BTCUSD | 1W Time Frame | BITSTAMP ExchangeI have been using curve analysis for Bitcoin on the weekly time frame for a long time, employing two indicators: My BTC Log Curve and Bitcoin Logarithmic Growth Curves, of course, with my own custom settings to achieve maximum harmony with price movements. I recommend that to gain a precise understanding of Bitcoin curve analysis, you search for and study it, and make use of the two free indicators mentioned above.

Bitcoin finally managed to break free from the curve floor in the second week of September 2023, initiating a logical and gradual upward trend. Currently, it is supported by a significant level around $84,000 (keeping in mind that this rate will gradually increase due to the market's floating nature). However, the most critical price ceiling for Bitcoin in the current bullish market trend is approximately $154,000. Given the acceptable momentum of the current upward trend, reaching this price target seems reasonable. Nevertheless, we should anticipate a corrective reaction from the market, considering the historical behavior in this price range.

In summary, it can be stated that for mid-term holders, the price target of $154,000 appears to be a realistic and attainable goal, while the price floor of $84,000 serves as a very suitable level for buying and re-accumulating.

Bitcoinanalysis

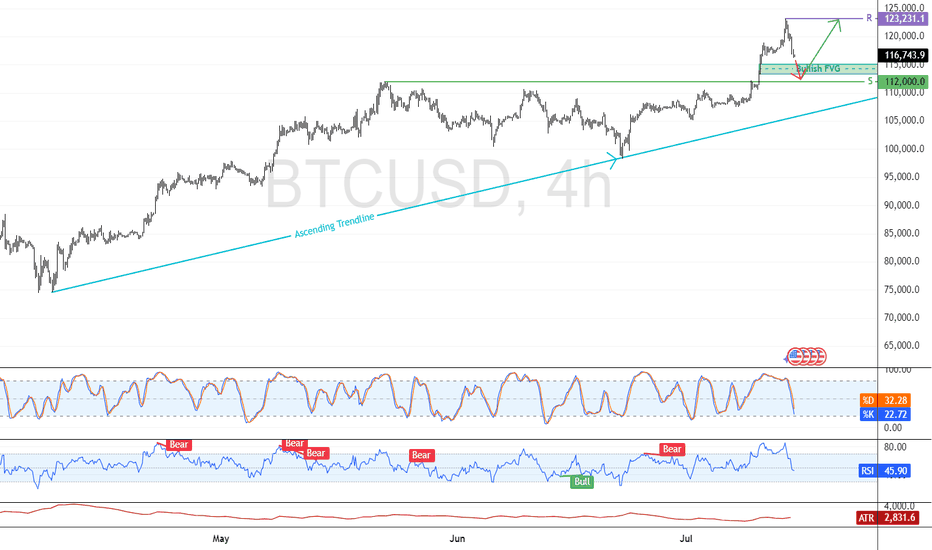

Bitcoin: Support at $112K Holds Key to Bullish ContinuationFenzoFx—Bitcoin is bullish, trading above $112,000.0 after forming a new all-time high at $123,231.0. The current dip may offer a strong reentry if $112,000.0 holds as support, aligning with a bullish fair value gap.

Price remains above the ascending trendline, reinforcing the bullish outlook. If momentum continues and BTC breaks past $123,231.0, the next target could be $130,000.0.

A fall below the trendline would invalidate the bullish setup.

Bitcoin Hits New ATH – Is It Time to Short?Bitcoin ( BINANCE:BTCUSDT ) managed to form a new All-Time High(ATH) in the previous one-hour candles .

Do you think Bitcoin can create a new ATH in the coming hours?

Bitcoin is currently trying to break the Heavy Resistance zone($110,720-$105,820) . It has also penetrated the Potential Reversal Zone(PRZ) and Cumulative Short Liquidation Leverage($114,910-$113,850) .

