NTEC Jumped above $0.70 since falling apartWhat are the thoughts here? News? -NOPE...pure momentum today? Biggest volume it's had since the big drop day so what can explain this move?

"Intec Pharma Ltd. is a biotechnology company that creates drugs using its Accordion Pill technology. This technology is designed to improve the safety of drugs when taken orally. The company currently has 5 treatments in its pipeline with AP-CD/LD in Phase 3 trials.Over the last 2 trading sessions, Intec’s stock price has seen significant gains. On August 27th the stock price rose 14.8% and in premarket trading, on the 28th it has risen another 15%. These percentage gains allowed the biotech penny stock to go from $0.45 to $0.61."

Original Article: 4 Penny Stocks To Watch Under $4

NASDAQ:NTEC

Biotechnology

Autonomous AI Robotic Trading Decimates Mallinckrodt Share PriceMallinckrodt named the best biotech stocks to sell short in a decade

Harmonic Cypher Final Data from Robarts study coming September, in Spain. To learn more about TAEUS, click here .

Company ran by ex-GE executives. TAM is in the Billions of Dollars $$. Low float.

Recently broke long-term down trend. Daily, Weekly, Monthly charts #BULLISH. Fibonacci convergence at 618 fib (projection) into September time frame.

Follow me on twitter and instagram @ #VolatilityWatch

Disclaimer: I am long NDRA. This is not a recommendation to buy or sell. Please do your homework before investing.

Davita - now a BULL trend Technicals analysis WEEKLY

Davita broke a downtrend channel, and is now in a consolidation above the 200SMA. (Bull)

50SMA is now crossing above the 200SMA. (Bull)

OBV and RSI show divergence, as they have moved in oposite directions since early August. (Short). However... on a daily chart , we see a decent uptrend since early June.

Headlines / Fundamental

On July 10th:

President Donald Trump on Wednesday signed an executive order reimbursing for kidney transplants and reducing the reliance on the costly treatments at dialysis clinics.

Analyst fair value target price is $79. Meaning 38% undervalued .

CODX buy NOW around 1.1usd - PUMP and DUMP - go to the MOONBUY CODX = 1.1$

STOP=0.7$

TARGET1=2.9$ R=4

TARGET2=3.8$ R=7

TARGET3=5.1$ R=10

Chart 1 month big big level and base = 0.8$ to 1.1$

NEXT level 3.0$ usd

CODX is setting up to be a major player in the extremely “Profitable” $100Bil Biotechnology sector focusing on “Cancer Detection” using its patented CoPrimer™ technology with applications in Liquid Biopsy and companion diagnostic tests.

CODX just announced exciting news of favorable results on a study to detect cancer mutations using its patented CoPrimer™ technology, with applications in liquid biopsy and companion diagnostic tests.

Co-Diagnostics Disrupting Multi-Billion Dollar Biotech Sector With State-Of-The-Art Patented CoPrimers Providing High-Performance Detection of Cancer Mutations in Liquid Biopsy Samples Co-Diagnostics Inc. looks to be moving forward in a record-breaking pace...

I believe at just $1.10 this NASDAQ biotech stock is seriously undervalued.

Look at one of CODX biggest rivals biotech Giant Illumina it trades at $286 dollars per share, another rival to look at is Myriad Genetics it trades at $25 dollars per share.

One of CODX biggest rivals is likely biotech giant Illumina which is a “Cancer Detection Stock.” Illumina trades at $286 dollars per share, and drew over $100Mil from Bill Gates, Jeff Bezos and others to launch Grail.

