ABCL - WW - SMALL OTM OPTIONSAll, ABCL in a pretty solid spot here imo. Definitely need conformation of bottom here, candle looks to be a reversal possibly. I would look at 17-20$ calls OTM longer term or leveraged stock position hold long with a very tight stop loss. Could drop one more level. Just watch, slap some alerts on it but ABCL definitely imo worth 20-22.

Biotech

Biotech - CSLModel has given entry signals for CSL Limited:

- CSL Limited is a global specialty biotechnology company that researches, develops, manufactures, and markets products to treat and prevent serious human medical conditions.

- We are very excited about opportunities in the biotech sector, as we believe the fight against COVID is going to move to the next phase in the nearest future.

- Technically in a Wyckoff accumulation structure with a spring, possibly testing the channel top.

GLHF,

DPT

Disclaimer:

We absolutely do not provide financial advice in any shape or form. We do not recommend investing based on our opinions and strongly cautions that securities trading and investment involves high risk and that you can lose a lot of money. Loss of principal is possible. We do not recommend risking money you cannot afford to lose. We do not guarantee future performance nor accuracy in historical analyses. We are not registered investment advisors. Our ideas, opinions and statements are not a substitute for professional investment advice. We provide ideas containing impersonal market observations and our opinions. Our speculations may be used in preparation to form your own ideas.

Bullish Reversal after Options Expiration Today for GALTGALT reported positive results for cancer immunotherapy one week ago. This was followed by algorithm trading taking the stock price lower. There is high open interest on $3, $4, and $5 calls expiring today. The price should reverse and move higher with the expiration of these calls, since the options traders accomplished what they were after to keep below the strike price and will now cover their short positions.

TipRanks data on 488,633 investor portfolios show that 8.4% more portfolios hold GALT in the last 7 days, so there is growth in the investor base. The temporary dip is from the options traders.

(See my previous Idea for summary notes on the due diligence setup.)

OCGN back to basicsOCGN kind of treading water for now. I think what we need to see are some rock-solid results from COVAXIN, which this rolling submission could be helpful in identifying. The Phase 3 results were interesting. With more warnings coming out about the current SOC EAU vaccines, another option might not be "too late" at this point. But a lot will clearly come down to the results. For now, speculation is probably playing a bigger role as we don't know much more beyond what Ocugen announced this week. Regardless, looking at chart levels, a quick Fib retracement shows a few "pain points" on the chart, namely the 618 fib that has been a frequent resistance level over the last few months.

"On July 2nd, Ocugen reported new evidence from Bharat Biotech. The company shared positive results of its Phase 3 study of COVAXIN™; a whole virion inactivated COVID-19 vaccine candidate. According to the company, it demonstrated a vaccine efficacy in mild, moderate, and severe COVID-19 disease of 77.8% with efficacy against severe COVID-19 disease alone of 93.4%.

“With the Delta variant becoming a dominant strain of COVID-19 in the United States, we believe that the Phase 3 efficacy results reported by Bharat Biotech demonstrate that COVAXIN™ has the potential to become an important option to expand protection against this emerging variant. Combining these data with the only Delta-variant results from a controlled Phase 3 clinical trial, evidence continues to support a favorable benefit-risk profile for COVAXIN™.” - Dr. Bruce Forrest, Acting Chief Medical Officer and a member of the vaccine scientific advisory board of Ocugen. "

Quote Source: 7 Penny Stocks For Your Watch List This Week If You Like Biotech In July

$SRNE Bullish Setup$SRNE has bounced off of the .618 fib level, which could mean a break to the recent high. I am anticipating a touch to the $15 zone within the next couple of months. Good Luck!

