Microsoft (MSFT)–Watching for Pullback Entry After $4T MilestoneMicrosoft Corp. NASDAQ:MSFT has become the second company after Nvidia to cross the $4 trillion market cap, powered by strong AI and cloud demand.

Azure revenue grew 34% to $75B in 2024, with a $30B AI infrastructure investment fueling future growth. Q4 EPS came in at $3.65 on $76.4B revenue, showing strong fundamentals.

We are looking for a pullback to key support for a long entry:

Trade Plan:

Entry Zone: $515 – $518

Take Profit: $536, $555

Stop Loss: $502

#Microsoft #MSFT #Stocks #Trading #StockMarket #TechnicalAnalysis #AI #Cloud #BigTech #NASDAQ

Bigtech

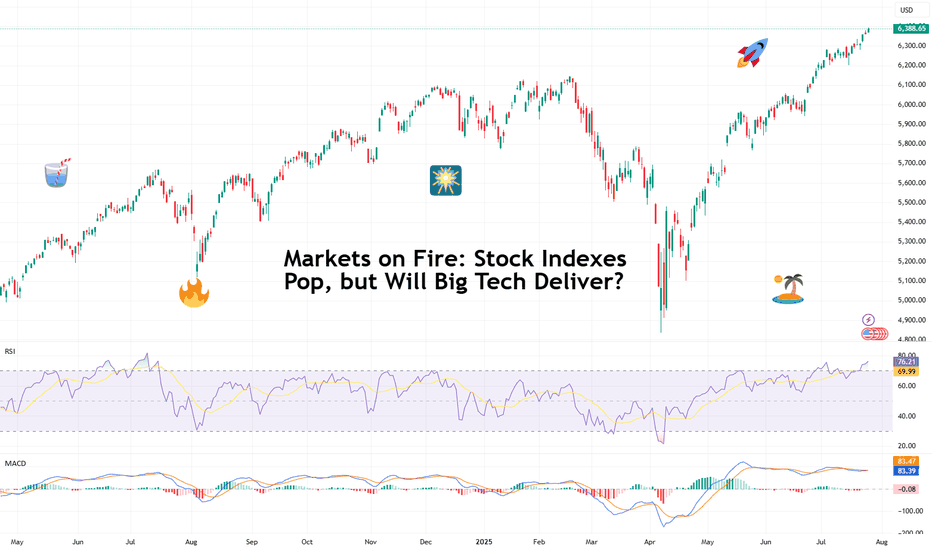

Markets on Fire: Stock Indexes Pop, but Will Big Tech Deliver?S&P 500 and Nasdaq set records. Now it's up to big tech to justify that.

Talk about forward-looking valuation. Tech companies’ valuations are largely based on future potential rather than current performance. And that’s what we’re seeing right now getting priced in across the big indexes.

You’d think we’d be bored of record highs by now. But no — Wall Street keeps hitting refresh on its all-time-high counter. 🎵 Over and over again. 🎵

On Friday, the S&P 500 SP:SPX notched its 14th record close this year, ending at 6,388.64. The Nasdaq Composite NASDAQ:IXIC followed with its 15th at 21,108.32. Even the Dow TVC:DJI — the older sibling who prefers yield over hype — climbed nearly 0.5% to 44,901.92, within a latte’s foam of its December record .

And while indexes are breaking personal bests, investors are buying ahead of some big data deliveries. Why? Because the week ahead is the Super Bowl of Earnings, and the bigger chunk of the Magnificent Seven is up next.

😎 What in the Magnificent Seven?

A highly exclusive club with just seven members, the Mag 7 has entered the earnings spotlight — and the audience isn’t going mild. Traders are pricing perfection, and the script better deliver.

Meta NASDAQ:META kicks things off Wednesday after the close with expected revenue of $44.8 billion and EPS of $5.87. Can Zuckerberg’s AI narrative get investors to forget about the metaverse?

Microsoft NASDAQ:MSFT shows up at the same time, hoping to dazzle with $73.8 billion in revenue and $3.38 EPS. Copilot AI better be doing overtime.

Then on Thursday, again after lights out, Amazon NASDAQ:AMZN joins the chat with its AWS and ecommerce empire expected to pick up $162.1 billion in revenue. Right behind is Apple NASDAQ:AAPL , fighting to stop its slide into meh-land with projected revenue of $89.2 billion and $1.43 EPS. (Fast fact: AAPL is down 12% year to date — among the worst performers in the crew.)

So far, Alphabet NASDAQ:GOOGL already crushed its quarter , posting $96.4 billion in revenue and $2.31 EPS, plus a spicy raise in capex to $85 billion.

Tesla NASDAQ:TSLA ? Not so great. The EV maker reported a 12% revenue drop and a 16% net income decline, spooking investors with a warning of “rough quarters ahead.” The stock is lower by 17% year to date.

