Berachain

BERAUSDT Major Breakout in Progress? Early Signal of a Potential📊 Full Technical Analysis

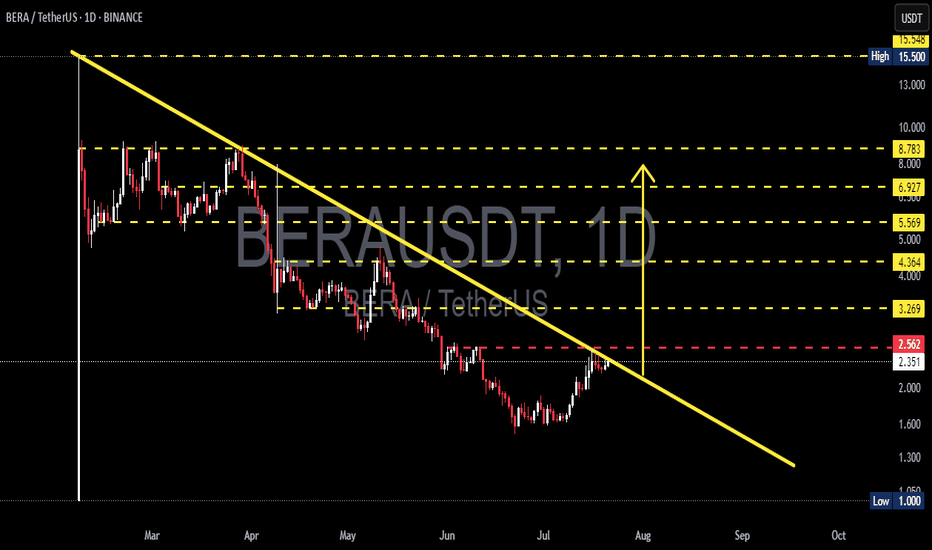

The BERA/USDT pair is displaying a highly compelling structure on the daily time frame, where the price has formed a Falling Wedge / Descending Triangle pattern over the past 4+ months.

This type of pattern often signals a large-scale accumulation phase by smart money, followed by an explosive breakout once selling pressure is exhausted and demand starts to dominate.

🧱 Pattern Structure: Falling Wedge / Descending Triangle

Descending trendline resistance (yellow line): Has suppressed price action since early March 2025

Horizontal support formed around the $1.00 to $2.00 zone (strong accumulation area)

Volume has been contracting — a typical sign of a wedge nearing breakout point

Price is approaching the key breakout zone at ~$2.56, showing early signs of reversal

---

✅ Bullish Scenario (Potential Major Reversal)

If the daily candle closes above $2.56 with strong volume confirmation, the breakout could trigger significant upside, with potential targets as follows:

Target Resistance Levels Notes

$3.269 Minor resistance + breakout confirmation level

$4.364 Previous support turned resistance

$5.569 Key historical distribution zone

$6.927 – $8.783 Mid-term targets / potential profit zones

$15.500 Long-term ATH target if momentum continues

💡 Additional Bullish Catalysts:

Volume compression aligns with classic breakout behavior

Breakouts from such macro patterns can yield 100–300% rallies in crypto markets

❌ Bearish Scenario (Rejection or Fakeout Risk)

If the price gets rejected at the trendline near $2.56 and fails to break above:

A pullback to the $2.00 – $2.35 support zone is likely

Further selling pressure may push price down to $1.00 (major support & psychological level)

A drop below $1.00 would confirm a continuation of the downtrend, forming new lower lows

🚨 Caution: Be wary of false breakouts — especially if the breakout happens with low volume or against bearish divergences.

🧠 Trading Plan & Strategy

Conservative Entry: Wait for a confirmed breakout + retest + volume confirmation

Aggressive Entry: Enter on daily candle close above $2.56

Stop Loss (SL): Below previous support: $2.30 or tighter at $2.00

Take Profit (TP): Scale out at $3.2 – $4.3 – $5.5 – $6.9 – $8.7

🧭 Conclusion: Critical Moment for a Macro Reversal?

> BERA is at a pivotal point that could define its next major trend. A successful breakout from this long-term pattern could mark the beginning of a powerful bullish cycle.

The technical setup is solid, the breakout level is near, and the reward-to-risk ratio is highly attractive — ideal for swing traders, breakout traders, and mid-term investors.