ARGX Bullish Trade Setup Looking to place some longs on ARGX. Argenx SE operates as a biotechnology company. The Company develops antibody based therapies for the treatment of severe autoimmune diseases and cancer. argenx serves customers in the Netherlands and Belgium.n top 10: 10 8 25.0% 6 (0.35%) 6 (0.35%) 0.0%

Funds Holding: 185 170 8.82% 63 (3.7%) 55 (3.19%) 14.55%

13F shares: 28.505 Million 25.49 Million 11.83% 10.773 Million 9.159 Million 17.63%

% Ownership 55.9632 53.8414 3.94% 21.1511 19.3456 9.33%

New Positions: 32 28 14.29% 14 5 180.0%

Increased Positions 84 60 40.0% 25 14 78.57%

Closed Positions 15 16 -6.25% 5 4 25.0%

Reduced Positions 50 58 -13.79% 17 23 -26.09%

Total Calls 225.886 Thousand 215.074 Thousand 5.03% 45.331 Thousand 67.3 Thousand -32.64%

Total Puts 160.044 Thousand 319.155 Thousand -49.85% 51.14 Thousand 237.809 Thousand -78.5%

PUT/CALL Ratio

SENS Back Testing The 382 Fib Watching To Act As SupportThe thing about SENS is that it's been a company crushing it in 2021. When it was first discussed this year it was still trading below $1. Despite recent volatility, it's up significantly year-to-date. I think volume remains steady but definitely on the lower end of the range. But good data from the last presentation on its PROMISE study seems to have sparked more attention.

"The data evaluating the safety and accuracy of the next generation Eversense system was presented by Satish Garg , MD, Professor of Medicine at the Barbara Davis Center of the University of Colorado, Denver , and the PROMISE study group Principal Investigator (PI). The Company presented previously released information demonstrating performance matching that of the current 90-day sensor available in the United States , with reduced calibration, down to one per day, with duration extended to 180 days. Accuracy measurements discussed in the oral presentation include a mean absolute relative difference (MARD) of 9.1% for the primary sensor and confirmed hypoglycemia alert detection rates at 60 mg/dL of 87% and at 70 mg/dL of 93%. For the subset of 43 modified sensors (referred to as the SBA sensor), the MARD was 8.5% and the confirmed hypo alert detection rates at 60 mg/dL and 70 mg/dL were 90% and 94%, respectively."

Another area of potential support/resistance is just below the 382 fib line (in yellow), which has held so far this week. It was resistance a few weeks back. With SENS failing almost right at the 236 Fib line, technical traders are liking monitoring these levels closely.

Latest on SENS: Best Penny Stocks to Buy Right Now? 7 Small-Caps For Your Morning List

HAPP - ABOUT TO BE HAPPENINGNo there is nothign wrong with this stock its a typical bio downtrend. I think this is due for a massssssssive move.

I actually rarely pay much attention to indicators regardless how many I have / most the time zoomed in double clicked in just using volume etc. However, to find end of long term downtrends they can be extremely useful on these.

Bollinger Bands (40 day and 14 day overalapping on bottom)

RSI dead on all time frames

Factors:

-Float 16M when this moves it will move even bigger

-Cash to Debt 18 RATIO. They are not at all hurting for cash in fact did direct offering also. Cash is without a doubt good for future far as I can tell.

-Postitive news / Ecommerce etc. I think it pops VERY similar to WNW

KURA - FALLING WEDGE HUGE PLAY HERE OPTIONS OR STOCK All,

I think this has a massive play possible here.

Why:

-Confleunce support (horizontally) + trend support

-Falling wedge downtrend

-40MA tight against trend (if you're a VWAP person I'm sure you would see a VWAP play)

-RSI/MACD both good

Recent news very positive. Looking into options Monday.

PIRS Pieris Pharmaceuticals a Sleeping Giant ??PIRS Pieris Pharmaceuticals has collaboration agreements with AstraZeneca, Boston Pharmaceuticals, Servier, Seagen and Genentech, part of Roche.

AZN AstraZeneca 70Mil upfront payment and 5.4Bil potential milestone payments

Boston Pharmaceuticals 10Mil upfront payment and 353Mil potential milestone payments

Genentech member of RHHBY Roche Group 20Mil upfront payment and 1.4Bil potential milestone payments

SGEN Seagen 35Mil upfront payment and 1.2Bil potential milestone payments

Servier 40Mil upfront payment and 447Mil potential milestone payments

So a best case scenario company with 9Bil Revenue

PIRS Pieris Pharmaceuticals Market Cap is only 254Mil now!!!