Nvidia NASDAQ:NVDA , the AI trailblazer, reports in late August. Until then, it’s chilling on a $4 trillion throne, as per our Top companies rankings, watching its friends sweat it out.

💸 Can the Mag 7 Keep Carrying?

Here’s a harsh dose of reality: the entire S&P 500 is riding on the backs of these seven stocks. Analysts expect them to post 14% earnings growth, while the other 493 companies limp along at 3.4%. Talk about top-heavy things.

So what happens if even one tech titan misses the mark big time and spooks with scary guidance? A market correction? A buy-the-dip opportunity?

And let’s not forget: valuations are stretched. The S&P 500 is now trading at nearly 23x forward earnings (that’s projected profits per share). And the Nasdaq? Don’t even ask. (We’ll tell you anyway — it’s close to 30x). In all that, now’s a great time to keep a close eye on the Earnings Calendar .

📊 Not All Is Big Tech: Fed and Jobs Loom

As if this week wasn’t already packed enough, macro is back on the menu. The Federal Reserve meets Tuesday and Wednesday, and Chair Jay Powell is expected to hold rates steady at 4.5%.

But don’t rule out drama. A single hawkish word and this party could quickly get some rain on. Powell, the man who moves trillions with a simple “Good afternoon,” has a track record of putting markets in their place when they get too euphoric.

And then there’s Friday’s nonfarm payrolls report. Consensus calls for just 108,000 jobs added in July — soft, but not disastrous, and fewer than June’s 147,000 . Blame summer hiring slumps, tariff uncertainty, or the market finally digesting its own hype.

Off to you : Can the Magnificent Seven keep this market magnificent? Or are we about to learn what happens when you ride too close to the sun on AI-generated wings?

Bitcoin (BITX) getting ready for a parabolic move? Here is a chart of probably my favorite swing trade for the year.

I am keeping it simple with this chart though. I am a firm believer in simple when it comes to trading. I think the previous descension and breakout is playing out very similarly to the current one. Both had a double top rejecting from their respective trendlines following the initial breaks of structure. BITX is currently making its second tap of the the trendline. If it plays out like the previous structure did that would suggest w could see one more low in store.

I don't believe this to be the case but if it is this run could be postponed until the end summer/beginning of fall. I think it is more important to point out the relative strength in Bitcoin as of late, the weakness in the US dollar, as well as global liquidity having broke out months ago.

I think the most likely scenario is a pullback from this point which will be followed by a higher low printing. I will say I also expect this pullback to be steeper than the one from the previous descension. Bitcoin and Indices are a lot more overextended than they were last time around and the structure in indices is a lot weaker than before.

All this being said I am expecting a breakout to occur over the next several weeks just based off probabilities. It all depends on if BTC and indices and hold their respective demand/support levels. Bitcoin needs to hold 85k in order for a summer breakout to occur. For the S&P equivalent level this could be somewhere around 5200-5300.

If these assets are not able to hold these levels my confidence will shift pretty dramatically. I would still expect a major rally to take place around the Q4 timeframe but I would be expecting a lot less upside. Price would likely have to chop around for a while before deciding if it wants to continue to the upside. I am basing this off market structure/Dow theory. It is important to take all possibilities into account and ultimately let the charts do the talking.

Big Tech Lines Up for Earnings Season: What Traders Should KnowPeak earnings season is right around the corner — the next two weeks are for the geeks with tech giants slated to report their quarterly financials all the while traders and investors weigh concerns over tariffs, trade wars, and export controls.

On tap to offload first-quarter earnings updates this week are Tesla NASDAQ:TSLA (Tuesday) and Google parent Alphabet NASDAQ:GOOGL (Thursday).

We’ll get more of the tech elite next week — Meta NASDAQ:META and Microsoft NASDAQ:MSFT deliver next Wednesday and Amazon NASDAQ:AMZN and Apple NASDAQ:AAPL report Thursday. Nvidia NASDAQ:NVDA reports late in May.

Let’s talk about that.

Welcome to earnings season, aka that rush hour of the quarter when traders hit refresh on the earnings calendar , their watchlists, and cortisol levels.

Once again, it's Big Tech in the spotlight — specifically the Magnificent Seven club, a pack of tech heavy hitters who spent the past year building the future of artificial intelligence only to be the first out the door this year when investors dumped risk in the face of looming global uncertainty.

Now, with Tesla and Alphabet kicking off what could be a market-moving series of updates, the real question isn’t just who beat the numbers — but who can still tell a good story in the face of tariffs, competition, and AI-fueled capex that’s starting to look like Monopoly money.

👜 The Setup: Seven Stocks, Seven Bags to Hold

The Magnificent Seven — Tesla, Apple, Amazon, Microsoft, Meta, Alphabet, and Nvidia — aren’t just the tech elite. They’ve been the main engine of the market for the last few years. But in 2025, the wheels have come off.

