What's Nifty Next?With rising tensions between countries, market sentiment is becoming increasingly cautious. This geopolitical uncertainty is likely to weigh heavily on investor confidence in the coming weeks.

Based on the current scenario, a realistic target for Nifty seems to be around 21,000 by July, especially if the negative sentiment continues and foreign institutional investors (FIIs) remain net sellers. Global cues, crude oil prices, and currency fluctuations could further impact the index's performance.

📌 However, if by any chance Nifty manages to close above 25,500, it would indicate an extremely strong bullish breakout, defying current market fundamentals. Given the present conditions, this seems highly unlikely, unless there is a sudden positive catalyst such as:

A major resolution in geopolitical issues

Strong corporate earnings

Aggressive policy support from the government or RBI

🧠 My Take:

For now, it’s wise to remain cautious and watch key support/resistance levels. Volatility may remain high, and short-term traders should manage their positions carefully.

💬 Let me know your thoughts in the comments below. Do you think 21k is coming soon, or can the bulls surprise us all?

Beyond Technical Analysis

TESLA ANALYSIS CAN WE HIT 380? Evening everyone

Here is the analysis on Tesla currently:

Thesis For Bullish: If we break the highs of 336 then we can hit levels of 380 or higher

Thesis for Bearish: If we break the low at 298 then a drop down to 291 then 275 makes sense

Trade Smarter Live Better

Kris/Mindbloome Exchange

$XRP Historical Golden Ratio - Weekly Timeframe The Historical Golden Ratio (HGR) is the Fibonacci-based market analysis methodology that I created in 2020 (but really discovered). It identifies critical price inflection points by applying Fibonacci in a very unique and fundamental way. It may appear complex from the outside to new and even experienced technical analysis, but under the hood is a very simple and logically built engine that only has two critical parts really. However, it reveals an underlying structure within markets that appears to be fractal-based and dictated by the Golden Ratio. For the experienced market participant, time behind the wheel will reveal that the driving force behind markets has been in plain sight all along; M = φ * H(t) * e^(k * I(t))

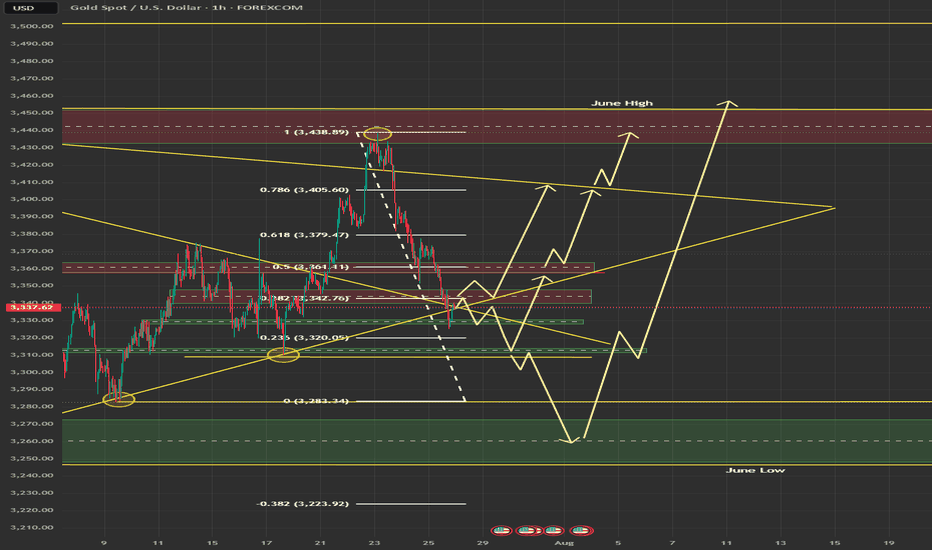

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

Gold Weekly Outlook (XAUUSD) -28th JulyGold Enters a High-Stakes Week

This week sets the stage for major moves in gold. The charts are signalling liquidity grabs, premium compression, and volatility driven by upcoming macro catalysts.

Key events ahead:

Tuesday: ADP Employment Data

Wednesday: The Fed

Gold is currently consolidating beneath a critical supply zone, suggesting potential for a breakout or rejection. We'll align macro drivers with Smart Money Concepts, ICT methodology, Fibonacci levels, EMAs, RSI, and Fair Value Gaps to craft a precise trading framework.

Technically, price action reflects a corrective phase within a broader uptrend. Confluence support from the ascending trendline and a key horizontal level is in play. As long as price remains above 3342, a bounce toward 3400 remains the preferred scenario.

The broader bullish structure and underlying momentum suggest that once this retracement completes, the uptrend may resume with strength.

