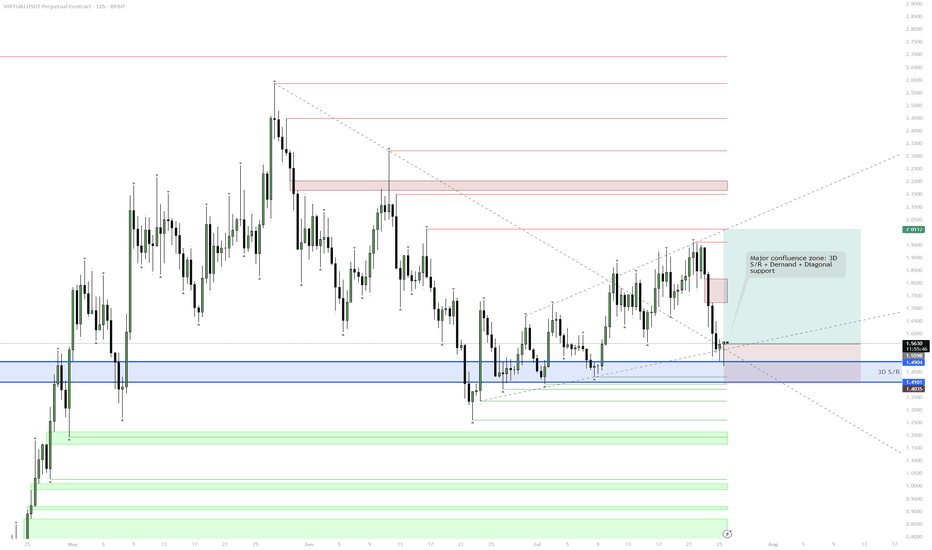

VIRTUAL – Major Confluence ZoneEntry into 3D S/R and Demand Zone (Blue Box)

The current price action is testing a key 3D support/resistance level, which aligns with a historical demand zone.

Multiple diagonal supports converge here, making it a high-probability zone for a reaction.

Accumulation & Reversal Play

The setup suggests that this zone is ideal for building a position.

Expect potential wicks/spikes into the lower blue zone, hunting liquidity before a reversal.

If price holds above ~$1.40 (blue line), look for signs of strength (bullish candles, reclaim of lost support).

Upside Targets

If the zone holds, the first target is the prior local highs ($2.00–2.05).

Further targets are the overhead supply zones (highlighted in red), especially if the momentum persists.

Invalidation

A daily close below $1.40 or sustained trading below the lower blue box invalidates the setup and signals a risk-off environment.

Beyond Technical Analysis

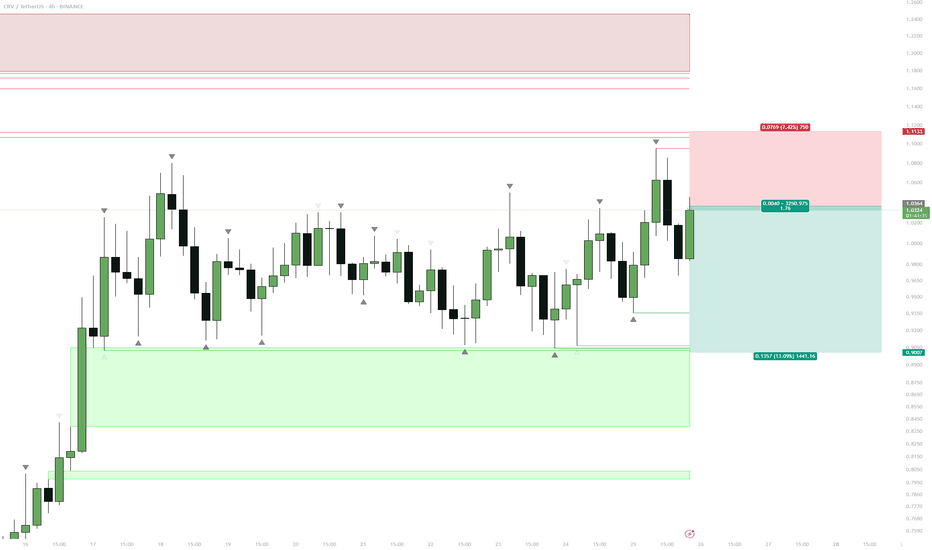

$CRV Equal Lows ShortExtended Range

CRV has been ranging for almost week with no clear direction.

Price has respected resistance above $1.10 multiple times.

Obvious Liquidity Pool

Multiple equal lows are sitting at the $0.90 level, a textbook liquidity magnet.

Market makers are likely to target this area before any substantial move higher.

Short Entry

Short from just above $1.00, stop above the range high.

Target is a sweep of the $0.90 lows.

Next Steps

Watch for signs of absorption or reversal if price wicks below $0.90.

Consider flipping long if strong buyback or deviation forms after the liquidity sweep.

Reasoning

CRV has spent week ranging, building up an obvious set of equal lows. This is classic “liquidity sitting on a platter” for larger players. Short setups are favored while the range top holds, aiming for a stop run below $0.90. After the sweep, be open to a fast reversal or potential swing long if bulls reclaim the level.

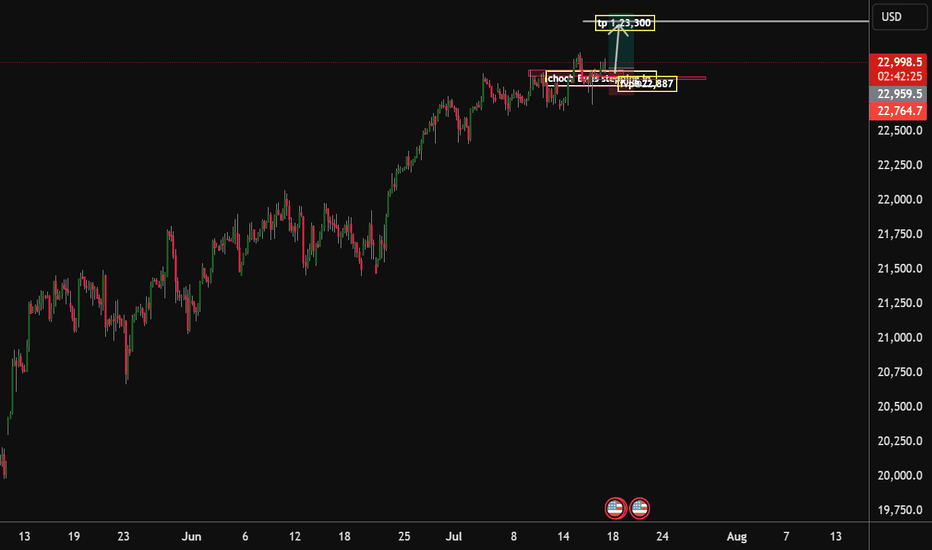

Nasdaq100 Bulls ready to drive the price to 23,300 handle With the choch on the market structure and with Key data released on Thursday, reflected strength in the U.S. economy. Stocks rose this Thursday, buoyed by fresh economic data reports and a slew of corporate earnings releases. The tech-heavy Nasdaq Composite has advanced 0.4%, and quarterly earnings reports released this week have exceeded Wall Street’s expectations, fueling investor confidence. I am expecting that by the end of this week or the beginning of next week will see the bulls drive the market to our 23,300 handle. I am with the bulls on this one

Tp1.23,300.

