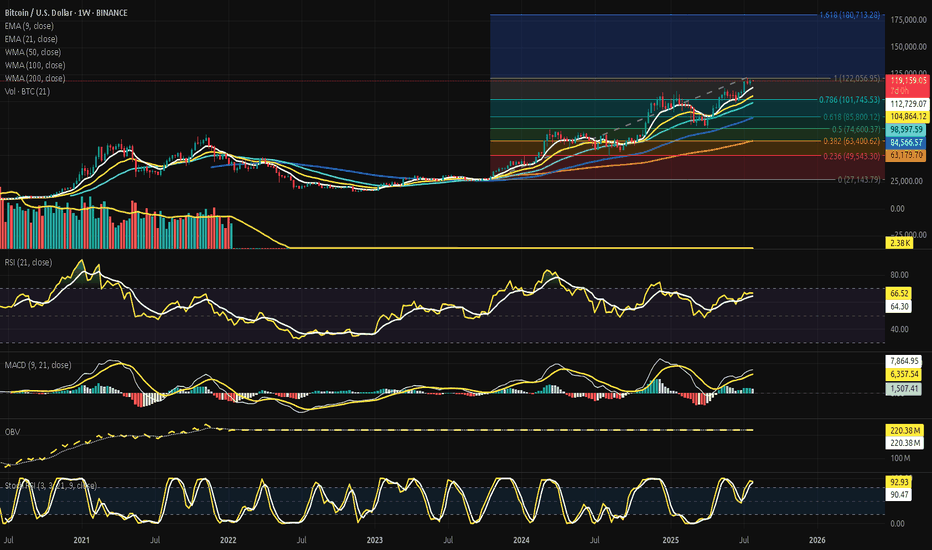

Bitcoin Weekly Seal at the Threshold 122K - No Gaps, No Retreat.⊣

⟁ BTC/USD - BINANCE - (CHART: 1W) - (Jul 27, 2025).

◇ Analysis Price: $119.374,00.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1W):

▦ EMA9 - ($112.771,21):

∴ The weekly close remains above the EMA9, preserving short-term bullish structure;

∴ The EMA9 continues rising at a consistent slope, reflecting sustained upward momentum;

∴ A retracement to this level would represent the first defensive support on a tactical pullback.

✴️ Conclusion: EMA9 acts as a dynamic short-range support and trend continuation marker.

⊢

▦ EMA21 - ($104.883,22):

∴ Price remains notably above the EMA21, confirming structural strength in medium-term trend;

∴ The EMA21 was previously retested during consolidation in Q2 2025;

∴ A weekly close below it would indicate a structural loss of momentum.

✴️ Conclusion: EMA21 confirms medium-term bullish bias as long as preserved.

⊢

▦ WMA50 - ($98.605,81):

∴ WMA50 serves as a major cyclical support and remains untouched since early 2024;

∴ The gap between price and WMA50 indicates strong extension, yet risk of mean reversion rises;

∴ This level aligns with a prior demand zone around ($95K–$100K).

✴️ Conclusion: WMA50 is a latent demand zone - strategic if market reverts from exhaustion.

⊢

▦ WMA100 - ($84.570,72):

∴ This weighted average aligns with the 0.382 Fibonacci level;

∴ A long-term correction toward this band would reflect the depth of macro pullbacks in previous cycles;

∴ Currently distant from price action, but structurally significant if macro volatility increases.

✴️ Conclusion: WMA100 anchors mid-cycle recalibrations and aligns with retracement symmetry.

⊢

▦ WMA200 - ($63.181,79):

∴ The 200-week WMA remains far below price and untouched since early 2023;

∴ This is the ultimate structural support in secular bull cycles;

∴ If revisited, it signals macro-level capitulation or black swan scenario.

✴️ Conclusion: WMA200 holds the foundational line of long-term structural integrity.

⊢

▦ Fibonacci Retracement - (Range from 0 = $27.143,79 to 1 = $122.056,95):

∴ 0.000 = $27.143,79 - Genesis base from Apr 2025 cycle;

∴ 0.236 = $49.543,30 - Psychological line of control in late 2023;

∴ 0.382 = $63.400,62 - Aligned with long-term moving averages;

∴ 0.500 = $74.600,37 - Symmetry pivot of current macro-leg;

∴ 0.618 = $85.800,12 - Golden pocket lower bound;

∴ 0.786 = $101.745,53 - Golden pocket upper edge and structural resistance pre-breakout;

∴ 1.000 = $122.056,95 - Current cycle high (resistance zone);

∴ 1.618 = $180.713,28 - Projected extension target for parabolic continuation.

✴️ Conclusion: Key retracement zones for tactical reactions lie at (0.786 - $101.7K) and (0.618 - $85.8K); upside breakout target confirmed at (1.618 - $180K).

⊢

▦ Volume + EMA21 - (Last: 2.38K BTC):

∴ Volume is stable and slightly rising compared to prior weekly sessions;

∴ No high-volume sell candles indicate panic or exit;

∴ EMA21 on volume shows baseline liquidity remains active.

✴️ Conclusion: Healthy volume confirms orderly continuation rather than climax or exhaustion.

⊢

⨀ II. Momentum & Pressure Indicators:

▦ RSI (21) + EMA9 - (66.71 / 64.34):

∴ RSI approaches the 70-level but remains below overbought territory;

∴ EMA of RSI confirms rising internal strength;

∴ No divergence is observed - internal price energy remains aligned with upward momentum.

✴️ Conclusion: RSI signals strong but not overheated momentum - bulls still in control.

⊢

▦ MACD (9, 21) - (MACD: 7,887.99 | Signal: 6,362.06 | Histogram: +1,525.93):

∴ MACD histogram remains green, showing continuation of bullish trend;

∴ The spread between MACD and Signal is positive and expanding again;

∴ No bearish crossover threat imminent at current slope.