🟡 – Summary

🔹 Macro & HTF View:

Bias: Bullish but weakening under premium supply

Key Events: ADP (Tue), FOMC (Wed) → potential for liquidity grabs

Indicators:

RSI divergence (75 → 66)

EMAs flattening

Unfilled FVGs above (3365–3405) and below (3280–3320)

Key Fib targets: 3405 (127%) and 3439 (161.8%)

🔸 Weekly Key Zones

Supply (Short Trap): 3350–3439 → heavy confluence, short bias unless W1 closes above 3439

Primary Demand: 3220–3285 → ideal for news-driven long

Deep Discount (Long Only if Panic): 2960–3050

🎯 Strategy Summary

Short Setup:

Target 3350–3439 → wait for rejection after news

Long Setup:

Target 3220–3285 or deeper

Look for wick rejections + bullish structure reclaim

Avoid: 3285–3350 → indecision zone

🧭 Daily Zones

Sell Zone: 3345–3415 → trap area with FVG + Fib + EMA confluence

Buy Zones:

3290–3320 (primary)

3240–3270 (deeper)

3000–3140 (only if USD spikes)

⏱ H4 + Intraday Bias

Bias: Bearish below 3350

Short Zones:

3365–3405 (rejection only)

3355 (flip zone)

Buy Zones:

3290–3310 (reclaim setup)

3250–3280 (panic flush)

📌 Key Intraday Levels

Resistance: 3405, 3385, 3375–3350, 3350–3340

Support: 3314–3302, 3289–3272, 3260, 3240

⚠️ Final Execution Notes

Stay out of 3340–3326 zone – it’s chop

Wait for confirmation candles (engulfing, pin bars, OB reactions)

Discipline over prediction. Sniper mode only.

Disclaimer: For educational context only.

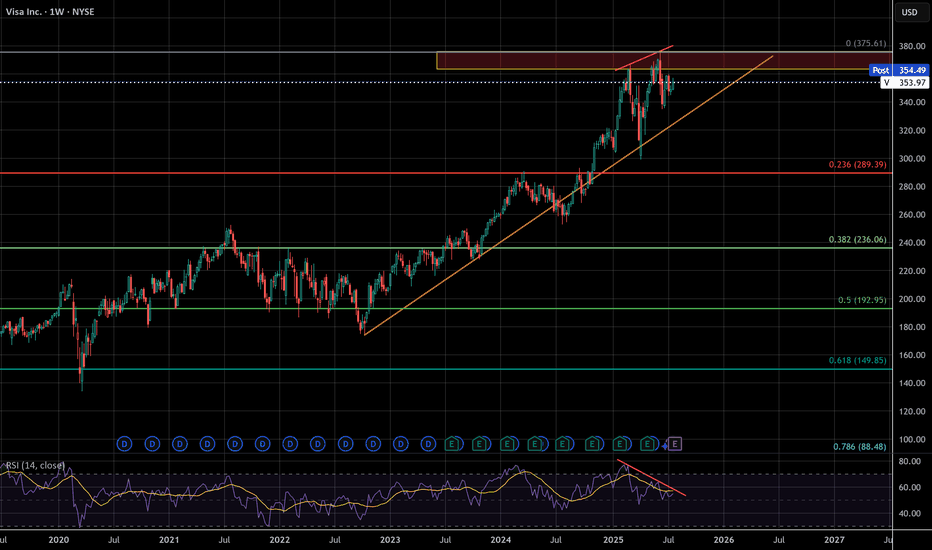

VISA - The missing puzzle piece - Suffering from successI've seen a lot of negative sentiment online lately about the impending bubble, but even with social media, crude AI, and the US dollar being the peak of that negativity this whale has been dying slowly and few have taken notice.

VISA has begun to censor what can be bought, overcharge merchants, and short change banks on interchange fees. These are acts of desperation as growth reaches diminishing returns, the beginning decline of a massive company. Think about it, who isn't using visa already? They have to wait for new users to be born. There will only ever be more competition, competition that has superior speed, accuracy, efficiency, and cost.

VISA may not lead this crash, but it's days look to be numbered unless they make radical changes . According to google results, antitrust violations can carry 3 times the monetary penalty gained from illegal activity. I don't think this will happen, but it's a TON of leverage for a massive settlement. The cracks are just beginning, but this company is made of glass

STELLAR LUMENS - DOLLAR COST AVERAGE FOR LONG TERM GAINSSTELLAR LUMENS (XLM) has taken off late 2024 from under .10 cents and now trading at .40 cents for a 400% Gain in 6 months so far, and there is much more upside to come potentially. It hit all time highs around .50 cents and now the token seems to want to test those highs in the near term 2025, we can easily see XLM approach $1.00 towards 2026 for a 100% gain and even higher longer term. Overall, XLM moves with XRP and we all know XRP is a blue chip project, it has all the funds and institutional backing, and so does XLM.

