deceptive recovery (bull trap), followed by a deeper correction and eventual accumulation.

If this pattern plays out again, we could be in the bull trap phase—right before a significant and unexpected drop.

What do you think?

Will history repeat itself, or are we heading to new highs?

Drop your thoughts in the comments!

Please support this idea with a LIKE👍 if you find it useful🥳

Happy Trading💰🥳🤗

$BTC: We Are in a Bear Market Until Proven Otherwise🚨 CRYPTOCAP:BTC : We Are in a Bear Market Until Proven Otherwise 🚨

📌 Follow-up to my December 2024 post:

🔗

Despite record-breaking bullish news, Bitcoin is not at an all-time high. Why? Because we’re still in a bear market—until the charts say otherwise.

✅ Bullish Factors:

Michael Saylor continues buying billions

President Trump & family pushing crypto/meme coins

Rumors: Fed buying CRYPTOCAP:BTC with gold?

Trump pinned the Bitcoin white paper at the White House

U.S. banks fully onboard with crypto

ETFs accumulating CRYPTOCAP:BTC

National crypto reserve announced

❌ Bearish Signals:

Fear & Greed Index in "extreme fear" for 30+ days

Price is below the EMA50 on weekly

Monthly MACD nearing bearish crossover

Trading volume decreasing

Crypto search interest at multi-year lows

Retails not buying — this is all institutions

Powell confirmed we're in a recession

Desperate whales calling for $5M–$9M BTC to bait retail

🧭 Monthly chart check the MACD:

🔗

⚠️ Key Insight:

Every cycle, people confuse a relief rally for a new bull run. This isn't new.

A relief rally = short-term price recovery in a bear market.

(AKA a dead cat bounce or sucker rally)

📊 Past relief rallies (check the chart):

+45% (Feb 2022)

+32% (June 2022)

Current one: only +16% — still within bear territory.

📉 Price could hit $91k and still drop lower while staying in an ongoing bear Market..

🧨 Bear Market Target: GETTEX:25K – FWB:27K

📈 Invalidation? Only if we close above $101K

Don’t trade your emotions. Trade the charts. They never lie.

#Bitcoin #CryptoMarket #BTC #BearMarket #CryptoAnalysis #SPX500 #CryptoTrading #Recession2025 #BTCPrice #CryptoCrash #CryptoNews #MichaelSaylor #TrumpCrypto #BTCBearMarket

BTC - Halving Cycle | Historical Patterns & 2025-2026 Projection

In this chart, we dive deep into the cyclical nature of Bitcoin price action post-halving and draw parallels between past and current movements, with a specific focus on how the market has historically reacted at various intervals following each halving event. This analysis incorporates both structural and temporal elements, providing a potential roadmap based on previous behavior.

---

Historical Context: Previous Cycles

3rd Halving – May 11, 2020

Following the 3rd Bitcoin halving, we observed a parabolic run-up over the next several months:

- 11 months after halving (April 2021): BTC reached a major peak, hitting nearly $65,000.

- This was followed by a significant correction.

- 19 months after halving (December 2021): Bitcoin printed a second top close to the previous all-time high, forming a classic double top pattern. This structure often signals market exhaustion and precedes deeper corrections.

Cycle Completion – Price Reversion

By 30 months after the 3rd halving (around November 2022), BTC had retraced much of its gains and returned to prices nearly equivalent to the halving level (~$8,000–$10,000 zone in log-adjusted terms). This marked the end of the cycle, confirming a full reversion to the mean after the double-top distribution phase.

---

Current Cycle: 4th Halving – April 19, 2024

We're now entering the 4th post-halving cycle , and so far, the structure appears to be rhyming closely with the previous cycle :

- Pre-halving rally took BTC to ~ FWB:73K (March 2024), indicating strong bullish momentum leading into the event.

- If this cycle follows a similar path, we may expect:

- A first major top around 9 months after the halving , potentially at or above $100K.

- A second top forming around 17 months after the halving (projected for September 2025), possibly signaling the beginning of a broader correction phase.

---

Projection: October 2026 (30 Months After Halving)

Using the same temporal framework:

- By October 2026 (30 months post-halving), the chart suggests a return to a much lower level , possibly around $50K.

- This projection mimics the post-double-top decline of the previous cycle, reinforcing the idea of cyclical mean reversion .

- It’s important to note: this isn’t necessarily bearish, but it highlights the cyclical and psychological nature of markets —boom, euphoria, distribution, and reversion.

---

The Macro View: Halving Cycles Are Rhythmic

- Every halving has historically set off a new bull run, but the timing of tops and bottoms is shockingly consistent :

- Peaks often occur 9–18 months post-halving .

- Full cycle completion is around 30 months post-halving.

- These cycles are heavily influenced by supply shocks , market psychology , and macro liquidity cycles .

---

Final Thoughts

This chart isn’t a guarantee—it’s a probability model based on cyclical symmetry. If history repeats or rhymes, we may be witnessing another textbook cycle play out, where a euphoric run in 2025 gives way to a deep correction by late 2026.

Stay alert for the double top pattern and macro divergences. Just as in 2021, timing the exit after the first peak can be the difference between profit and pain .

What do you think? Will Bitcoin follow the same 30-month post-halving trajectory?

The Road to $100k BitcoinBitcoin is most likely forming a left-translated 60-day cycle .

Expect Bitcoin to trend downward for the next month, making a lower low in this 60-day cycle and fully scaring the market.

People will start screaming “bear market” and panic-sell their coins to market makers, institutions, and patient investors.