✴️ Conclusion: MACD structure reinforces bullish pressure - trend still intact.

⊢

▦ OBV + EMA9 - (OBV: 220.38M):

∴ OBV remains in an uptrend, supporting price action;

∴ EMA overlay shows no divergence or flattening;

∴ Volume accumulation remains healthy, confirming underlying conviction.

✴️ Conclusion: OBV supports continuation - no signs of distribution.

⊢

▦ Stochastic RSI (3,3,21,9) - (%K: 93.68 / %D: 90.72):

∴ Both %K and %D lines are in the overbought zone (>90);

∴ Crossovers are still bullish but nearing potential exhaustion zone;

∴ Caution warranted for short-term momentum correction.

✴️ Conclusion: Overbought levels reached - watch for tactical slowing, though no reversal confirmed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The weekly chart exhibits a structurally intact bull trend, confirmed by the alignment and spacing of EMA's and WMA's across all horizons (short, mid, long);

∴ Fibonacci retracement levels delineate critical reaction zones, with (0.786 - $101.745,53) and (0.618 - $85.800,12) serving as dominant retrace supports in the event of a tactical correction;

∴ The presence of a projected (1.618 extension at $180.713,28) offers a sacred path forward should price breach and sustain above the current high of $122K.

∴ Momentum oscillators (RSI and MACD) continue their upward thrust without divergence, but the Stochastic RSI warns of temporal exhaustion - a typical hallmark before consolidation or rotation;

∴ Volume structure is stable and non-climactic, suggesting continuation rather than blow-off;

∴ No sign of distribution via OBV - accumulation remains intact.

✴️ Conclusion: The market remains within the upper chamber of the Fibonacci spiral. Tactical cooling is possible due to overextension in the momentum field, but no structural damage is observed. A controlled retrace into the golden pocket would be both acceptable and ritualistically symmetrical. The path to $180K remains open, but guarded.

⊣

⟁ BTC/USD - CME Futures BTC1! - (CHART: 1D) - (Jul 27, 2025):

◇ Current Price: $120.785.

◇ Chart Link:

⊣

▦ CME Futures GAP - Observation & Ritual Closure:

∴ The current chart shows a clustered consolidation near $120K–$121K with no immediate upper gap visible;

∴ The last prominent CME Gap was filled during the late June run-up and early July vertical move;

∴ No new gap formed during the weekend-to-weekday open for the last 3 sessions - continuity is intact.

✴️ Conclusion: There is no unfilled CME Gap between the current price and previous sessions. All recent discontinuities appear ritually sealed. Attention now turns to potential downside gaps from rapid bullish impulse moves around ($104K–$108K), which could remain structurally unfilled - unless tactically challenged during correction.

⊢

🜎 Strategic Insight - CME Oracle:

∴ The lack of open CME Gaps suggests a clean technical field - no magnet effect pulling price backward in the short term;

∴ The compression near $121K may precede either an explosive breakout toward the Fibonacci extension ($122K / $130K+), or serve as a false plateau before a tactical flush;

∴ Absence of gaps also removes "gap fill" traders from immediate relevance, allowing price to move freely based on liquidity and macro flows.

✴️ Conclusion: The CME chart confirms no active gravitational pull downward - the battlefield is neutral and favorably clean for bullish continuation, pending macro and liquidity alignment.

⊢

∫ III. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + 9EMA - (All Exchanges):

∴ Exchange inflows remain significantly suppressed, with no spikes above 75K BTC since Q4 2023, despite the price nearing $120K;

∴ The 9EMA of inflows is stable and near local lows, showing no abnormal movement toward exchanges;

∴ Historically, spikes in inflow coincide with distribution, fear, or profit-taking, none of which are currently present on a structural level.

✴️ Conclusion: The on-chain exchange inflow behavior confirms low distribution pressure at current highs. The lack of elevated Bitcoin deposits into exchanges indicates conviction among holders and the absence of a mass selloff attempt, even near critical Fibonacci resistance.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ While price consolidates near its cyclical high, exchange inflows remain muted, echoing behavior observed during earlier phases of strong market conviction (e.g., late 2020);

∴ This suggests the market is not preparing for heavy liquidation;

∴ The silence of inflows reinforces the tactical hypothesis that current price action is organic and not panic-driven, preserving the ritual path toward ($122K/$180K).

⊢

⧉ IV. Contextvs Macro-Geopoliticvs - Interflux Economicvs:

▦ US-EU Trade Accord: 1(5% Unified Tariff Across All Sectors):

∴ The United States and the European Union have reached a comprehensive trade agreement, averting escalation: a 15% unified tariff will apply across most EU exports to the US, down from a threatened 30%;

∴ Exceptionally high 50% tariffs remain on steel and aluminum, while some industries such as automotive, semiconductors, and pharmaceuticals will be capped at 15%;

∴ Zero-tariff exemptions have been granted to strategic sectors, including aerospace, select chemicals, semiconductor equipment, agricultural products, and critical raw materials;

∴ In return, the EU has committed to invest $600 billion in US infrastructure and tech, and to purchase $750 billion worth of US energy and defense products over three years.

✴️ Conclusion: The trade pact imposes moderate cost adjustments for key industries but restores transatlantic stability. Although friction remains in sensitive sectors, the agreement prevents global trade disorder and enhances strategic economic visibility.

⊢

🜎 Strategic Insight - Macro Oracle:

∴ The accord mitigates systemic trade risk and clears geopolitical uncertainty, which would otherwise impair market confidence in risk-on assets;

∴ Predictable tariffs (15%/50%) reduce abrupt inflationary shocks, enhancing macroeconomic forecasting and central bank policy latitude;

∴ Massive EU commitments in energy and defense inject transatlantic liquidity and strengthen demand for US dollar-based assets;

∴ While European manufacturers face pressure, the global system benefits from lower volatility and restored economic symmetry;

∴ This opens room for speculative and structural capital to flow more confidently into high-volatility instruments, including crypto assets.