These technology mainstays, towering over the growth sector, have shed hundreds of billions and are now nursing double-digit percentage losses. Each. One. Of. Them. The growth space, valued more on prospects of bright performance rather than current showing, has been hit hard this year. How hard? That hard:

Tesla NASDAQ:TSLA is down 36%

Nvidia NASDAQ:NVDA is down 27%

Amazon NASDAQ:AMZN is down 21%

Alphabet NASDAQ:GOOGL is down 20%

Apple NASDAQ:AAPL is down 19%

Meta NASDAQ:META is down 16%

Microsoft NASDAQ:MSFT is down 12%

On the outside, we all know what’s dragging stocks — it’s the widespread tariff jitters fanning recession fears and triggering waves of capital outflows. But on the inside, these tech giants are deep into a spending spree, and paring back that guidance might be too late.

AI spending is now at fever pitch, having gone from “impressive” to “uh… should we be concerned?” And that’s what investors will be watching when these masters of technology report quarterly numbers.

Besides the usual revenue figures, earnings per share and (likely timid) guidance, capital expenditures will draw a ton of attention. Capital expenditures, or capex, is the amount of money a company allocates for investments in new stuff like hardware and software and that may include beefing up existing infrastructure.

Injecting AI into systems and operations is top focus right now and Big Tech has decided to be generous and pony up some big money for it. Here’s what this year’s capex looks like, as per prior guidance:

Microsoft has allocated $80 billion

Alphabet has set aside $75 billion

Amazon? $100 billion ready to roll

Zuck’s Meta is in with up to $65 billion

The rest of the Mag 7 haven’t put out official capex projections but no one is sleeping on the opportunity.

Let’s go around the room and see what each of these is dealing with right now.

🚗 Tesla: A Look Under the Hood

Tesla reports first, and traders are bracing for either redemption — or another reason to panic sell.

On the surface, it’s not pretty: EV demand is sagging, especially in China and Europe. Musk’s political disruption and proximity to Trump aren’t helping the optics. And with shares already down 36% this year, the company enters this earnings call with bruises and baggage.

Revenue is expected to come in at $21.2 billion, down 1%, while earnings are projected to drop 8% to $0.42. Tesla delivered 336,681 cars in Q4 , a 14% drop from the same time a year ago.

🌎 Alphabet: Quiet Strength, But Still on Watch

Alphabet is expected to deliver solid results — $89.2 billion in revenue, up 11%, and $2.01 in earnings per share, up 6.3% from last year. Among the Mag 7, it’s one of the best-positioned players to weather trade volatility, thanks to its size, diverse revenue streams, and sheer dominance in advertising and cloud computing.

Its Gemini AI model is heating up the race against ChatGPT and Copilot, and its cloud division is quietly chipping away at AWS and Azure’s lead.

That said, traders will still be watching for any signs of slowdown in digital ad spending—a canary in the coal mine if the economy starts to sputter under tariffs and tightening global conditions.

💻 Amazon and Apple: The Slow Burners

Amazon, with its big-ticket spending on AI, is playing the long game — mostly through AWS, the company’s main driver of profitability. It's aggressive, even by Big Tech standards. The problem? AWS margins are under pressure, and retail is facing the squeeze from cautious consumers.

Amazon needs to prove it can turn AI into revenue, not just headlines. Amazon’s sales and earnings per share are projected to grow 8.16% and 38.7% respectively.

Apple, meanwhile, is in the risky position of relying a bit too much on China for its products — it ships about 90% of its iPhone from Asia’s biggest economy.

And while that may be irrelevant for first-quarter results, it may weigh on the company’s outlook, considering Trump’s flip-flopping on Chinese tariffs (is tech in or is tech out?) .

The iPhone maker is expected to report $93.9 billion in revenue and $1.61 in earnings per share.

🔍 Meta and Microsoft: AI Darlings With Something to Prove

Meta reports next Wednesday, and the pressure’s on. Zuck has gone full steam into AI, pushing for everything from AI chatbots in WhatsApp to personalized content generation across Facebook and Instagram.

But here’s the kicker: Meta still makes its money from ads. And if ad budgets start shrinking in response to tariffs or a slower economy, AI investments may not save the day — at least not right away.

Meta is expected to pull in $41.3 billion in revenue and $5.24 in earnings per share.

Microsoft, on the other hand, has positioned itself as the white-collar AI whisperer. Copilot is everywhere — Office, Teams, Edge, Windows — and its $80 billion in AI infrastructure spending is squarely aimed at enterprise dominance.

It still holds a 49% stake in OpenAI, and Azure is growing, albeit slower than expected. If Microsoft can show AI adoption translating into real revenue, traders may get the breakout they’ve been waiting for.