Both projects share a common creator in Jed McCaleb, however they have different focuses. Ripple, and its native token XRP, was initially designed to facilitate cross-border payments for financial institutions. Stellar, on the other hand, focuses on financial inclusion and aims to provide accessible financial services for individuals, including remittances and access to banking services.

CAN WE SAY BULLISH?! TO THE MOON!!!

GOLD prep work to ATH retap has started. seed at 3270!First thing first.

Diagram above is in reverse metrics (USDXAU)

--------

GOLD, has been met with some well deserved respite on price growth after a series of parabolic highs this past few weeks. And this healthy trims are warranted in the grand scheme of things -- to sustain its upward trajectory. A price rest is definitely welcomed.

Now based on our latest daily metrics, gold is showing some low key hints of shift -- it may not be visible to 99% of traders -- but it is there now to magnify.

Diagram above is in reverse metrics (USDXAU). It is currently showing some pressure expansion for bears and hinting of prep work to reverse.

This is a precursor of a massive structure change-- for that elusive upside continuation.

On the daily metrics, we got some hop signals here as well from -- first one in a while. Price baselines detaching itself from the descending trend line. There maybe something here now. A good zone to seed on the most discounted bargain levels -- with safety.

Spotted at 3260.

Interim mid target: ATH at 3500

Long term. 4k++

Trade safely.

TAYOR.

BTC Dominance Breaking Out — Rotation Incoming?BTC Dominance just broke a major downtrend and is holding above the breakout level — a possible shift in market control.

📌 If dominance continues higher, altcoins may lag

📌 Resistance zone at 62.5% could cap the move

⏱️ Timeframe: 1H

#btcd #bitcoin #altseason #dominance #marketcycle #quanttradingpro #tradingview

USOIL GROWTH AHEAD|

✅CRUDE OIL broke the key

Structure level of 69.50$

While trading in an local uptrend

Which makes me bullish biased

And I think that after the retest of the broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTCUSD – Descending Channel or Bullish Flag?BINANCE:BTCUSDT – Market Maker’s Game Inside a Descending Channel

Timeframe: 2H | MJTrading View

Market Structure Overview:

Bitcoin recently printed a new ATH at $122,000 after a parabolic run from the previous ATH at $111,937.

Since then, price has been consolidating inside a descending channel, which could act as a bullish flag in higher timeframes.

Liquidity pools are clearly formed:

Above $122K – resting stops of late shorts.

Below $115K–$114K – weak long stops and untapped demand near the Order Block (OB).

Key Levels & Liquidity Zones:

Upside:

$122K Liquidity Pool → If swept, could trigger momentum towards $124K–$125K.

Downside:

$116K OB → First defensive zone for bulls.

$112K Strong Support → Aligns with previous ATH breakout base.

Market Maker’s Dilemma:

If you were a market maker… which liquidity pool would you hunt first?

Price is coiling tighter within the channel, and both scenarios are possible:

Upside Sweep → Rapid breakout above $122K to clear shorts, then potential continuation.

Downside Sweep → Sharp drop into $116K–$112K liquidity, flushing longs before any recovery.

⚡ MJTrading Insight:

This is the classic market maker compression – first sweep likely determines direction.

Patience here is key; let the liquidity tell the story.

#BTCUSD #Bitcoin #Liquidity #SmartMoney #PriceAction #MJTrading #ChartDesigner #CryptoAnalysis

Psychology Always Matters:

Daily Analysis- XAUUSD (Thursday, 31st July 2025)Bias: Bearish

USD News(Red Folder):

-Average Hourly Earnings m/m

-Non-Farm Employment Change

-Unemployment Rate

-ISM Manufacturing PMI

Notes:

- No rate cut imposed, no decision made on September rate cut

- Looking for continuation to the downside

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3310

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

SPY Back from the Dead! Gamma Reclaim or One-Day Trap? Jul 31SPY Back from the Dead! Gamma Reclaim or One-Day Trap? 638 is the Battleground

🔍 GEX & Options Flow Insight (1st Image Analysis)

SPY surged off strong PUT support at ~630 and is now pressing into the CALL Resistance wall at 633–634, with upward momentum and a surprising gamma flip. However, it's running right into a stacked supply zone just below the next big Call Wall at 638.