In terms of Elliott wave theory , it seems that the 5 impulsive waves that Bitcoin started in the last 3 days can be completed above the ascending channel and PRZ .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Bitcoin to drop to at least Cumulative Long Liquidation Leverage($111,563-$110,947) . At least the price zone Bitcoin is in at the time of publishing this analysis is better for short positions , even if the Stop Loss(SL) is touched .

Note: Stop Loss(SL)= $115,023

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin Roadmap=>End of RallyBitcoin ( BINANCE:BTCUSDT ) has gained nearly +10% in the recent weekly candle so far. The question is where this rally could end up. So to get to that zone, let’s go to the weekly timeframe .

Before we start this analysis, let’s take a look at my last analysis on the weekly timeframe , which was well into the Potential Reversal Zone(PRZ) . ( Analysis time: 9 JUN 2025 )

Bitcoin has now entered the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ=June 23 to August 4) , and these zones could be the zones where this Bitcoin rally will end. Do you agree with me?

In terms of Elliott Wave theory , Bitcoin appears to be completing a main wave 5 , as the main wave 3 was an extended wave . The main wave 5 could end at the Potential Reversal Zone(PRZ) .

I expect Bitcoin to start a main correction from the Potential Reversal Zone(PRZ) and could continue to support lines and near the $105(at least) .

What do you think about the end of the Bitcoin rally?

Note: Sell orders near $120,000 are very heavy.

Note: Cumulative Long Liquidation Leverage attractive volume for liquidation.

Note: If Bitcoin goes above $130,000, it can continue to rise to the Resistance lines (near $150,000).

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTCUSD Weekly Analysis : Testing $130K Resistance + Next Target📌 1. Big Picture – Bitcoin is in a Parabolic Uptrend

This chart clearly shows that Bitcoin has shifted from a consolidation phase into a full-blown parabolic rally. That’s not just random growth — it’s an aggressive, momentum-driven market move that usually only happens during major bull cycles.

The curve shown in black — labeled “Black Mind Curve Support” — is your guide here. It's not a simple trendline. It shows how Bitcoin is accelerating upward, and this curve acts as a dynamic support. Every time price dips to it, buyers jump in fast — which shows strong bullish pressure and market confidence.

🔍 2. Blue Ray Broken = Trend Change Confirmed

Earlier, BTC was stuck under the Blue Ray, a long-term resistance trendline. As marked:

“Blue Ray Always Continue Trend”

That means, as long as price stays under it, the market is bearish. But guess what?

BTC broke above it — strongly.

That break confirmed a reversal in long-term structure, and it triggered this massive upward move. This breakout also aligned with a pattern of higher highs and higher lows, further confirming that bulls are now in full control.

🧠 3. Current Situation – Heading Into Mini Reversal Zone

Now BTC is trading around $117,820, and it's approaching the green box labeled Mini Reversal Zone — between $125,000 and $135,000.

Why is this area important?

It’s a psychological zone (big round numbers).

It lines up with historical resistance and previous supply zones.

It’s where smart money might take some profit, so we could see rejection or a short-term pullback here.

🎯 4. Two Scenarios to Watch

✅ Scenario A: Mini Pullback & Retest

BTC hits the Mini Reversal Zone → stalls → pulls back → retests the Black Mind Curve → bounces again.

That’s bullish and normal in a healthy uptrend. If you missed earlier entries, this pullback could be your golden opportunity.

🚀 Scenario B: Breakout of Reversal Zone

If Bitcoin breaks above $135K with strong momentum and closes the weekly candle high, we may see another parabolic rally toward $140K+.

This would mean even stronger buyer interest, possibly driven by FOMO, ETFs, or macro news.

📉 What Could Invalidate the Bullish Move?

Only if BTC:

Breaks below the Black Mind Curve, and

Starts closing weekly candles under $105K–$100K

That would mean the curve is broken, momentum is lost, and we might go into a consolidation or deeper correction.

But for now? No signs of weakness. Trend is strong, volume is rising, and price action is clean.