On 4/26/2021 HC Wainwright Brokerage set up a price target for PIRS at $9.00 per share.

What do you think it`s the real upside potential of Pieris Pharmaceuticals??

PIRS was on my private calls list since 3.42usd.

EVAX - Evaxion BiotechThe Biotech company Evaxion Biotech, EVAX, who develop drugs based on AI platforms, is poised to publish data from its phase 1/2a trials of EVX-01 and EVX-02 in the first half of 2021.

According to Yahoo Finance there are currently two analysts with price targets for the share, $18 and $23.

Evaxion is an AI-immunology platform company decoding the human immune system to discover and develop novel immunotherapies for cancer and infectious diseases.

Evaxion have developed an AI-immunology core technology to deeply understand the biological processes relevant for engaging the immune system aiming to harness its powers through novel immunotherapies. Evaxions scalable AI-immunology core technology enables broad applicability across diseases with immunological components. With deep insights into the biological processes of the immune system, Evaxion bridges technology, engineering expertise and drug development know-how to bring novel immunotherapies to patients.

Evaxion uses its proprietary AI-immunology platform to simulate the human immune system and generate predictive models to identify and develop unique immunotherapies and thereby revolutionizing the process of drug discovery and development.

PIONEER

PIONEER is Evaxions proprietary AI platform for the rapid discovery and design of patient-specific neoepitopes used to derive immuno-oncology therapies. It has been shown that neoepitopes, which arise from patient-specific tumor mutations, play a critical role in T-cell mediated antitumor immune response.

EDEN

EDEN is Evaxions second AI platform that rapidly identifies novel, highly protective antigens for the use in pathogen-specific prophylactic vaccines against bacteria. EDEN has been designed to rapidly identify those antigens that will trigger a robust protective immune response against almost any bacterial infectious disease. In addition, EDEN redesigns identified antigens to optimize their antigenic and structural properties as well prepare them for production, which allow us to move antigen candidates into the clinic far faster than traditional, vaccine discovery approaches.

EDEN has been pre-clinically validated in seven different pathogens in mouse infection models, and Evaxion believes that their approach can be used to target almost any bacterial infection and rapidly enables the discovery and development of vaccine candidates.

RAVEN

RAVEN is Evaxions third proprietary AI platform that brings their unique, machine learning approach to vaccine design and development for viral diseases. RAVEN combines the essential AI tools from our PIONEER platform with structural bioinformatic tools from EDEN to arrive at a novel potent T- and B-cell vaccine design for emerging and mutating viral diseases.

Pipeline

Evaxion’ pipeline of immunotherapies addresses two of the biggest unmet medical needs worldwide – cancer and infectious diseases.

Evaxion currently has four products in their pipeline. Two in pre-clinical and two in phase 2 trials. Evaxions lead candidates are EVX-01, for the treatment of metastatic and unresectable melanoma, non-small cell lung cancer, and bladder cancer; and EVX-02, for the adjuvant treatment of melanoma. EVX-01 and EVX-02 are both currently in Phase 1/2a trials, with data expected in the 1H21.

Evaxion intends to expand their current pipeline both within cancer and infectious diseases, and into other disease areas as we continue to explore new frontiers in AI-immunology.

IPO

Evaxion raised $30 million by offering 3 million ADSs at $10, the low end of the range of $10 to $12. The company offered 0.3 million more ADSs than anticipated.

Evaxion was listed on the NASDAQ on 5. february 2021.

Familiar T/A on ITRM Well, doesn't this look familiar? ITRM tested is previous level of support AND resistance in a wide channel today. IDK what the sell-off was but I'm guessing the re-entry had something to do with speculation on the FDA data set to come out next month.

"At the end of May, Iterum provided an update on its New Drug Application with the U.S. Food and Drug Administration. Currently, the NDA is still under review by the FDA, and the PDUFA goal date is July 25th, 2021. Since the application review for Sulopenem is on track at the moment, ITRM stock is performing well as a result. ITRM stock price has nearly doubled in the last month."