#BERA #BERAUSDT #CryptoBreakout #FallingWedgePattern #AltcoinAnalysis

#BreakoutSetup #TechnicalAnalysis #SwingTrade #CryptoSignals

#BullishReversal

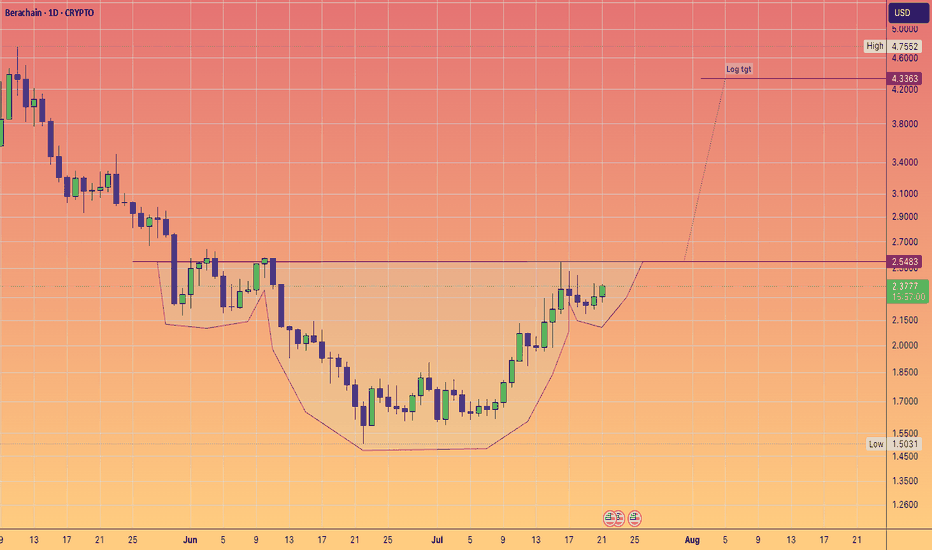

BERACHAIN Starts A Major Advance, Moving Fast (165% - 288% PP)The action never stops in a bull market. When one pair retraces a new pair starts to move forward. Choose wisely.

BERACHAIN (BERAUSDT) looks bullish to me. You can agree as I will show you the proof.

The downtrend has been broken and it is no surprise this happened after the 22-June low. We know this date to be a major turning point for many altcoins, it has been proven by the charts.

To keep it simple and short, because prices are rising fast, once the downtrend ends prices grow.

Here we have a short-term trade setup. We should see higher and higher in the coming hours and days. The bullish signals are fully confirmed; BERAUSDT is ready to move ahead. The main target can be seen on the chart. We are going for 165% but remember, it can go higher.

Thank you for reading.

Namaste.

BERAUSDT Bullish Wedge Breakout!BERAUSDT has been trading within a well-defined falling wedge pattern for the past several weeks, indicating a strong downtrend. However, recent price action shows a potential breakout from the upper trendline of the wedge, which could signal a bullish reversal.

Breakout Alert: Price has broken above the wedge resistance with strong bullish momentum.

EMA Confirmation: Price is pushing above the 50 and 100 EMAs, supporting a potential trend shift.

#BERAUSDT #1D (Bitget Futures) Descending wedge on supportBeraChain printed a bullish hammer that may have marked a double bottom here on daily.

Reversal seems around the corner, revisiting 50MA & 100EMA resistances would make sense.

⚡️⚡️ #BERA/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 4.8%

Entry Zone:

2.798 - 2.558

Take-Profit Targets:

1) 3.345

2) 3.848

3) 4.350

Stop Targets:

1) 2.120

Published By: @Zblaba

CRYPTOCAP:BERA BITGET:BERAUSDT.P #1D #BeraChain berachain.com

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +49.8% | +87.4% | +124.9%

Possible Loss= -41.7%

Estimated Gaintime= 1-2 months

$BERAUSDT (30M Chart) – Bullish Breakout in PlayBIST:BERA has broken out of the descending triangle with conviction and is now consolidating just above the breakout zone.

🔹 Triangle breakout confirmed

🔹 Retesting previous resistance as support

🔹 Holding above 200 EMA, showing momentum shift

🎯 Targets:

• TP1: $3.311

• TP2: $3.424

• TP3: $3.586

🛑 Stop-loss: $3.077 (below structure)

Momentum is shifting. Watch for a strong candle close or volume spike on the retest to confirm continuation.