* Call Walls & Resistance:

* 📍 633.78–634.34 → CALL Resistance + HVL zone

* 📍 636.39 → 2nd Call Wall (38.27%)

* 🧱 638.88–639.88 → GEX10 territory = squeeze potential, if bulls hold

* Put Support Zones:

* 🛡️ 632.00–631.00 → Flip zone from PUT-dominated to long gamma

* 🚨 629.73 → Highest negative NET GEX = anchor support

* 📉 626.19 → Breakdown risk zone

* Volatility Insight:

* IVR 14.9, IVx Avg 16.2 → Low volatility = cheap contracts

* PUTs Dominant at 72.3% = Dealer long gamma positioning

* GEX sentiment: 🟢🟢🟢 → Reversal confirmed into bullish territory

✅ Option Trading Suggestion:

Bias: Reversal long, but cautious at 638–640 resistance

Strategy: Vertical debit call spread or butterfly

* Entry Idea: Buy 636C / Sell 640C for Aug 2 or Aug 5 expiry

* Aggressive alternative: Naked 638C if breakout continues with volume

* Invalidation: Strong rejection + close back under 634

* Target: 638.88 → potential extension to 640–641.5

Why this works: SPY is squeezing dealers short from earlier PUT dominance. The reclaim above 633 into the gamma-neutral zone triggered forced hedging. If momentum holds above 636, short calls must be covered → squeeze scenario.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🔄 CHoCH → BOS → CHoCH → BOS again = high volatility reversal sequence

* SPY just broke out of descending wedge and reclaimed supply

* Current price is inside a major supply zone (purple box 636–639)

Trendline Dynamics:

* Broken wedge trend now back-tested

* Price at upper channel boundary — watch for rejection or breakout confirmation

SMC Zones:

* 🟥 Supply Zone (Purple Box): 636–639.88 → historical resistance

* 🟩 Demand Zone: 631–632.5 → HVL flip zone + previous OB

* 🚨 Breakdown below 629.73 → back into bearish territory

🔄 Price Action & Key Levels

* Support:

* ✅ 634.34 → 633.78 → Flip zone from gamma trap

* ✅ 631.00 → 629.73 → OB + Put Wall cluster

* 🔻 626.19 → Final support before further downside opens

* Resistance:

* 🚩 636.39 → 638.88 → Multiple Call Walls + supply

* 🧱 641.65 → Next upside zone = GEX extension if breakout

🧭 Scalping / Intraday Trade Setup

🟩 Bullish Setup (Preferred Now):

* Entry: 634.00–635.00 breakout hold

* Target 1: 638.00

* Target 2: 641.00

* Stop: Below 632

🟥 Bearish Fade Setup:

* Entry: Rejection at 638.88 + high-volume stall

* Target 1: 634.50

* Target 2: 631.50

* Stop: Breakout above 640

🔁 Summary Thoughts

* SPY is in recovery mode, reversing from a gamma-led flush and now facing resistance at a stacked CALL wall zone.

* Dealer positioning flipped positive. If bulls hold above 636, 640+ is realistic.

* However, failure to break 638.88 will turn this into a short squeeze fade.

* Scalpers can ride the momentum if price consolidates above 634. Rejection at 638 is the line between breakout and fakeout.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

AMZN Launches Out of Trap Zone! What's next on Jul 31AMZN Launches Out of Trap Zone! Will Gamma Push Us to 245+ or Fakeout from Supply?

🔍 GEX & Options Flow Insight (1st Image Analysis)

AMZN broke out aggressively from a coil and is now trading at $237.50, right under the Gamma Wall and 2nd Call Wall. Gamma positioning shows bullish momentum potential, but current price is sitting just beneath the highest resistance zone.

* Call Walls & Resistance:

* ✅ $237.50–240.00 → 2nd Call Wall (66.63%) and Gamma Wall

* 📍 $245–247.5 → GEX8 / GEX7 → Final gamma expansion ceiling

* Put Support Zone:

* 🛡️ $231.01–230.31 → Immediate bounce zone

* 🔻 $225 / 222.18 → 3rd PUT Wall and true gamma defense layer

* Strong PUT flow at ~217.5 → Risk level for breakdown

* Volatility Insight:

* IVR: 21.4, IVx Avg: 45.4 → Normal volatility, not overly juiced

* Call flow only 11.3% = moderate bullish, not euphoric

* GEX status: 🟢🟢🟢 → Full bullish gamma support

✅ Option Trading Suggestion:

Bias: Bullish continuation above 234.00, but cautious at 237.50–240

Strategy: Debit Call Spread (conservative)

* Entry Idea: Buy 235C / Sell 240C (Aug 2 or Aug 9 expiry)