✴️ Conclusion: The macro backdrop reinforces the sacred bullish path - a re-alignment of order in the West, combined with non-disruptive trade stabilization, lays the groundwork for continuation of liquidity-driven risk flows. Bitcoin stands to benefit as a speculative vessel in a structurally stable yet monetarily dynamic environment.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Tactically Watchful:

∴ Price remains above all critical EMA's and WMA's on the 1W chart;

∴ Fibonacci structure is intact, with the $122K high acting as ritual resistance and the (0.786 / 0.618 zone ($101K / $85K) as sacred fallback;

∴ Momentum indicators (MACD, RSI) sustain positive bias with no divergences;

∴ CME Futures show no unfilled gaps - the field is clean, allowing strategic extension.

✴️ Conclusion: The macrostructure supports continuation higher into the sacred extension zone ($130K–$180K), with short-term vigilance warranted due to overbought Stoch RSI and reduced volume velocity.

⊢

▦ Tactical Range Caution:

∴ Upper Limit: $122.056 - Cycle high and Fibonacci 1.0;

∴ Mid Guard: $112.770 - EMA9;

∴ Structural Support: ($101,745 - 0.786) Fib retrace;

∴ Golden Anchor: ($85.800 - 0.618) Fib retrace.

✴️ Conclusion: As long as price remains above $101K, the bullish code remains sealed. Breach of $85K would unlock deeper structural reassessment.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ The week closes at the threshold of the Fibonacci (1.0 mark - $122.056), beneath a ceiling forged by time and belief;

∴ All technical layers are aligned, yet the silence in the inflow, the clean CME field, and macro equilibrium whisper a rarer truth - no storm is seen, but no wind is promised;

∴ This is the zone of the Watcher - where action becomes hesitation, and hesitation becomes discipline.

✴️ Strategic Note & Final Seal: Do not confuse absence of danger with presence of opportunity. A vertical structure with no threat below can still falter from within. This is a time not to act, but to remain unshaken.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Beyond Technical Analysis

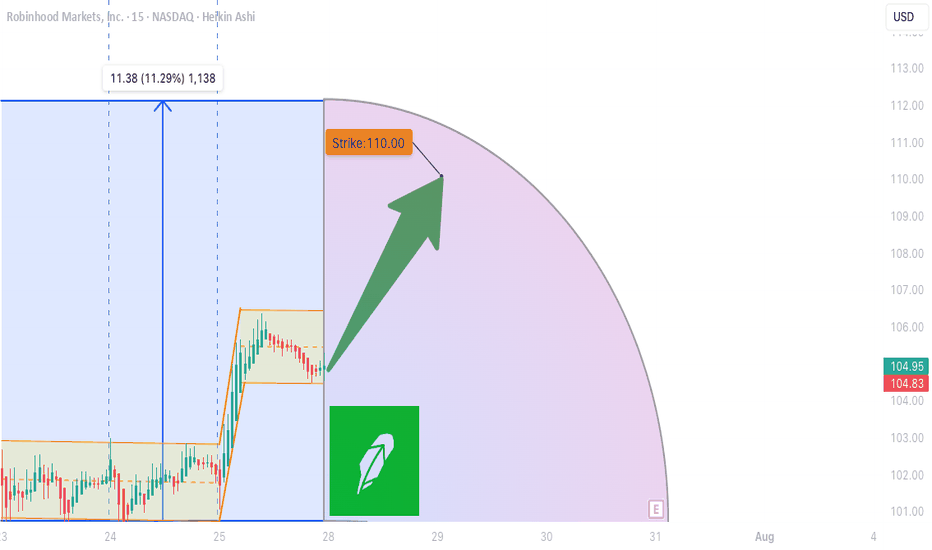

HOOD WEEKLY TRADE IDEA (07/27/2025)

**🚨 HOOD WEEKLY TRADE IDEA (07/27/2025) 🚨**

**BULLISH OPTIONS FLOW MEETS EVENT RISK CAUTION**

📊 **Options Flow Snapshot:**

📈 **Call Volume > Put Volume**

🧮 **Call/Put Ratio: 2.30** → **Institutional Bullish Flow**

📈 **Momentum Readings:**

* 🟢 **Daily RSI: Bullish**

* 🟡 **Weekly RSI: Mixed to Weak**

➡️ *Momentum is short-term positive, but not confirmed long-term*

📉 **Volume Insight:**

* **Only 0.7x** last week’s volume

➡️ *Lack of participation = ⚠️ caution*

🌪️ **Volatility Environment:**

* ✅ **Low VIX = Great Entry Timing**

* ❗ Fed Meeting ahead = Binary Event Risk

---

🔍 **Model Consensus:**

All 5 models (Grok, Claude, Gemini, Meta, DeepSeek) say:

🟢 **Moderately Bullish Bias**

✅ Bullish options flow

✅ Daily RSI uptrend

⚠️ Weak volume + Fed caution

---

💥 **TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Long Call

* **Strike**: \$110

* **Expiry**: Aug 1, 2025

* **Entry**: ≤ \$2.90

* **Profit Target**: \$5.80 (🟢 100%)

* **Stop Loss**: \$1.47 (🔻50%)

📆 Entry: **Market Open Monday**

📦 Size: 1 Contract

📈 Risk-Reward Ratio: \~1:2

---

🧠 **Key Risks:**

* 📉 Volume Weakness = No confirmation

* ⚠️ **FED Event Risk** = Watch for Wednesday volatility

* ⏳ Theta decay as expiry nears

---

📌 **JSON TRADE DETAILS (for bots/scripts):**

```json

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 5.80,

"stop_loss": 1.47,

"size": 1,

"entry_price": 2.90,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 15:09:35 EDT"

}

```

---

🔥 Stay sharp. Ride the flow, respect the risk.