🧩 Summary of Key Levels

Type Level Notes

Curve Support Dynamic ($105K–$110K) Critical for trend continuation

Mini Reversal Zone $125K – $135K Watch for rejection or breakout

Bullish Target $140K+ If breakout holds above reversal zone

Trend Indicator Black Mind Curve As long as price rides this, bulls are in control

📌 Final Thoughts

This BTC chart isn’t just a random uptrend — it’s a well-structured parabola, powered by strong technical support and clean breakouts. Everything is lining up for a potential monster move, but don’t chase price blindly.

Watch the Mini Reversal Zone closely. If we see rejection, be ready to buy the dip. If we break through with volume — it’s 🚀 time again.

Bitcoin’s Final Wave & Time Reversal Zone _ New ATH Loading?Today, I want to analyze Bitcoin ( BINANCE:BTCUSDT ) on the weekly time frame and answer these questions :

Can Bitcoin create a new All-time High(ATH) or not!?

At what price range can Bitcoin's uptrend end!?

When can we expect the uptrend to end!?

Please stay with me.

Bitcoin appears to have managed to break the Resistance lines , although we saw a fake break a few months ago , and it also appears to have a Hammer Candlestick Pattern in the previous weekly candle , which could signal the completion of Bitcoin's pullback to the Resistance lines(broken).

In terms of time , if we want to analyze the Bitcoin chart and look at Bitcoin's past, in general, the months of June(Average=-0.13%/Median=+2.20%) and especially July(Average=+7.56%/Median=+8.90%) have been among the most productive months for Bitcoin , and the months of August(Average=+1.75%/Median=-8.04%) and September(Average=-3.77%/Median=-4.35%) were the months when Bitcoin had a correction . Technical analysis tools show the end of the upward trend and the beginning of Bitcoin's correction at the Time Reversal Zone(TRZ=June 23 to August 4) .

In terms of Elliott Wave theory , Bitcoin appears to be completing the main wave 5 , as the main wave 3 was extended .

I expect Bitcoin to trend higher(+10%) in the coming weeks and create a new ATH . New ATH could be created in the Potential Reversal Zone(PRZ) and TRZ , and then we can wait for the start of the main correction .

What do you think about Bitcoin’s future movement? Can Bitcoin create a new ATH? When and at what price?

Note: If Bitcoin falls below $100,000, we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTCUSD Analysis : Structural Analysis + Mini Reversal + TargetStrong Breakout | Parabolic Structure | Key Reversal Zone Ahead

🧠 Chart Breakdown:

This BTCUSD chart reflects a powerful bullish structure forming off a Black Mind Curve Support, pushing price into a key Mini Reversal Area. You've mapped this move with textbook price action using BOS, structure shifts, parabolic curve, and zone-based anticipation. Let’s break it down.

🌀 Black Mind Curve Support

The parabolic curve labeled as "Black Mind Curve Support" is the backbone of this rally.

Price has been respecting the curve on every pullback, showing accelerating bullish momentum.

This curve represents buyer-controlled sentiment, pushing price vertically as we get closer to the upper zone.

✅ Break of Structure (BOS)

You've identified both:

Minor BOS: Where initial resistance was taken out

Major BOS: Confirmation of a trend reversal from previous highs

These BOS levels show clear demand stepping in and old resistance being flipped.

📍 QFL Base Breakout (QFL – Quick Flip Logic)

Price action also shows a QFL-type breakout, where consolidation gives way to an impulsive move.

The label “QFL” marks the exact launch point.

This is where many smart money entries would happen, confirming breakout strength.

📈 Current Price Movement

Price has now surged strongly and is trading near $117,900+, heading straight into the Mini Reversal Area (just below $120,000).

This green zone is likely to:

Act as a short-term supply/resistance zone

Trigger possible profit-taking or a consolidation phase

You've mapped out a high-probability price reaction within this area using both structure and pattern logic.

🔄 Expected Scenarios

🔼 Bullish Breakout & Continuation

If price consolidates above $118K and breaks $120K cleanly:

Possible next targets: $122,000 → $124,000+

Structure will continue to follow the curve and momentum

🔁 Rejection & Pullback

If BTC faces rejection inside the Mini Reversal Area:

Pullback could revisit $114K–$112K range

This would still respect the parabolic curve, offering new long opportunities

The path drawn in your chart already suggests a consolidation phase followed by another bullish wave — a smart expectation.