CODX buy NOW around 1.1usd - PUMP and DUMP - go to the MOON

G1 Therapeutics RALLYEarnings/News

Co's lead cancer therapy, trilaciclib, gets FDA's "breakthrough therapy" status, which is meant to speed up review of drugs that treat life-threatening conditions

GTHX says it will present new data on three of its drugs, including trilaciclib, at an upcoming conference in September

FDA's move is a recognition that clinical data presented so far reflects the potential for trilaciclib to address an urgent unmet medical need - Cowen & Co

Analyst Actions

JP Morgan Upgrades G1 Therapeutics to Overweight From Neutral, PT Raised to $45 From $38

Extended Parabola #VolatilitywatchKRYS has hit FIB golden ratio resistance and peaked out on 5th wave. Looking for pullback to low $40's then we'll find out if it wants to fill the gap.

Please like/ comment so I can continue looking for awesome trades. Thank you in advance.

Message me if your interested in learning more on pattern analysis . Follow trend, Buy low sell high!!

Follow me on Instagram or Twitter @VolatilityWatch

Disclosure: I am not a financial advisor. This is not a note to buy or sell. Please do your homework before investing

#IMMU look at Risk vs. Reward #VolatilitywatchThis trade brings opportunity for investors looking for a a company with great fundamentals and nice risk/reward potential into end of year. As the chart shows (blue arrows) I am awaiting a buying opp around the blue trend line.

From current stock price, potential risk/reward around 3.5 : 1

downside risk: $1.39

upside reward: $3.50-$5

Recent selloff after earnings showed strong support at the $11.59 level, which also made a double bottom.

This selloff started around July, 2018. to emphasize the double bottom even more, the pullback from peak to trough retraced .618; a key level of Fibonacci support.

MACD indicator showing strong convergence with price

Price above 20 day moving average.

5-day exponential moving average above 20 day moving average, indicating strength in trend.

Conclusion: $IMMU seems to bring opportunistic risk/ reward to investors who are sidelined. Double bottoms are significant patterns when looking for price reversal.

Tip # 11: Some investors wait to buy until after stock price crosses above moving averages such as the 20, 50, 100, and 200 day. These are key phycological levels to watch when trading and investing.

Like and follow so I can continue giving trend analysis and trade ideas. Thank you in advance =)

Follow me on twitter or Instagram @Volatilitywatch

Disclosure: I do not own IMMU. This is not a note to buy or sell. Please do your homework before investing.

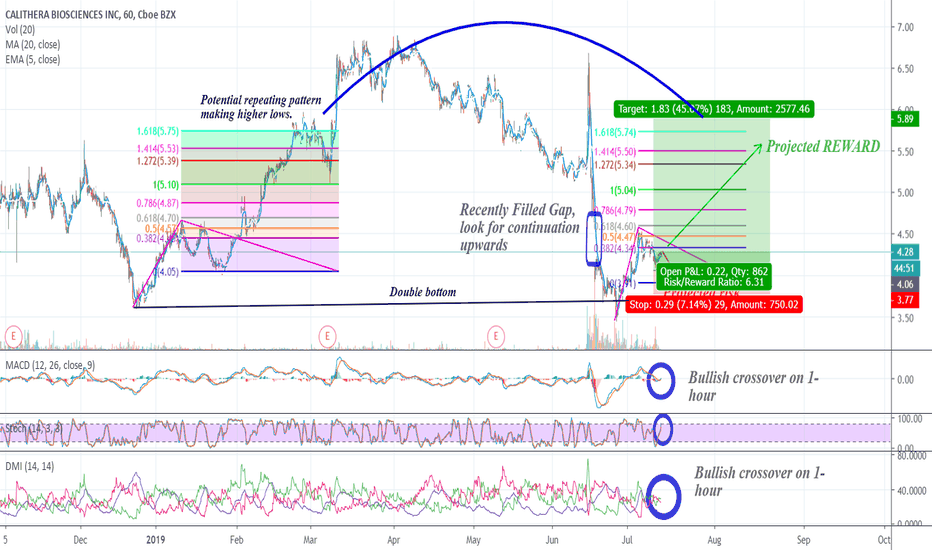

Cala #VolatilityWatchAfter a recent selloff in mid June 2019, Stock price went from from $6.70 down to $3.44. Cala looks to have established a double bottom. New strong uptrend suggests it has potentially capitulated from the selloff making these levels very attractive for any investors who are sidelined and looking for a good technical/ fundamental trade in biotech. Cala looks to be in the midst of a new uptrend.