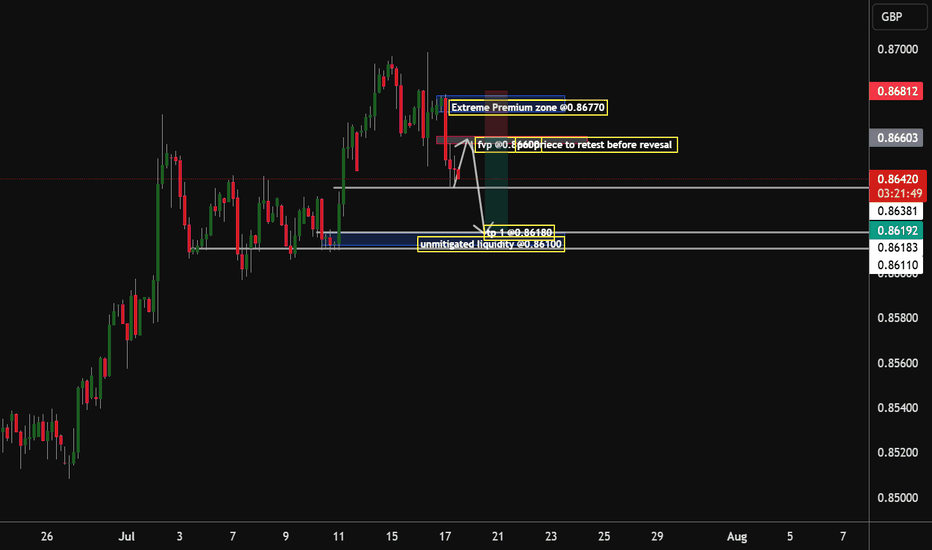

Eur/Gbp Bears to seek the 0.86180 Handle By early next week, my analysis according to the market structure being formed suggests that the institution that drives the market will have to be dovish on this pair, as there is unmitigated liquidity awaiting to be grabbed @ the 0.86100 zone by the end of next week will have to see that zone being mitigated

Tp 1.0.86180

BTC LONG SWING ENTRY OFF PREVIOUS LOW AREASWe are looking to make a BTC long entry on previously supported levels using just chart analysis. Looking at a rebound on a daily actual range trade where add on possible reversal and scale out into the a new local high.

In short, buying the gold, adding in the blue, scaling out into the green.

As you can see been a while so playing this small, getting back into the action

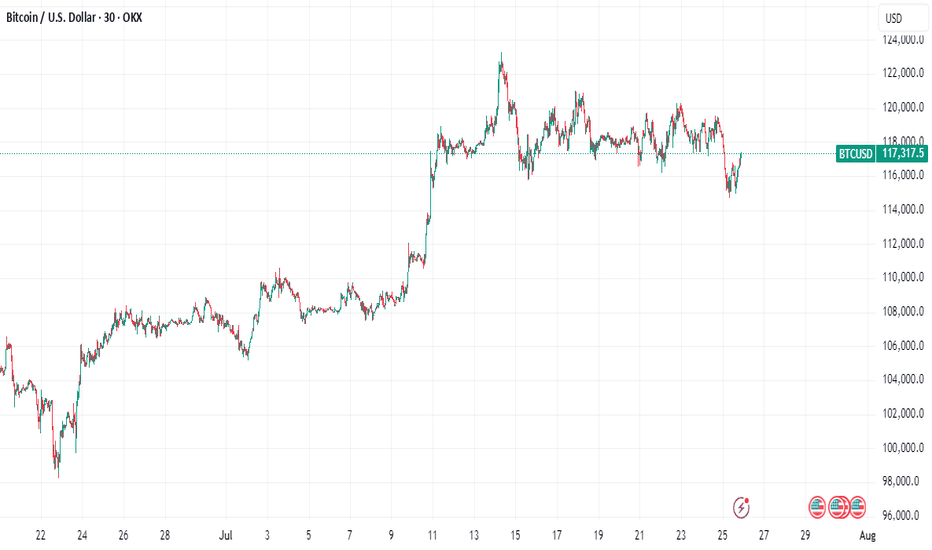

Why Bitcoin's Bull Run Hits a WallBitcoin's Bull Run Hits a Wall: A Deep Dive into the $115K Correction, Record Leverage, and the Battle for Market Control

A sudden and violent tremor has shaken the cryptocurrency market to its core. After a period of quiet range-bound trading, Bitcoin has decisively moved from consolidation to a sharp correction, plunging below the critical $116,000 support level and briefly touching $115,000. The abrupt downturn triggered a "bloodbath for crypto longs," liquidating hundreds of thousands of traders and wiping out nearly $600 million in leveraged positions. Yet, as the dust settles, a complex and contradictory picture emerges. While institutional sell-offs and cascading liquidations paint a grim short-term picture, record-high open interest, significant liquidity grabs, and bullish on-chain signals suggest the long-term uptrend may be far from over. This article delves into the anatomy of the crash, the forces that fueled it, and the fierce battle between bearish catalysts and bullish undercurrents that will define Bitcoin's next move.

Part 1: The Anatomy of the Correction - From Sideways to Sell-Off

For weeks, Bitcoin's price action was characterized by consolidation, a phase where an asset trades within a defined range, reflecting market indecisiveness. After a strong upward trend that pushed Bitcoin to new highs above $120,000, this period of sideways movement was seen by many as a healthy pause before the next leg up. However, this placid surface masked building pressure. The transition from this consolidation phase to a full-blown correction was swift and brutal.

A market correction is defined as a rapid price change, often a decline of at least 10% but less severe than a crash, that disrupts an asset's prevailing trend. The recent tumble below $116,000 fits this description perfectly. The sell-off was not a gradual slide but a violent dislocation, breaking through established support levels and triggering a wave of panic.

This dramatic shift was exacerbated by several key factors. On-chain data revealed that a significant institutional player, Galaxy Digital, unleashed a massive sell-off, reportedly moving billions in Bitcoin to exchanges. This sudden injection of supply into the market acted as a powerful catalyst, overwhelming buy-side pressure and initiating the downward price spiral. The market's reaction was immediate, with the price slicing through the psychological support at $116,000 and heading towards the next major liquidity zone around $115,000.

Part 2: The Cascade - A $600 Million Bloodbath for Leveraged Traders

The speed of the price drop had a devastating impact on the derivatives market, a space where traders use borrowed funds to amplify their bets on price movements. The sudden downturn resulted in one of the most significant liquidation events in recent memory, with 213,729 traders liquidated for a total of nearly $600 million over a 24-hour period.

What is a Liquidation?

In crypto futures trading, liquidation is the forced closure of a trader's position by an exchange. This happens when a trader can no longer meet the margin requirements for their leveraged position, meaning their collateral is insufficient to cover their mounting losses. For example, a trader using 20x leverage on a $1,000 position controls $20,000 worth of Bitcoin. However, a mere 5% price move against them can wipe out their entire initial capital, triggering a liquidation.

The recent event was a "bloodbath for crypto longs," meaning traders who had bet on the price of Bitcoin increasing were the primary victims. As the price fell, these long positions became unprofitable, and once they crossed their liquidation price, exchanges automatically sold the collateral on the open market to cover the losses.

This process created a deadly feedback loop known as a liquidation cascade. The first wave of forced selling from liquidated longs added more downward pressure on the price. This, in turn, pushed the price down further, triggering the liquidation of another set of long positions whose liquidation prices were slightly lower. This domino effect—where liquidations cause lower prices, which in turn cause more liquidations—is what transforms a standard price dip into a violent market crash. This automated, rapid chain reaction is a hallmark of the highly leveraged and volatile crypto markets.

Part 3: The Fuel for the Fire - Open Interest Reaches a Record $44 Billion

Underpinning this massive liquidation event was an unprecedented buildup of leverage in the market, best measured by a metric called Open Interest (OI). Open Interest represents the total number of active or unsettled futures contracts in the market. It’s a measure of the total capital and number of positions committed to the derivatives market, distinct from trading volume, which counts both opened and closed positions. An increase in OI signifies that new money and new positions are entering the market, often leading to higher volatility.

In a stunning development, as Bitcoin's price began to plunge, the total Open Interest surged to a new all-time high of $44 billion. This unusual divergence—where price falls while open interest rises—suggested that a significant number of new short positions were being opened to bet against the market, while many longs remained trapped, hoping for a reversal. This created a powder keg of leverage.

Further fueling this was a notable surge on the world's largest crypto exchange. On-chain data showed that traders added 10,000 Bitcoin worth of open interest to the BTCUSDT perpetual contract on Binance alone. This single-day surge in open interest on a key trading pair signaled a massive influx of speculative capital.

High open interest acts as fuel for volatility. With so many leveraged contracts open, any sharp price movement can trigger the kind of cascading liquidations that were just witnessed. The record-breaking $44 billion in open positions meant the market was more susceptible than ever to a violent deleveraging event.

Part 4: The Big Players - A Tale of Two Whales

The recent market turmoil cannot be fully understood without examining the actions of its largest participants: the whales and institutions. Their movements often create the initial waves that retail traders are forced to navigate.

On the bearish side, the primary catalyst for the sell-off appears to be Galaxy Digital. The digital asset financial services firm was observed moving tens of thousands of Bitcoin, worth billions of dollars, to centralized exchanges. These flows were reportedly part of a larger liquidation of holdings from a dormant "Satoshi-era" whale, with Galaxy acting as the intermediary to facilitate the sale. By strategically offloading such a massive amount, even if through over-the-counter (OTC) desks to minimize initial impact, the sheer volume of sell pressure eventually spilled into the public markets, triggering the correction. The firm's subsequent withdrawal of over a billion dollars in stablecoins from exchanges further suggests a large-scale profit-taking or strategic de-risking maneuver.