Breaking: Berachain Coin ($BERA) Breaks Critical Support LevelBerachain's native coin ( BIST:BERA ) underwent a "Break of Structure" (BOS) cracking through the critical support level dipping 15% today.

It is worth noting that the EVM-identical Layer 1 blockchain that introduces Proof of Liquidity (PoL), a novel consensus mechanism aligning network security with liquidity provision has consecutively dip every week placing the asset on the cusp of reaching its 1-month low as hinted by the RSI at 21.

BIST:BERA is deeply oversold, it will need the general market to revived for BIST:BERA to make a comeback. With CRYPTOCAP:BTC faking the $80k support, most assets are in a state of respite as most of them assets mirror CRYPTOCAP:BTC 's price action.

The grit on BIST:BERA is high, the support point has already being broken. In order for BIST:BERA to make a comeback, it has to break above the 61.8% Fibonacci level which is a point that aligns with the $5- $6 price points.

Berachain Price Live Data

The Berachain price today is $3.66 USD with a 24-hour trading volume of $193,816,088 USD. Berachain is down 14.32% in the last 24 hours. The current CoinMarketCap ranking is #108, with a live market cap of $393,434,029 USD. It has a circulating supply of 107,480,000 BERA coins and the max. supply is not available.

Breaking: $BERA coin Dips 14% Today The price of BIST:BERA coin saw a 14% nosedived today amidst general crypto and stock market bloodbath that saw over $2.85 trillion wiped out from the US stock market today.

All this irregularities came as result of Donald Trump's Tax Tariff rates on Crypto currencies and stock shares.

For BIST:BERA , the RSI already hints at a weaker trend channel but BIST:BERA is bouncing off of the 78.6% Fibonacci retracement level that is acting as a support point for $BERA. However, should extreme selling pressure emerge, the 1-month low s will be force to act as support point for $BERA.

About Berachain

Berachain is an EVM-identical Layer 1 blockchain that introduces Proof of Liquidity (PoL), a novel consensus mechanism aligning network security with liquidity provision. The protocol operates on a unique two-token model: BERA (gas and staking token) and BGT (non-transferable governance and rewards token).

Berachain Price Live Data

The live Berachain price today is $5.93 USD with a 24-hour trading volume of $175,431,304 USD. Berachain is down 16.38% in the last 24 hours, with a live market cap of $637,052,141 USD. It has a circulating supply of 107,480,000 BERA coins and the max. supply is not available.

Berachain BERA price analysis#BERA price has not been drained "to zero", as is common with all newly listed coins over the past year, which is a good sign.

The OKX:BERAUSDT price is currently in consolidation without much volume, either on the buy or the sell side.

It is worth following it, especially in the range of $5.50-6, if it is not allowed to go lower, this will be the second good sign.

📈 Well, there is no ceiling from above ... what would you like to see the price of the #Berachain token?

Breaking: $BERA Surge 13% Amidst Breaking Out Of A Falling WedgeBerachain's native token ( BIST:BERA ) saw its price rise nearly 15% today after breaking out of a falling wedge pattern albeit CRYPTOCAP:BTC is still consolidating.

Berachain is an EVM-identical Layer 1 blockchain that introduces Proof of Liquidity (PoL), a novel consensus mechanism aligning network security with liquidity provision. The protocol operates on a unique two-token model: BERA (gas and staking token) and BGT (non-transferable governance and rewards token).

As of the time of writing, BIST:BERA coin is up 10.72% trading within a bullish engulfing pattern, the asset's momentum is gearing up for another legged up with a 49% surge in sight as hinted by the RSI at 69.66.

Further adding to this bullish thesis, data from Defilama shows about $3.49 Billion is locked in Total Value Lock (TVL) in the Berachain ecosystem this is for a project that is barely 2 months from debut but data shows growing interest in the ecosystem.

Berachain Price Live Data

The live Berachain price today is $8.57 USD with a 24-hour trading volume of $222,650,821 USD. Berachain is up 12.20% in the last 24 hours, with a live market cap of $920,747,642 USD. It has a circulating supply of 107,480,000 BERA coins and the max. supply is not available.

BERAUSDT SHORT 4H Based on the obtained market variables , most likely the BERA coin will continue its downward movement towards the designated targets on the chart.

I want to wait for the local price return in blocks OB 4H and FGV 4H to search for potential entry points. If the reaction is positive and the 15th TF is confirmed, I will apply a short position as indicated on the trading chart.

