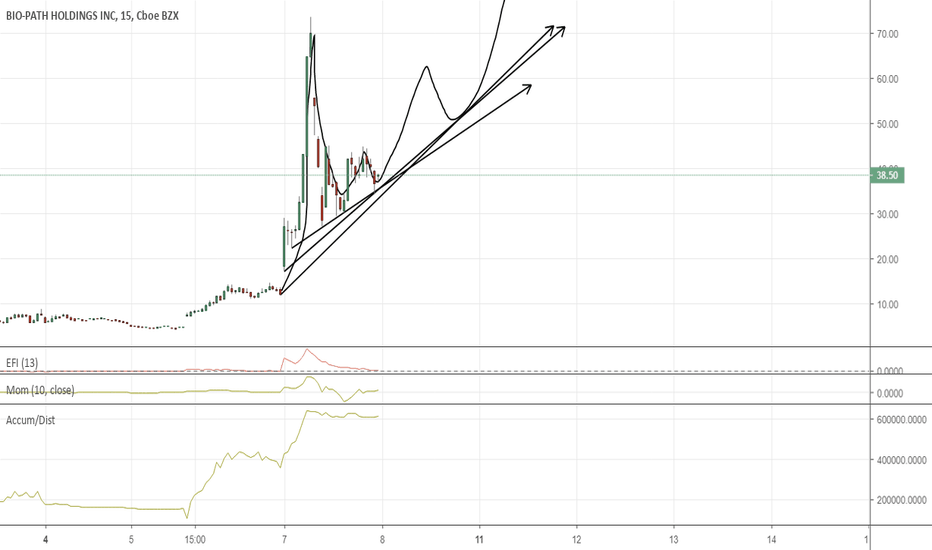

The hidden gem is Ready to explode Easy & risky trade

Price target as shown on the graph

Loss is 5%

Gain is 40% and above

Does it worth a try! Think about it and trade safe

Biostocks

$PFE Long term PT 300 and higher$PFE Lepas Calls 70 Jun 16th 2023 Returns +10,125%

$BNTX and $PFE Leaps

The FDA approval of Pfizer’s COVID-19 vaccine is a ‘critical step forward in vaccine confidence’: Doctor

Army gives Pfizer $3.5B contract to make 500 million COVID vaccine doses

Pfizer authorizes $1 billion for oral COVID-19 treatment, CEO says

Pfizer now expects its Covid vaccine to generate $33.5 billion in full-year sales, the company said Wednesday.

Pfizer Is Ready, Even For COVID-19 Variants

CDC NOW ADVISING STATES TO PREPARE TO DISTRIBUTE THE COVID-19 VACCINE AS SOON AS LATE OCTOBER

Is CRSP trading in an Ascending Triangle?It appears as though CRSP is potentially bottoming out and forming an Ascending Triangle pattern.

On the DMI there's been a bullish twist where I have placed the blue downward pointing finger.

On the KST there's been a bullish cross where I have placed the blue check mark and upon back-testing the red line we've seen a bullish bounce where another check mark.

MOTS Should have a nice bounce from hereLikely around a 40% upside potential, Take profit around 1.4$

Blue line is normal trendline support

Red line is Log chart support

Take profit is 0.5 - 0.618 Fib of previous bounce

SE SE SESN DIT! I'll just say that there are a lot of stocks and cryptos reaching breaking points, and they will most likely all do the same thing. I'm seeing plenty of potential for most everything to break to the downside but the bullish charts look strong so that's what I'm going with. This SESN chart looks really good, but it's at the tipping point as we speak.

Big Rock Partners Acquisition Corp Announces Merger with NeuroRxBig Rock Partners Acquisition Corp. Announces Merger with NeuroRx, Inc.

Combined Company to Have an Estimated Post-Transaction Equity Value in Excess Of $500 Million (Excluding Potential Earnout Payments), Assuming A Share Price Of At Least $10.00 Per Share

NeuroRx, Inc. is a clinical stage, small molecule pharmaceutical company which develops novel therapeutics for the treatment of COVID-19 (RLF-100 or "ZYESAMI™ (aviptadil)") and Bipolar Depression (NRX-100, 101)

The transaction is expected to occur in the first or second quarter of 2021.

Under the terms of the transaction, Big Rock will issue to NeuroRx's current equity holders an aggregate of 50 million shares of Big Rock common stock for their interests in NeuroRx

ubject to certain conditions, an aggregate of 25 million additional shares of Big Rock common stock will be issued to NeuroRx pre-merger equity holders if, prior to December 31, 2022, (1) RLF-100 receives emergency use authorization by the FDA and (2) the FDA accepts the Company's filing of its application to approve RLF-100.