Microsoft is expected to pick up revenue of $68.5 billion and $3.23 in earnings per share.

🤖 Nvidia: The Final Boss

Nvidia won’t report until late May, but it’s already looming over the entire earnings season. Every other tech company is spending billions on Nvidia’s chips — so when the chipmaker finally updates investors, it could swing sentiment across the entire sector.

The market wants to see that demand is real and growing, especially from hyperscalers like Microsoft, Amazon, and Google. If Nvidia disappoints, the fallout might be like watching a domino go down.

Nvidia is expected to bring home $43.1 billion in revenue and $0.90 in earnings per share.

⚙️ Final Thoughts: Big Bets, Big Risks

This isn’t just another earnings season — it’s a stress test for the Magnificent Seven amid times of big market shifts. The group that once carried the market now faces a reality check: AI is expensive, global trade is messy, and Wall Street is no longer giving out free passes for “vision.”

But where there’s risk, there’s also opportunity. Traders who can sift through the noise, spot the change in tone, and ride the next narrative — whether it’s autonomous Teslas, AI-powered spreadsheets, or ad-supported Metaverse avatars — will have the edge.

What’s your take? Which Big Tech name are you watching most closely — and are you betting on a rebound or bracing for more pain? Let’s hear it from you.

Oracle Liquidation - Short or Sell | Yellowstone Bubble Anyone?Awhile back I posted a chart, where I referred to this current market as the "Yellowstone Bubble".

Lol at the time, I was simply teasing about how ever since roughly season 4 of the show Yellowstone , it seems like everyone thinks they are some kind of tough-guy money-making, all-powerful market wizard.

Google: "Yellowstone Oracle".

Anyway, there's not much else to say here. The internet is a commodity.

Earnings Season to Show if Big Tech Stocks Can Justify AI HypeUpper echelon of tech realm is expected to report the most profits since early 2022 as the bar is set high thanks to the big promise of artificial intelligence.

Earnings season is about to hit fever pitch with the biggest names in the corporate world getting ready to deliver spring-quarter financial updates. The bar is set high thanks to the promise of artificial intelligence to rewire how businesses operate, spend and make money.

How high exactly? All S&P 500 companies collectively are predicted to knock out the biggest increase in profits in more than two years — year-on-year earnings growth is pinned at 8.8% for the quarter ended June, the highest since the first quarter of 2022.

Froth or Not?

Stakes are high. The upcoming string of earnings data will show whether big tech high-flyers can justify the AI hype that has propelled stocks to record after record . The S&P 500 has notched more than 36 all-time closing highs this year and is sitting on gains of more than 18% since it started trading in January.

The Big Dogs

Apparently, optimism is sweeping left and right, lifting valuations of companies big and small. A handful of them have been singled out as the biggest group of winners. And — you guessed it — they’re all involved in the AI narrative.

Chipmaking giant Nvidia (ticker: NVDA ) and a clique of big tech heavyweights are lined up to show if their earnings and revenue guidance will catch up to the sky-high valuations. Nvidia has more than doubled this year, soaring above $3 trillion in market value. Briefly, it became the world’s largest company . Its peers Microsoft (ticker: MSFT ), Facebook parent Meta (ticker: META ), Apple (ticker: AAPL ) and Alphabet (ticker: GOOGL ) have rocketed to records this year as well.

Heavy Concentration

The 10 biggest companies in the S&P 500 fill up about 37% of its worth, which presently gravitates toward $48 trillion. This said, these 10 titans of capitalism contribute 24% to the broad-based index’s earnings — the highest ratio since 1990.

To keep going with the numbers, before we dive into what’s coming over the next few weeks, the S&P 500 companies are trading at 21.4 times their projected earnings over the next 12 months. For comparison, the average multiple for a five-year stretch is 19.7.

It gets even more interesting when you zoom in and double click on five tech titans — Nvidia, Apple, Microsoft, Meta and Amazon. Their price/earnings multiples have ballooned to an average of 34 times projections, up from 28 times. The AI bellwether, Nvidia, has soared to 41 times, from 24 times in January.

Against that backdrop, analysts are quick to point out that a correction in stock prices may loom large if these corporate giants can’t beat out their earnings projections. Is there room for disappointment?

Stacked Up Against Expectations

Let’s go around the table and see what’s coming over the next few weeks. We’ll keep it tight so we’ll only look into the elite Magnificent Seven club .

July 23

Microsoft (ticker: MSFT )

Year-to-date performance: 23%

Revenue guidance: $64 billion

Alphabet (ticker: GOOGL )

Year-to-date performance: 33%

Revenue expectations: $79 billion

Tesla (ticker: TSLA )

Year-to-date performance: 0% ( find out the reasons ).