👀 Watch volume + Fed headlines!

💬 Tag your team: \ NASDAQ:HOOD Bulls loading?

\#HOOD #OptionsTrading #UnusualOptions #FedWeek #WeeklyTradeSetup #TradingView #StockMarket

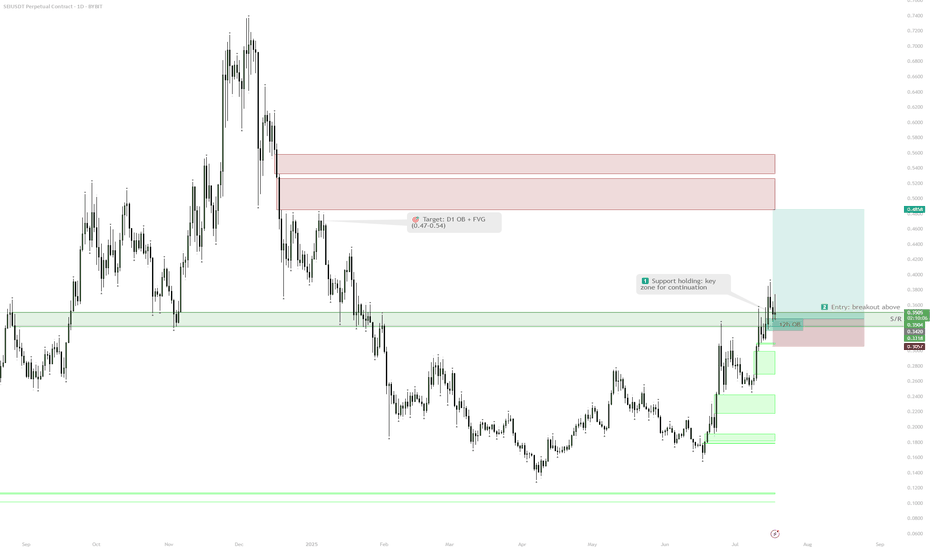

Can XRP Run 30% next week While we seen a clear cool of from XRP bullish movement in the last week are we now looking at an aggressive opportunity for the this sssest class shoot up %30 to create a new ATH of $4 and possibly beyond? Interesting times ahead with some strong news heading into next week XRP Army will have to wait and see what news comes out and will that influence XRP’s price point. The asset class sits around $3.28 at the time of this article post.

Cheers FC / EDub / AJ

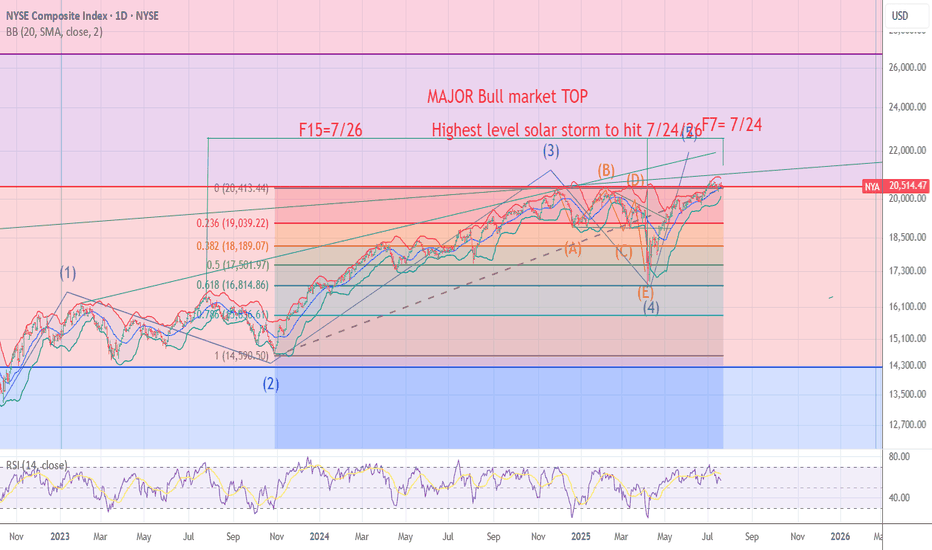

NYA chart Posted The signal for the Top is hours away .7/24/7/26The chart posted is my work based on the golden ratio and SPIRAL calendar work .We will be hit by one of if not the highest ever solar storms from 7/24 to 7/26 I will be re shorting into this date And will look for the markets worldwide to see a massive event .I have been talking a massive earthquake and the markets to begin a drop into OCT 10 to the 20th . best of trades .Wavetimer

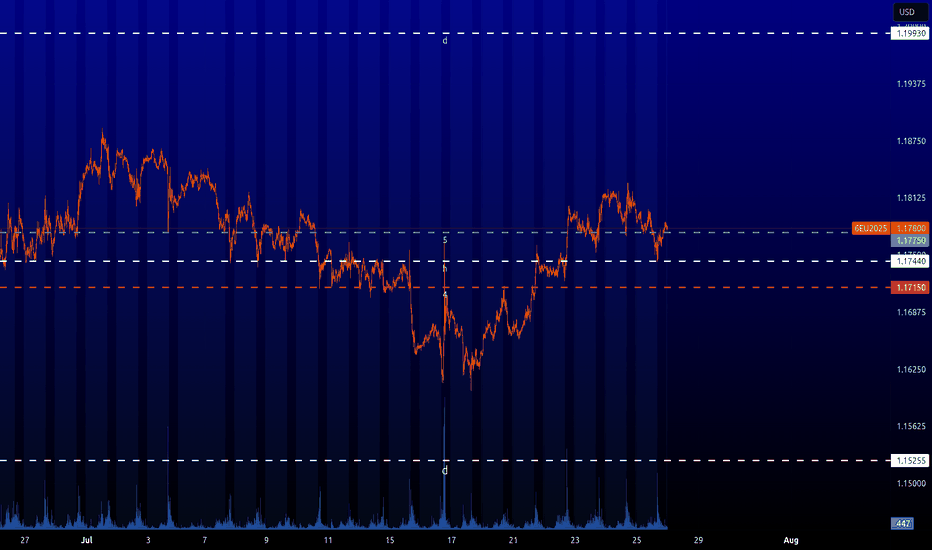

6E : Key levelsHere are the key levels for this instrument.