In addition, subject to certain conditions, a $100 million cash earnout may be payable to NeuroRx pre-merger equity holders if, prior to December 31, 2022, either (1) FDA approval of the Company's COVID-19 Drug is obtained and the Company's COVID-19 Drug is listed in the FDA's "Orange Book" or (2) FDA approval of the Company's Antidepressant Drug Regimen is obtained and the Company's Antidepressant Drug Regimen is listed in the FDA's "Orange Book".

finance.yahoo.com

CYCC Announces at-the-market $7 Million Strategic InvestmentCyclacel Pharmaceuticals Announces at-the-market $7 Million Strategic Investment by Fundamental Investor Acorn Bioventures

Cyclacel Pharmaceuticals has entered into a definitive securities purchase agreement with Acorn Bioventures, LP, a biotech-focused fundamental investor.

- Strategic investment from single biotech-focused institutional investor -

- Enables clinical development of both fadraciclib and CYC140 in hematological malignancies and solid tumors -

Acorn Bioventures has agreed to purchase in a registered direct offering 485,912 shares of common stock and 237,745 shares of newly designated Series B Preferred Stock (convertible into shares of common stock at a ratio of 1:5), and in a concurrent private placement, warrants to purchase 669,854 shares of common stock, for aggregate gross proceeds of approximately $7 million.

The warrants will be exercisable beginning twelve months following the date of issuance, will expire on the five-year anniversary of the date of issuance, and have an exercise price of $4.13 per share.

finance.yahoo.com

Only for investors : Biotech For those looking to diversify their portfolio or a long-term investment. Here I bring you an option in the biotech sector: Bluebird Bio INC, the leader in targeted cell therapy.

This stock is in an important support area. It is a zone where buyers will seek to accumulate to buy cheap. the risk in this operation is low compared to the profit potential

Is CRSP trading in a descending triangle or bull flag?Key Takeaways

A descending triangle is a signal for traders to take a short position to accelerate a breakdown.

A descending triangle is detectable by drawing trend lines for the highs and lows on a chart.

A descending triangle is the counterpart of an ascending triangle, which is another trend line based chart pattern used by technical analysts.

Bullish flag formations are found in stocks with strong uptrends. They are called bull flags because the pattern resembles a flag on a pole. The pole is the result of a vertical rise in a stock and the flag results from a period of consolidation. The flag can be a horizontal rectangle, but is also often angled down away from the prevailing trend. Another variant is called a bullish pennant, in which the consolidation takes the form of a symmetrical triangle. The shape of the flag is not as important as the underlying psychology behind the pattern. Basically, despite a strong vertical rally, the stock refuses to drop appreciably, as bulls snap up any shares they can get. The breakout from a flag often results in a powerful move higher, measuring the length of the prior flag pole. It is important to note that these patterns work the same in reverse and are known as bear flags and pennants.

EOM.

BIOS LONG SET UPBIOS BUY

ENTRY 1 $3.18 ORDER FOR MARKET OPENING

Entry 2 $2.98

Tp.1 $4.00

Tp.2 $6.00

Tp.3 $9.00

Tp.4 $11.50

BIOS Bullish Cup and HandleBIOS looks to potentially be in a bullish cup and handle pattern that could potential send the stock to $6.

Is 22ND Century trading in a descending triangle?Maybe a bull flag or ascending triangle as well. It looks like they're trading above the 200 Day MA, which is bullish for the stock in determining the direction of the trend at times.

$MLNT Breaks Out Ahead of Upcoming 9 Presentations at ECCMIDVery undervalued stock. 52 Week High was $46.00 52 Week Low was $3.22 Revenue for the 4th quarter of 2018 was $35.5 million, an 739% increase year over year. Total revenue for the year is $96.4 million. Could do 2x-3x from this level.

Key data presentations at ECCMID 2019 include:

Integrated Symposium Presentations

•“Update on acute bacterial skin and skin structure infection: current challenges and new therapeutic agents,” chaired by Javier Garau, M.D., Ph.D. (Saturday, April 13, 1:30 - 3:30 p.m., Hall D)

•“Light and shadows in the management of serious MDR G-negative infections,” chaired by Matteo Bassetti, M.D. (Monday, April 15, 4:00 p.m. – 6:00 p.m., Hall F)

Oral Presentation

•Abstract No. 3623 (Sunday, April 14, 11:00 a.m. - 12:00 p.m. CET, Exhibit Hall L): Development and Validation of a Risk Stratification Score for a Mixed Gram-Negative and Gram-Positive Infections among Patients Hospitalized with Skin and Skin Structure Infections in the U.S., Y. Tabek, BD.

Poster Presentations

Meropenem/vaborbactam (VABOMERE®)

•Abstract No. 8308 (Saturday, April 13, 3:30 - 4:30 p.m. CET, Paper Poster Area): Activity of meropenem-vaborbactam and single-agent comparators against KPC-producing Enterobacterales isolates from European countries (2016-2018) stratified by infection type, M. Castanheira, JMI Laboratories

•Abstract No. 2825 (Monday, April 15, 12:30 - 1:30 p.m. CET, Paper Poster Area): Multicenter Evaluation of Meropenem/Vaborbactam MIC Results for Enterobacteriaceae and Pseudomonas aeruginosa Using MicroScan Dried Gram-Negative MIC Panels, A. Harrington, Loyola University

•Abstract No. 4780 (Monday, April 15, 12:30 - 1:30 p.m. CET, Paper Poster Area): ETEST meropenem/vaborbactam for antimicrobial susceptibility testing of Enterobacterales and Pseudomonas aeruginosa: performance results from a multi-centre study, C. Anglade, bioMérieux, Inc.

