Biotech

Potential Reversal Marker TherapeuticsMRKR

Entered MRKR at $4.01 on Friday (11/1/19) and am monitoring for a sustained trend reversal. Watching for SP to bounce off $4.10, or if that does not hold, $4.01. If it does not reverse here I think it'll consolidate between $3.83 and $4.32. A reversal would coincide with a run-up into Q3 earnings which should be sometime this month and phase 2 data in Ovarian Cancer expected this quarter. Closing over $4.32 would be a good confirmation of a trend reversal. RSI and CCI on the daily support the stock is building momentum IMO.

NGM Post Data ChannelI exited NGM for a 26% gain yesterday and re-entered today at $12.80. The stock appears to found a new channel following the release of interim phase 2 NASH data. This trade involves chart patterns and fundamentals. NGM is backed by Column Group L.P and Merck (MRK). Their data was positive. The float is very low and locked up by the above NGM shareholders. Should bounce to ~$14.0. Could break out to the $16.0 range.

NUVA BUYBUY signal at 65.73$.

Timeframe - 1 week.

Nuvasive, Inc. is a medical device company. The Company focuses on developing minimally-disruptive surgical products and procedurally-integrated solutions for the spine surgery. Its product portfolio focuses on applications for spine fusion surgery, including biologics used to aid in the spinal fusion process.

If you want to see more history of this strategy, I able to show you if you request me.

It's one of two signal algo for NUVA.

ATTENTION this strategy may has downtrend about 10-15%, so you can split your buy order, that you have not big downtrend.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

Harmonic ButterflyMRKR showing signs of life after testing a key Fibonacci level of support.

Chart:

Double bottom

CCI moved positive (inferring a nice loading zone)

MS Signal is showing "Over-Sold" conditions

Key *Support needs to hold $3.80

Key *Resistance at $4.53 then $5.29 (highlighted in green shaded area)

Disclosure: I do not own MRKR. I may buy/ sell within the next 72 hours. This is not a recommendation to buy or sell. Please do your homework before investing.

Can TTNP Actually Gap Fill Or Is It Forever Going To Trade Here?TTNP has been catching attention on volume scans this month. Ever since gapping down on October 16, the daily action is noticeably greater than before. But is this a good or bad sign for the penny stock? Currently trading around $0.20. OS is around 17 million so it's not the biggest out there but not the smallest either.

Titan Pharmaceuticals is a company that develops treatments for chronic diseases using its ProNeura platform. Titan announced a $9 million public offering a week ago. While the company’s stock took a price hit due to the per-share pricing of the offering it is okay.It is okay because ever since the company did this, a surge of volume has entered the stock. In addition to this, analysts are taking notice of the company too. Maxim Group upgraded TTNP stock from “HOLD” to “BUY” this week and gave a $1 price target.

ABOUT TTNP

Titan Pharmaceuticals Inc is a specialty pharmaceutical company. It is engaged in the development of pharmaceutical products. Its product pipeline consists of Probuphine for Opioid addiction, Ropinirole for Parkinson's disease, Triiodothyronine (T3) for hypothyroidism. It generates revenue principally from collaborative research and development arrangements, technology licenses, and government grants.

QUOTE SOURCE: 4 Penny Stocks Catching Biotech Investors By Surprise

$SGEN Shorterm BearishHello Traders!

It looks like $SGEN has made a local top and will be headed for consolidation. Not to worry, I believe continued upside potential is favored. My plan includes stacking buy orders at $90-$75 with stops at $70. Do your own DD, and good luck!

Yo boy,

Pic

BIOT LongGood Entry for a little swing

Biot tripple bottomed and tripple bullish divergence on the RSI.

Trading inside a descending wedge for the last couple of weeks that signals that price action sending the price north is due .

Gartley + Additional data release todayFriday, October 11, 2019

ADVM is a clinical-stage gene therapy company targeting unmet medical needs in ocular and rare diseases,

ADVM is set to present additional clinical data for the first cohort of patients (n=6) in the OPTIC phase 1 clinical trial of ADVM-022, intra-vitreal injection gene therapy in wet age-related macular degeneration (wet AMD) at the Retina Sub-specialty Day Program of the American Academy of Ophthalmology (AAO) 2019 Annual Meeting in San Francisco, CA.