The nearest interesting level is at 1.17750. It is too early to buy it. The price needs to grow a little more and then it will be possible to buy this level with a limit order.

The other levels are still far away, but they will be interesting for the market.

Please note that I interpret these levels in my own way. I need special conditions to understand when exactly there will be a bounce from the level. Such as the conditions I described from 1.17750. So you should not trade these levels mindlessly, but you can use them in your strategy and using your logic.

Bullish or Bear trapHello Traders 👋

What are your thoughts on XAUUSD

Looking at the daily timeframe I anticipate manipulation by market players on gold.

Is likely that market players will stop Hunt Traders who have their stop losses at the different lows which is indicated with a red circle.

For every buyer there must be a seller and for every seller there must be a buyer.Where they are no sellers in the market the institutions will want to trigger stop losses in order to buy,which is known as stop hunting.That is to takeout previous buyers in the market and generate liquidity to buy.

And this stop hunting usually happens in a ranging market.

Looking at the structure of gold we can see that gold is ranging,

We can see a low or support of the range which was previously resistance and turned support for the ranging market.

I see the market using sell liquidity to liquidate buyers and react at the support or low of the range and move up to the range of the resistance

The Golden Age 7000 EOY SPXThe Golden Age (year) is here!

Have cash ready for May in April. Be heavy hedges going in to 26.

We're going to juice earnings with all the investments pouring in for just about every single industry. Once the injection is complete, we will reset while all the invested money completes projects.

GL!

Better Buy Bitcoin

NVDA to save IntelThis may be one of the best entries you get to intel in your life time. NVDA just announced today that all of their new super computer systems are utilizing Intel chips alongside NVDA chips. This is going to push a huge surge in demand for Intel, and also help them get back on track with creating chips that the market/future market actually wants/needs.

This gives actual opportunity for Intel to turn the ship around and lead to years if not a decade of growth.

Hugely risky play. GL

BTC/USD Buy Setup (6H Chart)📈 BTC/USD Buy Setup (6H Chart)

Strategy: Trendline Support Bounce

🔹 Entry

Price: $118,674.3

Reason: Price is bouncing off a supportive trendline and holding above the 1st Support zone.

🔻 Stop Loss (SL)

Price: $114,470.6

Reason: Below the 1st Support zone to protect against breakdown.

🎯 Take Profit Targets

TP1: $123,269.6

Reason: Near recent swing high, good for partial profit.

TP2: $127,661.4

Reason: Next resistance zone, ideal for full exit or trailing stop.

#MJTrading

#Bitcoin

A POTENTIAL TREND REVERSAL Hello Traders 👋

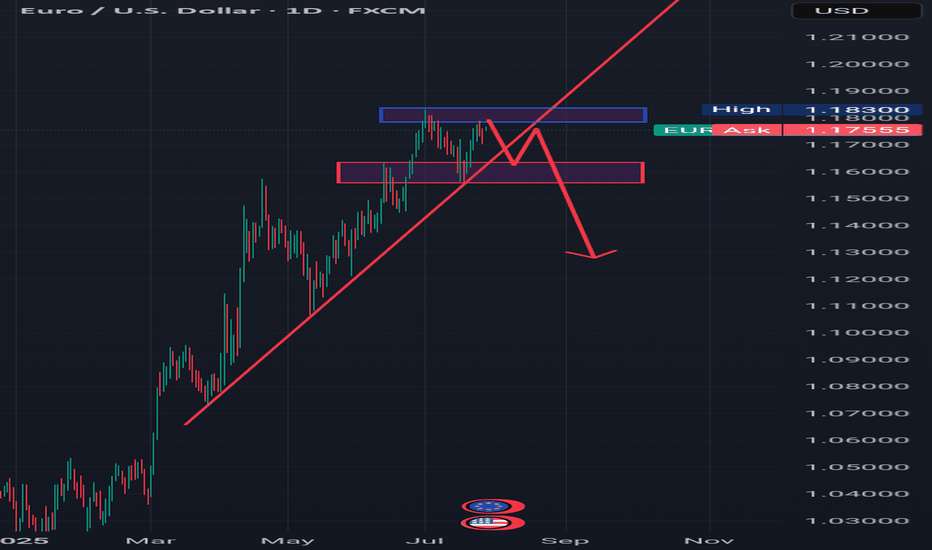

What are your views about EURUSD

Looking at the daily timeframe we can see that price action didn't take out liquidity at the top which is indicated with a blue rectangle.

Am seeing price action retracing to that liquidity zone which is indicated with a blue rectangle and from there reversing to the downside.

Let's look at the fundamental analysis of EURUSD.