June 2019 selloff marked double bottom for CALA.

This looks to be very attractive from risk vs reward standpoint (Assuming markets stay strong, I see approximately $0.40 downside vs $1.50 upside).

Extrapolating previous price patterns (shown in chart) Cala looks to be in the midst of 2nd wave (Bullish corrective wave).

the projection is based off previous price patterns where CALA retraced approximately .618 and extended above the 1.618 Fibonacci extension level.

trend indicators also signaling uptrend in play (see chart).

Tip # 9: Stop losses are a good way to get you out of a trade that you don't want to be in. But remember, they only work during market hours.

Please Like and Follow so I can continue giving trade ideas and build up my reputation. Thank you in advance =)

Have a Instagram or Twitter? follow me @VolatilityWatch

Disclosure : I do not own a position in Cala. I may buy/ sell within the next 72 hours. This is not a note to buy or sell. Please do your own homework before investing.

PhaseBio technical studyThere is a strong support area around $9.5 - $10.5

Could be a good opportunity if it keeps respecting the limits.

Technical data

RSI @42 (waiting for this indicator to go higher)

OBV reaching for higher highs

Bollinger bandwith relatively high.

Not buying yet, but it's worth it to keep on your watchlist.

MARKER THERAPEUTICS INC - NASDAQ: $MRKR ConsolidatesAfter recapturing its 200 DMA a week ago on meaningful volume, the shares of MARKER THERAPEUTICS INC - NASDAQ;MRKR have found themselves consolidating the recent move in a constructive and orderly manner as is evidenced in the Daily chart above.

With the stock now trading above all of its important moving averages 20/50/200 DMA's, the technical posture is favorable for MRKR .

In addition, there are potential catalysts for the stock forthcoming in the weeks ahead, in particular, Marker Therapeutics is to Report Updated Results from Phase 1/2 Trial with MultiTAA Therapy in Patients with Pancreatic Adenocarcinoma on July 20, 2019.

finance.yahoo.com

Thus, moving forward, both investors/traders may want to continue to monitor the action closely and should MRKR be capable of going topside of the $8.15 figure at any point in the days ahead, we suspect that the stock may just have eyes for the $9 - $10 zone once the present consolidation runs its course.

CYTOKINETICS INC - NASDAQ: $CYTK Grinding HigherAfter recapturing its 200 DMA in early Spring (March), shares of CYTOKINETICS INC - NASDAQ;CYTK have been grinding into higher ground as we can observe in the Daily chart above.

Additionally, CYTK continues to trade above all of its important moving averages 20/50/200 DMA's, suggestive of a favorable technical posture.

Furthermore, when extending out to both the Weekly and Monthly time-frames, CYTK remains in relatively good shape, thus, we have a stock that displays encouraging technical's across multiple time-frames.

Moving forward, both investors/traders may want to continue to monitor the action closely, particularly, should CYTK be capable of going topside of the $11.50 figure and perhaps of more importance the $11.95 level, such development would likely trigger its next advance into a primary objective of $13 with a secondary objective in the $16 handle.

Thus, investors/traders may want to put CYTK front-and-center on their radars and pay close attention to the levels mentioned above for additional clues/evidence that CYTK is ready to embark on its next major leg.

Biogen - opportunity to get in at the bottomAfter a recent downward gap, BIIB looks to me to have established a new upward channel. With bullish MACD, great analyst ratings, a history of earnings beats, and the next earnings coming up in mid-July, BIIB should be up in the short-to-medium term. Set fairly tight stops to protect against a downward channel breakout.