Revenue expectations: $20.16 billion

July 31

Meta (ticker: META )

Year-to-date performance: 44%

Revenue guidance: $36.5 billion to $39 billion

August 1

Apple (ticker: AAPL )

Year-to-date performance: 24%

Revenue expectations: $84 billion

Amazon (ticker: AMZN ) (date unconfirmed)

Year-to-date performance: 30%

Revenue guidance: $144 billion to $149 billion

August 21

Nvidia (ticker: NVDA ) (date unconfirmed)

Year-to-date performance: 168%

Revenue guidance: $28 billion

Let's Hear from You!

Are we going to see another blockbuster quarter of record revenue and profits? Or is the AI hype overblown and could this mean big tech may let us down? Share your thoughts below!

Alphabet - It is just a textbook company!NASDAQ:GOOGL has been one of the best performing stocks over the previous decade.

The most profitable stocks are the ones which trade under the radar. And Alphabet (Google) is definitely one of these stocks which is simply trending higher, providing textbook trading opportunities and not a "hype" stock. Slow and steady wins the race, but you have to be careful that you don't miss your chances. After a retest of the breakout level, you can enter a long trade.

Levels to watch: $150

Keep your long term vision,

Philip - BasicTrading

NAS100 H4 | Bullish momentum to extend further?NAS100 could fall towards a pullback support and potentially bounce off this level to climb higher.

Buy entry is at 18,955.13 which is a pullback support.

Stop loss is at 18,670.00 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement level.

Take profit is between 19,125.04 and 19,228.63 which is a zone that is identified by the 61.8% Fibonacci projection and the 127.2% Fibonacci extension levels.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd, previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

NAS100 H4 | Potential bearish reversalNAS100 could rise towards a pullback resistance and potentially reverse off this level to drop lower.

Sell entry is at 18,035.07 which is a pullback resistance.

Stop loss is at 18,200.00 which is a level that sits above the 127.2% Fibonacci extension level and the all-time high resistance.

Take profit is at 17,652.31 which is an overlap support that aligns close to the 61.8% Fibonacci projection level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd, previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

NAS100 H1 | Bullish bounce off 50.0% Fibo supportNAS100 is trading close to a pullback support and could potentially bounce off this level to rise towards our take profit target.

Entry: 16,761.10

Why we like it:

There is a pullback support that aligns with the 50.0% Fibonacci retracement level

Stop Loss: 16,700.00

Why we like it:

There is a level that sits under a pullback support and the 61.8% Fibonacci retracement level

Take Profit: 16,909.50

Why we like it:

There is a pullback resistance level

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EOY Review $GOOG strong year heading into exhaustion levelNASDAQ:GOOG

Magnificent 7 did great this year, GOOG included

strong close, 4 green quarters in a row

exhaustion risk -for what it's worth- around that 152 level

will be interesting to see how this level (and similar levels for the other big 6) will play any role in what the big guys/institutes will do here

let's watch and see, anything can happen, incl. big tech (check out '22)

🎯 Palladium to Platinum Metal Spread vs. American BigTech IndexThe breathtaking rally in palladium appears to be coming to the end.

Rising supply and slowing demand are undermining the price of a metal used to neutralize car exhaust emissions.

Palladium, once the cheapest of the major precious metals, soared from under $500 an ounce in 2016 to over $3,400 last March, leaving platinum and gold far behind.

The reason for the rally was growing demand from automakers who needed more palladium per vehicle to meet tightening emission standards.

However, supply could not keep up, resulting in huge shortages for some. And no less huge profits for others.

Now this is changing.

Electric vehicles (EVs) that don't need palladium are gaining more market share, and automakers are replacing some of the palladium with cheaper platinum in ICE vehicles.

Meanwhile, the supply of recycled cars is growing as those with more palladium are being scrapped more and more.

Palladium has fallen to around $1,600 an ounce, shedding more than 50 percent from its 2022 highs, and analysts are predicting an average price of just $1,150 an ounce in 2027.

Analysts at Morgan Stanley predict that demand from automakers will fall by about 400,000 ounces between 2022 and 2027, while supply from car recycling will increase by 1.2 million ounces, with demand for palladium almost 90% dependent on automotive industry.

This will push the market at around 11 million ounces per year to a near-million ounce surplus in 2027, they said.

Russia's Norilsk Nickel, which accounts for appr. 38-40% of the world's palladium supplies, said its palladium production will fall by 8-14% this year.

Techical picture indicates Palladium to Platinum metal spread erases as much as 50 percent vs. its peaked near 3.0 in 2022, whereas the Bearish market in Palladium has fully launched.

The similar case has happened in early 00s when Palladium to Platinum ratio lost more than 90 percent over decade, as well as Nasdaq - major american BigTech index.

Will the history fully repeat itself. Or will be written in a rhyme. Lets see.