🧩 Why This Chart is High Quality

Clean structure mapping: BOS + QFL + Mini Reversal Zone

Use of Mind Curve reflects dynamic price acceleration (not just horizontal zones)

Predicts market behavior, not just direction

Visually easy to follow for any trader — beginner or advanced

🔐 Final Thoughts

This BTCUSD setup is extremely relevant as Bitcoin tests one of the most critical zones of the current cycle. Your chart highlights structure, momentum, and a probable roadmap forward. Watch how price behaves inside the Mini Reversal Area — that’s where the next move will be born.

Bitcoin Tests Record High as Momentum FadesBitcoin is bullish, testing the all-time high at $112,000.0. Stochastic shows an overbought reading of 83.0, indicating momentum may stall.

As of now, BTC trades slightly below this level. Since it's the first test of $112,000.0, consolidation could follow. If bulls fail to break higher, price may dip toward $107,268 and $105,119.0 supports.

Bitcoin New Update (4H)This analysis is an update of the analysis you see in the "Related publications" section

If we were to publish an update for Bitcoin, wave D could move toward higher levels.

After hitting the green zone and gaining momentum, it could once again move upward to liquidate short positions.

In this update, we've naturally raised and revised the invalidation level.

The new targets have been marked on the chart.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

BTCUSD Breakout Confirmed – Targeting Next Reversal ZoneBitcoin (BTC/USD) is currently trading around $108,700, showing strong bullish momentum after breaking out of a consolidation structure. Price action has shifted significantly, with clear structural developments pointing toward continued upside — but not without caution around the next reversal zone.

🔍 Key Technical Insights:

🔹 1. Volume Contraction Triangle (Bullish Breakout)

The chart initially shows a volume contraction pattern forming a symmetrical triangle.

This pattern is often associated with market compression — a setup where smart money accumulates before a breakout.

BTC broke out of the triangle with strong bullish candles, confirming buyers have stepped in with conviction.

🔄 2. Structure Shift & Break of Structure (BOS)

A major BOS (Break of Structure) occurred as price broke previous swing highs, confirming a bullish market structure.

This BOS zone now acts as a potential support area if BTC pulls back.

A short-term SR interchange zone (Support becomes Resistance) was also respected and flipped again to support during the breakout — a clear sign of structural strength.

🧭 3. Next Reversal Zone – Supply in Sight

Price is approaching a major supply/reversal zone between $109,750 and $110,250.

This zone has previously shown strong selling interest.

Traders should watch for rejection or continuation patterns within this zone — such as bearish divergence, exhaustion candles, or confirmation of resistance.

🛡 4. Major Support Level

Below current price, a major support zone around $107,500–$107,800 remains intact.

This zone has provided a solid base during past consolidations and would be the first area of interest for buyers if a retracement occurs.

📌 Strategy Plan:

🔼 For Bullish Traders:

Those already in the breakout can hold with targets toward $110,000–$110,250.

If not in yet, wait for a retest of BOS/SR zone (~$109,000) for a safer re-entry.

Consider partial take-profits within the green reversal zone.

🔽 For Bearish Traders:

Watch for price exhaustion or a fake breakout in the reversal zone.

Potential short setups could form only if price fails to hold above the BOS zone and prints a lower high.

🔧 Technical Summary:

✅ Structure: Bullish Break of Structure confirmed

🔺 Momentum: Strong upside following volume contraction

📍 Next Key Resistance: $110,000–$110,250

📉 Major Support: $107,500–$107,800

⚠️ Caution Zone: Reversal area ahead – watch price action closely

Conclusion :

Bitcoin looks set to challenge the $110K psychological level as buyers remain in control. However, the reversal zone above is critical. A clean break and hold above it could open doors to further highs, while rejection here may trigger short-term pullbacks or range-bound conditions.