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

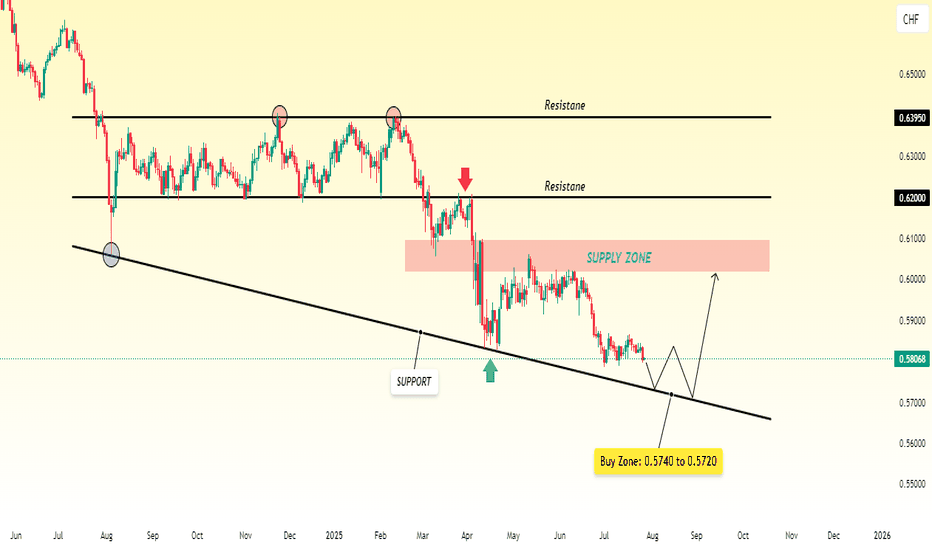

CAD/CHF Falling Toward 0.5740–0.5720: Buyers May Step In1. Trend Direction :

CADCHF is currently bearish — the price is going down consistently.

2. Price Action :

The pair is still falling and has not shown signs of reversing yet.

3. Target Area for Drop :

I expect the price to continue falling toward the 0.5740 to 0.5720 zone.

→ This is a support area, where price may slow down or bounce.

4. Support Level Importance :

This zone has acted as support in the past, meaning buyers might step in again here.

5. Buy Interest Zone :

If the price holds above 0.5720 and shows signs of strength, buying interest could return.

6. Possible Reversal :

From this support zone, there's a chance that CAD/CHF may reverse and move back up.

7. What to Watch For :

Look for bullish price action (like strong candles or a break of minor resistance) in the support area before considering long (buy) positions.

A POTENTIAL TREND REVERSAL Hello Traders 👋

What are your thoughts on EURUSD

Looking at the daily timeframe we can see that price action didn't take out the liquidity which is located with a blue rectangle which is also acting as the all-time high for EURUSD.

I'm seeing price retracing to reach the liquidity around that blue rectangle and then after start falling downwards.

Let's look at the fundamentals of EURUSD

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

A POTENTIAL TREND REVERSALHello Traders 👋

What are your views about GBPUSD

Looking at a daily time frame we can see that press action has broken a rising trend line and also we are seeing a potential head and shoulder pattern.

For further clarification we need to see if the price action can break a demand zone which is indicator with a red rectangle.

This will give us a strong conviction that the dollar is already buying and GBPUSD is set for further downside.

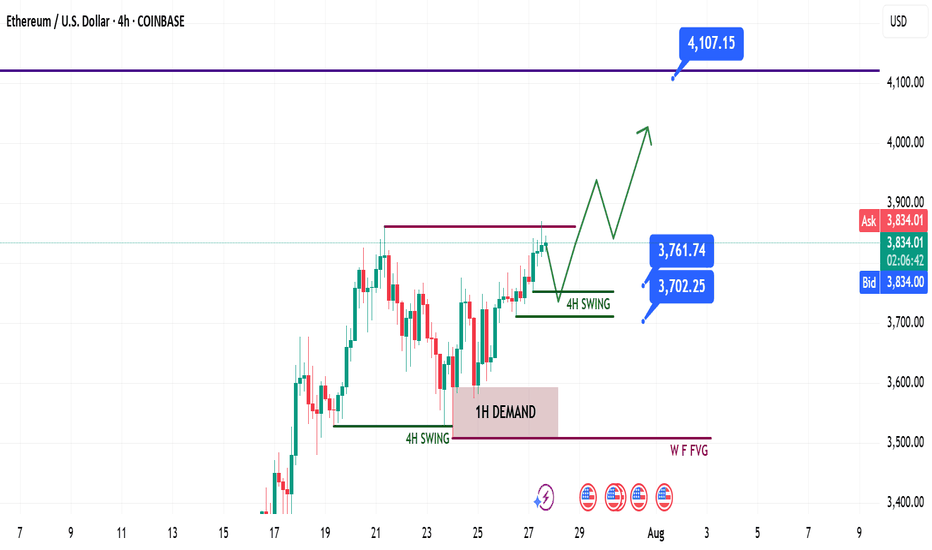

Ethereum Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

ETH followed the broader crypto market momentum led by Bitcoin, supported by institutional demand and positive macro policies in the U.S.

Last week’s plan played out cleanly — we saw strong gains from the 1H demand zone.

🧾 Weekly Recap:

• Price swept 4H swing liquidity and formed a 1H bullish BOS

• Created a solid 1H demand zone, from which price bounced strongly

• Momentum remained bullish as forecasted in last week’s post

📌 Technical Outlook:

→ Expecting a short retracement into 4H liquidity levels around 3761$ or 3702$

→ Then a continuation move towards ATH zone

🎯 Setup Trigger:

What I’m watching:

✅ Sweep of 4H liquidity

✅ Bullish BOS on 15M–30M

→ This will serve as the confirmation for long entries

📋 Trade Management:

• Stoploss: Below the confirmation swing low

• Target: 4100$

💬 If you found this helpful, don’t forget to like, comment, and follow — I share setups like this every week!