Once that’s done, Bitcoin will resume its bull market, heading toward a market top in Q2/Q3 2025.

This would mirror 2021’s bull market behavior, align with the 4-year Bitcoin cycle, and leave enough time for the market to fully reset by late 2026.

$DXY suffers worst day since Nov 10, 2022 – What does it mean?💵 The US Dollar Index just posted its biggest daily drop in nearly 2.5 years, crashing through the 100 level with strong volume. This breakdown signals weakness in the dollar that could have massive implications across all asset classes:

📉 Why it matters:

A weak dollar makes US exports more competitive globally, but also reflects investor fear or policy shifts.

Commodities like gold, oil, and crypto tend to rally when the dollar drops.

Could indicate a pivot in monetary policy, potential rate cuts, or macroeconomic concerns.

🧠 From a technical standpoint, this break of support could trigger further downside. The last time this happened, we saw a significant shift in risk appetite.

📊 What to watch:

Upcoming Fed statements

Inflation & jobs data

Reaction in equities and crypto

👇 Is this the start of a larger trend, or just an overreaction?

Let’s discuss!

#DXY #USD #DollarIndex #Forex #Macro #MarketUpdate #Commodities #Gold #Crypto #TradingView

S&P500 vs Unemployment vs Yield CurveI'd be surprised if that was the bottom in equities. 10yr/2yr is still coming out of inversion which historically is followed by a recession and a decline in equities, and we have unemployment remaining stubbornly low with only one direction to go from current levels. Market selloffs usually mean investors lose money while main street loses jobs so we should start to see the unemployment rate begin to rise from here assuming that the tariff war isn't over.

Trump proved today that he has no intention of relenting on the new tariffs; when China retaliated with 34% tariffs on US goods, he immediately hit them with 50% tariffs. Not sure which side will cave first, but as long as there is uncertainty around US/China trade the risk for further declines in equities remains.

The previous two times the yield curve inverted, we saw 50%+ declines in equities and rising unemployment when the curve came out of inversion. There was also a short-lived inversion in 2019 with a spike in unemployment and falling equity prices due to Covid, but the Federal Reserve lowering interest rates to 0% and printing trillions of dollars kept that bear market short and sweet.

We currently have a Federal Reserve that needs higher rates to fight inflation while at the same time we have a president who wants lower rates to stimulate growth. Catch-22 for the Fed: if they lower rates, they risk reigniting inflation. If they raise rates or keep them flat during a market decline it will speed up the decline in equities. Trump knows this which is why I don't think that the tariff war and market decline are over.

$SPX Flirting With a Bear Market alongside $QQQ NASDAQ fell another 4% touching down 26%

S&P 500 walking a tight rope falling 21% to play with the idea of a Bear Market, but has rebounded a bit.

NASDAQ:QQQ did have a stronger response from buyers than SP:SPX

Nonetheless, we would need several WEEKLY closes sub 20% losses to enter a textbook Bear Market.

The S&P 500 Has Officially Entered a Bear MarketThe technical definition is simple:

✅ A decline of 20% or more from recent all-time highs.

That’s exactly where we are.

🔻 The S&P 500 has been free-falling and just hit that 20% mark.

🔴 The index is on pace to close the day deep in red — confirming what many feared:

We are in a bear market.

👀 What does this mean?

Expect continued volatility, emotional markets, and high sensitivity to macroeconomic news.

Historically, bear markets can last from a few months to over a year, depending on policy response and investor sentiment.

While painful, bear markets often plant the seeds of the next bull run 🌱 — but that doesn’t mean we’re there yet.

🧠 Time to zoom out, stay informed, and trade with caution. Capital preservation becomes just as important as returns.

What’s your strategy during bear markets? Averaging down? Hedging? Sitting in cash?

#SP500 #BearMarket #StockMarketCrash #TradingStrategy #MarketUpdate #InvestSmart

Russell 2000: How deep can the Bear Market go?As the markets navigate uncertainty, the Russell 2000 appears to have entered a #bearmarket, contrasting with other indices that are still correcting. A pressing question looms: Has the market correction concluded, or are we on the brink of a broader bear market?

Last Friday's market turmoil saw panic-like sell-offs, deeply affecting major U.S. and European #stocks with losses ranging from 6% to over 10%. Such widespread sell-offs suggest a panic reaction, possibly indicating a market bottom. However, panic alone cannot confirm this hypothesis.

To evaluate the likelihood of a deeper bear market and potential buying opportunities, several factors need consideration.

Currently, the Russell 2000 is approximately 30% down from its previous all-time high. Technically, it rests in a horizontal support zone. However, the strength of this zone is debatable. Let’s explore why.

The initial moves by President Trump to impose reciprocal tariffs have already been felt, but the reactions of other nations remain unpredictable. Should other countries react strongly or if further tariffs and legal changes are introduced by President Trump, we could be heading toward a global trade war. Such a development could compromise the support zone, potentially driving the Russell 2000 down by 50%, reminiscent of the COVID-19 pandemic drop in 2020. A target range of 1250–1200 points could thus be realistic.

If the situation deteriorates further and we revisit pandemic lows, the Russell 2000 could plummet by nearly 60%, reaching as low as 950 points, mirroring the 2020 scenario.

I've recently suggested that this scenario may be the right time to cautiously start building small positions, considering additional declines could occur. A cautious and incremental market entry is a wise strategy during such uncertain periods.

We hope this focused analysis on the #Russell2000 provides valuable insights as you navigate these turbulent times.