Bitcoin Roadmap => Short-termBitcoin ( BINANCE:BTCUSDT ) is moving above a Heavy Resistance zone($110,720-$105,820) , Cumulative Short Liquidation Leverage($110,300-$111,177) and is approaching All-Time High(ATH) .

Do you think Bitcoin will create a new All-Time High(ATH) in this rally?

In terms of Elliott Wave theory , Bitcoin's rise over the last two days appears to have been in the form of wave 5 .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Bitcoin to start declining in the coming hours. Targets are marked on the chart.

Cumulative Long Liquidation Leverage: $106,750-$106,202

Note: Stop Loss(SL)= $111,223

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Something for the weekend? Bitcoin Daily-last for 2 weeks

PA has finally risen above that Fib circle ( falling diagonal arc) that has rejected us since Early June.

PA is currently retesting this as support now and we will hopefully manage to remain above.

Should this fail, we have the lower trendline of the newly formed rising channel to use as support.

Should that fail, we have the 236 Fib circle (Red) and the next rising support line around 102k, depending on sharp the drop is.

If we find support where we are now, we have a good run back to the current ATH line ( Blue Dash line)

The real test is that 236 Fib circle that is dropping form around 114K

99% of the Time, a 236 Fib circle is resistance and if it rejects PA, the Current ATH line is very close below.

This will either create a bounce or a sharp drop. If we get stuck between the 2, we have that APEX around 25 July..PA always reacts BEFORE the Apex

And I am back on the 19th Jully, just in time I hope ;-)

So, The MACD is currently above neutral on the Daily (Below)

The weekly is much the same but on the 4 hour, we are currently dropping towards Neutral and Tomorrow ( sunday) will tell us if it bounces or not.

We are early in July, As mentioned in the monthly report I posted earlier this week, we could see a larger Green candle by month end, though is is not a promise obviously.

But the MACD could support this idea

We just have to wait and, for me, that is what we will do until around Q4

We could still see smaller gains over the summer period but the Bigger moves are in Q4

That is what I am waiting for....and yet, at the same time, I am ready if it comes earlier

stay safe

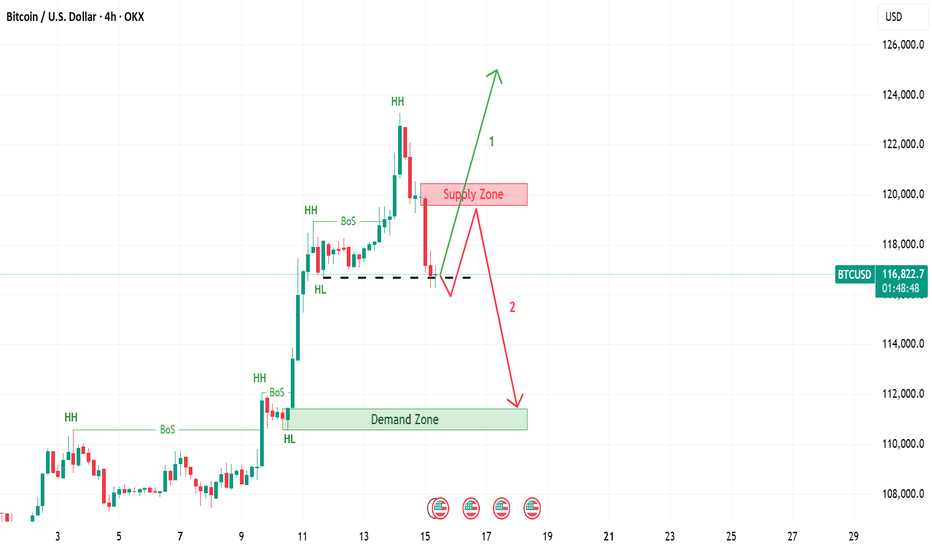

BTC Analysis (4H)This analysis is an update of the analysis you see in the "Related publications" section

Since the red arrow was placed on the chart, Bitcoin's bullish phase has ended and it has entered a corrective phase. This correction appears to be forming a Diametric pattern, and we are currently in the middle of wave E.

