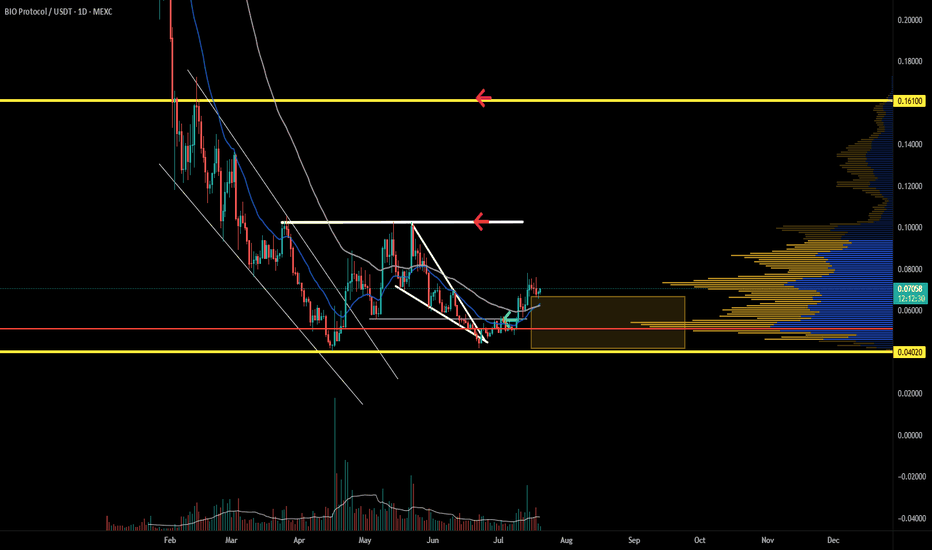

BIOUSDT Forming Strong PotentialBIOUSDT is currently presenting a highly promising technical structure, suggesting a strong potential upside. The chart shows the price has recently bounced from a key support zone and has started forming higher lows—an early signal of bullish accumulation. With multiple support blocks holding firm and upward price projection arrows indicating potential targets, the setup leans toward a breakout continuation. The volume pattern also confirms healthy market activity, which reinforces the strength of this possible trend reversal.

The price action seems to be coiling just beneath resistance, which typically precedes an impulsive breakout move. Based on the chart’s structure and market dynamics, there is a clear path for a substantial price rally. The projected targets indicate a potential gain of 140% to 150%, making BIOUSDT a high-potential candidate for short- to mid-term traders. The confluence of horizontal support zones and higher timeframe trend signals suggest that momentum may continue to build in the coming sessions.

What sets BIOUSDT apart right now is the growing investor interest around the project. Whether driven by ecosystem developments or speculative momentum, the increased volume and social buzz are helping sustain price levels and set the stage for a bullish continuation. A confirmed breakout above the recent consolidation could lead to rapid gains, especially if broader market conditions remain favorable.

Traders should keep an eye on a daily close above the marked resistance region with increased volume as a confirmation signal. Given the sharp projected upside and the clear technical roadmap laid out on the chart, BIOUSDT remains a compelling opportunity for those monitoring altcoins with breakout potential.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

BIO

BIO creating a bullish structure BIO is forming a healthy structure backed by market participation. As long as price action does not fall below the bottoms, it is likely that new highs will be made. Momentum and trend oscillators are looking bullish and are trending towards overbought states.

Full TA: Link in the BIO

Bio Protocol Short-Term (PP: 315%) —Trading vs InvestingFor some trades, we focus on the short-term. Lately, when the charts are young we are using them for the short-term signals. Rather than ignoring them completely, these tend to be hot and attract a lot of interest from market participants. We should also play.

BIOUSDT produced a bottom pattern here, notice the cup and handle. Enough to open a trade. Something like this: Buy and wait for the market to move in your direction (up). Set up your sell order on target before the target hits, normally after buying. When the target hits, the project in question will have disappeared from your portfolio, but you will see new funds in USDT (or BTC if you are trading a Bitcoin pair).

In short, buy and hold, the market takes care of the rest.

There are two targets on the chart, which one you choose is up to you. You can also choose both or none. By none I mean you keep holding long-term. While this is a short-term chart/trade setup, this does not cancel out the fact that we are entering the 2025 bull market cycle and phase. Which means that there is room for massive growth. By both I mean selling a portion at each target. Whatever you do is up you. I give you great entry prices and great timing. Also the analysis to remove any doubts when it is time to wait.