However, this institutional selling pressure is contrasted by a powerful bullish undercurrent. Even as the market reeled, other large players were making bold, long-term bets. Reports surfaced of a significant whale bet on Bitcoin reaching a staggering $200,000 by the end of the year. This dichotomy highlights the deep division in market sentiment. While some large entities are taking profits or repositioning, others view this correction as a prime accumulation opportunity, demonstrating unwavering conviction in Bitcoin's long-term trajectory.

This clash of titans—the institutional seller and the long-term bullish whale—defines the current market structure. The price is caught in a tug-of-war between immediate, heavy supply and deep-pocketed, long-term demand.

Part 5: Reading the Tea Leaves - A Healthy Reset or the Start of a Bear Market?

While the headlines scream "bloodbath" and "crash," a deeper analysis of market mechanics and on-chain data offers a more nuanced perspective. Several key indicators suggest that this brutal pullback, while painful, may be a healthy reset rather than the beginning of a sustained bear market.

Argument 1: The Pullback Remains Within Normal Volatility Range

Bitcoin is notoriously volatile, and sharp corrections are a historical feature of its bull markets. Drawdowns of 30-40% have been common pit stops during previous bull runs. While a drop from over $120,000 to $115,000 is significant, analysts point out that such moves are not out of character for the asset. Historically, major cycle-ending bear markets have seen drawdowns exceeding 75-80%. In contrast, mid-cycle corrections serve to wipe out excess leverage, shake out weak hands, and build a more sustainable foundation for future growth. This event, though severe for leveraged traders, may fall into the category of a standard, albeit sharp, bull market correction.

Argument 2: A Necessary Liquidity Grab

Sophisticated market analysis suggests the plunge below $115,000 was a textbook liquidity grab. This is a maneuver, often initiated by large players or "smart money," where the price is intentionally pushed to a level where a high concentration of stop-loss and liquidation orders are known to exist. By triggering these sell orders, large buyers can absorb the resulting liquidity to fill their own large positions at more favorable prices before reversing the market direction. The area just below a key psychological level like $115,000 is a prime location for such a maneuver. The rapid dip followed by a stabilization could indicate that this was not a panic-driven crash, but a calculated move to hunt liquidity before the next leg up.

Argument 3: Bullish Signals from Spot Markets and On-Chain Data

While the derivatives market was in turmoil, other indicators flashed bullish signals. One analyst pointed to a strong correlation between surges in Binance's spot trading volume and subsequent price upswings. Recently, Binance's share of the spot market volume surged significantly, a move that has historically preceded rallies. High spot volume indicates genuine buying and selling activity, as opposed to the paper bets of the futures market, and can signal strong underlying demand.

Furthermore, key on-chain metrics suggest the long-term bullish scenario remains intact. Analysts highlighted that Bitcoin's price found support near the "Realized Price" for short-term holders, indicating that recent buyers were not panic-selling in large numbers. Other metrics, such as those showing that major long-term holders are retaining their assets despite record prices, paint a picture of underlying market strength that contrasts with the short-term speculative chaos.

Conclusion: A Market at a Crossroads

The dramatic plunge to $115,000 was a multifaceted event, a perfect storm of institutional profit-taking, extreme leverage, and the brutal mechanics of the crypto derivatives market. For the over-leveraged trader, it was a catastrophe. For the long-term investor, it may have been a fleeting opportunity.

The market now stands at a critical juncture, defined by conflicting forces. On one hand, the specter of institutional selling, exemplified by the Galaxy Digital offload, looms large. The record-high open interest, though slightly diminished after the liquidations, still represents a significant amount of leverage that could fuel further volatility.

On the other hand, the arguments for a bullish continuation are compelling. The idea that the crash was a calculated liquidity grab, the historical precedent for sharp bull market corrections, the strength in spot market volumes, and the conviction of long-term holders all suggest that the core uptrend is resilient. The whale betting on a $200,000 price by year-end serves as a potent symbol of this underlying confidence.

The coming weeks will be crucial in determining which of these forces will prevail. The battle between the short-term pressures of deleveraging and the long-term thesis of accumulation will be fought in the charts and on the blockchain. While the bloodbath for longs served as a stark reminder of the perils of leverage, it may have also been the violent, necessary purge required to cleanse the market and pave the way for a more sustainable ascent.

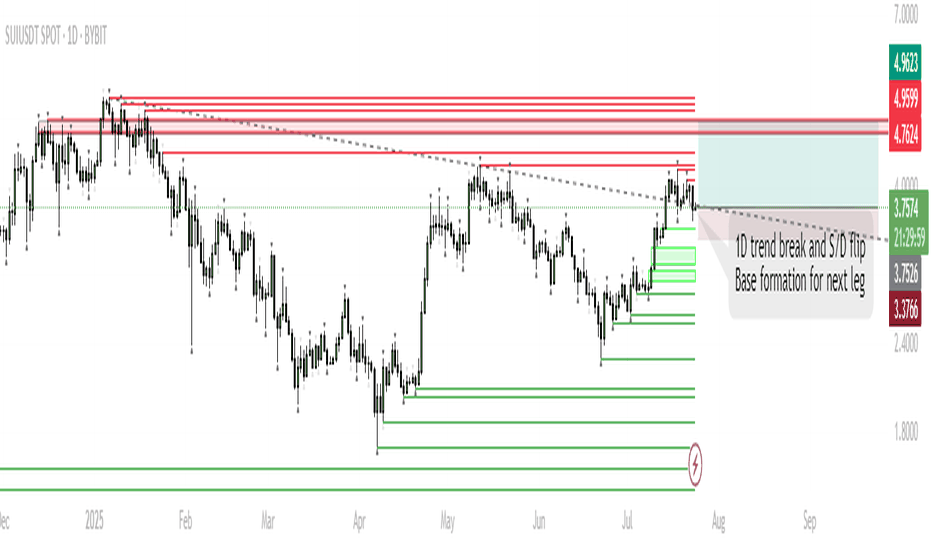

SUI – Base Formation for Next Leg HigherTrend Shift:

SUI has broken the 1D downtrend and is now consolidating above a key supply/demand zone, suggesting accumulation.

Short-Term Range:

Expect ranging/chop as price tests acceptance above broken resistance. This phase could last up to a week.

Trigger for Next Move:

Sustained closes above $4.0 will signal buyers are in control, opening the way for a move higher.

Targets:

If the base holds and SUI establishes above resistance, the next push is toward $5.10–$5.40 (previous highs/ATH zone).

Invalidation:

A sustained move below $3.37 would invalidate the bullish base thesis and open the door for deeper retrace.

SUI has flipped its 1D trend and is now consolidating above a key S/D level. Historically, such consolidations above reclaimed resistance often precede strong trend continuation. While a short-term range is likely as the market digests recent gains, the structure favors an eventual push toward previous highs and potentially new ATHs in August. Patience during this ranging phase is key; the setup remains bullish unless price falls back below $3.37.

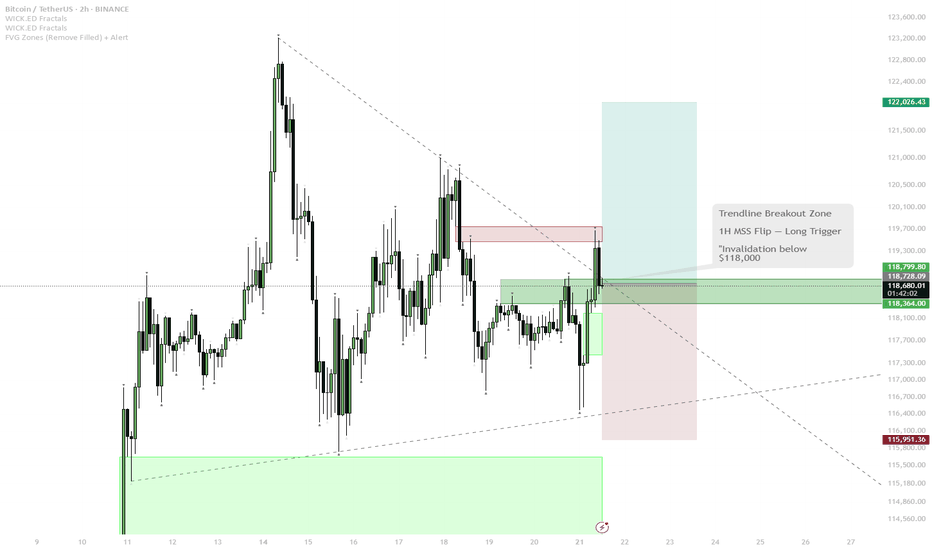

BTC Reloading for Breakout — Watching for 1H MSS Flip

BTC has bounced from local support (green zone) and is challenging the descending trendline.