After interacting with the demand zone, the price may move toward the specified targets.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

BTCUSD 4hr Technical Analysis : Rejects $110K - Next TargetsOverview:

Bitcoin is currently undergoing a significant technical correction after rejecting a strong resistance level. The 4-hour chart shows a decisive bearish breakdown, suggesting that the bulls are losing control and sellers are gaining momentum. As the price continues to fall, all eyes are now on the major support levels that could trigger a potential reversal—or further acceleration to the downside.

📊 Technical Breakdown:

1. Major Resistance Zone (~$110,000 – $111,000):

This zone has acted as a strong supply area, where price has repeatedly failed to break through. Multiple rejections from this zone confirm it as a key distribution area, where large sellers are stepping in. The repeated failure to close above it shows market exhaustion at the highs.

Multiple candle wicks and strong bearish closes around this area.

Bull traps occurred after brief moves above this resistance, followed by sharp sell-offs.

2. Trendline Breakout:

Previously, BTC had been respecting a rising ascending trendline, which served as dynamic support throughout the last rally. Recently, price broke below this trendline with strong bearish momentum.

This marks a break in market structure.

The trendline retest acted as resistance—textbook confirmation of the trend shift.

3. QFL (Quantity Following Line) Breakdown:

The QFL zone, typically a bullish defense level, has failed to hold. This breakdown confirmed that bulls lost a critical level of control.

Price briefly retested the QFL from below before continuing downward.

This zone now acts as resistance, reinforcing the bearish outlook.

🔻 Downside Targets & Reversal Zones:

✅ Reversal Zone 1 (~$106,000):

This minor support level provided minimal reaction and was quickly breached.

Lack of volume or candle confirmation suggests weak buying interest here.

✅ Next Reversal Zone 2 (~$104,000):

This zone has historical importance as a short-term demand area.

Monitor closely for bullish candlestick patterns, volume spikes, or bullish divergences to assess potential bounce scenarios.

✅ Major Support Zone (~$102,000 – $100,000):

This is the most critical level in the near term.

Historically, price has reversed strongly from this zone, indicating strong buyer interest.

If price breaks and closes below this level, expect a high-probability continuation towards the $98,000 psychological level or lower.

🧠 Market Psychology:

The breakdown from the trendline and QFL indicates panic or profit-taking.

Many late long positions are likely being liquidated.

Smart money may be waiting at the $100K zone to accumulate, depending on market conditions and macro factors.

🎯 Trading Strategy Ideas:

🛑 For Bears (Shorts):

Stay short below $110K resistance.

Trail stop-loss above QFL zone or trendline breakdown.

Look to take profit at $104K and $102K zones.

Add to positions on confirmed bearish retests of broken supports.

📈 For Bulls (Longs):

Wait for clear confirmation (e.g., bullish engulfing, double bottom, RSI divergence) near $104K or $102K before entering.

Avoid catching falling knives—patience is key.

Consider scaling in with smaller position sizes and tight stops.

Watch for a reclaim of the QFL zone or a strong bounce from the $100K psychological level.

🧭 Bias: Bearish

Structure: Lower highs & lower lows.

Momentum: Selling volume increasing, bulls losing steam.

Invalidation: A strong daily close above $111K would flip bias back to neutral/bullish.

🧩 Final Thoughts:

Bitcoin is currently in a fragile state as it retraces from a failed breakout. With multiple key support zones ahead, the next few sessions will be critical in determining whether bulls can reclaim control or if we see deeper downside movement. Watch for signs of exhaustion from sellers or fresh accumulation zones to position accordingly.

BTC Eyes $105,119 Support Before Targeting $112,000FenzoFx—Bitcoin is trading just below the previous monthly high at $109,110.0, while the Stochastic remains overbought for the third consecutive day, signaling short-term overheating.

Although the broader trend is bullish, a pullback toward the anchored VWAP at $105,119.0 is expected. This level may offer a low-risk reentry, with a potential move toward the all-time high at $112,000.0.