NEXT EARNING: Nov 11, 2019

MARKET CAP: $333.254 Million

Technical Analysis:

-Bullish Gartley pattern

-Fibonacci 876 retracement is an important reversal level in high volatility trades.

-Our MS Signal oscillator indicating RSI moving higher and now being a potential good time to buy for a bounce.

-MS CCI Squeeze also indicating that bulls are re-gaining control (over mid-line suggests potential squeeze incoming)

Please like, share, and follow so I can continue finding awesome trades. Check out MS Money Trade Ideas for pre-researched trades to add to your watchlist!! Thanks in advance.

Disclosure: I am long ADVM. I may buy or sell within the next 72 hours. This is not a recommendation to buy or sell. Please do your homework before investing.

ADIL10:09 AM EDT, 09/11/2019 (MT Newswires) -- Adial Pharmaceuticals (ADIL) said Wednesday that it has successfully retested a previously manufactured supply of clinical trial packaged tablets of the investigational drug AD04 for the treatment of alcohol use disorder.

The company said tests showed that the clinical trial materials passed reevaluation and are eligible for use in the phase 3 trial.

The company has great information about it on their website with promising statisics.

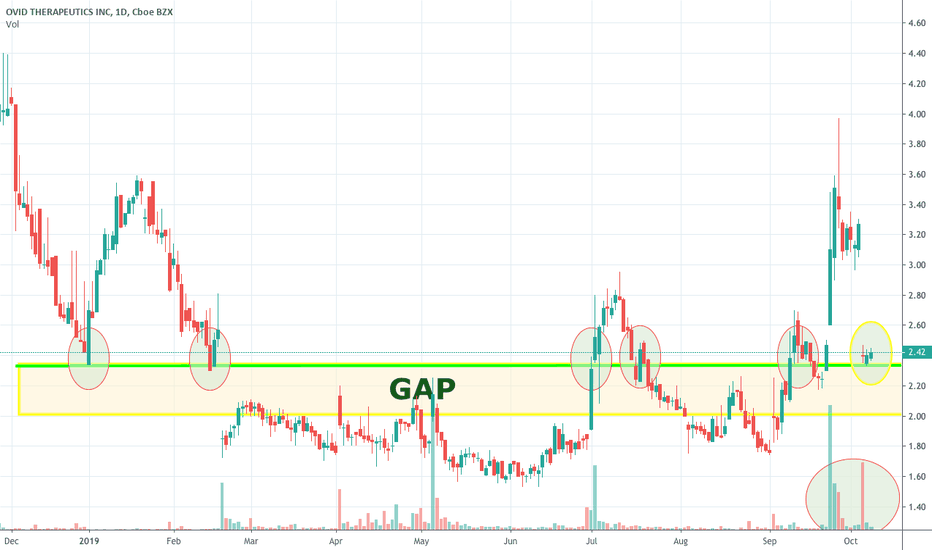

$OVID Holding The Gap But Can it Sustain?One thing to look at especially when it comes to penny stocks is volume. If you look at this chart, OVID stock is holding above the previous gap zone. However, volume has consistently deteriorated. My question is can this sustain levels above the gap zone or are we looking at a further pullback?

" Since June, shares of this biotechnology penny stock rallied from lows of $1.53 to highs of $3.97 late last month. However, on Friday, the stock tanked 27% after announcing a public offering to raise money for the company.Even so, the proceeds of the gross $32.5 million will be put to immediate use. Proceeds from the Offerings will be used “primarily to advance the clinical development of its OV101 and OV935 programs.” The remainder will be for working capital and general corporate purposes. " *

About OVID

Ovid Therapeutics Inc is a US based biopharmaceutical company. The firm is engaged primarily in developing impactful medicines for patients and families living who are suffering with rare neurological disorders. It is targeting disorders such as intellectual disability, severe speech impairment, problems with movement and balance, sleep disorders and anxiety to transform the patient's life.

* Quote Source: 3 Penny Stocks To Watch After Latest Biotech News