Longest Consolidation Period Since 00's | 1D, 1W ChartsAAPL Tech Giant vs The World

AAPL has had a rough couple of weeks so to speak. With Treasury yields, to their new iPhone 15 overheating issue, there is much to be said about how this will playout in the long run for AAPL stock. Tech giants 12 month price-to-earnings ratio fell to 27 from 34, but APPL is forecasted to reach higher earnings in Q4 and beyond. September could be said to be a messy month for The Magnificent 7, but hopefully this is the calm before the storm.

1W Chart

- Moving Average: Let me explain why this is such an important indicator. As you can see I have labeled the number of times AAPL ducked bellow the 50 D SMA, and after every duck came a rally to the upside, as soon as it broke through the average. This has been a 15 year trend. Now if it were to duck under the 50 D SMA again, after it already had, then this would be a very bad sign . Expect to be consolidation for God knows how long.

- RSI: In every bull rally, I have shown the average support levels in the RSI, this is to make sure we are staying on trend. Now there is a red line that can be seen at 37, this indicates the lowest level the RSI has gone during a Bull Rally, if it were to break this level, we are now in the longest consolidation period since the 00's.

1D Chart

- Moving average: Nothing fancy, it's there just in case, However, there are important levels that need to be discussed. There are 2 potential levels of support that AAPL needs to hit in order for it not to be considered consolidation. 164 and 157, with 157 being the lowest. Obviously not these exact same numbers but around this area is what we need to be looking at for a couple of days.

- Stoch RSI: Is at a level where we can start breaking higher.

Extra

- Make sure to look at other Tech Giants and Treasury Yields for any correlation, as I did not have the time to include them in this Idea.

Please let me know your thoughts in the comments, if you liked this Idea, give it a boost as it helps he out in making more charts for you guys!

Nice shortThe price was rejected from the resistance zone. It can try another push towards the downtrend line. I opened a small position (small position because big techs love to come back very strong), SL above 300, TP 250 approx. If it plays out it should fall very fast. Take 80% of the profit at 260, you never know with this high cap stocks.

Snowflake - Is It Time To Stop Gambling On Chop?Snowflake, a Nasdaq company, has earnings looming post-market, which has IV on weekly calls and puts juiced to 150%.

Yet people are still gambooling on the next big instawin. The problem is you'll blow your account and won't need TradingView anymore and won't be able to have any fun in your community.

Really, a far better proposition if you want 5 and 8:1 odds on things that are like 10 or 20:1 against to hit is to deposit on a sportsbook and put the same risk into a 3-bet parlay on late season MLB.

If you're right you'll even get paid the same day and not have to mess around with charts and bars all day.

Snowflake is one of the tech sector dump casualties, but has never bounced.

The monthly shows very clearly we're simply sitting in $90 worth of range spanning almost a year and a half.

And while $90 in range is pretty good, the problem is that it doesn't pump. There will eventually be a change in market structure and the most likely target is under $110.

Weekly bars show us that the May low has been taken out before earnings, and this is a factor that is not consistent with bank/fund sponsorship to take out the highs.

Which hints to us that the largest players who can move the market of a company that is still valued at $49 billion while printing $650~ million in quarterly revenue are probably targeting the bottom of "the flag" and not the top.

While the failure swing at $190 forms a double top and becomes a target, the problem is that everything is set up, with Jackson Hole as the Federal Reserve and the world's most critical financial policy decision pending on Friday, to continue to correct and correct violently into the fourth quarter.

Nasdaq Futures - The Trend Is Your Friend, Until The End

Moreover, a lot of the worldwide economic situation is being heavily driven by what's going on Mainland China with Xi Jinping and the Chinese Communist Party he still hasn't thrown away.

Word in the Western media is that the regime's de facto state run corporations, for whatever reason, are sitting on something like $3 or $4 trillion in real estate debt that's about to explode in their hands.

There's still the problem of natural disasters like the Beijing floods, economic calamities like the International Rules Based Order jawing and chattering about "de-risking" from China, and the impact of the virus that has claimed many, many more people than the few hundred thousand the CCP has officially reported to John Hopkins for the official trackers.

Worst of all is the 24-year persecution and organ harvesting genocide against Falun Dafa's 100 million spiritual practitioners looms over the head of the Party. Even though Xi isn't responsible for the persecution and hasn't participated, it was done by former Chairman Jiang Zemin and the toad faction nested in Shanghai-Babylon, Xi is the one with his head in the prisoners' box because he's now the Chairman of the Party.

And on top of that is an epidemic of arsons masquerading as climate change that have burned to death tens of thousands of hectares of trees and forests and their associated plants and animals.

This world is out of control, but it's not allowed to stay out of control for long.

And while it's on the brink, you're being told to get long by furus, Discord, Telegram, Wechat, Stocktwits, and Reddit, and are happy to take the bait, because you don't see the danger.

So here's what's up for SNOW on earnings.