The price is now testing the red resistance zone and the upper boundary of the 1H MSS (market structure shift) box.

Scenario A (Bullish):

— If BTC cleanly breaks the trendline and flips the 1H MSS box into support (with a strong close above), this is a trigger for a scalp long.

— Target for the move is the upper green box/previous high area near $122,000.

Scenario B (Bearish/Invalidation):

— If price is rejected at the red resistance and falls back below the green support box, risk of deeper pullback toward $116,000 increases.

BTC has shown resilience by quickly reclaiming support after a sweep lower, indicating strong demand. The market looks to be reloading for another push, with liquidity building up just below resistance. The setup favors a breakout if NY Open brings momentum. The flip of the 1H MSS box would confirm bullish intent. However, caution if the breakout fails — structure remains choppy and a failed breakout can trap late buyers.

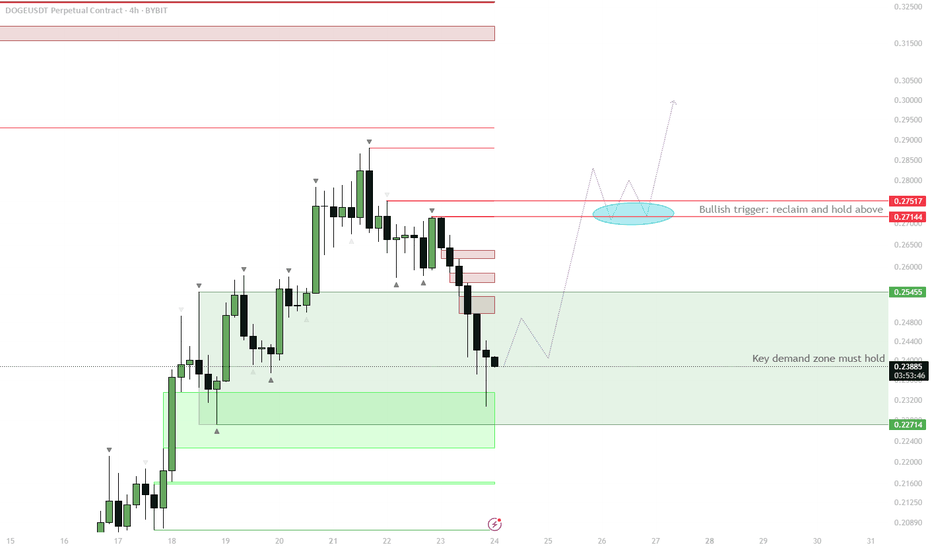

DOGE H4 – Demand Zone Reclaim as Bullish Trigger

Price is currently testing the H4 demand zone (~0.227–0.254).

Watch for price to reclaim the demand zone and close back above 0.254.

If confirmed, expect a move up toward the red resistance cluster at 0.271–0.275.

Consolidation above this area (highlighted in blue) would be a strong signal for continuation.

Invalidation: clean breakdown and acceptance below 0.227 signals failure of demand and deeper retrace.

This setup aims to capitalize on a classic liquidity sweep and demand reclaim. Typically, after taking out the flat open and collecting late shorts/stop losses, strong buying often steps in if demand is genuine. A successful reclaim and consolidation above the previous resistance will set the stage for bullish continuation. If this zone fails to hold, the move is invalidated and lower targets come into play. Waiting for confirmation reduces the risk of a failed bounce.

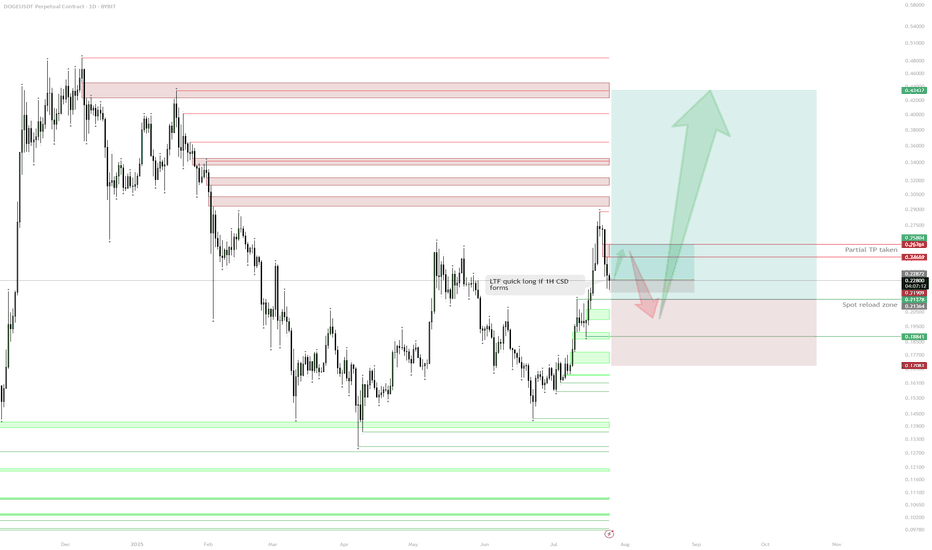

DOGE – HTF Plan & Spot Reload ZoneSpot Position & Realized Profit:

Spot position held from the $0.19 sweep.

Previous long from demand taken and partially realized at $0.26, de-risking the core position.

Current Structure:

After reaching resistance ($0.26–$0.27 zone), price is retracing.

Daily demand/support sits around $0.20–$0.21, with multiple confluences for spot re-accumulation.

Immediate Plan:

Waiting for price to revisit daily demand ($0.20–$0.21) to reload spot and/or open fresh longs.

Watching for a possible lower timeframe (1H) bullish confirmation (e.g., 1H change of structure/1H CSD) as a trigger for a tactical long before daily demand is tagged.

LTF Play:

If price prints a 1H CSD, a quick long up to daily imbalance ($0.24–$0.25) can be considered.

Invalidation:

Loss of daily demand ($0.188) would invalidate the bullish scenario and require re-evaluation.

Upside Target:

If demand holds, looking for moves back into daily supply/imbalance, with ultimate HTF targets at $0.26, $0.32, and higher.

Reasoning:

The core plan is to build spot exposure at strong demand after de-risking on the first move up. The context is that DOGE has shown willingness to bounce at major demand, and with realized profits in the pocket, risk can be managed comfortably on new entries. Short-term, LTF confirmation (such as a 1H CSD) can offer a tactical long back into daily imbalance before the main reloading zone is tagged. Patience and precise triggers are key—no need to rush until price action confirms.

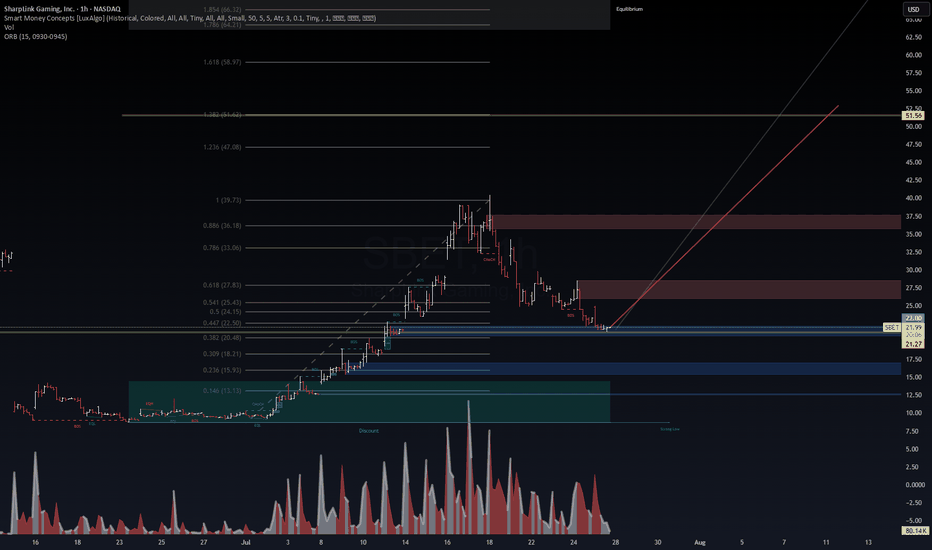

SBET – Holding the Key Zone for a Potential SqueezeSBET – Holding the Key Zone for a Potential Squeeze 🚀🔥

SBET is sitting at a critical support zone (21.0–21.3), right inside the 0.382 Fibonacci retracement. VolanX signals accumulation as volume cools down, setting up for a possible next leg higher.