If prices drop you have two options:

1) Who cares? This option means that you keep on waiting until the market turns. The wait can last 1 day, 3 days just as it can last 1 week or 6 weeks or months. It depends on the broader market cycle.

2) After prices drop a certain pre-defined number, you close the trade; sell at a loss.

These are two options. Some people will buy and hold, others will decide to trade.

If you go with #2, you are trading.

If you go with #1, you are investing.

Thank you for reading.

Namaste.

BIO Protocol price analysis⁉️ Someone reminded MM - #BioProtocol that after the listing it would be nice to maintain the price, and ideally to pump a little, finally woke up)

We think that many people have #BIO in their portfolios under the name: “let it lie there, maybe it will grow someday” :)

So, we keep our fingers crossed for growth.

🟢 It will be difficult for OKX:BIOUSDT to go up the range of $0.08-0.16, as longs were collected there and some of them will definitely want to go out “to zero”.

🔴 But if and when MM gets to the shorts and “forces” them to cover, then growth can accelerate significantly.

In general, I would like to see the price of #BIO at least $0.28-0.30 and with a project capitalization of about $500 million.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BIO after listing, zones of interestPretty simple idea for BINANCE:BIOUSDT after listing

Always work with IAP model (shared in my ideas for free)

2 main zones of interest marked on a chart! 12h tf.

Invalidation of idea if token drop under listing price!

Zone of fixation local swing trade on a spot marked red block

Hope you enjoyed the content I created! You can support this idea with your likes and comments so more people can see it.

✅ Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only, not for financial investment purposes.

Check out my ideas about interesting altcoins in the related section below ↓

For more ideas, please hit "Like" and "Follow"!

BIO COIN NEXT POSSIBLE MOVES AND TRADE SETUPS !!NYSE:BIO Coin Updates & Next Possible Moves!!

• From Last 4 days price consolidating now i a range... Now if CRYPTOCAP:BTC get little bit stable too then i am expecting now minimum 30% bounce back in its price.

- High Risk Coin Without Stoploss Don't Build trade on it🚨

Warning : That's just my analysis DYOR Before Taking Any Action🫡.

Bluebird Bio (NASDAQ: BLUE) Posing Strong Bearish TrendBLUE is currently trading above its 50-day and 200-day simple moving averages (SMA), indicating a bullish trend. However, the 50-day SMA is below the 200-day SMA, forming a death cross pattern, which is a bearish signal.

The 20-day exponential moving average (EMA) is also above the current price, acting as a resistance level. A break above the 20-day EMA could signal a continuation of the uptrend, while a break below the 50-day SMA could signal a reversal of the trend.

Earnings and Revenue: The earnings per share (EPS) of BLUE is expected to decline by 37.50% in the current quarter (Dec 2023) and increase by 333.30% in the next quarter (Mar 2024). The EPS for the current year (2023) is estimated to be -$11.7, which is a 59.10% decrease from the previous year (2022). The EPS for the next year (2024) is projected to be -$8.6, which is an 26.50% increase from the current year2. The revenue of BLUE is expected to decrease by 3.10% in the current quarter (Dec 2023) and increase by 9.00% in the next quarter (Mar 2024). The revenue for the current year (2023) is estimated to be $289.2 million, which is a 0.80% decrease from the previous year (2022). The revenue for the next year (2024) is forecasted to be $313.6 million, which is a 8.40% increase from the current year.

The technical analysis of BLUE shows that the stock is in a mixed trend, with some bullish and bearish signals. The stock is also facing low volatility and uncertain momentum. The earnings and revenue estimates suggest that the company is going through a challenging period, but might recover in the future.

$LABP First Supply Test and VolumeCrazy volume on this one relative to it's history and .58 supply test and rejection but stock is still hovering above .4 resistance which is promising for longs.

I'm in at .3 and holding for .7 Target, to trim some along the way.