Bitcoin Breakdown? Support Zone & CME Gap in FocusBitcoin ( BINANCE:BTCUSDT ), as anticipated in my previous analysis , attacked the Resistance lines and then resumed its decline. In previous analysis, both Long and Short positions could have been profitable .

Bitcoin is approaching a Support zone($106,800-$105,820) and the CME gap($106,645-$106,295) .

From an Elliott Wave theory perspective , it appears that Bitcoin has finally completed a five-wave impulsive move with the help of an Expanding Ending Diagonal .

I expect Bitcoin to attack the Support zone($106,800-$105,820) after breaking the lower line of the Expanding Ending Diagonal .

Note: To break through the Support zone($106,800-$105,820), Bitcoin may potentially use either a Head and Shoulders pattern or a Bearish Quasimodo formation.

Note: If Bitcoin breaks the Resistance lines, we can expect more pumps.

Cumulative Long Liquidation Leverage: $106,249-$105,094

Cumulative Short Liquidation Leverage: $109,483-$108,790

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

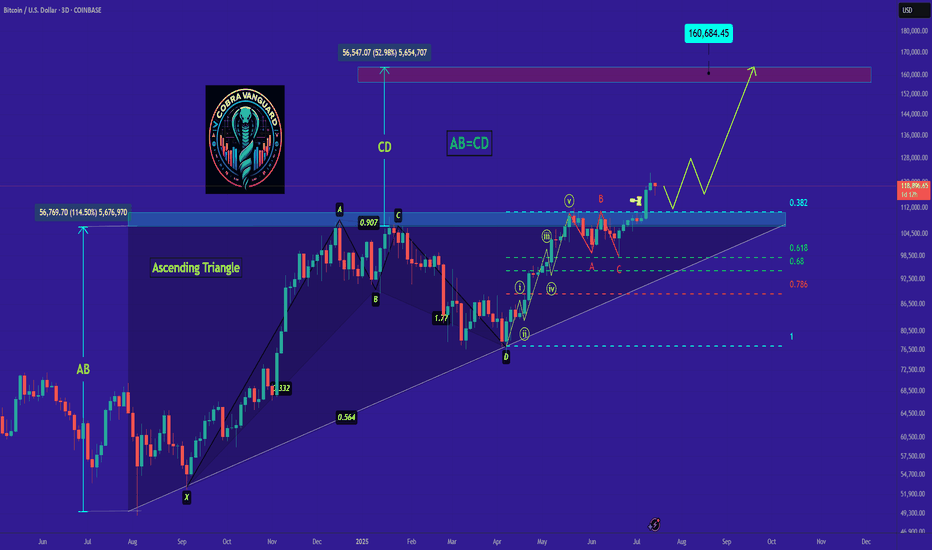

BTC's Situation, A Comprehensive Analysis !!!The situation has become quite strange. Bitcoin is forming deceptive patterns, and altcoins continue their downward trend. Currently, Bitcoin is positioned within two triangles—one symmetrical and the other descending. Now that Bitcoin has reached the top of the triangle and appears ready to break upward, it might actually be hiding yet another trap within the price action.

This market has shown disregard for technical patterns, and every time the price approaches historically significant levels, it reveals its true intentions and disappoints us. This cycle tends to repeat.

In my opinion, we’re likely to see one more drop in Bitcoin’s price. After that, instead of continuing the expected downtrend from the pattern, the price could break the descending formation and experience a strong upward move.

Stay Awesome , CobraVanguard.

BITCOIN - under resistance since 2011-Birth of a new cycle soon

The Chart Clearly explains itself

Since before Bitcoin PA went into its current channel, it was under a Huge Arc that resisted any move higher...strongly, Every single ATH, Every one, even the most recent

This is Easily seen by the Blue Arc

And as you can see, maybe THIS is the real reason why PA is struggling to break higher....It just cannot break over that Arc.

The main chart is Monthly, Lets look at the weekly.

You can clearly see what happened in 2021, rejected twice and again this cycle.