Key Levels to Watch

Support: 21.0 – 21.3 (Fib 0.382 + structure base) 🛡️

Breakout Zone: 24.8 – 27.8 (Fib 0.5 – 0.618) ⚡

Targets: 33.0 – 36.0 🎯 | Long-term squeeze zone: 51.5 – 64.0 🏆

VolanX Signal

Bullish Bias: As long as 21 holds, liquidity favors upside.

Volume Clue: High spikes suggest prior distribution is cooling, potentially loading for a run.

Momentum Trigger: Close above 24.8 confirms buyers stepping in.

Risk Management

Stop-Loss: 20.4 (below structure) ⛔

Scale Strategy: Add on confirmation above 24.8 and 27.8 to ride the trend.

Profit Zones: 27.8 (TP1) → 33–36 (TP2) → 51+ (runner target).

Question: Are we seeing a base for another SBET explosion or just a pause before deeper discount?

#SBET #Fibonacci #VolanX #TradingView #BreakoutWatch #LiquidityFlow 🚀📊

SBET – VolanX Probabilistic Targets (1–3 week horizon)

For informational/educational purposes only. Not financial advice.

📈 Bullish Paths

P1: Bounce to 24.8–25.5 (Fib 0.5 / structure reclaim) → 58%

Trigger: 21.0–21.3 holds + momentum close above intraday VWAP.

P2: Extension to 27.8 (0.618) / first supply → 38%

Trigger: Clean acceptance >24.8 with rising volume & improving tape.

P3: Squeeze into 33–36 (0.786–0.886 + supply) → 24%

Trigger: Options/flow flip long (OTM calls clustering) + BOS over 27.8.

P4: Parabolic leg to 51.6–64.2 (1.382–1.786) → 10%

Trigger: Narrative + liquidity vacuum (low float + IV expansion).

(Probabilities are conditional—each higher target assumes confirmation of the one before it.)

📉 Bearish Paths

N1: Slip under 21 → 18.2–19.0 (0.309/discount shelf) → 27%

Trigger: Failure to defend 21 with increasing sell volume.

N2: Deeper flush to 16.6 (0.236) zone → 17%

Trigger: Persistent risk-off / liquidity drain, IV spike without demand.

N3: Capitulation toward 13.1 (0.146) / prior demand → 6%

Trigger: Macro shock or failed financing/newsflow, liquidity gap.

🧠 VolanX Read (today)

Bias slightly bullish as long as 21.0–21.3 holds. The engine scores Path P1 > P2 > N1. Expect chop → impulsive move once 24.8 is cleanly reclaimed or 20.4 is lost.

🛡️ Risk Management

Invalidation (swing): Daily close < 20.4.

Sizing: 0.5–1.0% account risk; micro-cap jump risk.

TP ladder: 24.8 ➜ 27.8 ➜ 33–36 ➜ leave runner for 51+.

Adjust: Move to BE after 24.8 reclaim; trail under last 4h HLs.

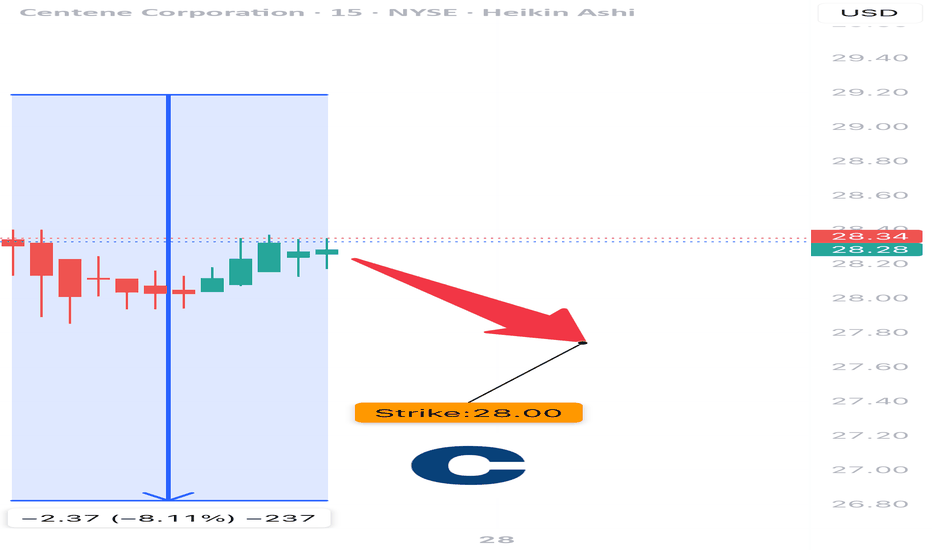

CNC EARNINGS TRADE IDEA – JULY 25, 2025

⚠️ CNC EARNINGS TRADE IDEA – JULY 25, 2025 ⚠️

💊 Healthcare Pressure + Missed Guidance = Bearish Setup for AMC

⸻

📉 Sentiment Snapshot:

• 🚨 Last quarter: Broke 100% beat streak

• 📉 Thin margins + rising medical costs

• 💬 Analyst bias: Neutral to Negative

• 🧮 Fundamentals Score: 4/10

⸻

📊 Technical Breakdown:

• 📍 Price: $26.76 (below 50DMA of $48.12)

• 📉 RSI: 32.4 = Oversold but still trending down

• 🛑 Testing 52W Low @ $26.25

• 🔻 Volume = 2.67x Avg → Heavy Distribution

⸻

🧠 Options Flow Insight:

• 🛡️ Heavy institutional put activity @ $28

• ⚠️ Weak call interest = bearish skew

• 📉 IV crush possible post-earnings

• Options Score: 6/10

⸻

🧬 MACRO CONTEXT:

• Rising sector costs crushing providers

• VIX < 15 = complacent market, sharp reactions possible

⸻

✅ TRADE IDEA:

🎯 CNC $28 PUT (0DTE)

💵 Entry: $0.20

🎯 Profit Target: $0.60 (3x 💥)

🛑 Stop Loss: $0.10

📅 Expiry: Today (July 25, 2025)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings (AMC)

📆 Close trade within 2 hours post-earnings

⸻

📍 RISK REMINDER:

• Theta decay will be brutal if flat

• Watch for volatility and potential IV crush

• Ideal exit zone = stock retests $26 support

⸻

💡 Weak guide = collapse risk.

👍 Like & repost if you’re tracking CNC puts tonight!

#CNC #EarningsPlay #PutOptions #HealthcareStocks #OptionsTrading #0DTE #EarningsTrade #TradingView #SPX #GammaRisk

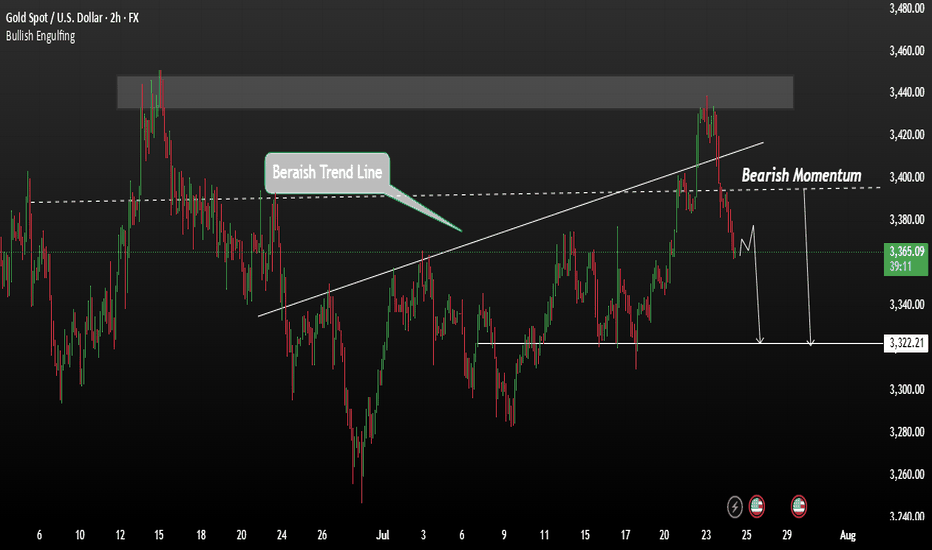

Gold remains in a bearish trendGold followed our previous analysis closely, rejecting from the strong resistance level at $3430, confirming bearish momentum. This rejection has opened the door for a potential move toward the 3400 level, and further downside is likely.