BIO | Medical Device Co | Good EntryBio-Rad Laboratories, Inc. manufactures, and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America. The company operates through Life Science and Clinical Diagnostics segments. The Life Science segment develops, manufactures, and markets a range of reagents, apparatus, and laboratory instruments that are used in research techniques, biopharmaceutical production processes, and food testing regimes. It focuses on selected segments of the life sciences market in proteomics, genomics, biopharmaceutical production, cellular biology, and food safety. This segment serves universities and medical schools, industrial research organizations, government agencies, pharmaceutical manufacturers, biotechnology researchers, food producers, and food testing laboratories. The Clinical Diagnostics segment designs, manufactures, sells, and supports test systems, informatics systems, test kits, and specialized quality controls for clinical laboratories in the diagnostics market. This segment offers reagents, instruments, and software, which address specific niches within the in vitro diagnostics test market. It sells its products to reference laboratories, hospital laboratories, state newborn screening facilities, physicians' office laboratories, and transfusion laboratories. In addition, the company offers products and systems to separate complex chemical and biological materials, as well as to identify, analyze, and purify components. The company offers its products through its direct sales force, as well as through distributors, agents, brokers, and resellers. Bio-Rad Laboratories, Inc. was founded in 1952 and is headquartered in Hercules, California.

$MIRM bear proof 👁🗨

*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management

My team entered Mirum Pharmaceuticals $MIRM today at $25 per share. Our take profit is $30. We also have a stop less set at $24

OUR ENTRY: $25

FIRST TAKE PROFIT: $30

STOP LOSS: $24

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$AMGN LONG IDEA$AMGN is one of my favorite bio tech stocks as it has solidified its place as a winner over the years. They had a bit of a slowdown and consolidation over the past few years as they didn't have as much involvement with COVID, but certainly didn't lose too much value.

Watch for a 4hr close above $241.50 to send us back to $260+ over next few weeks.

$MIRM november update*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

Recap: My team entered $MIRM on 10/29/21 at $15.70 per share. Our first take profit is at $26.

Mirum Pharmaceuticals $MIRM released their 3rd quarter earnings today after market close. In this report they announced a loss of -$1.55 per share on revenue of $5.0 million. This earnings beat is staggering, especially when acknowledging the fact that the revenue consensus was only $0.8 million. $MIRM is still an under the radar company currently, but a revenue beat of 502.4% will definitely turn some heads. In addition, post-earnings five insiders accumulated a vast amount of shares. These insiders know what's coming, and lucky for us we do too. Our first take profit is honestly a huge underestimate of this companies potential, and in the future we may have to make some major adjustments.

This is a buy and throw away the key type of investment. My teams holding! Will you?

OUR ENTRY: $15.70

FIRST TAKE PROFIT: $26

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$EDSAEdesa Biotech Inc (NASDAQ: EDSA) is surging higher Monday after the company announced positive Phase 2 data of its monoclonal antibody in hospitalized COVID-19 patients. Critically ill patients demonstrated a 68.5% reduction in the risk of dying when treated with EB05 over standard of care.

An independent Data and Safety Monitoring Board concluded that "a clinically important efficacy signal" was detected and that the study "met its objective." The DSMB recommended continuation of the study into a Phase 3 trial.

"The strong effect in reducing death in the most critically ill hospitalized patients who have been treated with systemic corticosteroids, including dexamethasone, and IL-6 inhibitors, shows the potential life-saving impact of this drug, irrespective of SARS-CoV-2 variant," said Par Nijhawan, CEO of Edesa Biotech.

Edesa Biotech is a biotechnology company focused on inflammatory and immune-related diseases. It is involved in exploring novel ways to treat these diseases.

Edesa Biotech, Inc., a clinical-stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases. Its lead product candidates are EB05, a monoclonal antibody, which is in Phase 2/Phase 3 clinical study for the treatment of acute respiratory distress syndrome in covid-19 patients; and EB01, a topical cream containing non-steroidal anti-inflammatory compound that is in Phase 2B clinical study to treat chronic allergic contact dermatitis. The company also develops EB02, an extension of sPLA2 anti-inflammatory cream for treating erythema, swelling, and exudation associated with hemorrhoids disease; and EB06, a monoclonal antibody candidate. It has a collaboration agreement with NovImmune SA to develop products containing toll-like receptor 4 and chemokine ligand 10 for therapeutic, prophylactic, and diagnostic applications in humans and animals; and Yissum Research Development Company for the development of products for therapeutic, prophylactic, and diagnostic uses in topical dermal and anorectal applications, as well as for the use in dermatologic and gastrointestinal conditions. Edesa Biotech, Inc. was founded in 2015 and is headquartered in Markham, Canada.