Targets:

$6,909

$6,019

$5.417

$4.752

Risk management - 1% on stop order

BERA Defies Market Odds: Can the Bullish Flag Lead to 30% Surge?The recently launched BIST:BERA token, built on the Berachain blockchain, has caught the attention of traders and investors after surging 8% today, defying market odds. With a well-formed bullish flag pattern, technical indicators suggest a potential rally of 30% or more if key levels hold.

Technical Analysis

BIST:BERA has been consolidating within a bullish flag pattern, a continuation signal that often precedes a significant breakout. The Relative Strength Index (RSI) is at 65, indicating strong momentum without being overbought, allowing room for further upside.

The 38.2% Fibonacci retracement level serves as key support. A break below this level could invalidate the bullish outlook and lead to a potential trend reversal.

With these factors in play, a breakout above resistance could send BIST:BERA soaring toward the anticipated 30% upside target.

Berachain's Explosive Growth

Beyond the technical setup, Berachain boasts impressive fundamentals that add to its bullish case:

- $3.212 Billion TVL: Data from DeFiLlama reveals that the Berachain ecosystem holds an astonishing $3.212 billion in Total Value Locked (TVL), an extraordinary achievement for a blockchain launched just months ago.

- $798.24 Million in Stablecoins: The ecosystem also has $798.24 million locked in stablecoins, further demonstrating the network’s credibility and adoption.

Berachain Price Live Data

As of now, BIST:BERA is trading at $8.28, with a 24-hour trading volume of $492,482,647. It has climbed 8.17% in the last 24 hours with a market cap of $890,051,046*and a circulating supply of 107,480,000 BERA.

Conclusion

With strong technical indicators and robust fundamentals, BIST:BERA is positioned for a potential rally. If it breaks out from its bullish flag pattern while maintaining key Fibonacci support, a 30% surge could be on the horizon. However, a drop below support might trigger a pullback, so traders should stay vigilant.

BERACHAINBerachain's PoL mechanism fundamentally changes how L1 economics are structured by creating an efficient marketplace between validators, users, and applications. Validators stake BERA (250K-10M) to secure the network and receive BGT rewards, which they can direct to application reward vaults in exchange for protocol incentives. This system allows chain rewards to scale with actual demand for economic security and chain liquidity.

BERAUSDTThe BERA/USDT trading pair is showing a moderate upward trend. The price is gradually increasing, indicating a steady buying interest without significant volatility. While the movement is not aggressive, it reflects a positive market sentiment. Key support and resistance levels should be monitored to assess potential breakout points or retracements.

BERA Defies Market Trends, Eyes 160% Surge Amid Bullish MomentumIn a market facing significant volatility, BIST:BERA has emerged as a top-performing Layer 1 (L1) blockchain coin, surging 13% in 24 hours and inching closer to its all-time high (ATH) of $15.20. With a resurgence in buying pressure, increased spot inflows, and a strong technical outlook, BIST:BERA is positioning itself for a remarkable recovery.

Why is BIST:BERA Pumping?

- Strong Buying Pressure: The Chaikin Money Flow (CMF) indicator stands at 0.04, signaling bullish inflows.

- Capital Movement: After witnessing $2.6 million in outflows, BIST:BERA has now recorded $316K in fresh spot inflows, indicating renewed investor interest.

- Investor Sentiment: Holders are choosing to accumulate rather than sell, reinforcing long-term confidence in the asset’s value.

Moby Expands to Berachain, Strengthening Its DeFi Ecosystem

A pivotal development for the Berachain ecosystem is the launch of Moby, the No.1 options protocol on Arbitrum, on the Berachain Mainnet. Moby has facilitated over $3.5 billion in total trading volume and is now set to transform on-chain derivatives trading within the Berachain network.

Berachain distinguishes itself as an EVM-identical Layer 1 blockchain that operates on the revolutionary Proof of Liquidity (PoL) consensus mechanism. Unlike traditional Proof-of-Stake (PoS) networks, PoL embeds liquidity provisioning directly into the security model, ensuring that validators, applications, and users benefit from a seamless and capital-efficient ecosystem.

Moby’s selection for Berachain’s prestigious Request for Application (RFA) program signals its critical role in the ecosystem. The protocol has also forged key partnerships with Kodiak, Infrared, PumpBTC, and GMX, further expanding its influence in DeFi.