•Abstract No. 7426 (Tuesday, April 16, 12:30 - 1:30 p.m. CET, Paper Poster Area): An FDA-approved study for an AST disc 510(k) submission: comparison of an oxoid AST disc to a predicate AST disc for meropenem-vaborbactam, N. Hunter, Thermo Fisher Scientific

Delafloxacin (BAXDELA®)

•Abstract No. 6363 (Monday, April 15, 1:30 - 2:30 p.m. CET, Paper Poster Area): Delafloxacin tentative ECOFF values for common Gram-positive and Gram-negative bacteria, G. Menchinelli, Università Cattolica del Sacro Cuore

Oritavancin (ORBACTIV®)

•Abstract No. 4151 (Monday, April 15, 1:30 - 2:30 p.m. CET, Paper Poster Area): Oritavancin Activity against Staphylococcus aureus Clinical Isolates Causing Serious Infections in Hospitalized Patients in Europe (2017-2018), C. Carvalhaes, JMI Laboratories

marketwirenews.com

$BPTH Posts Positive Phase 2 Trials for Leukemia DrugBio-Path released updated Phase 2 data for its lead candidate prexigebersen, codenamed BP1001, for treating acute myeloid leukemia, or AML, and also divulged a plan of action for taking the compound through clinical development toward registration.

Updated data from the Stage 1 of the Phase 2 study that evaluated the efficacy and safety of prexigebersen in conjunction with the low-dose chemotherapy regimen cytarabine in 17 newly diagnosed AML patients revealed that the proportion of patients showing a response increased from 47 percent when assessed in April 2018 to 65 percent.

Of the patients showing a response, 5, or 29 percent, showed a complete response compared to the benchmarked percentage of 7-13 percent.

AML: A Cancer Of Blood Cells:

AML is a form of blood cancer that develops in the bone marrow, where blood cells originate. It afflicts a group of white blood cells called myeloid cells that develop into mature blood cells such as red blood cells, white blood cells and platelets.

A patient with AML will see rapid accumulation of immature myeloid cells in the blood, resulting in a drop of other blood cell types.

BP1001's Mode Of Action:

Prexigebersen is a neutral-charge, liposome-incorporated antisense drug designed to inhibit protein synthesis of growth factor receptor bound protein 2, or Grb2.

Grb2 has a role to play in cancer cell activation via the RAS pathway.

Inhibition of Grb2 is found to halt cell proliferation and enhance cell killing by chemotherapeutic agents without added toxicity.

A Lucrative Market:

AML accounts for roughly 36 percent of all leukemias, with about 20,000 new cases diagnosed each year, Bio-Path said, citing National Cancer Institute estimates.

A critically unmet need exists for non-toxic therapies for older, fragile AML patients who are unfit or ineligible for high-dose chemotherapy or a stem cell transplant.

What's Next:

Bio-Path said it believes it now has a plan with definable paths to registration.

It plans to amend the Stage 2 prexigebersen + decitabine Phase 2 AML cohort in untreated new patients to add untreated high-risk myelodysplastic syndrome, or MDS, patients.

The company also intends to cancel the Stage 2 prexigebersen + LDAC Phase 2 AML cohort in untreated de novo patients.

It also plans to test a triple combo of prexigebersen + decitabine + venetoclax for untreated AML and high-risk MDS patients in a registration-directed trial to determine if more durable responses and longer survival are observed compared to patients treated with the decitabine + venetoclax combination.

The next major catalyst for Bio-Path will be the fourth-quarter results expected sometime in the next month.

$CRBP BIO STOCK >200 MA Break @ 7.08 > Median Analyst Target 26+$CRBP BIO STOCK >200 MA Break @ 7.08 > Median Analyst Target 26+

Chart is setting up with the 200 MA break for a early set up to the Golden Cross, as the 50 MA is edging up. The stock will Blue Sky with a 11 break. Most Analysts have a target over 26 +.

Fundamental Catalysts

With Data coming and potential approvals could be " the excuse" to what the chart is telling us. With a median target of 26+ puts tremendous upside with limited downside here.

I expect this to be rich with catalysts, data points, and potential approvals till years end.

The Phase 2 -3 studies

dermatomyositis and lupus

cystic fibrosis

systemic sclerosis

seekingalpha.com

BIOTECH poised for much more upsideBIOTECH stocks look as though they have quite a bit f upside to go. what is most interesting is that the S&P and dow generally seem to be nearing a top, but this chart indicates much more bull-side momentum. Im very interested to see how this all pans out. My guess is tactical asset allocation and active investing will soon come back into the fray