A really likely theory is that it doesn't do much at all because the option sellers will just hold the price where it is in advance of Jackson Hole, let IV decline, collect all the premium from you as everything expires worthless on Friday and laugh.

And somewhere along the way, Snowflake will have a $12 retrace to bring in breakup traders and take out short sellers to $165. But this $165 will be another form of optimal short entry to target the $100 mark before Q4 expires.

If there's to be upside on this stock, based on the length of time and range of the chop and the specific price action amid the overall market and macro conditions, it would be a lot more likely to come after the lows get taken.

Be careful.

Nothing to do here, just waitPrice just landed on a key level, that is also the bottom of the channel from Dec 2022. I could be a test of the broken resistance now support but I don't see any buyers activity. It could easily dead cat bounce off the support and break down the key level and drop to the next support at 250. I'm just watching this one, nothing to do. It may also start a consolidation to continue its uptrend. Time will tell.

Following the herdBig tech keeps pushing up, not sure why but is doing it. Google seems to catch up very quickly. Looks like is forming a bullish flag prior to break out the 160 resistance and test 140 level. I'm not sure how long is going to take so I just opened a long position (no calls this time) and wait.

$AMZN Still strong, a pull back and reversal back up (?)Decent shooter on the 2D could signal a pull back on NASDAQ:AMZN , would be nice to see a reversal move up further North.

With Monthly OPEX for May behind us, see how it moves from here.

AMZN strong, but not the ultra strong move AAPL had so far on the year. Also giving it more potential before it reaches exhaustion risk like AAPL at current levels.

No FOMO, no chasing for me. Definitely looking for to long AMZN IF this scenario will unfold.

IF this THEN that.

IF not, also fine. There will be hundreds if not thousands more trading opportunities. As long as you stay in the game. Hence, patience.

$AAPL still strong, but with some exhaustion risk (?)Apple one of the leading names so far on the year, still going strong.

Especially after it took out high of last August (see 2W chart), now could face some exhaustion risk.

On track to take out previous year high, let's see how it plays out.

No chasing for me, not according to plan.

Overvalued Tech: Time for Tangible Assets & Fair ValuationsThe tech sector, specifically the 'Big Tech' companies have seen massive gains since the massive accumulation in 2010-2014. However, these increases seem disconnected from the companies' actual value or tangible contributions to the real-world economy. Their high price-to-earnings ratios suggest overvaluation and potential for a market correction.

Invest in sectors with real-world utility and reasonable valuations - Allocate capital to sectors like industrials, materials, consumer staples, or healthcare. These sectors provide tangible products and services and often have more reasonable valuations.

1. High Valuations: Tech stocks, in particular, often trade at high multiples of their earnings or revenues. These high valuations can make them more vulnerable to market downturns, as they can fall more dramatically if investors reassess their growth prospects or risk tolerance.

2. (GOOGL, APPL, AMZN, MSFT, META, NVDA, ADBE, and TSLA) all represent a significant portion of the SNP-500 index due to their large market capitalizations.

3. So, in a S&P-500 meltdown , these tech companies could potentially see significant declines in their stock prices due to these factors. However, it's important to remember that the specifics would depend on a wide range of factors, including the reasons for the market downturn, the companies' financial health and growth prospects, and overall investor sentiment.

4. I would choose Tesla as the only pick out of all 8 as this company has shown lots of potential compared to our tech giants of the now. Even with the upbringing of AI it is not enough to save google or meta, but Apple and Microsoft might hold up strong as they are largest caps.

5.

Google (Alphabet) : ~$1.5 trillion

Apple Inc. (AAPL): ~$2.5 trillion

Amazon (AMZN): ~$1.7 trillion

Microsoft (MSFT): ~$2.2 trillion

Meta Platforms : ~$1 trillion

NVIDIA (NVDA): ~$500 billion

Adobe (ADBE): ~$300 billion

Tesla (TSLA): ~$800 billion

TOTAL = 10 Trillion roughly

No Reason To Get Long YetThe play here is near term puts for move to 140s, which is the black path.

Best case scenario for longs is it shows sign of strength with move to 165 (green path) - in that case it would still need a Bu/Retest which eliminates significant upside risk,

Worst case for longs is red path - move to low 130s, dead cat, then more down.

Black path most likely case, this should get hit fast.

Shopify - It's Bear *and* Bull Hunting SeasonBefore Shopify's 10:1 split, it was trading for $1,800 USD. Notable because it was the Toronto Stock Exchange's biggest stock, trading over $2,000 CAD. This was the kind of stock that all the eyes used to be on.

The company processes payments on the Internet and the work from home lockdown glory days are gone. The next time we're all under house arrest will be because the governments want to act like the Chinese Communist Party; the priority won't be keeping people stable and placated like it was in 2020. Things will be scary, and so the fundamentals for this company will never be as good as they were before.