* Invalidation: Rejection below 233.20 or bearish engulfing under 231

* Target: 240 → 245 zone on squeeze

Why this works: Gamma positioning is stacked toward the upside and dealers are likely still short calls. Price just reclaimed the entire prior range — breakout traders are being trapped if this stalls under 238. If bulls stay above 234.72, a move toward 245 is likely.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* ✅ CHoCH → BOS → 2nd CHoCH → strong BOS confirmed with today’s breakout

* 🚀 Price ripped out of descending wedge + liquidity trap below 230

* Purple Supply Zone (237.5–240) now in play as potential final resistance

Trendline Analysis:

* Long-term wedge broken to the upside

* Channel upper bound rising into 240–245 zone

SMC Zones:

* 🟩 Demand / OB Zone: 230.00–231.01 → Major flip zone

* 🟥 Supply Zone (Purple Box): 237.50–240.00 → If rejected, will trap late bulls

🔄 Price Action & Key Levels

* Support:

* ✅ 234.00–234.72 → Local structure support

* ✅ 231.01–230.31 → Flip zone and invalidation level

* 🔻 222.18 → 3rd PUT Wall → downside defense

* Resistance:

* 🚩 237.5–240.00 → Gamma Wall and supply resistance

* 🚀 245.00–247.50 → Final GEX extension zone

🧭 Scalping / Intraday Trade Setup

🟩 Bullish Setup:

* Entry: 234.50–235.50 (on retest)

* Target 1: 238.00

* Target 2: 240.00 → 245.00 extension

* Stop: Under 231.00 (invalidation)

🟥 Bearish Pullback Setup:

* Entry: Rejection at 237.50–238.00

* Target 1: 234.00

* Target 2: 231.50

* Stop: Close above 240

🔁 Summary Thoughts

* AMZN printed a clean breakout with volume, reclaiming full structure from CHoCH.

* GEX layout supports bullish continuation with targets toward 245 if 238–240 breaks.

* Price is in the final squeeze zone — gamma momentum + dealer hedging = fuel.

* Caution for late bulls: if AMZN stalls here and breaks under 233, it’ll retrace fast to 230–228.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

NVDA Squeezes to $187 or Pullback from Supply? Jul 31NVDA Explodes into Gamma Cloud! Squeeze to $187 or Pullback from Supply?

🔍 GEX & Options Flow Insight (1st Image Analysis)

NVDA just broke through major resistance and is trading at $183.35, sitting in the middle of stacked Call Walls and a strong positive GEX zone. Gamma positioning is highly bullish—but a stall near current levels is possible as dealers begin to hedge less aggressively.

* Call Walls & Resistance:

* ✅ $180.00 → Highest positive NET GEX zone

* ✅ $182.5 → 2nd Call Wall (68.77%) — current area of battle

* 🧱 $187.5–190.0 → GEX9 and GEX10 zones = possible squeeze targets

* Put Support:

* 🛡️ $175.18–175.51 → Strong PUT Support zone and demand on price chart

* 🔻 $172.5 → HVL zone = invalidation for breakout thesis

* Volatility Insight:

* IVR 12.6, IVx Avg 41.7 → Neutral-to-low IV

* Calls Bias: 15.4% → Slightly bullish, but not euphoric

* GEX sentiment: 🟡🟢🟢 = Cautiously Bullish

✅ Option Trading Suggestion:

Bias: Bullish with caution around 185

Strategy: Vertical debit call spread

* Entry Idea: Buy 182.5C / Sell 187.5C for Aug 2 or Aug 9

* Stop: Close below 179.65 (trap candle base)

* Target: 187.5 (GEX9 ceiling)

Why this works: NVDA is entering a highly stacked gamma region. If bulls hold above 182.5, momentum may carry price toward the outer GEX bands at 187.5. However, IV is not stretched, so premium decay is a risk—spreads protect against it.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* ✅ CHoCH → BOS → BOS confirmed since July 29

* 🚀 Strong bullish continuation from discounted OB area near 175

* NVDA is currently riding mid-upper range of an ascending channel

Trendlines:

* Perfect channel structure respected since July 25

* Currently touching upper channel resistance around 183.35–184.50

SMC Zones & Supply/Demand:

* 🟩 Demand Zone: 175.18–177.32 → Last bullish OB

* 🟥 Supply/Exhaustion Zone: 183.5–185 (purple box) → caution here

🔄 Price Action & Key Levels

* Support:

* 📌 179.65 → Key structure base (trap candle)

* ✅ 177.32–175.18 → Demand + OB + GEX Put Support

* ❗ Below 172.5 = structure breaks

* Resistance:

* 🚩 183.35–185.00 → Supply + top channel + GEX7

* 🧨 187.5–190.0 → GEX9/GEX10 extension zone = possible parabolic breakout

🧭 Scalping / Intraday Trade Setup

🟩 Bullish Setup (Preferred):

* Entry: 182.50–183.00 breakout

* Target 1: 185.00

* Target 2: 187.50

* Stop: 179.65 break & hold

🟥 Bearish Pullback Setup:

* Entry: Rejection at 184.5 supply zone

* Target 1: 180.00

* Target 2: 177.30

* Stop: New high above 185.5

🔁 Summary Thoughts

* NVDA is showing classic breakout behavior with gamma fuel behind the move.

* SMC and structure are fully bullish, supported by rising channel and BOS continuation.

* Price is approaching a key exhaustion zone, so either it breaks through to 187.5 or pulls back to retest 179–177.

* Intraday long trades are favored above 182.5. Swing traders should wait for a dip to demand or a clean breakout above 185.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

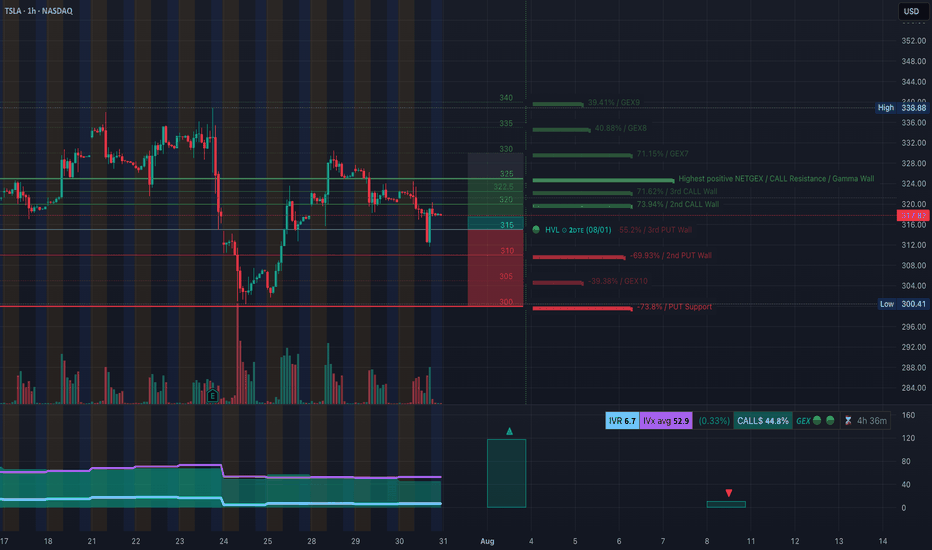

TSLA Breaks Bull Structure - Gamma Trap or Breakdown? Jul 31TSLA Breaks Bull Structure — Gamma Trap or Breakdown? Watch 315/300 Closely!

🔍 GEX & Options Flow Insight (1st Image Analysis)

TSLA is trading at $317.82, having just lost support at the 2nd Call Wall ($322.5) and now hovering near key PUT Wall clusters. Options positioning reveals strong downside pressure unless bulls reclaim 321+.

* Call Walls / Resistance:

* 📍 $322.5 → 2nd Call Wall (73.94%) — recently rejected

* 📍 $324.5–328 → Heavy net GEX zones and dealer resistance

* 📍 $336–338 → 3rd Call Wall + GEX9 — parabolic ceiling

* Put Walls / Gamma Risk Zone:

* 🔻 $316.0 / $312.0 → GEX transition zone (dealer flip risk)

* 🔻 $305.0 / $300.4 → Major PUT Support (73.87%) and HVL demand

* Extreme risk below $300 → Gamma cascade toward $290

* Volatility Insight:

* IVR 6.7, IVx Avg 52.9 → Low relative IV = cheap options

* Call Bias: 44.8% → Dealers still net short calls, but flows are softening

✅ Option Trading Suggestion:

Bias: Leaning bearish below 321.2, bearish confirmation under 315

Strategy: Bearish vertical or put debit spread

* Entry Idea: Buy 315P / Sell 305P for Aug 2 or Aug 9 expiry

* Aggressive alt: Naked 310P or 305P if breakdown confirmed

* Invalidation: Reclaim 321.20 with volume = close or reverse

Why this works: Dealer gamma exposure has flipped to negative under 316. If TSLA fails to hold above 315, dealers must hedge by selling into weakness, potentially accelerating downside toward 300.4–305.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 Recent CHoCH confirmed on July 30 — bearish shift