Here's my Biogen trading plan Monday morning:

Limit buy 238.17

Stop Loss: 231

Take profit: 287

Is CRSP going to "technically" break the bear trend this weekIn my previous post on #CRISPR I talked about the Green upward sloping trendline & how every time CRSPR has traded on or below it since May 2017 we've seen parabolic action.

I don't want to say I told you so, but we've seen some parabolic action.

To my surprise, the parabolic movement came the news of Vertex upfront payment of $175 million upfront payment. Specifically, Vertex gets worldwide rights for CRISPR/Cas9 technology along with other items such as AAV vectors for DMD and DM1. This deal totals just about $1 billion when you factor in all milestone payments for these programs, plus royalties.

Moving on to the chart now..

It appears as though CRSP is about to "technically" breakout of the bear trend which started in May 2018 after reaching ATH's.

The blue downward sloping trendlines are the attached to the swing highs, and one has already been broken to the upside, which could be considered the first real confirmation of a trend reversal. Once the second blue downward sloping trendline is broken to the upside CRSP is "technically" out of the bear trend, IMO.

Time will tell per usual.

ZIOPHARM ONCOLOGY INC. - NASDAQ: $ZIOP Building BaseAfter recapturing its 200 DMA back in March and subsequently vaulting from a 3 to 4 - handle, ZIOPHARM ONCOLOGY INC - NASDAQ:ZIOP has found itself in a sideways drift and appears to be building a base these past couple of months as we can observe from the Daily chart above.

With the stock trading above all of its important moving averages 20/50/200 DMA's, ZIOP remains in a favorable technical posture as the base building process continues to develop.

In addition, if one were to zoom-out to both the Weekly and Monthly time-frames, we can also see that ZIOP may just be in the process of building-out a potential inverted H&S pattern and should such development materialize and complete, the longer-term measured move implies an initial $8 objective.

Moving forward, if and when at any time in the days/weeks ahead ZIOP is capable of clearing the $4.85 figure and perhaps more importantly the $5 level, such occurrence would likely suggest that higher levels are in the offing.

Thus, both investors/traders may want to continue to monitor the action closely moving forward.

AMARIN CORP - NASDAQ: $AMRN Setting-UpAfter breaking to higher ground in 1Q19 and subsequently drifting back down to its original break-out level in the upper teen's, the shares of AMARIN CORP NASDAQ: AMRN are once again starting to show signs of potentially setting-up for another attempt at loftier levels as evidenced in the Daily chart above.

While AMRN presently finds itself in drift mode working on its right-side, the stock continues to display favorable technical characteristics trading above all of its important moving averages (20/50/200 DMA's).

Although further work is required, it appears that we may just witness a repeat of 1Q whereby buyers once again start to take control of the stock and should such scenario materialize, we suspect that it may have eyes for the $22 - $24 zone once again in the short-term.

Thus, both investors/traders may want to continue to monitor the action closely in the days/weeks ahead for signs/clues that a move for greener pastures is underway.

CHIMERIX INC. - NASDAQ: $CMRX Shaping-UpAfter breaking higher in early April on large volume, Chimerix Inc. (NASDAQ:CMRX) spent the next several weeks digesting/consolidating the move before breaking higher yet again last month (May) and in the process, recapturing its 200 DMA as evidenced in the Daily chart above.

With the stock presently trading above all of its important moving averages (20/50/200 DMA's), CMRX remains in a favorable technical posture.

Moving forward, should CMRX be capable of clearing the $3.80 hurdle, such development would likely trigger its next advance into higher ground.

Nevertheless, CMRX remains in decent shape from a technical lens and both investors/traders may want to continue to monitor the action closely in the days/weeks ahead.

BLUEBIRD BIO INC - AWESOME TIME TO LONG THIS STORYAnother pharma company - with amazing correct Elliot 5 waves which you can try to ride.

1. Buy 131.32

2. Take profit: 213

3. SL: 115.90

RISK/REWARD: 5.38, potential profit 62.39%