Technical Outlook: BIST:BERA ’s Bullish Setup

At the time of writing, BIST:BERA is up 4%, ranking among the top-performing altcoins of the week. Despite a 65% decline from its listing price, key indicators suggest that BIST:BERA could be on the verge of a substantial breakout:

- Relative Strength Index (RSI) at 65: Holding strong, indicating sustained momentum without being overbought.

- Falling Wedge Pattern: A classic bullish reversal pattern, hinting at an imminent uptrend.

- Potential 160% Surge: BIST:BERA could aim to reclaim its previous ATH of $15.20, presenting a significant upside opportunity.

Conclusion

With a combination of **strong technical indicators, surging capital inflows, and an expanding DeFi ecosystem**, BIST:BERA is well-positioned for a significant rally. As the asset gains traction, traders and investors should closely monitor its price action, as the next leg up could be the most explosive yet.

Will BIST:BERA reclaim its ATH and set new records? The market is watching, and the momentum is undeniable.

After Losing About 65% of Value Is There Hope for $BERA?The cryptocurrency market is no stranger to volatility, and BIST:BERA , the native token of the newly launched Berachain blockchain, is a prime example. After reaching an all-time high of $15, BIST:BERA has plummeted by 65%, currently trading at around $5.37. Despite this steep decline, the token is showing signs of resilience, with a 4.68% gain in recent trading and a strong Relative Strength Index (RSI) of 54. This raises the question: Is there still hope for BIST:BERA , or is this just a temporary reprieve before further downside?

What is Berachain?

Berachain is an EVM-compatible Layer 1 blockchain that introduces a novel consensus mechanism called Proof of Liquidity (PoL). Unlike traditional Proof of Stake (PoS) systems, PoL aligns network security with liquidity provision, creating a unique incentive structure for participants. This approach aims to address some of the key challenges in decentralized finance (DeFi), such as liquidity fragmentation and inefficient capital allocation.

Two-Token Model

Berachain operates on a dual-token system:

- BIST:BERA : The gas and staking token used for transactions and securing the network.

- NYSE:BGT : A non-transferable governance and rewards token designed to incentivize long-term participation and alignment with the network’s goals.

This model is designed to foster sustainable growth and reduce speculative trading, which could benefit BIST:BERA in the long run.

Market Performance and Sentiment

Despite its recent price drop, BIST:BERA has a live market cap of $576 million and ranks #112 on CoinMarketCap. The token’s 24-hour trading volume of $432 million indicates significant interest and liquidity. However, the initial sell-off was largely driven by airdrop participants cashing out their tokens, a common occurrence in new crypto projects. This suggests that the dip may be more about short-term profit-taking than a reflection of the project’s fundamentals.

Technical Analysis

BIST:BERA is currently forming a falling wedge pattern on the charts, which is typically a bullish reversal signal. This pattern occurs when the price consolidates between two converging downward-sloping trendlines, indicating that selling pressure is weakening. A breakout above the upper trendline could signal the start of a new upward trend.

RSI Holding Strong

The token’s RSI is at 54, which is in neutral territory but leaning toward bullish momentum. This suggests that BIST:BERA is not overbought or oversold, leaving room for further price appreciation if buying pressure increases.

Key Support and Resistance Levels

- Support: The $1 mark is a critical psychological and technical support level. If the price falls further, this level could act as a strong floor.

- Resistance: The immediate resistance lies near the $6-$7 range. A breakout above this level could pave the way for a retest of higher prices.

Why is BIST:BERA Showing Resilience?

1. Innovative Technology: Berachain’s Proof of Liquidity (PoL) mechanism and two-token model are unique value propositions that could attract developers and users to the ecosystem.

2. Strong Community Interest: Despite the sell-off, the project has maintained a high trading volume, indicating ongoing interest from traders and investors.

3. Market Positioning: As an EVM-compatible blockchain, Berachain is well-positioned to tap into the growing demand for scalable and efficient Layer 1 solutions.

Risks and Challenges

- Volatility: As a new token, BIST:BERA is highly susceptible to market swings and speculative trading.

- Competition: The Layer 1 blockchain space is crowded, with established players like Ethereum, Solana, and Avalanche dominating the market.

- Adoption: The success of BIST:BERA will depend on Berachain’s ability to attract developers and users to its ecosystem.