Gold remains in a bearish trend. A temporary pause or minor consolidation may occur, but the overall direction remains to the downside. This week, markets are watching the outcome of the ES–US agreement closely. If a resolution is reached, it could strengthen the USD and increase risk appetite—potentially pushing gold even lower.

We expect gold to remain under pressure unless major market sentiment shifts. A break below 3400 could accelerate the drop toward 3322.

You May find more details in the chart.

Ps Support with like and comments for better analysis Thanks.

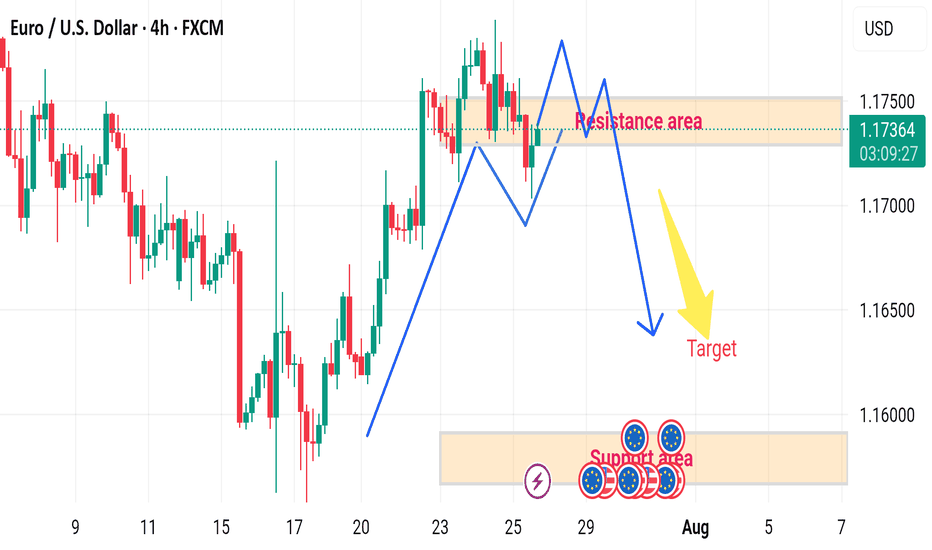

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

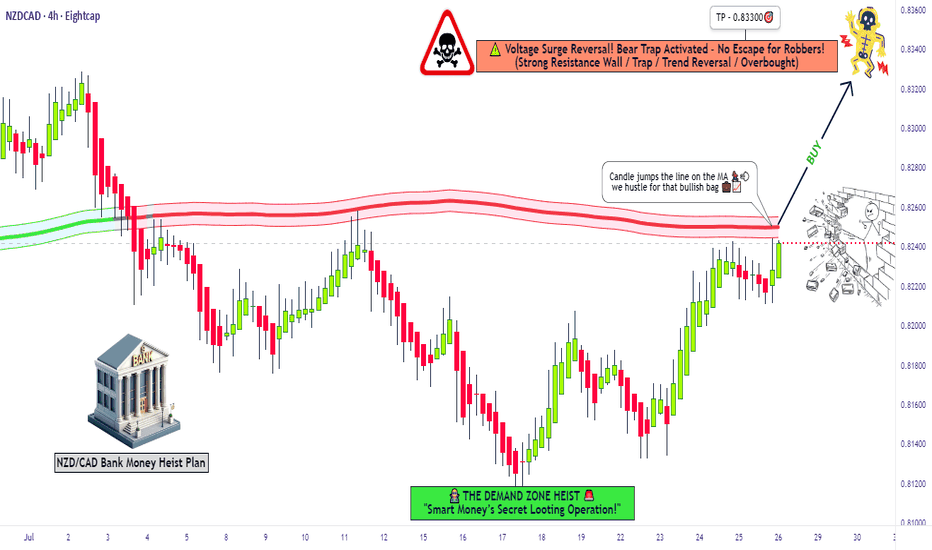

"NZD/CAD Reversal Play – Ride the Bullish Wave!🦹♂️💰 "THE KIWI-LOONIE HEIST: High-Voltage Forex Robbery Plan (NZD/CAD)" 💰🦹♂️

🌍 Attention all Market Pirates, Thieves & Profit Bandits! 🌍

🔥 Thief Trading Alert – NZD/CAD Bullish Heist Setup! 🔥

The "Kiwi vs Loonie" is setting up for a high-risk, high-reward robbery—and we’re locking in the master plan. Long entry is the play, but this ain’t for the weak hands. Overbought? Consolidation? Reversal trap? Perfect. That’s where we strike.

🎯 THE HEIST BLUEPRINT

🔑 ENTRY ZONE (Breakout & Retest Strategy)

"Wait for the 4H candle to CLOSE ABOVE 0.82600 (MA Breakout + Retest)."

Option 1: Place a BUY STOP above the MA (momentum confirmation).

Option 2: BUY LIMIT near recent swing lows (15M/30M precision).

🚨 Set an ALERT! Don’t miss the breakout—timing is everything.

🛑 STOP LOSS (Escape Route)

SL at 0.82000 (near swing low wick on 4H).

⚠️ Golden Rule: NO ORDERS BEFORE BREAKOUT! Wait for confirmation.

Adjust SL based on your risk, lot size, and multi-order strategy.

🎯 TARGETS (Profit Escape Plan)

Take Profit 1: 0.83300 (First resistance).

Or… Exit Early if the market turns shaky.

Scalpers: Long-only scalp plays! Use trailing SL to lock in gains.

⚡ THIEF TRADER PRO TIPS

✅ Fundamental Backing: Check COT reports, macro trends, intermarket signals.

✅ News Alert: Avoid new trades during high-impact news—protect open positions with trailing stops.

✅ Risk Management: Small lots, multiple entries = smarter heist.

💥 BOOST THE HEIST! (Let’s Get Rich Together) 💥

👉 Smash that 👍 LIKE button to fuel our next robbery plan!

👉 Follow for daily high-voltage setups.

👉 Comment "🚀" if you’re joining the heist!

🤑 NEXT HEIST COMING SOON… STAY TUNED, BANDITS! 🤑

🔥 WHY THIS TRADE? (Thief’s Edge)

Bullish momentum but trapped bears = perfect robbery setup.

Institutional levels + retail traps = our opportunity.

Not financial advice—just a well-planned theft. 😉

⚠️ Warning: Trading = Risk. Only play with funds you can afford to lose.

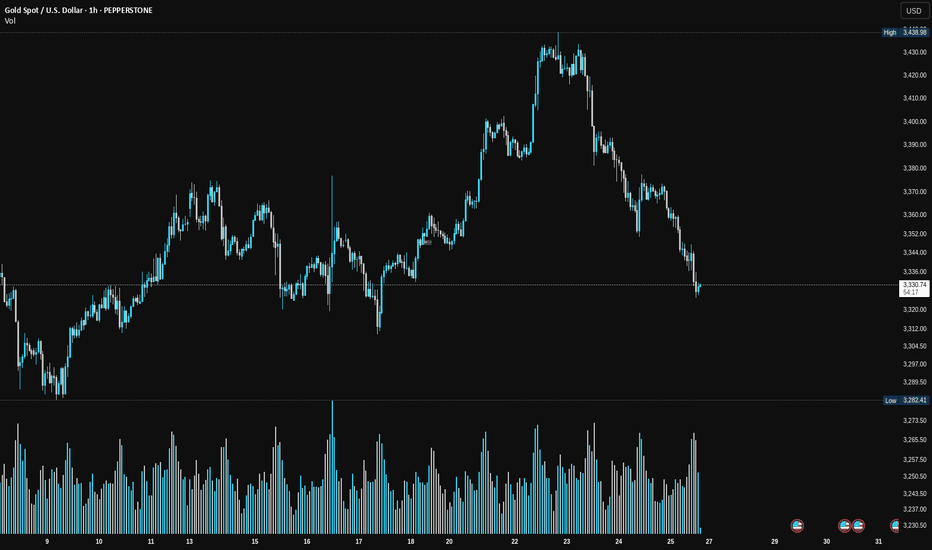

Is Smart Money Selling Gold? A VSA LookHey Traders,

Let's take a look at the Gold (XAU/USD) 1-hour chart using Volume Spread Analysis (VSA). The price made a strong run-up to a new high around $3,438, but the volume is telling us a story of potential weakness.