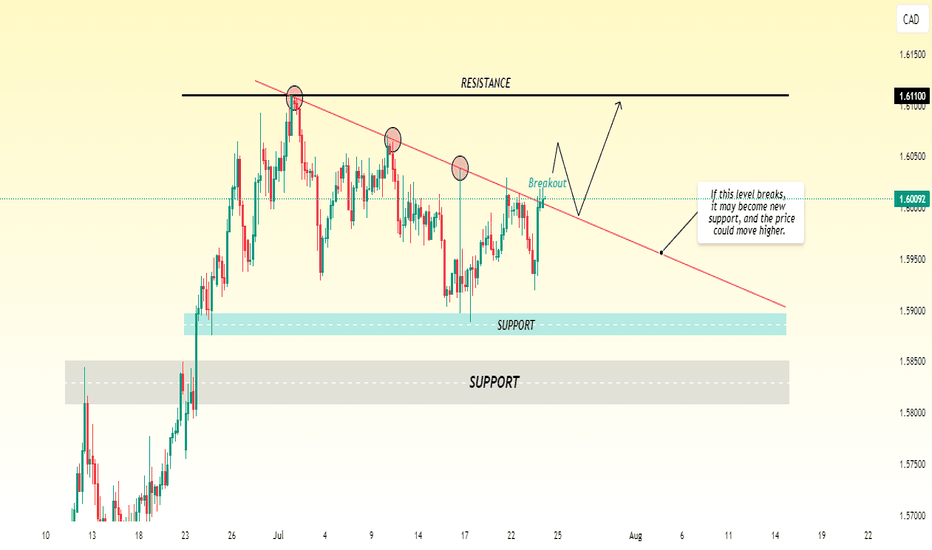

EUR/CAD Tests Resistance — Bullish Breakout in Sight?EUR/CAD appears to be showing bullish momentum and is likely heading toward the 1.6110 level. Currently, the pair is testing a key resistance zone. If the price manages to break above this resistance with strong volume or confirmation, we could see further upside continuation toward the next target at 1.6110. Traders should watch for a clear breakout and possible retest of the broken level turning into support, which could provide a good entry point for long positions.

GOLD - GC Weekly Recap & Outlook | 27.07.2025🧾 Weekly Recap:

• Price tapped into the 1H Demand Zone (red box) and ran the 4H swing liquidity before bouncing to clear internal range liquidity.

• This move was followed by a retracement which led to a break of the bullish trendline.

This may signal the beginning of a broader accumulation phase. Expect choppy price action targeting internal liquidity both above and below, before a clear trend resumes.

📌 Technical Analysis:

Price has closed below the bullish trendline, leading to two possible scenarios:

1. Bullish scenario (black path):

– Price runs the W C DOL (3313$) →

– Finds rejection →

– Retests broken trendline →

– Breaks above the trendline →

– Continues toward 3444$ and potentially 3474$

2. Bearish scenario (orange path):

– Price runs W C DOL (3313$) →

– Rejects from the broken trendline →

– Fails to reclaim it →

– Continues downward to target M C DOL (3256$)

📈 Setup Trigger:

Wait for clear 1H–4H supply/demand zone creation and structure shift before initiating a trade.

🎯 Trade Management:

• Stoploss: Above/below relevant supply-demand zone

• Targets:

– Bullish: 3444$, 3474$

– Bearish: 3256$

🟡 If you liked the idea, feel free to drop a like & comment — and don’t forget to follow for more weekly updates.

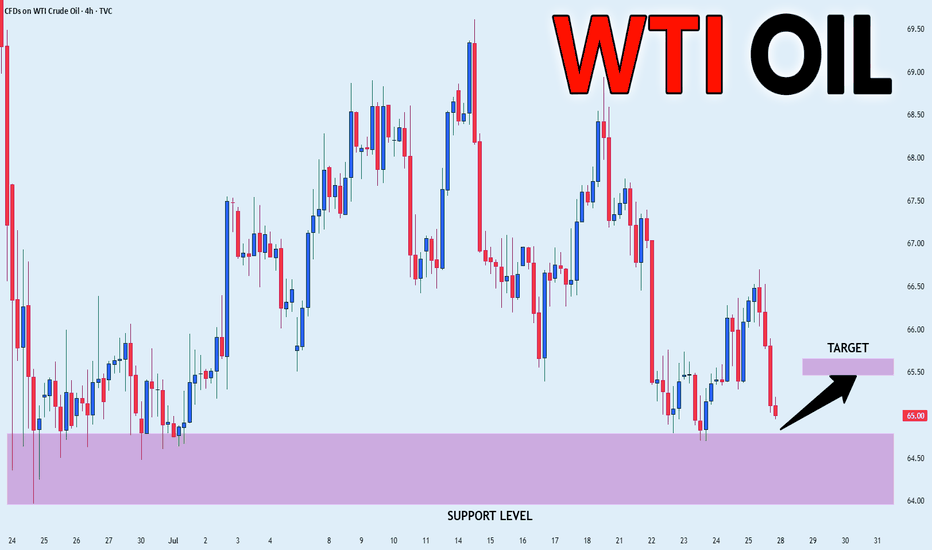

CRUDE OIL REBOUND AHEAD|LONG|

✅CRUDE OIL is going down now

But a strong support level is ahead at 64.69$

Thus I am expecting a rebound

And a move up towards the target of 65.50$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

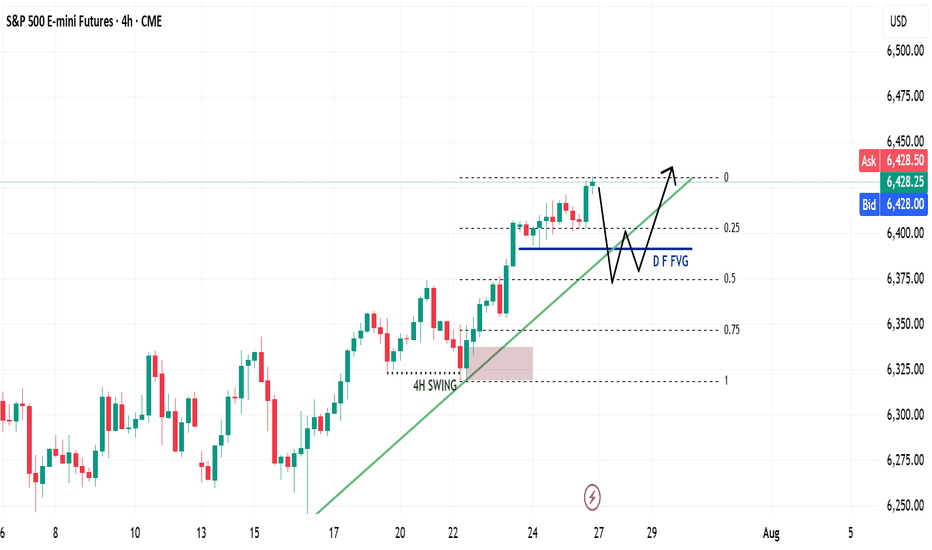

ES Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Declining inflation figures

• Trump’s pivot toward aggressive rate cuts

This shift reinforces a risk-on environment across U.S. indices.