And you can see how, by December This year, 2025, PA will be squeezed very tight.

And PA usually moves before the APEX>

And, if we are going to repeat the previous cycle moves, the 1st year after a New ATH usually sees a decline in price, as can be seen by the red boxes.

But PA needs to break OVER that Arc first. and then remain ABOVE IT.

This would then create a new cycle pattern.

And we need it.

Currently, we can go back to Lows of 88K before we loose support on that lower trendline but from there, we need to break over.

A Strong move in SEPTEMBER / OCTOBER would be Ideal

Just saying

Bitcoin Monthly Candle Close colour and patterns since 2011

At the beginning of June , I wrote this

""On only 2 occasions have we had a GREEN JAN, RED FEB, RED MARCH, GREEN APRIL

And Both of them were on the way to ATH. (Boxes )

On both those occasions we also had a GREEN MAY, though the gains were minimal and one was followed by a Green June and the other by a Red June."

We just got the GREEN June and so this draws my eye to the sequence on the left, ( arrow )

If we are to follow this, then July should be a larger Green (Arrow) - BULLISH

In-fact, in both the sequences we have been following ( boxes), July was GREEN- BULLISH

And using just the month candle colours, we have a higher chance of another Green candle, with July having had 9 Green to 4 Red previously. - BULLISH

However

Of the previous 8 Green June Closes , only 3 went to a Green July - BEARISH

And I have to say, on NONE of the previous Green Junes were we so close to the current ATH.

July 2021 being the closest with a price at 41K, around 18K below the current ATH at the time.

We are currently only around 200 usd below Current ATH

This adds enormous resistance to the ability to rise

I wanted a RED June because I felt it was more sustainable and would lead to a cycle ATH at the end of the year. As can be seen in the middle Box

If we look back toward the 2012 Box on the left, we may now get a Hot July / August , September and then a Cool off for October, November & December.

But something tells me this will not happen.

The Candles for our current cycle in April, May and June are diminishing in size, the opposite of 2012

But they are similar to the 2020 box, except for the red June close.

This could lead to the desired "Cooling" in August & September and a new lift off in autumn.

And if you look at the chart Candle Colour Count, , August and September are usually RED by some majority

This also gives us the Bigger Green July candle that the "Odds" point towards.

So, as ever, we have to wait and see how this plays out.

Odds in favour of a Green July using previous cycle Data

PA position just below current ATH could lead to a slightly Bearish out look in the short term.

And if you are hoping to see ALTS Rally, PLEASE keep your eye on the BTC.D chart

This also points to wards BTC ATH in Q4 this year

And then, we have the BIG question.......Will we ever see a Classix Bear again ?

With so many Holding Bitcoin LongTerm.....How would a Bear market arrive ?

BUY BITCOIN

HOLD BITCOIN

But, as ever, we just have to wait and see,

Bitcoin Daily in a large pennant with apex end of July

Bitcoin is once again getting rejected off the Fib circle just above.

This is also just under a 618 Fib extension and so a combined rejection zone.

Beneath this, we have support on that Bold dashed line. This is a Local line of supprt but has strength.

And so, we find outselves in apennant again and that apex is around 22 July.

PA tracts before the apex.

As will be explained in the monthly chart I iwll post later, this all points towards a Calm July, possibly RED month.

PA does however, have the ability and strength to push higher if the Bulls decide to make a move.

The MACD

The Daily MACD is just above Neutral and has enough room to move.

So, if we drop, support is arouns 103K

If we loose that then 100K and then we land on that red 236 Fib circle that will offer a sliding line of support.

But I do not think we will get there just yet

Enjoy

Bitcoin Eyes $110K Target Above Key Support LevelBitcoin trades slightly below last week’s high near $107,660.0, while RSI 14 shows bearish divergence without a clear downward move.

Immediate support is at $107,230.0, and resistance at $108,550.0. If BTC closes above resistance, a rally toward $110,651.0 may follow. The bullish outlook remains valid as long as the price stays above $104,681.0.