* ❌ Failed to hold BOS structure from July 29 → trendline break

* ⚠️ Currently retesting broken structure as resistance (321.20–324.50)

Trendline Dynamics:

* 📉 Break below upward sloping trendline confirmed → downside pressure

* New bearish structure forming lower highs under OB zone

SMC Zones & Reversal Blocks:

* 🔴 Supply Zone (Purple Box): 321.2–324.5 → Rejected twice, now acting as resistance

* 🟩 Demand Zone (Green Box): 312–315.25 → Minor bounce zone; if fails, opens flush to 305–300

🔄 Price Action & Key Levels

* Support Levels:

* 🔻 315.25 → 312.00 → Minor demand + retest zone

* ⚠️ 300.41 → PUT Support + HVL zone (gamma wall)

* 🚨 Below 300 = fast move to 290

* Resistance Levels:

* 🚫 321.20 → 324.50 → Supply zone (order block + 2nd Call Wall)

* 🧱 330.48 → 336 → Next upside wall if bulls reclaim trend

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Scenario (Preferred for Now):

* Entry: 316.00–317.00 rejection

* Target 1: 312.00

* Target 2: 305.00

* Stop: 321.50 reclaim

🟩 Bullish Reversal Scenario (Low Probability):

* Entry: Only on breakout and close above 324.50

* Target: 330.00 → 336.00

* Stop: 321 intraday flip back down

🔁 Summary Thoughts

* TSLA broke bullish market structure with a clean CHoCH and is now trading under OB resistance.

* Gamma positioning supports further downside if price stays under 321.

* Strong Put Walls at 305–300 create a natural magnet if breakdown continues.

* Option premiums are relatively cheap — attractive for directional plays.

* Scalpers and swing traders can ride the downside with tight stops; bulls must wait for reclaim above 324.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

AUD_USD BEARISH BREAKOUT|SHORT|

✅AUD_USD broke the key

Structure level of 0.6460

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of

The broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PLTR Breaking Out or Bull Trap? Jul 31PLTR Breaking Out or Bull Trap? Options Flow Says Bulls Might Win!

🔍 GEX & Options Flow Insight (1st Image Analysis)

PLTR is pushing into key resistance around $159.77, just under the 2nd CALL Wall at $161.44, with massive gamma clusters building overhead. Here's the breakdown:

* Call Walls & Gamma Resistance:

* 📍 $159.77 → Current wall that price is testing

* 📍 $161.44 → 2nd CALL Wall / Highest positive NET GEX

* 📍 $165–168 → 3rd Call Wall and deeper GEX levels = high resistance/squeeze potential

* Put Support Zones:

* 🔻 $155.00 / $153.00 / $151.06 → Multiple layers of liquidity and support

* 🛡️ $145.00 → 3rd PUT Wall = Strong downside defense

* Volatility Metrics:

* IVR: 35.4, IVx Avg: 73.5 → High IV suggests elevated premium

* Calls Flowing Heavy (40.4%), Bullish GEX 🌕🟢🟢

* Options sentiment is decisively bullish with strong open interest at upper walls

✅ Option Trading Suggestion:

Bias: Bullish momentum with caution at overhead resistance

Strategy: Debit Call Spread or Vertical Fly

* Entry Idea: Buy 160C / Sell 165C (or 168C) for Aug 2 or Aug 9

* Risk: Price must hold above $156.24 to remain valid

* Target: $161.44 → $165.00 if gamma squeeze plays out

Why this works: PLTR is pressing into a GEX transition zone. If price breaks through $161.44 with volume, dealers will likely hedge net short exposure by buying more, pushing toward $165+. But risk is tight — failure to break 160 convincingly can lead to fast reversal.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis below)

Market Structure & SMC:

* ✅ CHoCH → BOS confirmed mid-July, with aggressive bullish structure

* ⚠️ CHoCH again on July 30 = possible trap or reload

* Price now retesting previous BOS zone under supply

Trendline Analysis:

* Ascending trendline holding support from July 29 to now

* Price approaching upper wedge resistance around $160–161

SMC Zones:

* Order Block Support: Around 156.24–154.91

* Reversal Zone / Supply: Purple box between 159.77–161.44 → Caution for fakeout traps

* Below 153.06, liquidity opens to HVL gap zone at 151–145

🔄 Price Action & Key Levels

* Support:

* ✅ 156.24 → Critical order block + trendline confluence

* ✅ 154.91 → Confirmed demand wick

* 🔻 151.06 → Liquidity base

* ⚠️ 145.00 → 3rd PUT Wall (GEX-based demand)

* Resistance:

* 🔼 159.77–161.44 → Major supply + 2nd Call Wall = high-conviction resistance

* 🚀 165.00 → Next wall for gamma expansion

* 🧨 Above that → Blowoff zone (168+)

📉 Bearish Reversal Zone

If price fails to close above 160 or gets rejected from 161.44, watch for:

* Breakdown to 156.24 → If this fails, opens up to 154.91 then sweep to 151.06

* Options IV is high → risk of premiums collapsing on rejection, so avoid chasing long OTM calls

🔁 Summary Thoughts

* PLTR is coiling tightly under a strong gamma ceiling with a bullish structure intact.