Here’s a simple breakdown of what I'm seeing.

The Trap at the Top (Signs of Weakness)

Think of the market as being moved by "smart money" (professionals) and "herd money" (the crowd).

Climax Volume: See that huge volume spike right at the peak on July 23rd? While it looks like strong buying, this is often a classic sign of a Buying Climax. This is where smart money starts selling their positions to the excited crowd who are buying at the top, fearing they'll miss out.

No Real Buyers Left: After the peak, notice how the price tried to push higher a few times but on much lower volume? This is a "No Demand" signal. It’s like a car trying to rev its engine, but it's out of gas. It shows there isn't enough buying power to push the price any higher.

Sellers Take Control: As the price started to fall from the top, look at the volume on the down bars. It got bigger. This tells us that supply (selling pressure) is now in control, and they are pushing the price down with force.

Where Are We Now?

The price has dropped and is now hovering around the $3,330 area. The volume has dried up for now, which means the market is taking a pause and deciding where to go next.

What to Watch For Next

Based on the VSA story, here are two possible scenarios:

Scenario 1 (Bearish 📉): The weakness continues. If we see the price try to rally from here but the volume is very low, it would be another major red flag. It would suggest sellers are still in control, and we could see a break below the recent low of $3,320 for another leg down.

Scenario 2 (Bullish 📈): This is a bear trap. For this to happen, we would need to see a strong sign of buying returning. For example, a sharp drop on massive volume that is quickly bought back up. This would signal that the sellers have been absorbed and smart money is starting to buy again.

Conclusion:

For now, the evidence points more towards weakness. The action at the top suggests that smart money was distributing (selling) their gold.

Key Takeaway: Be cautious of any weak-looking bounces. The sellers appear to have the upper hand until we see a clear sign of strength with high buying volume.

This is not financial advice. This is just my interpretation of the chart using VSA. Always do your own research and manage your risk. Good luck trading!

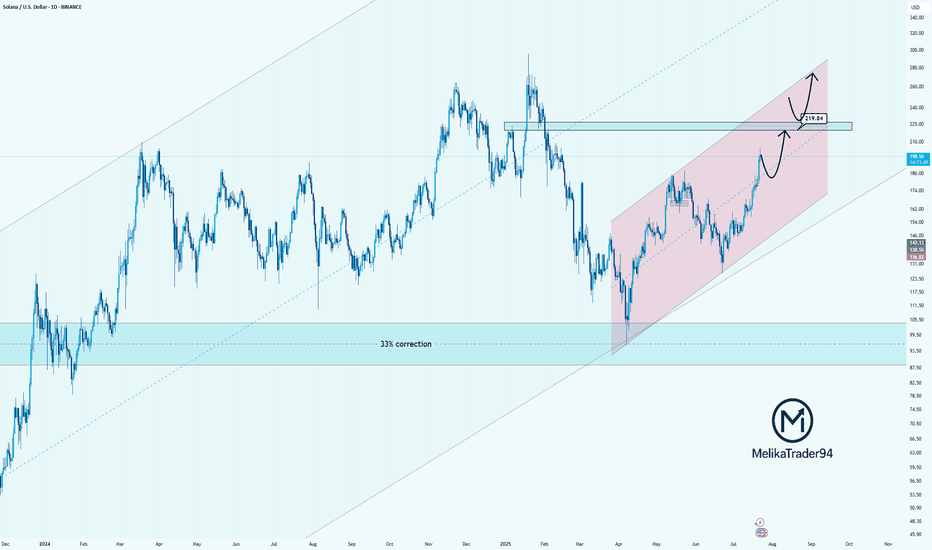

Solana Approaching Key Resistance: watch for $219Hello guys!

Solana has been trending strongly inside a rising parallel channel, recovering steadily after a significant 33% correction. The bullish momentum is clear, and the price is now approaching a key resistance zone near $219.84, which previously acted as a major turning point.

Here’s what I’m watching:

Strong uptrend within the pink channel shows controlled and healthy growth.

$219.84 is a critical decision zone. Price could:

React with a pullback before pushing higher,

Or break through it and flip the level into support for the next bullish leg.

The reaction in this zone will determine the next structure.

Whether we see a temporary correction or continuation to new highs.

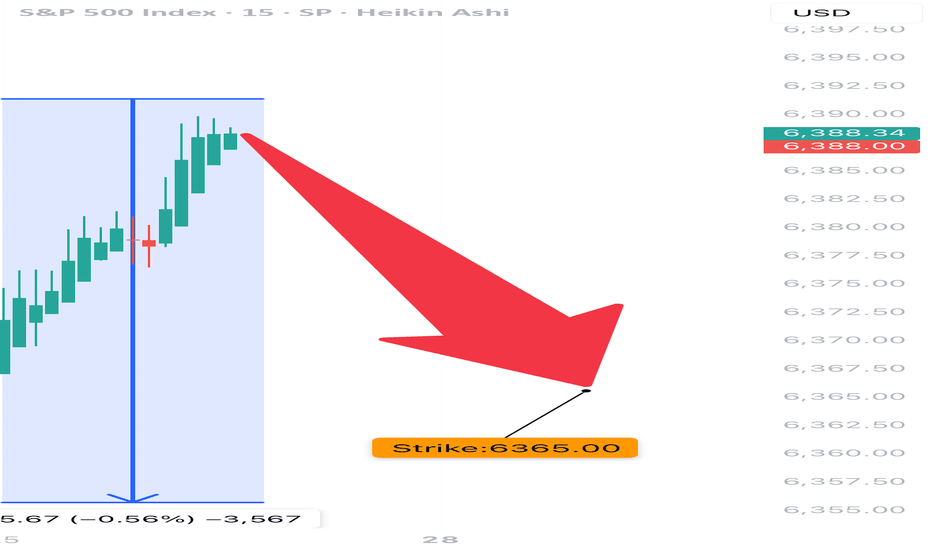

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

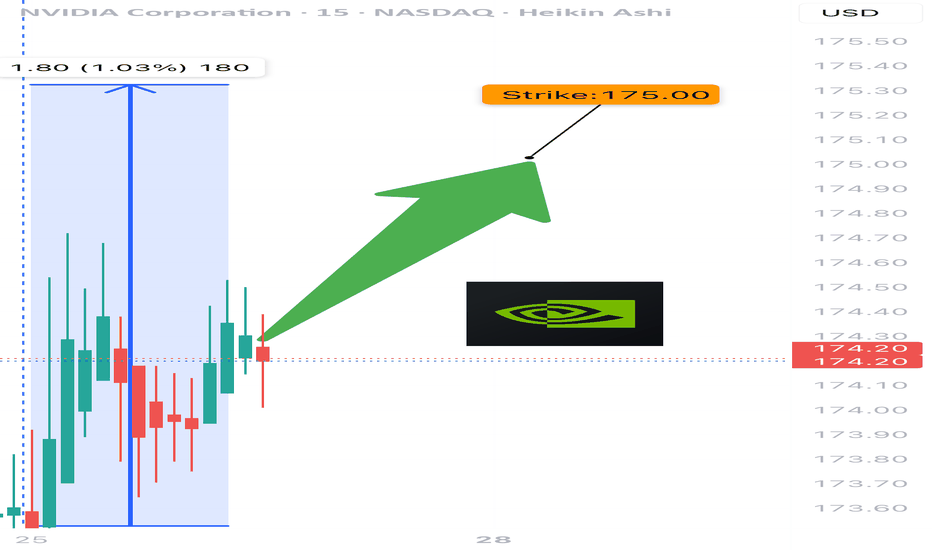

NVDA 0DTE TRADE SIGNAL – JULY 25, 2025

⚡ NVDA 0DTE TRADE SIGNAL – JULY 25, 2025 ⚡

🚀 Strong Bullish Momentum – But Friday Expiration = Gamma Trap?