Not sure if it gets the approvals necessary but "buy the rumor" might be playing a role here.

Quote Source: Top 9 Penny Stocks With High Volume to Watch Right Now

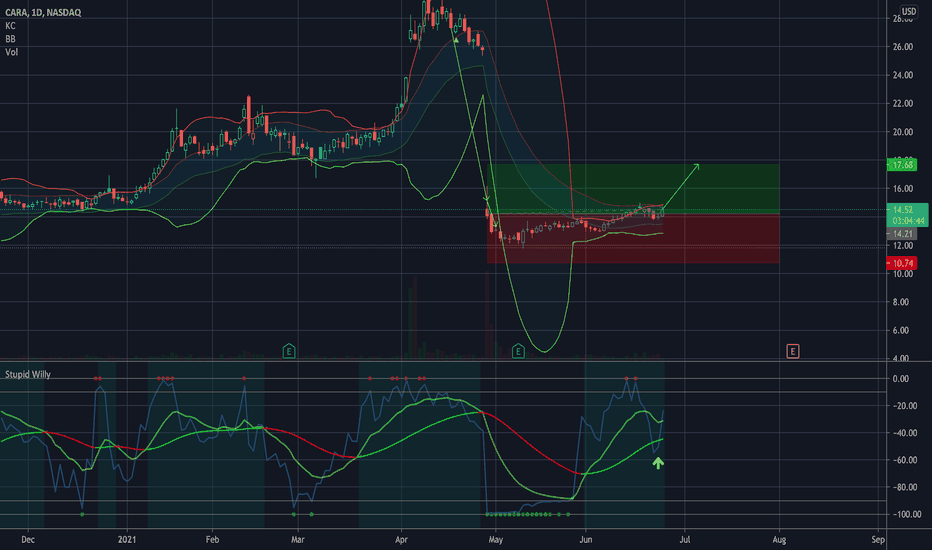

$CARA Target 17.68 for 24.42%$CARA Target 17.68 for 24.42%

Or double position at 10.74

I'm not sure if I published this one when I first bought on that hellacious dip, haha. 🤣 Anyway, it looks like it found a little bit of support here so, might as well publish it here

This might not be a trade you want to play... I will post better ones... just for reference here.

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

I finally added my YouTube Training Video to my profile tagline since I’m not allowed to on here. It’s a quick 15 minute training video on how to set up your chart and how to spot opportunities. So check here first but If you have questions just message me.

$LCTX biotech company analysis *This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

My team has been following clinical-stage biotech company $LCTX for the past few months. $LCTX pipeline looks very promising. We believe that current price levels are undermining the companies potential. We entered $LCTX on 5/14/21 at $2.23 per share and have been holding ever since. Following its correction from its 52-week high of $3.13 $LCTX now sits at $2.80 per share.

My team averaged up on our $LCTX position this morning at $2.70 per share and intend to take profit at $4.20.

ORIGINAL ENTRY: $2.23

AVERAGING UP AT: $2.70

TAKE PROFIT: $4.20

STOP PROFIT LOSS: $2.50

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Here We Go (Again?) With ATOSThis is familiar territory with ATOS . Not only is there a very clear and significant support level on the chart, there's also a multi-year level of resistance the ATOS is sitting at right now. The biggest question is Now What?

" Earlier this month, Atossa revealed data from a Phase 2 Endoxifen study in breast cancer. It met primary and secondary endpoints. The Phase 2 study was conducted on behalf of Atossa by Avance Clinical, a leading Australian CRO. Based on the results, the company also discussed its plan to apply to the FDA for approval to begin a clinical study in the US 'as soon as possible.' With meaningful results and potential for more clinical trials in the US, ATOS could be on the list of biotech penny stocks on Robinhood to watch this summer ."

Quote Source: 7 Penny Stocks On Robinhood To Watch In June 2021

PROG looks strongI like what PROG is doing here.

A lot of buying volume on June,11, consolidation, forming bullish flag.

Now breaking out above 3.00 level

Strong close yesterday means possible continuation today

Possible jump to 3.60 area, next target 5.00