Conclusion

While BIST:BERA has lost 65% of its value since its all-time high, the token is showing signs of stabilization and potential recovery. The innovative Proof of Liquidity mechanism, combined with a strong technical setup (falling wedge pattern and neutral RSI), suggests that BIST:BERA could be poised for a rebound. However, investors should remain cautious, as the token’s price action will largely depend on broader market conditions and Berachain’s ability to deliver on its promises.

For risk-tolerant investors, BIST:BERA represents a high-potential opportunity in the evolving blockchain space. Keep an eye on key support and resistance levels, and watch for developments in the Berachain ecosystem that could drive long-term value.

Breaking: $BERA dips -50% Just A Day After Listing. The cryptocurrency market is no stranger to volatility, and the recent performance of BIST:BERA , the native token of Berachain, is a testament to this. Launched just yesterday, BIST:BERA has already experienced a whirlwind of price action, capturing the attention of traders and investors alike. After an initial surge of 650%, the token has since dipped by 50%, currently trading at $7 per coin. This dramatic price movement has left many wondering: Is this a temporary shakeout or a sign of deeper issues?

Technical Analysis

From a technical perspective, BIST:BERA ’s price action is forming a symmetrical triangle pattern on its daily chart. This pattern is typically a continuation signal, suggesting that the asset is consolidating before making its next significant move. The key levels to watch are the upper resistance (ceiling) and the lower support (floor) of the triangle.

- Bullish Scenario: If BIST:BERA breaks above the triangle’s ceiling, it could trigger a bullish run with an estimated upside potential of 107%. This would likely attract fresh buying interest, pushing the price toward new highs.

- Bearish Scenario: Conversely, if the price fails to break out and instead falls below the triangle’s support level, BIST:BERA could test the $5 support zone. This scenario would likely be driven by profit-taking from early investors and airdrop participants.

The current price dip of 28.06% in the last 24 hours may seem alarming, but it could also be a healthy correction after the initial euphoria. The symmetrical triangle pattern suggests that the market is undecided, and the next major move will depend on whether buyers or sellers gain control.

Berachain’s Innovative Approach to Blockchain

Beyond the price action, BIST:BERA ’s underlying technology and ecosystem are worth examining. Berachain is not just another Layer 1 blockchain; it introduces several innovative features that set it apart from its competitors.

1. Proof of Liquidity (PoL): A Novel Consensus Mechanism

Berachain’s Proof of Liquidity (PoL) is a groundbreaking consensus mechanism that aligns network security with liquidity provision. Unlike traditional Proof of Work (PoW) or Proof of Stake (PoS) systems, PoL incentivizes users to provide liquidity to the network, ensuring a more robust and efficient ecosystem.

2. EVM Compatibility and Modular Design

Berachain is fully compatible with the Ethereum Virtual Machine (EVM), making it an attractive option for developers looking to build or migrate decentralized applications (dApps). Its modular design allows for the creation of customized Layer 1 blockchains without sacrificing interoperability or performance.

3. Two-Token Model: BERA and BGT

Berachain operates on a unique two-token model:

- BERA: Used for gas fees and staking, BERA is the utility token that powers the network.

- BGT: A non-transferable governance and rewards token, BGT aligns the interests of network participants by incentivizing long-term engagement.

Market Sentiment and Exchange Listings

The current market cap of $806 million and a circulating supply of 107.48 million BERA coins indicate that the token is still in its early stages. With a max supply yet to be determined, BIST:BERA has room for growth as the ecosystem matures and adoption increases.

Conclusion

While the 50% dip may deter some investors, the technical and fundamental factors suggest that this could be a buying opportunity for those with a higher risk tolerance.

As always, it’s crucial to conduct thorough research and consider your risk appetite before investing in any cryptocurrency. BIST:BERA ’s journey is just beginning, and its future will depend on both market dynamics and the team’s ability to deliver on its ambitious vision. Whether you’re a trader or a hodler, BIST:BERA is undoubtedly a coin to watch in the coming weeks and months.

Berachain BERA price analysisLet's vote on whether the next one "newly listed coin" - #BERA - will get the “kiss of death” from Binance

👍 up - if you believe that there will be a rise to $20 - $25 - $32

👎 down - to $4 - $2.80 - $2.30 - $1.8

P.S:

our voice is on the chart ;)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Berachain (BERA) Falls From $15 as Airdrop Selling Pressure MounBerachain (BERA) surged to $15 after its highly anticipated airdrop and mainnet launch, but post-airdrop selling pressure has quickly pulled the price lower. As seen with recent airdrops like HYPE and PENGU, BERA now faces a challenging path forward unless market sentiment shifts.