That being said, it looks like we're about to head/already heading into what I believe is a tech bear trap before Nasdaq goes big or goes home, a two-sided move which I outlined a few weeks ago:

Nasdaq NQ QQQ - Reality Will Be a Tough Pill for Permabears

Shopify is something to keep on your radar because, no matter how they file shelf offerings to dilute their share count and how that ought to affect share price because it's a really a function of marketcap, Shopify is the kind of thing that likes to go up and down 10 or 15 percent in a day, and when it does go, it has significantly major upside potential, which you can see on weekly bars:

And look, I get it, $45 --> $30 --> $115 is a real too good to be true sort of call, but it's not without its principled rationality.

After 179 trading days and 263 real days of consolidation, Shopify finally started to take out highs in the earliest part of '23. This comes after it took out significant long term lows in the October Low of the Year for indexes.

These two factors combine to tell you that the algorithms no longer point down, but point up. It's only that there is the risk that the "up" peaked when the stops over $50 were taken and everything is going down for real now. I'm only partially psychic. You'll have to get Jamie Dimon and Ken Griffin to tell you the concrete manifestation of what's going to happen.

But Shopify's price action is not that significantly different from what Netflix has done, except Netflix just never bothered to run the bottom and never really liked to go down, and has already gone up significantly.

What bears are missing from their doom thesis is this:

The markets will crash when the Federal Reserve pivots, not before. It's a "buy the rumor, sell the news" equation, my friends. They've been hiking for over a year, and long term, none of the big 3 indexes are actually bearish on monthly or weekly candles.

What people don't realize is that everything is setting up for a situation where inflation appears to be waning and will continue to appear to be waning for the next few months, and it's because we're in winter. This apparently deflationary environment will set the stage for the narrative that leads us to Nasdaq 14,500+.

Natural gas, oil, and gasoline will all supermooncycle in the summer because of significantly increased societal demand, and that means food, goods, services all go up too.

And in the meantime, the Fed is going to continue to hike at least 25 bps a session. So they're going to hike and hike and we're going to walk right back into big inflationary numbers starting in late May and through July while the FFR is already too high.

The Fed won't be able to start hiking 50 and 75 bps when we're already at 5.5% because the national debt is so super bloated thanks to the U.S. socialists spending trillions and trillions of dollars on so-called "stimulus," which really just amounts to raiding the Treasury and the future generations like pirates.

And so, the Fed is going to be forced to pivot at the worst time: in the middle of inflation that was worse than 2022, and the two factors combined is what is really going to cause the big gap downs.

And the gaps are going to run, because the Fed obviously won't be able to bail out the market this time, so there won't be any hopium for retail to huff.

There are other things that can unfold geopolitically around the same time, like the collapse of Xi Jinping and his Chinese Communist Party, Russia defeating NATO in Ukraine, and large scale environmental disaster and significant genuine pandemic diseases that are beyond the control of the globalists and their technology.

All of this combines to tell you that the dumpster the bears dream of is far away, which means that much higher prices are coming. It presents a death trap for people who are obediently following Discord signal groups, Zerohedge, Fintwit, and CNBC, instead of thinking for themselves, and an opportunity for the "few" who understand that "The Big Short" is being set up, and that "The Big Short" inherently means a run back towards high levels.

So buy this coming dip, don't capitulate, and enjoy the fruit of the moon mission that is the biggest exit pump of all time. Just make sure you get out, take profit, and keep your risk light.

You have to keep your eye on the Chinese Communist Party. It's been two weeks since the Lunar New Year and all the resulting travel stimulus from hundreds of millions of people being freed from months of house arrest have finished, and now there are reports that there are multiple significant mutations of Omicron SARS-CoV-2 emerging all over the world.

Meanwhile, if you check Our World in Data or the other aggregators, you'll see that the CCP claims there have been 0.00 new COVID cases or deaths since roughly Jan. 6.

This is obviously totally impossible. Not to mention the Communist Party is a chronic liar that only cares about its "stability" and isn't one bit concerned with how many people might die as it lies to the world and the Chinese people.

All of this should tell you that the pandemic situation is volatile outside of China, and extremely dangerous inside of China. The situation could devolve at any time, and at any time you can be stuck on the wrong side of a gap.

What you have to understand about the Communist Party and the globalist factors who have cultivated its methods and ways, who seek to export them globally for the unveiling of the One World Government/New World Order, is that the Specter of Communism's life's work is to destroy your life and to destroy humanity.

No joke. Its fundamental wish and its fundamental goal is to ruin each and every person and each and every thing. And so, the test for all of Creation is whether you can evidence, with both your words and deeds, that you don't want the Devil Red, and instead you want to enter the future that is the resurrection of China's 5,000 year-old culture of Heavenly Dynasties.

The choice is yours. It's your job to choose.

It's my job to tell you these words.