* Option flow shows aggressive CALL positioning, suggesting bulls are betting on breakout.

* Smart money might be stacking up before pushing through 161.44 — or could trap retail and unwind.

* Day traders can long above 157.5–158 on dips toward 160–161.44. Swing traders should avoid entries until breakout confirmation or dip to OB.

* Watch gamma squeeze to 165 if bulls break structure.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

GOOGL Eyeing Gamma Squeeze to $202? Jul 31GOOGL Eyeing Gamma Squeeze to $202? Smart Money Sets the Trap!

🔍 GEX & Options Flow Insight

GOOGL is trading around $196 and sitting just under the 2nd Call Wall at $197.5, with a visible Gamma Wall / Resistance around the psychological $200 level. Here's how GEX is positioned:

* Call Walls:

* 📍 $197.5 → Current hot zone (2nd CALL Wall — 91.21%)

* 📍 $200.00 → Highest Positive NET GEX / Gamma Resistance

* 📍 $202.5 and above → Extreme GEX buildup with potential squeeze fuel

* Put Support:

* 🚨 $188.41 → Strong PUT Support (−16.52%)

* 🔻 Below that: Risk increases toward $187.5 (major demand zone)

* Volatility Context:

* IVR 15.8 and IVx Avg 31.1 → IV is relatively low

* Calls Outweigh Puts (12.6%) → Bullish GEX skew

* Green GEX, Green Sentiment, Long Gamma Zone Active

✅ Option Trading Suggestion:

Bias: Moderately bullish with potential for gamma-driven breakout

Strategy: Debit Call Spread or Naked Call if aggressive

* Entry Idea: Buy GOOGL 195C / Sell 200C (or 202.5C) for Aug 2 or Aug 9 expiration

* Risk: Tight invalidation below 194.50 (under price structure)

* Target: $200–202.5 (Gamma Wall exhaustion)

Why this works: Price is coiled just under a heavy call wall. If GOOGL pushes above $197.5 with volume, gamma hedging can amplify the move to $200+ — where dealers are net short calls and may have to buy shares to hedge.

🧠 Technical Analysis (1H Chart)

Market Structure:

* ✅ Bullish Break of Structure (BOS) confirmed on July 29

* ⚠️ Change of Character (CHoCH) seen on July 30 with a mild pullback

* Currently trading inside a rising channel, respecting trendline support

Trendline:

* Upper trendline rejection seen at ~198

* Lower channel support aligning near 195–195.5

Smart Money Concepts (SMC):

* Order Block Zone formed around 195.75–195.97 = current support

* Premium/Discount zone separation validates possible retest and continuation

* Purple Box = Supply Zone → Sellers active below 198.50

🔄 Price Action & Key Levels

* Support Zones:

* 📌 195.75–195.97 → Order block + Trendline

* 📌 194.91 → Minor support + fib confluence

* 🚨 191.56–190.85 → Liquidity pocket below CHoCH

* Resistance Zones:

* 🚩 197.5–198.5 → Call Wall + Prior swing highs

* 🔼 200.0–202.5 → Gamma squeeze zone / possible parabolic move

📉 Bearish Reversal Zone

If GOOGL fails to reclaim 197.5 or gets rejected again at 198.5:

* Expect retracement toward 195.7 → 194.91

* Breakdown below 194.91 → Opens test of CHoCH zone and fills inefficiency to 191–192 range

🔁 Summary Thoughts

* GOOGL is consolidating near a high-conviction breakout zone.

* GEX flow favors bullish continuation with strong gamma clustering above.

* Smart Money has already swept liquidity and flipped structure; bulls are in control if they defend the OB.

* Scalpers can long dips to 195.75 with stop under 194.91, targeting 198–202.

* Avoid calls above 202.5 unless new GEX builds show extended flow.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market at 23613-23625

STOP LOSS AT 23720

Once the NAS pull back toward 23580-65 - BRING STOP LOSS TO BE

TARGET 1: at 23540-20

TARGET 2: at 23480-65

LETS GO