⸻

📊 Market Stats:

• 💰 Call Volume: Strong

• 🔻 Weak Volume Overall

• ⚖️ Call/Put Ratio: Bullish

• 📈 RSI: Overbought but still pushing

• ⏳ Time Decay: Accelerating

• ☠️ Gamma Risk: 🔥 MAX today (0DTE)

⸻

🧠 Model Summary:

• Grok/xAI: 🔒 NO TRADE today – wait for Monday

• Claude: 🛑 Caution – avoid entries today

• DeepSeek: ⏸️ 4/5 Bullish, wait for cleaner setup

• Gemini: 💡 Suggests $180C next week

• Llama: ✅ Bullish bias, but gamma risk = no go for Friday

⸻

📌 TRADE IDEA: Wait for Monday

📍 Strike: $175 Call

📆 Expiry: Today (0DTE)

💵 Entry Price: $0.56

🎯 Target: $0.95

🛑 Stop: $0.30

📈 Confidence: 65%

🕒 Entry Timing: Monday open IF support holds

⸻

⚠️ Key Warning:

Don’t get trapped by 0DTE gamma swings. Momentum says yes, time decay says no…

✅ Best move? Watch NVDA closely, then strike on Monday if volume confirms.

⸻

👍 Like & save if you’re tracking NVDA.

🔁 Repost if you’re waiting for the perfect Monday setup!

#NVDA #OptionsTrading #0DTE #GammaRisk #BullishSetup #TradingView #TechStocks #WeeklyOptions

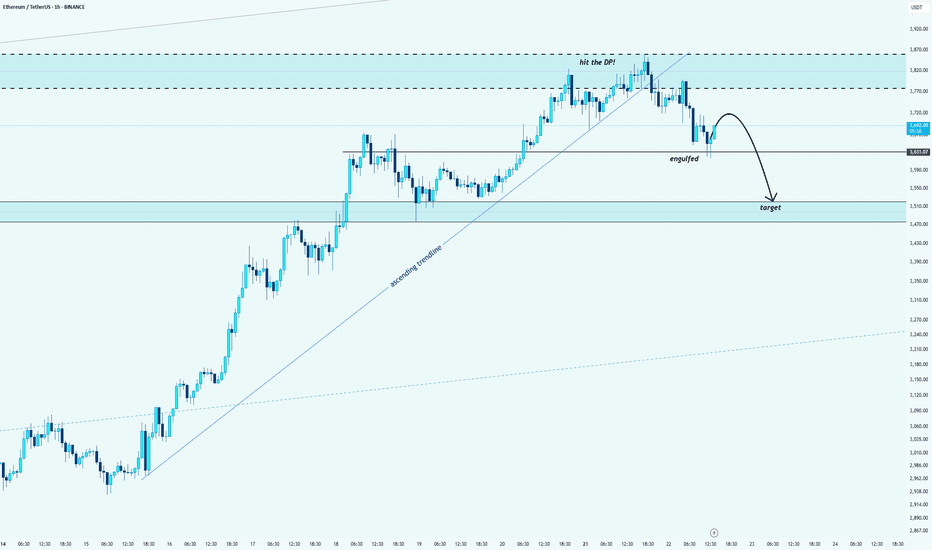

ETH/USDT: Bearish Reversal After Hitting the Decision PointHello guys!

After a strong rally, ETH finally hit the Decision Point (DP) zone marked above. Like what I said:

And we’ve already seen signs of rejection from that level.

🔹 The ascending trendline is broken

🔹 A key support got engulfed

🔹 Price is now forming a bearish structure

The target zone is mapped out around $3,500 – $3,470, where previous demand sits.

We might see a small pullback before continuation, but overall momentum is shifting downward.

Wait for confirmations and protect your capital

META WEEKLY TRADE SETUP – JULY 25, 2025

📈 META WEEKLY TRADE SETUP – JULY 25, 2025 📈

🔥 Institutional Bulls Are In Control — 3.05 C/P Ratio!

🚨 BUT — It’s 0DTE Friday, so don’t get caught in gamma fire.

⸻

🧠 Model Consensus:

✅ All Models = STRONG BULLISH

⚠️ Entry Timing: Monday preferred (due to gamma + time decay)

📉 Volume still weak = caution on conviction

⸻

🔍 META Flow Stats:

• 🟢 Calls: 65,379

• 🔴 Puts: 21,409

• 📊 C/P Ratio: 3.05 = Institutional bulls stepping in hard

⸻

✅ RECOMMENDED TRADE – PLAN FOR MONDAY

🎯 Instrument: META Call Option

🟢 Strike: $720

📅 Expiry: August 1, 2025

💵 Entry Price: $0.97

💰 Profit Target: $1.45

🛑 Stop Loss: $0.49

⚖️ Confidence: 75%

🕒 Entry Timing: Market open Monday

⸻

⚠️ TRADE NOTES:

• Don’t enter on Friday – too much gamma risk

• Wait for volume confirmation Monday morning

• Expect short-duration swing (hold 3–5 days max)

⸻

📊 Smart money is bullish, timing is everything.

👍 Like & Follow if META is on your radar!

#META #OptionsTrading #0DTE #GammaSqueeze #BullishSetup #TradingView #WeeklyOptions #TechStocks

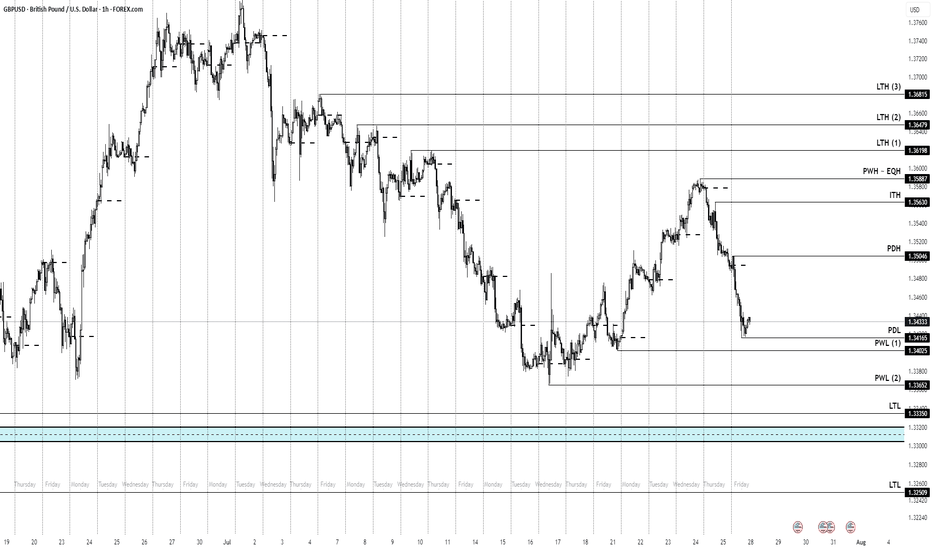

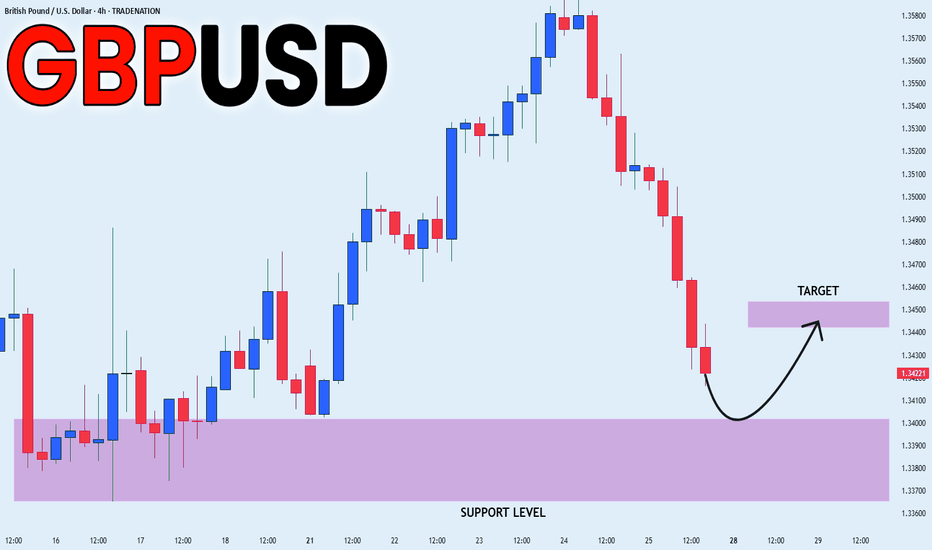

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.