Key Bearish Indicators:

🔻 RSI Drops to 48 – Down from nearly 70, indicating weakening bullish strength.

🔻 CMF Falls to 0.01 – From +0.20 earlier, signaling intensified selling pressure.

🔻 Capital Outflows Increasing – Liquidity is leaving the market, reinforcing bearish momentum.

What’s Next for BERA?

📉 If RSI continues declining toward 30, it could indicate further downside movement.

📉 A negative CMF suggests sellers are in control, meaning further drops are possible unless buyers step in.

📈 However, if RSI stabilizes and CMF reverses, BERA may enter a consolidation phase before finding its next direction.

As post-airdrop trends remain weak, BERA may struggle to recover unless a strong catalyst reignites demand. Will buyers absorb the selling, or is more downside ahead? Watch these key indicators closely.

Berachain($BERA) Listed on Major Exchanges: Is a Surge Incoming?Berachain ( BIST:BERA ) has officially debuted on major exchanges, marking a pivotal moment for this innovative blockchain. With listings on Binance, Bybit, MEXC, and Bitget, BIST:BERA witnessed a sharp surge to $14 before retracing to $8, where it now holds support. The question remains—will BIST:BERA see further upside, or is another dip incoming?

The Rise of Berachain

Berachain initially started as a meme but has rapidly evolved into a revolutionary blockchain through its novel Proof of Liquidity (PoL) consensus mechanism. Unlike traditional proof-of-stake models, Berachain integrates liquidity provision into its security infrastructure. Validators are required to stake BERA tokens while providing liquidity, creating a self-sustaining ecosystem where network security scales with liquidity demand.

Key Metrics:

- Funding Raised: $142M from top-tier investors.

- Protocols Testing on Berachain: 234 projects actively exploring its ecosystem.

- Market Capitalization: $911.8M.

- Circulating Supply: 107.48M BERA.

- 24-Hour Trading Volume: $2.11M.

- Price Movement: Listed at $8, surged to $14, currently retraced to $8.48.

With these impressive fundamentals, Berachain is positioning itself as a serious contender in the Layer-1 blockchain space.

Technical Analysis:

Despite its recent retracement, BIST:BERA ’s price action remains constructive. The listing catalyzed an initial spike to $14, but profit-taking pushed prices back to key support at $8. Here’s what the technicals suggest:

Key Support and Resistance Levels

- Immediate Support: $8 (psychological and historical level)

- Major Resistance: $14 (listing peak)

- Potential Target: $20-$50 if bullish momentum sustains

2. Moving Averages & RSI

- While the trading history is still limited, a moving average crossover on lower timeframes suggests a potential reversal.

- The Relative Strength Index (RSI) is cooling off from overbought levels, indicating a healthy consolidation before another leg up.

3. Breakout Patterns & Volume Analysis

- Bullish Flag Formation: The recent price action suggests a potential bullish flag, signaling accumulation before the next breakout.

- Volume Confirmation: While overall trading volume has been volatile, sustained liquidity from exchange listings could act as a catalyst for a continued uptrend.

What Sets Berachain Apart?

Berachain’s two-token model further enhances its economic security:

- BIST:BERA (Gas & Staking Token): Used for transactions and securing the network.

- NYSE:BGT (Governance & Rewards Token): Non-transferable, incentivizing validators and network participants.

This unique system ensures that rewards scale with demand rather than being diluted, which could sustain long-term value appreciation.

Market Sentiment & Future Projections

- Short-Term Outlook: With a strong support zone at $8 and growing adoption, BIST:BERA could see a retest of $14 and a breakout toward $20 if volume and sentiment remain positive.

- Mid to Long-Term Potential: Given its robust PoL model, strategic partnerships, and significant backing, a $50 price target isn’t unrealistic in a bullish market cycle.

Conclusion: Dip or Surge?

Berachain’s fundamentals and technical indicators point toward strong upside potential despite its recent pullback. With its innovative PoL consensus, growing developer ecosystem, and major exchange listings, BIST:BERA is poised to capitalize on the current market trend. If bullish momentum builds, a significant rally could be on the horizon. However, traders should monitor support at $8 and volume inflows for confirmation before making a move.

Will BIST:BERA surge past $20 or dip further? The coming weeks will be crucial for its price trajectory.