🔙 Previous Week Recap

• ES continued its price discovery journey

• Price ran the 4H swing liquidity and shifted market structure

• A clean 1H demand zone was established post-MSS, leading to a strong move toward new ATH

• A bullish trendline has also formed as a visual representation of this momentum

• I anticipated a deeper retracement last week but adjusted my execution based on the ICT SMT concept — see previous week’s ES plan for details

📊 Technical Analysis

Looking forward:

• My expectation is a continued bullish price discovery

• Watching for price to tap into and potentially deviate below the Daily Fair Value Gap (D-FVG)

• This zone also aligns with the 0.5 Fibonacci equilibrium level, which I consider a discounted entry zone

• Confluence of liquidity + trendline + FVG + Fib makes this an ideal location for new long setups

⚙️ Setup Trigger & Trade Plan

Entry Strategy:

• Wait for a clear 1H–4H market structure shift

• Look for demand zone formation within the discount zone

• Execute long trades after confirmation and retracement into this zone

Trade Management:

🎯 Target: New All-Time Highs

⛔ Stoploss: Swing low beneath 1H–4H demand structure

🗨️ If you found this analysis helpful, don’t forget to like and drop a comment below — I’d love to hear your thoughts and setups for the week!

📥 Follow me for more weekly breakdowns and real-time updates throughout the trading week.

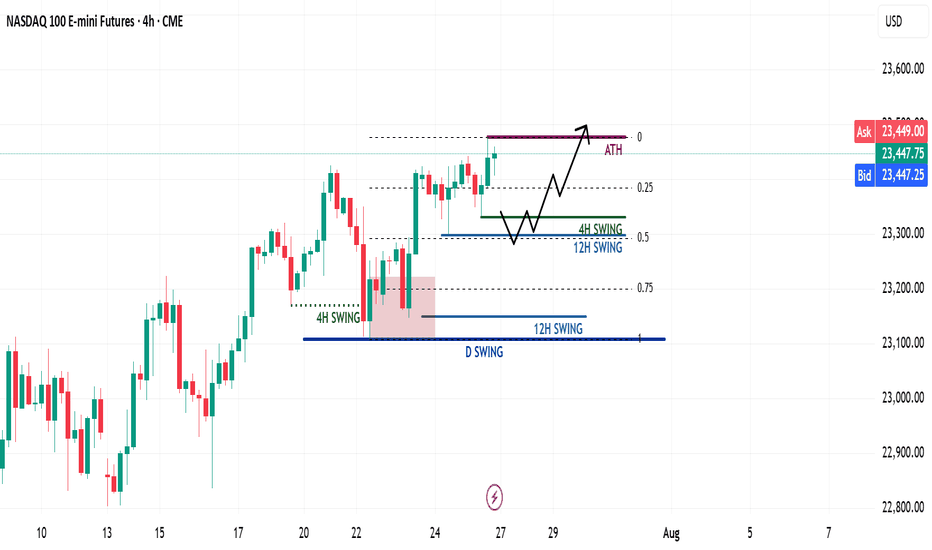

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

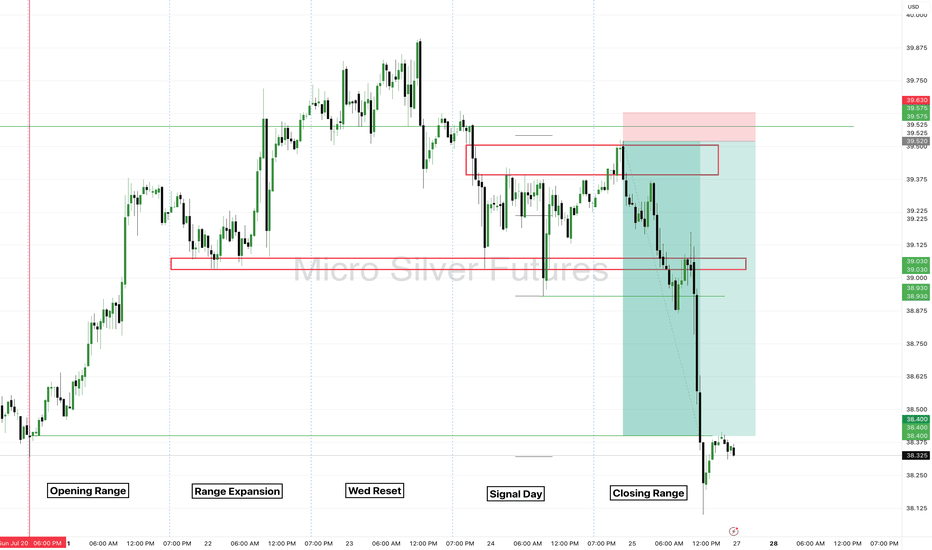

Silver Futures - Closing Range of the Week.Real trading comes down to the patience combined with emotional control to have the highest possible edge.

COMEX_MINI:SIL1!

There is no reason for your chart to filled be filled with ineffective distraction. Instead focus on simplicity to know exactly what to take a trade on. Be a hunter looking for the easy prey!

XAUUSD about to trade downwardsToo many tries on the higher high created by Gold that have failed , now the price has broken a treblndline from months back signalling a bearish move down to 3000 with few breaks to lead it there if the dollar doent slip, which the decline might take up to November according to how I see the pattern formations